Have you ever wondered if your child would have a safe future? Children’s Life Insurance is one way to protect your finances, but you may not be clear on the benefits and what this child Life Insurance policy entails for your child’s future. Many parents and guardians have to deal with this at some point when they are trying to figure out insurance.

Most of them then talk about how different things in life caught them off guard. Like Maria, who lives in Toronto and is a single mother. In every situation, Maria always tried to make sure that her daughter Sophia had some money saved up. However the many choices and rules that came with insurance were too much for her. She knew what Whole Life Insurance was, but she wasn’t sure how it could help someone so young like Sophia.

It can be hard to tell if getting Whole Life Insurance for your child in Canada is a good idea. Hence, this blog seeks to clarify that. The first thing we’ll talk about is what Whole Life Insurance is, what its benefits are, and how much Life Insurance is if you decide to buy Life Insurance each month. What else are we going to find out? How might this policy help protect your child’s future? Let’s discuss securing a bright and secure future for your children and how Canadian LIC can be of help in such a noble cause to purchase Life Insurance.

Whole Life Insurance Explained

Permanent Life Insurance includes Whole Life Insurance, whereby the insured person is basically guaranteed insurance cover for their entire life as long as regular payments are continued.

Whole Life Insurance is a type of permanent life insurance designed to provide lifelong protection. This means that once the policy is active, the insurance coverage continues until the death of the insured, regardless of age or health changes—so long as the premiums are paid on time. It removes the worry of outliving the policy, which is a concern with term life plans. This lifetime guarantee of coverage offers peace of mind to policyholders and their families, especially when planning for long-term financial security.

Unlike Term Life Insurance, which covers one for only a term or a particular period, Whole Life Insurance has an investment feature whereby the cash value accrues over some time.

Term Life Insurance provides protection for a fixed number of years—typically 10, 20, or 30 years—and pays out only if the insured passes away within that period. In contrast, Whole Life Insurance not only guarantees lifelong coverage but also includes a built-in savings component known as cash value. Over time, part of the premium you pay is set aside and invested by the insurance company. This accumulated amount grows steadily and safely, offering an extra layer of financial benefit on top of the death benefit.

This cash value can be a significant advantage as it grows tax-deferred and can be borrowed against if needed.

One of the key advantages of Whole Life Insurance is that the cash value grows on a tax-deferred basis, meaning you won’t pay taxes on the growth as long as it stays within the policy. Over the years, this can lead to substantial accumulation. Additionally, the cash value serves as a financial resource that you can borrow against, usually at a lower interest rate compared to traditional loans. Whether it’s funding your child’s education, managing emergencies, or supplementing retirement income, this feature gives you financial flexibility while keeping your life insurance coverage intact.

Why Consider Whole Life Insurance for Your Child?

