Do you want to know if you can actually change your beneficiaries on a Canadian Term Life Policy? With the addition of new members to the family, a change in marital status, or any other shift like personal relationships, it is essential to keep your insurance policies up to date. We will show you how and why to update your beneficiaries using real-life scenarios that our clients deal with at Canadian LIC, Canada’s premier insurance brokerage.

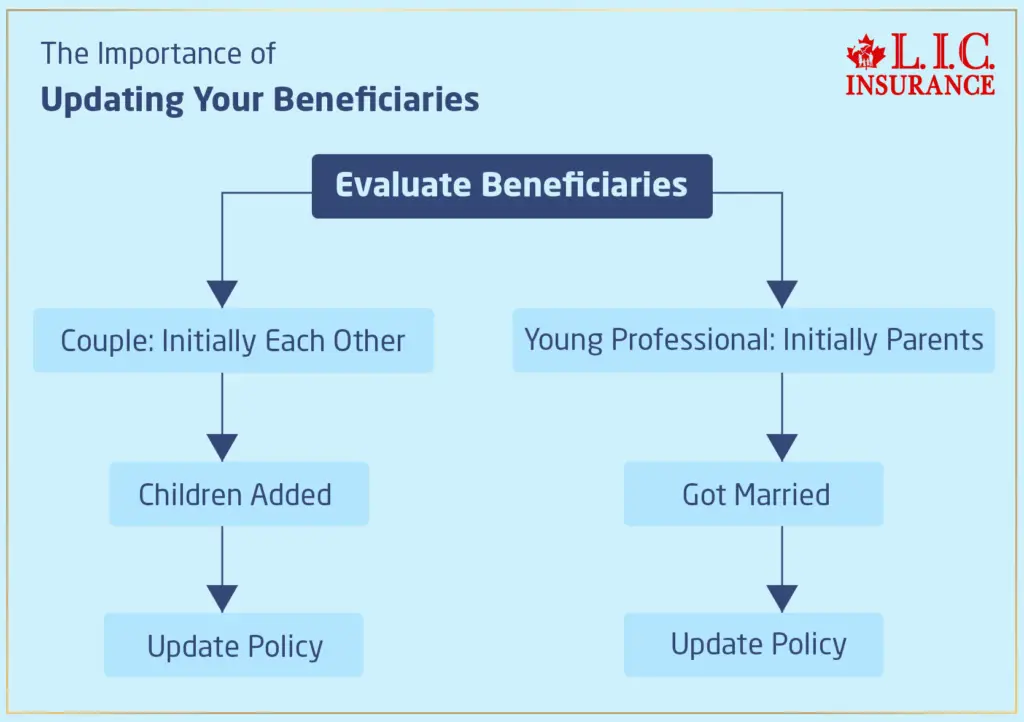

The Importance of Updating Your Beneficiaries

Beneficiary designation is one of the major considerations that must be factored into a Canadian Term Life Policy. That is, who benefits from the proceeds of such a policy in the event something happens to you? However, life is not static; it changes, and so must your insurance policy.

Imagine a couple that once named each other as sole beneficiaries, realizing the need to update their policy due to the addition of two children in the family. Consider again a young professional whose initial policy named his parents as beneficiaries but found it imperative after his marriage to update the policy and include his spouse. These are everyday stories the team at Canadian LIC encounters, illustrating that life is fluid and that Term Life Insurance Plans have to be updated to keep up with reality.

