Have you ever been at a family gathering, a cousin sipping coffee with you, and he proudly tells you about this new Term Life Insurance Policy that he just bought, though you realize you still don’t know what your Term Life Insurance needs are? You are possibly in your late 40s, then. That triggered a small worry in your head: “Am I already old enough to consider buying Term Insurance? What if I pay for something that I don’t actually need?” Yes, these are some of the very common questions and concerns that one goes through as one age, and deciding at what age you ought to stop buying Term Insurance is the most confusing. Buying Term Insurance isn’t just about opting for a policy—it goes way beyond that. It includes knowing how Term Life Insurance fits into your whole strategy, knowing the pros and cons of Term Life Insurance, and, most importantly, the right point in time to reevaluate your needs. This blog will help you make such decisions with practical advice, relevant stories, and a very clear breakdown of such important considerations. Let’s go through it together to understand if there is a right age to stop investing your money in Term Life Insurance and how you can make that decision with confidence.

When Should You Consider Stopping Term Life Insurance?

Term Life Insurance: The Basics

Just to have a clear understanding of what a Term Life Insurance Policy actually is—let’s relay the review. Term Life Insurance is one of the life insurance products designed to cover a fixed number of payments over a stipulated period, normally ending in a set number of years. Insurance policies usually end at the end of this time, but they can be renewed for another term. That’s why Term Insurance is so popular; it delivers a significant death benefit for relatively low premiums, particularly when you’re young.

The Aging Factor in Term Life Insurance

As you get older, the cost of new Term Life Insurance policies increases dramatically. This is because insurance companies assess the risk of insuring older individuals as higher. Consider John, the 50-year-old accountant. He found that the premiums for a new twenty-year term policy were nearly three times what he had to pay when he was in his 30s, all for the exact same amount of coverage. Of course, increasing premium prices do bring us to the main question: At what age is it no longer financially wise to renew or take out a brand-new Term Life Insurance Policy?

Weighing the Pros and Cons of Term Life Insurance in Later Life

| Pros | Cons |

|---|---|

| Provides financial security for dependents. | Premiums increase with age, becoming costly. |

| Helps cover outstanding debts. | Decreased need as financial obligations lessen. |

| Useful for estate planning to cover taxes or leave a legacy. | No cash value accumulation; premiums paid are not recovered if outlived. |

| Offers tax-free benefits to beneficiaries. | Possible challenges in medical requalification for new policies. |

Pros

Dependents’ Financial Security: If you still have dependents, such as young children or a spouse who relies on your salary, your early death will not hurt them financially.

Mortgages and Debts: Coverage can provide peace of mind if you have significant debts or a mortgage that would be burdensome to your family if it were left unpaid.

Cons

Premiums Are Prohibitively Expensive: The cost of new policies may be high.

Dependents are Financially Independent: Your grown children are succeeding on their own and are not financially dependent on you.

Strategic Considerations

Consider Lisa’s story. At 65, she’s a retired nurse with grown, financially independent children. She has a small mortgage left on her home and a healthy retirement fund. Lisa questioned whether renewing her Term Life Insurance Policy made sense. Her scenario illustrates a common situation many older adults find themselves in—evaluating the necessity of extending Term Life Insurance against its increasing cost and decreasing financial obligations

Age-Specific Guidance on Term Life Insurance

Age Group | Guidance |

Under 50s | Secure Your Family’s Future |

50s to 60s | Reevaluating Needs |

Over 70s | Weighing Costs and Benefits |

Under 50s: Securing Your Family’s Future

If you are below 50, then the benefits that come with taking up a Term Life Insurance Policy are immense, more so if you have dependents or major debt. At this point in life, you are most probably supporting young children, paying for a mortgage, and even striving to climb the career ladder, which makes Term Life Insurance quite invaluable at this stage, premiums generally being pocket-friendly, yet offering a way through which you can ensure financial security for your family without you having to alter your current lifestyle.

Let’s take, for instance, Marina, who is a 38-year-old graphic designer and mother of two. Marina recently found out that if something unexpected happened to her, then her family would never be able to cover the mortgage payments, children’s education, and any other living expenses from the income of her husband alone. This gave her a great deal of peace of mind, knowing that her children and spouse would be financially secure. The takeaway from the above is the fact that Term Life Insurance is, therefore, an insurance policy that is very essential to act as a safety net, giving huge coverage during the period when the financial liabilities are high and continuous.

