Think of a family who, after years of diligently paying one’s Whole Life Insurance Monthly Cost, suddenly faces a financial crisis, only to discover that the death benefit on which they were counting may not be paid. It is a wrenching situation many Canadians fear. But what are the circumstances under which Whole Life Insurance won’t pay out its benefits? This is not just a hypothetical concern. At Canadian LIC, we know from experience the actual struggles our clients have faced due to misunderstandings or overlooking some of the policy details. Today, we are going to share with you the critical nuances of Whole Life Insurance derived from our daily practice and enlighten you by sharing stories on this highly complex subject. All of our efforts today are put in for the purpose of protection: protecting you with the knowledge that will save your family from a financial worst-case scenario becoming your reality.

Misconceptions and Misunderstandings

The Misunderstood Clause

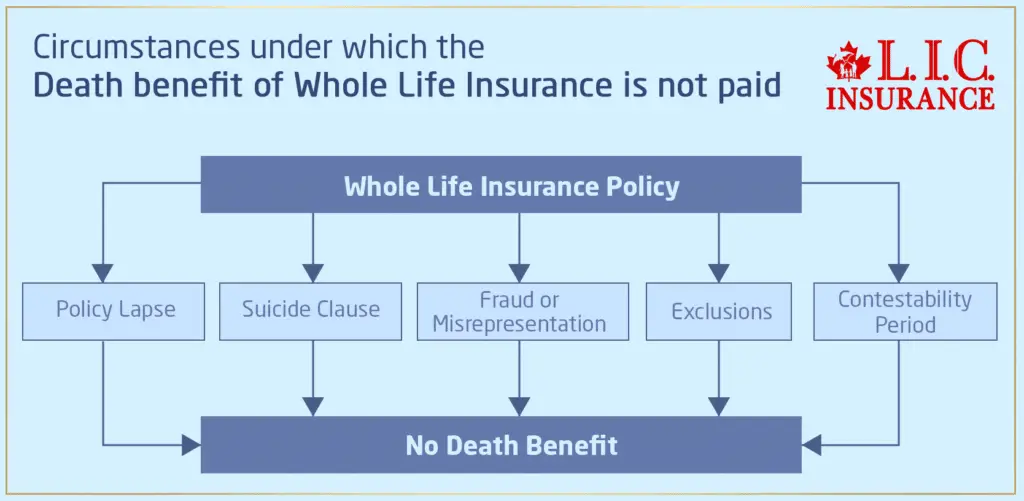

John had a Whole Life Insurance Policy in force for years, repeatedly telling Marie their financial futures were well taken care of. John died prematurely, and suddenly, shockingly, Marie was to find out that the policy would not pay off. Why? Well, quite simply, John had loaned against the cash value of their policy covering his business and never paid back that loan. This large outstanding amount, plus interest, was removed from the death benefit, significantly reducing what Marie received.

This very real example illustrates the importance of knowing the fine details in your Whole Life Insurance Policy. It is not just a matter of comparing Whole Life Insurance Quotes; it is about your actions today and their bearing on how the policy ends up. Be sure to know the implications of borrowing against your policy’s cash value. Canadian LIC advisors take the time to go through these scenarios with our clients to ensure they understand each and every detail.

The Exclusions List

The Exclusion That Was Overlooked

Another such client was Sana. Her partner, Tom, had purchased a Whole Life Insurance Policy without reading the fine print, which included some exclusions regarding the policyholder’s death by certain high-risk activities. Being an enthusiastic skydiver, Tom met with an accident during one of his jumps. Shockingly, Sana found that the policy did not cover accidents caused by skydiving.

This story serves as a reminder of the reasons it’s very critical to understand what sort of specific exclusions your policy might have. At Canadian LIC, we impress our clients with the need to discuss their lifestyles and hobbies with their broker to ensure that their policy covers them adequately without unpleasant surprises.

Financial Mismanagement and Policy Lapse

The Unnoticed Lapse

Another common problem we come across is the lapse of most life insurance policies due to non-payment of life insurance premiums. Take the case of Roger, who was paying diligently every month for his Whole Life Insurance until he fell upon hard financial times. Not knowing that he could have changed the terms under which he was making the payments or used the cash value of his policy to pay for premiums temporarily, he simply stopped paying. His policy lapsed, and his family was left unprotected when he died prematurely.

