- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can Term Life Insurance Be an Investment?

- Understanding Term Life Insurance: Is It Really Just Protection?

- The Potential Investment Value of Term Life Insurance

- Comparing Term Life Insurance to Traditional Investments

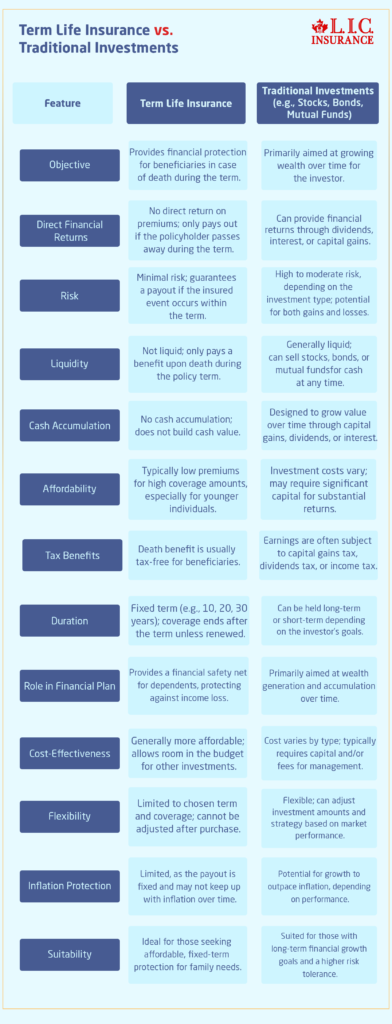

- Term Life Insurance V/S Traditional Investments

- Common Scenarios Where Term Life Insurance Shines as a Financial Tool

- Balancing Cost and Benefit with Term Life Insurance

- Calculating the Potential Return on a Term Life Insurance Investment

- Term Life Insurance as Part of a Diversified Financial Plan

- The Role of Term Life Insurance Agents in Crafting Your Financial Plan

Can Term Life Insurance Be An Investment?

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 15th, 2024

SUMMARY

A Fresh Perspective on Term Life Insurance as an Investment

In Canada, many are still trying to determine whether a Term Life Insurance Policy can indeed be something similar to an investment. There is a tendency, when discussing “investments,” for people to think of something that grows their wealth, such as stocks, real estate, or savings plans. Term Life Insurance, traditionally viewed from the angle of protection rather than investment, sometimes leaves people questioning its value. Many of our clients at Canadian LIC ask questions about whether term life can really fit into their long-term financial strategy. Most Canadians deal with the monthly bills and family expenses, and it’s not hard to wonder, “Is this Term Life Insurance Policy worth my investment, or am I just paying for something I might never need?

If you’ve ever had those thoughts, you’re certainly not alone. Our customers, coming to us to search for online Term Life Insurance quotes, are similarly beset by these concerns. With so many choices in front of you, it’s only natural to want to squeeze every last penny from your hard-earned dollars. In this blog, we’re going to bust some common myths, describe how Term Life Insurance works, and take a look at the strategic place that this often-maligned tool might occupy within your more general financial objectives.

Understanding Term Life Insurance: Is It Really Just Protection?

It is, at its core, a payout to your loved ones in case you die within a specified time frame. And because term life policies do not accumulate cash value or have a return element to them, as Whole Life Insurance or Universal Life Insurance does, one tends to think of Term Insurance not really as an investment.

However, Term Life Insurance can still have a useful place in your financial plan, especially if it is considered in terms of protection for your family’s future. Let’s take a look at how it can work in an investment-like capacity if structured sensibly.

The Potential Investment Value of Term Life Insurance

Perhaps the most universal myth about “investment” is that it has to return in some physical sense. But talking about financial security, an investment can be seen in a much broader manner. Term Life Insurance will not only bring peace of mind and stability to your family but also can be indirectly considered an investment into financial security in the following ways:

- Financial Risk Management: Many Canadians come to Canadian LIC with one primary concern: securing their loved one’s future. Consider Term Life Insurance as a protective barrier that ensures a steady income stream for your family if something unexpected happens to you. From our experience, clients often feel reassured when they realize that Term Life Insurance policies can cover mortgage payments, education costs, and other essential expenses. This layer of security can be a key financial asset, offering a form of financial return for your family if you’re no longer around.

