The concept of term life insurance in Canada is often surrounded by questions and uncertainties, especially regarding the financial flexibility it offers. Most people understand the primary function of term life insurance — to provide financial security for your family and loved ones in the event of your untimely passing. However, a common question arises: Can you cash out a term life insurance policy?

In this blog, we’ll explore the difficulties of term life insurance, focusing on its structure, benefits, and limitations. We’ll also discuss why term life insurance differs from other types of policies and what options you might have if you’re looking to leverage your policy for financial gain.

Understanding these details is crucial, especially when comparing term life insurance quotes and considering the long-term implications of your policy choice.

Explaining Term Life Insurance

Term life insurance is a special kind of life insurance policy that offers coverage for a specified term or period, typically ranging from 10 to 50 years. The primary function of term life insurance is to provide a death benefit to the beneficiaries if the policyholder passes away during the term. This type of insurance is particularly popular in Canada due to its affordability and straightforward nature.

When you start looking for Term Life Insurance quotes, you’ll notice that compared to permanent life insurance, the premiums are usually lower. This is because term life insurance does not accumulate cash value over time. It’s purely designed to offer peace, being aware that your family and loved ones will be well taken care of financially if in case something happens to you during the term of the policy.

Term life insurance is perfect for all those individuals who need coverage for a specific period, like in the case til their children become financially independent or their mortgage amount is paid off. It’s a budget-friendly option that still provides substantial financial protection.

Can You Cash Out?

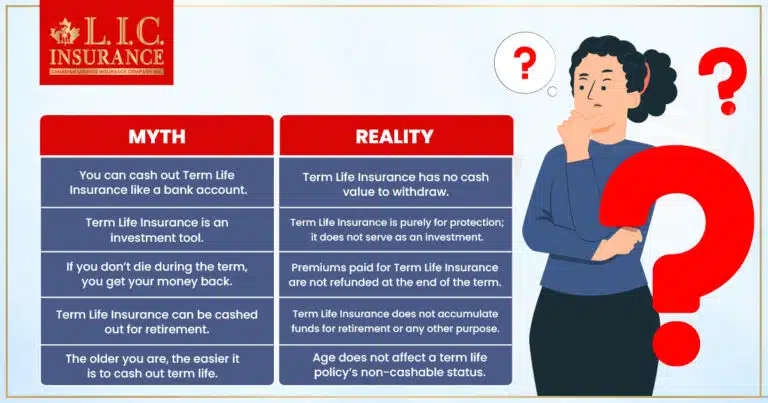

Understanding the limitations and functionalities of term life insurance in Canada is crucial, especially when you’re evaluating your long-term financial planning and insurance needs. One of the primary aspects that often come to light is the absence of a cash value component in term life insurance. This key feature, or rather the lack of it, defines the fundamental nature of term life insurance policies and sets them apart from other types of life insurance.

No Cash Value Component

Unlike whole life or universal life insurance policies, term life insurance doesn’t accumulate any cash value over the life of the policy. This means that the premiums you pay are solely for the purpose of providing a death benefit to your beneficiaries if you pass away within the policy’s term. It’s important to understand this when you’re getting term life insurance quotes, as it impacts the kind of financial benefits you and your beneficiaries can expect.

The absence of a cash value component means:

No, Cashing Out: You cannot withdraw or borrow against your term life insurance policy.

Pure Protection: The policy is designed exclusively to offer financial security to your beneficiaries in the event of your passing during the term.

Term Life Insurance: A Pure Protection Product

Term life insurance is often described as a ‘pure protection’ product. This means that its primary purpose is to offer financial protection and mental peace rather than acting as an investment or savings vehicle. When you compare term life insurance quotes, you’ll notice that the premiums are generally more affordable than those for permanent life insurance. This is because you’re not paying to build up any cash value; you’re paying solely for the death benefit protection.

Here’s a simple comparison to illustrate this point:

| Insurance Type | Cash Value Component | Primary Purpose |

|---|---|---|

| Term Life Insurance | No | Death Benefit |

| Whole Life Insurance | Yes | Death Benefit + Savings |

| Universal Life Insurance | Yes | Death Benefit + Savings |

Term Life Insurance Quotes: What Are You Paying For?

When you receive term life insurance quotes, it’s essential to recognize what you’re paying for. In comparison to permanent life insurance, the premiums for term life insurance are typically lower because you’re not contributing to a cash-value fund. Your payments are calculated based on the likelihood of the insurance company needing to pay out the death benefit during your policy’s term. Factors like your age, health, lifestyle, and the length of the term you choose play a significant role in determining your premiums.

So, term life insurance offers a straightforward, budget-friendly way for individuals in Canada to ensure their loved ones are financially protected without the additional complexity and cost of a cash value component. It’s an insurance solution that focuses solely on protection, making it an excellent choice for those who need coverage for a specific period without the necessity of an investment element.

