Have you ever thought that what would be the cost of your mental peace? Specifically, when it comes to ensuring your loved ones are cared for after you’re gone? In the world of financial security, Whole Life Insurance policies can be trusted with full faith. But, many of you might be wondering, at what cost? Today, let’s understand the monthly cost of Whole Life Insurance.

A Warm Welcome to the World of Whole Life Insurance

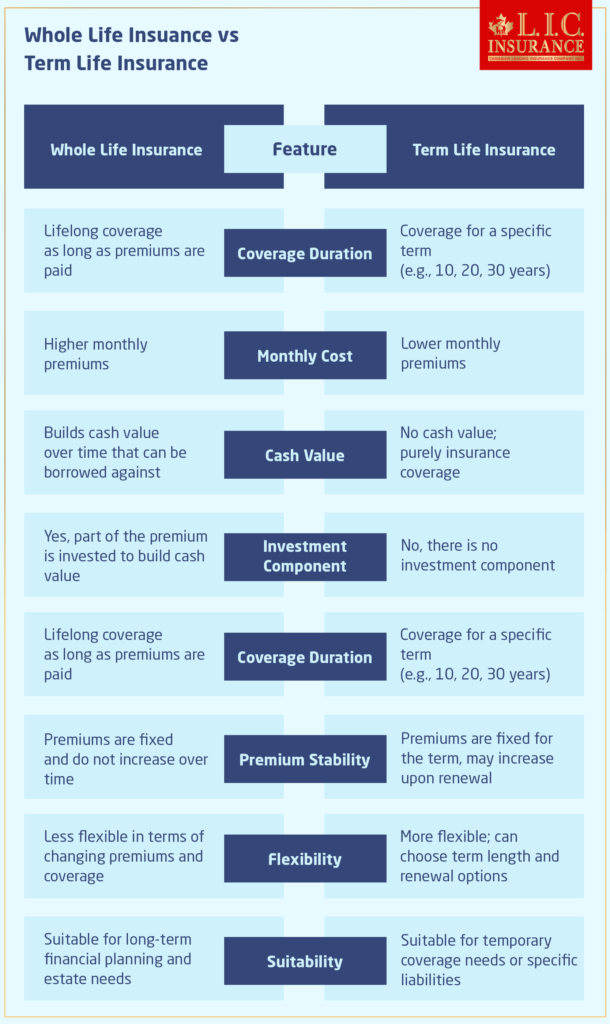

Can you think of financial protection that stays with you from the moment you grab onto it until your very last breath? That’s what a Whole Life Insurance Policy offers. It’s not just about the payout upon death; it’s about building cash value over time, a feature that distinguishes it from Term Life Insurance Plans. But with great benefits come great questions: “Is it too expensive for me?” Now, let’s get to know about this together.

Understanding Whole Life Insurance Monthly Cost

When talking about Whole Life Insurance, it’s essential to know that the monthly cost can vary widely. Several factors influence this, such as your age, health, the policy’s death benefit, and any additional riders you choose to add. But don’t let the complexity scare you!

Here’s a simplified table to give you a rough idea:

Age GroupApproximate Monthly Cost for a $100,000 Policy

| Age Group | Approximate Monthly Cost for a $100,000 Policy |

|---|---|

| 20s | $80 – $100 |

| 30s | $100 – $130 |

| 40s | $130 – $170 |

| 50s | $170 – $230 |

| 60s | $230 – $300+ |

Note: These are approximate figures to give you an idea. Actual rates can vary.

Is It Worth the Investment?

Now, you might think, “Those numbers look a bit high!” And it’s true that Whole Life Insurance can be pricier than Term Life Insurance. However, remember the cash value we talked about? That’s a part of your premium that grows tax-deferred. Over time, this can become a significant asset, something you won’t find in Term Life Insurance.

Consider Maria, a young professional in her 30s. She decides to invest in a Whole Life Insurance Policy. Yes, she pays a bit more each month than she would for a term policy, but she sleeps well knowing she’s building a financial cushion that her family can rely on or even she can borrow against if need be.

A Closer Look

To better understand how this works, let’s understand with the help of more real stories:

John, in his 40s, is healthy: John opts for a Whole Life Insurance Policy with a monthly premium of $150. Fast forward 30 years, John has not only secured a $200,000 death benefit for his family but also accumulated a considerable cash value, providing an extra layer of financial security.

Sara, is in her 50s, with minor health issues: Sara’s monthly premium is around $220. It seems high, but considering her health status and the instant coverage she gets, it’s a strategic move for her mental peace and her family’s future stability.

Alex, in his 30s, extremely healthy: Alex decides to start a Whole Life Insurance Policy early in his career. His monthly premium is approximately $120 for a $250,000 policy. Over the years, not only does Alex secure a significant death benefit for his loved ones, but he also enjoys a growing cash value, which he can leverage for future financial needs, such as a down payment on a house or funding his children’s education.

