Have you ever been at family gatherings, listening to your relatives talking about their financial planning, and suddenly felt like you have so much catching up to do? Maybe it was your cousin who told you about getting his financial future in line with a Whole Life Insurance Policy right out of college. Or maybe it was a family friend who told you about waiting too long and facing steep premiums as the years pass. These conversations often lead all of us to the question: “At what age should I consider Whole Life Insurance?”

Purchasing Whole Life Insurance is a crucial component of financial planning and a timing decision that is similar to attempting to find your way through a confusing pathway without a map. It can be hard to figure out what age is best to buy Whole Life Insurance in a place like Canada, where there are many possibilities and the financial landscape is potentially as varied as its people. This blog will simplify the choice by giving you tips to make an informed decision. Any fresh graduate, new parent, or individual approaching retirement needs to understand the nitty-gritty details of a Whole Life Insurance Cover. In this process, they can be secured with a stable financial future.

Understanding Whole Life Insurance Essentials

First, let’s take a moment to break down the core elements of Whole Life Insurance before we look at what age it becomes best to buy Whole Life Insurance. Whole Life Insurance gives the beneficiary coverage for the rest of the insured’s life if premiums are paid continuously. This is to be compared to the Term Life Insurance Policy, which covers you for the specified term period only. The death benefit amount aside, whole life offers an element of saving that grows cash value tax-deferred. In addition to serving the twin purpose of safeguarding assets and accumulating savings that can be borrowed against when needed down the road, these plans also provide peace of mind.

Find Out: Is Whole Life Insurance expensive?

Find Out: The difference between Whole Life Insurance and Money Back Life Insurance?