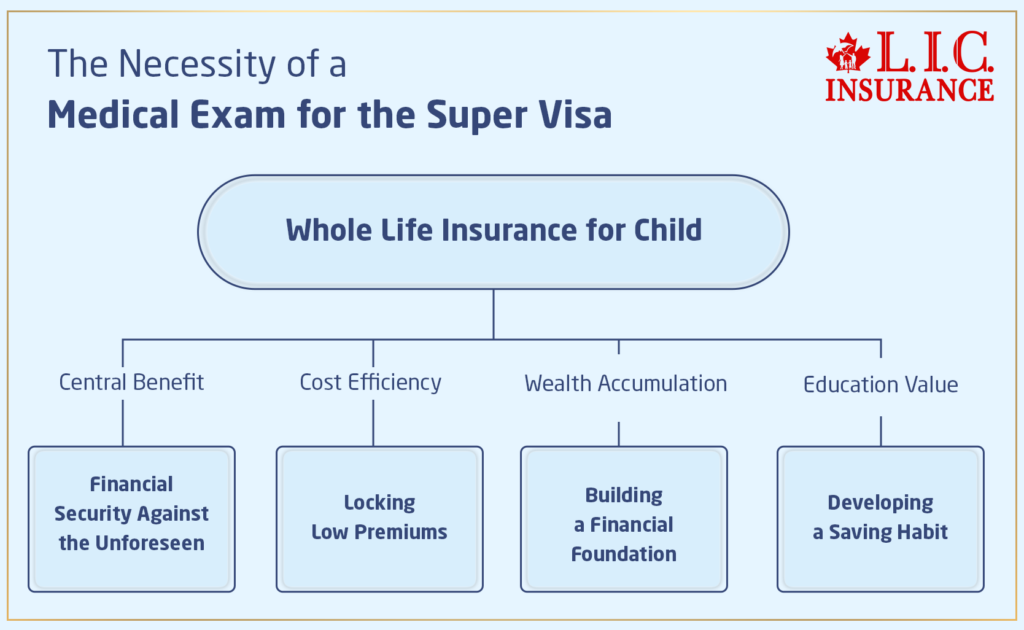

Financial Security Against the Unforeseen

Financial security is the reason for having Life Insurance, and Whole Life Insurance doesn’t differ here. Imagine that an entire family has to deal with some unexpected hardships. This is the case for one of our clients from Edmonton, James, who lost his brother unexpectedly. His brother had a Whole Life Insurance Policy, which became a financial safety net for his children.

Buying Life Insurance for your child shall ensure that, if something tragic befalls the child in the near future, then his or her financial needs can be taken care of well—exactly as it happened for James’s nieces.

Locking in Low Premiums

Not surprisingly, as you age, all of your bills tend to go up. Interestingly, Life Insurance policies and whole life don’t increase in cost on a monthly basis when insuring a child. As seen to be less of a risk, the children receive a lower premium. These rates are locked in, remaining constant as your child matures, offering significant savings over time.

In Mississauga, Anita bought Whole Life Insurance for her 15-year-old son for what seemed like a very small amount of money. She paid for it over several months. This has been a very smart and cost-effective choice over the years, as everything has stayed the same.

Building a Financial Foundation

That’s because the cash value accumulating on Whole Life Insurance Policies is more than just a figure on paper; it is financial security for your child. This cash value grows tax-deferred over the life of the policy and can be borrowed against when your child might need it for major life events, such as funding for higher education, a down payment on a first home, or even seeding their startup capital.

Consider that Rahul in Vancouver is using the cash value from his whole-life policy to help start his very own tech company—a venture that likely would have been out of reach without that critical opening-stage infusion.

Developing a Savings Habit

These basic facts, if introduced from the earliest, would guide an individual to be financially responsible and literate when one gets into adulthood. A Whole Life Insurance does more than insure; it teaches. It truly serves as a tool to teach your child the core of savings and planning for the future.

The features of a Whole Life Policy are just what Lisa in Calgary started to talk to her daughter about from the age of twelve. This early education helped her daughter value the money and understand how much security a financial plan brings.

By choosing to take up a Whole Life Insurance Policy for your child, not only will you be securing them, but you will also be teaching your child life lessons worth learning. Every premium paid is a contribution to their current protection and, at the same time, to their future security and independence.

It is an investment that educates fiscal responsibility. And doesn’t it feel comforting that with that decision, you are putting your child on the road to lifetime financial prudence?

Investing in your child’s future is a profound step. Essentially, Whole Life Insurance Coverage is more than just an assurance; it presents a proactive strategy for preparing your child for them to emerge as the financially stable and responsible adult that they should become.

So, why not take this step today? Start a conversation with an advisor on how getting Whole Life Insurance Policies now comes with significant benefits for your child’s tomorrow. So, secure their future—one smart choice at a time.

The Story of Amir and His Whole Life Insurance Decision

Imagine being first-time parents of twins. The joy that overpowers the heart at the twin additions to life is unimaginable, and so is the huge sense of responsibility that makes one feel daunted. That is exactly what Amir, our client, the dad from Vancouver, was feeling. The arrival of twin daughters threw up a fundamental question: how to secure their financial future? Like any other parent, Amir too looked forward to making investments for his children’s future. However, he was not very clear on how he should go about doing this.

But it wasn’t until his daughters were born that Amir started looking for opportunities for investment. He talked to other parents, read a number of articles, and even attended seminars. Along the way, he figured out that, indeed, the most critical thing would be securing a future of economic security for his children.

This is a concern many of you might also have. How do you choose the right option that offers both security and growth? Amir does some of his own research to determine if a Whole Life Insurance Policy would be right for him. He gets advice from many financial advisors on making a sound decision when it comes to a Whole Life Insurance Policy.

