- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Types of Death Are Not Covered in Term Insurance?

- The Reality of Exclusions in Term Life Insurance

- Common Types of Death Not Covered in Term Insurance

- Common Types of Deaths Covered Under Term Insurance Plans

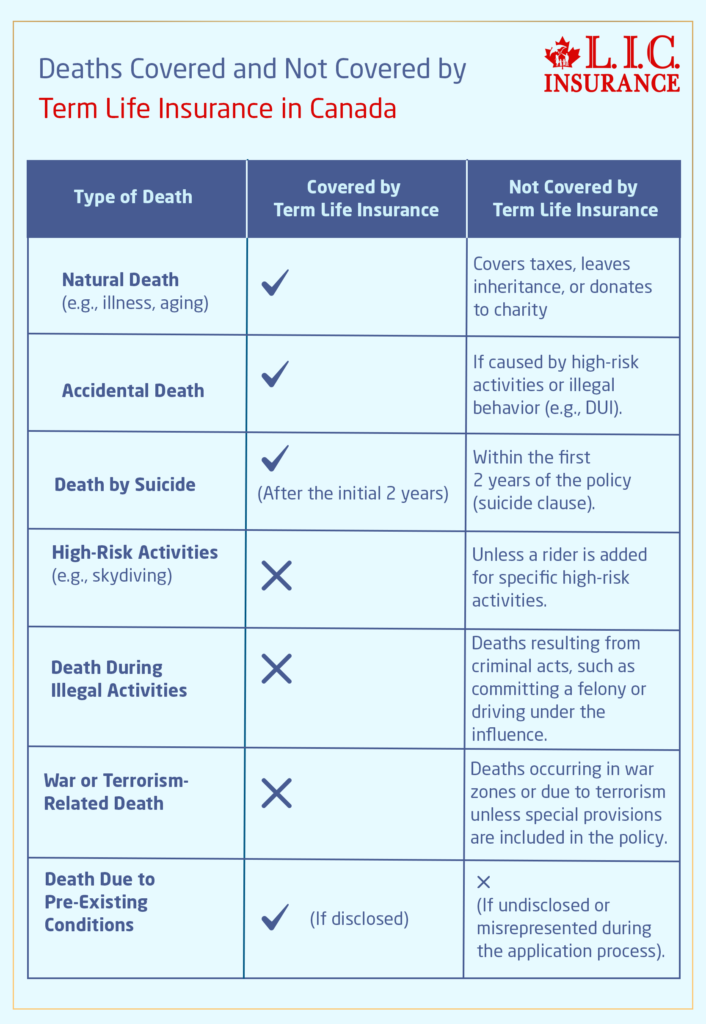

- Deaths Covered and Not Covered by Term Life Insurance in Canada

- Why Knowing What's Covered Matters

- Steps to Claim Term Insurance Policy After Death

- Tips for a Hassle-Free Claim Process

- How to Ensure Your Claim Isn't Denied

- Lessons from Canadian LIC Clients

- Choosing the Right Policy to Protect Your Loved Ones

What Types Of Death Are Not Covered In Term Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 25th, 2024

SUMMARY

When one is considering a Term Life Insurance Plan, one assumes it offers coverage for every possible scenario. Much of the financial security and promise of stability are provided by Term Life Insurance. However, Term Life Insurance also has some exclusions. These exclusions can leave families without Term Life Insurance and death benefits. Let us explain these common scenarios further in which Term Insurance might fail to pay and help guide you in making a decision before purchasing your policy.

The Reality of Exclusions in Term Life Insurance

For many, Term Life Insurance provides the peace of mind they need when purchasing the policy, knowing that their family will be completely taken care of in case anything untoward happens in life. Ever read the fine print or asked your insurer what’s not covered?

We have had a hard-working dad of two children tell us how he missed exclusions within his policy. His brother died in an accident that was classified as “high-risk” when he found out the Term Life Insurance Death Benefits didn’t apply due to specific policy exclusions. Stories like this remind one of how very important it is to know exactly what your Term Life Insurance covers and what it doesn’t.

