- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

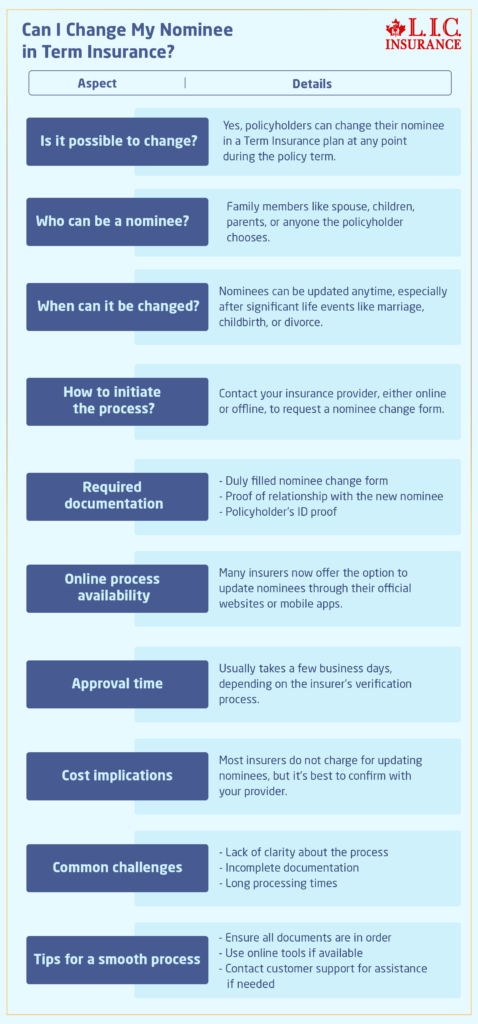

- Can I Change My Nominee In Term Insurance?

- Importance of Nominees in Term Insurance Policies

- Reasons to Change Nominees

- Step-by-Step Process for Changing Nominees

- Required Documents and Forms

- Impact on Policy and Beneficiaries

- Legal Considerations

- The Importance of Regular Policy Reviews

- Can I Change My Nominee in Term Insurance?

- Final Thoughts

Can I Change My Nominee In Term Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 20th, 2025

SUMMARY

The blog describes the process of how to change a nominee in Term Life Insurance Policies in Canada. It focuses on keeping the beneficiary information updated, including reasons for changing nominees, step-by-step instructions, necessary documents, common mistakes to avoid, legal considerations, and its effect on the policy payout. The blog further describes how the Canadian LIC, being a trusted insurance broker, guides its clients through this process, thereby ensuring the protection of the financial security of their loved ones.

Introduction

Term Life Insurance Policies are primary in securing one’s loved one’s financial future. Any Term Insurance Policy consists of several critically important aspects with perhaps the very important one involving choosing a nominee in the case of unfortunate, untimely death of the insured one. Now suppose a need does arise to make changes to some nominees. So here is for you an all-inclusive guide that takes you through the reason, process, and considerations toward updating your nominee according to your changing wishes over the Term Life Insurance Cover.

Importance of Nominees in Term Insurance Policies

The most important choice you will need to make when you are purchasing Term Life Insurance is choosing a nominee. The nominee is the family member on whom the rights of the legal policy are bestowed. This will make sure that your loved ones will be protected when you are no longer around to provide for them. However, life is not always predictable. Then maybe the person you initially chose as a nominee may no longer match your current situation and relationships.

For example, the Canadian LIC customer had nominated their sister when they were single. Over time, now married with children, they felt the nominee should ideally be their spouse. Unfortunately, most people remember to update that critical information only when it leads to complications thereafter. Maintaining the nominee’s information up-to-date means the policy pay-out goes exactly to the correct person, as desired, without legal litigation or delay.

It’s more than just paperwork when you choose the right nominee; it’s fulfilling the promise you made to your family about the future. When a payout from a policy does not go to the person you intended, it may bring about emotional and financial distress among your loved ones. This is why one should regularly review their Term Life Insurance Policies and change them when they need to be changed.

Reasons to Change Nominees

There are several reasons why policyholders decide to update their nominee in a Term Insurance Policy:

- Marriage or Divorce: Marital or divorce events often call for changes in the nominees. Most people like to change the nominee to their spouse after marriage or eliminate an ex-spouse after divorce. For instance, a young professional in Ontario had named his best friend as the nominee when he first bought a Term Life Insurance Policy. He later changed it to his spouse after getting married since he wanted to secure the financial future of his new family.

- Birth of Children: Parents may wish to secure their children’s financial future by nominating them. This always occurs when couples begin planning for their children’s education and other long-term needs.

- Death of the Current Nominee: In case the existing nominee dies, the policy needs to be updated with a new nominee in order to prevent complications. This was the situation of a Vancouver client, and she was so relieved to learn that it is simple with the guidance of Canadian LIC.

