- What are the Biggest Life Insurance Companies in Canada?

- The Importance of Life Insurance

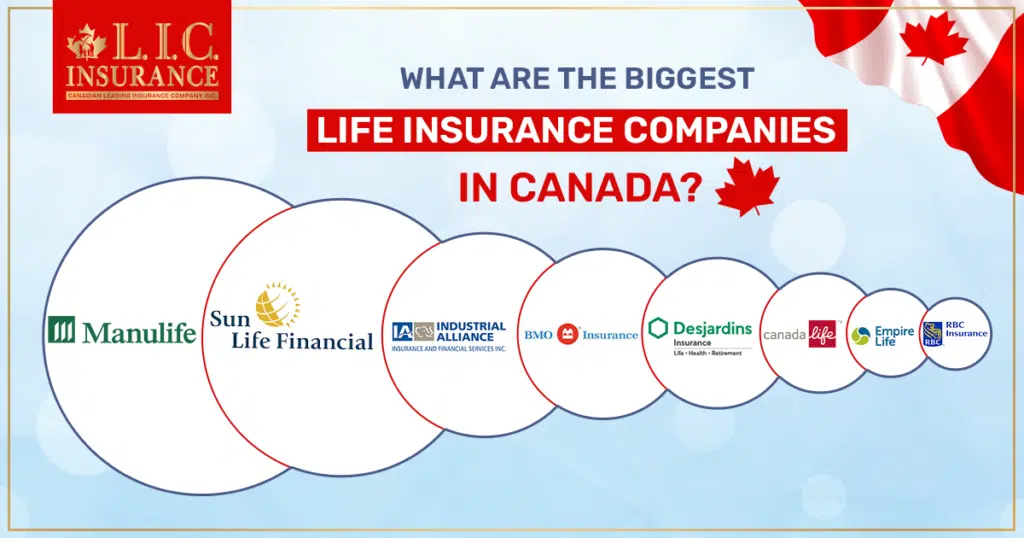

- The Biggest Life Insurance Companies in Canada – 2023

- Factors to Consider When Choosing a Life Insurance Company

- Why should you choose a bigger insurance company?

- Why should you choose a smaller insurance company?

- Coming to The End

Life insurance plays a crucial role in providing financial security and peace of mind for individuals and families in Canada. Choosing the right life insurance provider is a significant decision, as it involves safeguarding your loved ones’ future. In this comprehensive guide, we will explore the biggest life insurance companies in Canada as of 2023. These companies have a strong presence in the Canadian insurance market and offer a range of life insurance products to meet the diverse needs of policyholders.

The Importance of Life Insurance

Before delving into the list of major life insurance companies, it’s essential to understand the significance of life insurance:

- Financial Protection: Life insurance provides financial protection to your family and beneficiaries in the event of your death. It ensures that they have the financial resources they need to cover expenses, such as mortgage payments, education costs, and daily living expenses.

- Estate Planning: Life insurance can be a valuable tool for estate planning, helping to minimize the tax burden on your assets and ensuring a smooth transfer of wealth to your heirs.

- Debt Repayment: Life insurance can be used to pay off debts, such as loans and credit card balances, preventing your loved ones from inheriting your financial liabilities.

- Income Replacement: For families that rely on your income, life insurance can replace lost income, allowing your dependents to maintain their standard of living.

The Biggest Life Insurance Companies in Canada – 2024

Now, let’s explore the largest life insurance companies in Canada based on their market share, reputation, and the range of insurance products they offer:

Manulife Financial Corporation

Manulife Financial is one of Canada’s largest and most well-known life insurance companies. Founded in 1887, it has a rich history of providing insurance and financial services. Manulife offers a wide range of life insurance products, including term life, whole life, universal life, and critical illness insurance.

Sun Life Financial Inc.

Sun Life Financial is another major player in the Canadian insurance industry. Established in 1865, it has a strong presence both in Canada and internationally. Sun Life provides various life insurance options, retirement planning services, and investment solutions.

Industrial Alliance Insurance and Financial Services Inc. (iA Financial Group)

iA Financial Group is a leading Canadian insurer with a wide range of insurance and financial products. It offers life insurance, disability insurance, and annuities, catering to individuals, businesses, and groups.

BMO Life Insurance Company

BMO Life Assurance Company is a subsidiary of the Bank of Montreal (BMO) and is known for providing life insurance solutions, including term life, whole life, and universal life insurance policies.