Common Types of Death Not Covered in Term Insurance

Understanding exclusions in a Term Life Insurance policy can prevent financial hardship for your loved ones. Here are the most common exclusions:

Most Term Life Insurance policies do exclude deaths by suicide in the first two years of a policy. This is commonly known as the “suicide clause.”

Insurers include this exclusion to prevent people from buying the policies with the intention of using them immediately to reap financial benefits. One of our clients once recounted the following: a close family member had mental health struggles but had not disclosed it when filling out the policy application. When he passed away within the cooling-off period, his family was unable to receive Term Life Insurance Death Benefits.

Most insurers regard activities such as skydiving, bungee jumping, or scuba diving as high-risk. Even if the policyholder dies while engaging in such an activity, his claim can be rejected unless he has paid an additional premium for a specific rider or add-on that covers high-risk activities.

For example, we assisted a young man who was an adventure sports enthusiast but did not have any riders for his basic policy. After explaining the risks, he decided to include the rider. If you are one of those thrill-seekers, this is one of the most important conversations with Term Life Insurance Brokers.

Another exclusion is death from illegal or criminal activities, including such acts as driving under the influence or felony. The argument that insurers present for this is that the risks involved were deliberately taken and, therefore, not compensable.

A couple came to us for advice, sharing how a distant relative lost their life in a similar situation, leaving the family with nothing. Knowing these exclusions beforehand ensures that your family is not surprised.

Most policies exclude deaths that occur in war zones or due to terrorism. If you’re in the armed forces or plan to work in a high-conflict area, this exclusion might apply. Special insurance policies for military personnel or those travelling to war-prone regions are available but require separate arrangements.

Honesty is very crucial when completing your insurance application. If a policyholder fails to give information about a pre-existing medical condition or provides false information, the insurer can deny claims.

One of our clients, a teacher, came in distress to us complaining that her cousin’s claim had been rejected, as she did not disclose her undeclared health issues. She later realized the importance of transparency when purchasing a policy.

Common Types of Deaths Covered Under Term Insurance Plans

A Term Life Insurance Plan is designed to provide financial support to your loved ones in case of your untimely death. While there are exclusions to be aware of, it’s equally important to understand the types of deaths that are typically covered. This clarity ensures your family receives the promised Term Life Insurance Death Benefits without unnecessary complications. Let’s break down the scenarios generally included in a Term Insurance policy:

Then, Term Insurance pays if death is caused by natural causes-for example, illnesses or old age-provided it happens within the term of the policy. For instance, if the insured dies from heart disease or another medical condition, but the exclusions do not relate to pre-existing conditions, then the beneficiaries will get the full pay-out.

Most Term Life Insurance policies cover accidental deaths, that is fatal injuries caused by some unexpected accidents like those caused by car accidents, falls or workplace hazards. Accidental deaths are amongst the most common claims that people make for Term Life Insurance Death Benefits. This is an important component of your coverage.

If the policyholder dies as a result of illnesses that were diagnosed after purchasing the policy, the claim will be paid out. These include cancer, respiratory diseases, or any other major health condition. This coverage emphasizes the necessity of stating any pre-existing medical conditions when applying for a policy.

Under Term Insurance, deaths that occur due to travelling for work or recreation, unless caused by exclusion criteria such as high-risk activities or travel to an area prone to war, are normally covered. For example, a death due to natural causes or an accidental death during a business travel would be recovered under the policy.

Suppose the policyholder is not engaged in a high-risk job (e.g., mining or working in conflict zones) and passes away due to an occupational hazard. In that case, most standard policies will provide coverage. Be sure to disclose your occupation accurately during the application process to avoid claim disputes.

Deaths that occur as a consequence or related to medical treatment are usually included, assuming the procedure was not experimental or deemed highly risky without specific consent. For example, complications arising from a routine surgery would probably be included under a Term Life Insurance policy.