In case of a lapse, the Canadian LIC proactive intermediary contacts the client to discuss options. Your policy needs to be enforced. Take your time getting in touch with your broker when facing financial difficulties.

Suicide Clause and Contestability Period

The Tragic Timing

Lastly, there was the tragic story of Emily and her husband, who purchased his Whole Life Insurance Policy but died within a year thereafter. The death has been ruled a suicide. Because the death fell under the contestability period of the policy and its specific suicide clause, the claim was denied. This applies to the first two years, beginning when the policy is initially in force, under which an insurance provider investigates and denies claims based on misrepresentation or certain kinds of death, like suicide.

Through stories like Emily’s, Canadian LIC emphasizes the importance of understanding these sensitive clauses. Our advisors are trained to approach these discussions with compassion and good detail so clients and their families aren’t left in the dark.

The Final Note

The stories of John, Marie, Sana, Tom, Roger, and Emily are not just deterrent examples; they represent very real scenarios that bring out the criticality of deeply understanding your Whole Life Insurance Policy. We at Canadian LIC give you the commitment of the most detailed advice and the best Whole Life Insurance Quotes for the various intricacies of this life of yours. Let not confusion or misconception be a hurdle in your family’s financial protection. Contact Canadian LIC today, and let’s ensure that your Whole Life Insurance Policy truly looks after your loved ones. Act now—because the right knowledge today can prevent financial heartache tomorrow.

More on Whole Life Insurance

What Is The Impact Of Smoking On Whole Life Insurance Premiums?

Can I Adjust My Whole Life Insurance Policy?

How Can You Find The Best Whole Life Insurance Without A Medical Exam?

What Age Does Whole Life Insurance End?

What Are The 2 Disadvantages Of Whole Life Insurance?

At What Age Is Whole Life Insurance Good?

Can I Buy Whole Life Insurance For My Child?

Who Should Opt For Whole Life Insurance?

Is Whole Life Insurance Expensive?

Understanding How Does A Whole Life Insurance Policy Work: A Comprehensive Guide

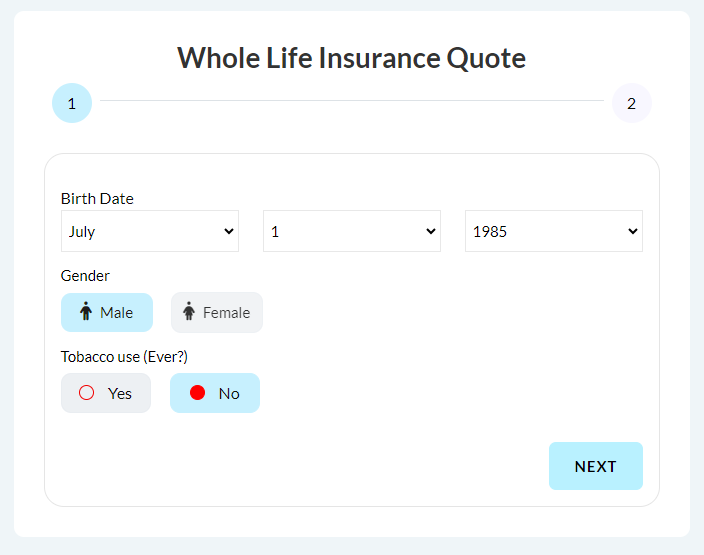

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Visitor Insurance in Canada

Getting a quote for Visitor Insurance is simple: you may begin with a visit to insurers’ websites or an online comparison of various insurance companies offering insurance. All that is required is for you to provide details on the age of the visitor, period of stay, and any specific coverage required—like coverage of pre-existing conditions, to get presented with a number of choices in plans. Think of it as shopping online for a great deal: You want the most protection you can get for the least expensive price that fits into your budget.

