One day, you just woke up in the morning, and while you enjoy your favourite cup of tea, you have some time to think about the little things that bother you every day. One of which is how long you will really have to pay into that Whole Life Insurance Policy that you’ve committed to. It’s a common question—many Canadians ponder upon, wondering about being tied down to payments forever. Figuring out when to pay your Whole Life Insurance premiums is more than just a matter of good money sense; it’s also about giving yourself and your family peace of mind. Today, we are going to try to drill down into some of the complexities of Whole Life Insurance Policies here in Canada, particularly with respect to how long you are going to make payments. New policyholders and potential buyers should understand the dynamics involved in their purchase of a Whole Life Policy and how to get the best from their investment.

How Many Years Do You Pay on a Whole Life Policy?

What’s to understand about Whole Life Insurance

But first, before dwelling on the time needed to make the payments, let us know exactly what Whole Life Insurance is. Whole Life Insurance is quite different from Term Life Insurance, which covers an individual for a specified period. This type of insurance secures not only a death benefit but accumulates cash value over time, a facet that may be a handsome contribution to your long-range financial blueprint.

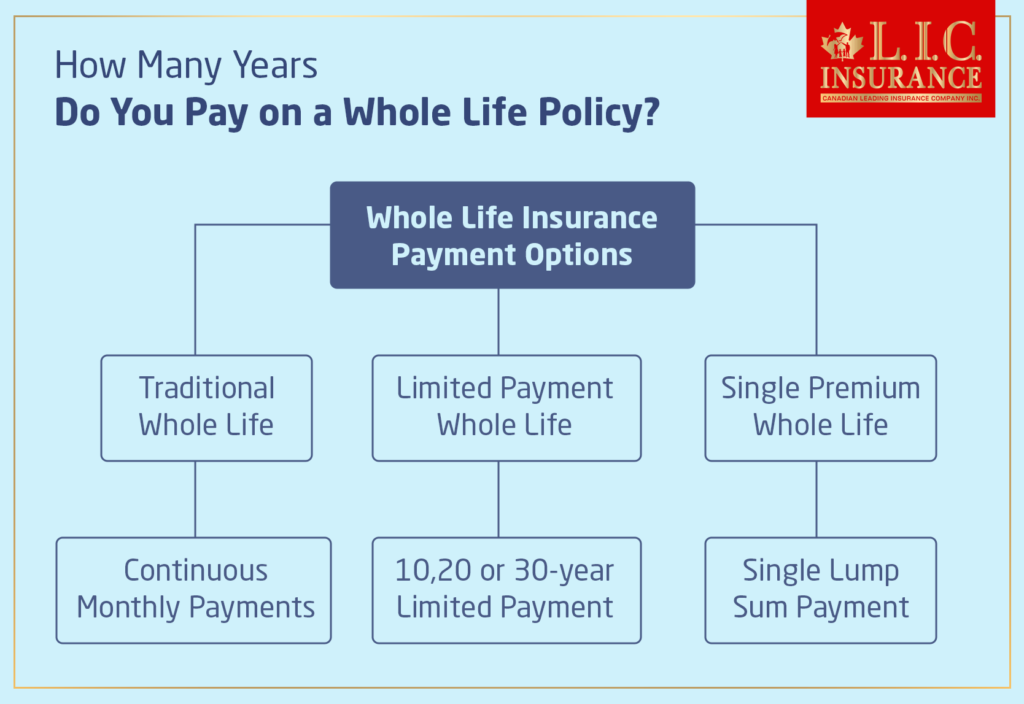

The Payment Timeline: It’s More Flexible Than You Think

Let’s dig deeper into the payment options of Whole Life Insurance Plan premiums, because this is often a flexible point that can make a huge difference in your financial planning. Many people, like Sarah from Toronto, start off thinking that the payment of premiums is a never-ending process. But, as we will see in a moment, there is great flexibility in the available options, which can cater to different financial stages and goals.

