Life Insurance is given a lot of importance when it comes to financial protection, especially when considering policies like a Million Dollar Life Insurance Policy. A Million Dollar Insurance Policy is not just about leaving behind a large sum—it’s about securing your family’s future with clarity and confidence. Many Canadians choose this level of coverage to ensure their loved ones are not financially burdened after their passing. Understanding how a Million Dollar Life Insurance Policy is paid out helps beneficiaries prepare better and avoid delays during emotionally difficult times. Whether it’s for replacing income, paying off large debts, or supporting long-term goals, this kind of insurance policy plays a crucial role in comprehensive financial planning.

How Does It Work?

A Million Dollar Life Insurance Policy stands as a pivotal financial protection designed to provide substantial coverage to beneficiaries upon the insured person’s passing. This policy is structured to offer a lump-sum payment, often referred to as the death benefit, amounting to one million dollars. This significant payout aims to serve as a very important financial safety guard for the insured person’s loved ones in the event of an unexpected demise.

Coverage Aim and Implications:

The gravity of a Million Dollar Insurance Policy is that it should cover all financial liabilities of the family members and provide for the needs of the dependents. This large amount of coverage has a definite purpose; it’s designed to give a financial buffer to anyone who is financially dependent on the insured after the insured person dies.

The figure behind this coverage, generally a million dollars, is based on a list of financial needs and commitments that are going to surface following the death of the insured.

Beneficiary Support and Financial Security:

When the insured person passes away, the recipients they’ve chosen—normally family or dependents—are eligible to receive this significant death benefit. This money will be used for a variety of purposes, including paying for short-term expenses such as funeral costs, unpaid debts, and mortgage payments, to providing long-term financial support.

It may provide continuous support to the beneficiaries, enabling them to continue their lifestyle or achieve future objectives without any stress about money.

Role in Comprehensive Financial Planning:

A Million Dollar Insurance Coverage is typically an important component of an overall financial plan for a person. It’s the foundation for safeguarding the financial future of those who matter to you, and much more: It is a tool for helping to protect their financial future. This sound coverage brings peace of mind in troubled times, as it helps recipients cope with the repercussions of a death without the burden of costly expenses.

How Timing and Financial Planning Influence the Impact of a Million Dollar Insurance Policy

A lesser-known yet crucial factor in optimizing the benefits of a Million Dollar Insurance Policy lies in the timing of its purchase and the coordination with broader financial planning strategies. Many individuals view life insurance as a standalone product, but those with high-net-worth goals often integrate it into a comprehensive estate and legacy planning framework. This strategic approach is not widely discussed, yet it can significantly influence how impactful the policy becomes for beneficiaries.

Purchasing a Million Dollar Insurance Policy at a younger age not only results in lower premiums but can also open opportunities to align the policy’s payout timeline with major life milestones of the beneficiaries, such as university expenses, home purchases, or even retirement support. Coordinating this policy with trusts or structured inheritances can allow families to manage tax exposure, fund intergenerational wealth transfers, or protect business continuity.

This proactive planning ensures the death benefit doesn’t merely serve as reactive support after loss, but as a tool for long-term empowerment. Unlike general coverage, this kind of foresight turns the policy into a generational asset.

When combined with trusted financial advice and legal structures, a million-dollar benefit does more than provide—it transforms futures.