The Best Ages to Buy Whole Life Insurance

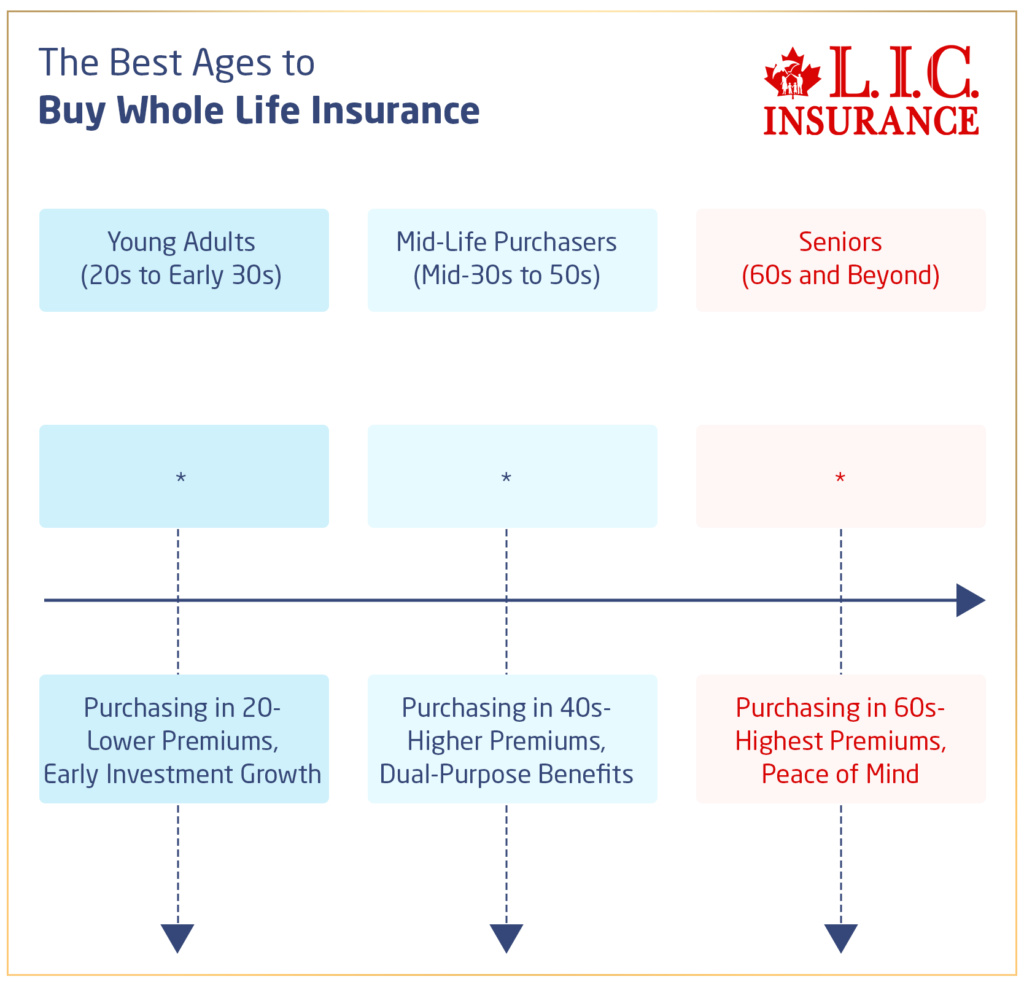

Jenna, a 24-year-old graphic designer, purchased herself a Whole Life Insurance Policy immediately after getting her first very highly paid job. The death benefit wasn’t something that drove her to get insurance; it was just that the monthly payment for Whole Life Insurance got too attractive for her to miss it. By locking in a low rate early, Jenna benefits from more affordable premiums, compared to waiting for her 40s or 50s.

Buying Life Insurance may seem like a premature purchase for a young adult, but it is one of the most reasonable financial moves one can make. You will pay much lower premiums than older ones because, obviously, the earlier you are, the much less risk for insurance companies. Starting early also allows more time for the cash value of your policy to grow, maximizing your investment.

Mid-Life Purchasers (Mid-30s to 50s)

At age 45, Mark is a single father of two teenagers who had to look after a mortgage. He decides to purchase Whole Life Insurance, making sure that all debts are cleared and the family is well taken care of from the payout. The cash element is a value addition for him as an added retirement fund.

You can buy Life Insurance even in midlife. Of course, the premiums would be much more costly than what you could have paid in your twenties. This is also the age when most people start thinking about planning for retirement and seriously building up a legacy; hence, Whole Life Insurance serves dual-purpose needs.

Seniors (60s and Beyond)

65-year-old Linda went for Whole Life Insurance to cover final expenses and leave a legacy behind for her grandkids. Even though the cost of her policy was at higher premiums for her age, it gave her a sense of peace that her family would not be burdened financially upon her passing.

Whole Life Insurance is a product that can make seniors feel at peace. This policy is designed to help seniors to manage their final expenses. It’s important, though, to find a balance between the desire for coverage and the increased premium costs at this stage of life. Seeking guidance from a trusted insurance broker can assist in successfully going through this.

Factors to Consider

However, the decision to buy a Whole Life Insurance Policy is not only about making a financial decision; it is a commitment towards securing both you and your family’s future. We shall now look deeper into some key aspects that you should consider beforehand to ensure this represents your personal and financial situation in the best light.

Whole Life Insurance Monthly Cost

The Whole Life Insurance monthly cost is a very important aspect, especially for young professionals who are just starting out. Take, for example, Sam, a 30-year-old software developer. Sam had all these years thought Life Insurance was for the years way ahead, but a financial adviser took time to explain to him how the cost of the premium is affected by the insured’s age. Hence, it’s always the best idea to get a Whole Life Insurance Policy now so that Sam should have to pay lesser monthly premiums than he would be required to if he waited for another decade. The earlier you commence, the more you save, not only on premiums but also in the accumulation of a higher cash value over the life of the policy.

That said, for anyone considering Whole Life Insurance, analyzing how these Whole Life Insurance monthly costs will fit into your budget makes all the sense in the world. Whole Life Insurance is not just an insurance policy but, in fact, a financial tool. Does the premium work within your current financials? Will you even be able to afford it down the road with everything that your career and potential salary bumps will bring you? Those are some things that need to be answered.

Financial Obligations

Your financial obligations are mirrors to reflect the complexities of your life—be it debts, family responsibilities, or income stability. Take the case of Maria, who juggles student loans and a newly started business. Considering the need to fulfil her financial obligations, she also had to balance the desire to provide financial security for her parents. A Whole Life Insurance Policy functions as a strategic asset tailored to her financial requirements, providing long-term flexibility and comprehensive life protection.