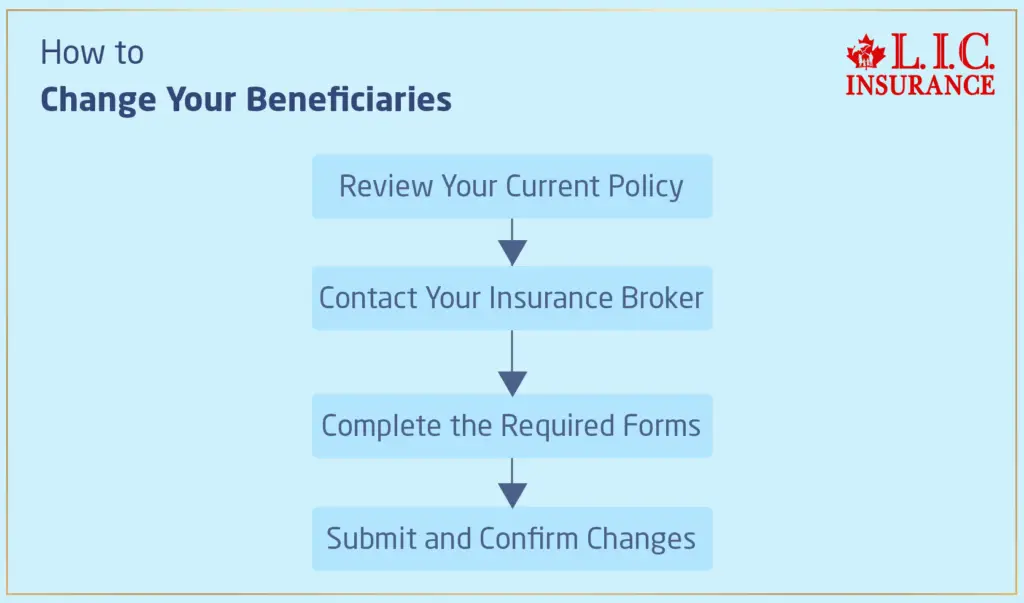

How to Change Your Beneficiaries

Changing your beneficiaries is a very simple process but one that requires thoughtful consideration:

Review Your Current Policy: Understanding who is currently named and what conditions are crucial. This initial step helps you see the big picture and decide how you want to proceed.

Contact Your Insurance Broker: At Canadian LIC, our team is ready to guide you through the process. We help you evaluate your current Term Life Insurance Plans and decide on the best course of action.

Complete the Required Forms: Changing a beneficiary typically involves filling out a form that must be submitted to the insurance company. This form will ask for information about the new beneficiary and how you want the benefits to be allocated.

Submit and Confirm Changes: Once the paperwork is in, your next step is to submit it and ensure the changes take effect. Confirmation from your insurer that the changes have been made is crucial.

Stories from Canadian LIC

The Unexpected Life Twist

Johny, a long-term client of Canadian LIC, had his life turn upside down when he unexpectedly lost his spouse. Amidst this traumatic life change, Johny had to manage practical matters, including updating his Canadian Term Life Policy. We assisted Johny through this difficult time, ensuring that the policy reflected his new reality and that his children were now listed as beneficiaries, securing their financial future.

The Happy Addition

Maria and Alex welcomed a new baby and realized the need to add their child as a beneficiary to their existing policies. Our team at Canadian LIC walked them through the process, helping them understand how these changes would protect their growing family’s future.

The Impact of Not Updating Your Policy

Keeping up-to-date beneficiaries when managing your Term Life Insurance Plans is one of the most important things you can do as your personal situation changes. Not doing so can result in unintended and often complicated consequences. Let’s explore what can happen if you don’t keep your Canadian Term Life Insurance current with regard to beneficiaries.

Legal Disputes Among Family Members

Thomas had not updated his beneficiary information after his divorce and remarriage. Upon his untimely death, both his ex-wife and current wife claimed the life insurance death benefit. This led to a prolonged legal battle that drained resources and caused significant emotional distress for the family. At Canadian LIC, we witnessed first-hand how devastating the impact of outdated beneficiary information could be on a family, emphasizing the necessity to keep this information current to prevent legal wrangling among loved ones.

Financial Hardship for Intended Beneficiaries

Emily, a client at Canadian LIC, passed away unexpectedly. She had intended to update her policy to include her two young children as beneficiaries but never completed the process. As a result, her life insurance proceeds went to her parents instead of her children, causing financial difficulties for the children’s guardians. This situation highlights why it’s critical to act promptly when changes are needed. At Canadian LIC, we encourage clients to review their Term Life Insurance Quotes and policies regularly, ensuring their plans accurately reflect their current wishes.

Benefit Claims Denied Due to Outdated Information

Mario still needed to update his beneficiary designation to reflect his current marital status, leaving his ex-partner as the sole beneficiary. After Mario’s sudden death, his current partner attempted to claim the death benefit but was denied because the policy listed the ex-partner who had no ongoing financial interest. This case at Canadian LIC underscores the importance of updating your policy to avoid potential disputes and ensure that the life insurance benefits go to those you currently wish to support.