Desjardins Financial Security Life Insurance Company

Part of the Desjardins Group, this company offers various life and health insurance products, including term life, permanent life, and critical illness insurance, serving both individuals and groups.

Canada Life Insurance Company

Canada Life, previously known as The Canada Life Insurance Company, is a well-established life insurance provider in Canada. It offers a wide array of insurance and wealth management

Empire Life Insurance Company

Empire Life has been serving Canadians for over 90 years and provides a range of life insurance and investment products. Their offerings include term life, whole life, and universal life insurance.

RBC Insurance

RBC Insurance is a subsidiary of the Royal Bank of Canada (RBC) and offers a wide range of insurance products, including life insurance, critical illness insurance, and disability insurance.

Factors to Consider When Choosing a Life Insurance Company

Selecting the right life insurance company is a crucial decision. Here are some factors to consider when making your choice:

- Financial Strength: Ensure that the company you choose has a strong financial rating, indicating its ability to meet future obligations.

- Coverage Options: Evaluate the range of life insurance products offered to find one that aligns with your specific needs and goals.

- Customer Service: Research the company’s reputation for customer service and claims processing efficiency.

- Premiums: Compare premium costs and payment options to find a policy that fits your budget.

- Rider Options: Look for customizable options or riders that can enhance your policy’s coverage.

- Policy Terms: Understand the terms and conditions of the policy, including the length of coverage and any exclusions.

- Reviews and Recommendations: Seek feedback from trusted sources, including friends, family, and online reviews, to learn about others’ experiences with the company.

Why should you choose a bigger insurance company?

Choosing a bigger insurance company in Canada can offer several advantages, which may make it a preferable option for many individuals. Here are some reasons why you might consider selecting a larger insurance company:

Financial Stability and Security:

Bigger insurance companies often have more substantial financial resources and assets. This financial stability is crucial because it ensures that the company can meet its financial obligations, including paying out policyholder claims. This stability provides peace of mind to policyholders, knowing that their benefits are secure.

Variety of Products:

arger insurance companies typically offer a wider range of insurance products and coverage options. This variety allows you to choose policies that align more closely with your specific needs and financial goals. Whether you’re looking for life insurance, health insurance, investment products, or retirement planning, bigger insurers often have you covered.

Experience and Expertise:

Established larger insurance companies often have a long history of serving customers. This experience can translate into a wealth of knowledge and expertise in the insurance industry, helping you make informed decisions and navigate complex insurance matters.

Accessibility and Convenience:

Bigger insurers often have a more extensive network of branches, agents, and customer service representatives. This widespread presence can make it easier for you to access services, ask questions, or seek assistance when needed. Moreover, they may offer online platforms and mobile apps for added convenience.

Innovative Solutions:

Large insurance companies tend to invest in research and development to offer innovative solutions and products. This can include advanced underwriting processes, digital tools, and technologies that enhance the overall customer experience.

Global Reach:

Some larger insurance companies have a global presence, which can be advantageous if you have international insurance needs or if you plan to move or travel abroad. These companies may offer seamless coverage transitions when crossing borders.

Strong Customer Support:

Many bigger insurers prioritize customer service and have dedicated customer support teams. This can result in faster response times, efficient claims processing, and better support in case you need assistance.

Reputation and Trust:

Bigger insurance companies often have well-established reputations and a history of earning trust among policyholders. Their credibility can provide you with confidence that your insurance provider is reliable and will honor its commitments.

Financial Strength Ratings:

Large insurers are more likely to receive higher financial strength ratings from reputable rating agencies. These ratings indicate the company’s ability to meet its financial obligations and pay out claims, offering an additional layer of security.

Stability in the Market:

Larger insurance companies are better equipped to weather economic downturns and market fluctuations. This stability can translate into consistent premium rates and policy terms, providing predictability for policyholders.

While bigger insurance companies offer numerous advantages, it’s essential to remember that the choice of an insurance provider should align with your specific needs and circumstances. Smaller or specialized insurers may also offer competitive products and excellent customer service. Therefore, when selecting an insurance company in Canada, it’s crucial to assess your individual requirements and compare offerings from various providers to find the best fit for your situation.

Why should you choose a smaller insurance company?

Choosing a smaller insurance company in Canada can have its advantages depending on your specific needs and preferences. While larger insurers offer extensive resources and coverage options, smaller insurers may provide unique benefits that align with certain individuals or situations. Here are some reasons why you might consider selecting a smaller insurance company:

Personalized Service:

Smaller insurance companies often prioritize personalized service and customer relationships. With fewer clients to manage, they can offer more one-on-one attention and tailor insurance solutions to your specific needs.