When considering Whole Life Insurance, carefully consider the amount of current debt, the responsibilities already owed to a family and even the stability of the incoming money. This particular insurance is custom-made to adjust right along with changes in life, given that it happens, and thus the coverage will be able to become an adequate benefit. A Whole Life Insurance Policy can answer that question: How much are my financial obligations in 10, 20, or 30 years?

Health Factors

One of the greatest determinants of your health is the cost and availability of Life Insurance to you. Generally, young and healthy individuals will have the best offers, as they pose the least risk to Life Insurance Companies. But then, enter Robert, now 50 and “able to be managed health-wise”—he has spent all these years worrying that he waited for too long. With the best Whole Life Policy that is suitable at hand, he will be able to derive substantial cover benefits, among which include fixed premiums and accrued growing cash value with time.

Age is definitely not a barrier to exploring suitable Whole Life Insurance Coverage. Even if you have crossed over into a stage in life where minor health issues have started kicking in, a suitable Whole Life Insurance cover can still hold abundant benefits in store. Take a thorough look at your health and seek advice from the insurance experts to ensure you secure the most favourable rates and coverage available to you.

Long-Term Goals

How Whole Life Insurance helps meet long-term financial goals: Let’s understand this through Emily’s story. Emily wanted to leave behind a large estate for her kids and, at the same time, make sure she gets taken care of in her retirement. Whole Life Insurance was more than a death benefit for her; it was an important part of her retirement plan and legacy. The policy offers a cash value that can contribute to her retirement savings and grow tax-deferred, if necessary, making it easily accessible.

Your personal long-term goals: “You may want to ensure a financial safety net for the children, assist a spouse, or perhaps give back to charitable causes when you are gone. Whole Life Insurance can be the basis of such plans, ensuring lifelong security and growth. Find out how this investment would work within your overall financial plan to make the best decision.

The Bottom Line

Choosing the right time to purchase Whole Life Insurance is a critical decision that might really affect your financial health and peace of mind. We’ve looked at it, and there is no similar answer, but wisdom does lie in looking at your specific circumstances alongside the backdrop of what Whole Life Insurance might provide.

Canadian LIC is known for its unsurpassed ability to deal with the unique layers of Canada’s insurance landscape. When you get in touch with Canadian LIC, you get a flexible Whole Life Insurance product to respond to the demands of life at any stage. Take this very important decision of life as soon as possible. Secure your loved ones’ future and well-being by purchasing Whole Life Insurance today. Act now and take the first step toward securing your financial legacy with Canadian LIC, where your future is our priority.

Find Out: Can you buy Whole Life Insurance for your child?

Find Out: Who should buy Whole Life Insurance?

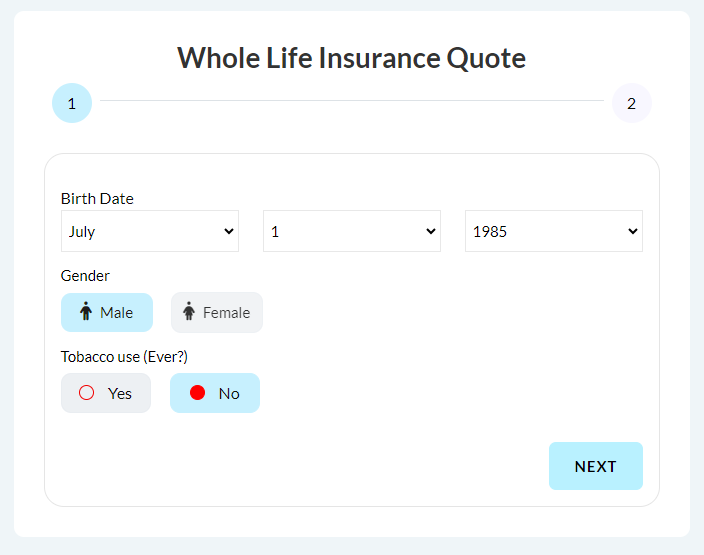

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Whole Life Insurance

Imagine that you were in Clara’s shoes, a diligent saver and most careful planner when it comes to finances. Clara had been concerned for a while whether the monthly cost of Whole-Life Insurance would fit into her budget or not. Opting for a Whole Life Insurance Policy at the start of one’s career meant paying a smaller premium compared to a current policy. Incorporating it into her monthly expenses did not disrupt her financial plans. Just keep in mind that insurance policies are seen as part of a long-term investment strategy. The sooner you start, the more stable the costs will be in the future.

