- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is the Longest Term Life Insurance?

- The Longest Term Life Insurance Policy: Understanding the Basics

- Who Should Consider a Long Term Life Insurance Policy?

- Pros and Cons of a Long Term Life Insurance Policy

- How to Choose the Right Term Length?

- Term Life Insurance Quotes Online: Get the Best Deals

- The Benefits of Working with Term Life Insurance Brokers

- Conclusion: Why Choose Canadian LIC for Your Long Term Life Insurance Policy?

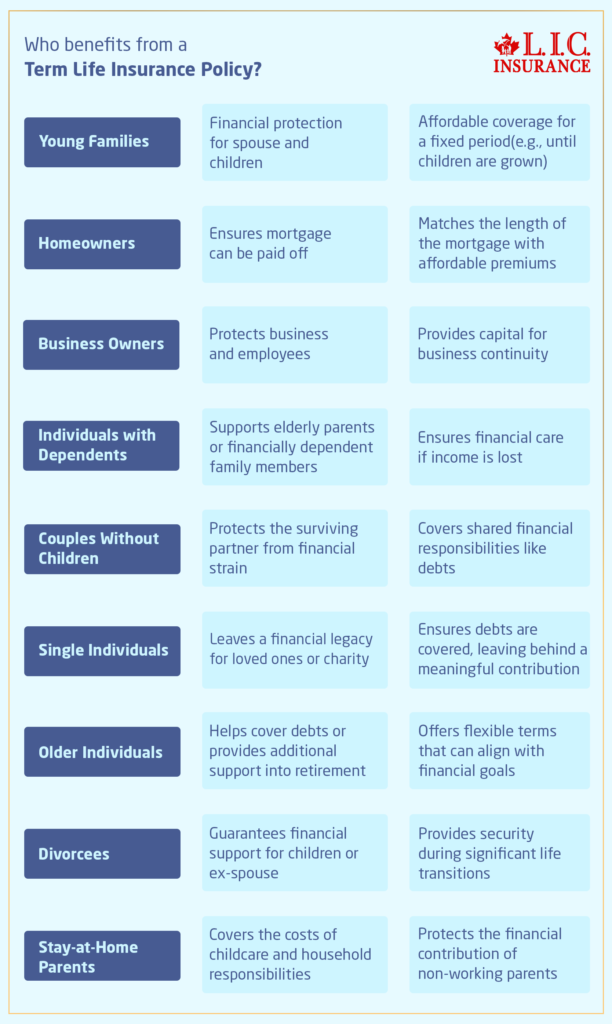

Who Benefits from Term Life Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 17th, 2024

SUMMARY

Young Families Seeking Financial Security

Homeowners with Long-Term Debt

Business Owners Protecting Their Legacy

Individuals with Dependents

Couples Without Children

Individuals Planning for Major Life Events

Those Who Want Affordable, Flexible Coverage

Term Life Insurance for Different Needs

Single Individuals Looking to Leave a Legacy

It is also largely assumed that single people don’t need life insurance because they’re not dependents or have financial obligations tied to anyone else. Many, however, are simply buying Term Life Insurance policies for the purpose of leaving behind a financial legacy. Be it a preferred charity, extended family members, or a cause they are passionate about, the ability to make a difference after they’re gone gives a reason for buying a Term Life Insurance Policy.

Parents of Adult Children

Many parents assume that when their children have grown old enough and become financially secure, there is no longer a need for life insurance. In reality, many parents maintain a Term Life Insurance Policy to provide for the benefit of their adult children or grandchildren. This might include savings for educational payments, a down payment on a home, or even just a cash reserve for times when money is tight.

Older Individuals Planning for Retirement

While many might think of Term Life Insurance as for younger people, there are also thousands of older Canadians who would benefit from it. Term Life Insurance might be an intermediate step between retirement savings and other savings goals for those soon-to-be retirees. For example, if you are paying off a mortgage or other debts and fear that the family may be left behind once you are gone, a Term Life Insurance Policy can cover the risk.

Term Life Insurance for Divorcees

Divorce often leads to significant changes in financial responsibilities, and for many, that includes the need for life insurance. In the majority of cases, divorce will cause one or both exes to have to continue carrying life insurance to support any children and/or ex in the event that something happens to one of them. Sometimes, even life insurance becomes a mandatory aspect of the divorce decree to ensure that child support or spousal alimony would be paid in case one spouse dies.