- Changing Relationships: At times, over the years, relationships change, and you might want to update those changes in your policy. You may have chosen a sibling or friend as a nominee at the initial stage, but your family might be growing now, and you would like to have your spouse or children as the nominee instead.

- Financial Dependents: Your financial dependents might change over time, such as when aging parents or siblings become reliant on you. In such cases, updating your nominee ensures that the policy benefits reach those who need them the most.

- Legal Requirements: Some cases of legal necessity, such as adopting a child or a change ordered by a court, demand that you revise the nominee. These situations exemplify why reviewing your policy and staying current with what you are living nowadays is necessary.

With these above reasons in mind, you’ll be able to make sure your term life policies are always valid and helpful for those you want to provide for.

Step-by-Step Process for Changing Nominees

It is not that hard to update the nominee in your Term Life Insurance Policy, but it requires a lot of proper steps to avoid delay. Here’s how you can do it:

- Contact Your Insurance Provider: Contact your Term Life Insurance Company -either through Term Life Insurance agents or online directly and let them know of your intentions to change the nominee. For instance, Canadian LIC has an easy process for facilitating changes, which is, therefore, hassle-free.

- Obtain the Necessary Forms: Request the Nominee Change Form from your insurance company. Most providers, such as Canadian LIC, offer the facility to download the forms online for your convenience. This way, you can ensure that you get the right and updated document for your policy.

- Complete the Form: Fill out the form with the correct information. Some of the details you need to fill include:

=Your policy number

=Current nominee’s information

=New nominee’s name, relation to you, and contact

Ensure all the information is correct and readable so that your application is not rejected or delayed in processing.

- Attach Required Documents: Attach all necessary supporting documents, such as proof of identity for the new nominee and any legal documents, if applicable. Make sure that all the documents are valid and current.

- Submit the Form: Upon completion, submit the form along with all required supporting documentation directly to your insurance provider. It is usually possible to do this in person, through the mail, or online. Canadian LIC customers like the ease of submitting forms online, which saves them a lot of their time as well as effort.

- Confirmation: Once the insurance company processes it, they will issue confirmation. Keep this confirmation with your records; it is proof that the nominee details have been updated correctly.

Each of these ensures that your nominee change request gets processed in a smooth and efficient manner.

Required Documents and Forms

Changing your nominee involves submitting certain documents along with the application form. These may include:

- Policy Document: A copy of your Term Life Insurance Policy is sent to the insurer for proof of details from your policy document.

- Identity Proof of New Nominee: A government-issued ID such as a passport, driver’s license, or birth certificate. This ensures the new nominee’s identity is correctly recorded.

- Relationship Proof: If the nominee is a family member, then the relationship can be proved by producing documents such as a marriage certificate or birth certificate.

- Death Certificate: This is applicable if the new nominee has been deceased, and the change will be processed together with their death certificate.

It is only through complete, accurate documentation that there can be the smoothest and swiftest updates. The team of the Canadian LIC even advises clients before preparing these to avoid any undue delay.

While changing nominees is relatively straightforward, there are common mistakes you should steer clear of:

- Delaying the Update: Procrastinating the nominee change can lead to complications if something unforeseen happens. A client from Calgary regretted not updating their policy in time, leading to unnecessary legal disputes.

- Incomplete Documentation: A request submitted with incomplete or improper documents is always delayed or disapproved. Paperwork must, therefore, always be verified properly before being sent.

- Not Informing Stakeholders: This is a best practice as the new nominee is informed of his or her role and responsibilities. Thus, if the need arises to make a claim for policy benefits, both rights and obligations are known.

- Forgetful of Legal Heirs: The nominee should be on the same page as your estate planner. Many times, the nominees are not legal heirs, and this may cause many disputes. One must take the advice of experts in law and insurance experts to avoid such problems.

- Omitting Regular Reviews: Regularly reviewing your Term Life Insurance Policies helps avoid outdated nominee details. Canadian LIC emphasizes this practice during annual client consultations.

Impact on Policy and Beneficiaries

The nominee is updated to ensure that policy benefits reach the person intended to benefit without unwarranted quarrels or delay. However, failing to update the information brings about complications. For instance, when a Canadian LIC client died, their ex-spouse, being an outdated nominee in their policy, caused quarrels in courts, which might have been averted by just updating the nominee.

Keeping the nominee information updated makes sure:

- Smooth policy payout

- Reduction of litigation

- Financial security for the right beneficiaries

Legal Considerations

In Canada, certain legal aspects govern the nominee’s role and rights:

- Nominees vs. Legal Heirs: Although the nominee is entitled to the payout, he or she might not hold the money if the legal heirs disagree with the decision. It’s very important to make sure that your nominee is aligned with your will or estate planning.