Deaths Covered and Not Covered by Term Life Insurance in Canada

Why Knowing What's Covered Matters

The knowledge of what kinds of death are covered under the Term Life Insurance Plan keeps the family well-prepared in case of any event. This opens up the probability of them seeking help from the financial package presented at a tough hour.

For personalized advice and tailored policies, seek the help of experienced Term Life Insurance Brokers such as those at Canadian LIC. Whether you are comparing term life quotes or even looking to buy Term Life Insurance online, their expertise ensures that you and your family are better protected.

Steps to Claim Term Insurance Policy After Death

Claiming a Term Life Insurance policy can be a daunting procedure during a time of grieving. The process can be made simpler and stress-free if you’re prepared with the steps required and the necessary documents that must be presented. That’s exactly what we want to help you within a step-by-step approach.

The first part of the process is reporting the death to the insurer. Most insurance companies have a claims team or a direct helpline that can initiate the process. Prepare the policy number and any other basic information about the deceased, such as how they died.

At Canadian LIC, we’ve helped many families streamline this step, ensuring they avoid delays caused by incomplete notifications.

You’ll need specific documents to file a claim, including:

- Original policy document: This confirms the existence of the policy.

- Death certificate: An official certificate issued by the local government or health authority.

- ID proof of the claimant: A government-issued ID to verify the beneficiary’s identity.

- Medical records (if applicable): These may be required if the death was due to an illness.

- Post-mortem report or FIR (if applicable): For deaths caused by accidents or unnatural circumstances.

Ensuring these documents are in order will help expedite the claims process.

Fill out the insurer’s claim form accurately. The form typically requires details such as:

- The name of the deceased policyholder

- Policy number

- Date and cause of death

- Beneficiary details

Double-check the form before submission to avoid errors that could delay approval.

Finally, submit your completed claim form together with all necessary supporting documents to the insurer. This can be done online, by mail, or in person, depending on how the Life Insurance Company processes submissions. Many families prefer working with Term Life Insurance Brokers who can assist with submitting and following up on the claim.

Once a claim is filed, the insurance company will go through the documentation submitted. When further information is required for clarification, the claimant is immediately notified. Keeping the communication line open and responding prompts the process to continue.

After the claim is approved, the insurer pays out the Term Life Insurance Death Benefits to the beneficiary. This Life Insurance Payout may be a lump sum or a structured payment depending on the policy terms.

Tips for a Hassle-Free Claim Process

- Review the policy exclusions upfront: Ensure the cause of death is not excluded under the policy’s terms.

- Work with trusted brokers: Experienced Term Life Insurance Brokers can guide you through the claim process and resolve any complications.

- Stay organized: Keep all policy-related documents in a secure but accessible location.

At Canadian LIC, we’ve helped families navigate the claims process with care and efficiency. With the proper guidance, claiming the Term Life Insurance Death Benefits can be a manageable and stress-free experience, ensuring your loved ones receive the financial support they need.

How to Ensure Your Claim Isn't Denied

- Work with Reputable Brokers

Working with trusted Term Life Insurance Brokers ensures you receive all the necessary information. Brokers can help you understand policy exclusions and recommend the best policy based on your lifestyle. - Disclose All Relevant Information

Be honest about your medical history, lifestyle habits, and activities. Transparency ensures the insurer can’t deny claims due to misinformation. - Understand Policy Riders

Riders are optional add-ons that enhance your policy’s coverage. If you engage in high-risk activities or have a pre-existing medical condition, riders can bridge the gap in coverage. Always discuss these options with a broker before finalizing your policy. - Review Your Policy Regularly

Life changes—whether it’s starting a new hobby, taking up an adventurous activity, or moving abroad. Reviewing your Term Life Insurance Plan ensures your coverage adapts to your needs.

Lessons from Canadian LIC Clients

At Canadian LIC, we have guided several families through tough times to understand what is in place for them. One such story that comes to mind is of a young couple, who had not really considered riders. Upon addressing each potential risk and exclusion, they opted to have additional coverage. Years later, when the husband fell ill without warning, the claim was made against them without any problem since they were honest and detailed at the application stage.

Choosing the Right Policy to Protect Your Loved Ones

Selecting a Term Life Insurance policy means more than just comparing Term Life Insurance Quotes. It’s a lot about deciding on the right policy that would serve your family’s needs with no bad surprises. Whether you are purchasing the policy for the first time or updating an existing one, consider contacting Term Life Insurance Brokers who can guide you through every step.

Why Canadian LIC Is the Best Choice for Term Life Insurance

Canadian LIC specializes in helping clients navigate the complex world of insurance, offering a seamless experience from obtaining Term Life Insurance Quotes to purchasing a tailored Term Life Insurance Plan. Our clients have come to trust us for clarity, every answer, and the very best solutions to their unique circumstances.

Act Now to Secure Your Family's Future

Understanding what is excluded in a Term Life Insurance policy empowers you to make informed decisions. Don’t gamble the financial security of your family away. Get in touch with Canadian LIC today to work with expert Term Life Insurance Brokers, compare Term Life Insurance Quotes, and find a Term Life Insurance Plan that assures peace of mind.

More on Term Life Insurance

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: What Types of Death Are Not Covered in Term Insurance?

Term Life Insurance Plans generally exclude deaths caused by suicide within the first two years of the policy, deaths resulting from high-risk activities (like skydiving), and deaths occurring during illegal activities or wars. Reviewing your policy’s exclusions with Term Life Insurance Brokers ensures you fully understand the coverage.

If the policyholder disclosed their pre-existing medical conditions during the application, most policies cover such deaths. However, if the condition was not disclosed, the insurer might deny the claim. This is why honesty during the application process is critical when you decide to buy Term Life Insurance online or through a broker.

Yes, accidental deaths are typically covered unless the accident occurred during a high-risk activity or involved illegal behaviour, such as driving under the influence. Always review the fine print with Term Life Insurance Brokers to confirm.

Standard-Term Life Insurance policies often exclude deaths caused by war or terrorism. If you frequently travel to high-risk areas, consider adding a rider or specialized policy. Experienced brokers can guide you in finding the right Term Life Insurance Plan for such situations.

If a claim is denied due to exclusions, the beneficiaries won’t receive the Term Life Insurance Death Benefits. Working with reputable brokers can prevent this by ensuring you select a plan that aligns with your lifestyle and needs.

Be transparent during the application process. Disclose your medical history, lifestyle habits, and hobbies. Regularly review your policy to ensure it still meets your needs. Trusted Term Life Insurance Brokers can help you navigate these steps.

Riders are optional but can enhance your policy. For example, if you engage in high-risk activities or want additional coverage for critical illness, a rider can cover those gaps. Including a rider may impact your Term Life Insurance Quotes, but it offers tailored protection.

A suitable plan balances your budget and coverage needs. Compare Term Life Insurance Quotes and consult with brokers to understand your options. At Canadian LIC, we’ve seen how the right advice can prevent costly mistakes.

Yes, you can buy Term Life Insurance online and still consult brokers for guidance. Online platforms often provide quotes, but brokers like those at Canadian LIC ensure you understand the exclusions and benefits.

Brokers help you choose a policy tailored to your needs, explain exclusions clearly, and assist during claims. Their expertise ensures you and your family are well-protected. At Canadian LIC, we’ve helped countless clients secure the best Term Life Insurance Plan for their unique circumstances.

Yes, life insurance payouts can be used to cover funeral expenses. Beneficiaries receive the Term Life Insurance Death Benefits as a lump sum, which they can allocate toward funeral costs, outstanding debts, or other financial needs. This ensures families have the financial support they need during difficult times.