50s to 60s: Reevaluating Needs

Getting into your 50s and 60s would mean looking at your Term Life Insurance needs differently. This is a time when you need to review your situation specifically. Are your children already out of the nest and financially independent? How close are you to paying off your debt?

Please pay close attention to these things because they will have a big impact on whether you need to renew, change, or even cancel your Term Life Insurance Policy.

Robert is 57 years old, and his Term Life Insurance is almost up. Let’s talk about him. His kids were now grown up, and the debt was almost paid off. Robert had to decide whether to renew the policy with a much higher payment or let the policy expire. One problem with Term Insurance at this age is that you may have to pay higher and higher costs even though the returns are usually very low. For most people like Robert, this is the time to weigh the costs of a new policy against falling obligations.

Over 70s: Weighing the Costs and Benefits

For individuals in their 70s, purchasing new Term Life Insurance often becomes less feasible. Premiums skyrocket at this age due to the increased risk insurers take on. Unless you have pressing financial responsibilities, such as dependent family members or significant outstanding debts, the high costs might outweigh the benefits of a new Term Life Insurance Policy.

Take Eleanor, for example. At 72, she considered buying a new Term Life Insurance Policy after her previous one expired. However, upon reviewing her financial situation—no dependents, a comfortable retirement fund, and her home fully paid off—Eleanor decided against renewing. The costs simply did not justify the benefits, illustrating a common situation for many seniors. Her story emphasizes a critical point: the cons of Term Life Insurance at this age, where the financial burden of high paying premiums may not match the practical need for coverage. Each age group usually has distinct challenges when dealing with Term Insurance. Whether you are like Marina, working to secure a future for a young family, Robert, who has needs that change with new financial obligations, or Eleanor, who simply does not renew because they have a nice cushion in the bank account—your decision has to fit where you are in life.

So, as you read through these stories and think how they could possibly relate to your own life situation, consider opening up a discussion about your own needs and options with an advisor you trust on insurance matters. Just remember, though: the properly aligned Term Life Insurance Policy can be there for peace of mind and protection, but it must be kept tailor-made to fit the unique chapters of life.

The Final Verdict

Deciding whether to continue investing in term coverage as you age is a nuanced decision that depends heavily on personal and financial circumstances. It’s about balancing the security it offers with its rising costs. As we’ve explored through various scenarios, there is no universal right age to stop buying Term Life Insurance. But as you go through this, you might want to talk to experts who can give you help that is tailored to your specific situation.

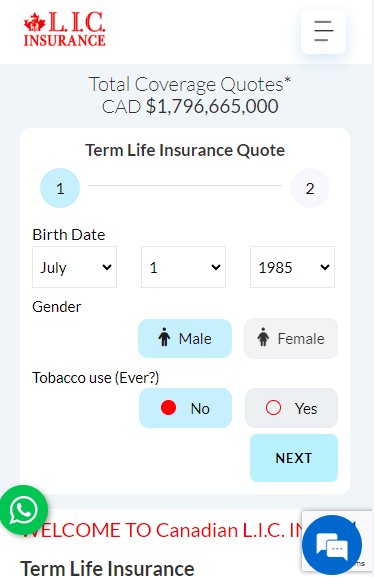

If you are more inclined to secure or update your Term Life Insurance, then get in touch with Canadian LIC, one of the best insurance brokerages. They have a professional team that can provide you with solutions tailor-made to give you peace of mind at whatever stage in life. Do not wait; the right time to secure your future is now. Make that call today to take the first step toward a secure financial future for you and your loved ones by understanding your needs, being informed about the pros and cons of Term Life Insurance, and carefully assessing your personal situation.

Find Out: The advantages of Short Term Life Insurance

Find Out: Which is better: Whole Life or Term Life Insurance?

Find Out: How do you choose Term Life Insurance?

Find Out: What’s the longest Term Life Insurance you can get?

Find Out: Do I get money back from Term Life Insurance?

