It’s just one of the ordinary days when you are sitting at your desk, and the light of your computer screen hardly lights up the whole room. You are just done with a long day’s work, and your thoughts drift toward the family.

Then it hits you, and it is a hard-hitting thought: what if something happens to me? Will it be good for all? Will they survive without the money you earn? These are questions that most of us have in our minds, but not all take the step to secure the future of their family. This is where a million-dollar insurance policy comes in—the one thing that sounds terrifying but is a necessity for many.

If monthly payments for Million Dollar Life Insurance Policies sound like something very difficult to you, you’d be perfectly right. Many find themselves lost within the terminology and numbers, not understanding fully what they are doing.

This blog sets out to take some of the mystery out of everything that needs to be known about securing a Million Dollar Life Insurance Policy in simple, actionable steps. It’s going to be a journey together from confusion to clarity, from anxiety to assurance.

That’s where a life insurance Million Dollar Policy becomes more than just a safety net—it becomes a foundation for financial confidence. Whether you’re protecting your income, your children’s future, or ensuring your family isn’t burdened with debt, a Million Dollar Policy life insurance plan can make a meaningful difference. Contrary to what many believe, Million Dollar Life Insurance is not just for the wealthy—it’s for anyone who wants lasting financial security. As more Canadians realize the value of Million Dollar Insurance Policies, the demand for clear, practical guidance has never been higher. This guide is here to simplify the path to securing Million Dollar Life Insurance Policies with clarity and confidence.

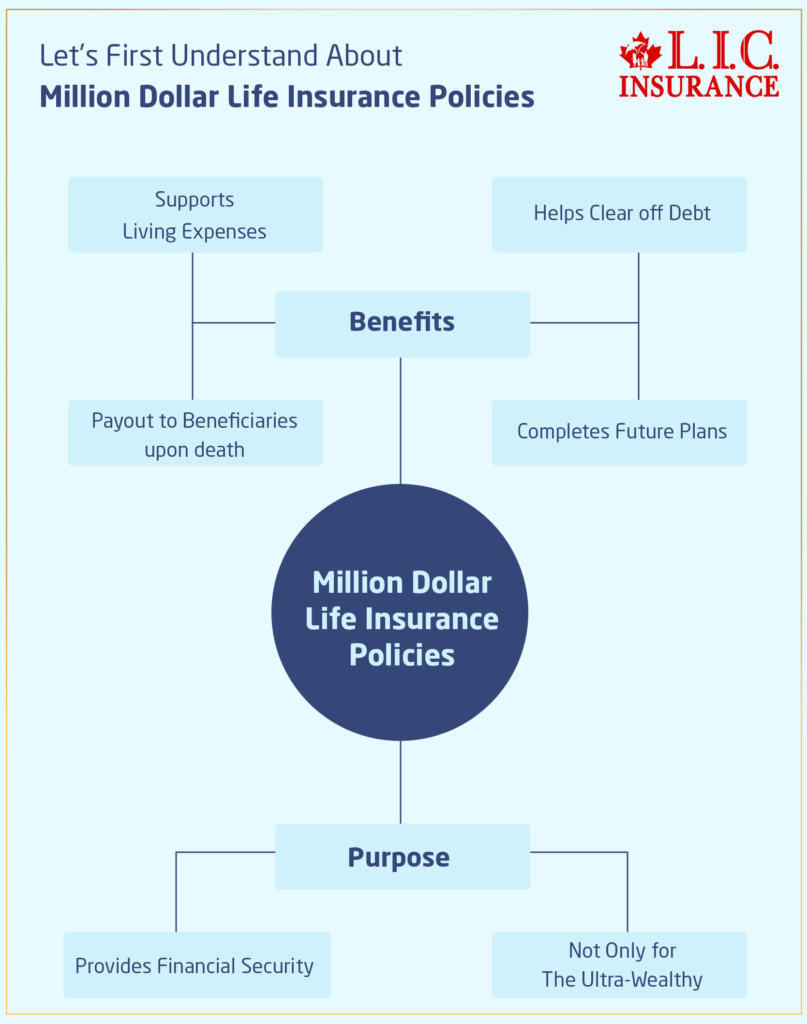

Let's First Understand About Million Dollar Life Insurance Policies

A Million Dollar Life Insurance Policy isn’t just for the ultra-wealthy; it’s a practical choice for anyone looking to provide a high level of financial security for their family. This policy is quite simple in the sense that, in case of death, there is a payout to the beneficiaries, which may be of help to meet their living expenses, clear off some debt, or complete the future plans you have.

