- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Is There a Medical Exam for Term Life Insurance?

- What Is a Medical Exam for Term Life Insurance?

- Are There Term Life Insurance Options Without a Medical Exam?

- Why Do Some Policies Require a Medical Exam?

- How Medical Exams Influence Term Life Insurance Quotes

- Real-Life Challenges and How Canadian LIC Solves Them

- How to Decide if a Medical Exam is Right for You

- Tips to Prepare for a Medical Exam

- Why Canadian LIC Is the Best Choice for Your Term Life Insurance

- The Role of Online Tools in Simplifying Your Decision

- Addressing Common Myths About Medical Exams and Term Life Insurance

- Final Thoughts

Is There A Medical Exam For Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- January 8th, 2025

SUMMARY

The blog discusses whether a medical exam is required for Term Life Insurance in Canada, exploring options like simplified and guaranteed issue plans that skip exams. It explains how medical exams impact premiums, provides tips for preparation and highlights tools like a Term Life Insurance Calculator. It also shares insights from Canadian LIC, showcasing how their brokers guide clients to find the right Term Life Insurance Plan, whether online or through tailored quotes.

Introduction: The Anxiety Around Medical Exams for Term Life Insurance

You decide on a Term Life Insurance to provide for your family’s future. But then there’s the question that makes you halt: “Do I need a medical exam?” Many individuals freeze at the prospect of taking a medical examination upon application for life insurance.

This is quite common, and Canadian LIC agents frequently encounter clients who express worry about how their health might impact the ability to secure a policy or what effect a medical exam will have on the process of securing coverage. In this blog, we will discuss if a medical exam is invariably needed to buy Term Life Insurance, what effect it has on your premium, and what your choices are if you don’t want to go through the medical exam altogether. At the end of this guide, you will feel assured about choosing the perfect Term Life Insurance with the expert help of Canadian LIC- The best insurance brokerage.

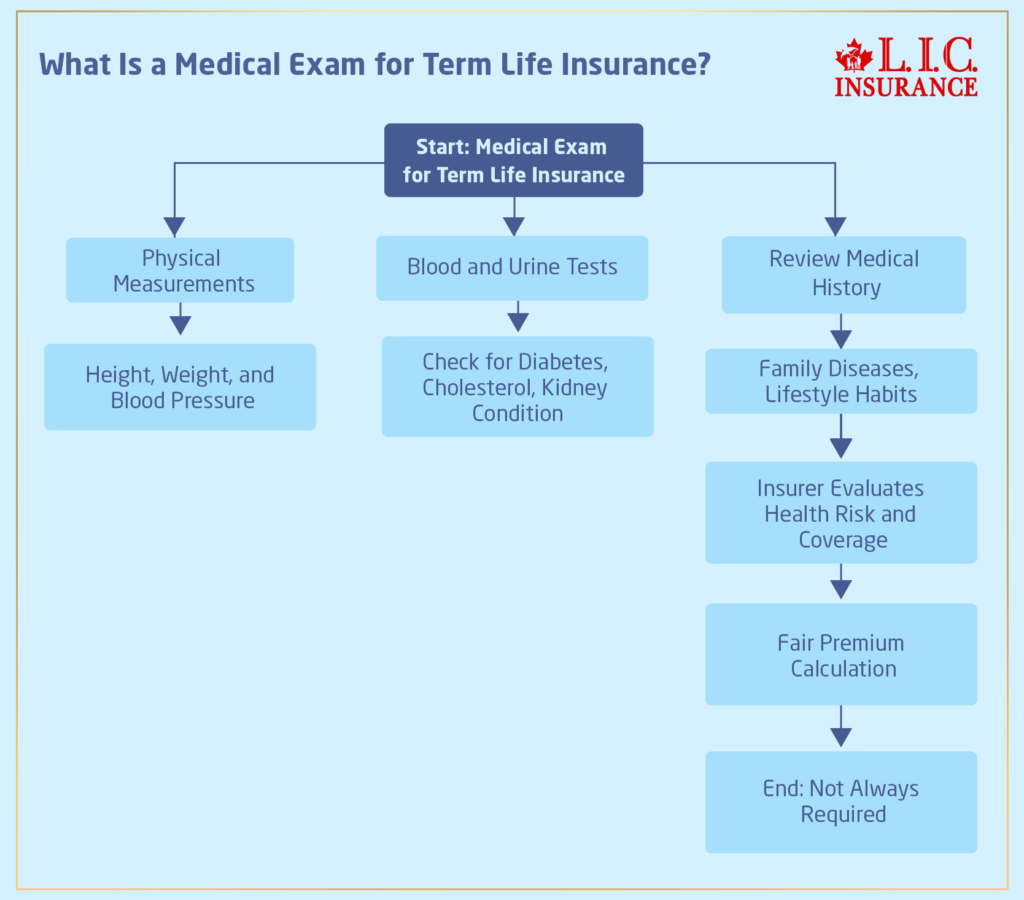

What Is a Medical Exam for Term Life Insurance?

