John and Lisa, a married couple living in the heart of Toronto, face a common problem. They’ve been thinking about the future—about their mortgage, their kid’s education and how to protect all of that from any unexpected events. The question on their minds is, “Should we both get Term Life Insurance?” This isn’t just their story; it’s a scenario that countless Canadian couples face as they plan their financial futures together.

For many who buy life insurance online, it feels overwhelming. Questions like “Should we both get it?” and “How will the premiums affect our budget?” are common. These concerns reflect a deeper need for security and assurance—something Canadian LIC knows all too well through daily interactions with clients just like John and Lisa. In this blog, we’ll get to know why Term Life Insurance for married couples isn’t just a choice but a crucial step toward securing a mutual future.

Why Consider Term Life Insurance Policy for Both Spouses?

- Shared Financial Responsibilities: These days, most couples split financial obligations, from mortgages to car loans down to everyday living expenses. At Canadian LIC, we have witnessed time and again how the loss of one income significantly affects this balance. Term Life Insurance acts as a financial safety net, ensuring that if one partner passes unexpectedly, the other isn’t left struggling with financial burdens alone.

- Coverage for Debts and Future Plans: Take the example of Michelle and Tom from Vancouver, who recently purchased a house with a large mortgage. Their Canadian LIC advisor showed them how Term Life Insurance might be used both for paying off the mortgage and other debts so that the family is not thrown into a financial crisis in the event of death. Their story eloquently explains how insurance can help protect not only what one builds up but also one’s plans for the future.

- Support for Dependents: The Term Life Insurance takes on even more importance when one has children. It’s about ensuring nothing comes in the way of your children’s futures—education, health, and overall well-being. Following detailed consultation with Canadian LIC, Saba and Amir decided upon Term Life Insurance to simply protect their kids from the uncertainties of life ahead.

- Affordability of Term Life Insurance: Among the biggest advantages of Term Life Insurance is its affordability as compared with Permanent Life Insurance. Quotes for Term Life Insurance might light the eyes of many couples as they come to realize the feasibility of this option. Canadian LIC offers competitive quotes that help couples know that they can make some of the best decisions without giving up their current way of living.

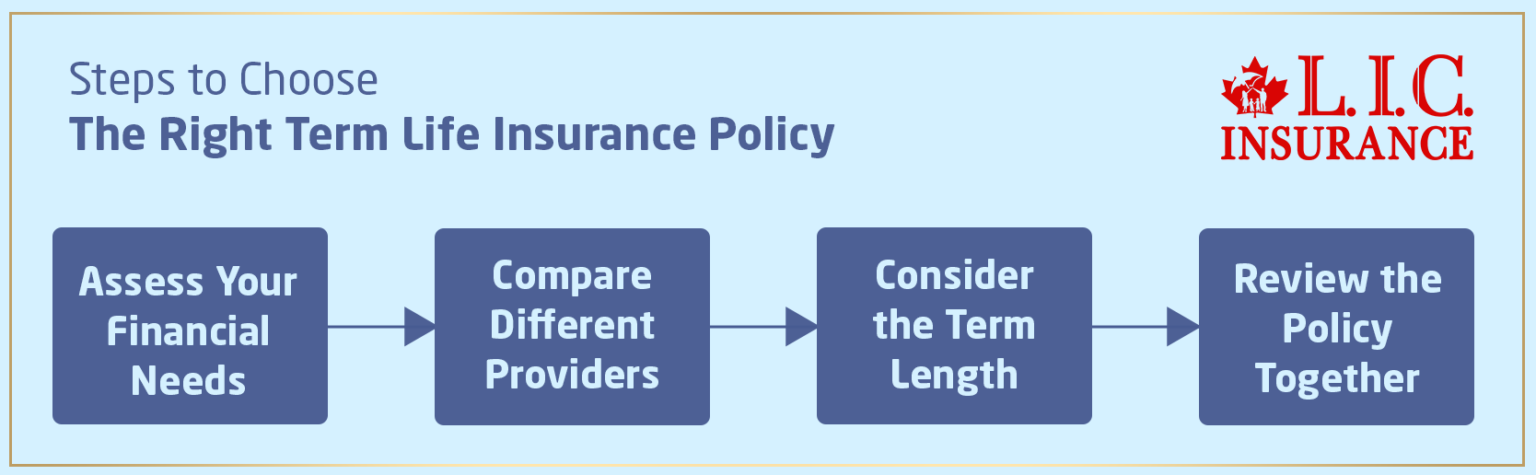

How to Choose the Right Term Life Insurance Policy

- Assess Your Financial Needs: Each family is different and has different financial situations. You would want to look at your debts, what your day-to-day expenses are, and the commitments you have in the future. A Canadian LIC advisor would very often work in a highly personalized approach, guiding couples like you to know how much coverage you need to make sure that all financial aspects are taken care of.