Linda, in her late 50s, smoker: Linda, aware of the higher risks associated with her smoking, opts for a Whole Life Insurance Policy. Her monthly premium is around $350 for a $150,000 policy. While the premium is steep due to her smoking status and age, the policy guarantees her family will have financial support, and she appreciates the cash value accumulation as an additional safety net.

These examples serve to highlight the flexibility and long-term benefits of Whole Life Insurance policies, showing how they can be tailored to meet the unique needs and circumstances of each policyholder. While the premiums might seem high, especially for individuals like Linda, the guaranteed death benefit, alongside the potential for cash value growth, offers a multifaceted approach to financial security and planning.

Key Takeaways

Whole Life Insurance policies provide a blend of death benefit protection and an opportunity to build cash value over time. Whether you’re in excellent health, facing higher risk factors, or somewhere in between, there’s a policy structure that can align with your financial goals and needs. The examples above illustrate how individuals at various stages of life and with different health backgrounds can benefit from the security and financial planning potential that Whole Life Insurance offers.

Remember, these scenarios are simplified to help you understand the potential impacts and benefits. Your actual premiums and policy values will depend on various factors, including your specific health status, lifestyle choices, and the insurance provider’s policies. It’s always best to consult with a financial advisor or insurance specialist to get a personalized quote and advice tailored to your situation

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

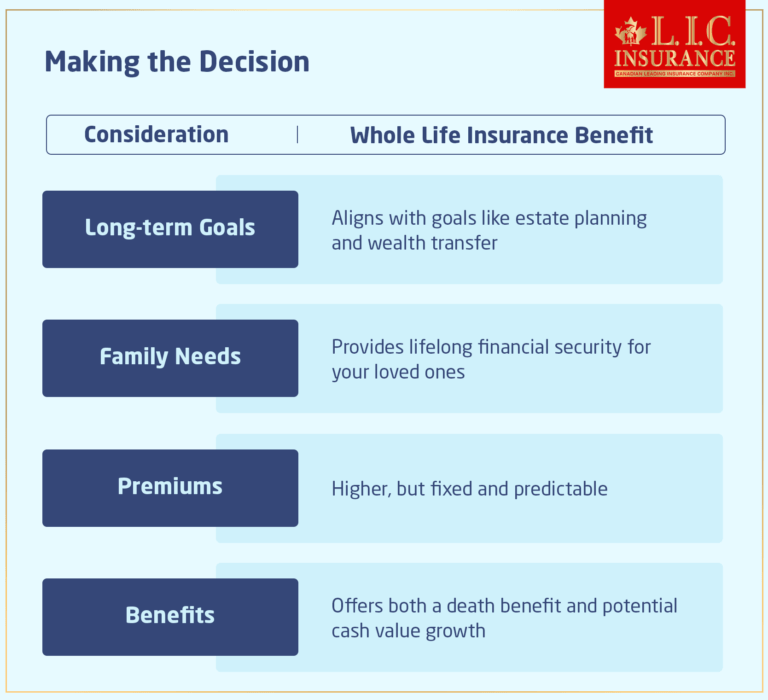

Making the Decision

Now, you might be thinking, “Is Whole Life Insurance right for me?” It’s a valid question and one that deserves careful attention. Think about your long-term financial goals, your family’s needs, and how a Whole Life Insurance Policy fits into that situation. Yes, the premiums are higher, but the benefits extend well beyond your lifetime, offering a blend of financial security and growth potential.

Find Out: What is the biggest risk for Whole Life Insurance?

Concluding Thoughts: Time to Take Action

As we wrap up our journey through the Whole Life Insurance cost and benefits, it’s clear that while the premiums might be higher than other types of insurance, the long-term benefits can be invaluable. It’s not just insurance; it’s a financial strategy that grows with you, offering peace and security for your loved ones. Talk to a financial advisor, crunch some numbers, and see if a Whole Life Insurance Policy is the right for you or not.

Ultimately, it’s not just about the Whole Life Insurance monthly costs; it’s about the value it brings to your life and the lives of those you cherish. Whole Life Insurance coverage might be the key to unlocking that peace we’re all searching for.

Note—The numbers provided are for illustrative purposes only. For a detailed quote and more information, consult with a licensed insurance professional in Canada.

Find Out: The Benefits of Whole Life Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Whole Life Insurance Policy and Monthly Cost

Think of it as a safety net that’s always there, from the moment you say “yes” to it, till your very last day. A Whole Life Insurance Policy is just that. Unlike a winter coat that you outgrow or wear out, this policy sticks with you for your entire life, offering your loved ones financial protection and even growing a little savings pot (cash value) on the side. It’s like having a loyal friend who’s always got your back.