- Minor Nominees: If your nominee is a minor, you’ll need to appoint a guardian to manage the policy benefits until the nominee reaches adulthood. This adds on extra responsibility but ensures the funds are used wisely.

- Court Orders: If a divorce or separation petition is filed, the court order may change who the nominee is. Seek legal advice for such situations.

Legal and insurance professionals, including Term Life Insurance Brokers, should be consulted to ascertain compliance with the relevant statutes of Canada.

The Importance of Regular Policy Reviews

Life is continuously changing, and so should the insurance policy. Checking for updates on the term life policies regularly helps your coverage and nominees stay current with life’s developments. According to Canadian LIC, conducting an annual review with your client would reflect any change that occurs in your life.

Keeping your policy up-to-date is a proactive step toward ensuring the safety of your loved ones. It is a way that ensures the benefit goes where they are needed without unnecessary complications.

Can I Change My Nominee in Term Insurance?

Final Thoughts

Switching your nominee for your Term Life Insurance Policy can be an important but straightforward process. It ensures that your policy benefits align with your current life circumstances and provide financial security for the intended beneficiaries. Canadian LIC- one of the best Term Life Insurance Brokers- can ensure that you can easily complete this process. Update your Term Life Insurance Policy today and secure your loved ones forever.

More on Term Life Insurance

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs: Changing Nominees in Term Life Insurance Policies in Canada

Yes. You can change the nominee in your Term Life Insurance Policy. Changes are frequent among policyholders in light of newly-experienced life events, such as marriage and divorce or even through the birth of children. Clients with Canadian LIC can easily get them to update their nominee details so their policy can reflect reality.

To replace your nominee, you can do so by writing to your insurer or Term Life Insurance broker. You would then be required to fill in the Nominee Change Form and supply other documents required, such as proof of the identity of your new nominee. They will take care of your request at their insurer.

Photocopy of the policy along with the new nominee’s identity proof, say the driver’s license and passport. Proof of their relationship, marriage certificate, and death certificate. All such documents must pass through proper scrutinization.

Yes, you can update your nominee details multiple times as your circumstances change. However, it’s essential to inform your insurer each time and provide the required documentation.

No, changing the nominee will not impact the terms and benefits of your policy. It simply updates the person who would receive the payout. More importantly, Canadian LIC makes sure that the clients are well aware of making their nominee information current.

Most insurance providers do not charge a fee for updating the nominee. However, it’s always best to confirm with your insurer or Term Life Insurance broker.

Yes, a minor can be named as a nominee, but one must appoint a guardian to take care of policy benefits until he or she comes of age legally. Canadian LIC guides clients on this so that proper documents are in place.

If you fail to update your nominee, your payout may land in the pocket of an undesired person or cause legal complications. For example, one Canadian LIC client experienced a delay in payouts because the client had failed to update her nominee after divorcing. Avoiding such instances is possible through frequent reviews.

Yes, you can name more than one nominee and state the percentage of the benefit each will receive. This is very helpful for people who have more than one dependent.

They specialize in Term Life Insurance Policies for their clients in the Canadian region. It can either be to make them updated regarding procedures or support them with all the papers; they will see that procedures run pretty smoothly with periodic updates.

Term Life Insurance is usually updated at any major life event such as marriage, childbirth, or death in the family. Regular review ensures that term life policies reflect your changing priorities and needs at any point in time.

Many insurance providers, including those partnered with Canadian LIC, offer the option to update nominee details online. This method is convenient and saves time, especially for busy individuals.

Brokers like Canadian LIC streamline the process by providing expert advice, handling documentation, and ensuring all changes are correctly processed. Working closely with clients and being concerned about their queries helps to bring the best solution to them.

By updating your nominee, the payout process will be smoother and directed towards the right person. If the information of your nominee is outdated, there could be a dispute over or delay in the disbursement of the benefits.

Yes, you can update your nominee even if you buy Term Life Insurance online; you just have to contact the insurer or use the online policy management portal. Canadian LIC can help its clients navigate these portals effectively.

Yes, you can even change your nominee anytime during your policy term, but you really should keep an updated record of the information.

Yes. Anyone can be your nominee, not necessarily a member of your family. But then, it would be recommended to choose someone you trust and who knows your financial intent.

It usually takes the insurance company a few business days to process, according to your insurance provider. Canadian LIC is assured of completing the procedure quickly by guiding its clients through all the procedures and documents necessary.

If you do not have a nominee, the payout will be paid out according to the legal heir laws in your province. It might take time, and you would not like that. Generally, Canadian LIC always advises their clients to nominate a nominee so that such situations can be avoided.

You can nominate a charity as the recipient if you wish to give back to a cause close to your heart. In that case, the necessary paperwork would be facilitated by Canadian LIC.

It’s not legally required to inform the current nominee before making a change. However, it’s a good practice to communicate your decision to avoid confusion.