Find Out: Why to get Term Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Term Life Insurance

The following are several pros and cons of term life policy you should weigh out: By far, it is one of the pros that Term Life Insurance is much cheaper compared to other policies, and for this reason, more suitable for most young families, including Marina. When put against your significant financial responsibilities, the policy offers a financial safety net for a specified term. There is no cash value accrual, as found in Whole Life Insurance or Universal Life Policies; this makes it one of the cons of Term Life Insurance. The other con is that if you decide to renew the policy after the term is over, the premiums are likely to be a lot higher because you are now older than before, just like Robert, who found in his late 50s, it to be quite a jump in premiums. And for that matter, it is less attractive to older people with fewer financial obligations.

It’s wise to reevaluate your Term Life Insurance Policy whenever you experience a significant life change. For example, if your children become financially independent, as was the case with Robert, or if you finish paying off your mortgage. These milestones may decrease your need for coverage, making it a good time to assess whether to continue, adjust, or end your Term Life Insurance Policy. Regular reviews every five years can also ensure that your coverage matches your current needs without overpaying for unnecessary protection.

Whether Term Life Insurance is worth maintaining as you near retirement depends on your circumstances; for example, a person with no dependents and a firm financial footing might find Term Life Insurance prohibitively expensive in their 70s. However, if you have continuing financial responsibilities, like taking care of a spouse with health problems or uncompensated debts, the ability to continue coverage might deliver vital security. Weigh the pros and cons of Term Life Insurance for your situation to make an informed decision.

Your age has a big impact on the cost of a Term Life Insurance Policy. If you are younger when buying a policy, your premiums are likely to be significantly lower than those of an older applicant. This is because the younger you are, the lower the risk for insurers. Premiums go up with age because the risk of insuring you goes up. This is a crucial consideration, as higher premiums towards later life become a financial burden, especially post-retirement.

Many Term Life Insurance Policies contain a conversion option. This provision enables you to convert your term policy into a Permanent Life Insurance Policy without the need for a medical exam. This can be very helpful if your health has worsened since you first bought the Term Insurance. Converting will enable you to maintain your premium, thus keeping the Life Insurance Coverage and cash value building. Be aware, however, that your premiums will increase very significantly when you convert. Just like in the case of Robert, check whether the conversion will serve your financial planning goals in the long run.

If you outlive your term life policy, the policy expires, and there will not be any death benefit for you. This scenario points to one of the cons of Term Life Insurance: in the event you outlive the policy, no paid premiums are returned. But what if you still need the coverage after your term expires? You can consider either renewing the policy or taking a new one but at higher rates due to your increased age. You might even consider investing in another type of insurance policy that has a cash value component.

The correct amount of Term Life Insurance Coverage needs to be determined after a person evaluates current and future financial needs. Among the factors to consider are income, debts, mortgage, children’s education, and any other financial responsibilities to account for. A general guideline is to choose a policy that is 5 to 10 times your annual income. For example, suppose Ana, a software developer, earns $80,000 annually and has two young children. In that case, she might consider a policy between $400,000 and $800,000 to ensure her family’s financial stability should anything happen to her. Regularly reassess your coverage as your financial situation changes to ensure it remains appropriate.

The two primary reasons people purchase Term Life Insurance policies are convenience and, notably, the powerful sense of financial security at a low cost. The following are among some of the benefits of a Term Life Insurance Policy: providing a safety net for your family during critical years—covering living expenses, debts, and education costs in case of your untimely death. Here’s why: After Tom had his second child, he went out and bought a Term Life Insurance Policy that would protect the financial needs of his newly expanded family. Notice how the purchase of Term Life Insurance was primarily event-driven.

Generally, Term Life Insurance policies are straightforward without hidden costs. The premiums, terms, and death benefits are defined at the outset. However, some policies may have fees for policy issuance or include specific riders that carry additional costs. This explains why Clara needed to read the small print and ask about any additional fees or rates that may have been applied. Clara learned that lesson the hard way when she found a small administrative fee on her policy that she really didn’t notice at first.

Term length should go hand-in-hand with the period of time your dependents will need financial protection, or until your major financial obligations are met. The most common term lengths are 10, 20, 30 or 50 years. Age, financial goals, and needs of family are some important things to consider when determining the term. George started his family in his late 30s and has decided on a term length of 20 years so his fam

For most Term Life Insurance policies, the premiums are fixed and will not increase during the term of the policy. This stability is one of the pros of Term Life Insurance. However, if you renew the policy after the term ends, the new premiums will likely be higher based on your age and health at that time. Samaira renewed her policy at age 55 and discovered her premiums were significantly increased because she was older and also because of her medical history, as was the case for many in the insurance industry.

You should contact your insurer if you find it difficult to pay your Term Life Insurance premiums. Contact your insurer for help immediately; in most cases, there are grace periods, payment plans, or other choices you can make to obtain temporary reductions in coverage. For example, by sharing his story, Nick, a small business owner who ran into economic downturns, was able to negotiate a temporary reduction of coverage with his insurer in order to lower his premiums until his financial situation stabilized.

When choosing a Term Life Insurance company, look at its reputation, financial stability, customer service, and the clarity of its policy terms. The choice of an insurer should be based on reputation, prompt payment history, and clear terms of the policy to be issued. For example, when Laura was shopping for a policy in her Term Life Insurance, she read online reviews and checked the financial ratings of several insurers to ensure that she chose a company that was not only reliable but had a strong customer satisfaction record.

Yes, health has a huge impact on pricing your Term Life Insurance. Most of the time, applicants will be required to go through a medical examination before the level of risk is set. If you are in good health, you will be regarded as low-risk, and you will earn reduced rates. However, in the event of health problems, your premium will be increased. For instance, Michael, a non-smoker with no major health problems, qualified for a much lower rate than his friend Alex, who smokes and has high blood pressure.

If you decide to cancel your Term Life Insurance Policy, you can do so at any time without penalty. However, you will not receive a refund for the premiums paid unless you cancel during a free-look period, which is typically within 30 days of policy initiation. Consider Michelle’s experience; she cancelled her policy after a significant life change, reduced her need for coverage, and found the process straightforward but without any premium refund.

Yes, you can own more than one Term Life Insurance Policy at a time. Layering of Term Insurance can be arranged so that coverage diminishes in size over time for various financial obligations. For instance, John has a policy on his mortgage, which will expire when he pays off his mortgage and another policy to fund his kids’ education.

Death benefits paid from a Term Life Insurance Policy to a beneficiary are usually received tax-free. It is a major pro in Term Life Insurance, as it is one of the powerful instruments in financial planning. Sheeba was relieved to hear that ‘the benefit her children would derive from her policy would not be eroded by taxes’, ensuring her objective of providing complete financial security for her children.

Term Life Insurance should be reviewed every five years or sooner with significant life events, such as marriage, childbirth, home purchase, or when one’s financial situation changes. Reviewing the policy at regular intervals ensures that the coverage still meets the criteria. After the birth of his second child, David reviewed his policy and realized he had to increase his coverage to protect his growing family.

Sources and Further Reading

For readers looking to delve deeper into the topic of Term Life Insurance and making informed decisions about when to stop buying it, here are several sources and further reading suggestions:

“Life Insurance Basics” by Investopedia

An extensive resource that covers all aspects of life insurance, including Term Life Insurance, with detailed explanations about how policies work, what you should consider before buying, and how to choose the right type for your needs.

Investopedia Life Insurance Basics

NerdWallet Life Insurance Blogs

These articles discuss critical life events that should trigger a review of your life insurance needs, helping you decide whether to continue, adjust, or end your Term Life Insurance Policy.

Policygenius Life Insurance Blogs

An informative piece that explains how your age impacts life insurance rates, with a focus on the increasing cost of premiums as you age and how that affects the decision to buy or renew Term Life Insurance policies.

Policygenius on Age and Insurance Rates

“How to Choose the Right Amount of Life Insurance” by Consumer Reports

Consumer Reports provides a critical look at Term Life Insurance, discussing who it is best for and highlighting the pros and cons of these policies.

Consumer Reports on Term Life Insurance

These resources will provide comprehensive insights and help you navigate the complexities of Term Life Insurance, ensuring you make the most informed decision about when to stop purchasing such policies.

Key Takeaways

- As you age, Term Life Insurance premiums increase significantly, warranting a cost versus benefit evaluation.

- The need for Term Life Insurance often decreases as major financial obligations are fulfilled.

- If your health has declined or if you still have dependents, maintaining or purchasing Term Life Insurance could be beneficial.

- Weigh the pros and cons of Term Life Insurance, especially the financial strain of higher premiums against the benefits.

- Seeking advice from financial advisors or insurance professionals can provide personalized insights.

- If concerned about future insurability, consider conversion options to a whole or universal life policy.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]