The Impact of Group Term Life Insurance

Many Canadians receive group life insurance through their employer, and what happens to this group life insurance when you leave the job? One of the downsides of group life insurance is that it usually ends at the end of the job change, retirement, or loss of employment. An individual Term Life Insurance Policy, on the other hand, is portable; therefore, it will follow you to a new job. For many people, having an individual policy in addition to any group coverage can serve as that little added protection factor.

Coverage for Stay-at-Home Parents

A stay-at-home parent does not generate an income like others, but the value to the household is priceless. In the event of their death, the surviving spouse may face significant costs related to childcare, household management, and other daily tasks that the stay-at-home parent previously handled. Stay-at-home parents need Term Life Insurance to provide financial resources for the additional expenses.

Key Takeaways: Choosing the Right Term Life Insurance

Term Life Insurance can offer much-needed financial security regardless of the age and stage of life. Whether you are a young family, homeowner, business owner, or individual approaching retirement, the flexibility and affordability of Term Life Insurance can be an ideal solution for many Canadians.

Who benefits from a Term Life Insurance Policy?

Final Thoughts: Secure Your Future with Canadian LIC

No matter your age or life situation, having a Term Life Insurance Policy can provide essential financial security for you and your loved ones. From young families to business owners, the benefits of Term Life Insurance are vast and adaptable to meet individual needs. Whether you’re concerned about covering mortgage payments, protecting your business, or ensuring that your dependents are taken care of, a Term Life Insurance Policy is an innovative, cost-effective solution.If you’re ready to explore your Term Life Insurance options, Canadian LIC—is here to help. Protect your family, your business, and your financial future with a Term Life Insurance Policy that fits your life perfectly. Reach out today to get started.

More on Term Life Insurance

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

FAQs Around Term Life Insurance in Canada

The Term Life Insurance Cost can vary based on factors like your age, health, and the length of the policy. However, Term Life Insurance is generally more affordable than Permanent Life Insurance. Many of our clients at Canadian LIC are surprised by how affordable their Term Life Insurance Quotes are. We always work to find the best rates for our clients.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) Offers a comprehensive overview of life insurance types and industry regulations in Canada. https://www.clhia.ca

- Government of Canada – Life Insurance Guide Provides information on choosing life insurance policies, including Term Life Insurance and its benefits. https://www.canada.ca

- Canadian Life Insurance Quotes Comparison Tool Helps compare Term Life Insurance Quotes from various providers in Canada to find the best rates. https://www.insurancehotline.com

- The Globe and Mail: Life Insurance in Canada – Articles and insights on the Canadian life insurance market, trends, and considerations. https://www.theglobeandmail.com

- Canadian LIC – Term Life Insurance Policies – Access helpful guides, client stories, and professional advice from one of Canada’s best insurance brokerages. https://www.canadianlic.com

Key Takeaways

- Term Life Insurance offers affordable coverage for a specific period, making it ideal for individuals with temporary financial responsibilities.

- It benefits a wide range of people, including young families, homeowners, business owners, and even single individuals who want to leave a legacy.

- Term Life Insurance policies are flexible, allowing you to choose coverage that aligns with your needs, such as mortgage payments or children’s education.

- The Term Life Insurance Cost is generally lower than Permanent Life Insurance, making it an accessible option for many Canadians.

- Comparing Term Life Insurance Quotes can help you find the best rates for your unique situation, ensuring your loved ones are financially secure.

- You can renew or convert most Term Life Insurance policies if your financial situation changes, providing long-term flexibility.

- Canadian LIC offers personalized guidance to help you choose the right Term Life Insurance Policy based on your needs and financial goals.

Your Feedback Is Very Important To Us

IN THIS ARTICLE

- Who Benefits from Term Life Insurance?

- Young Families Seeking Financial Security

- Homeowners with Long-Term Debt

- Business Owners Protecting Their Legacy

- Individuals with Dependents

- Couples Without Children

- Individuals Planning for Major Life Events

- Those Who Want Affordable, Flexible Coverage

- Term Life Insurance for Different Needs

- Who benefits from a Term Life Insurance Policy?

- Final Thoughts: Secure Your Future with Canadian LIC

Sign-in to CanadianLIC

Verify OTP