- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Term Life Insurance Plan for All Age Groups

- Why Term Life Insurance for All Ages?

- Term Life Insurance for Young Adults (20s and 30s)

- Term Life Insurance for New Families and Middle-Aged Adults (40s)

- Term Life Insurance for Pre-Retirees (50s)

- Term Life Insurance for Seniors (60s and Beyond)

- Choosing the Right Term Length

- Finding Affordable Term Life Insurance Quotes Online

- Benefits of Working with a Term Life Insurance Broker

- Factors Influencing Term Life Insurance Costs

- The End

Term Life Insurance Plan For All Age Groups

By Harpreet Puri

CEO & Founder

- 11 min read

- November 14th, 2024

SUMMARY

People from all walks of life in Canada search for financial security for their families in uncertain times. From young professionals building a financial future to parents securing their family’s well-being and retirees ensuring their legacy, the need for affordable and dependable insurance has become universal. Term Life Insurance stands out as a simple solution that is cost-effective. However, many Canadians face challenges when choosing a Term Life Insurance Policy suited to their unique needs and age group.

So, the battles are real: How much coverage is enough? Is there an ideal term length? Will the premium be affordable? Often, we notice at Canadian LIC that clients want a pretty solid plan without breaking the bank and also wonder if they can qualify or whether the policy will offer them the desired protection at their current life stage. This blog guides you through the Term Life Insurance options available for any age group. Pertinent questions are answered, relatable insights are shared, and a road map accompanies this on how to pick up the best policy.

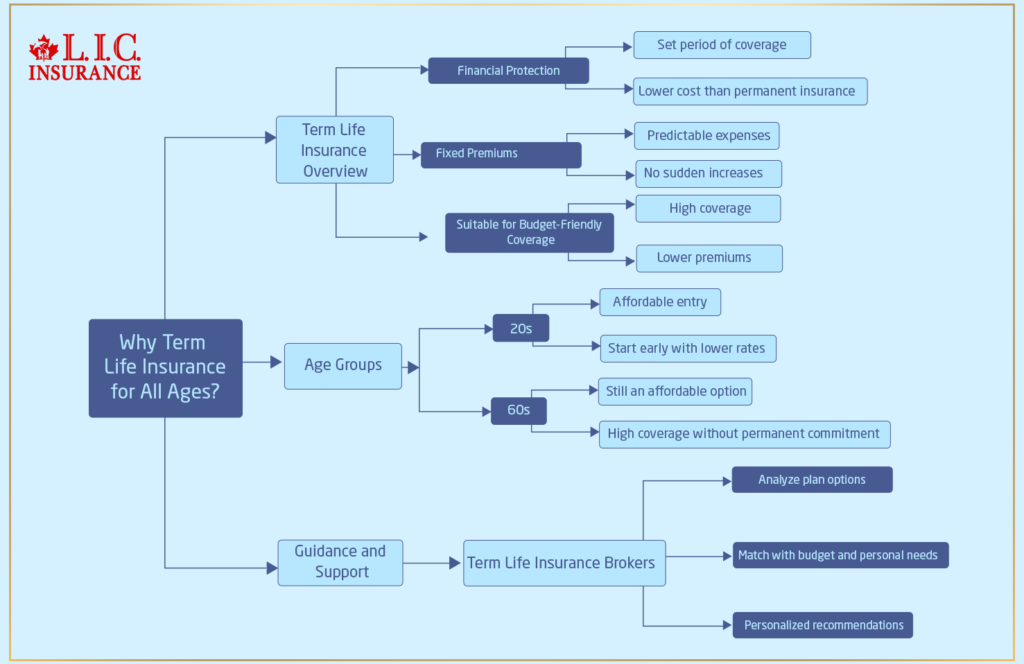

Why Term Life Insurance for All Ages?

Whether you are in your 20s or 60s, Term Life Insurance provides financial protection for a set period at a generally lower cost than Permanent Insurance Options. It makes a perfect choice if you are looking for cheap, high-coverage protection. Since the premium is fixed for the term duration, you can confidently plan your finances without worries about sudden increases. Term Life Insurance Brokers such as Canadian LIC can help you analyze the various plans that may interest you, ensuring you match them with your budget and needs for a personalized recommendation.

Term Life Insurance for Young Adults (20s and 30s)

At this stage of life, most young adults have very few financial commitments. Ironically, this is actually one of the best times in their lives to settle on a Term Life Insurance Policy at a low rate. Here’s why:

- Low Premiums: At this stage, your age and health make you eligible for the lowest Term Life Insurance Cost. Securing coverage early can save you significantly over time, especially if you opt for a longer term.

- Debt Protection: If you have student loans or are considering large purchases, like a car or a first home, Term Life Insurance can protect your family from bearing the burden of debt if something happens to you.

