Do you ever get curious about the taxability of the cash value of your Whole Life Insurance Policy? Let’s take a closer look at a scenario that might sound familiar. Imagine you are reviewing your monthly bills and expenses, trying to optimize where your money goes each month. That monthly cost of your Whole Life Insurance is certainly one of those expenses. It’s a steady figure, predictable, but you remind yourself that your policy is two things: a death benefit as well as a cash value. The next thing that will come to your mind is, “What about the taxes on this percentage?” I worked hard for my money.

How Is the Cash Value of a Whole-Life Policy Taxed?

By Harpreet Puri, February 17, 2026, 6 Minutes

- How Is The Cash Value Of A Whole-Life Policy Taxed?

- How Cash Value Grows And Its Tax Treatment

- Whole Life Insurance Cost And Tax Strategies

- How CRA Defines Policy Cash Value and ACB (Adjusted Cost Basis)

- Considering Whole Life Insurance Quotes

- Insurance Tax Mistakes to Avoid

- Concluding Thoughts

- FAQs on Taxation of Cash Value in Whole Life Insurance Policies

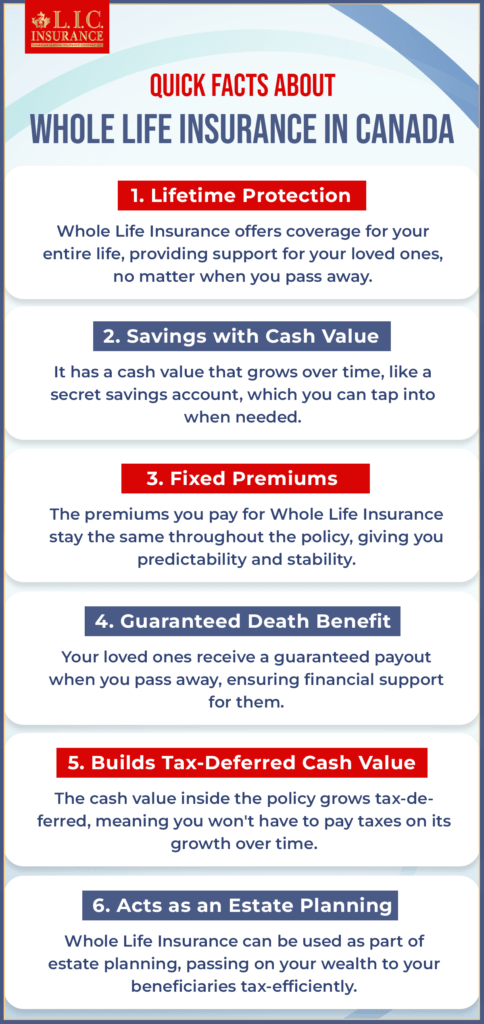

Do you ever get curious about the taxability of the cash value of your Whole Life Insurance Policy? Let’s take a closer look at a scenario that might sound familiar. Imagine you are reviewing your monthly bills and expenses, trying to optimize where your money goes each month. That monthly cost of your Whole Life Insurance is certainly one of those expenses. It’s a steady figure, predictable, but you remind yourself that your policy is two things: a death benefit as well as a cash value. The next thing that will come to your mind is, “What about the taxes on this percentage?” I worked hard for my money. Have I gotten the most out of it? It can be hard to understand how life insurance works, especially if you’re trying to plan for your financial future, since the cash value in a Whole Life Policy will affect your money. There are important tax rules in Canada that affect the cash value of your policy. This is true whether you are looking to buy a policy and comparing Whole Life Insurance Quotes, or you already have a policy and are thinking about how good it is when you want to have its cash value in the long run. The goal of this blog is to help you understand some of those complicated rules by telling you stories that you can relate to. The goal of this blog is to help you understand some of those complicated rules by telling you stories that you can relate to.