Alternatives to Cashing Out

While you can’t cash out a term life insurance policy in Canada, there are several alternative strategies to consider for financial flexibility. Each of these options has its own set of conditions and benefits, which can provide different solutions depending on your personal and financial circumstances.

Selling Your Policy

Selling your term life insurance policy, also known as a life settlement, is a less common but viable option in Canada. This process involves transferring your policy to a third party in exchange for a lump sum. It’s a way to get some financial return from a policy that you may no longer need or can afford.

However, it’s important to note that not all term life insurance policies are eligible for sale, and the option to sell is subject to specific conditions set by the insurer. Additionally, the amount you receive from selling your policy is typically less than the death benefit but more than the surrender value (if any). When considering this option, it’s crucial to get term life insurance quotes for new policies to compare the potential financial outcomes.

Converting Your Policy

Conversion of a term life insurance policy into a permanent life insurance policy is another alternative. Many insurers in Canada offer this option, allowing policyholders to switch to a policy with a cash value component without having to undergo a new medical examination.

Converting your policy to a permanent one like Whole or Universal Life Insurance can provide long-term financial benefits, including the accumulation of cash value. However, this usually comes with higher premiums. Here’s a quick comparison to help understand the change in policy structure:

| Policy Type | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (e.g., 10, 20, 30 years) | Lifetime coverage |

| Cash Value Component | No | Yes |

| Premiums | Generally lower | Higher, but builds cash value |

Adjusting Your Policy

If your current term life insurance policy becomes unaffordable or your coverage needs change, adjusting your policy is a practical solution. This could involve reducing the death benefit, which in turn would lower your premiums. This adjustment helps make the policy more manageable within your budget and still provides a level of protection for your beneficiaries.

When considering adjusting your policy, it’s a good idea to compare current-Term Life Insurance quotes to ensure that you’re still getting a competitive rate. Policy adjustment can be a flexible way to maintain life insurance coverage while adapting to changing financial circumstances.

So, even though you cannot directly cash out a Term Life Insurance policy in Canada, these alternatives provide different paths to achieve financial flexibility. Whether it’s selling your policy, converting it to a permanent one, or adjusting your coverage, each option has its own set of advantages and considerations. It’s important to review these options in the context of your personal financial situation and long-term goals.

Why You Can’t Cash Out Term Life Insurance

The inability to cash out Term Life Insurance in Canada is fundamentally rooted in its structural design, which significantly differs from that of permanent life insurance policies. Understanding these differences is key when considering Term Life Insurance quotes and the type of coverage they provide.

Structural Differences

Term Life Insurance is strategically designed to offer pure death benefit protection. This means that the policy’s sole purpose is to provide a financial safety net to your beneficiaries in the event of your death during the policy term. Unlike permanent life insurance, Term Life Insurance doesn’t include an investment or savings component. This absence of a cash value component is a defining feature and directly impacts the policy’s cost and purpose.

Here’s a breakdown of the differences:

| Feature | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Cash Value Component | No | Yes |

| Premiums | Lower | Higher |

| Coverage Duration | Fixed term (e.g., 10, 20, 30 years) | Lifetime |

| Primary Purpose | Death benefit protection | Death benefit + savings/investment |

Implications of No Cash Value

Since Term Life Insurance lacks a cash value component, the premiums paid are solely for the death benefit protection. This is why premiums for Term Life Insurance are generally lower in comparison to permanent life insurance. When you receive Term Life Insurance quotes, you’re essentially looking at the cost of pure insurance coverage without any portion of your payment being diverted into an investment or savings plan.

In contrast, permanent life insurance policies include a cash value component that grows over time. This component serves as an investment or savings tool within the policy, contributing to the higher premiums. The cash value can be borrowed against or even cashed out under certain circumstances, providing financial flexibility that Term Life Insurance does not offer.

Target Audience and Purpose

Term Life Insurance is particularly well-suited for individuals who require coverage for a specific period — for example, until their mortgage is paid off or their children are financially independent. It’s an affordable way to ensure that your beneficiaries are taken care of financially in case of your unexpected death during this period. On the other hand, permanent life insurance is geared towards individuals looking for lifelong coverage with an added component of cash value growth, suitable for long-term financial planning.

Hence, the structural design of Term Life Insurance in Canada, focusing solely on providing a death benefit without a cash value component, is the primary reason you cannot cash out these policies. When comparing Term Life Insurance quotes, it’s essential to consider this fundamental difference and how it comes in line with your financial goals and coverage needs.

Understanding the distinctions between term and permanent life insurance ensures that you choose a policy that best fits your individual circumstances.

Term Life Insurance Quotes in Canada

When it comes to selecting Term Life Insurance in Canada, obtaining and comparing quotes is a crucial step. Term Life Insurance quotes not only provide you with an estimate of your premiums but also reflect the coverage you can expect. Understanding how these quotes are determined and what factors influence them is key to ensuring you get the perfect coverage at a price that fits your budget.

Key Factors Influencing Term Life Insurance Quotes

Coverage Amount: The amount of coverage you opt for is directly proportional to the premium you’ll pay. More coverage typically means higher premiums. When deciding on the coverage amount, consider your financial obligations, like debts (mortgages, loans), daily living expenses, and future needs of dependents (education, care).

Policy Term: The length of the policy also plays a significant role. Term Life Insurance policies are available for various durations, such as 10, 20, or 30 years. The ideal term length usually aligns with the period your beneficiaries would be most financially vulnerable, like until your children reach adulthood or your mortgage is paid off.

Age and Health: Your age and health at the time of application significantly impact the premium. Generally, younger and healthier individuals receive lower quotes as they are considered lower risk.

Lifestyle and Occupation: Certain lifestyle choices (such as smoking) and high-risk occupations can lead to higher premiums.

Here’s a simple table illustrating how these factors might impact Term Life Insurance quotes:

| Factor | Impact on Term Life Insurance Quote |

|---|---|

| Coverage Amount | Higher coverage leads to higher premiums |

| Policy Term | Longer terms can result in higher premiums |

| Age and Health | Younger and healthier individuals typically get lower premiums |

| Lifestyle and Occupation | Riskier lifestyles or jobs may increase premiums |

Finding the Right Balance

When evaluating Term Life Insurance quotes, it’s necessary to find the right balance between adequate coverage and affordability. While it’s tempting to go for the lowest premium, this might not provide sufficient coverage. Conversely, the most extensive coverage might not be affordable or necessary for your situation.

Regular Review and Adjustment

It’s also important to remember that your insurance needs may change over time. Regularly reviewing and adjusting your Term Life Insurance policy ensures that your coverage continues to meet your evolving needs. For instance, if you’ve paid off significant debts or your dependents are now financially independent, you might opt for a lower coverage amount, which could reduce your premiums.

So, when looking for Term Life Insurance quotes in Canada, it’s crucial to consider how various factors such as coverage amount, policy term, age, health, lifestyle, and occupation affect your premiums. The goal is to ensure that your policy provides sufficient financial protection for your beneficiaries while still being affordable for you. By carefully evaluating these elements, you can make a smart decision about your Term Life Insurance coverage, ensuring mental satisfaction for both you and your loved ones.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

To Wrap Up

While you cannot cash out a Term Life Insurance policy in Canada, understanding the nature and limitations of your policy is essential. This information will guide you in making informed choices about your insurance needs and explore alternative options if necessary. Remember, Term Life Insurance is about providing financial security for your loved ones, and choosing the right policy involves balancing coverage, term length, and affordability. When seeking Term Life Insurance quotes, consider all these factors to find a policy that best suits your unique needs and circumstances.

Faq's

No, you cannot borrow against a Term Life Insurance policy as it does not have a cash value component.

At the end of the term, the policy expires. You can choose to renew it, convert it to a permanent policy, or let it lapse.

Term Life Insurance is best for those needing temporary, affordable coverage. It’s ideal if you have specific financial obligations for a set period.

Compare quotes from various insurers, assess your coverage needs, and consider the premium affordability and the policy’s term length.

Yes, the death benefit received from a Term Life Insurance policy is generally tax-free for the beneficiaries in Canada.

Most Term Life Insurance policies in Canada offer the option to renew at the end of the term. However, premiums may increase upon renewal based on your age at that time.

If you outlive your Term Life Insurance policy, the coverage ends, and you won’t receive a payout. You can consider renewing the policy, converting it to a permanent policy, or purchasing a new policy.

Yes, Term Life Insurance policies may have exclusions, such as death due to participating in high-risk activities or pre-existing medical conditions. It’s important to read and understand the policy terms.

Yes, non-Canadians and new immigrants can typically buy Term Life Insurance in Canada. However, the eligibility criteria and the application process might vary depending on the insurer.

Generally, Term Life Insurance premiums increase with age. The younger you are when you purchase the policy, the lower the premiums will usually be.

Yes, you can have multiple-Term Life Insurance policies in Canada. People often do this to cover different financial obligations or to increase overall coverage.

Yes, smokers generally pay higher premiums for Term Life Insurance than non-smokers due to the increased health risks associated with smoking.

Yes, you can usually change the beneficiary of your Term Life Insurance policy. It’s advisable to review and update your policy’s beneficiaries as needed.

The processing time for Term Life Insurance claims can vary but is typically prompt once the insurer receives all necessary documentation and verifies the claim.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com