- Affordable Term Life Insurance Premiums Mean More Investment Room Elsewhere: One of the reasons people seek Term Life Insurance Quotes Online is that term policies generally offer lower premiums compared to Permanent Life Insurance Options. By opting for a Term Policy, you free up money in your budget, for other investment vehicles, such as a TFSA or RRSP. We regularly see clients using the savings from their term insurance policy to bolster their other investments, creating a well-rounded financial portfolio.

- The Flexibility to Invest with Life Stages in Mind: At Canadian LIC, we often see families juggling multiple financial responsibilities, from paying off student loans to saving for their children’s education. With Term Life Insurance, you’re able to tailor your coverage to suit different stages of life without tying up resources in a long-term commitment. This flexibility makes Term Life Insurance an adaptable choice that can work as a strategic financial tool rather than simply an insurance expense.

Comparing Term Life Insurance to Traditional Investments

Some may argue that Term Life Insurance doesn’t offer a direct return on investment in the same way stocks or bonds might. But, let’s think about this: if a covered individual dies, perhaps before they are expected to, the Term Life Insurance will provide the financial protection that can be that much bigger “return” than any individual stock or investment. The payout from a Term Policy is much higher than the amount paid in premiums, and it thus forms a good investment for anybody interested in providing long-term security to their family.

In our experience at Canadian LIC, we find that clients who invest in Term Life Policy alongside other savings plans, such as mutual funds or a high-interest savings account, build a more resilient and diversified financial future. This diversified approach is what we often suggest to those who are interested in balancing immediate protection with long-term growth.

Term Life Insurance V/S Traditional Investments

Common Scenarios Where Term Life Insurance Shines as a Financial Tool

Let’s look at a few scenarios we often discuss with our clients to demonstrate how Term Life Insurance can fit into different financial contexts:

- Young Families: Many parents reach out to Canadian LIC to discuss Term Life Insurance Quotes Online. For young families, Term Life Insurance is a cost-effective way to secure financial stability without taking on hefty premiums. By investing in a 20- or 30-year Term Policy, these families can ensure their children’s needs—such as college tuition and living expenses—are covered if an unexpected event occurs.

- Mortgage Protection: Homebuyers often take on Term Life Insurance policies that match the length of their mortgage. This ensures that if the policyholder passes away, the insurance payout can be used to pay off the mortgage, leaving the family with a paid-off home. This scenario is a common one we see at Canadian LIC and is a great example of how Term Life Insurance functions as a financial safeguard.

- Supplementary Financial Tool for Retirement Planning: Although Term Life Insurance doesn’t build the cash value component, it can still play a role in retirement planning by freeing up resources. If a term policy covers you during your working years, you may feel more comfortable taking a higher risk on other investments, knowing that your family’s immediate financial security is protected.

Balancing Cost and Benefit with Term Life Insurance

Of course, there’s always the cost factor, particularly in financial planning. Many people come to Canadian LIC with questions about the cost-effectiveness of a Term Life Insurance Policy. They ask: “Is term insurance a good investment when I’m only paying for coverage and not gaining any cash value?” The answer depends on how you view the benefits.

- Affordable Premiums for High Coverage: Term Life Insurance offers high coverage at a low cost. You might pay a modest monthly premium for a policy that covers hundreds of thousands of dollars. This makes it a sensible financial decision if you’re seeking a way to provide maximum financial protection for your family without sacrificing other investment opportunities.

- Access to Expert Advice and Support: Working with Term Life Insurance Agents, such as those at Canadian LIC, ensures you have access to the guidance and expertise you need. Insurance professionals can help you tailor a Term Life Insurance Policy to suit your budget and needs, making sure your policy provides optimal protection at the best possible rate.

Calculating the Potential Return on a Term Life Insurance Investment

Let’s consider a final common question: “What is the return on investment with Term Life Insurance?” It’s not an easy question because, unlike other investments, Term Life Insurance does not have an inherent direct monetary appreciation, but it does offer substantial indirect returns:

- Protection for Life’s Biggest Investments: Whether you’re covering a mortgage, funding your child’s education, or simply ensuring household expenses are manageable, the financial impact of a Term Life Insurance payout can be substantial. The premium payments you make are an investment in your family’s peace of mind, offering a payout that far outweighs the premiums should the unexpected occur.