Unintended Tax Consequences

Jennifer, a client with Canadian LIC, updated her will but not her Canadian Term Life Policy. The inconsistency between her will and insurance policy led to complex tax issues for the beneficiaries, as different rules applied to assets passed via will and through direct beneficiary designations. This misalignment not only complicated the estate process but also resulted in unexpected tax liabilities for her heirs. Our team at Canadian LIC advises all clients to align all estate documents with their insurance policies to avoid such tax complications.

Missed Opportunities for More Suitable Beneficiary Options

Alex had a policy from his younger days that designated his brother as the beneficiary. Years later, his life circumstances had changed significantly, with a spouse and children to consider. Unfortunately, Alex neglected to update his policy before he was incapacitated by illness, leaving his immediate family vulnerable. This experience taught us at Canadian LIC the critical lesson that keeping your policy up-to-date ensures that the right people benefit, reflecting your current familial and financial situation.

These very stories from Canadian LIC underline the potential pitfalls of not updating your Term Life Insurance beneficiaries, but they also serve as examples of peace of mind by keeping your insurance plans aligned with your life. Canadian LIC is here to help guide you through this with individually catered Term Life Insurance Quotes and advice on the best Term Life Insurance Plans for your unique situation.

Getting your beneficiary information updated is not some formality; it is for financial wellness and a continuous process. Let not any single bad mistake make life difficult for your loved one. Reach out to us at Canadian LIC. Our experience is your peace of mind. Let us ensure that your Canadian Term Life Policy works for you today and in the future. However, life may change.

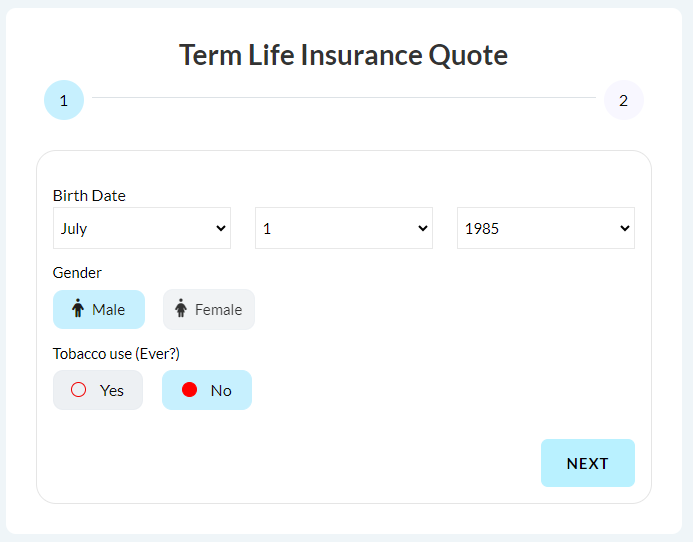

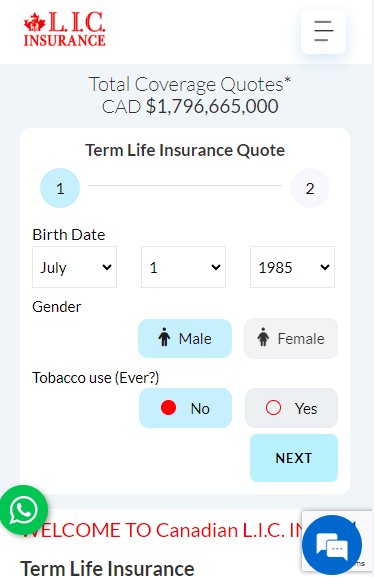

Getting Term Life Insurance Quotes

When updating your policy, which includes updating or adding beneficiaries, it may be a good time to review the actual policy. Is it still suitable for you? Canadian LIC can provide competitive Term Life Insurance Quotes to help you decide whether you need to adjust not just your beneficiary but your level of coverage as well.

Why Choose Canadian LIC?

Where you manage your Term Life Insurance Plans is just as important as the particulars of the policy. At Canadian LIC, we pride ourselves on knowing our clients individually so that we can afford personalized advice and solutions. Our approach in this regard will ensure that your Term Life Insurance reflects your correct circumstances at present for peace of mind, knowing that your loved ones are cared for in the best possible way.

The Ending Note

Life is full of surprises, and while we cannot predict events in advance, there are certain things we can and should prepare for. Preparing for life changes is in our hands. Refreshing your Canadian Term Life Policy for accuracy regarding current beneficiaries is not just a piece of paperwork; it is a significant step in the process of securing your family’s future. At Canadian LIC, we make this process straightforward and stress-free so you can adjust your coverage whenever life changes.