Only if you allow it will the nominee be able to view your policy details. Many policyholders like to share basic information with their nominees so that the nominee knows how to claim the benefits.

If the nominee does not have the necessary documents, the payout will be delayed or denied. Canadian LIC helps its clients educate their nominees on the necessary documents to avoid such issues.

Yes, you can make different nominees for each policy. You can call your spouse as a nominee for one and your children as a nominee for another. Canadian LIC helps clients strategize nominee designations under their various financial goals.

Yes, your insurer will send a confirmation once the update is processed. Keep this confirmation for your records to ensure your nominee information is accurate.

Yes, if Term Life Insurance is bought online, updating the nominee information is possible using your insurer’s portal or contact directly with the provider. Canadian LIC is assisting its clients when more help may be needed through online updates.

Yes, dealing with brokers such as Canadian LIC makes it easier. They provide you with professional advice and ensure that all updates are dealt with correctly, saving you time and effort.

If your nominee cannot claim the payout, the benefits will typically pass to your legal heirs. Reviewing and updating your nominee regularly is advisable to prevent such situations.

Yes, you can name a contingent nominee who will receive the payout if your primary nominee cannot claim it. This is especially useful for long-term policies.

Some insurers may require a witness to sign the Nominee Change Form. Canadian LIC informs clients about such requirements to ensure a smooth update process.

You can share details of the policy and the claims process with your nominee. It is advised to keep the copy of policy documents in a safe but accessible area and discuss such location with the nominee.

Yes, you can allocate specific percentages of the policy benefits to multiple nominees. This is common for policyholders with multiple dependents.

If there’s an error on the form, the insurer may reject your request. Double-check all details before submission, and work with Canadian LIC to ensure accuracy.

Yes, you can name a nominee residing outside Canada. However, the claim process might take longer due to additional verification requirements.

Experienced agents ensure that the process is smooth. They take care of the paperwork, offer one-to-one advice and attend to every query, making it easier for you to focus on protecting your loved ones.

You can always ask for more questions or refer to the Canadian LIC for specific advice. Updating your nominee information ensures that the right person receives your benefits without hassle.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

Offers comprehensive resources on life insurance, including guidance for business owners in Canada.

Financial Consumer Agency of Canada (FCAC)

https://www.canada.ca

Provides insights into financial products and services, including Term Life Insurance plans for business needs.

Insurance Bureau of Canada (IBC)

https://www.ibc.ca

Features valuable information about insurance trends, business continuity, and financial protection.

Business Development Bank of Canada (BDC)

https://www.bdc.ca

Discusses financing options and the importance of life insurance in securing business loans and investments.

Insurance Business Canada

https://www.insurancebusinessmag.com/ca/

Includes articles on Term Life Insurance, its benefits for business owners, and industry trends in Canada.

Globe and Mail – Business Section

https://www.theglobeandmail.com

Covers financial planning, insurance for entrepreneurs, and practical advice for Canadian business owners.

Key Takeaways

- Essential for Business Continuity:

A Term Life Insurance plan ensures your business can continue operating smoothly by covering debts, payroll, and other expenses in unforeseen circumstances. - Affordable and Flexible Coverage:

Term Life Insurance plans offer cost-effective solutions tailored to the specific needs of business owners, such as loan protection or succession planning. - Key Support for Loans and Investments:

Financial institutions often require life insurance as collateral, making a Term Life Insurance plan a vital tool for securing funding. - Easy Access to Online Quotes:

Business owners can compare Term Life Insurance Quotes online to find policies that align with their financial goals and budgets. - Supports Family and Succession Planning:

A Term Life Insurance plan helps in smoothly transitioning ownership to heirs or partners without disrupting business operations. - Protects Key Employees:

Key person insurance, as part of a Term Life Insurance plan, safeguards businesses reliant on specific individuals for success. - Tax Advantages:

In some cases, premiums may be tax-deductible, and death benefits are generally tax-free, adding financial benefits to the coverage. - Future-Ready Policies:

Emerging trends like personalized plans, digital tools, and integration with financial planning ensure Term Life Insurance plans remain relevant and effective for modern businesses.

Your Feedback Is Very Important To Us

Thank you for taking the time to fill out this questionnaire! Your feedback will help us understand the challenges people face when changing a nominee in their Term Insurance.

Thank you for sharing your feedback! Your input will help improve services and processes related to nominee changes in Term Insurance.

IN THIS ARTICLE

- Can I Change My Nominee In Term Insurance?

- Importance of Nominees in Term Insurance Policies

- Reasons to Change Nominees

- Step-by-Step Process for Changing Nominees

- Required Documents and Forms

- Impact on Policy and Beneficiaries

- Legal Considerations

- The Importance of Regular Policy Reviews

- Can I Change My Nominee in Term Insurance?

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP