- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

What Will Disqualify You From Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 20th, 2024

SUMMARY

The blog discusses factors that can disqualify you from Term Life Insurance in Canada, including severe medical conditions, risky lifestyles, non-disclosure, high-risk jobs, and financial instability. It highlights the importance of honesty during applications and how Term Life Insurance Brokers can help find solutions. Tips for overcoming challenges and comparing Term Life Insurance Quotes Online are also shared to help applicants secure coverage.

Introduction

The process of securing the future of your loved ones through a Term Life Insurance Policy should be simplified and smooth. However, for many people, acquiring Term Life Insurance in Canada can be overwhelming, especially when they hit unexpected walls that disqualify them from coverage. Whether the cause is a past medical condition, a lifestyle decision, or even miscommunication on the Term Life Insurance application, the effort to qualify is very real.

We at Canadian LIC—The Best Insurance Brokerage have witnessed many clients who were left disappointed because they could have enhanced their possibilities with proper preparation. It is through understanding what will disqualify you that you avoid such pitfalls and move forward confidently.

Let’s discuss what may disqualify you from Term Life Insurance and how you can still find solutions with trusted Term Life Insurance Brokers by your side.

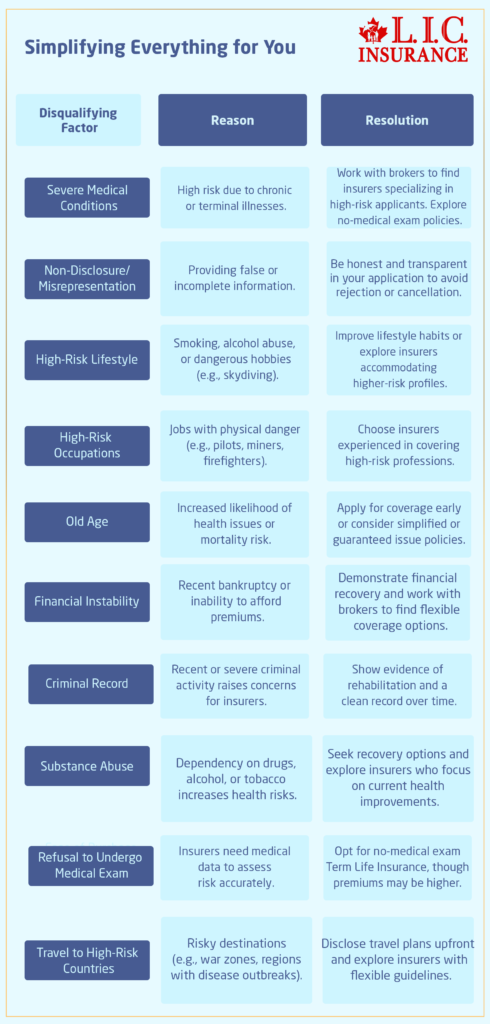

Medical Conditions That Pose a Risk

Health is the most important determinant when it comes to eligibility for Term Life Insurance in Canada. The insurance companies measure your risk level based on medical history, and there are some conditions that would disqualify you.

Conditions That Raise Red Flags:

- Cancer or Terminal Illnesses: You could be under treatment for cancer or suffering from a terminal disease, and it might not be easy to get insurance coverage.

- Heart Diseases: A history of heart attacks, strokes, or serious cardiovascular conditions may be a concern.

- Chronic Illnesses: Certain conditions like advanced diabetes, liver disease, or kidney failure can also disqualify you.

- Mental Health Disorders: Some illnesses, such as advanced diabetes, liver diseases, and severe kidney failure, may disqualify a candidate.

At Canadian LIC, we meet many clients who believe that past illness automatically disqualifies them from insurance. Some serious medical conditions will bar you, but most insurance companies will have options for cases that pose manageable risks. A good Term Life Insurance broker can help you find an insurer who will look out for your specific needs.

Non-Disclosure or Misrepresentation

Honesty is very important when filling out your insurance application. If you miss out on important details or provide false information, insurers can reject your application straight away or cancel your policy later on.

Common Misrepresentation Areas:

- Health History: Not disclosing past surgeries, illnesses, or chronic conditions.

- Lifestyle: Failing to report smoking, alcohol consumption, or drug use.

- Occupation Risks: Hiding that you work in high-risk professions like mining, construction, or aviation.

- Travel Plans: Avoid mentioning extended trips to high-risk regions.

For instance, we once had a client who refused to declare his smoking status. When the insurer verifies the health record, they end up disqualifying the application. Small failures such as these can eventually disqualify an individual; hence, it is advisable to be candid. As long as you get reliable Term Life Insurance Brokers, mistakes of this kind will always be avoided, and your true profile will reflect in your application.

High-Risk Lifestyles and Occupations

Lifestyle and occupation are the determinants of eligibility for Term Life Insurance. Risks-carrying activities are a danger to the life expectancy of the person, and insurers would be worried about that.

Risky Lifestyle Factors:

- Dangerous Hobbies: Activities such as skydiving, rock climbing, and scuba diving may affect your approval.

- Substance Abuse: Excessive alcohol use, drug abuse, or prescription medication addiction.

- Smoking or Vaping: Tobacco and nicotine use raise your premium rates and, in extreme cases, disqualify you.

Risky Professions That May Disqualify You:

- Commercial pilots

- Deep-sea divers

- Firefighters

- Loggers and miners

At Canadian LIC, we have helped clients in dangerous professions find Life Insurance Coverage options. It is possible to get coverage tailored to your profession and hobbies by finding the right insurers who specialize in such categories.

Old Age or Poor Health in Senior Applicants

Age is another critical factor in Canada’s application for Term Life Insurance. A lot of people people in their 20s and 30s can easily qualify for a Term Life Insurance Policy. Older applicants, however, find it challenging because health is a concern.

Why Age Can Disqualify You:

- Increased Risk of Illness: Insurers assume older individuals are more likely to develop chronic illnesses.

- Higher Mortality Risk: Life expectancy decreases with age, making insurers wary of offering long-term policies.

For seniors, Canadian LIC will come up with alternative Term Life Investments, such as guaranteed-issue policies. These are generally easy to qualify for, though they have slightly higher premiums compared to other policies.

Poor Financial Stability and Bankruptcy

Your financial status also determines if you qualify for Term Life Insurance in Canada. Insurance companies assess your income and debt to ensure that they can make regular monthly payments.

Key Disqualifiers:

- Unstable Income: If you cannot show stable income, then the insurer can deny coverage.

- Bankruptcy: Recent bankruptcy, especially within the past two years, raises concerns about your ability to pay premiums.

- High Debt-to-Income Ratio: If your debts outweigh your income, insurers may question your financial stability.

At Canadian LIC, we have counselled clients with a history of bankruptcy to more flexible insurers when it comes to financial issues. Using professional advice and comparing Term Life Insurance Quotes Online, you can still find affordable policies that suit your budget.

History of Criminal Activity

Any criminal record will disqualify you from obtaining Life Insurance. They check your background to determine if any criminal activity increases your risk.

Factors Insurers Consider:

- Type of Offense: Minor infractions may not impact your application, but serious crimes like felonies can lead to disqualification.

- Recent Convictions: If convicted within the last few years, your application may be declined by an insurer.

- Rehabilitation: Demonstrating positive changes and a clean record over time can improve your chances.

Even with a criminal record, all hope is not lost. Canadian LIC has partnered with Term Life Insurance Brokers, which specializes in high-risk cases. Our company has managed to work out fair policies with insurers on behalf of past-recorded clients.

Refusal to Undergo Medical Examinations

Many insurers need a medical exam to get to know about your health before approving your application form. Refusing to complete this process can also disqualify you.

Why Insurers Need Medical Exams:

- To evaluate your current health status

- To verify the information contained in the application

- To determine premium rates

If you hate medical exams, you can choose no-medical exam Term Life Insurance. Although it costs more, the coverage offered is reliable.

Failure to Comply with the Insurer’s Guidelines

Every insurance provider has a set of requirements and guidelines. This can be health benchmarks, policy limits, or income criteria. Not meeting the requirements disqualifies you.

Examples of Insurer-Specific Rules:

- Policy Amount Limits: Some companies have limits on the amount of coverage based on income.

- Residency Status: Non-permanent residents are disqualified unless the immigrants have valid work or study permits.

- Family Health History: Insurers may also consider hereditary illnesses when reviewing your risk.

Compare Term Life Insurance Quotes Online through Canadian LIC to get an idea of insurers that are interested in your profile.

Substance Abuse and Addictions

One of the most common grounds for rejection in Term Life Insurance is substance abuse. Addiction is considered one of the biggest health risks by most insurers.

Substances That Impact Eligibility:

- Alcohol

- Tobacco and nicotine products

- Recreational and illegal drugs

If you’ve had issues with substance abuse in the past but are now in recovery, some insurers will still consider your application. Canadian LIC helps clients in recovery find insurers who evaluate their current health rather than focusing solely on the past.

Risky Travel Habits

You will be excluded from Canada Term Life Insurance if you journey to countries or areas prone to high safety risks, political instability, or outbreak diseases. The insurers prevent an early Life Insurance Claim by evaluating and assessing the risks of travelling.

Examples of High-Risk Destinations:

- War-torn regions

- Countries with high crime rates

- Areas with disease epidemics

If you plan to travel regularly, discuss your options with expert Term Life Insurance Brokers. They can connect you with insurers who are more accommodating towards frequent travellers.

Take Charge of Your Eligibility

At Canadian LIC, we understand that disqualifications are frustrating, but this still doesn’t mean that hope is lost. If someone has faced medical issues, financial trouble, or lifestyle issues, these are things that the right people can help with.

What You Can Do to Improve Your Chances:

- Be honest and thorough in your application.

- Work with trusted Term Life Insurance Brokers to identify insurers that fit your profile.

- Compare term insurance quotes online to find flexible and affordable policies.

- Focus on improving your health and lifestyle habits where possible.

Simplifying Everything for You

Why Canadian LIC is Your Best Choice for Term Life Insurance

When it comes to Term Life Insurance in Canada, Canadian LIC is behind you every step of the way. We have developed great relationships with major insurance companies that can offer tailor-made solutions according to your case, no matter how complicated your case might be. Expert brokers will work to make sure you get the cover you deserve, all with minimum stress.

Don’t wait till the obstacles start to block you. Get in touch with the Canadian LIC today and obtain affordable Term Life Insurance Investment opportunities to safeguard your future securely with your family.

More on Term Life Insurance

- Does Term Life Insurance Payout Immediately?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs:

Smoking does not always preclude you, but it may cause you to pay higher premiums. Some insurers will only accept you if you have been smoke-free for a period of time.

Lying or making false statements can result in your application being declined or even having your policy cancelled later.

Yes, some insurance companies offer special policies for people who have manageable pre-existing conditions.

It depends on the seriousness and the date of the offence. Some insurers cover applicants who have a clean record after rehabilitation.

Canadian LIC connects you with expert brokers who compare Term Life Insurance Quotes Online and provide solutions tailored to your needs.

These will include age, health conditions, occupation, and lifestyle habits, amongst others. All these, therefore, determine an individual’s Term Life Quotes Online. The insurers process this to determine a client’s risk level for premium determination.

Some companies provide coverage for people with chronic diseases. Professional Term Life Insurance Brokers will help you find the best policies based on your health condition.

Substances like smoking, alcohol dependency, or drug abuse will increase your rates or result in exclusion. However, if you’re in recovery, some insurers may consider your improved health.

Definitely. A history of engaging in high-risk sports like sky diving, scuba diving or rock climbing may affect rates or deny someone coverage altogether, so discussing such hobbies right off the bat helps find one’s insurance coverage more clearly.

Sure! Being declined doesn’t mean you are out of options. Canadian LICs Term Life Insurance Brokers work with specialized insurers who also have a lot of experience covering high-risk cases.