- Compare Different Providers: One should be wise in comparing Term Life Insurance Quotes and policies from a number of providers. Canadian LIC prides itself on transparency, always providing customers with comparisons of Term Life Insurance companies available throughout Canada to enable clients like you to make the best decision.

- Consider the Term Length: Your term length really should be aligned with large financial commitments, like a mortgage. If you have 20 years left on your mortgage, then a 20-year can be great. This could match up so that you’re protected during the most financially vulnerable years.

- Review the Policy Together: It is essential to have both spouses involved in making a decision. By having both review the details of the Term Life Insurance Policy, it is ensured that both will be aware of what coverage it has, the terms provided and the implications of the policy on the family’s financial health.

Ending Note

Are both husband and wife obtaining life insurance a financial decision or a commitment to each other no matter what life throws your way? At Canadian LIC, we understand the complexity of this decision. Our life insurance expert will guide you through every step and ensure you choose a Term Life Insurance Policy that meets your financial needs and gives you peace of mind.

Remember to secure before the unexpected. Act now and secure your family’s future. Buy Term Life Insurance Online through Canadian LIC, the best insurance brokerage in Canada, and you and your spouse will be well protected. Your future self will thank you.

More on Term Life Insurance

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) on Term Life Insurance for married couples

Term life insurance for husband and wife is a joint policy that provides coverage for both spouses for a set term, ensuring financial protection for the family in case of an unexpected loss.

It’s looking out for each other, even in the darkest moments. Hundreds of couples, just like James and Anita from Calgary, share their experience with Canadian LIC when buying Term Life Insurance online, which gives them the peace of mind needed. Couples are extremely pleased with the pace at which they can insure and get protection for both partners, where each one is properly guided to alleviate unexpected financial burdens that may come their way.

Comparing the quotes gives a person the best deal. We at Canadian LIC make this whole process very easy and transparent. We encourage you to get quotes from other Term Life Insurance Providers available in Canada, for which we also provide online tools and other methods. This approach will ensure that you get a policy within your budget and tailored according to your life insurance needs.

Absolutely! Take the case of Sophia and Raj, who spoke to Canadian LIC when they were newly married. But what really clicked for them was the fact that it brought them financial security. Term Life Insurance for couples means that in the unfortunate event of the death or demise of one of the spouses, the other partner will be able to financially handle debts, ongoing living expenses, and future plans, like the education of children.

These are just a few things you should seek out when looking for providers: transparency, reliability, and supportive customer service. These are just some of the reasons that set Canadian LIC apart. We help couples like Lisa and Mark, who are initially overwhelmed, understand exactly what different Term Life Insurance Providers offer in Canada and guide them through the fine print to find a provider who will support their long-term financial goals.

You will want to review your policies at a minimum every five years or following a major life event, including the birth of a child, purchasing a new home with a mortgage, or any significant change in income. For instance, Kevin and Emily from Montreal shared how a review session with Canadian LIC helped them get proper married couples’ life insurance coverage that aligned with their growing family—making sure they are always protected.

Not necessarily. Indeed, some providers will discount their policies when purchased jointly. At Canadian LIC, for instance, we usually find dual coverage to be cost-effective. Take the example of Daniel and Laura from Ottawa. They found that joint coverage saved them money and also reduced complexity in their financial planning by putting their insurance needs under just one Term Life Insurance Policy.

That would be a good beginning, but we should evaluate whether the sum assured is okay. Most workplace policies offer basic coverage, which might not be what we need for our families. Canadian LIC recommends that families like Alex and Nina’s add on to their basic covers with additional term life cover to cater to the void and protect their future once and for all.

Starting is easy and can even be pretty enlightening. Initial contact with Canadian LIC let one Edmonton couple, Sarah and Jeff, realize that starting an application online wasn’t just easy; it gave them the ability to start looking at life insurance options for themselves at their own pace. First, visit our website, where you will find a basic information form to help you get started. Following this, we will then provide you with individual Term Life Insurance Quotes tailored to your needs and financial situations.

Compare quotes based on coverage amount, length of term, premium costs, and other additional benefits. One of the things our customer Michael from Halifax learned with Canadian LIC is to watch carefully how premiums change over time and what happens in case renewal is required. Our consultants help clients understand each factor so that they pick a quote for the best protection and value.

Yes, some of them do have plans designed for married couples that can offer more competitive rates and advantages that are more applicable to jointly held financial commitments. Canadian LIC has relationships with many well-regarded Term Life Insurance Providers in Canada, and we walk couples like Anita and Carlos through picking a life insurance company specializing in married couple policies, making sure they get the most suitable coverage.

One of the unique benefits of Term Life Insurance is that it offers high coverage amounts for a defined period at lower premiums compared to whole life. This was an important issue with clients like Nina and George, who really needed cheap coverage to protect their new home and young children during the most financially vulnerable years of their lives.