- Opportunity to Focus on Other Financial Growth: By choosing an affordable Term Life Insurance Policy, you may be able to allocate funds to high-growth investments or savings plans. This approach allows you to build wealth actively while safeguarding your family’s financial future, which is often the ultimate goal of any investment strategy.

Term Life Insurance as Part of a Diversified Financial Plan

An investment portfolio is built typically on diversification—a strategy that manages and balances risk and potential returns by combining different types of financial instruments. Having Term Life Insurance in your financial plan offers a unique form of diversification. It does not provide a cash return, but it gives risk coverage that other investments do not. Here is how Term Life Insurance complements other financial strategies:

- Risk Mitigation: Traditional investments, such as stocks and bonds, come with inherent risk, and while they can yield returns, they cannot guarantee your family’s security in the event of an untimely death. Term Life Insurance, on the other hand, offers a defined payout, providing a safety net that helps protect your family’s financial future.

- Financial Stability Without Cashing Out Other Investments: We’ve seen numerous clients at Canadian LIC who worry about cashing out their investments if they face financial hardship. With a Term Life Insurance Policy in place, your family can receive a payout without disturbing other financial assets. This ensures that your long-term investment plans remain intact.

- Cost-Effective Protection for Younger Investors: Younger clients often wonder if it’s worth buying Term Life Insurance when they’re just starting out. With lower premiums available for younger policyholders, Term Life Insurance is a cost-effective way to secure financial protection early on, allowing you to invest more aggressively in other areas while ensuring your family has the necessary coverage.

The Role of Term Life Insurance Agents in Crafting Your Financial Plan

The most significant benefit of consulting a Term Life Insurance Agent, like those at Canadian LIC, is that they can offer you individually tailor-made advice from one person with your financial goals in mind. A great number of clients who contact us online for a quote in Term Life Insurance tell us that they would like to link the insurance plan with their overall financial objectives. And that is exactly where our agents will come in to help you:

- Assessing Individual Needs and Goals: A dedicated Term Life Insurance agent understands that no two financial situations are alike. At Canadian LIC, we assess each client’s goals, budget, and priorities, tailoring Term Life Insurance policies to complement other investments. For instance, a young professional might need a high-coverage, low-premium policy, while someone nearing retirement might want a shorter-term policy for mortgage coverage.

- Finding the Best Rates: Shopping for Term Life Insurance Quotes Online can be overwhelming. Our agents streamline this process, using their expertise to find policies with the best rates for the coverage you need. By finding affordable options, agents allow you to allocate funds toward other financial investments without sacrificing your budget.

- Explaining Policy Details in Clear Terms: Insurance policies often contain complex details, which can be challenging to interpret. Our agents make sure clients understand the full terms of their policy, from coverage duration to specific exclusions, ensuring they feel confident in their choice. This clarity is crucial for those who wish to incorporate Term Life Insurance effectively into their financial strategy.

Long-Term Benefits of Term Life Insurance for Different Life Stages

Term Life Insurance is not one size fits all, and benefits may vary at different stages in life. We work with clients of all ages at Canadian LIC and guide them on how Term Life Insurance can improve financial stability at each stage.

- For Young Professionals and New Families: If you’re just starting your career or have a young family, Term Life Insurance can be a powerful financial tool. A term policy with a 20- or 30-year duration can help cover major expenses, such as education and housing, should the unexpected happen. The lower premiums also make it easier to focus on other investments, such as RRSPs or mutual funds.

- Mid-Career Individuals Managing Mortgage and Education Costs: For clients in their 40s and 50s, Term Life Insurance is often chosen to align with major financial responsibilities, like paying off a mortgage or supporting children through college. With the right policy in place, families can avoid financial strain if a primary breadwinner is lost, making Term Life Insurance a worthwhile investment in financial stability.