He was advised that Whole Life Insurance Policies is different from Term Life Insurance in the sense that Whole Life Insurance Policies would cover the daughters for the whole of their life and not for any fixed term. This, coupled with the investment element of the whole life policies building up cash value over time, did seem a good footing for financial planning.

But the major consideration was the Whole Life Insurance Monthly Cost. Whole Life Policy monthly premiums, considering also the cash value, are normally more expensive than Term Life Policy monthly premiums because Whole Life Insurance Policyholders pay until life is lost. Amir had to do the math, look at his budget, and weigh this against potential future benefits. That was really a hard decision, more so considering the long-term financial commitment that would be involved.

Many of you might be in Amir’s shoes, wondering if the higher premiums are justifiable. Thus reasoned Amir: This may cost more on a monthly basis, but the price is fixed and will not rise with his daughters’ age, despite prospective increases in premiums for new insurance owing to age or health difficulties. By locking in the cost now, he could avoid higher premiums later in their life.

Plus, Amir saw this choice as a way to learn, and he did it by getting Whole Life Insurance Coverage. This is in such a way that through such an arrangement, he could instill financial planning for his daughters right from their formative years. They would grow up knowing that they have some sort of a financial cushion if they do need it for college education or to get their first house. It is also possible to borrow against this cash value if there are times of financial hardship.

He bought a whole-Life Insurance policy that would cover both of his daughters. He took it as dual benefit: first, he had secured his daughters’ future, and second, he was making them money-wise. His decision to take Whole Life Insurance Coverage brought peace of mind since if he died, his earnings may have died with him, but the insurance would leave a sufficient sum for his daughters, which would enable them to have a secure future.

So, the question for you guys is: do you all really need something that can secure your children’s future while they can also learn a good financial lesson? If it is so, then definitely go for this Whole Life Insurance. Although the monthly cost would be more in the beginning, the benefits of it are attractive. You can provide them with a financial security blanket that grows and matures with them, getting them ready for anything in life, as Amir’s dad did for his daughters.

How to Choose the Right Whole Life Insurance Policy

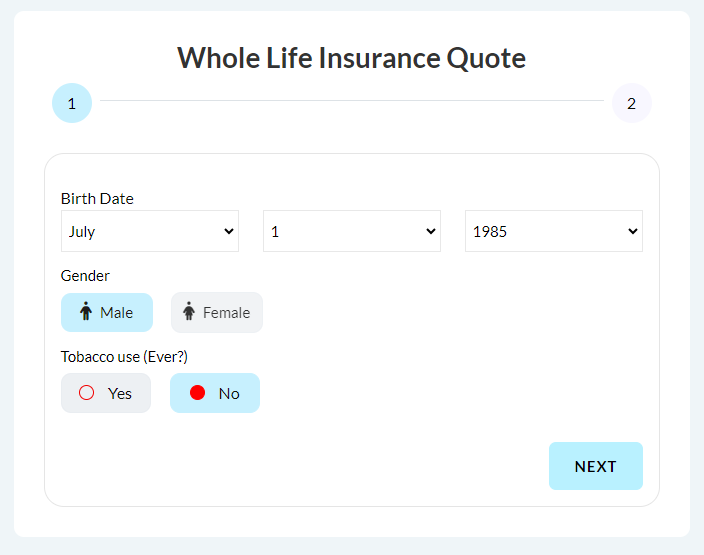

- Coverage Needs: This is to estimate the amount of coverage based on the future needs of the children in terms of educational expenses and startup money at early adulthood period.

- Whole Life Cost per Month: It is necessary to understand what expenses this monthly Whole Life Insurance Policies cover. The required monthly premiums have to be sufficient to cover the holder’s lifetime and still allow the holder to comfortably take care of other financial obligations.

- Insurance Provider: Always go for a reliable provider with a good track record. You may go for, say, Canadian LIC, which is very good in dealing with customers and offers a wide range of coverages to choose from.

- Policy Features: Check for the extra benefits and the riders, making it a more worthwhile policy, such as waiver of premium in case of disability by the holder.

Find Out: Is Whole Life Insurance expensive?

Conclusion: Why Act Now?

Whole Life Insurance Policies purchased for a child is buying not only a good financial future but, in return, peace of mind for the parent. With the insights shared in this blog, you have the best judgment to make an informed decision which will benefit your child in the years to come.

We strongly advise you not to procrastinate over this vital decision of your children’s Life Insurance policies. The advantages of Whole Life Insurance, such as low premiums and financial security, are literally reaped if taken since birth. Canadian LIC is with you, walking along all these steps of this vital financial journey.

Contact us today on 1 416 543 9000 to ensure your children’s future is as promising as you imagine it. Do it now; secure your child’s future financially with the top insurance brokerage in Canada—Canadian LIC.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions(FAQ's) About Whole Life Insurance for Children

A Whole Life Insurance Policy is a form of Permanent Life Insurance, which keeps the insured for all his or her life, subject to premiums being paid on schedule. However, contrary to a Term Life Insurance Policy with an expiry date, Whole Life Insurance caters to an investment component that can also be cashed out. There is cash at the disposal of the holder to be used during their lifetime under conditions.

Yes, you can get whole life insurance for your child in Canada. Many parents choose this to lock in low premiums and build lifelong financial security. It also creates a cash value that can be accessed later in life.

Before buying whole life insurance for a child, check the policy’s cash value growth, premium payment options, and the ability to transfer ownership when your child becomes an adult. It’s a long-term decision, so compare plans carefully.

To choose the best whole life insurance policy for a child in Canada, look at factors like guaranteed cash value, dividend potential, policy flexibility, and the company’s reputation. Consult with a trusted insurance advisor to compare top providers.

Parents often buy whole life insurance for their children to secure lifelong coverage, build savings, and ensure their child is insurable even if health issues arise later. It’s also a gift of future financial flexibility.

You can buy whole life insurance through licensed insurance advisors, brokers, or directly from insurance companies. Online platforms now also make it easier to compare and buy whole life insurance with child-focused options.

The monthly fee for Whole Life Insurance for a child could vary with several underlying aspects, including the amount of coverage, the health of the child, and the provider you choose. Normally, the premium for children is also lower than that for adults, as the risk is relatively low for young and healthy people.

The case with a family, for example, is when parents decide to buy Whole Life Insurance for a newborn. They can opt to pay a level premium, approximately 50 dollars a month, a rate that never increases for the life of the child, thus avoiding the burden of not only age but possibly high premium hikes related to health in the future.

Yes, Whole Life Insurance does allow for the accumulation of cash value, and it may do so prior to a child reaching the age of 18, but it almost always requires the permission of the holder, who would be the parent. This cash can be borrowed against or withdrawn for various needs, such as funding educational expenses or another large investment for child development. This feature carries out the required flexibility in Whole Life Insurance, making it a dynamic tool for long-term financial planning.

In such an eventuality, where you are not able to meet the premiums, various choices abound according to the terms of your policy. Such a policy may allow you to use the cash value you have been collecting to pay for the outstanding premiums on a temporary basis while at the same time covering your duties.

Alternatively, one can reduce the amount of coverage to a level where the premiums that will be payable are affordable. The most important thing is to have such discussions with your insurance advisor to understand the right steps that do not make the policy’s benefits fly away.

In such an eventuality, where you are not able to meet the premiums, various choices abound according to the terms of your policy. Such a policy may allow you to use the cash value you have been collecting to pay for the outstanding premiums on a temporary basis while at the same time covering your duties.

Alternatively, one can reduce the amount of coverage to a level where the premiums that will be payable are affordable. The most important thing is always to have such discussions with your insurance advisor to understand the right steps that do not make the policy’s benefits fly away.

There are good reasons to begin early with a Whole Life Insurance Policy for your child. Premiums are very low, as children are in excellent health, and these are on top of having a rate lock for life. It further has the aspect of the policy being held for an extended period. Hence, cash value has more time to grow. Starting now maximizes the investment benefit and ensures that your child stands a better chance when it comes to financial security in the future, as many smart parents have done.

One of the appealing aspects of Whole Life Insurance is its tax benefits. The cash value in Whole Life Insurance is, as a matter of fact, tax-deferred: the person is not supposed to pay taxes on the growth as long as the money sits inside the policy.

Additionally, the death benefit paid out from the policy is generally tax-free to the beneficiary. This makes it an appealing choice to parents, such as Lisa from Montreal, who was looking at getting the full benefits of her financial support to her son, not being burdened with taxes.