No, Term Life Insurance policies do not accumulate cash value, so you cannot pull money out of them. They are designed to provide a death benefit to beneficiaries in the event of the policyholder’s death during the coverage period. For policies with cash value, like whole life insurance, consider speaking with Term Life Insurance Brokers to explore options.

If your policy lapses due to unpaid premiums and you pass away, the insurer may not pay the death benefit. However, most policies include a grace period—usually 30 days—during which coverage remains active. Always stay on top of payments to ensure your Term Life Insurance Plan remains valid.

Term Life Insurance typically does not cover deaths caused by suicide within the first two years of the policy, deaths from illegal activities, high-risk activities (unless a rider is added), and deaths due to war or terrorism. Reviewing exclusions with your insurer or a trusted broker helps avoid surprises.

Yes, natural deaths, including those caused by illness or aging, are covered under most Term Life Insurance Plans, provided the policyholder was truthful during the application process and the policy was active at the time of death.

Yes, accidental deaths are usually covered, but exceptions may apply if the accident occurred during high-risk activities or illegal behaviour. For comprehensive coverage, consider adding an accidental death rider to your policy.

No, Term Life Insurance does not cover all deaths. Exclusions like suicide in the initial policy years, high-risk activities, illegal acts, and deaths during war or terrorism are standard. Knowing these exclusions ensures you select the right policy for your family’s needs. Speak with Term Life Insurance Brokers to get detailed advice tailored to your situation.

These FAQs aim to clarify common concerns about Term Life Insurance exclusions. For more personalized advice, reach out to a trusted insurance broker today.

Sources and Further Reading

- The Co-operators: Offers insights into what life insurance policies typically do not cover.

- Blue Cross of Canada: Explains Term Life Insurance workings and common exclusions.

- Sun Life Financial: Addresses common questions about life insurance, including coverage limitations.

- RBC Insurance: Offers sample life insurance policies for review.

Key Takeaways

- Understanding Exclusions Is Crucial

Term Life Insurance policies typically exclude deaths caused by suicide in the first two years, high-risk activities, illegal acts, and war-related incidents. - Transparency Is Key

Honesty during the application process ensures coverage, especially for pre-existing medical conditions and lifestyle habits. - Natural Deaths Are Covered

Most Term Life Insurance Plans cover deaths due to natural causes, such as illness or aging, provided the policy is active. - Accidental Deaths Are Included with Caveats

Accidental deaths are covered unless they result from risky or illegal behavior. Consider riders for high-risk activities. - Policy Lapses Can Deny Claims

Late or missed premium payments may lead to policy lapses, affecting coverage. Always stay on top of payments. - Work with Trusted Brokers

Engaging experienced Term Life Insurance Brokers ensures you select the right policy and understand all exclusions clearly. - Tailor Your Coverage with Riders

Riders enhance coverage for high-risk activities, accidental death, or critical illnesses, addressing potential gaps in your policy. - Claims Require Proper Documentation

Beneficiaries must provide accurate documentation, including death certificates and policy details, to access the death benefits.

Your Feedback Is Very Important To Us

We appreciate your time in helping us better understand the challenges people face when it comes to Term Life Insurance exclusions. Your feedback will allow us to provide better information and services.

Thank you for your feedback!

Your insights will help us improve our services and offer better solutions tailored to your needs.

IN THIS ARTICLE

- What Types of Death Are Not Covered in Term Insurance?

- The Reality of Exclusions in Term Life Insurance

- Common Types of Death Not Covered in Term Insurance

- Common Types of Deaths Covered Under Term Insurance Plans

- Deaths Covered and Not Covered by Term Life Insurance in Canada

- Why Knowing What's Covered Matters

- Steps to Claim Term Insurance Policy After Death

- Tips for a Hassle-Free Claim Process

- How to Ensure Your Claim Isn't Denied

- Lessons from Canadian LIC Clients

- Choosing the Right Policy to Protect Your Loved Ones

Sign-in to CanadianLIC

Verify OTP