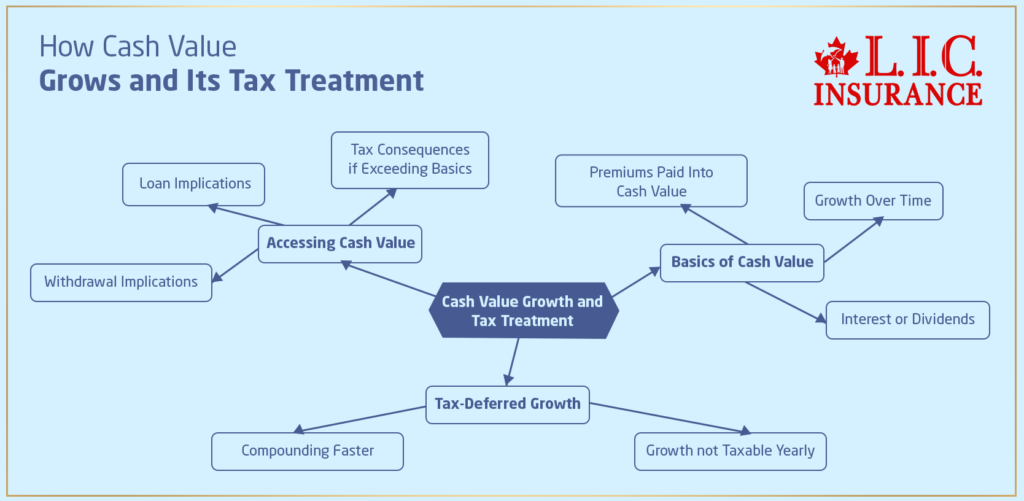

How Cash Value Grows and Its Tax Treatment

The Basics of Cash Value

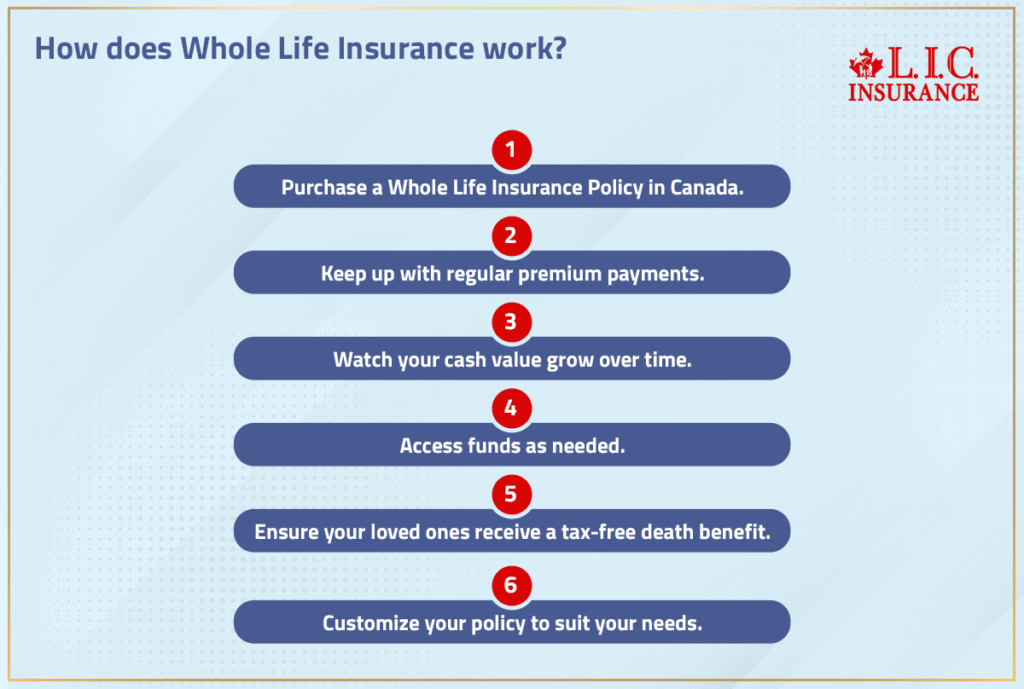

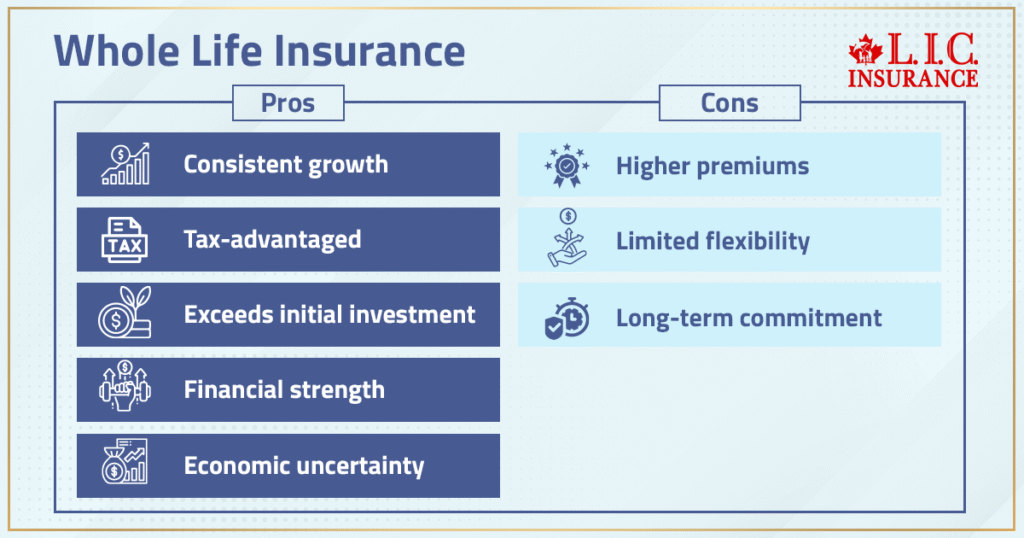

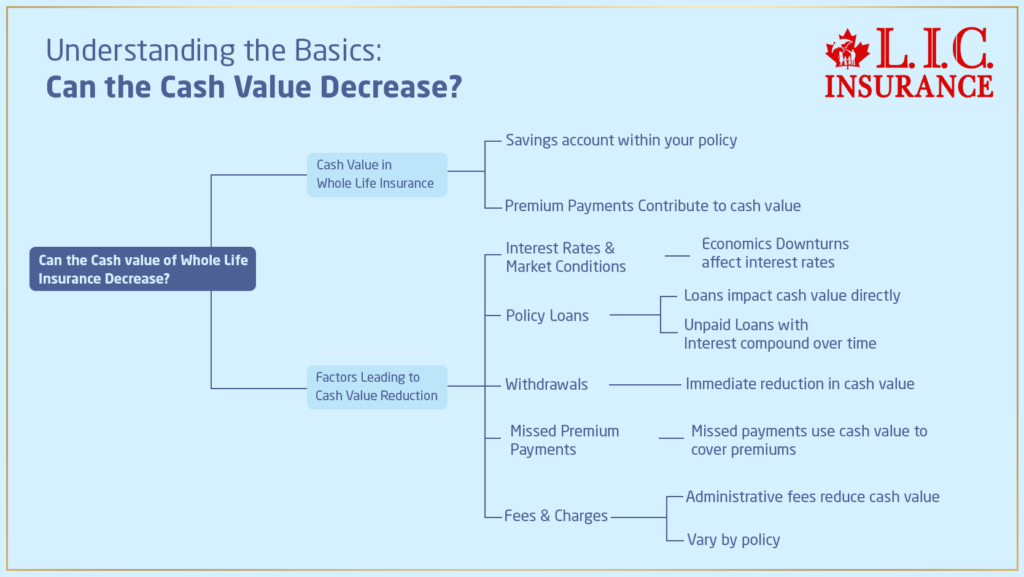

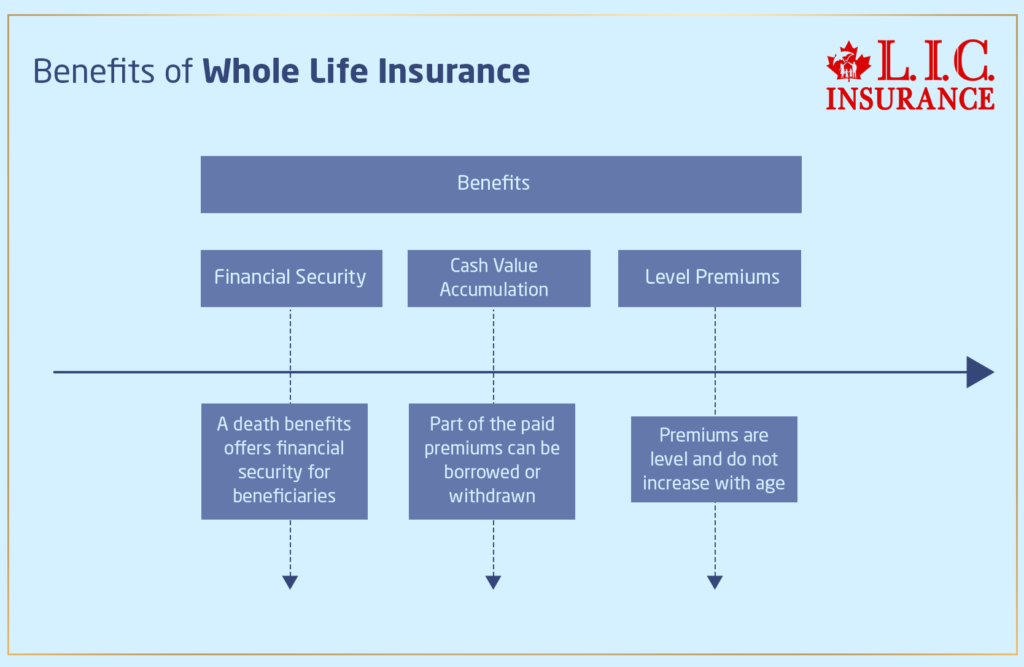

In general, as you pay premiums on a Whole Life Insurance Policy, a fraction of every payment goes into your Whole Life Insurance Policy’s Cash Value. This part increases over time, based on guaranteed policy values and, in participating policies, dividends declared by the insurance company, depending on the terms of your policy. What you are seeing regarding this growth is not mere statistics, but actual money that can be there for you in your lifetime.

Tax-Deferred Growth: A Real-Life Situation

Samaira, a graphic designer, purchased her whole life policy ten years ago. As she climbed up the ranks in her career over the years, she earned more money in a higher tax bracket. Yet the increase in her policy’s cash value was considered a form of tax deferral, so it did not increase her taxable income each year. That meant the money she had in the cash value of her policy could sit and grow tax-deferred for years, compounding faster than an equally sized taxable investment might.

When you take cash from the cash value, either a withdrawal or a loan, there are tax implications. It is tempting to just take your cash value, but realize that if you take withdrawals above your Adjusted Cost Basis (ACB), as calculated by the insurer, there may be a tax bill.

