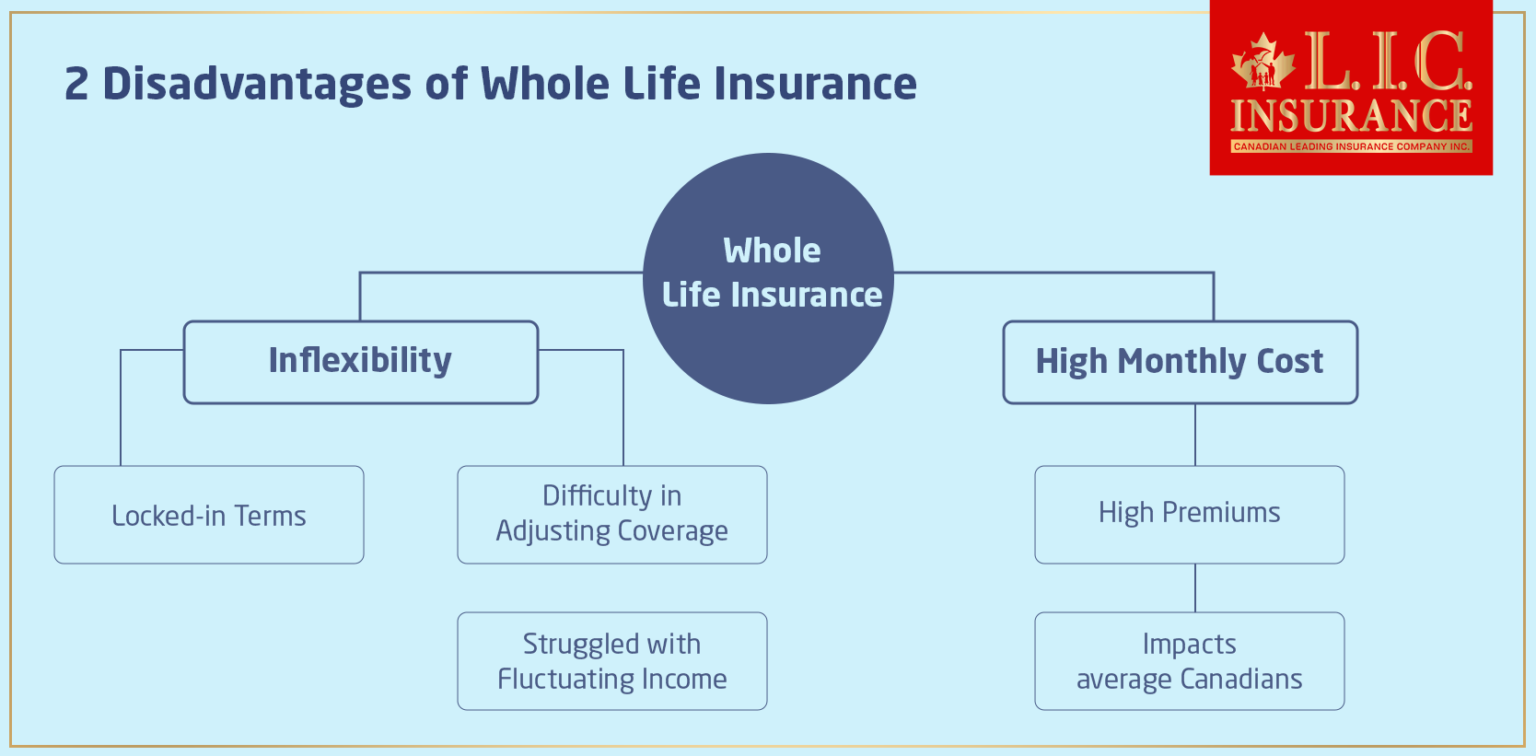

When it comes to securing the financial future of both yourself and your loved ones, the decision on which type of life insurance to go for is sure to feel overwhelming. As great a concept as Whole Life Insurance may seem, with its features of lifetime coverage and the possibility to accumulate cash value, there are many Whole Life Insurance pros and cons that many Canadians fail to consider. Put yourself in the shoes of a small business owner in Vancouver, walking that tightrope between budget management and looking for solid financial protection. Or maybe you are a first-time parent in Toronto, worrying about how this life uncertainty will, in the long run, affect your ability to provide for your child. It’s in these everyday situations that the cons of Whole Life Insurance, such as high monthly costs and inflexibility, really come to the fore. Today, we will take a look at two big cons that you potentially run into regarding Whole Life Insurance—factors that may affect your decision. Our goal? Keep you abreast and fully involved, knowing we are always here to help you navigate with ease and confidence through the complex insurance world.