- Future-Ready: Many young clients come to us wanting protection but are not sure how much coverage to get. We often recommend Term Life Insurance Quotes Online to help them understand the costs associated with different coverage amounts and term lengths.

Example from Canadian LIC: We worked with a young professional, Mark, who had just begun his career. He was worried about paying life insurance premiums in addition to his student loans. However, after receiving a few Term Life Insurance Quotes Online, he saw that a 20-year term policy would be manageable. Today, he knows that if something happens, his family will not inherit his student loan debt.

Term Life Insurance for New Families and Middle-Aged Adults (40s)

In their 40s, Canadians typically begin planning very seriously for long-term family financial security. Those years are filled with many stresses and anxieties when it comes to such great responsibilities as mortgage repayment or education for dependent children; having a Term Life Insurance Policy is a huge comfort during these years.

- Family Protection: For parents, the most important reason for purchasing Term Life Insurance is to provide for their children’s future. Term Insurance can ensure financial stability for your loved ones and help maintain their lifestyle, even if you’re not there to support them.

- Mortgage Coverage: Many people in this age group have a mortgage. A Term Life Insurance Policy can be a lifesaver, covering mortgage costs and ensuring your family won’t lose the home.

- Affordable Long-Term Coverage: While the cost may be higher than in your 20s, Term Life Insurance remains affordable. Canadian LIC’s Term Life Insurance Brokers can provide options tailored to cover major liabilities, helping you select the best coverage for your family’s needs.

Example from Canadian LIC: Alex and Lisa, both 40-year-olds, were coming to us very distressed about the cost of life insurance versus everything else. Our Term Life Insurance broker spoke with them about a 25-year term plan, which would cover their mortgage until it’s paid off and support their children’s education. They now have a clear, affordable path to protecting their family.

Term Life Insurance for Pre-Retirees (50s)

If you are in your 50s, you’re probably close to retirement. However, this does not necessarily mean that you don’t have any other financial commitments to clean up or pay off. You may still be paying a mortgage or providing for dependents. Pre-retiree Term Life Insurance provides a “bridge” that will protect your loved ones financially while you take up other remaining commitments.

- Securing Dependents’ Future: Many in this group have older children who may still rely on parental support or are helping to care for elderly parents. A term policy can offer financial security for dependents or cover your parents’ needs if you’re no longer there.

- Legacy Planning: As retirement nears, you may also want to consider leaving a financial legacy. Some people use Term Life Insurance to ensure their family will have funds for milestones like weddings, university education, or even business ventures.

- Reasonable Premiums for Shorter Terms: While Term Life Insurance Cost rises with age, brokers like Canadian LIC can help you find shorter-term policies—such as 10- or 15-year plans—that offer a balanced premium to meet your specific needs.

Example from Canadian LIC: Anne is 55 years old with two children, and she said that when she was supporting both her aged mother and adult children, she needed a good plan. After scanning the Term Life Insurance Quotes Online, she settled on a 15-year term policy for peace of mind without putting a strain on her retirement savings.

Term Life Insurance for Seniors (60s and Beyond)

In your 60s and older, Term Life Insurance will help meet the particular needs of older adults to pay for final expenditures and assist your beneficiaries. It is more expensive, but at this stage, it can still be very useful.

- Final Expense Coverage: Many seniors opt for a term policy to cover end-of-life expenses, ensuring their loved ones won’t face unexpected costs.

- Financial Support for Adult Children or Grandchildren: Some seniors choose Term Life Insurance to leave a legacy for their children or grandchildren. By selecting a term that aligns with their financial goals, they can create security for future generations.

- No-Burden Legacy: For seniors with outstanding debts, like medical or personal loans, Term Life Insurance can relieve family members of financial burdens, enabling a debt-free legacy.

Example from Canadian LIC: The retired teacher, Paul, wanted to leave the money for his grandkids’ education. He was able to find a 10-year policy from Canadian LIC’s Term Life Insurance Brokers that cost more, but that way, he would feel more in control of being able to support his family in that respect.

Choosing the Right Term Length

The term length also becomes very important. Do you go for 10, 20, or even 30 years? All that depends on the age at which you are buying it, your financial goals, and your liabilities. Here’s a quick guide for life stage terms:

- Young Adults (20s-30s): Typically, a 20- to 30-year term is ideal, covering future income potential and long-term obligations.

- Middle-Aged Adults (40s): A 15- to 25-year term is often sufficient to cover major liabilities like a mortgage.

- Pre-Retirees (50s): A 10- to 15-year term may suit individuals looking for shorter-term protection.

- Seniors (60s and beyond): Shorter terms, such as 5- or 10-year policies, may be suitable, balancing affordability with immediate needs.

Finding Affordable Term Life Insurance Quotes Online

Today, with a few clicks, you can easily look up your Term Life Insurance options online. Canadian LIC offers flexible online Term Life Insurance quotes that give you the ability to compare premiums and consider long-term policy options to find an ideal solution for your budget. Now that online quotes are giving you a much clearer view of what will cost, it becomes easier to plan without having in-person consultations.