Alex bought a basic Whole Life Insurance Policy in his twenties. Over the years, as he progressed with his career and improved his financial condition, so did he progress with the coverage. Whole Life Insurance policies are flexible, and most, in fact, enable an individual to adjust his or her coverage according to his or her financial needs. In simple terms, an individual can always start with what he or she can comfortably afford, then from there, graduate upwards as the financial capacity continues to grow.

Starting a Whole Life Insurance Policy at a young age would be beneficial because, being young, you will get an opportunity to lock in lower premiums, as very few health risks are associated with youth. Look at Nadia, who bought a policy at 25. She benefited from low monthly costs, and her policy’s cash value had more time to grow, offering her significant savings and financial resources in the future. Starting young is a proactive step towards long-term financial stability.

Consider the story of Liam, who used the cash value from his Whole Life Insurance Policy as an integral part of his retirement plan. The policy he undertook would mature in time, just like the cash value that also matures with it, which he could borrow or withdraw and supplement his retirement income. A Whole Life Insurance plan is as important as your retirement planning; it is a way to secure your money with the built-in savings component and to make sure your retirement years are as comfortable as possible.

The decision to take a Whole Life Insurance Policy should consider your current financial obligations, health, and long-term financial goals. See how Maya chose her policy. She estimated the debts which have accumulated and the responsibilities coming from the family, also the desires for the future of the children. Choose a policy whose premium you feel is affordable in your current financial situation but consider one which is balanced with your future goals and makes sure it can change as your life changes.

Generally, health factors rank as one of the major determinants of your Whole Life Insurance rates. Think of Jordan, who took up a policy in his good health; he got favourable rates. You may, however, have a high premium due to a pre-existing condition, but that should be the least of your worries. Get covered earlier and enjoy the peace that comes along with knowing that you are covered.

Again, there is no “right” age that fits every person to buy a Whole Life Insurance Policy; rather, it depends upon your individual circumstances. Generally, when you are young, you can benefit from paying lower premiums and having the cash value accumulate for a longer period. However, there are certain advantages that even seniors can find valuable in securing Whole Life Insurance, such as for estate planning or final expenses. Weigh personally and financially.

The monthly costs of your Whole Life Insurance Policy will depend on a host of factors, ranging from health and age to the amount of coverage you would like to purchase. Take Lisa, for example a 28-year-old non-smoker who elected a Whole Life Policy early in her career. Due to the fact she was very young and healthy, she was locking in much, much lower monthly costs. Compare this to John, who takes the policy at the age of 50. The monthly premium that he will have to pay is going to be very high because of his age and some minor health issues. If you are considering a Whole Life Policy, remember that earlier is usually cheaper in terms of locking in your monthly cost.

The correct Whole Life Policy depends on an assessment of the financial goals, current financial obligations, and family needs. For example, a person like Priya, whose only concern was that something untimely might happen to her, wanted a secure future for her children. She chooses a policy with a benefit amount that is enough for her mortgage payments and a certain fund for the education of the children. Look at coverage amounts, terms, and potential cash value growth. Consulting with a knowledgeable insurance advisor can also help tailor a policy to fit your specific situation.

The main concern arises from the fact that this Whole Life Insurance is linked to an aspect of affordability. Take, for instance, a freelance photographer by the name of Michael, who has a very varied monthly income; he would be worried whether it was going to be possible to have an expenditure that was fixed every month. With the help of his insurance advisor, Michael was able to compare monthly-rated Whole Life Insurance premiums both in peak and off-peak seasons to ensure that the rates would be affordable without sacrificing the coverage. In this case, one can figure these out by seeing how the monthly and yearly insurance payments fit into their budget, using some tools for financial planning, or talking to a financial advisor.