Local Focus:

Smaller insurers may have a strong local presence and focus on serving the needs of the community or region they operate in. This local knowledge can be valuable in understanding unique risks and offering specialized coverage.

Niche Expertise:

Smaller insurers may specialize in niche markets or specific types of insurance. If you have specialized insurance needs that larger companies may not cater to as comprehensively, a smaller insurer with expertise in your area of interest can be a better choice.

Flexibility in Underwriting:

Smaller insurers may have more flexibility in underwriting policies, which can benefit individuals with unique circumstances or medical histories. They may be more willing to consider non-standard risks.

Competitive Premiums:

Smaller insurance companies may offer competitive premium rates, especially for certain types of coverage. This can result in cost savings for policyholders.

Quick Decision-Making:

Smaller insurers typically have streamlined decision-making processes, which can lead to faster policy issuance and claims processing. This agility can be advantageous when you need prompt service.

Community Involvement:

Smaller insurers often have a strong commitment to their communities and may be involved in local charities, sponsorships, or events. Supporting a local company can be appealing to those who value community engagement.

Access to Senior Management:

In smaller insurance companies, you may have direct access to senior management and decision-makers. This accessibility can be beneficial if you have questions or concerns about your policy.

Lower Overheads:

Smaller insurers typically have lower overhead costs than larger corporations. This can translate into cost-effective solutions and potentially lower premiums for policyholders.

Tailored Coverage:

Smaller insurers may be more willing to customize coverage to meet your specific needs. This can result in a policy that closely aligns with your unique circumstances and preferences.

Supporting Local Business:

Choosing a smaller, locally-owned insurance company can be a way to support local businesses and contribute to the growth of the local economy.

While smaller insurance companies offer these advantages, it’s essential to conduct thorough research and due diligence when selecting one. Consider factors such as the company’s financial stability, reputation, customer service record, and the scope of coverage offered. Additionally, assess your individual insurance needs and compare offerings from both smaller and larger insurers to find the best fit for your situation in Canada.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Coming to The End

Choosing the right life insurance company is a significant decision that requires careful consideration of your financial goals and needs. The largest life insurance companies in Canada, such as Manulife, Sun Life etc, offer a wide range of options to cater to various individual and family situations. By assessing your circumstances and comparing policies, you can make an informed choice to secure your financial future and provide peace of mind for your loved ones.

Faq's

A life insurance company is a financial institution that provides insurance products designed to protect individuals and their families financially in the event of the policyholder’s death. These products include term life insurance, whole life insurance, universal life insurance, and others.

Choosing a reputable life insurance company is essential because it ensures that your policy will be honored and your beneficiaries will receive the intended benefits when needed. Reputable companies have a strong financial foundation, good customer service, and a history of fulfilling their obligations.

You can assess the financial strength of a life insurance company by checking its financial ratings from reputable agencies like A.M. Best, Moody’s, or Standard & Poor’s. These ratings reflect the company’s ability to meet its financial obligations.

Choosing the right life insurance policy depends on your individual circumstances, financial goals, and budget. Consider factors such as the amount of coverage you need, the length of coverage, and any specific riders or additional benefits you may require. It’s advisable to consult with a licensed insurance advisor.. Canadian LIC will help you to make an informed decision.

Yes, many life insurance companies allow policyholders to customize their policies with riders (additional benefits). Common riders include critical illness riders, disability income riders, and accidental death benefit riders. These riders can enhance the coverage to better meet your needs.

The need for a medical exam depends on the type and amount of coverage you apply for, as well as your age and health history. Some policies may require a medical examination, while others offer simplified underwriting processes without the need for an exam.

Several factors can influence the cost of life insurance premiums, including your age, health, smoking status, the type and amount of coverage, the length of the policy, and your lifestyle and occupation.

To file a life insurance claim, you typically need to contact the insurance company’s claims department and provide the necessary documentation, such as the policyholder’s death certificate and any required forms. The company’s customer service or claims department can guide you through the process.

Depending on the policy type and the terms and conditions, you may have the option to make changes to your life insurance policy, such as adjusting coverage amounts, adding or removing riders, or changing beneficiaries. It’s essential to consult with your insurance company or agent to understand the options available.

These FAQs provide valuable insights into the world of life insurance in Canada, helping individuals make informed decisions when selecting a life insurance policy and understanding how these policies work with the biggest insurance companies in the country.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]