Benefits of Working with a Term Life Insurance Broker

Sometimes, finding the right Term Life Insurance can be challenging with all the options available. A broker at Canadian LIC can alleviate this while assisting with details of the policy; this way, one receives coverage based on their need since a broker will recommend without bias. That is why it is important:

- Personalized Guidance: Brokers have a thorough understanding of the products and can help tailor a solution that aligns with your current and future goals.

- Cost-Effective Options: Brokers often have access to a variety of policies and can recommend ones with lower premiums, saving you money over time.

- Knowledgeable Support: With expertise in Canadian regulations, our brokers ensure the policy you choose meets all legal requirements and offers optimal benefits.

Factors Influencing Term Life Insurance Costs

The cost of a Term Life Insurance Policy depends on several factors. Here are the primary aspects impacting premiums:

- Age: Younger applicants enjoy lower rates, which is why it’s advantageous to purchase a policy sooner.

- Health: Healthier individuals can qualify for lower premiums, while pre-existing conditions may lead to higher costs.

- Coverage Amount: The more coverage you need, the higher the premium.

- Term Length: Longer terms typically have higher premiums but offer extended protection.

The End

With Term Life Insurance available at every stage of life, Canadians are no longer required to wait to insure their financial futures. Canadian LIC, the best insurance brokerage, is fully prepared to serve you by presenting an affordable and effective plan suitable for your age group and precise requirements. Whether you are a young adult just beginning your career, a parent looking to secure your family’s future, or an aging adult seeking to ensure that your legacy makes a difference, term life can serve as a kind of safety net for you and your loved ones.

Act now and get in touch with Canadian LIC to obtain Term Life Insurance Quotes Online and see exactly how our Term Life Insurance Brokers can make this vital coverage accessible and understandable to all age groups across Canada.

More on Term Life Insurance

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions about Term Life Insurance for All Age Groups

A Term Life Insurance Policy provides coverage for a set period, such as 10, 20, or 30 years. If something happens to you within this period, your beneficiaries receive a payout. Many clients at Canadian LIC choose term policies because they’re affordable and provide straightforward protection for specific financial goals.

Term Life Insurance Costs are usually lower than Permanent Life Insurance. This is because Term Life Insurance covers you for a specific term rather than for life. Our clients find this cost-effective, especially when looking for high coverage on a budget. Canadian LIC’s brokers can show you cost comparisons to help you find an affordable plan that works for your needs.

Yes, you can get Term Life Insurance Quotes Online, and they are typically very accurate. At Canadian LIC, we provide instant quotes to help clients quickly estimate the cost. While an online quote gives you a good idea, remember that final premiums may vary slightly based on medical exams or personal information.

Term Life Insurance Brokers, like the experts at Canadian LIC, have access to a wide range of policies and can help you find the best one for your specific situation. They guide you through each detail, answer your questions, and help you compare quotes so that you’re confident in your choice. Many clients appreciate the clarity and support a broker provides, especially when understanding different options.

Yes, you can purchase a Term Life Insurance Policy at almost any age, though premiums increase as you get older. Canadian LIC helps clients across all age groups—whether they’re just starting out or nearing retirement—find policies that offer affordable coverage. We’ve helped clients as young as 20 and as old as 70 secure protection that aligns with their needs.

Several factors influence Term Life Insurance Cost, including your age, health, coverage amount, and the length of the term. Younger, healthier applicants generally receive lower premiums. Our brokers at Canadian LIC often help clients understand these factors so they can make an informed decision. By adjusting the term or coverage amount, many clients find options that fit their budget.

Yes, most Term Life Insurance policies allow renewal, though the premium usually increases. Many of our clients choose to renew their term policy but consult with Canadian LIC brokers to review the cost and other options. Sometimes, exploring a new policy or a shorter term is more cost-effective.

Yes, many people buy Term Life Insurance specifically to cover debts, such as a mortgage, in case they pass away unexpectedly. At Canadian LIC, we often recommend aligning your term length with the remaining years on major debts, such as a mortgage. This way, you ensure your loved ones won’t be left with a financial burden.

Yes, you may still qualify, though your Term Life Insurance Cost could be higher. Canadian LIC brokers work with clients who have health conditions to find insurers that offer fair coverage options. While some clients pay a bit more, they’re relieved to secure coverage and protect their families.

The term length depends on your goals. If you’re young and need coverage until your kids are grown, a 20- or 30-year term may work best. For those closer to retirement, a shorter term may make sense. Canadian LIC brokers help clients assess their needs and future plans to recommend the best term length for their situation.