Do not wait until the unexpected happens to take serious care of the current Term Life Insurance Plans sent to you. Please get in touch with Canadian LIC today to discuss any changes so that it meets your living conditions today. Allow us to help secure the future, no matter what it holds, making the process easy and your coverage robust. Choose Canadian LIC—the best insurance brokerage in Canada—for all your Term Life Insurance needs, and take the step today to protect tomorrow.

More on Term Life Insurance

What’s The Longest Term Life Insurance You Can Get?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Updating Beneficiaries for Canadian Term Life Insurance

Dealing with the world of Canadian Term Life Insurance can often raise questions, especially when dealing with updating policy details such as beneficiaries. At Canadian LIC, we have put together some of our most frequently asked questions, along with real-life examples of times we’ve dealt with these scenarios in the past, so you can better understand why it is important to keep your insurance policy up to date.

We would encourage our clients to review their beneficiaries at least once every two years or upon any major life changes like the death of a spouse, divorce, marriage, or birth of a child. At Canadian LIC, we had a client, Michael, who learned about the importance of regular reviews the hard way in the middle of a family dispute over his father’s unchanged policy, which still listed the ex-spouse as the beneficiary. Regular reviews will help avoid such conflicts and ensure that your policy still reflects your current wishes.

In order to change a beneficiary, a ‘Change of Beneficiary’ form must be filled out. This can usually be obtained from an insurance provider and most often includes the full name and relationship to you; sometimes, the address and social security number of a new beneficiary are needed. Now, one client of Canadian LIC was in a position to do so pretty fast when she managed to get all the information needed, thus showing how much power preparation carries.

Yes, you can name multiple beneficiaries for your Term Life Insurance Plan. You can also specify what percent of the death benefit each beneficiary will receive. We helped a client, Jacob, who wanted to provide for his wife and children from a previous marriage by showing him how to allocate specific percentages to each of his beneficiaries.

If a beneficiary is a minor, the life insurance proceeds will typically be managed by a trustee until the minor reaches the age of majority. Canadian LIC helped a client, Emma, set up a trust to ensure that her young children would be financially supported in a way that aligned with her wishes in case she passed away before they became adults.

Most life insurance policies do not charge to update the beneficiary. However, it is best to confirm with your insurance provider. Our team at Canadian LIC reassured clients like Tom—who was worried about its potential costs—that this could be updated without charge.

You can get quotes for Term Life Insurance by contacting the life insurance companies directly or through web-based services comparing plans of various insurance companies. At Canadian LIC, we provide personalized quotes that consider your specific needs and circumstances, helping clients like Linda find the best Term Life Insurance Plans that fit their budget and coverage requirements.

You can change the beneficiaries in a Term Life Insurance anytime and to whomever you would like, without their knowledge or even consent. It is always best to inform your beneficiaries regarding the policy details so that in the case of death, they know exactly how and where to claim the death benefit. Just like our client Derek, who found out the hard way. His relatives were unaware that they were beneficiaries; hence, it caused a delay in claiming insurance proceeds.

Adding a charity as a beneficiary to your Canadian Term Life Policy is a generous way to leave a legacy. When updating the beneficiaries, you only have to provide the legal name of the charity along with its contact information. We helped a lady named Rachel, one of our clients from Canada LIC, to donate money to a charity close to her heart and ensured she did it effectively.

Yes, you can and should; your Term Life Insurance Plan requires that you indicate a contingent beneficiary to ensure the death benefit always goes according to your wishes if the principal beneficiary cannot claim. For example, when Canadian LIC’s client Patricia was diagnosed with a terminal illness, she changed her policy to name her brother as the contingent beneficiary; her husband was already named as the primary beneficiary. That foresight preserved her financial wishes under unforeseen circumstances.

You’ll be asked for their full legal name, your relationship with them, your date of birth, and, in some cases, the beneficiary’s Social Insurance Number or address. We recently helped someone named James update his beneficiary after his daughter changed her last name to married. Correct and up-to-date information can smooth things out and ensure accuracy for his Canadian Canadian Term Life Policy.

Beneficiary alterations in Canadian Term Life Policies are usually processed on short notice after the company has received all necessary documents. At Canadian LIC, such beneficiary changes are updated within a few days of business. For example, Seema recently wanted to change her beneficiary urgently because of a family emergency. We expedited the entire process, and so her policy was updated in no time.

No, changing your beneficiary has no effect on premiums. Actually, the premiums are based on age, health, sum insured, and term length, not on the persons that make up your beneficiaries. This was a major relief for our client, Kevin, who was concerned that adding his grandchildren would increase his costs. Again, we reassured him that only coverage adjustments or changed health would do so in his Term Life Insurance Quotes.

In case your intended beneficiary has special needs, careful planning is very important. You would not want the act of receiving a death benefit to affect their eligibility for other benefits or assistance. More than a few of our clients, for example, Lisa from Canadian LIC, set up a trust or consulted a lawyer to ensure the management of benefits in such a way that it works best to serve the long-term interest of the beneficiary without any unintended consequence.

Failing to update your beneficiaries can lead to legal disputes among surviving family members, unintended recipients of the death benefit, and potential challenges to the estate. One of our clients, Michael, experienced a contentious legal battle among his children because he had not updated his beneficiary designations after remarrying. This serves as a stark reminder of the need to keep all aspects of your Canadian Term Life Insurance up to date.

Once you submit the change form, your insurance company should confirm this change form in writing. In the case of Canadian LIC, we see to it that our clients get a letter or an email for confirmation regarding updating their Term Life Insurance Plans. We have helped a client, Rachel, track her beneficiary change status since she never got confirmation because of an email error, thus emphasizing follow-up.

If there is no beneficiary named, or if all the named beneficiaries are deceased, then the death benefit would normally become part of your estate, and the money would be distributed according to your will or in accordance with provincial laws. This added a complication that client George did not expect: his only named beneficiary predeceased him, and he hadn’t named an alternate. We helped his family navigate the estate process, which delayed access to the funds during a time of need.

In Canada, life insurance beneficiary rules specify that the policyholder can designate one or more beneficiaries to receive the death benefit, with specific legal requirements around beneficiary designations, including insurability and rights to the benefit.

The following FAQs and scenarios from Canadian LIC should hopefully provide you with higher confidence and a clear understanding of your Term Life Insurance Plans. Updating your policy on a regular basis is required so that your insurance coverage is up to date with your life situation and your loved ones or beneficiaries get the protection you desire.

Sources and Further Reading

Here are some sources and further reading materials that can provide additional insights into managing Canadian Term Life Policies in Canada, including changing beneficiaries and understanding insurance terms:

Insurance Bureau of Canada – Provides comprehensive resources on different types of life insurance and tips for policy management.

Website: Insurance Bureau of Canada

Financial Consumer Agency of Canada – Offers detailed guidance on life insurance products, including rights and responsibilities of policyholders.

Website: Financial Consumer Agency of Canada

Canadian Life and Health Insurance Association – A repository of information on life insurance policies in Canada, including how to choose beneficiaries and make changes to your policy.

Website: CLHIA – Canadian Life and Health Insurance Association

Advocis, The Financial Advisors Association of Canada – Provides articles and professional advice on managing life insurance, including considerations for choosing and changing beneficiaries.

Website: Advocis

Investopedia: Life Insurance – Offers a range of articles explaining the basics of life insurance, including Canadian Term Life Policies and beneficiary management.

Website: Investopedia – Life Insurance

These resources can help deepen your understanding of Canadian Term Life Insurance and assist in making informed decisions about your policy.

Key Takeaways

- Life changes like marriage or childbirth require updating your Term Life Insurance beneficiaries.

- Changing beneficiaries involves filling out a form from your insurance company, typically at no cost.

- Not updating beneficiaries can lead to legal disputes and unintended financial consequences.

- For complex situations, consulting with legal or financial professionals is advisable.

- Always ensure that changes to your policy are confirmed by your insurance provider.

- You can name multiple primary and contingent beneficiaries to ensure precise distribution of benefits.

- Regularly review your Canadian Term Life Policy, especially after major life events, to keep it current.

Your Feedback Is Very Important To Us

Thank you for taking the time to complete our questionnaire. Your feedback is crucial in helping us understand and improve the process of changing beneficiaries on Canadian Term Life Policies.

Thank you for sharing your experiences and suggestions! Your input is invaluable in helping us enhance our services and ensure that our processes meet your needs.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]