A medical exam for Term Life Insurance forms part of the standardized process in which the insurers examine your health for eligibility for your coverage and for the calculation of your premiums. It usually includes

- Physical Measurements: Height, weight, and blood pressure.

- Blood and Urine Tests: To evaluate the presence of underlying conditions such as diabetes, cholesterol, and kidney condition.

- Review Medical History: Discussion on the patient’s records, history of family diseases and lifestyle habits.

A medical examination would ensure that the insurer could offer you a fair rate on your health risk. Not everyone is obligated to go through the process of the medical exam.

Are There Term Life Insurance Options Without a Medical Exam?

Yes, you can choose no-medical-exam Term Life Insurance Plans. These policies are for those who want to apply faster or do not care about their health.

Simple Issue Term Life Insurance

With streamlined issue policies, you will be asked only a few health-related questions with no full medical examination. The benefit of this type of policy is that clients of Canadian LIC want to get insured fast without intrusive procedures. However, the premiums might be a bit higher because of more risk assumed by the insurer.

Guaranteed Issue Term Life Insurance

If you have significant health concerns, guaranteed-issue plans are probably ideal for you. These insurance products do not ask for a medical exam nor pose health questions to the applicant. With the benefit of having less medical concern during coverage, premiums could be costly, as well as lower insurance coverage.

Why Do Some Policies Require a Medical Exam?

A medical check-up lets insurers review the risk more closely. Here’s how it will benefit both the insurer and you:

- Customized Premiums: This medical examination ensures your premiums are made according to the specific health profile. If in good health, this could then mean lower premiums.

- Higher Coverage Amounts: Most policies that require medical check-ups allow coverage at higher levels, making it ideal for those who want to give the best protection to their families.

How Medical Exams Influence Term Life Insurance Quotes

A medical checkup greatly contributes to your premium determination. For example:

- If you’re a non-smoker with a healthy lifestyle, your exam results could qualify you for preferred rates, which means you’ll save a lot over the term of your policy.

- If there are health complications after the exam, the premiums may increase to account for the increased risk. This can be discouraging, but often, a Canadian LIC’s brokers assist a client in finding the most favourable rates among quotes, despite whatever health complications may have been found.

You can use a Term Life Insurance Calculator to estimate premiums with and without a medical exam. This might help you determine which policy is most important for your purposes and budget.

Real-Life Challenges and How Canadian LIC Solves Them

Many clients often visit Canadian LIC with uncertainty if they qualify with pre-existing medical conditions. Take, for example, a client who had recovered from a slight health condition the previous month but feared that appearing for a medical exam would cancel their eligibility. The Term Life Insurance Brokers of Canadian LIC shopped around many term life quotes and looked up no-medical-exam Term Life Insurance Coverage, which resulted in an affordable product that met his requirements.

These stories show why knowledgeable brokers are important. They do not just sell policies; they guide you through challenges, ensuring you get the right protection for your family.

How to Decide if a Medical Exam is Right for You

If it’s between a no-medical-exam policy and one that does, the following should be taken into consideration:

Your Health Status

If you’re in good health, a medical exam could help you get lower premiums.

If you have health issues, no-medical-exam policies might be faster.

Your Timeline

Do you need coverage right away? Simplified or guaranteed issue policies are often approved within days.

Your Budget

Policies that require medical exams tend to come with lower premium rates, although if affordability is a priority, streamlined plans could work best.

Your Needs

For the highest coverage amount, traditional plans with medical exams tend to offer more options.

Tips to Prepare for a Medical Exam

If you are choosing a policy that needs to be underwritten by a medical exam, then a little preparation goes a long way:

- Hydrate: Hydration is the key to proper blood test results.

- Avoid Caffeine and Alcohol: These can raise blood pressure.

- Get a Good Night’s Sleep: Rest helps normalize vital signs.

- Fast if Necessary: Some exams require fasting for accurate results.

These steps may be able to put your health in the best possible light and possibly lower your premiums.

Why Canadian LIC is Your Trusted Partner in Finding the Right Term Life Insurance Plan

Choosing between a medical exam or a no-exam policy is tough, but you don’t have to face this alone. At Canadian LIC, brokers work specifically to find Term Life Insurance tailored to each person’s requirements. Whether you’re looking to purchase Term Life Insurance online or just need a comprehensive guide to help you compare quotes, they’ll make the process much easier for you.