Step 1: Assessing Your Need

The first question would be to ask: Does one really need a million-dollar policy? The answer then shall lie with due consideration towards one’s financial status and a well-planned future need for the family. Consider present income, debts, and probable family expenses in the future.

As a thumb rule, multiply your annual income by ten, and that is the policy one should seek. However, a person who is burdened with loans and a few specific future financial obligations, like children’s college expenses, marriage, etc., may need to adjust this figure downwards.

Step 2: Understanding the Types of Life Insurance Coverage

Before we understand how to buy Million Dollar Insurance Policy, let’s first make clear the basic kinds of life insurance: Term Life Insurance and Whole Life Insurance.

Term Life Insurance, on the other hand, is designed to pay out if you die within the period that you’ve agreed to be protected for—generally known as the Term Policies, include cover for anything from 10 to 30 years and are simple and cheaper forms of life insurance. Hence, many take it. Whole Life Policies, in contrast, protect a person for their entire life, hold cash value, and demand higher monthly costs.

Real-Life Tip: How Financial Institutions View a Life Insurance Million Dollar Policy — And How It Can Be Used as Leverage

One of the least-discussed yet incredibly valuable uses of a Million Dollar Life Insurance Policy is its role as a financial asset when structured strategically. Many people assume that Million Dollar Life Insurance Policies are only about providing for loved ones in case of death. However, when properly designed, particularly with Permanent Life Insurance options, they can serve as tools to access liquidity, enhance creditworthiness, or even support business financing.

Financial institutions often view Million Dollar Insurance Policies with built-in cash value (such as whole or universal life) as collateral for loans. This can be particularly advantageous if you’re a business owner or investor seeking leverage without liquidating other long-term assets. When applying for a line of credit or commercial loan, a Million Dollar Policy life insurance document showing accumulated cash value can weigh heavily in your favour.

This adds another layer of practicality and value to securing a Million Dollar Life Insurance plan, not just as a safety net but as a dynamic financial instrument. Whether you’re planning for legacy, liquidity, or leverage, well-structured Million Dollar Life Insurance Policies offer far more than death benefit protection—they can become part of your active wealth strategy.

Step 3: Getting Quotes

Now, what could be done in the practical term? Starting with the insurance, an individual could get a quote from several insurance companies. This will give you a rough idea on what’s the monthly payment for 1 million life insurance.

And don’t let the numbers scare you off. The premiums in Term Life Insurance are usually really affordable. Use online calculators as a guide, and talk with insurance agents to get a good idea of the potential premium levels.

Step 4: Evaluating Your Health

Your health usually determines the premium you pay for insurance. Generally, the healthier you are, the lower the premium you will have to pay. But do not worry—there are a lot of policies for those not in the best of health. Be honest in your health assessment to avoid any complications with your policy down the line.

Step 5: Choosing the Right Term

When you decide on a term for your Term Life Insurance Policy, select a term length that will come closest to your most significant financial obligations. For example, if you are 30 years from retirement and will have other financial arrangements for your family by then, then this would be ideal.

Step 6: Completing the Application Process

You fill out papers, and you might also undergo a medical exam. An insurance company uses them to decide how much of a risk you are to them and what your premium is going to be. This process is not the same for everyone, so it’s better to stay prepared in advance.