Many Term Policies allow conversion to a Permanent Plan within a specific timeframe. This option is popular with clients who want flexibility. Our brokers at Canadian LIC can explain if your policy offers this feature and when it’s best to consider conversion.

Yes, buying a Term Life Insurance Policy sooner often means lower premiums. Many clients realize that waiting only increases the cost, especially as age and health factors change. We encourage younger clients to start early to lock in affordable rates that won’t rise during the policy term.

Start by using an online quote tool, which Canadian LIC offers, to compare rates based on different coverage amounts and terms. Our brokers also help clients adjust factors like the term length or coverage to make premiums more manageable. Many people find there’s a policy that fits their needs and budget with a little customization.

If you outlive your term, the policy typically expires without a payout. Some clients decide to renew or buy a new policy at that point, while others may no longer need coverage. Canadian LIC’s brokers review each client’s situation before the term ends to discuss the next steps.

It depends on your financial goals. Many people still choose Term Life Insurance to cover debts or leave something behind for family, even if they don’t have dependents. At Canadian LIC, we often work with clients who want coverage for peace of mind and protection against financial obligations.

Yes, some policies allow coverage increases, though this depends on the insurer. Our brokers at Canadian LIC guide clients on flexible policies and ensure they understand when and how coverage adjustments can be made.

To begin, simply request Term Life Insurance Quotes Online or connect with one of Canadian LIC’s experienced brokers. They will walk you through policy options, answer your questions, and help you find coverage that’s tailored to your age, budget, and goals.

These FAQs cover the essentials of Term Life Insurance for all age groups in Canada. For more details or personalized assistance, Canadian LIC is ready to support you in making the best decision for you and your loved ones.

Sources and Further Reading

- Sun Life Canada – Term Life Insurance: Offers detailed information on Term Life Insurance options, coverage periods, and application processes.

Sun Life - Manulife – Term Life Insurance: Provides insights into various Term Life Insurance products, including benefits and eligibility criteria.

Manulife - TD Insurance – Term Life Insurance: Features comprehensive details on Term Life Insurance Plans, including term lengths and premium information.

TD Insurance - Canada Life – Term Life Insurance: Explains Term Life Insurance offerings, customization options, and policy conversion features.

Canada Life - MoneySense – Best Life Insurance in Canada for 2024: Offers a comprehensive guide on life insurance options, including Term Life Insurance, with comparisons and recommendations.

MoneySense - Blue Cross Canada – Term Life Insurance: Provides information on Term Life Insurance policies, coverage options, and application processes.

Blue Cross - RBC Insurance – Term Life Insurance: Details Term Life Insurance Plans, including coverage amounts and premium information.

RBC Insurance - TermCanada – Best Term Life Insurance Quotes and Rates: Offers tools to find and compare Term Life Insurance quotes from various Canadian companies.

Term Canada

Canada Protection Plan: Provides information on life and critical illness insurance products, including no medical test options.

Wikipedia

Key Takeaways

- Term Life Insurance is Cost-Effective: Term Life Insurance offers affordable, high-coverage protection, making it a practical choice for people across all age groups in Canada.

- Coverage for Different Life Stages: Whether you’re a young adult, middle-aged, pre-retiree, or senior, Term Life Insurance provides flexible terms to meet your unique financial goals.

- Term Length and Cost Depend on Age and Health: Age, health, and term length affect your premium. Locking in a policy sooner can help secure lower rates.

- Brokers Offer Guidance: Working with Term Life Insurance Brokers like Canadian LIC can simplify the process, providing personalized recommendations and access to competitive quotes.

- Online Quotes Make Comparison Easy: Term Life Insurance Quotes Online let you explore and compare options conveniently, helping you choose the best policy within your budget.

- Renewal and Conversion Options: Many policies allow renewal or conversion to Permanent Insurance, offering flexibility as your needs change over time.

- Protection for Financial Obligations: Term Life Insurance can cover debts like mortgages, helping protect loved ones from financial burdens if you’re not there to support them.

Your Feedback Is Very Important To Us

We’re interested in learning about your experiences and challenges with the “buy term and invest the difference” approach. Your feedback will help us provide better guidance on Term Life Insurance and investments.

Thank you for your valuable feedback! Your insights help us improve our services and better understand the unique challenges Canadians face with Term Life Insurance.

IN THIS ARTICLE

- Term Life Insurance Plan for All Age Groups

- Why Term Life Insurance for All Ages?

- Term Life Insurance for Young Adults (20s and 30s)

- Term Life Insurance for New Families and Middle-Aged Adults (40s)

- Term Life Insurance for Pre-Retirees (50s)

- Term Life Insurance for Seniors (60s and Beyond)

- Choosing the Right Term Length

- Finding Affordable Term Life Insurance Quotes Online

- Benefits of Working with a Term Life Insurance Broker

- Factors Influencing Term Life Insurance Costs

- The End

Sign-in to CanadianLIC

Verify OTP