Traditional Whole Life

This may be a very daunting thought—the fact that in a traditional Whole Life Insurance Plan, you are bound to keep paying your premiums for your whole life. That couldn’t be further from the truth, though, because that would only make sure that coverage lasts. In addition, it increases with time; thus, it creates a financial cushion that may be depended upon in the later days. The continued consistency in payment structure helps forecast long-term financial needs and gives your beneficiaries a stable financial environment. Think of it this way: John is a 40-year-old man from Montreal who opted for traditional Whole Life Insurance. The reason behind his choice was that he wanted to make a decision not only to get his insurance coverage but also to accumulate some savings for himself. Each month, his premium payment feeds into the cash value of his policy, which grows tax-deferred. Over time, the amount can grow to be quite significant, and it does provide John with further financial security as he ages.

Limited Payment Whole Life

Whole Life Limited Payment Insurance Plans are suitable for those who want to cover the payment of insurance premiums in a lesser span but still want to be sure that they get lifelong coverage. Under these plans, a 10, 20, or 30-year payment plan may be opted for. Once the payment has reached an amount enough to cover the real costs of insurance, you are the one who decides when you will receive the policy—no further premiums are due, yet your coverage continues. This option is particularly appealing because although the premiums are higher than those of traditional plans, the financial commitment is not lifelong. Consider Lisa, a freelance consultant in Winnipeg, who decided to go for a 20-year payment plan because she wanted to have retired by the time it ended. This was also an approach that helped her be in a better position to handle her cash flow and thus enabled the premiums to be paid off; thereafter, she would focus on other investment opportunities. The Whole Life Insurance Policy cash value that her policy accumulated becomes an important part of her retirement strategy, providing an available source of backup money that can be taken out through loans or withdrawals.

Single Premium Whole Life

For people who can afford the one-time lump-sum payment, one of the best things about single premium Whole Life Insurance is that you can buy the policy outright from the start and not have to pay any more premiums. That not only makes your financial planning way easier but also builds up the cash value of your insurance policy rapidly. Mark, a retired businessman from Vancouver, settled for this plan for quite a number of reasons. First of all, the single premium payment is significantly used to boost the Whole Life Insurance Policy’s cash value right from the beginning so that it enhances the borrowing potential and investment power of the policy. Secondly, the fact that it takes away concerns with the future premium payments might be of much appeal to an individual looking for simplicity and efficiency in controlling their finances upon retirement.

Now, put yourself in the shoes. You could be in the beginning stages of your career, mid-way through your professional life, or you might even be contemplating retirement. These payment options in Whole Life Insurance Plans can really impact your course of financial planning in a very big way. “Are you more of a John, building up cash value at a steady pace with level premiums, or do you relate more with Lisa, who likes paying off early and enjoying the later years without having to worry about making so many payments? Or in a similar situation to Mark’s, where he was trying to make a one-time payment to protect his financial future. These strategies have their merits and can be diversified from different life stages and financial goals. Consider these options; you may find something that makes sense to your outlook and for your family. Whole Life Insurance is more than just a policy; it’s the solid base of a well-thought-out financial plan.

Real-Life Struggles: Balancing Costs and Benefits

When choosing the ideal payment plan for your Whole Life Insurance Policy, the decision normally lies on your personal financial position and long-term financial goals. We will look at how these different people in different situations go about making these choices, all with a similar aim in mind: to make the most out of their Whole Life Insurance Policy. Their stories shed light on the practical aspects of how to balance costs with the benefits of building cash value in Whole Life Insurance Plans.

Anita: Freelance Flexibility

Situation: Anita, a freelance graphic designer from Calgary, loves the freedom her career provides but faces variable income that makes long-term financial commitments challenging.

Challenge: Needing to keep her later years free from regular financial burdens while ensuring she has a solid financial safety net.

Solution: Anita opted for a limited payment Whole Life Insurance Plan. By choosing to pay her premiums over a 20-year period, she strategically plans to have her insurance fully paid by the time she’s in her mid-50s. This approach not only fits her fluctuating income model but also ensures that her Whole Life Insurance Policy cash value continues to grow, providing her with a potential source of funds that can be accessed later on.