The High Monthly Cost of Whole Life Insurance

The Reality of Premiums

Whole Life Insurance is known to be very expensive monthly. For example, a 40-year-old entrepreneur, Saran, who lives in Calgary, looked at a Whole Life Insurance Policy to cover his business and family. Saran was astonished to have received Whole Life Insurance Quotes with high premiums compared to Term Life Insurance Policy. He found out that the monthly cost of a life insurance policy with a death benefit of $500,000 was nearly three times what she would pay for a similar-term life policy. This higher cost arises because the Whole Life Insurance will cover the individual during his entire lifetime; hence, part of the premium he will be paying will cater to the building of the cash value. This cash value component grows over time and can be borrowed against in the future. But for the likes of Saran, whose current financial responsibilities are taking care of a family and growing a business, such huge premiums are a turnoff. Again, the high cost of the premiums would lock out quite a good number of average Canadians who would need such financial security but may not be in such a position to be able to pay premiums daily and still cater to all their other financial responsibilities.

The Impact on Personal Finance

Take, for example, Rajendar, who is a professional software developer in Montreal. He opted to buy a Whole Life Insurance Policy at an early age. The concept of building up cash value along with coverage seemed pretty attractive to him at first look. But as the family’s needs grew, like paying for new school fees and fixing up the house, Rajendar found it harder and harder to pay the high policy payments. While he tries to find a balance between his short-term financial needs and his long-term security, the stress of “Whole Life Insurance Monthly Cost” starts to mix with his immediate financial needs.

The Inflexibility of Whole Life Insurance

Locked-In Terms

Whole Life Insurance Policies are less flexible than their term counterparts, which can be a significant disadvantage. Generally speaking, by committing to a Whole Life Insurance coverage, you’re locking yourself into a fixed premium and death benefit unless, of course, you decide to surrender or buy additional coverage with the policy. The 25-year-old teacher from Edmonton, Emeesha, finally understood that her policy could not be changed to fit her and her family’s needs. She had to start a new policy or pay high surrender fees when she tried to change her coverage to match her new financial situation, which included less mortgage debt but more school costs for the kids.

Difficulty in Adjusting Coverage

The lack of this flexibility can be one of the worst things, especially in a fast-moving world. For example, Kevin, a freelance graphic designer working in Halifax, found that his Whole Life Insurance Policy, which he had at first seen as a guarantee and a safety net, turned out to be a financial burden when his job changed, and he made less regular income. The fact that Whole Life Insurance was inflexible in its structure meant that he could not even, at least for some years, downsize the coverage or, say, reduce the amount of premiums in respect to his fluctuating income vis-à-vis required expenses. This, in a broader perspective, brought about financial strain, even in other aspects of life.

The End

One will find both great opportunities and formidable obstacles when considering Whole Life Insurance. As seen from some examples such as Saran, Rajendar, Emeesha, and Kevin, Whole Life Insurance carries quite high costs and is very rigid. However, it is important that these aspects are kept very clear so one can make an educated decision, helping fulfill long-term financial objectives.

If the shared stories resonate with your personal or family struggles in their financial planning, it might be time for you to act. Consult with a professional advisor from Canadian LIC who will help you tailor a plan that best suits your budget and lifestyle. Canadian LIC is one of the finest Insurance Brokerages in Canada, delivering extremely personalized services and helping its clients make their way through the complex paths of insurance possibilities. Do not wait until the last minute. Secure your future by reaching out to Canadian LIC today. By doing this, you will not only have peace of mind for yourself but also for your family for many years to come.

Dealing with the complexities of Whole Life Insurance might not be something you would like to do on your own. Let Canadian LIC guide you in finding just the right plan to make sure you have the coverage you need. Secure your consultation today and get a step ahead on the pathway to a more secure financial tomorrow.

Find Out: How many years do you have to pay for the Whole Life Policy?

Find Out: Can you buy Whole Life Insurance for your child?

Find Out: Who should opt for Whole Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Whole Life Insurance

The cost of monthly premiums for whole life coverage is determined by various factors such as your age and health at the time of applying for the insurance, the amount of coverage that you choose, and the terms of the policy as set by the insurance company. Take a man like John, a 35-year-old accountant from Ottawa who is in perfect health and a non-smoker, who receives an offer much less than his 35-year-old friend Alex, who is also in good health but with some health problems. The risks vary, and that is reflected in their cost. This knowledge can greatly help you work out an effective budget for your insurance needs.