Costs for Visitor Insurance vary widely. They can be much lower if the covered party is younger, the stay is shorter, or the required coverage is also lower. For instance, there may be low premiums for insurance for young visitors without existing illnesses compared to the premiums that may be required for insurance by old parents requiring comprehensive coverage. Consider it as choosing between safety nets of varying strength. The stronger the net, the more it costs—though you have peace of mind.

Yes, Visitor Insurance can be purchased even after your parents have arrived in Canada, but ideally, you should purchase it for them before they actually leave for the journey. Early purchase would mean that insurance coverage would be effective at an earlier date than most, usually covering any unexpected medical expenses arising from sudden illnesses after the effective date. It is a situation you can imagine: your mother comes, and the second day, she falls sick. It’s possible to buy Visitor Insurance a day before you arrive. Many policies will cover the medical visits if the waiting time starts after a day.

Choosing the right plan can be a headache, though looking at a few Visitor Insurance Quotes and being guided by factors such as the parent’s health and duration of the visit helps. In the case of pre-existing conditions for the parents, you have to go in for plans that offer such coverage. Consider this—Sarah does everything it takes to ensure her mother’s diabetes is taken care of. You would be the best judge of the value of the plans; maybe you would also like the plans with more benefits but at a slightly higher price.

Visitor Insurance is not much of a requirement for issuance with the Canadian visitor visa, but on the contrary, it is very much insisted on. Without the coverage, visitors may bear high out-of-pocket medical service costs, which could be very burdensome financially. So, think of John’s dad. His time without that insurance just cost him a $30,000 medical bill. “It is better to have insurance and not need it than to need it and not have it.”

Contact your Canada travel insurance company immediately if your parents become ill during the visit. Most companies have hotlines open 24 hours a day, seven days a week. Take the insurance information with your parents so that he or she will be able to present it at the health facilities if needed. This will streamline the treatment from their own initiative, just the way it would have helped in Alex’s case when his mother needed urgent care after falling.

When looking for visitor Canada insurance for parents, specifically when they have pre-existing medical conditions, one has to go through the policy details very carefully. Many insurance companies claim they cover pre-existing conditions, but there might just be a certain waiting time that has to pass after such a condition. For instance, your father has hypertension, and while in Canada, he suddenly needs serious medical attention. For this kind of case, take out a policy that covers the condition to avoid instances when you are paying huge medical bills out of your pocket because this was excluded from the standard policy.

Typically, where one expects them to stay longer than what has been applied for or expected, they can extend the visitor’s medical insurance coverage if the parent needs to extend his stay period. However, the extension must be requested before the expiry of the original policy. Take, for instance, Helen’s parents, who came to visit for a fortnight and ended up extending their visit because of unexpected legal matters that came up. Helen successfully extended her insurance because she phoned the insurance provider three days before the expiry of her policy to give them the information.

Yes, Visitor Canada Insurance Cover usually provides coverage for the provinces and territories in Canada. In other words, your parents’ travelling from the cultural sites of Quebec to the natural landscapes of British Columbia would be possible under one policy. Imagine your folks paddling a peaceful boat on a definitely insured Banff National Park, followed by a walk on the lively streets of Montreal—all under one policy.

While comparing different Visitor Insurance Quotes, consider aspects such as the coverage limit, the deductible to be paid by the client, the inclusion of pre-existing condition coverage, and the credibility of the insurance provider. That’sThat’s like when you’re shopping for a new car. You wouldn’t just look at the price; you’d look at features, reviews, and safety ratings. For example, when comparing plans, Amit considered taking the plan with lower deductibles and higher limits of coverage, considering that he knew his mother would go for hikes, and that was the activity that led to an increase in the risk of medical emergencies.

Most visitor health insurance plans will have a list of exclusions, which may include routine check-ups, elective treatments, and, in some instances, injuries from some adventurous activities like skydiving. Make sure you read and understand what is not covered to avoid surprises. This is much like what happened to Claudia’s father when he realized too late that his Visitor Insurance did not include any dental emergencies, thereby incurring quite a big out-of-pocket expense for a tooth extraction.

Visitor Insurance is usually cancellable in case your parents have to cancel their trip. Depending on the policy, you might get a prorated partial or full refund at the time of cancellation. It’s almost like returning a product that you bought because you found it at a lower price elsewhere—just remember to do it within the return policy period. Lisa heaved a sigh of relief when, two days before her parents’ travel, she cancelled the insurance just in time, as their visa was declined at the very last moment.