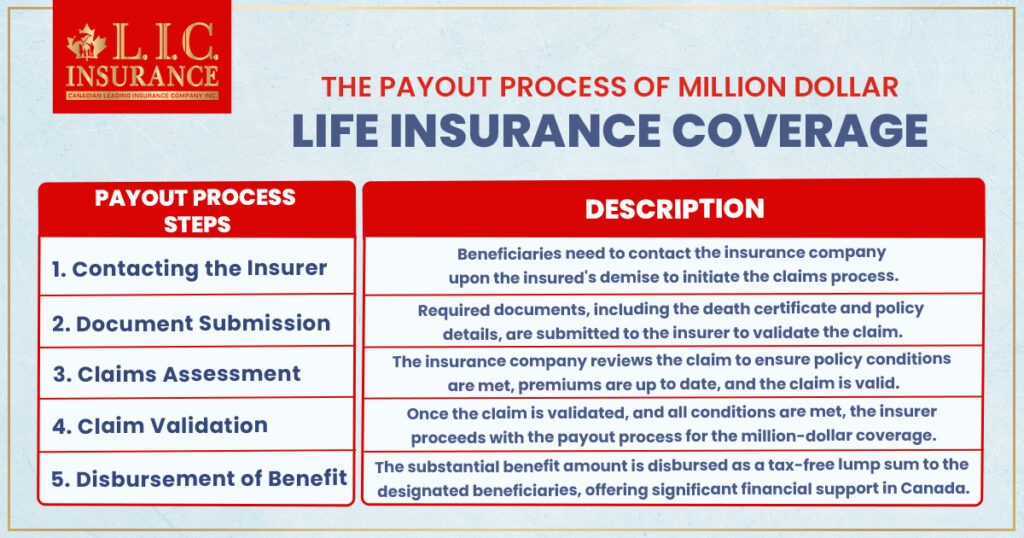

The Payout Process of Million Dollar Life Insurance Coverage

Let’s understand it with the following points:

Initiating the Claim:

In case of the death of the insured, the nominees have to get in touch with the insurance company to aid the claim process without delay. This crucial step entails contacting the insurer, giving them the news of the passing of the insured person, and to get the ball rolling on the formal claim process for the Million Dollar Insurance Coverage.

Document Submission:

When an heir calls on the insurer, they’re walked through the paperwork that will need to be filed. This generally requires that certain forms are filed with necessary paperwork, including the death certificate, proving the life insured has passed on. Furthermore, ready access to policy details makes it easy to file claims on the Million Dollar Life Insurance Policy.

Claims Evaluation:

The insurance company reviews the submitted claim once the essential documents are received. This evaluation phase serves as a critical checkpoint, where the insurer assesses if the claim adheres to the policy’s conditions. Simultaneously, they confirm that premiums for the Million Dollar Insurance Coverage are up to date.

Validation and Payout:

If the insurer successfully validates the claim, it will not hesitate to pay the handsome death benefit in accordance with the terms of the policy. This fateful scene is the culmination of the claims process, as the beneficiaries collect their planned-for million-dollar payday.

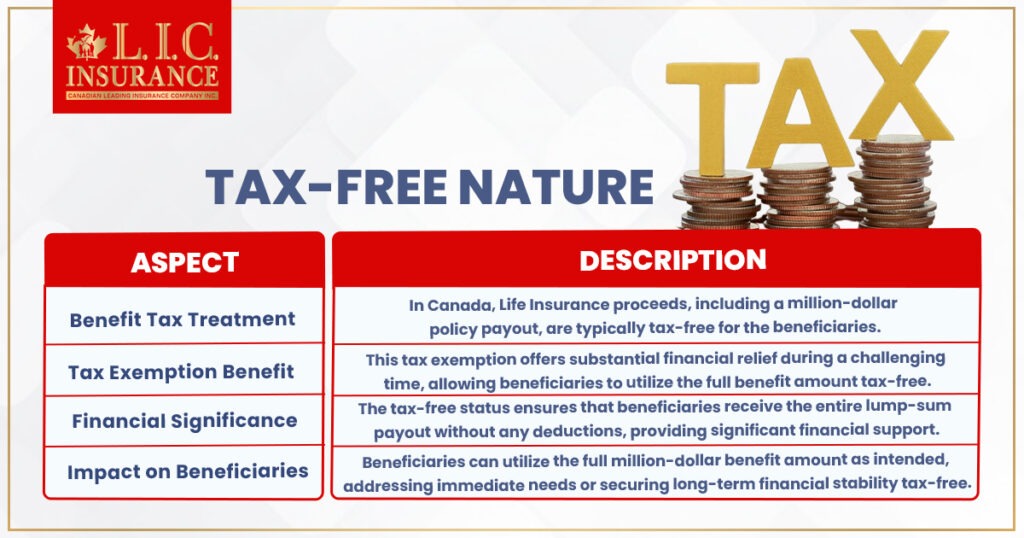

Tax-Free Nature

Canadian Tax Regulations:

Benefits of a Million Dollar Insurance Policy for Both Canadian and U.S Residents. In Canada, the tax status of the proceeds of Life Insurance, including a fat check of Life Insurance proceeds from a Million Dollar Insurance Policy, is very advantageous to the beneficiaries. The tax-free nature of the benefit can be particularly appealing since many other types of income, and benefits themselves, are subject to different taxes, and even if the death benefit of a Life Insurance Policy provides a million dollars, the death proceeds from the policy are almost always tax-free for beneficiaries.