- Approaching Retirement: For those nearing retirement, Term Life Insurance can be structured to cover any remaining debts, ensuring your estate remains intact. In addition, term policies with shorter durations and targeted coverage can offer peace of mind without committing to long-term, high-premium plans.

Choosing the Right Term Life Insurance Policy: Key Considerations

The difference in Term Life Insurance policies goes further than just selecting the term but also coverage: “How do I choose the right term and coverage?” It depends upon a few very important factors that will directly determine how effective your policy will be in assisting your family in achieving their financial goals:

- Policy Term: The duration of a Term Life Insurance Policy should align with your financial obligations. For example, if you want to ensure your mortgage is covered, choose a term that matches the length of your mortgage. Our agents at Canadian LIC help clients determine the optimal term by considering their age, health, and financial commitments.

- Coverage Amount: How much coverage do you need? This is one of the most common questions our agents answer. It’s essential to choose a coverage amount that’s high enough to support your family’s financial needs, including living expenses, debt repayment, and future goals like education. Our experience has shown that a well-chosen coverage amount can make a significant difference for families, providing them with much-needed stability.

- Affordability: Balancing premiums with your budget is crucial. With Term Life Insurance, you’re often able to secure high coverage for a low cost, but it’s still essential to choose a premium you can comfortably afford over the policy’s duration. Our agents work with clients to find policies that strike the right balance between affordability and comprehensive coverage.

How Canadian LIC Clients Make Term Life Insurance Work for Them

We meet everyday clients who value the term life through personal experiences at Canadian LIC. Some have witnessed friends or family members struggle financially after the loss of a loved one, while others seek to protect their growing families. Here are a few insights that our clients have shared which might sound familiar to you:

- Prioritizing Family Security: Many of our clients view their Term Life Insurance Policy as a personal commitment to their family’s future. Knowing that a Term Life Insurance Policy can keep their loved ones financially stable if the unthinkable happens gives them immense peace of mind. One client shared how securing Term Life Insurance freed them from worrying about the “what ifs” so they could focus on growing other parts of their financial portfolio.

- Flexibility in Financial Planning: For some clients, Term Life Insurance offers the flexibility to invest more aggressively in other areas. By choosing a cost-effective term policy, they free up funds that can be directed toward long-term savings or even high-risk investments. This flexibility enables them to pursue financial growth without compromising family security.

- Simple but Powerful Protection: We often hear clients say that Term Life Insurance provides straightforward, powerful protection. Unlike more complex insurance products, Term Life Insurance is easy to understand and access. This simplicity appeals to those who value a no-fuss approach, making it an ideal addition to any well-rounded financial plan.

Final Thoughts: Is Term Life Insurance an Investment Worth Considering?

While Term Life Insurance does not provide the same traditional investment returns, indirect advantages do exist. A high-value protection service at a lower cost, a vast flexibility option within your greater financial plan. Term Life Insurance can indeed function as an essential component of a responsible, balanced financial strategy. In its zealous commitment to making clients understand the unique opportunities that Term Life Insurance presents and its role as a complement to other investments, Canadian LIC always looks forward to guiding clients through other great ways of managing and optimizing their funds.

Term Life Insurance turns out to be quite a meaningful investment in peace of mind for those who are ready to secure their family’s future while continuing to grow their wealth. By getting a hold of Canadian LIC, the best insurance brokerage, guidance can be assured to be tailored to individual needs who are willing to give their time back to building a stable and prosperous future for themselves and their loved ones.

Is Term Life Insurance an investment? We believe it can be, especially when viewed through the lens of long-term security and financial resilience. Our agents can guide you through this process so that it becomes part and parcel of your financial goals. Contact our agents, find the best Term Life Insurance Quotes Online, and begin your journey to a financially secure future.

More on Term Life Insurance

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions about Term Life Insurance as an Investment

A Term Life Insurance Policy isn’t an investment in the traditional sense since it doesn’t build cash value or offer direct returns. However, it provides critical financial protection that can feel like a valuable investment for your family’s future. At Canadian LIC, we see clients who value the security a Term Life Insurance Policy offers, as it can help cover expenses like mortgages, education, and living costs if the unexpected happens. Think of it as investing in your family’s financial stability.