David: Planning for Early Retirement

Situation: David, an IT consultant in Toronto, is aiming for early retirement by the age of 50.

Challenge: David needs a financial plan that allows him to retire early without worrying about ongoing financial obligations.

Solution: David selected a Whole Life Insurance Plan with a 30-year limited payment period. This plan matches his career timeline, allowing him to finish payments while he’s still working. The policy’s cash value is an integral part of his retirement strategy, offering a buffer that will grow tax-deferred over the decades.

Maria: Securing Her Children’s Future

Situation: Maria, a single mother in Vancouver, is focused on providing for her two young children’s future, especially for their education.

Challenge: Maria needs a flexible yet secure way to save for future expenses and ensure financial security for her children, regardless of what might happen to her.

Solution: Maria chose a traditional Whole Life Insurance Plan, drawn by the dual benefits of lifetime coverage and the growing cash value. The plan’s guaranteed cash value growth means she has a built-in savings mechanism that can help fund her children’s education or serve as an inheritance.

Ethan: Combating Health Uncertainties

Situation: Ethan, a freelance writer in Halifax, recently faced a serious health diagnosis that made him reconsider his financial plans.

Challenge: Ethan needs a strategy that accommodates his potentially high medical costs and provides financial stability.

Solution: He opted for a Whole Life Insurance Policy with a limited payment term of 10 years. This accelerated payment plan is more expensive monthly but will free him from premiums quickly while ensuring that the Whole Life Insurance Policy cash value provides a financial safety net that can support medical expenses if his health deteriorates further.

Jenna: Diversifying Investment Portfolios

Situation: Jenna, an entrepreneur in Ottawa, is keen on diversifying her investment portfolio to include secure, long-term assets.

Challenge: Jenna wants to enhance her financial planning with investments that offer stability and growth without requiring ongoing attention.

Solution: Jenna invested in a single premium Whole Life Insurance Policy. By paying upfront, she locks in her coverage and immediately boosts her policy’s cash value, which complements her other investments and offers a reliable financial tool for future needs.

These stories show that life insurance isn’t a one-size-fits-all solution. Each of these individuals found a strategy that suits their unique financial landscapes and life goals. Whole Life Insurance Policies bring out the advantage of flexibility in coverage and financial planning since they allow one to select a plan of payment that is in conformity with their economic abilities and future aspirations. Now, think of your own financial position. What might be your long-term financial goals, and how is your current income or, in other words, financial planning affecting those goals? Think about that and make a decision about which of the Whole Life Insurance payment plans would be more suitable for you. Bear in mind that each decision will potentially affect your financial health and safety to a great extent. In addition to being peace offerings, these are solid cash plans for the future.

The Cash Value Advantage

Another of the huge benefits that Whole Life Insurance Policies offer is cash value accumulation. This part of the plan would serve to act as another layer of financial security and could be borrowed against or drawn upon if necessary. The cash value grows as the policy matures, giving you an option that Term Life Insurance cannot offer.

How Cash Value Works: A Real Example

Take Jamal, for example. He purchased a Whole Life Insurance Policy in his early 30s. The cash value in his policy has realized substantial growth over time and may now allow him several ways to fund his daughter’s college education or even the down payment on his first home.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

The Financial Flexibility of Whole Life Insurance

Whole Life Insurance is more than just a death benefit; it’s a strategic financial tool that offers flexibility. In the meantime, the accumulated cash value allows the policyholder to adjust and readjust their financial strategies, giving both peace of mind and financial relief when needed.

Concluding Words

Frequently Asked Questions About Whole Life Insurance Plans

Whole Life Insurance Policies are generally worth the investment for individuals looking for a long-term financial planning vehicle that includes more than just the death benefits. All these policies have a cash value that grows with the policy over time, and it may be ready to be used if one needs to cash or borrow against it. Take the case of Michael, a Toronto-based entrepreneur, who looked at his Whole Life Insurance as a critical part of his retirement planning. That guaranteed growth of the cash value and permanent protection gave him peace of mind that his financial obligations could be safe and secure, covered, and his family could be secure in whatever happened.

In Canada, generally, dividends paid on Whole Life Insurance Plans aren’t taxable as long as they remain within the policy. These dividends can be used for purchasing additional coverage, reducing future premiums, or even as cash, not part of a tax event. This makes it a good option for adding value to your insurance policy. Janet, living in Calgary, used her dividends to buy paid-up additions. The tax-free dividends and paid-up additions successfully raised both the death benefit and the cash value of the policy. She was effectively building the financial legacy for her family.

Yes, one can cash in Whole Life Insurance. This means being able to surrender the policy and receiving cash surrender value, which is a sum representing part of the Whole Life Insurance Policy cash value, less any surrender charges. One of the key points to keep in mind is the decision to cash out; it should be taken very thoughtfully since it becomes the termination of coverage. Omar is a graphic designer from Vancouver who cashed out his policy when he was urgently in need of funds for one big family emergency. While it did allow for the needed funds, it did mean that he would lose the life insurance coverage he has been very dutifully paying for quite a few years.

The determination of the amount of Whole Life Insurance one needs is strongly dependent on factors such as your financial goals, debts, income, and the financial needs of the dependents. As a rule of thumb, your coverage should be 10 to 15 times your annual income. However, this figure can greatly vary based on individual specifics. Emma is a doctor from Ottawa. She calculated that she would need coverage to provide for her kids’ future education, cover her mortgage, and contribute to family revenue, thus ensuring that her Whole Life Insurance would indeed be adequate to support the family without her.

Major types of life insurance plans include Whole Life Insurance and Term Life Insurance, which cater to majorly two different kinds of financial requirements. Whole Life Insurance allows coverage for an entire lifetime and comprises a cash value that keeps growing with time. This accumulation in cash value can be taken out in the form of loans or even withdrawn. On the other end, a Term Life Insurance policy is good for particular years, say 10, 20, or 30 years, with no cash value being added. It’s very much like renting an apartment (Term Life Insurance) versus buying a home (whole life); with whole life, you’re actually investing in a financial asset, not just the protection. Danny is a young professional from Montreal who decided to opt for Whole Life Insurance instead of Term Insurance due to his financial need for family protection and a sound investment component in his financial strategy.

One big differentiator is the cash value of a Whole Life Insurance Policy. Value accumulates and grows over time. A portion of every premium payment made is set aside in this cash account, where it grows at a guaranteed rate. It may, in a way, be considered a financial safety net through loan or withdrawal accessibility, or it may be used as a supplementary fund for retirement or other needs.

The duration for paying premiums varies with Whole Life Insurance Plans. You may either go for a conventional plan, where the payment of premiums will take place over your lifetime, thereby ensuring cover and growth in the cash value amount throughout your lifetime. Otherwise, limited plans of payment allow paying the premiums over a certain period, for example, 10, 20, or 30 years, after which no further premiums are due, yet your coverage continues.

Contact your Canada travel insurance company immediately if your parents become ill during the visit. Most companies have hotlines open 24 hours a day, seven days a week. Take the insurance information with your parents so that he or she will be able to present it at the health facilities if needed. This will streamline the treatment from their own initiative, just the way it would have helped in Alex’s case when his mother needed urgent care after falling.

Certainly, you are allowed to make cash withdrawals from the cash value of your Whole Life Insurance Policy. This is meant to give you some flexibility in case you need money before the insurance matures. For example, Peter, an artist in Saskatoon, used this feature to invest in a new studio, showing how it can be used as a financial resource when it’s needed the most.

If you allow your Whole Life Insurance Policy to lapse, you might lose coverage completely, but most policies do give a little bit of leeway: You can use the accumulated cash value temporarily to cover premium payments and thus keep the policy in effect. At this point, you should speak to your insurance advisor to fully understand your policy’s specific terms.

Yes, many types of Whole Life Insurance Policies fit various needs and preferences. It includes Traditional Whole Life, which comprises consistent coverage with fixed premiums. On the other hand, limited-payment whole life allows for one to be premium-free after a specified number of years. Single Premium Whole Life entails issuing one significant payment that is supposed to take care of the whole premium cost of the policy once. Both have benefits and drawbacks, but one may be better for you, given your financial circumstances and goals.

The cash value of a Whole Life Policy increases at a guaranteed rate the policy specifies. This growth is actually tax-deferred; you do not pay taxes on the growth while it continues to accumulate. This feature allows your cash value to increase over time, providing a reliable source of funds that you can tap into when needed. For example, Emily, a small business owner from Edmonton, used the cash value of her policy to help bridge gaps in business expenses during slower periods.

Yes, once sufficient cash value has accumulated in your Whole Life Insurance Policy, you can use it to pay premiums. This offers quite some financial flexibility when one needs it most. Take Robert, for example, who, after suddenly losing his job, used the cash value in his policy to continue coverage without interruption to his family’s financial security.

Withdrawing cash value from your Whole Life Insurance Policy can have tax implications. Withdrawals up to the basis (the amount paid in premiums) are typically tax-free, but any amount exceeding the basis may be taxed as ordinary income. This is another important point to consider, as it will affect your overall financial planning. For example, Laura in Quebec decided to withdraw some of her cash value to do renovation work at her place. She has to work out the budgeting process, keeping in mind probable taxes.

Choosing the right Whole Life Insurance Plan involves evaluating your financial goals, current financial situation, and long-term needs. Maybe this is an area where you would want to talk to a financial advisor to help evaluate your situation and suggest a plan that gives the best balance between coverage, cash value growth, and the premiums you can afford. Jordan, a young professional from Halifax, worked with an advisor to select a limited payment plan that corresponded with his goal of having the financial freedom of any heavy debt with retirement around the corner.

This is the amount that is paid out to your beneficiaries in case you should die. It equals the face value of the policy plus any accumulated cash value minus any outstanding loans that have been taken out against the policy. One key benefit from this fact is that it ensures the people who depend on you are not thrown into an insecure financial place in the event of your death. Sarah from Toronto, a mother of two, had a solace that her policy would make a provision for the educational and other future needs of the two kids even when she is not there to take care of them and hence not under any strain.

Understanding these basic features of Whole Life Insurance Policies will help you better understand the details of financial planning and empower you to make decisions that will strengthen your longer-term security with greater confidence.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA) – Comprehensive information on life insurance products available in Canada, including detailed guides on Whole Life Insurance Policies.

Website: CLHIA

Investopedia – Whole Life Insurance – An in-depth look at Whole Life Insurance, including benefits, drawbacks, and how cash values work.

Article: Whole Life Insurance Explained

Financial Consumer Agency of Canada (FCAC) – Government resources on life insurance options, helping consumers make informed decisions about financial products.

Website: FCAC

Forbes – The Value of Whole Life Insurance – An article that explores the financial value and strategic benefits of Whole Life Insurance as part of a comprehensive financial plan.

Article: What is Whole Life Insurance?

These resources provide additional context and data that can help deepen your understanding of Whole Life Insurance Policies and assist you in making a well-informed decision regarding your insurance needs and financial planning.

Key Takeaways

- Whole Life Insurance Plans offer various payment options to fit diverse financial situations and goals.

- Whole Life Insurance provides lifetime coverage, ensuring financial security for beneficiaries.

- The policy's cash value accumulates over time, can be borrowed against, and offers financial flexibility.

- Whole Life Insurance supports wealth building, retirement planning, and financial liability management.

- Starting a Whole Life Insurance Policy early often results in more favorable premiums and greater cash value growth.

- Health and age significantly influence the cost and benefits of Whole Life Insurance Policies.

Your Feedback Is Very Important To Us

We’d love to hear about your experiences with Whole Life Insurance Policies to better understand the challenges you face and how we can provide information that’s most relevant to you. Please take a few moments to fill out this questionnaire. Your responses will remain confidential and help us tailor our content to your needs.

Thank you for taking the time to provide your feedback. Your insights are invaluable in helping us address the real-world challenges people face with Whole Life Insurance Policies.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]