Financial Relief for Beneficiaries:

This tax relief is especially significant at the emotional time of a person’s death. Because the Million Dollar Insurance Coverage is tax-free, the full benefit amount goes to survivors, offering significant financial assistance while avoiding taxes on the benefit received.

Utilizing the Full Benefit:

The tax-free nature of the Million Dollar Insurance Policy payout empowers beneficiaries to utilize the entire lump sum as intended. This allows them to address various financial needs comprehensively, ranging from immediate expenses such as funeral costs or outstanding debts to securing long-term financial stability for themselves and their families.

Impact on Financial Planning:

This tax-free status is extremely significant in financial planning. Recipients need only to allocate the received million-dollar benefit and can do so with the confidence that the money will not erode from taxes, giving them greater financial autonomy to make sound financial choices as needed in the short term and long term.

The tax advantage of Life Insurance in Canada, especially a large Million Dollar Insurance Policy, is an important advantage for a beneficiary. This exemption provides financial relief during a difficult time, since it allows beneficiaries to receive the entire death benefit without being subject to taxes.

Utilizing the Payout

Beneficiaries have the freedom to use the million-dollar benefit they receive according to their needs. Common uses include:

Addressing Immediate Needs:

With the nice big million-dollar benefit from the insurance, beneficiaries have options to invest those proceeds based on what their financial needs are at that time. Generally speaking, they cover the cost of any immediate needs that come up when the policyholder dies:

- Funeral Expenses: The payout can be used to pay for the funeral, and ensure the funeral is not a financial burden on the family while their emotions are tested.

- Debts: If preferred, the beneficiaries are able to use some of the annuity payment to cover financial debts and have a clean break.

Mortgage Repayments: The received benefit can also be applied to paying down a mortgage, keeping up with mortgage repayments, and protecting the family home.

Ensuring Long-Term Financial Stability:

But beyond these immediate costs, the Million Dollar Insurance Coverage may be a chance of a lifetime for your loved ones to ensure their financial security for years to come:

- Investing for security of tomorrow: Some beneficiaries may prefer to save a part of the benefit received to safeguard the family’s future. This might include setting up investment portfolios or savings accounts to add to your regular income.

- Education and Missionary: Many choose to apply a budget towards children’s or grandchildren’s education. It gives recipients the ability to view the future by investing in education with less tension of a monetary burden.

Income Replacement: There are many scenarios in which income loss affects the family as opposed to the insured, but the cash provided will allow the loss of the benefit to be replaced, meaning the family’s stability remains intact.

Strategic Financial Decision-Making:

Since the Million Dollar Insurance Policy payment can be used for a number of purposes, the knowledge of this dynamic variety of functions alerts the beneficiaries and guides them to make the right decisions. The percentage of the benefit set aside between the immediate and the long-term needs should allow the beneficiary to maximize the benefit for their particular needs today and tomorrow.

Payment of a Million Dollar Insurance Policy is flexible to enable beneficiaries to maneuver the financial pressures. Whether to cover existing debts or make a smart investment for the future, the value of the benefit amount cannot be overlooked as a crucial aid to help achieve long-term financial security and secure financial stability and future comfort of the beneficiaries.

Considerations

These considerations need to be kept in mind:

Understanding Policy Details:

Beneficiaries of a Million Dollar Insurance Policy must familiarize themselves with the policy’s intricate details to ensure a smooth claims process and proper utilization of the benefits:

- Terms of Coverage: You need to be very clear about the terms of coverage. Know: Beneficiaries should understand which critical illnesses or conditions are provided for by the policy, and the details of the death benefit.

- Nominee Declarations: A nominee is the assigned beneficiary, and this list can help guarantee that the possible Million Dollar Life Insurance Policy reaches the right people. Correct beneficiary designations are essential for the proceeds to go to the appropriate people.

- Contact Information: Save the insurance company’s contact information, since you may need to use it in case a claim occurs, and that can help you get your claim processed and paid out faster.

Regular Review of Beneficiary Designations:

Regular review and, if necessary, revision of your beneficiaries is important to ensure your designations reflect changes in life events:

- Life changes: Significant life events, including marriages, divorces, births, and deaths within the family, may require a change to beneficiary designations. Such timely updates in the policy ensure no confusion at the time of the distribution of benefits.

Precision and Purpose: One should review beneficiary designations to ensure that both accuracy and agreement with his or her wishes are reflected. Updates keep the accuracy and relevance of the game in tune with the evolving family dynamic.

Importance of Clear Communication:

Open communication among family members is extremely crucial. The insured person should communicate the policy’s existence, details, and intended beneficiaries to avoid confusion or disputes among family members during a challenging time.

Ensuring Smooth Execution:

It is a proactive process to know the policy details and review the beneficiary designations on a regular basis. The Million Dollar Insurance Coverage is guaranteed to be directed where it’s needed most, without interference, allowing the financial protection options to remain intact.

Having knowledge about the policy’s fine print and the importance of keeping your beneficiary updated still can count as a necessary part to manage a Million Dollar Insurance Policy. Being informed and keeping information up-to-date allows beneficiaries to easily navigate through the process, to even receive a significant benefit, giving much-needed financial assistance at a difficult time.

Earning a Million Dollar Life Insurance Policy plan represents a powerful monetary version, and it offers great protection from the illness or death of the insured person. Having a good grasp of the payout and tax-free nature of the benefits associated with these great products will definitely give some peace of mind and allow those who are to receive them to make wiser decisions on how much they deserve, even before they buy a Million Dollar Life Insurance Policy.

For additional information on Million Dollar Insurance Coverage or an explanation about how these polices work, insurance professionals can provide customized advice depending on a person’s specific situation.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

A Million Dollar Life Insurance Policy typically gives out a lump-sum payment to beneficiaries upon the death of the insured person. The coverage terms usually include specified critical illnesses or conditions outlined in the policy.

Familiarize yourself with the Million Dollar Life Insurance Policy’s beneficiary designations. Review and update these designations on a regular basis to reflect any life changes, ensuring the benefit reaches the right recipients.

Contact the insurance company promptly to update beneficiary details. Provide accurate and updated information to ensure the intended recipients receive the Million Dollar Life Insurance Policy.

Necessary documents may include the death certificate, policy details, and beneficiary information. Ensure these documents are readily available for a smooth claims process.

Yes, beneficiaries have the flexibility to use the received benefit according to their needs. It can cover immediate expenses like funeral costs and outstanding debts or be invested for long-term financial security.

It’s advisable to review the Million Dollar Life Insurance Coverage details and beneficiary designations in a periodic manner or after significant life events to ensure accuracy and alignment with current intentions.

In Canada, Life Insurance proceeds, including a million-dollar benefit, are generally tax-free for beneficiaries. This tax exemption offers significant financial relief during a difficult time.

Contact the insurance company directly for any inquiries regarding the policy, claims process, or any concerns related to managing the Million Dollar Life Insurance Coverage.

Yes, it’s beneficial to communicate the Million Dollar Life Insurance Policy’s existence, details, and intended beneficiaries to family members to avoid confusion or disputes regarding the benefit distribution.

Understanding the Million Dollar Life Insurance Policy details, maintaining accurate beneficiary designations, and keeping necessary documents readily available facilitate a seamless claims process, ensuring the benefit reaches the intended recipients efficiently.

Beneficiaries need to contact the insurance company to initiate the claims process. This typically involves submitting necessary documents such as the death certificate and policy details.

Communication is key. Inform beneficiaries about the policy’s specifics, coverage terms, and beneficiary designations, and provide contact information for the insurance company.

Yes, it’s possible to designate multiple beneficiaries. Ensure that the shares or percentages allocated to each beneficiary are clearly outlined in the policy.

Seeking guidance from financial advisors or legal professionals can offer valuable insights, especially when considering updates to beneficiary designations or navigating the claims process.

A lapsed Million Dollar Life Insurance Policy or non-payment of premiums may impact the benefits. It’s crucial to ensure timely premium payments to maintain coverage and avoid potential lapses.

Generally, beneficiaries have the freedom to use the received benefit according to their needs. However, understanding any specific limitations outlined in the Million Dollar Life Insurance Policy is advisable.

Yes, designating a trust as a beneficiary is possible. Consult legal professionals to understand the implications and ensure proper documentation for trust designations.

Exclusions specified in the Million Dollar Life Insurance Policy might affect the claims process. Understanding policy exclusions and their implications is crucial for a realistic expectation of the coverage.

Some policies may offer conversion options. Contact the insurance company to inquire about potential conversion opportunities, depending on the policy terms.

In case of disputes, seek resolution through communication with the insurance company or legal guidance if necessary to ensure fair and accurate benefit distribution.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]