Accordingly, one can find the most affordable Whole Life Insurance Quotes by comparing different insurers and exploring various policy options. An example is Linda from Saskatoon, who saved on the premiums paid to her after comparing quotes from multiple providers. For this, she used an internet tool to compare quotes and, later, talked to an insurance advisor, whereby she understood the benefits and limitations. Thus, a proactive approach on her part provided the possibility to get a cost-effective policy that would fit into her long-term financial planning.

Lowering your monthly cost directly may be challenging once a policy is in place because Whole Life Insurance premiums are typically fixed. In this case, you can look for indirect ways to reduce financial stress, like adjusting the death benefit or borrowing against the cash value. In one example, a small business owner from Vancouver named Michael found himself in a downturn in business revenues. When that happened, he opened up his policy with his insurer. They managed to use some of his accumulated cash value to cover some premium payments, hence giving Michael relief from the financial burden without losing the policy.

If the prices seem too steep afterward, you might even talk to your insurer about options or other alternatives. Emma, a freelancer from Quebec City, found herself in this situation and worked with her insurance advisor to partially surrender her policy, reduce the coverage, and lower the premiums to something more manageable. This adjustment helped her maintain some level of coverage while freeing up more of her monthly budget.

You should look over your Whole Life Insurance Policy and quotes from other companies at least once every few years or after big events in your life, like getting married, having a child, or big changes in your finances. Mark, a doctor in Halifax, revisits his policy every five years. That is a routine process of reviewing his coverages, still matching his changing financial goals and family responsibilities, and making changes as necessary to ensure that he is on track for long-lasting security.

However, before buying into a Whole Life Insurance Quote, there are some things you need to make sure of. The financial stability of the company and details of the policy, including benefits and exclusions and how well it actually lives with your financial goals. Sofia from Toronto, for instance, has looked at the different types of Whole Life Insurance, thinking about how long-lasting the company is, whether a long-term commitment is possible, and how open the policy’s cash value growth is. She chose a policy that would give her protection and, in the form of cash value, a good rate of return that fit with how she planned to spend her retirement.

Whole-life policies can come with additional or hidden costs, such as fees for policy loans, surrender charges, and administrative fees. These are all things to ask about upfront. In this regard, James in Kelowna was shocked by the high administrative fee on his policy. However, after talking to the insurance company about his worries, he realized that the policy’s fee schedule was not reasonable. He can, however, work out a better fee schedule with the provider.

Your health has everything to do with affecting Whole Life Insurance Quotes. In general, if you are healthy, your premiums will be substantially lower. One such beneficiary of a healthy lifestyle when it came time to apply for Whole Life Insurance was Maria—a yoga teacher from Montréal. They have qualified because she has an excellent record of health and active lifestyle; thus, her insurance premiums were very low. With the reduced premiums, her insurance remains very affordable while still offering her the same coverage.

Even though these terms for the Whole Life Insurance Policy are normally firm, an individual can likely negotiate with the insurance provider to adjust his/her coverage to fit his/her financial situation completely. For instance, Amir, an engineer from Edmonton, found his initial premiums too high. By consulting with his insurance agent, he reduced the amount of the death benefit and, therefore, was able to effectively reduce his monthly costs while still offering substantial financial protection for his family.

If you encounter financial difficulties and cannot afford the monthly premium, alert your insurer for advice on how you can temporarily use the cash value to pay premiums or reduce the level of benefits. That was exactly what happened to Anita—one of the thousands of small business owners in Vancouver—during one of the toughest economic times. She had to use some of the money that had built up in her policy just to keep it going so she wouldn’t have to give it up totally.

Comparing Whole Life Insurance Quotes properly includes more than just premiums; it consists of sifting through specifics that range from death benefits to the potential for cash value growth and the terms of policy loans. Take Annette from Halifax, for example. She compared the quotes of the different insurance companies with a spreadsheet, emphasizing the value over time rather than just what was quoted as the initial cost. Besides, she also addressed an independent insurance broker who, in all likelihood, could have reasonably helped her understand all the nuances of each policy. In the end, it made sure that the family could choose the best option for them.

If you find the Whole Life Insurance Monthly Cost unsustainable and decide to cancel, you’ll likely be subjected to surrender charges, and you will likely get the cash value less than the charges. Where do you think Carlos, a restaurateur in Quebec City, would be if he cancelled the policy after a certain number of years of paying premiums? He was disappointed to learn about the surrender charges but was able to use the remaining cash value to invest in his business. This is very important since, before making this kind of decision, he needs to have an exhaustive discussion with his insurer or even a financial advisor on the likely impacts.