The Role of Online Tools in Simplifying Your Decision

Using a Term Life Insurance Calculator can assist you in projecting costs and coverage according to your preference. A number of clients prefer to analyze several plans prior to consulting the Canadian LIC’s brokers so they can be as well-prepared to discuss options with them.

Addressing Common Myths About Medical Exams and Term Life Insurance

“I’ll Be Declined If I Have Health Issues”

This isn’t always true. Many insurers consider manageable conditions and offer competitive rates. Canadian LIC helps clients navigate such concerns.

“The Exam Is Time-Consuming and Complicated”

Medical exams are often straightforward, and the process can be scheduled at your convenience. Simplified policies are also available if time is a constraint.

“No Medical Exam Means Poor Coverage”

Simplified and guaranteed issue policies still provide robust coverage. Canadian LIC ensures you understand the trade-offs and benefits.

Final Thoughts

Now, knowing whether a medical exam is required, the other requirement is selection of the right plan. Canadian LIC’s brokers will make this a walk in the park by comparing policies, for instance, whether you can go traditional with a medical exam or rather go for a no-exam to save on time and rush. With expertise, you will secure a good Term Life Insurance Plan that keeps your family set and within your budget.

Let today be the day you consider taking care of your family’s financial security. Check Term Life Insurance Quotes, try a Term Life Insurance Calculator, and contact Canadian LIC to buy Term Life Insurance online easily.

More on Term Life Insurance

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About Medical Exams for Term Life Insurance

Not all Term Life Insurance Plans require a medical exam. A number of plans are simplified issue or guaranteed issue policies, for example, that don’t require an exam. Those are good options for clients looking for faster approval or who may have health issues. Canadian LIC’s brokers recommend these options when convenience is paramount for the applicant.

A medical exam will help insurers to assess your health and determine your premiums. Good health may mean a lower-Term Life Insurance quotation. However, if there are a few health concerns, your premiums could be higher than when you are in good health. You can use a Term Life Insurance Calculator to estimate your costs with and without a medical exam.

The medical exam is usually basic and includes blood pressure, weight, and blood tests. This information helps the insurer determine the health risks involved. Most Canadian LIC brokers try to calm down their clients by saying that it is easy and will help in determining the right premium rates.

Yes. You may not be required to take a medical exam to still acquire strong coverage with easy-to-issue policies or guaranteed-issue policies, and perhaps your Canadian LIC’s broker can assist you in determining the most appropriate Term Life Insurance within the client’s budget.

No-medical-exam plans benefit people with health concerns, those requiring quick coverage, or generally anyone uncomfortable with a medical exam. Where Canadian LIC usually finds a plan suitable for the client without compromising coverage with no-medical-exam plans.

Yes, the insurance company usually pays for the Term Life Insurance cost of the medical exam as part of the application process. It is normal to do this for policies that require a health evaluation. Canadian LIC ensures that their clients understand this and are comfortable with the process.

Pre-existing conditions may affect premiums but won’t necessarily result in disqualification. Many insurers believe that well-controlled health issues aren’t a factor. Canadian LIC’s brokers specialize in finding policies which accommodate individual health histories.

Yes, one can purchase Term Life Insurance without a medical examination. Most companies provide online purchases using their simplified issue policies. LIC usually assists the client in selecting a policy that meets their requirements and needs.

Right-Term Life Insurance would depend on one’s health, coverage needs, and budget. Canadian LIC provides tools such as the Term Life Insurance Calculator to help a client compare their options and decide on the best plan.

If your examination shows health problems, you could still be accepted, but the premiums might change. Canadian LIC brokers help their clients find affordable term life quotes, even if the circumstances are difficult.

Approval timelines vary and can take anywhere from a few days to a couple of weeks. All Canadian LIC brokers keep clients updated throughout the process and help ensure a smooth experience.

While high coverage amounts often require a medical exam, some no-medical exam policies offer competitive coverage. Canadian LIC helps clients explore these options when higher coverage is needed.

The process is simplified by brokers like Canadian LIC, who compare multiple quotes, explain policy details, and address client concerns. They ensure you find the best Term Life Insurance Plan tailored to your needs.

In a simplified issue plan, you’re asked basic health questions, but no medical exam is required. Guaranteed issue plans do not ask health questions or require a medical exam. Simplified plans tend to have better rates compared to guaranteed plans. Canadian LIC brokers generally recommend that their clients get simplified plans if they want to get coverage fast and with reasonable premiums.

The company will accommodate you if you want to switch, but depending on the insurance firm, another medical exam might be required. Brokerages that cater to Canadian LICs compare various term life quotes for a customer. Even when it comes to a switch, an appropriate policy could be sought under such brokers’ guidance.