Whole Life Insurance offers lifelong coverage and a cash value component, unlike Term Life Insurance and other types of insurance. Anita chose Whole Life Insurance because she appreciated the ability to accumulate cash value alongside lifelong coverage. This cash value provides a financial cushion that she can borrow against if needed, offering financial flexibility throughout her life. Additionally, the lifelong coverage ensures that her family will have financial support regardless of when she passes away. When comparing insurance types, it’s important to consider both the immediate and long-term financial benefits.

The cash value of Whole Life Insurance Coverage is versatile. For example, James, a small business owner, used his policy’s cash value as collateral to secure a business loan, which helped expand his operations. You can use the cash value for significant expenses like education costs, down payments on property, or as an emergency fund. It is crucial to discuss with your insurance company the best ways to utilize this feature without undermining the policy’s primary purpose of providing death benefit coverage.

If you temporarily cannot pay premiums, like Sandra during her job loss, whole life policies often include a feature that allows the cash value to cover the premiums. It’s important to communicate early with your insurer to explore Life Insurance options like reducing the death benefit to lower premiums or using the accumulated cash value to keep the policy active without additional payments.

Though exceptions exist, most insurers require a medical exam to assess your risk and determine your premium. For those like Nick, who dread medical exams due to a fear of needles, no medical exam Life Insurance policies are available. These policies may cost more and offer lower coverage limits, but they provide an alternative for those wanting to bypass the traditional underwriting process.

Choosing the right type of Life Insurance depends on your personal and financial goals. Angela, for example, wanted a safe, long-term way to protect her finances that would also help her save money. She chose a Whole Life Insurance Policy because it covers her for life and builds cash value over time. Consulting a financial advisor or a reputable insurance broker can help you assess which policies suit your circumstances and compare them effectively.

Whole Life Insurance policies offer significant tax advantages. The death benefit is generally tax-free to beneficiaries, and the cash value grows on a tax-deferred basis, meaning you won’t pay taxes on the gains as they accumulate. Consider Edward’s case, where the tax benefits of his Whole Life Insurance allowed his family to fully utilize the policy’s payout free from federal income tax, thus maximizing the financial legacy he left behind.

By addressing these questions, you can better understand how a Whole Life Insurance Policy might fit into your life strategy. If you have more questions or need personalized advice, consulting with an insurance expert can provide clarity and direction, ensuring you make the best decision for your personal and financial circumstances.

Sources and Further Reading

To deepen your understanding of Whole Life Insurance and assist in making an informed decision about when to purchase a policy, consider exploring the following resources:

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA Homepage

This site provides comprehensive information on Life Insurance products in Canada, including detailed guides on Whole Life Insurance policies.

Financial Consumer Agency of Canada (FCAC)

Website: FCAC Consumer Services

FCAC offers valuable resources on managing personal finances and understanding different insurance products, including the benefits and considerations of Whole Life Insurance.

Investopedia – Whole Life Insurance Definition

Link: Investopedia Whole Life Insurance

A detailed article explaining the fundamentals of Whole Life Insurance, including the benefits of the cash value component and how it grows over time.

Life Insurance Canada – Learning Centre

Website: Life Insurance Canada Learning Centre

An educational resource offering articles, FAQs, and expert insights into Life Insurance policies in Canada, including strategies for choosing the right policy based on your age and financial situation.

These resources will provide you with a thorough backdrop to better understand Whole Life Insurance, helping you make a well-informed decision tailored to your personal and financial needs.

Key Takeaways

- Whole Life Insurance covers the policyholder's entire life with premiums, including a tax-deferred savings component.

- Younger individuals benefit from lower premiums and a longer period for cash value growth.

- The policy can adapt to life changes such as income increases or family expansion.

- Better rates are available for younger and healthier individuals, but it is beneficial at any age.

- The cash value of a policy provides financial flexibility, allowing borrowing against it for significant needs.

- Whole Life Insurance supports long-term financial planning, including retirement and legacy concerns.

- Personalized planning with financial advisors is essential to maximize the policy's effectiveness in financial strategies.

Your Feedback Is Very Important To Us

We appreciate your participation in this survey. Your responses will help us understand the challenges people face when deciding the right age to purchase Whole Life Insurance in Canada. Please answer the following questions to the best of your ability. Your feedback is invaluable.

Thank you for sharing your insights with us. Your feedback is crucial in helping us improve our understanding and support for those considering Whole Life Insurance in Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com