Whole Life Insurance has a guaranteed cash value growth rate provided by the insurance company. Some even earn dividends that could either buy extra coverage, reduce future premiums, or, in some cases, pay cash to the policy owner. Making it a valuable resource; this is considered compound growth.

Take, for example, the case of John, who is an Edmonton dad. He bought a policy for his daughter and used the dividends to pay for his first year at university. Again, this example brings home the realistic applications of these whole-life policies.

Yes, you can always buy Whole Life Insurance for your child, whether he has health issues or not. The only thing is that it might affect the monthly Whole Life Insurance cost or the terms of the Whole Life Insurance Policy. The insurer will require medical examinations or detailed health information on your child before he/she is issued with the policy. It’s worth taking your time to look around and talk to a number of Life Insurance companies so that you can get the best policy for your child.

Parents in Halifax, like Shah, who has two young boys, one of whom has severe asthma, will sometimes be able to find the right insurance for their asthmatic child with insurers who will take into account the child’s health conditions.

First, before considering this policy for the child, it is good to consider the extent of coverage, premiums, and stability and reputation of the company, including any additional benefits like riders that could play a vital role in the future of the child. Look out for the policy features where the premium is waived off and can be raised to the fullest sum assured without any more medical examination.

Jane of Surrey has gone for a policy with a built-in education fund rider that provides her peace of mind for securing her family.

It is always a good practice to review your child’s Whole Life Insurance Policy from time to time, especially when some major life events have taken place, like improving or changing your financial situation, or your child getting to a landmark age.

This will be, in turn, instrumental in ensuring that the coverage is still adequate and able to optimize the investment portion of the policy. One way to think about it is like making regular checks on a long-term investment. For example, Simon from Quebec changes his approach as his children get older and their needs change.

We hope that this has cleared up some of the questions you may have had when considering purchasing Life Insurance for your child. If you have more questions or would like advice tailored to your situation, consider speaking with a financial adviser who can guide you based on your family’s specific needs.

Sources and Further Reading

To deepen your understanding of Whole Life Insurance for children in Canada, and to help you make informed decisions, here are some recommended sources and further reading options. These resources offer comprehensive insights into Life Insurance policies, their benefits, and considerations.

Books

“Personal Finance For Canadians For Dummies” by Eric Tyson and Tony Martin

A great starting point for anyone new to personal finance in Canada. This book covers a range of topics including insurance policies and provides practical advice for managing your financial life.

“The Insurance Maze: How You Can Save Money on Insurance and Still Get the Coverage You Need” by Kimberly Lankford

This book offers valuable insights into navigating the complex world of insurance, helping you understand how to choose the best policies, including Life Insurance, for your family’s needs.

Online Resources

Canadian Life and Health Insurance Association (CLHIA) – www.clhia.ca

The CLHIA website provides detailed information about Life Insurance products available in Canada, including Whole Life Insurance. It also offers guides and publications that can help clarify insurance terms and benefits.

Insurance Bureau of Canada (IBC) – www.ibc.ca

This site is a valuable resource for information on all types of insurance available in Canada, including detailed sections on Life Insurance. It also provides tips on choosing the right policy and how to file claims effectively.

Articles

“Understanding Whole Life Insurance” – Investopedia

This article provides a detailed breakdown of Whole Life Insurance, explaining the core concepts, benefits, and considerations that come with this type of policy.

“Why Whole Life Insurance Works Well for Kids” – Forbes

A comprehensive look at the reasons parents might consider Whole Life Insurance for their children, discussing long-term benefits and strategic financial planning.

Blogs and Forums

RedFlagDeals Forums – Insurance Section – www.redflagdeals.com

A Canadian forum where real users share their experiences and advice on insurance matters, including discussions about Whole Life Insurance Policies for children.

Moneysense – www.moneysense.ca

A Canadian personal finance website that regularly publishes articles on insurance, investments, and savings plans, which can be beneficial for understanding how Whole Life Insurance fits into a broader financial strategy.

These resources provide a solid foundation for understanding the complex world of insurance and will help you make informed decisions about securing a Whole Life Insurance Policy for your child in Canada. Whether you’re reading expert-written books, browsing through regulatory information, or engaging with community discussions, you’re taking important steps toward ensuring financial security and peace of mind for your family’s future.

Thank you for taking the time to provide your feedback. Your responses will help us better understand the needs and challenges parents face, and how we can better support those considering Whole Life Insurance for their children.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]