Occupations that are dangerous, such as construction, aviation, or firefighting, might result in higher premiums or even disqualification. Insurers that understand your occupation will be able to offer you the best coverage.

Yes, Term Life Insurance is available for smokers in Canada, but it is more expensive. Once you quit smoking, you can ask for a review after a certain period from the last smoke.

Yes, most companies have no-medical-exam policies. Although they might have slightly higher premiums, they tend to get approval faster for people who don’t want to go through the medical process.

Travelling to countries with unstable political situations or high health risks can disqualify or increase premiums. Always update your insurer about your travel plans.

Term Life Insurance Brokers have experienced finding policies for people having health issues, risky jobs, or complicated cases. They compare Term Life Insurance Quotes Online to find coverage that suits your needs.

Failure to disclose medical conditions or treatments can lead to policy cancellation, rejection, or denied Life Insurance claims in the future. Always provide accurate information to avoid issues.

Yes, Guaranteed Issue Policies or Simplified Term Insurance Plans are alternative options for those who face disqualification. These policies do not require a detailed medical history or exams.

Yes, qualifying for affordable coverage becomes more challenging as you get older. Applying early ensures you get lower premiums and better terms.

Yes, Canadian LIC provides expert assistance, helping you compare Term Life Insurance Quotes Online from trusted insurers to find the best rates and coverage.

Yes, a poor financial history or recent bankruptcy can impact eligibility. However, Canadian LIC can connect you with insurers who are flexible with financial challenges.

Yes, insurers often consider your family’s medical history, especially hereditary conditions like heart disease or cancer. It may affect eligibility and premium rates.

Transparency in your health matters a lot. Working with experienced Term Life insurance agents and making comparisons and queries for Term Life quotes can greatly enhance the acceptance percentage.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Website: www.clhia.ca

Provides insights on life insurance policies, eligibility, and industry standards in Canada.

Government of Canada – Financial Consumer Agency of Canada (FCAC)

Website: www.canada.ca/fcac

Offers resources on understanding insurance products and consumer rights.

Insurance Bureau of Canada (IBC)

Website: www.ibc.ca

Covers essential information about life insurance and risk assessment.

Canadian Cancer Society

Website: www.cancer.ca

Provides guidance on life insurance options for individuals with a history of cancer.

Diabetes Canada

Website: www.diabetes.ca

Shares advice for individuals managing diabetes seeking life insurance policies.

Canadian Mental Health Association (CMHA)

Website: www.cmha.ca

Offers resources on mental health and its impact on life insurance eligibility.

Life Insurance Canada

Website: www.lifeinsurancecanada.com

It offers detailed guides on term life insurance, including factors affecting eligibility.

Key Takeaways

- Health and Medical History Matter: Severe illnesses, chronic conditions, and undisclosed medical issues can disqualify you from Term Life Insurance in Canada.

- Honesty is Crucial: Misrepresenting or hiding information like smoking habits, medical history, or risky hobbies can lead to rejection or policy cancellation.

- Lifestyle and Occupation Risks: High-risk jobs, dangerous hobbies, and substance abuse may increase premiums or disqualify you from coverage.

- Age and Financial Stability Impact Eligibility: Older applicants and individuals with recent bankruptcies may face challenges but can explore alternative coverage options.

- Work with Expert Brokers: Term Life Insurance Brokers can guide you to insurers who specialize in high-risk cases and provide tailored solutions.

- Compare Policies Online: Reviewing Term Life Insurance Quotes Online helps you find insurers offering flexible policies that meet your needs.

- Alternative Options Exist: If disqualified, options like guaranteed issue policies can still provide essential coverage.

- Stay Transparent and Prepared: Complete applications accurately, maintain a healthy lifestyle and seek expert advice to improve your chances of approval.

Your Feedback Is Very Important To Us

Thank you for taking the time to help us understand the challenges individuals face when applying for Term Life Insurance in Canada. Your responses will help us serve you better and provide the right solutions.

Thank you for your feedback!

We will use your responses to better assist clients like you in securing Term Life Insurance in Canada.

Sign-in to CanadianLIC

Verify OTP