It works just like a subscription service, like your favorite streaming platform, but you’re getting contentment instead of movies. You pay a fixed monthly amount, which doesn’t change, making it easy to plan your finances. Part of this payment goes towards keeping your insurance active (so your family is protected), and part of it goes into a savings account within your policy, which grows over time.

The great news is that it doesn’t! It stays the same once you lock in your rate when you sign up. Whether you’re just joining or you’ve been with us for decades, your monthly cost keeps steady.

If you are buying groceries with coupons, you will pay less, right? Similarly, while the monthly cost is fixed, you can “reduce” your overall expenses by staying healthy (lower rates for non-smokers and those in good health) or choosing a policy that fits just right—not too big, not too small. It’s all about finding the sweet spot that suits your needs and budget.

It’s like comparing a sturdy, all-weather coat to a light summer jacket. Yes, the coat costs more upfront, but it offers more protection and lasts through every season. Whole Life Insurance coverage does the same by providing lifelong coverage and building cash value with the passing of time. So, while it might seem pricier than term insurance (the summer jacket), you’re getting a lot more value for every penny spent.

Absolutely! Think of your policy like a piggy bank. Over time, as you keep adding to it, it grows. You can borrow against the cash value you’ve built up if you ever need it. It’s like lending money to yourself, with the plan to pay it back, of course. This feature is one of the unique perks that makes Whole Life Insurance so special.

If you’re planning a big trip. You’d need a map, right? Similarly, deciding on Whole Life Insurance requires a bit of planning. Consider your long-term financial goals, your family’s needs, and whether you’re looking for more than just insurance (like a savings component). It’s a bit like choosing the right travel buddy who’s in it for the long haul with you.

Life is full of ups and downs, just like a roller coaster. If you hit a bump and find it hard to pay your premium, don’t worry. Many policies have a grace period, giving you time to catch up. Plus, if your policy has built up enough cash value, you might be able to use it to cover your premiums for a bit. It’s like having a backup battery for your phone.

Yes, it does! Think of it like planting a seed in your garden. Over time, with a bit of sunshine and water, it grows into a big, beautiful tree. Similarly, the cash value in your policy grows over time, earning interest. This part of your policy isn’t just sitting there; it’s working hard, growing, and providing you with more security for the future.

Absolutely! When you retire, you can tap into the cash value you’ve built up over the years, using it like a personal pension to supplement your retirement income.

In simple terms, the death benefit is the amount your family receives when you die, while the cash value is a savings component you can use while you’re alive.

Not always. It’s like applying for a membership at a club. Some clubs might want to meet you first, while others welcome you right away. Similarly, some Whole Life Insurance policies might require a health check to determine your monthly cost, but there are also “no exam” options. These might cost a bit more, as the insurer is taking a bigger risk by not checking your health first.

As the name suggests, a Whole Life Insurance Policy lasts your whole life. It’s like a loyal friend who sticks by you through thick and thin, from the day you start the policy until the end of your journey. This permanence is one of the key features that makes Whole Life Insurance a valuable part of long-term financial planning.

Yes, there are! It’s like a little financial shelter. The cash value in your Life Insurance Policy grows tax-deferred, meaning you don’t pay taxes on the growth while it accumulates. And, if managed correctly, the death benefit paid to your beneficiaries is usually tax-free.

Your Whole Life Insurance Policy is like a seed you plant. With regular payments (your Whole Life Insurance monthly cost), this seed grows into a strong tree. This tree gives you two key things: a steady shade (protection for your family if you’re not around) and fruits (a growing savings element called cash value). It’s a lifelong commitment that offers lasting benefits.

It’s more than just an investment; it provides financial protection for your family while also growing your money slowly through the cash value. It’s suitable for those who prioritize long-term security and financial growth in one package.

Riders customize your Whole Life Insurance Policy, much like add-ons for a car. Key options include:

- Accidental Death Rider: Extra payout for accidental death.

- Waiver of Premium Rider: Keeps your policy active if you can’t work due to illness.

- Critical Illness Rider: Offers a lump sum if you’re diagnosed with a serious illness.

These enhance your policy to fit your specific needs better.

A Whole Life Insurance Policy can be wise even if you’re single. It ensures your final expenses are covered and builds a cash reserve you can use later in life. Getting insured while young locks in a lower Whole Life Insurance monthly cost and prepares you for whatever lies ahead, solo or not.

These FAQs answered above are just the tip of the iceberg, but we hope they’ve shed some light on Whole Life Insurance policies and their monthly costs. Remember, every person’s situation is unique, so it’s like finding a glove that fits just right. If you’re curious or have more questions, don’t hesitate to reach out to a professional who can guide you and help you make the best choice for you and your loved ones.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com