Generally, the Whole Life Insurance monthly fees are a fixed rate and don’t increase over time. And that was a factor to Mei, the Toronto graphic designer, who selected whole life over term life because she didn’t want premiums to rise as she got older. This, therefore, goes a long way in helping policyholders like Mei budget more accurately on a long-term basis.

Economic changes can have an impact on Whole Life Insurance Policies, considering the interest rates the cash value may be earning; however, they don’t usually impact the premiums since they are issued on a fixed, direct basis. Neil lives in Edmonton and is retired. His experience from life shows him that during economic depressions, policyholders wouldn’t experience exponential growth in cash policy value. Therefore, a discussion should be held with the insurer or advisor about how some of these economic factors might affect policy performance and any alternatives that could reduce the adverse impact.

Proper monthly cost planning for Whole Life Insurance means taking into account long-term financial commitments and the stability of your income. Imagine this story of Helen, a freelance graphic designer from Ottawa. Helen planned out her normally arising expenses and further financial goals. She avoided the strain that accompanies financial obligations by making sure she secured the needed coverage with an elaborate budget to show how much of it is going to be managed within the Whole Life Insurance Monthly Cost.

Significant improvements in your health after purchasing a Whole Life Insurance Policy won’t necessarily lower your premiums directly since the policy’s terms are fixed at the outset. However, Jonathan, a fitness coach from Surrey, experienced a significant health improvement and discussed this change with his insurer. While his existing policy’s costs remained the same, he was able to negotiate better terms for additional coverage, leveraging his improved health.

In the event that you notice inconsistencies in the quotes provided, it is therefore important to get in touch with insurance companies or the broker for the purposes of clarification and a go-ahead that, indeed, all the quotes are based on the same parameters and coverage options. Susan, a school principal from Quebec City interested in the issue, on the investigation, found that a few had added riders to her policy, of which she had not asked, and therefore, her costs were also getting affected. This will clarify the details and help her make an informed decision.

Each and every one of the above questions aims at typical concerns or situations which you, in all probability, find yourself facing while dealing with Whole Life Insurance. This knowledge will enable you to make decisions that will assure you that your insurance provides you with the needed security and at the same time being flexible enough to accommodate the ever-changing situations in your life.

Sources and Further Reading

Understanding Whole Life Insurance – An in-depth guide by Investopedia that explains the basics of Whole Life Insurance, including its costs and benefits. This source can provide a foundational understanding of how Whole Life Insurance works.

Investopedia: Whole Life Insurance

Comparing Whole Life and Term Life Insurance – A detailed comparison by NerdWallet that helps differentiate between whole life and Term Life Insurance, highlighting the financial implications of each.

NerdWallet: Compare Life Insurance

The Impact of Lifestyle on Insurance Costs – This article from Forbes discusses how lifestyle choices can affect insurance premiums and what you can do to possibly lower your costs.

Forbes: How Lifestyle Affects Insurance Costs

Financial Advisors on Life Insurance – A resource from the Financial Consumer Agency of Canada, offering advice on choosing the right type of life insurance based on personal financial needs and life situations.

Research on Canadian Life Insurance Trends – This report by the Canadian Life and Health Insurance Association provides insights into the latest trends and statistics in the life insurance industry in Canada, useful for understanding the market context.

CLHIA: Canadian Life Insurance Trends

These sources offer a wealth of information that can help deepen your understanding of Whole Life Insurance, its costs, benefits, and strategic considerations. They are valuable for anyone looking to make informed decisions about life insurance in Canada.

Key Takeaways

- Whole Life Insurance is more expensive than term life, due to lifetime coverage and cash value features.

- Once a policy is chosen, changes to premiums or benefits typically incur financial penalties.

- Committing to high premiums long-term can be challenging, especially with financial uncertainties.

- Managing Whole Life Insurance can be complex with elements like cash value and dividends.

- Cash value is subject to investment risks and depends on the insurance company's performance.

- Higher premiums could lead to missed opportunities in potentially higher-return investments.

- Understanding and managing these policies is easier with resources and professional advice.

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand your experiences and struggles with Whole Life Insurance. Your feedback is invaluable in helping us provide better information and support to individuals like you.

Please share any specific experiences or stories related to these questions that you think could help us understand your situation better. Your insights not only contribute to our learning but also help others who might be facing similar challenges. Thank you for your participation!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com