Accessing Cash Value: Tax Implications

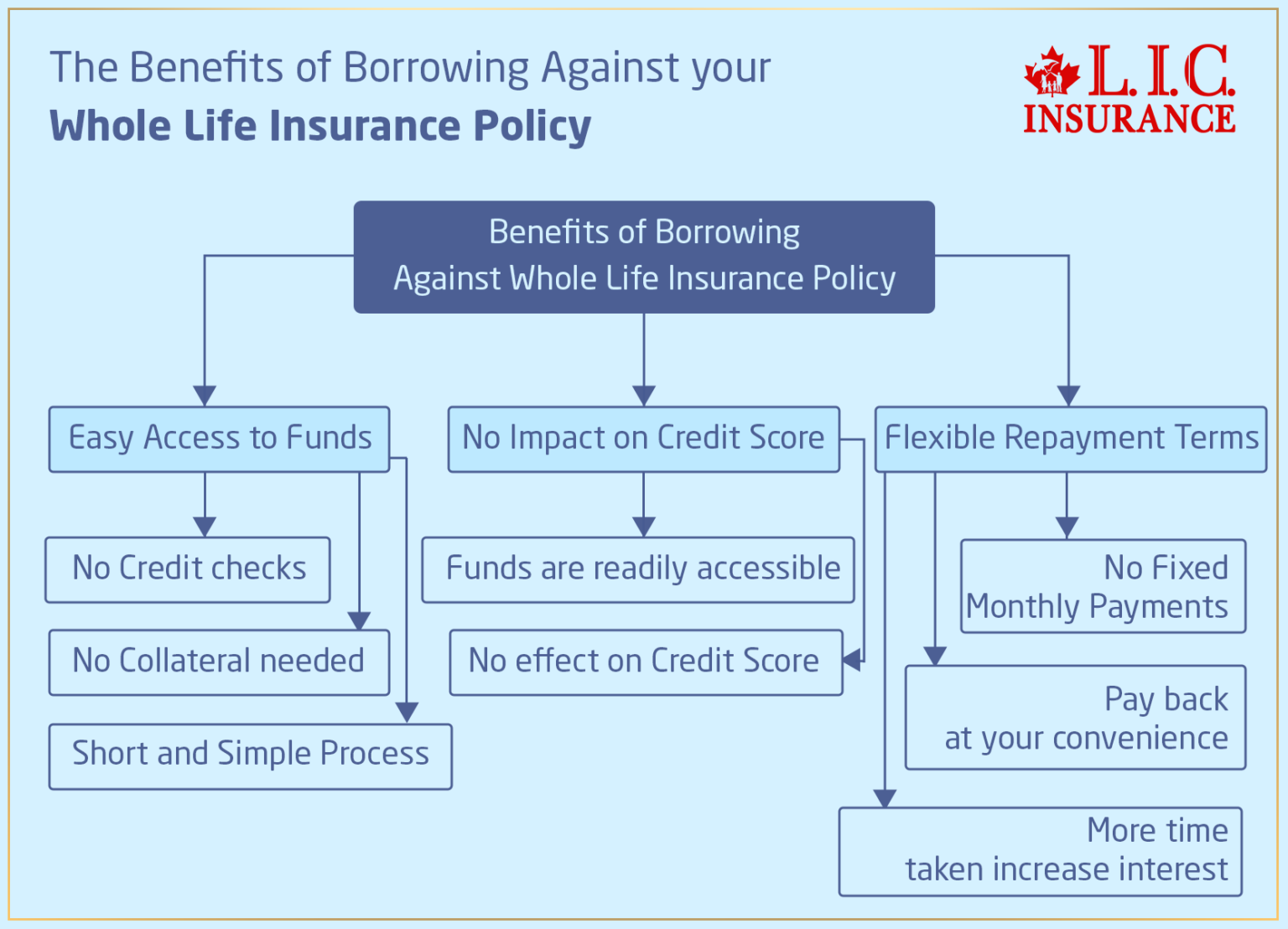

When you decide to access the Whole Life Insurance Policy Cash Value, be it through withdrawal or a loan, there are different tax consequences. Withdrawing your cash value might seem like a straightforward option, but it’s essential to understand the potential tax hit if withdrawals exceed your policy’s basis, the amount of total premiums you have paid.

Example of Withdrawal Impact

Let’s take the case of Mike, a small business owner. When he needed to fund his business’s expansion, he considered withdrawing from the cash value of his insurance. However, upon consulting his financial advisor, he learned that withdrawing an amount beyond what he had paid in premiums would be taxable. This realization made him rethink his strategy to avoid an unexpected tax bill.

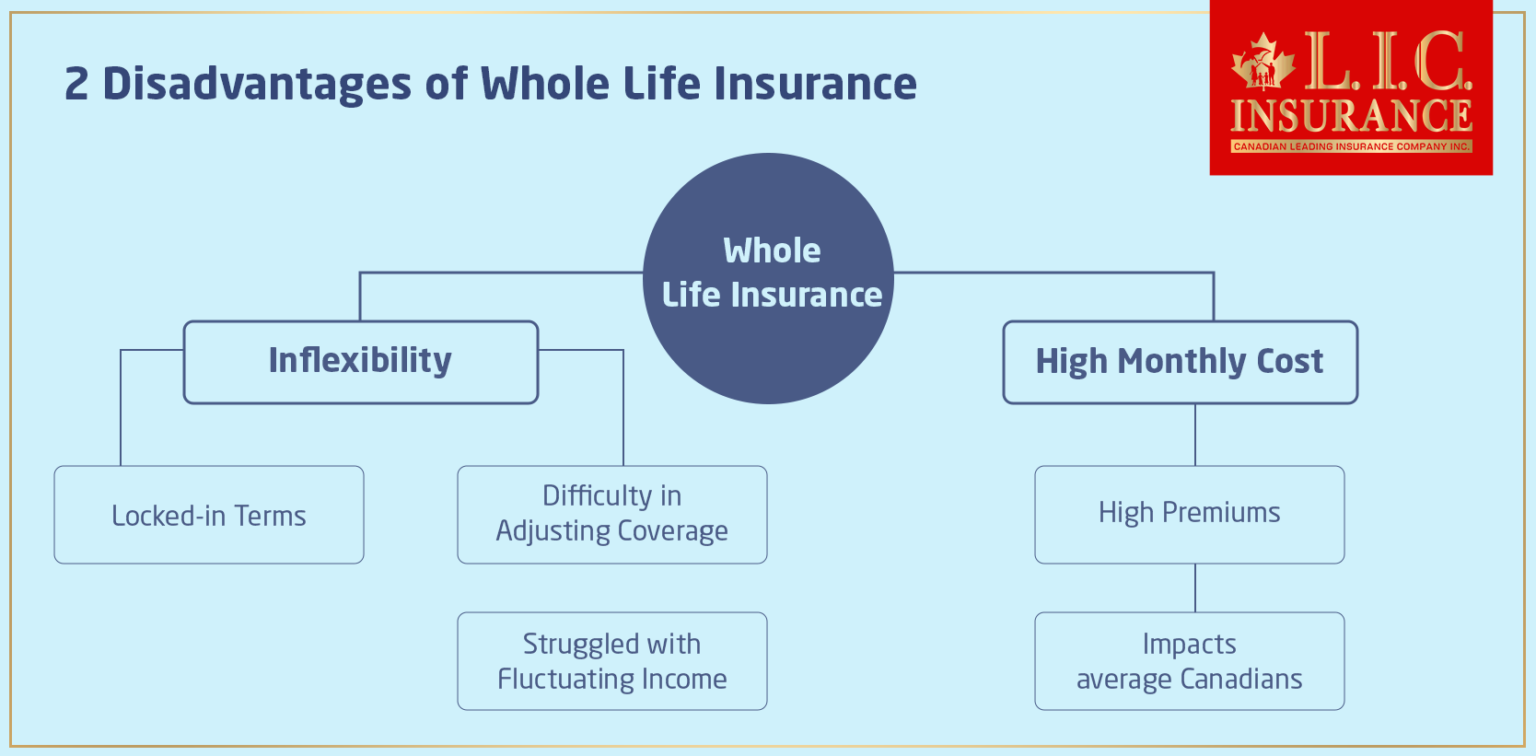

Whole Life Insurance Cost and Tax Strategies

Structuring Your Policy for Tax Efficiency

An essential part of managing Whole Life Insurance Costs is understanding how to structure your policy to maximize tax efficiency. This is important for anyone with high Whole Life Insurance premiums wishing to lessen the financial burden.

Real-Life Strategy Implementation

Imagine a couple, John and Linda, who are in their mid-50s. They’ve been paying into their whole life policies for nearly three decades. Their financial advisor recommended they borrow against the cash value to pay the premiums, lowering their monthly out-of-pocket expense but keeping the policy intact.

Note: policy loans may trigger a taxable policy gain at the time the loan is taken if proceeds exceed the policy’s ACB, and additional tax consequences may arise if the policy later lapses with an outstanding loan. This move not only helps in managing their expenses better but also keeps the policy’s benefits intact when properly structured and monitored.

How CRA Defines Policy Cash Value and ACB (Adjusted Cost Basis)

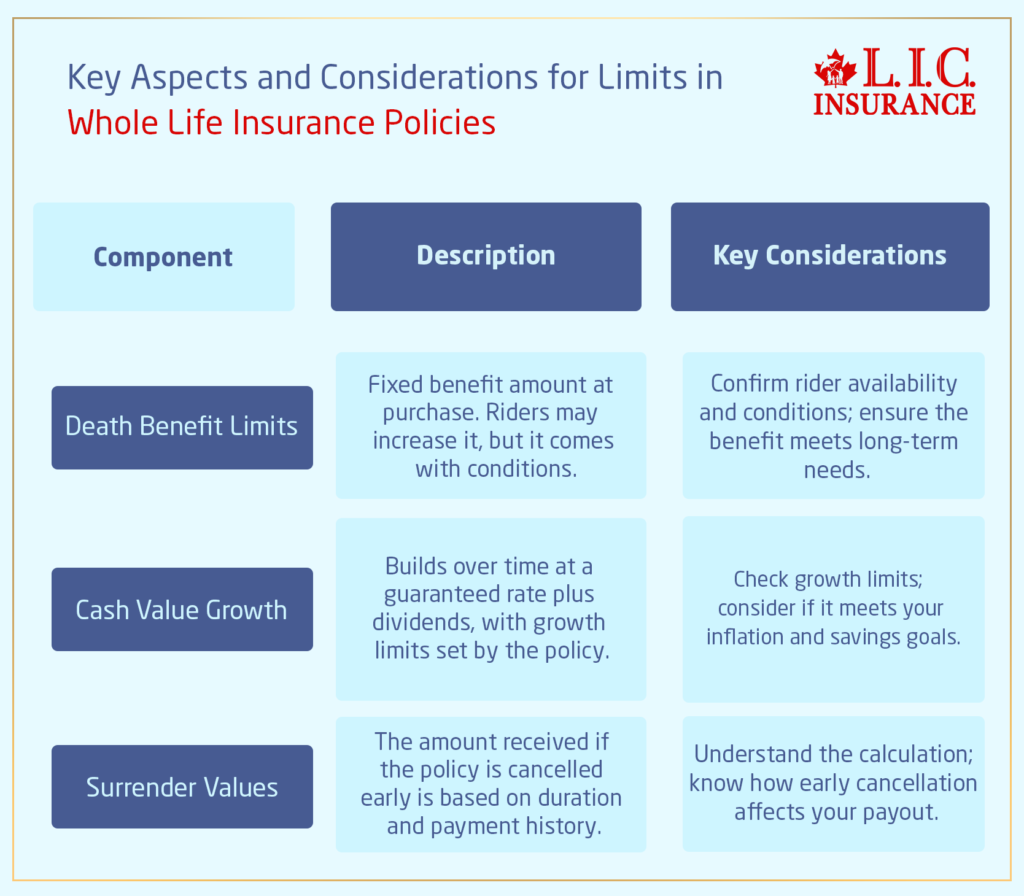

Understanding how the Canada Revenue Agency (CRA) treats the cash value of a Whole Life Insurance Policy is key when it comes to taxes. While many Canadians know that these policies build cash value over time, few understand when and how the taxable portion is calculated. That’s where ACB — Adjusted Cost Basis — becomes very important.

What is ACB in Whole Life Insurance?

ACB (Adjusted Cost Basis) is the value CRA uses to determine how much of your cash value is non-taxable and how much is taxable when you make a withdrawal or surrender your policy.

It represents the total amount you’ve contributed to your policy (mostly through premiums), minus any cost of insurance and plus/minus any adjustments like policy loans or dividends, depending on how they’re used.

In simple terms:

ACB = Total premiums paid – Cost of insurance + other allowable adjustments

So, if you’ve paid $50,000 in premiums over the years, and your policy cost of insurance was $10,000, your ACB might be around $40,000, depending on other factors.

How is ACB Calculated?

CRA calculates ACB using a set formula that considers:

- Premiums paid into the policy

- Policy dividends (if received as cash or used to buy more coverage)

- Cost of pure insurance (COI) charges

- Policy loans and withdrawals

- Any additional riders or changes in coverage

Over time, your ACB decreases as the cost of insurance increases. This means the longer you hold the policy, the lower your ACB may become, increasing the chance of taxation when you access the cash value.

CRA Guidelines Around Withdrawals and Loans

➤ Withdrawals

If you withdraw from your policy, the amount over and above your ACB is considered taxable income and must be reported to CRA in the year of withdrawal.

➤ Policy Loans

Taking a loan against the cash value does not automatically trigger taxes — but it can, if:

- The policy lapses while the loan is still outstanding

- You borrow more than your ACB

If either occurs, CRA treats the excess as a deemed disposition, and you’ll receive a T5 slip for the taxable portion.

Mini Case Scenario: ACB Exceeds Cash Value and Tax Bill Triggers

Let’s say Jaspreet, a 45-year-old engineer, has had a Whole Life Insurance Policy for 15 years. He has:

- Paid $75,000 in total premiums

- Incurred $20,000 in insurance costs over time

- No policy loans or extra riders

So his ACB is approximately $55,000.

Now, his cash value has grown to $70,000. Jaspreet decides to withdraw $65,000 to help his child with a down payment on a home.

CRA will assess the taxable portion as:

Taxable policy gain = proceeds of disposition – ACB allocated to the portion withdrawn

$65,000 (withdrawal) – $55,000 (ACB) = $10,000 taxable income

That $10,000 will need to be reported on his tax return for the year and taxed at his marginal rate. Jaspreet is surprised — he thought the entire withdrawal was tax-free.

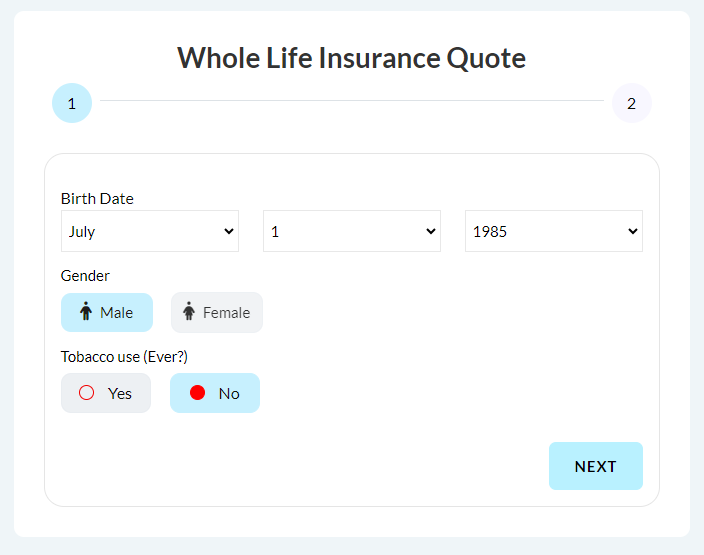

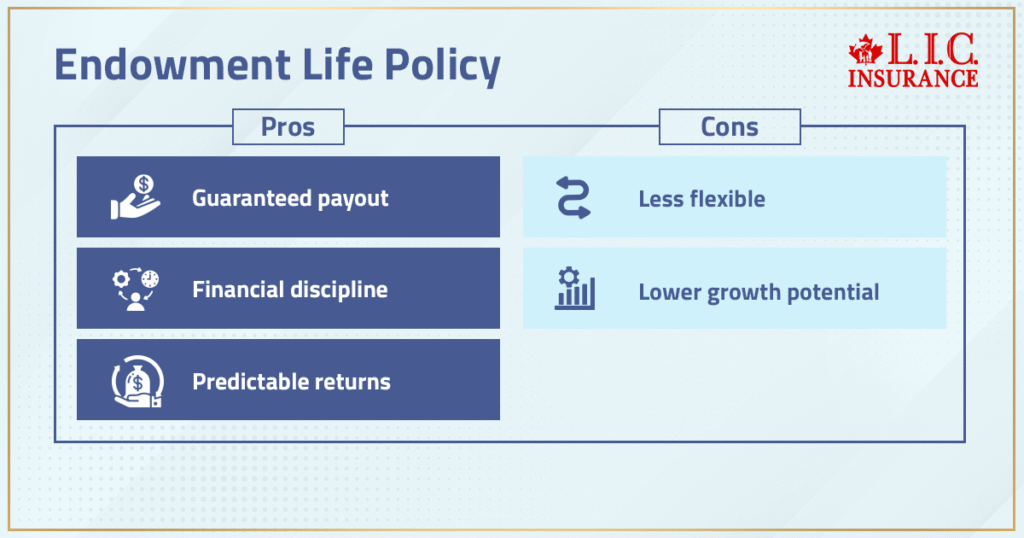

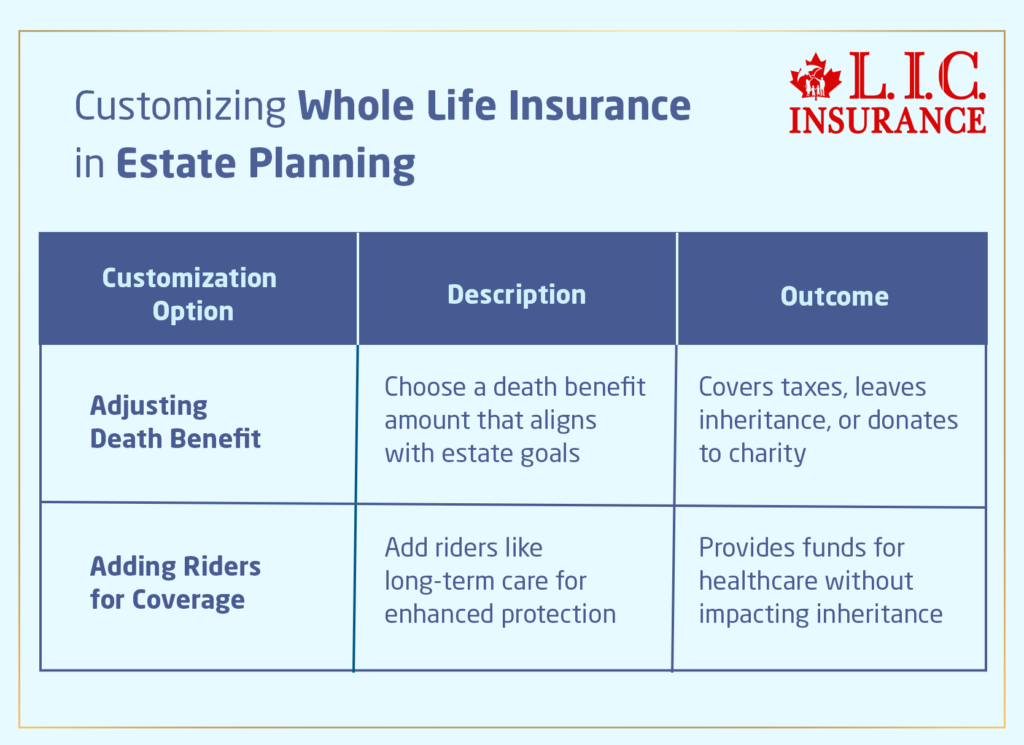

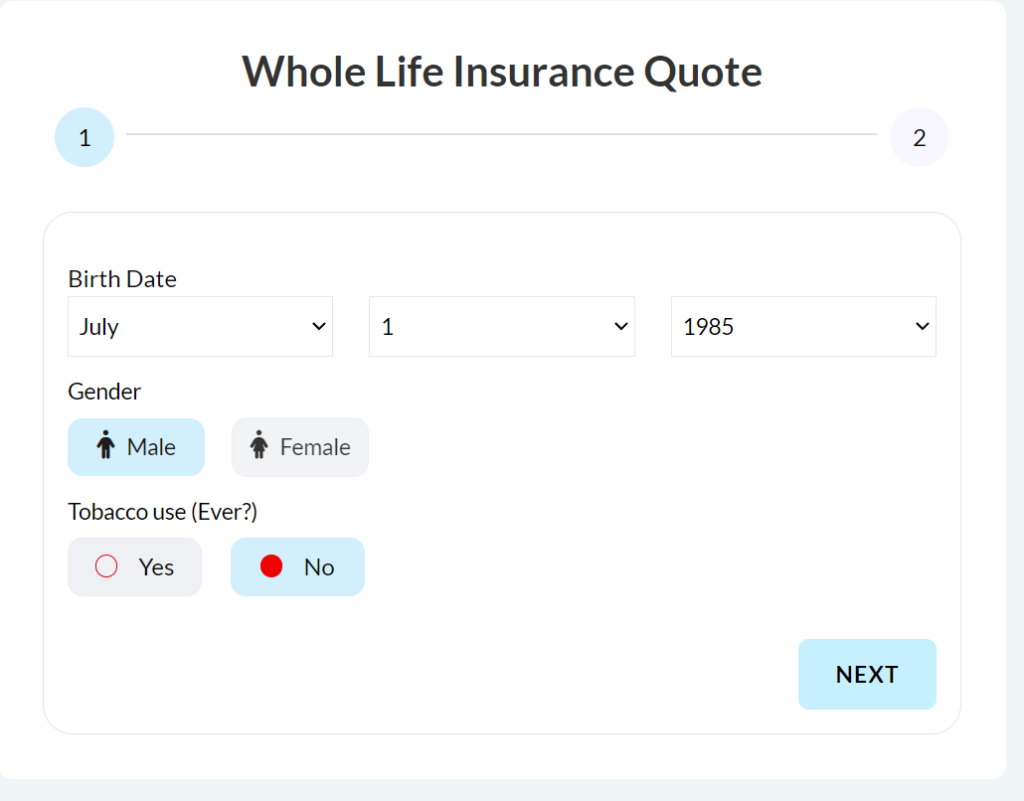

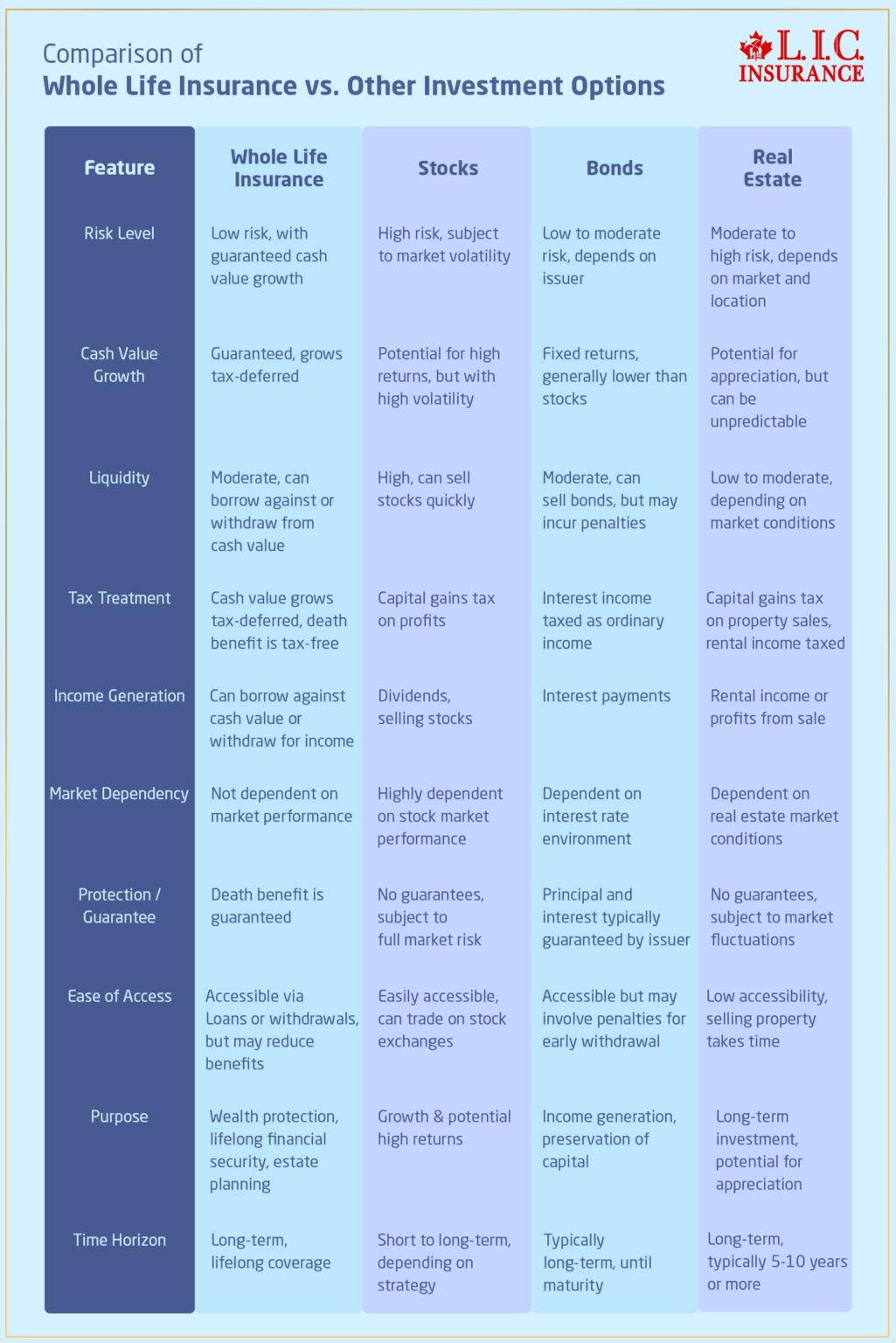

Considering Whole Life Insurance Quotes

While you might think comparison shopping when it comes to a Whole Life Insurance Policy refers solely to getting quotes, it is about more than just dollar numbers. It is more about dissecting the numbers and, more importantly, how the underlying tale or the tax treatment of the cash value in the policy.

A Tale of Comparing Quotes

Elena, a teacher, spent weeks comparing different Whole Life Insurance Quotes, trying to find the best value for her investment. She looked specifically at how different policies handled the accumulation and taxation of cash value, eventually choosing a policy that offered a favourable balance between growth potential and tax advantages.

Insurance Tax Mistakes to Avoid

Understanding how Whole Life Insurance is taxed can make a significant difference in how much of your policy’s value you actually keep. While a Whole Life Insurance Policy offers stable, long-term benefits, tax missteps can reduce the gains you’ve worked hard to build. Many policyholders don’t realize that the Whole Life Insurance cash value is taxable under certain conditions. Here are some of the most common tax mistakes Canadians make—and how to avoid them.

1. Withdrawing Too Early and Triggering Taxes

A common misconception is that all withdrawals from a policy’s cash value are tax-free. That’s not always true. Do you have to pay taxes on Whole Life Insurance cash value? Yes—if you withdraw more than the premiums you’ve paid (your adjusted cost basis), the excess amount becomes taxable.

Let’s say you contributed $50,000 in premiums over the years, and your cash value has grown to $90,000. If you withdraw $70,000, you may owe taxes on the $20,000 gain. It’s critical to consult a tax advisor before withdrawing to understand exactly how Whole Life Insurance is taxed in your case.

2. Failing to Pay Back Policy Loans

Using a policy loan is a smart way to access your funds without immediately triggering taxes, but only if you repay it. If you take a loan against your cash value and don’t repay it, and the policy lapses, that loan amount may be considered a taxable distribution. Many people believe “loans aren’t income.” That’s true—until the policy terminates. Once it does, the CRA considers any outstanding loans plus gains over your premium contributions as taxable income. This is one reason why Whole Life Insurance taxation can surprise even long-time policyholders.

3. Cancelling a Policy with High Gains Without Expert Advice

One of the biggest mistakes is cancelling or surrendering a policy without understanding the tax consequences. If I cash out my Whole Life Insurance Policy, is it taxable? Yes, it could be—especially if your cash value has grown significantly over the years.

When you cancel a whole life policy, any amount received above what you’ve paid into the plan is subject to income tax. People often cash out to meet short-term financial needs, only to be hit with an unexpected tax bill the following year. Before you take that step, it’s crucial to speak with a tax specialist who understands Whole Life Insurance taxation in Canada.

Whole Life Insurance is a powerful tool—but missteps in how you access its cash value can cost you more than you expect. Whether you’re reviewing your policy, taking a loan, or planning to withdraw funds, take the time to understand:

Is Whole Life Insurance taxable in Canada? It depends on when and how you use your cash value.

Life insurance policy gains are taxed as policy income under the Income Tax Act and are not treated as capital gains.

Avoiding these three tax mistakes can help you make smarter decisions and protect the long-term value of your policy.

Common Tax Questions Canadians Ask About Whole Life Insurance

With the growing popularity of the Whole Life Insurance as a protection and long term financial planning tool, Canadians tend to seek direct answers to the very narrow tax related questions. Most of these questions are not raised during the purchasing process, but come to the fore many years later, when policyholders start to think over the possibility of receiving the value of their policy or take into consideration the extension of the value to the rest of their financial needs. The following section dwells on such common concerns in a straightforward manner..

Is Life Insurance Taxable in Canada?

The question on whether life insurance is taxable in Canada is among the most searched questions. The brief is that life insurance is not necessarily taxable, but some transactions on a policy could lead to taxable income.

The policy of Whole Life Insurance in Canada is subject to provisions of the Income Tax Act. The internal growth is not recorded as taxable income as long as the policy stands and of course adheres to the rules of an exempt policy. Nevertheless, taxation may come in accordance to the use of the policy in the lifetime of the policy holder.

Understanding when tax applies is more important than assuming life insurance is always tax-free.

Is the Cash Value of Life Insurance Taxable?

The taxes are another common issue as to whether the cash value of the life insurance is taxable or not. Cash value in itself is not tax creating. The mere fact that you have an increasing cash value in a Whole Life Insurance Policy does not mean that you have a tax due.

Tax is applicable only when you act i.e. when you withdraw the money, when you surrender the policy or when you borrow under some conditions. This explains why a lot of Canadians are mistaken about life insurance cash value being taxed all the time when this is not necessarily the case since it all depends on how and when it will be accessed.

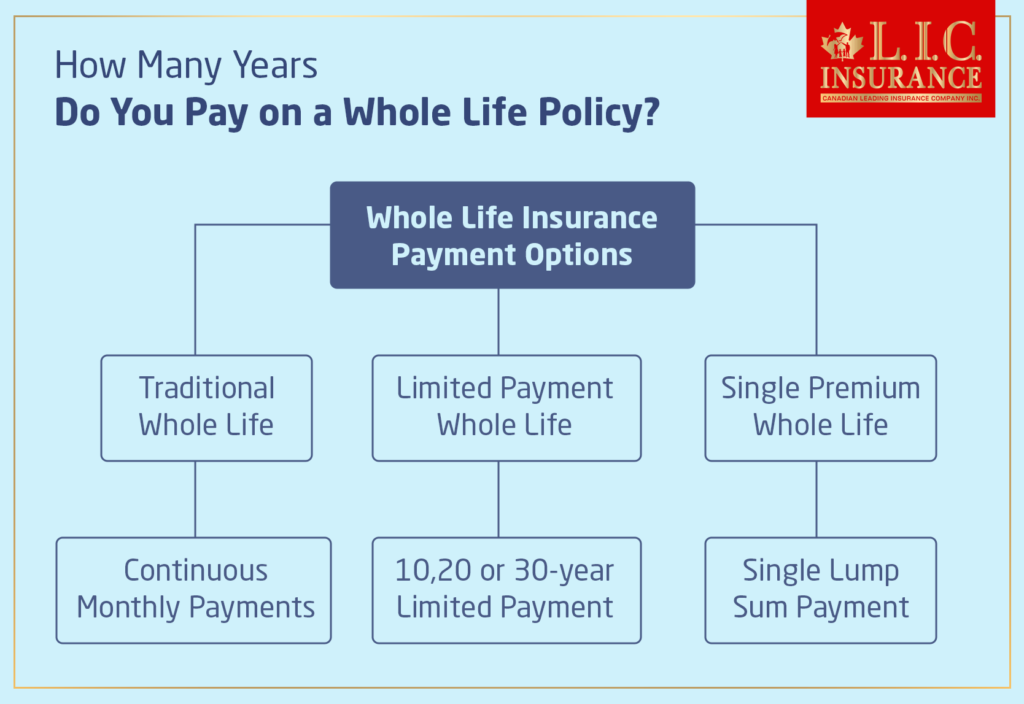

How Is Cash Value Calculated in a Whole Life Policy?

Under policy comparison, people tend to enquire on how the cash value is determined. The insurer uses actuarial assumptions applied to the contract to determine cash value in a Whole Life Insurance Policy. These are guaranteed policy values and in participating policies, declared dividends by the insurance company.

The value of cash is not subject to change as market investments. It develops as per the format of the policy, the premium trend that has been chosen and utilization of dividends (when possible). The insurance company is supposed to be able to give official figures of cash values annually which is utilized in any tax or policy transactions.

Does Money From Withdrawing From a Life Investment Plan Count as Taxable Income?

The majority of Whole Life policies are sold as long-term financial instruments, which makes people make parallels between them and investment plans. This brings confusion as to whether money withdrawal is taxable income or not.

Money withdrawn under a Whole Life Insurance Policy may be treated as taxable income in Canada, depending upon the tax properties of a policy at the withdrawal date. This contrasts with registered plans, such as TFSAs or RRSPs and has its own taxation under the Income Tax Act.

This difference is significant since Whole Life Insurance is not a registered investment plan although it may be used in long-term financial planning.

Is Whole Life Insurance Cash-Out Taxable?

When people search “Whole Life Insurance cash out taxable,” they are usually referring to surrendering the policy or withdrawing a large amount of cash value.

Cashing out a Whole Life Insurance Policy can trigger taxation if the amount received exceeds the policy’s tax cost as defined by CRA. This is why surrendering a policy late in life—when cash value is high—can result in a larger tax bill than expected.

This tax consequence often surprises policyholders who assumed that all insurance proceeds are tax-free.

Is the Life Insurance Surrender Value Taxable?

A Whole Life Insurance Policy has what is termed as the surrender value that is paid to the policyholder when the policy is cancelled. Life insurance surrender value is taxable in Canada, but this is subject to tax position of the policy during the time of the surrender.

The insurer is just the one that decides whether there is a taxable amount and reports the same. This explains the necessity to be knowledgeable of surrender consequences prior to cancellation of a long-term policy of short-term cash requirements.

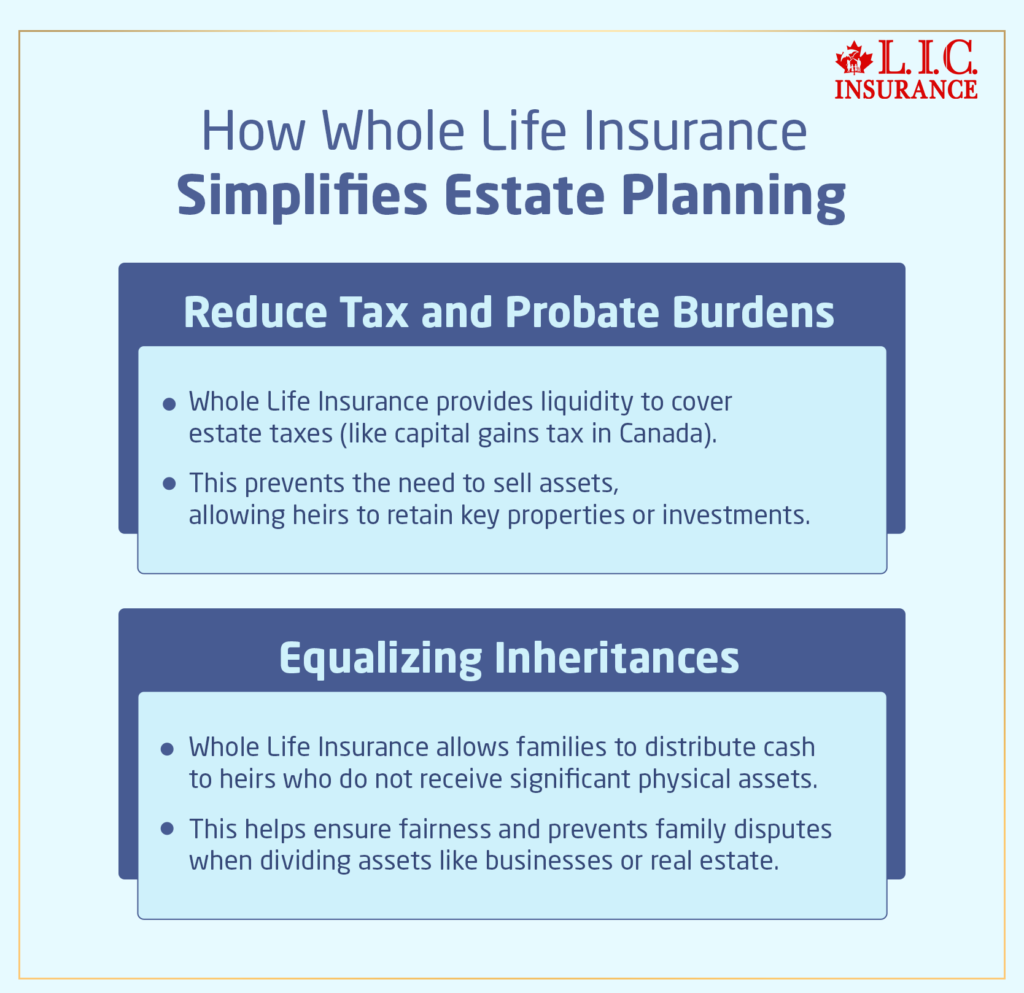

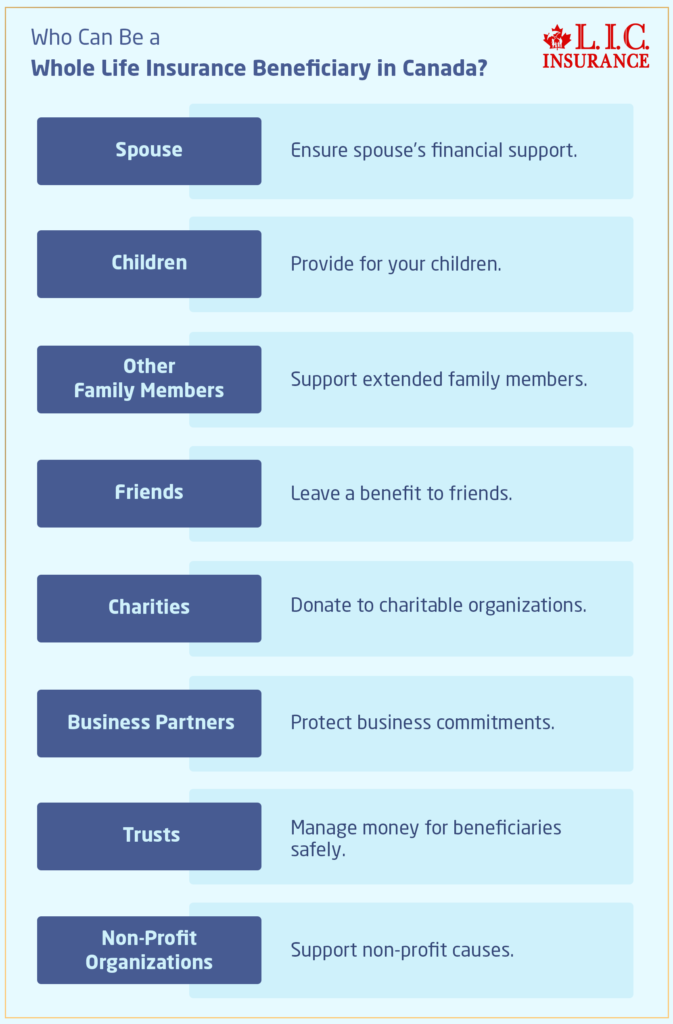

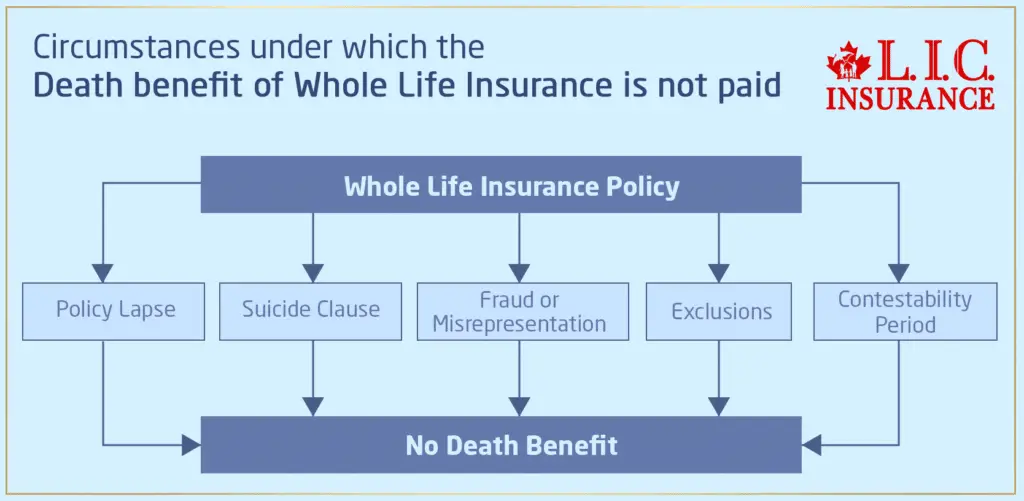

What About the Death Benefit of Whole Life Insurance?

The death benefit of Whole Life Insurance is one of the areas that are not complicated. In Canada, in most instances, the death benefit is usually given tax free to the beneficiaries. It is among the fundamental reasons why Whole Life Insurance is a prevalent example in the estate planning.

Death benefit is not regarded as income to the beneficiary and does not have to be taxed in his or her tax return. This taxation does not change even when the policy has accumulated substantial cash value over the years so long as the policy has not been designed to change its tax status.

Concluding Thoughts

Appreciating the tax treatment of the cash value in Whole Life Insurance Policies in Canada can make a huge difference in how you approach your financial planning. Even in the stories we’ve seen, from Smaira’s tax-deferred benefits to Michael’s thoughts on the tax implications of transfers, it’s important to understand these kinds of things so that when they happen, you know what’s going on and can make smart decisions about your future. You can make the same kinds of changes to your cash problem or goal right now. One of the top insurance brokerages, Canadian LIC, is here to support you with Whole Life Insurance Policies. They can help you craft a policy that will not only suit your insurance needs but also it can be in a tax-efficient manner that helps the overall state of your long-term finances. Confusion about taxes should not prevent you from ensuring a financially sound life ahead. Contact Canadian LIC today on +1 416 543 9000 to ensure that you begin your journey towards a more financially secure future by purchasing a Whole Life Insurance Policy that is best suited for you.

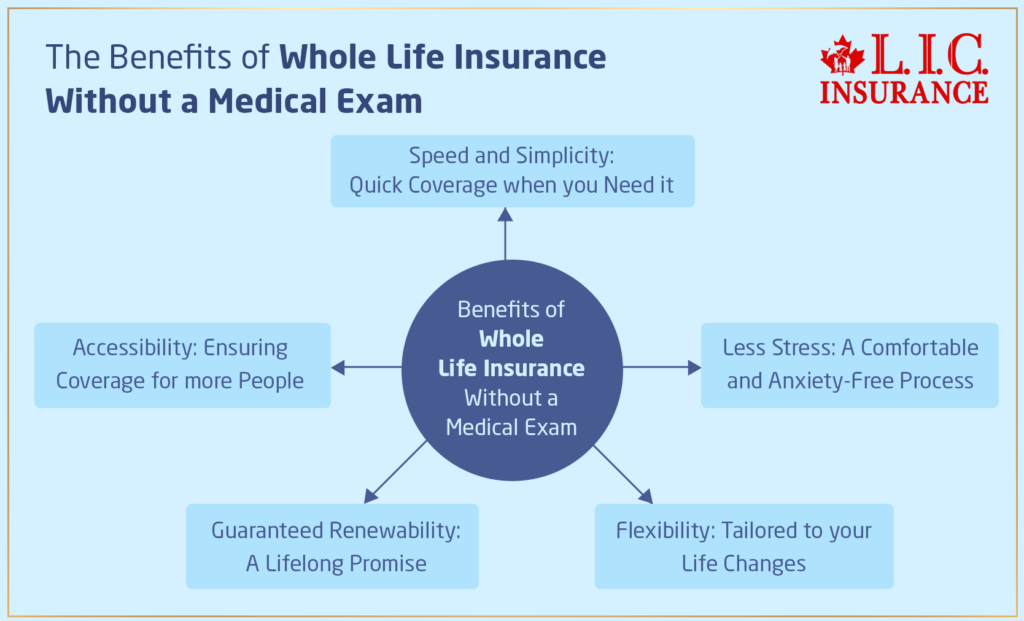

Find Out: How to find the best Whole Life Policy without a medical exam?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

Great question! With a Whole Life Insurance Policy, pulling out your cash value does not immediately reduce the cost of your policy across the board. But let’s take the case of Raj in trying to borrow against his policy cash value to cover his daughter’s wedding. While borrowing against the cash value did not affect his monthly cost for the Whole Life Insurance Policy, it meant that the loan amount was set to charge him interest. If Raj doesn’t pay back the loan, the loan amount plus interest may be subtracted from the policy’s death benefit, which will, in turn, affect the value of the policy to his beneficiaries.

Absolutely, this is a way to save money on taxes! The additional cost per month is generally your contribution to the Whole Life Insurance Policy Cash Value component of your policy and is growing tax-deferred. It was for Patricia, a consultant, who selected a slightly higher premium option in order to grow her cash value faster. This enables her to not only have a higher fund with her in the future but also allows her to stop paying taxes on the growth of these funds, optimizing her tax-deferred account.

Comparing Whole Life Insurance Quotes becomes important in order to know the tax aspect of your cash value with different policies. A self-employed man named Alex, for example, pored over several quotes and concentrated on how much the cash value would appreciate and be taxed. What he found was that with some policies, there was the ability to allow for accelerating the growth of the initial cash value, and some had different tax consequences. Comparing those rates allowed Alex to find a policy that not only fit his budget but also provided a model tax treatment best suited to his financial objectives.

Answer: When you begin to draw on the cash value, any withdrawals or loans against your policy could have a taxable and also taxable nature. Let’s look at Mei’s scenario. Mei, a real estate agent, planned on using some of her cash value toward purchasing a property. She decided to use a loan against her policy to defer taxes and keep her policy intact. This strategy allowed her to invest without facing the tax consequences that would come with withdrawing the funds outright.

The tax treatment of the cash value in your policy can make a big difference in terms of its entire value over time. If Sam and his wife Nora had both bought Whole Life Insurance Policies at the same age, then they both would have paid the same premiums and received the same death benefit. Sam elected a policy with a higher cash value accumulation rate that grew tax-deferred, so his cash value ended up growing much faster than Nora’s, who selected a lower fee policy but with slower growth of cash value. Sam’s policy over the years not only acted as a large safety net for both of them but grew beautifully being heavily invested in his policy — causing the total value of their financial assets to increase economically with an attractive tax treatment.

Yes, the cost of your Whole Life Insurance Policy has some bearing on future tax liabilities, especially if you surrender the policy or make withdrawals from the cash value. Take Oliver, for example, who decides to surrender his entire life policy after several years to gain some cash right now. Since the cash value was greater than the premiums he had paid, this surrender triggered a taxable event. Maybe he would have planned his money differently if he’d known about the taxes he would owe.

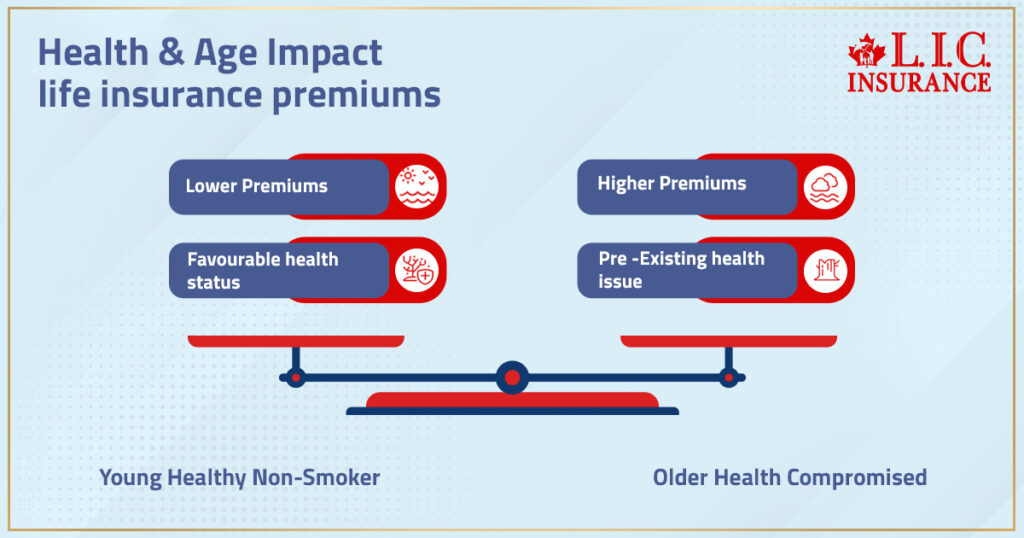

Whole Life Insurance – Your initial premium cost for your Whole Life Insurance Policy can be very different for a 20-year-old in perfect health, and an overweight 50-year-old concerned about covering final expenses. Take, for example, Javier, a thirty-something gym instructor who inquired about a Whole Life Insurance plan. Javier, who was very healthy and did not smoke, did qualify at good rates. To find the most affordable Whole Life Insurance Policy rates based on your health, you will need to compare Whole Life Insurance Quotes from several Whole Life Insurance companies.

Yes, it can. Gender has been among the factors insurance companies use to calculate premiums and is based on life expectancy statistics. For example, married couple Lisa and Mark experienced that while Lisa’s premium was only slightly lower than Mark’s, even though they were the same age and in almost the same health. The latter is often due to the fact that women statistically live longer than men and so their risk profile can be reduced.

Whole Life is a versatile product and its cash value use adds a big asset for estate planning. George, who has since retired, took advantage of his policy’s cash value to pass on an inheritance to his grandchildren as he lived. He had borrowed against the cash value to send his grandchildren to school while the death benefit would pay off the loan and still leave a legacy.

Yes, it is absolutely possible to get a Whole Life Insurance quote online, and it can be very convenient and effective. Online methods arrived to Emily – a sales and marketing consultant who is too in demand to sort out – to help her get estimates. This enabled her to compare interest rates swiftly and avoid the hassle of having to meet up physically with agents. Quotes are often more generalized when you receive them online, and there are bespoke factors about you and your belongings that should be addressed with an agent to provide more accurate price quoting.

Stopping your premium payments can lead to a policy lapse, where coverage is cancelled. An entrepreneur, Tom, ran into financial troubles and stopped making payments. The cash value in his insurance policy allowed his policy to remain in force for a couple of months so that he could get his finances in order before the policy lapsed. If you expect that you will have trouble making payments in the future, it is important for you to reach out to your insurer about options such as premium holidays or loans against the cash value.

Dividends are an important selling point for Whole Life Insurance. If you receive dividends, they can significantly reduce your costs. For example, Sandra owns a participating Whole Life Insurance Policy. Every year, her insurance company pays her dividends from the general surplus, and she applies the refunds toward her premiums, lowering, in essence, her annual direct out-of-pocket expense. Dividends aren’t guaranteed, but there are plenty of companies out there with long histories of paying them.

Knowing some of these FAQs will help you go through the complexities of Whole Life Insurance and allow you to execute decisions that are in line with your financial and tax planning goals. Each choice is crucial and can go a long way in affecting the strength of your policy and subsequently your wallet.

Sources and Further Reading

Canada Revenue Agency (CRA) – Official site for tax regulations and guidelines specific to insurance products in Canada. Visit CRA

Insurance Bureau of Canada – Provides detailed information on various types of insurance, including whole life policies available in Canada. Visit Insurance Bureau of Canada

Financial Consumer Agency of Canada – Offers comprehensive guides on life insurance products, helping consumers understand the nuances of insurance policies. Visit FCAC

Investopedia – Useful for explanations on financial terms and concepts, particularly regarding the taxation of life insurance policies. Visit Investopedia

Life Insurance Canada – Provides resources and articles on different aspects of life insurance, including cost comparisons and what to expect from whole life insurance. Visit Life Insurance Canada

These resources will provide you with further insights into whole life insurance, its costs, taxation, and how to effectively manage your policy in Canada.

Key Takeaways

- The cash value in whole life insurance grows tax-deferred, allowing effective compounding over time.

- Understanding when taxes apply to your policy's cash value can guide financial decisions.

- Factors like age and health influence whole life insurance costs; comparing quotes is essential.

- Use the cash value strategically for financial needs such as loans, retirement funds, or premium payments.

- Consulting financial professionals and tax advisors ensures your policy aligns with financial goals and tax situations.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com