Many people choose Term Life Insurance for its affordability and flexibility. Term policies usually come with lower premiums, allowing you to allocate your savings toward other investments. Clients who visit Canadian LIC often start by looking for Term Life Insurance Quotes Online because it’s a cost-effective way to secure substantial coverage for a specific period. This approach is perfect for those who want to protect their families while still having funds to invest elsewhere.

A Term Life Insurance Policy is best used as part of a balanced financial plan rather than as a standalone investment. It offers valuable protection, especially during your working years or when you have significant financial obligations. Many clients at Canadian LIC choose Term Life Insurance for specific financial needs, like covering their mortgage or supporting their children through college, while also investing in other long-term financial products like RRSPs or TFSAs. Term insurance gives your family security without tying up your entire investment budget.

While Term Life Insurance doesn’t accumulate cash value, it provides peace of mind by covering essential financial risks. If something happens to you, the policy’s payout can help your family maintain their lifestyle, cover debts, and manage future costs. This kind of protection can allow you to take on higher-risk investments elsewhere, knowing that your family’s security is in place. Canadian LIC often advises clients that Term Life Insurance can complement other investment efforts rather than replace them.

Yes, Term Life Insurance Agents can be a valuable resource when selecting a policy. At Canadian LIC, our agents help clients find the right policy by understanding their budget, coverage needs, and future goals. Our team can assist in comparing options and ensuring you receive the best possible rates, which can be challenging when relying solely on online quotes. Working with an agent provides personalized advice that can make the policy selection process simpler and more suited to your unique needs.

The right term length typically aligns with your financial obligations. For instance, if you want coverage until your children are financially independent or until a mortgage is paid off, a 20- or 30-year term might be ideal. Canadian LIC agents often help clients assess their needs to find a term length that provides the most value. By considering factors like your age, financial goals, and family needs, we can recommend a policy that fits well within your life’s plan.

Many Term Life Insurance policies offer options for increasing coverage, but it depends on the specific policy and provider. If your financial needs change, such as buying a home or having a child, you may want to increase your coverage. At Canadian LIC, we see clients who revisit their policies every few years to ensure their coverage still meets their needs. Our agents can help you explore options for adding to your policy so you’re always covered.

Term Life Insurance policies generally come with lower premiums than Permanent Life Insurance Policies because they cover a fixed period and don’t accumulate cash value. Many clients at Canadian LIC choose Term Life Insurance for its affordability, especially when their primary goal is protection rather than cash growth. Lower premiums allow you to use the savings for other investments, making Term Life Insurance a flexible and budget-friendly choice.

Most Term Life Insurance policies don’t offer a return of premiums. If the policy term ends and you’re still alive, the coverage simply expires, and no payout occurs. Some people see this as a drawback, but many of our clients at Canadian LIC feel that the low premiums make term insurance a worthwhile safety net, even without a refund. Knowing your family has been protected provides value beyond the cost of the premiums paid.

Yes, comparing Term Life Insurance Quotes Online is a great starting point for getting an idea of pricing and coverage options. However, our clients often find that speaking to an agent provides more insight and helps refine their choices. At Canadian LIC, we offer access to detailed Term Life Insurance quotes, allowing you to understand each option thoroughly before making a decision. Online quotes are a useful tool, but personalized advice can make a big difference in finding the right policy.

Some Term Life Insurance policies offer a conversion option, allowing you to convert your term coverage to a Permanent Policy before the term expires. This can be beneficial if you decide that you want lifelong coverage later on. Many clients at Canadian LIC start with term policies for affordability and flexibility, then consider converting to Permanent Life Insurance as their needs change. Our agents can guide you through conversion options if you think this might suit your future plans.

Choosing the right coverage amount depends on your family’s financial needs and lifestyle. Consider factors like outstanding debts, daily living expenses, future goals, and educational costs for children. At Canadian LIC, we help clients determine coverage by examining their financial responsibilities, ensuring the policy amount aligns with their unique situation. The right coverage should provide adequate support to your family without overextending your budget.

These FAQs answer common questions about using Term Life Insurance as a financial tool, helping you understand how it can fit into your overall financial plan. Suppose you’re considering Term Life Insurance. Canadian LIC agents are here to provide you with tailored advice. In that case, the best Term Life Insurance Quotes Online and all the support you need to make an informed choice that benefits your family.

Sources and Further Reading

To deepen your understanding of Term Life Insurance and its role in financial planning, consider exploring the following resources:

- MoneySense: Best Life Insurance in Canada for 2024

- This comprehensive guide discusses various life insurance options available in Canada, including Term Life Insurance, and offers insights into selecting the best policy for your needs.

MoneySense

- This comprehensive guide discusses various life insurance options available in Canada, including Term Life Insurance, and offers insights into selecting the best policy for your needs.

- Serenia Life Financial: Term Life Insurance in Canada

- This resource provides detailed information on Term Life Insurance, comparing it with whole life insurance, and offers guidance on choosing the right term length and coverage amount.

SereniLife

- This resource provides detailed information on Term Life Insurance, comparing it with whole life insurance, and offers guidance on choosing the right term length and coverage amount.

- Wealth Awesome: 13 Best Term Life Insurance Companies in Canada (2024)

- This article reviews and compares Term Life Insurance providers in Canada, helping you make an informed decision when selecting a policy.

Wealth Awesome

- This article reviews and compares Term Life Insurance providers in Canada, helping you make an informed decision when selecting a policy.

- Manulife: Term Life Insurance Canada

- Manulife offers insights into their Term Life Insurance products, including coverage options and benefits, assisting you in understanding how Term Life Insurance can fit into your financial plan.

Manulife

- Manulife offers insights into their Term Life Insurance products, including coverage options and benefits, assisting you in understanding how Term Life Insurance can fit into your financial plan.

- HelloSafe.ca: How Life Insurance Investment Works in Canada in 2024

- This article explores the investment aspects of life insurance in Canada, providing valuable information on how life insurance can be integrated into your investment strategy.

HelloSafe

- This article explores the investment aspects of life insurance in Canada, providing valuable information on how life insurance can be integrated into your investment strategy.

These resources offer valuable perspectives and detailed information to help you make informed decisions about incorporating Term Life Insurance into your financial planning.

Key Takeaways

- Term Life Insurance as Financial Security: While Term Life Insurance doesn’t offer cash growth, it provides a substantial financial safety net for your family in case of unexpected events, covering essential expenses like mortgage payments and education.

- Cost-Effectiveness and Flexibility: With generally lower premiums, Term Life Insurance allows you to balance protection with investments in other areas, making it a flexible option for those prioritizing budget and financial growth.

- Support at Every Life Stage: Term Life Insurance can be adapted to various life stages—whether you’re starting a family, paying off a mortgage, or approaching retirement, the coverage can be tailored to align with your needs.

- Value in Diversified Financial Planning: Term Life Insurance acts as a foundational part of a balanced financial plan, helping you protect your family while leaving room for higher-return investments elsewhere.

- Personalized Guidance with Agents: Term Life Insurance Agents, like those at Canadian LIC, offer tailored advice and help you find affordable, effective coverage, ensuring that your policy aligns with your financial goals.

Your Feedback Is Very Important To Us

We’d love to hear about your experiences and thoughts on using Term Life Insurance as part of your financial strategy. Your feedback will help us understand the common struggles and concerns Canadians face regarding Term Life Insurance as an investment.

Thank you for taking the time to share your thoughts! Your insights will help us improve our understanding of how Canadians view Term Life Insurance as an investment tool and address any challenges you face.

IN THIS ARTICLE

- Can Term Life Insurance Be an Investment?

- Understanding Term Life Insurance: Is It Really Just Protection?

- The Potential Investment Value of Term Life Insurance

- Comparing Term Life Insurance to Traditional Investments

- Term Life Insurance V/S Traditional Investments

- Common Scenarios Where Term Life Insurance Shines as a Financial Tool

- Balancing Cost and Benefit with Term Life Insurance

- Calculating the Potential Return on a Term Life Insurance Investment

- Term Life Insurance as Part of a Diversified Financial Plan

- The Role of Term Life Insurance Agents in Crafting Your Financial Plan

Sign-in to CanadianLIC

Verify OTP