The Policy should, therefore, be adjusted to changing financial situations. Canadian LIC revised the cover for a couple, Linda and Peter, following Peter’s promotion to a higher salary earner. We recommend reviewing on a regular basis and having flexible options that will allow you to increase or reduce your coverage as required.

The devil is in the details. Canadian LIC takes pride in transparency and education. We hold workshops and one-on-one sessions, like those attended by clients such as Rachel and Sam, to explain the nuances of Term Life Insurance Policies. Always feel free to ask questions until you fully understand your policy—our advisors are here to clarify and simplify the information.

Changes in health can impact premiums if one renews Term Life Insurance. For example, if a spouse is diagnosed with a health condition, then during renewal, the premiums become higher. Canadian LIC, in this process, supported Tim and Daisy in assessing their options and finding the best possible rates despite health changes.

Online tools are very instrumental in giving you a comprehensive view of your options. For instance, Bob and Priya from Quebec used Canadian LIC’s online comparison tool to compare multiple Term Life Insurance Quotes side by side. We recommend that you pay close attention to the amount of coverage, duration of the term, rates of premiums, and benefits applying specifically to married couples. Our licensed insurance agent is always prepared to help you with all the details each quote has so as to ensure that you can make a very well-informed decision.

A common mistake is underestimating the amount of coverage needed. Tom and Leah from Ontario made the mistake of choosing very minimal coverage to save on premium costs but soon realized it wasn’t enough for their growing family after seeking advice from Canadian LIC. The accuracy in the assessment of your financial obligations and future plans should assess the adequate coverage. Always check the credibility of the insurer or Policy’s credibility at the time of purchase.

Yes, spouses can be covered by different providers if individual scenarios better suit their needs. For David and Susan, one provider gave them better rates for Susan, and another had some specific benefits that matched David’s health considerations. Canadian LIC can help you analyze such scenarios to ensure each spouse is appropriately covered. Be careful to make sure the Term Life Insurance Policies play well with each other, though.

Term Life Insurance Policy is an integral part of holistic financial planning. Take Jenny and Marco, for instance: They aligned their Term Life Insurance with their investment strategy to ensure that the coverage supported the long-term financial goals of funding the children’s education and retirement planning. Canadian LIC advises using Term Life Insurance as a financial safety net, aligning it with other tools like retirement accounts and educational savings plans to create a robust financial foundation.

After major life events such as the birth of a child, a significant career change, or purchasing a new home, reviewing your policy is key. Canadian LIC helped Emily and Alex adjust their Term Life Insurance coverage when they welcomed their second child, ensuring their policy reflected their new financial responsibilities. The steps include reassessing your financial needs, obtaining updated quotes, and possibly undergoing additional health assessments.

The process of claims may vary, but what remains important is transparency and quick service. Canadian LIC ensures that right from the beginning, clients such as Richard and Anita are aware of the process of claim. As a couple, it is important to know what type of documentation is required, what type of time it takes to settle the claim, and what type of issues may pop up. It’s important to have all the documents related to the Term Life Insurance Policy in order, and each spouse has to be aware of the details so that the process of claim runs smoothly.

The above FAQs are specially designed to try to answer the most pressing concerns about Term Life Insurance Policies for married couples from real-life scenarios encountered by Canadian LIC. Our professionals will do everything possible to help you make the right, most informed decisions to get the best life insurance policy and to protect what matters most. Have more questions? Go ahead and contact Canadian LIC, the best insurance brokerage dedicated to securing your family.

Sources and Further Reading

- Insurance Bureau of Canada – Provides comprehensive guidelines and regulatory information regarding life insurance policies in Canada. Visit IBC

- Financial Consumer Agency of Canada (FCAC) – Offers useful advice on choosing life insurance products and understanding different types of coverages. Visit FCAC

- Canadian Life and Health Insurance Association (CLHIA) – A resource for detailed insights into life insurance products, including Term Life Insurance. Visit CLHIA

- Investopedia: Term Life Insurance Guide – An informative article that explains the specifics of Term Life Insurance, ideal for understanding basic terms and considerations. Read on Investopedia

- NerdWallet: How to Choose Life Insurance in Canada – Provides practical tips on selecting the right life insurance provider and policy for your needs. Read on NerdWallet

These sources offer reliable information that can help deepen your understanding of Term Life Insurance, assisting you in making informed decisions tailored to your unique situation.

Key Takeaways

- Both spouses having Term Life Insurance ensures financial stability and peace of mind.

- Term Life Insurance offers high coverage at lower premiums, providing affordability and flexibility.

- Couples should compare quotes and policies from multiple providers to find the best match.

- Regularly reviewing and adjusting policies is crucial, especially after significant life changes.

- Consulting with knowledgeable advisors like those at Canadian LIC aids in making informed insurance decisions.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. Your insights are invaluable in understanding the struggles Canadian couples face when considering Term Life Insurance. Please answer the following questions to help us improve our services and support.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]