Step 7: Designating Your Beneficiaries

The most important decision is who you want your beneficiaries to be. These are the persons or parties who will receive the insurance payout in case you die. Consider carefully, though, who may most need the funds or would be tasked with administering the estate for you.

Find Out: How is a Million Dollar Life Insurance Policy Paid Out?

Find Out: Is it possible to have a Million Dollar Life Insurance Policy?

Overcoming Common Struggles

Sometimes, getting started on the search for a million life insurance policies can look like jargon, numbers, and decisions that appear daunting at first glance. But with simplification, consulting experts, and keeping our eyes on the insurance quotes, an assured future for loved ones, we surely can pass these hurdles very easily.

Tackling Language Barriers: The insurance industry uses a bit of complex terminology. However, understanding the specifics of a Million Dollar Insurance Policy and the monthly payment for a million life insurance policies doesn’t have to be a barrier.

Many insurance companies now offer resources in multiple languages, and some agents specialize in serving diverse communities. Feel free to ask for materials in your first language or for an interpreter if it helps. Remember, clarity is key in these discussions, and it’s important that you fully understand the policy you are considering.

Demystifying Financial Terms: Going alone, some of the terminologies like “premiums,” “beneficiaries,” or “death benefit” might be speaking a foreign language. To do away with some of the mysteries these terms hold, demystify them for the client: a premium is just the monthly payment that you make to keep your insurance policy active. Let’s talk about the monthly premium or average monthly costs of such a Million Dollar Life Insurance Policy. We are talking about the amount that you have to budget to keep this safety net for your family every month. In the form of online resources, brochures, and meeting with the insurance agents face to face, the best means to build your understanding. Remember, no question is too small or silly to ask.

Addressing the Fear of High Premiums: Most have common worries—a Million Dollar Insurance Policy sounds like it would be expensive to secure. It’s a valid worry, definitely, because not too many people take such financial commitments lightly. What may surprise you, however, is that the monthly million life insurance policy payment may actually be friendlier to your pocket than you’ve always thought.

Your age, health, and lifestyle, as well as the length of the term of the policy, will all matter to the policy and will give definition to the key amount of premiums you are to pay. For example, healthier, younger people tend to have lower rates. Shopping around with different providers of insurance, comparing quotes, and asking lots of questions may help you find a policy that will work with your budget and at least secure some financial protection for your family.

Seeking Professional Advice: A range of life insurance includes help from an agent or financial advisor of an insurance company. An insurance company’s agent or financial advisor can help cut through the jargon, compare policies, and give a clear picture of what kind of insurance would best fit the need and budget.

They can offer individual consultation on approaches that will ensure the needed coverage and further dictate guidelines to follow in making the monthly payment for the Million Dollar Life Insurance Policy bearable. Do not hesitate to consult with professionals. It’s their job to assist you in securing the best possible coverage for your situation.

Focusing on the Goal: If during the process at any time you find the task daunting in front of you, remind yourself again why you were even considering getting a Million Dollar Insurance Policy in the first place; it’s all about mental peace and satisfaction, security, and your loved ones.

Keeping that perspective can help you get encouraged to push through the complexities and find an arrangement that ensures, in a very literal sense, that your family’s future is taken care of, no matter what.

By addressing these common struggles with practical steps and a focus on the ultimate goal, securing a Million Dollar Insurance Policy becomes not just a possibility but a clear path forward. Remember, the journey to protect your family’s future starts with understanding, planning, and action. Let’s take that step today, all of us together.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

To Wrap Up

While this might sound rather daunting—having to secure a Million Dollar Life Insurance Policy, believe it or not, it is definitely manageable and in fact, a very responsible move on your part to ensure that your family’s future financial security has been well taken care of, even long after you are gone.

And remember, the best time to buy life insurance coverage is now. Your future self—and definitely, your family—will be most grateful. Never let uncertainties hold you back. Start your journey to financial security today, knowing you have taken a significant step by taking care of your loved ones.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs Related to Buying a Million Dollar Life Insurance Policy

A Million Dollar Insurance Policy is ideal for a person who wants to ensure family financial security in case he is not around. Suppose your annual income, debts, and even future financial obligations, or paying off a mortgage, suggests your family would need significant financial support, this policy might be right for you.

Yes, the monthly payment for a million life insurance policy can be surprisingly affordable, especially if you opt for a Term Life Insurance Policy and are in good health. Premiums vary by many determinants, including age, health status, and more; hence, it would be important to get quotes from different insurers and compare policy options.

Normally, you must attach identification and financial information that will show your income and assets, with medical records. In addition, the insurer can request a medical exam that will reveal the state of your health.

But then again, you would still be eligible for the one-Million Dollar Life Insurance Policy even if you have a pre-existing medical condition, with some considerations, of course, on premium rates. They might then try and assess the health risks in your health and recommend paying a higher premium or taking another life product.

Lengths of approval time can largely vary by the insurer, your health at the time of application, and whether a medical exam is required or not. It usually takes anywhere from a few days to several weeks. Obtain faster approval times with policies that feature simplified underwriting.

Yes, many insurance companies allow coverage to increase, but they are subject to further underwriting. Suppose your financial standings are different from before, and a greater coverage amount is felt to be needed. In that case, contact your insurer and consult the opportunity to increase policy coverage.

Some insurers have a grace period during which the payment can be done without losing the coverage if one misses the payment date. Failure to make the payment within the stipulated number of days of grace would subject your policy to lapse, hence leaving you without coverage.

You can cancel at any time. Really, if it is a Term Life Insurance Policy, then all you would have to do is stop paying the premiums, and, therefore, the coverage would stop. If you have a whole-life policy, you might receive a cash value if you cancel, depending on the terms of your policy.

Companies selected should have strong financial stability, positive customer reviews, and rates for premiums that could reasonably compete. It would be prudent on your part to choose such a life insurance company that offers the type of policy most suitable for your requirements and holds a reputation for excellent customer service.

You can have several life insurance policies from various insurers or from one insurer; it will depend on the number of policies that a person can own. Your income and financial holding can accommodate an amount justifiably convertible for total coverage. This strategy can also help as a means of tailoring coverage to certain needs or goals.

Other factors to be considered in the computation of premiums include your age, the current state of health, and lifestyle choices such as smoking and indulging in dangerous activities. It is critical to the type of policy chosen in making the determination of the amount, together with the term length for Term Life Insurance Policy. The amount of money is used to determine the amount of risk in insuring you.

Term Life Insurance Policy is a type of policy that includes a specific period of time in which, by paying premiums, a death benefit is offered to the nominee if the insured dies within the said term. It is usually cheap and offers no cash value. On the other hand, Whole Life Insurance, as the name suggests, does cover one’s entire life and comes with a death benefit, including cash value or investment that can be borrowed against or withdrawn under certain conditions, although at higher premiums.

Most of the time, the death benefit from a life insurance policy, such as a million-dollar policy, beneficiaries receive is untaxed. However, if you have a whole life policy with a cash value component, there might be tax implications if you withdraw or borrow against the cash value. It’s advisable to consult with a tax professional for specific advice.

Some insurers do offer “no medical exam” policies, even for amounts up to a million dollars, but such policies may have the premium rates significantly above average. These are generally applicable to people below 50 years of age or good health. One should look carefully into comparing these policies, the cost, and the setup of coverage limits.

Life events such as marriage, having children, or getting a windfall of money in a substantial raise in your financial status should push you to re-evaluate your needs for life insurance. Many policies offer adjustability, where you can upgrade either the amount of your policy or change a term policy into a full life policy. If you are concerned with such aspects, ask your insurer about it.

Compare rates, look beyond the monthly payment for Million Dollar Life Insurance, and delve deeper into what coverage is included, policy exclusions, and the financial strength and customer service reputation of the insurer. You can work with an insurance agent or a financial advisor who can help you review your options based on your needs and financial goals.

Once issued, the life insurance policy is rarely, if ever, cancelable by the insurance company as long as the premium is paid. But, of course, the applicant must be honest, and the policy will be void if one misrepresents or omits facts.

If the premiums are too high to afford, that should engage the insurer in discussion; maybe the terms of the policy could be reshaped or the type of policy changed, or maybe means of cutting the size of the premium down without substantially reducing the coverage found.

The policyholder may be anybody else, either a spouse or a business partner. With the consent of the other person, any person may take out life insurance covering the life of any other person for whom he has an insurable interest. The insured person must participate in the application process, including any required medical exams.

Keep the policy documents safe, and let the people you trust know the details of the million dollar coverage, including where the people described as the beneficiaries can find it and how to claim it. You should also, from time to time, review the policy itself and the beneficiary to be sure it accounts for your current desires and state of life.

Sources and Further Reading

To deepen your understanding of securing a million-dollar life insurance policy and managing it effectively, consider exploring the following resources. These sources offer comprehensive insights into life insurance, guiding you through the process, clarifying terms, and helping you make informed decisions:

Life Insurance Guide by the National Association of Insurance Commissioners (NAIC)

- Website: naic.org

- Description: NAIC provides an extensive guide to life insurance, covering different types of policies, how to choose the right one for you, and tips on what to consider before purchasing.

“Life Insurance Basics” by the Insurance Information Institute (III)

- Website: iii.org

- Description: This article offers a primer on life insurance, including the differences between term and Whole Life Insurance, and advice on how much insurance you may need.

“How to Shop for Life Insurance” by Consumer Reports

- Website: consumerreports.org

- Description: Consumer Reports provides unbiased advice on shopping for life insurance, including how to compare policies and choose the right insurer.

“Life Insurance Buyer’s Guide” by the American Council of Life Insurers (ACLI)

- Website: acli.com

- Description: This guide helps consumers understand the process of buying life insurance, the types of life insurance available, and how to assess the amount of coverage needed.

Further Reading:

“The Total Money Makeover” by Dave Ramsey

- Description: Ramsey covers the importance of life insurance within the context of a comprehensive financial plan, offering practical advice on choosing the right amount and type of insurance.

“Questions and Answers on Life Insurance” by Anthony Steuer

- Description: This book provides detailed answers to common questions about life insurance, helping readers make informed decisions about their life insurance needs.

“Life Insurance, 10th Edition” by Kenneth Black Jr. and Harold D. Skipper Jr.

- Description: This textbook offers an in-depth look at life insurance, including the industry's history, its role in financial planning, and detailed explanations of policy types and features.

Online Forums and Community Groups

- Websites like Reddit’s r/personalfinance or Bogleheads.org feature discussions and advice on life insurance from a community of knowledgeable individuals. These platforms can provide personal anecdotes and practical advice.

By consulting these sources and further reading materials, you can gain a solid foundation of knowledge on life insurance policies, including the nuances of a million-dollar life insurance policy. Whether you’re a novice or somewhat familiar with the topic, these resources will equip you with the information needed to navigate the life insurance purchasing process confidently.

Key Takeaways

- Million-dollar life insurance policies are accessible to a wide audience, not just the wealthy.

- Assess your financial needs to determine if a million-dollar policy is right for you.

- Know the differences between term and Whole Life Insurance before choosing.

- Monthly payments for a million-dollar policy can be affordable, especially for the young and healthy.

- Health significantly impacts insurance premiums, with healthier individuals paying less.

- The application process requires honesty about health and financial status.

- Match Term Life Insurance length with your major financial obligations.

- Overcome challenges like language barriers and complex terms by breaking down the process.

- Consulting with insurance professionals can clarify policy options and processes.

- Life insurance needs can change, and policies may allow for adjustments over time.

Your Feedback Is Very Important To Us

We appreciate your time in reading our blog about purchasing a million-dollar life insurance policy. To better understand your struggles and how effectively our information has helped you, we kindly ask you to fill out this brief questionnaire. Your feedback is invaluable in helping us improve our content and services.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]