Usually, seeking a quote for Visitor Insurance comes with certain questions about some of the basic pieces of information regarding one’s parents—ages, the period they intend to stay in Canada, and any specific health conditions. This is much the same way you book a flight, requiring you to proceed with the passengers’ details. For example, when James was inquiring about insurance for his mom, the site only wanted the age of his mom and the travel dates; he didn’t need to give full details about his mom and even got a quote for the trip.

Some of the insurance providers allow discounts on purchasing Visitor Insurance for more than one visitor, even provide discounts while buying the policy for an extended period. It’s kind of availing a discount on family cell phone plans. When it came to the purchase of Visitor Insurance for my parents and in-laws, I got to know that purchasing all together was allowing me to take a discount of 10%, which was a great relief.

If your parents are already under any kind of treatment for a certain condition at home, make sure the Visitor Insurance covers continued treatments. If it does not, then perhaps you can make arrangements in such a way that there is continuity of care in Canada for them, at least concerning health. This is important for the avoidance of any possible interruptions in healthcare. For example, when Tom’s mother had to keep on taking her chemotherapy during the six months of staying there, it was clearly necessary to know which policy to take so that there wouldn’t be any discontinuation of her treatment in Canada.

In general, most parents’ visitors’ insurance plans can be renewed if your parents’ stay in Canada is extended. But usually, it has to be done before the expiry of the original policy. Think about it like renewing the lease of your home before the lease expires so that you don’t have to lose your rental home. Sofia had to renew her insurance in advance so there wouldn’t be a gap in the coverage when her parents had to stay longer because of the pandemic.

In most cases, in order to make a claim, you will forward the medical bills and any supporting documentation to the insurance company. Most insurers will also have to notify before obtaining, say, certain types of medical treatment. That is much like filing a claim for car damage after an accident. When Raj’s father had to go through an emergency surgery, he got to claim it since he had submitted all the documents from the hospital through the insurer’s online portal, thus making it very convenient for him to get reimbursement.

Gain knowledge with these FAQs on Visitor Insurance to be in a better position while making your decisions, which guarantees safe and enjoyable visits by your loved ones. With the right information at your disposal and the perfect Visitor Insurance plan in place, you are not preparing for the worst but rather ensuring the best visit possible for your parents.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA) – Comprehensive guides and resources on life insurance products available in Canada. Visit CLHIA

Financial Consumer Agency of Canada (FCAC) – Offers information on choosing the right life insurance for your needs and understanding different insurance policies. Visit FCAC

Investopedia – Provides detailed articles on Whole Life Insurance, including advantages, disadvantages, and key features. Visit Investopedia

Insurance Bureau of Canada – Resources on life insurance and personal financial planning with insurance products in Canada. Visit IBC

NerdWallet – Comparison tools and expert advice on Whole Life Insurance versus other types of life insurance, and how to evaluate the best option for you. Visit NerdWallet

These resources can provide further detailed information and help deepen your understanding of Whole Life Insurance, guiding you through making informed decisions about your insurance needs.

Key Takeaways

- Borrowing against your policy's cash value can reduce the death benefit if not repaid.

- Know your policy's exclusions, such as activities not covered, highlighted by Tom's skydiving accident.

- Keep up with premium payments to avoid policy lapse and loss of coverage, as seen in Roger's case.

- Be mindful of the contestability period and suicide clause, critical in the first two years of the policy.

- Regular consultations with your insurance provider ensure your policy suits your changing needs.

- Customize your coverage with riders or adjustments to protect against evolving personal circumstances.

- Maintain open communication with your insurance provider to align the policy with your needs continuously.

Your Feedback Is Very Important To Us

We appreciate your participation in this questionnaire. Your responses will help us better understand the challenges faced when claiming Whole Life Insurance benefits and improve our services. Please answer the following questions:

Your feedback is crucial for us to ensure that Whole Life Insurance serves its intended purpose effectively. Thank you for sharing your experiences and suggestions.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]