Of course, family history can play an important role. Insurers pay attention to those hereditary factors when calculating a premium. What Canadian LIC brokers do is guide their clients in recognizing the relevance of their family history in Term Life Insurance Quotes.

A Term Life Insurance Calculator makes a rough estimate of what your pay-per-month amount could be; depending on a given age profile, health aspect, and degree of coverage the customer requires, speaking with your Canadian LIC brokers helps make sure this plan is proper to your unique circumstances.

Most insurance companies offer flexibility in the scheduling of a medical exam. You can go to a clinic or a neutral location. Many Canadian LIC brokers help clients organize a location that feels convenient and comfortable.

Yes, you may reapply with a better likelihood of approval since your health can improve over time. Alternatively, you may pursue no-medical-exam policies. Canadian LIC brokers frequently handle clients in such circumstances and thus often find accessible term life policies.

Yes, brokers like Canadian LIC provide tips and guidance for medical exams. They share tips about avoiding caffeine the night before and staying hydrated to help clients achieve accurate results, which may lead to better premiums.

Yes, smoking usually increases the premium since it is a health risk. Still, some insurance companies might quote competitive rates to smokers. Canadian LIC brokers help their clients find the best Term Life Insurance Plan despite their smoking history.

The age limit varies by insurance company. No-medical-exam policies tend to cap the eligibility age lower than traditional plans. Canadian LIC brokers can assist clients in finding plans that meet their age and coverage requirements.

Yes, many insurance companies now let you buy Term Life Insurance online without a medical exam. Canadian LIC makes it easy for clients to understand what they have in store and make the right choice.

Brokers like Canadian LIC, who handle coordination between you and the insurer, really make the process less painful by guiding you from scheduling the exam to explaining the test results.

Lying may result in denial or policy cancellation. There’s honesty. Brokers of Canadian LIC stress this honesty to secure the right Term Life Insurance Policy for clients, free from issues.

Yes, this depends on the lifestyle: diet, exercise, hobbies. Healthy lifestyles may lead to lower premiums. Canadian LIC agents often recommend that people be fit before they take out an LIC.

Yes, some calculators are tailored for no-medical-exam policies. Canadian LIC brokers can guide you in using these tools to compare Term Life Insurance Quotes effectively.

Yes, many policies allow you to add riders, like accidental death benefits, without additional exams. Canadian LIC brokers help clients customize their Term Life Insurance Plans with suitable riders.

Sources and Further Reading

Canada Life

Visit Canada Life to explore Term Life Insurance Plans and coverage options available in Canada.

Sun Life Canada

Learn more about Term Life Insurance Policies from Sun Life Canada, including medical exam requirements and alternatives.

Manulife Financial

Explore Term Life Insurance options, calculators, and no-medical-exam policies at Manulife Financial.

Desjardins Insurance

Desjardins provides insights into Term Life Insurance Quotes and medical exam guidelines. Visit Desjardins Insurance for details.

Insurance Bureau of Canada (IBC)

Access resources on life insurance policies and consumer rights at IBC.

Equitable Life of Canada

Find information on Term Life Insurance Plans tailored for Canadians at Equitable Life of Canada.

Assumption Life

Check out no-medical-exam and simplified issue life insurance options at Assumption Life.

Key Takeaways

- Medical Exam Options: Not all Term Life Insurance Plans require a medical exam. Simplified and guaranteed issue policies offer alternatives.

- Premium Impact: A medical exam can lower premiums for healthy individuals, while no-exam plans may have slightly higher costs.

- Fast Coverage: No-medical-exam policies provide quicker approval, ideal for those needing immediate protection.

- Customized Plans: Use a Term Life Insurance Calculator to estimate costs and compare quotes for tailored coverage.

- Expert Guidance: Canadian LIC brokers help find the best Term Life Insurance Plan, whether online or through personalized support.

Your Feedback Is Very Important To Us

We appreciate your taking the time to help us understand the challenges you face when determining if Term Life Insurance can be a business expense. Your input helps us serve you better.

Thank you for sharing your insights. We will use your feedback to provide better resources and services tailored to your needs. You will hear back from us soon!

IN THIS ARTICLE

- Is There a Medical Exam for Term Life Insurance?

- What Is a Medical Exam for Term Life Insurance?

- Are There Term Life Insurance Options Without a Medical Exam?

- Why Do Some Policies Require a Medical Exam?

- How Medical Exams Influence Term Life Insurance Quotes

- Real-Life Challenges and How Canadian LIC Solves Them

- How to Decide if a Medical Exam is Right for You

- Tips to Prepare for a Medical Exam

- Why Canadian LIC Is the Best Choice for Your Term Life Insurance

- The Role of Online Tools in Simplifying Your Decision

- Addressing Common Myths About Medical Exams and Term Life Insurance

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP