- Is Visitor Insurance The Same As Travel Insurance?

- Visitor Insurance Vs. Travel Insurance: What’s The Difference?

- Coverage Details And Why They Matter

- Differences Between Visitor Insurance And Travel Insurance

- Similarities Between Visitor Insurance And Travel Insurance

- Visitor Health Insurance Plans: Importance And Considerations

- Choosing The Right Plan

- The Final Verdict

The time which you have been eagerly waiting for has finally arrived for your dream vacation in Canada. From the busy streets of Toronto to the peaks of the Rockies, you are set and ready to explore, having sorted them all with visitor visas and scheduled flights. So, while you recheck and double-check the list of things to travel with, this question starts nagging your mind: “But do I have the right insurance for the trip?” This has left many travellers in doubt: Is Visitor Insurance the same as Travel Insurance? This has caused confusion and sometimes stressful situations, like being underinsured when faced with a medical emergency or losing money following an unexpected trip cancellation. This blog will clear this confusion and help you make an informed choice about the exact insurance that you really need for your travels in Canada.

We will also see some of the real-life cases of travellers who had trouble with insurance, the differences and similarities between Visitor Insurance and Travel Insurance, and most importantly, why a person should be very clear about this. By the end of this blog, you’ll be armed with all the details required in order to get a Visitor Insurance Quote, you will be very well aware of the Visitor Health Insurance Plan’s importance and know that your trip is safe and fun to the best of your ability.

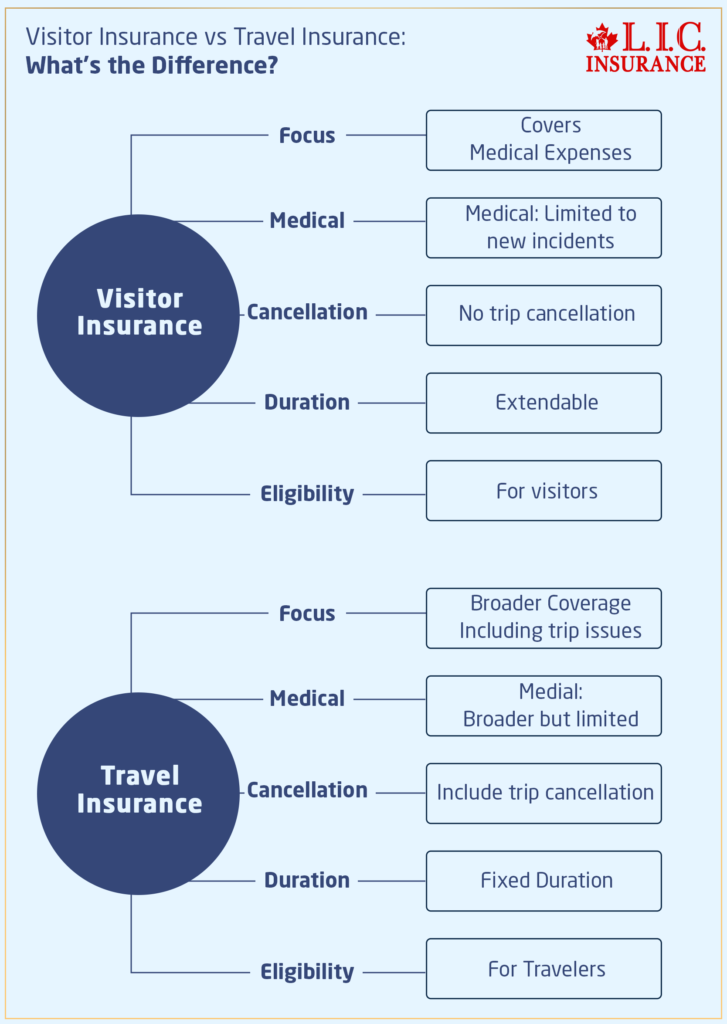

Visitor Insurance vs. Travel Insurance: What's the Difference?

Understanding the Basics

But first, let’s define the terms. Visitor Insurance, also known as Visitor Health Insurance, covers one’s medical expenses as he visits Canada. It includes covering medical expenses that you incur from either illness or accident occurrences, which may be unanticipated during your travels. Travel Insurance is the larger category that can include coverage for medical incidents during travels but can also include coverage for cancelled trips, lost luggage, and many other categories of coverage.

This UK visitor learned it in the most painful way: he believed that his Travel Insurance would ensure his being insured medically if ever an emergency popped up during his visit to Montreal. Unfortunately, a few years back, after a skiing accident, he had to face the fact that he had to pay huge medical bills since his policy could cover the loss of items on the trip and the delay but not any expenses related to medical care. So, the moral of the story is to take a Visitor Insurance Quote specific to your situation that includes full medical coverage.

Coverage Details and Why They Matter

Medical Expenses in Visitor Insurance

When you look for a Visitor Insurance Quote, you will look at the plans designed to indemnify you against high healthcare costs in Canada. Normally, those plans provide hospitalization and emergency medical care; sometimes they include dental emergencies, too. Understanding the scope of these plans is crucial for any traveller, especially if you have pre-existing conditions.

Travel Insurance: Beyond Medical Care

Travel Insurance may include medical coverage, though very often, it is aimed more at the logistics of travelling. This may include such things as coverage for flights or lost baggage and trip interruption. These features are great for dealing with the bumps in your travelling journey, but they’re no replacement for medical coverage.

Differences between Visitor Insurance and Travel Insurance

| Feature | Visitor Insurance | Travel Insurance |

|---|---|---|

| Primary Focus | Covers medical expenses during your stay. | Broader Optional coverage, including trip cancellation, baggage loss, and travel delays. |

| Coverage for Medical Expenses | Primarily provides coverage for new illnesses and accidents | May include limited medical coverage; the focus is not solely on medical expenses. |

| Trip Cancellation | Generally, it does not include trip cancellation benefits. | Often includes trip cancellation, interruption, and delays. |

| Duration of Coverage | Can be purchased for the duration of the stay, from a few days to a year, extendable in some cases. | Typically covers the exact duration of the trip, usually not extendable |

| Eligibility | Available to visitors, including tourists, students, and temporary workers. | More suited for residents and citizens planning to travel abroad. |

| Pre-existing Conditions | Some plans cover acute onset of pre-existing conditions. | Coverage for pre-existing conditions is less common and usually limited. |

| PPO Network | PPO NetOften includes access to a PPO network, offering lower rates at specific hospitals and clinics. | Does not usually include a PPO network; claims are often reimbursement-based. |

| Availability | Can be purchased before or after arrival in Canada. | Must be purchased before departure. |

| Refund Policy | Refund policies may vary, with some flexibility before or after the policy start date. | Generally offers a “free look” period but is non-refundable once the trip begins. |

| Suitable For | Designed for medical emergencies during visits to Canada. | Designed to cover a range of travel-related issues, from logistics to minor medical needs. |

Similarities between Visitor Insurance and Travel Insurance

| Aspect | Visitor Insurance | Travel Insurance |

|---|---|---|

| Purpose | Designed to provide financial protection during travel. | Designed to provide financial protection during travel. |

| Coverage for Medical Emergencies | Often includes emergency medical expenses. | Often includes emergency medical expenses. |

| Available to Foreign Visitors | Yes, designed for individuals visiting from abroad. | Yes, also available for foreign visitors and often for residents too. |

| Can Cover Short Trips | Yes, suitable for short visits and can be adjusted based on trip length. | Yes, typically covers the trip duration, suitable for short trips as well. |

| Regulatory Compliance | Helps comply with visa and country entry requirements regarding health insurance | Helps comply with travel requirements and visa regulations in some cases. |

| Pre-purchase Requirement | Best purchased before traveling to ensure coverage from arrival. | Best purchased before departure to ensure coverage starts with the trip. |

| Coverage Extension | Some plans allow for extension if the visit is prolonged. | Some plans may allow for extension under certain circumstances. |

| Protection Level | Provides a safety net against unforeseen health issues during the stay. | Provides a safety net against various unforeseen travel and health issues. |

| Plan Flexibility | Offers various options tailored to the length of stay and health needs. | Offers a range of plans tailored to travel needs and trip duration. |

| Claim Process | Typically involves submitting evidence of expenses for reimbursement. | Also involves claims submission for covered expenses and losses. |

Visitor Health Insurance Plans: Importance and Considerations

Why It’s Essential

Now, let’s consider another traveller, Maria from Brazil, who really had no interest in health insurance for visitors. She was all involved in only planning her trip’s adventure parts. A sudden illness left her stranded in a Canadian hospital, facing not only health challenges but also a financial dilemma. Her story is a perfect reminder of why Visitor Health Insurance is indispensable.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Choosing the Right Plan

Visitors looking for the right Visitors Medical Insurance Plan do not just look at it as ticking off any box but rather as securing their peace of mind while exploring Canada. We shall look at some of these key factors which you should consider in making your choice so that you get what best suits your traveling needs, after all the right plan acts as your financial shield against unexpected medical expenses.

Length of Stay: Tailoring Coverage to Your Travel Timeline

Moreover, the visitor’s insurance should match the period of the stay exactly. Whether you are just coming over to get a few snapshots on your digital camera by Niagara Falls or you are staying long enough to enjoy the great diversity of British Columbia, the insurance you get should cover the period of your entire stay. Consider the case of Angela, where a visitor’s three-month stay was purchased for the coverage of only two months to economize. The tragic part of the story now is that Angela fell sick just after the expiry, and she got to face some hefty medical bills without any help from her expired policy. Don’t make Angela’s mistake. Extend your coverage to your full duration of stay, and never find yourself uncovered when you least expect it.

Coverage Limits: Ensuring Adequate Protection

Thus, organizing medical care in the Canadian health system can be very expensive, especially for tourists. That is why the option of a plan with adequate coverage limits is very important. With these limits, you can see the sum paid by the insurance company for your medical treatments. Take the case of Tom, who skied himself into trouble on the slopes of Whistler. He underwent some minor surgery, and he was in hospital for a few days, and then poof. The bill went over thirty grand in no time. Tom was lucky in this regard since he bought a plan with a high coverage limit. He did not need to worry about the pending medicals and expenses, piling up and burying him under debt. Always make a point to compare Visitor Insurance Quotes before selecting a specific plan and ensure that financial protection is provided at a higher limit. Remember, in healthcare, it’s better to have more coverage than you think you’ll need.

Pre-existing Conditions: Special Considerations for Your Health History

The cover for pre-existing medical conditions with acute onset is among the things you cannot take lightly. That would be an important cover, as normal health problems may aggravate unexpectedly during a stay abroad. Take, for instance, Sarita, who had controlled hypertension. One of her episodes of the sudden rise in blood pressure was while she was in Toronto; that episode landed her in a very critical situation, needing urgent medical attention. She was able to get proper treatment without the turmoil of finances as her insurance policy indeed covered the acute onset of pre-existing conditions. You really should read the fine print to make sure your insurance does, in fact, provide for emergencies related to already existing health issues. Doing so ensures you’re not caught off guard.

So now, after knowing all that, it’s time to figure out how to use that knowledge. Start by listing your specific needs: trip length, expected medical expenses, and, eventually, any pre-existing conditions. Compare different health insurance visitor plans actively. And in case you may have any doubts or need personalized advice, do not hesitate to get in touch with insurance experts to help clear any doubt. And remember, the right visitors’ insurance plan does more than meet a legal need; it provides you a cushion so you can enjoy your Canadian adventure fully without worrying.

Understanding and acting on these vital factors shall fully arm you in making an informed choice on a Visitor Health Insurance plan that does not only meet your needs but exceeds them. Get ready to explore Canada with complete confidence and assurance of full protection.

Making an Informed Decision

Comparing quotes for visitors’ insurance is fairly easy, as some websites are dedicated to that, and the same insurance policy can be found from different insurers. Look for transparent pricing and clear information on what is being covered and what is not.

Consulting with Experts

If you are still confused about the kind of insurance you will need, you might be best advised to talk to a duly licensed insurance broker. They give advice tailored to individual travel needs and health requirements.

The Final Verdict

As we’ve explored throughout this blog, the differences between visitors insurance and Travel Insurance are significant, each serving unique but equally important roles in your travel experience. By choosing the right visitors insurance, you safeguard not only your health but also your financial wellbeing during your stay in Canada. Do not let cheaper prices or common beliefs put your life at stake.

Contact a team member at Canadian LIC to help you procure your visitor visa and visitor visa insurance. With the right coverage, you get another peace giver alongside Canada’s beautiful landscapes and vibrant cultures. Remember, the right insurance isn’t just a requirement; it’s an essential part of your travel preparation.

Ensure your travels to Canada are secured with the best insurance choice made now. Protect yourself, your family, and your finances from surprises by getting the best insurance for yourself long before setting foot in the country. Be one of the smart travellers who are both adventurous and safe. Get your Visitor Insurance Quote today and embark on your Canadian journey with confidence!

Find Out: Can I get insurance as a Visitor in Canada?

Find Out: The differences between Visitor Visa and Super Visa

Find Out: What does Travel Insurance not cover?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Visitor Health Insurance

Chalk out the limit of coverage. Choose a high enough limit, with due regard to the major medical expenses in Canada, where healthcare expenses may be on the higher side. Imagine being in the shoes of Carlos, who had chosen a low limit just because he was inclined to save money. But after a biking accident in Vancouver, Carlos had to deal with hospital bills far in excess of his coverage limit, thus personally paying thousands of dollars. To avoid Carlos’s situation, evaluate potential medical costs for your activities and health conditions. A good rule of thumb is to select a limit that makes you feel secure, considering the worst-case scenario.

Some policies will allow purchase after arrival, but it’s wiser if you have your insurance sorted out before you travel. Look at the experience of Lisa, who travelled to Canada and thought she could buy visitors insurance upon landing. But, indeed, at the eleventh hour, it had become really stressful work to find a suitable plan, and obviously, options were quite limited. Secure your insurance before departure and let it start to work from day one of your trip, securing against any immediacy from health issues or emergencies.

If you have a pre-existing condition, look for plans that cover the acute onset of a pre-existing condition. Alex, a traveller who has diabetes, was able to choose a plan that actually included emergencies, considering his condition. That anticipation paid off when he had to get urgent care after his symptoms suddenly flared while kayaking in Quebec. Always disclose your health conditions when seeking a quote to ensure you find a plan that adequately covers you, and double-check the terms regarding pre-existing conditions.

While a few Visitor Insurance plans offer extra benefits like dental emergencies or repatriation, most of the time, they are not used and only mainly cater to medical emergencies. For instance, Janet had a dental-coverage policy, so when she had an emergency extraction to be done in Ottawa, the policy covered that. These add-ons could really save your life, so try to consider what types of extra protections might be needed during your trip.

Travel Insurance, unlike Visitor Insurance, covers a complete range of coverage that includes trip cancellations, lost luggage, travel delays, etc. Mark and Emily’s Travel Insurance came to their rescue when their Calgary flight was cancelled at the last moment. Similarly, when Mark had a skiing injury and needed medical attention, all the expenses at the time of hospitalization were borne by the visitor’s health insurance. Understanding these differences helps you choose the right insurance for your needs.

Most visitors insurance offer the possibility of an extension, which is important in case your travel period is prolonged. Michael learned it hard: he had to extend his stay for some legal reason but had no insurance for an extra month. To avoid such issues, check if your chosen plan allows extensions and under what conditions you can renew your policy.

It’s good if you never have to use your visitors insurance because if you have to, this means you didn’t have a safe or healthy trip! Look at it as kind of a safety net. For example, Neha travelled from India to Toronto and, by God’s grace, did not have to visit any hospital where she would use her insurance. According to Neha, she considered her unused insurance a small price for her mental peace during travelling. Remember, insurance is there to protect against risks, not as a pre-payment for services you wish to use.

Most modern visitors insurance plans also cover the health issues of a COVID-19-infected person up to an equal amount of coverage offered for any other medical condition. For example, in the case of Simon, who contracted Covid-19 during a business trip to Montreal, he had to be hospitalized. At least he could relieve some of the financial pressures for the treatment; his visitors’ insurance therefore paid his hospitalization expenses. Always check if your prospective insurance plan covers pandemics to ensure you’re covered for COVID-19.

It is personalized coverage; thus, each visitor will need to have his or her own insurance plan. It had become really useful since every one of them had taken out their individual plan based on their health needs when the Lee family from South Korea visited Canada, and their youngest daughter needed pediatric care unexpectedly. Purchasing separate plans ensures that each person’s specific medical needs and risks are adequately covered.

Filing a claim may look cumbersome, but it’s pretty easy with a well-outlined plan. Take the case of Roberto: he had an accident while skiing and had to go to a Calgary emergency unit. He contacted the helpline from his insurance provider and followed the instructions on how he would go around doing a claim, such as the submission of hospital bills and a medical report. Generally, you are to inform your insurer as soon as possible by retaining all the receipts and reports from doctors. Generally, you should inform your insurer as soon as possible, keep all receipts and medical reports, and submit a detailed claim form to ensure timely processing.

Coverage for adventure sports is not standard and varies widely among insurance plans. Jenna’s experience is the kind of cautionary tale; she assumed her visitor’s insurance would pay her medical bills after her rock climbing accident, but in fact, her plan specifically didn’t cover high-risk activities. Look specifically for plans that include adventure sports if you look forward to engaging in such sports, or otherwise purchase an additional cover for it.

So, it should be an insurance company that will be researched and proven in its credibility. Look for reviews, check their licensing status in Canada, and consult online forums or local contacts. Thomas, who travels on business frequently, has this piece of advice for you: “The insurance company should be contacted directly to clarify any doubts. One also notices the time and clarity with which they respond, which indicates good customer service.

Our hope is that, by answering these FAQs with clear, practical advice and relatable stories, you will be armed with the knowledge of how best to choose and apply for your visitor medical insurance. Your journey through Canada should be memorable for all the right reasons—ensure your insurance supports that goal!

Sources and Further Reading

For those looking to deepen their understanding of visitor and Travel Insurance in Canada, the following sources and further reading suggestions provide comprehensive information and insights into selecting the best insurance plan for your needs:

Government of Canada – Travel Insurance

The official Canadian government website offers essential advice on Travel Insurance, including what to look for in a policy and how to understand the various types of coverage available.

Canadian Life and Health Insurance Association (CLHIA) – Guide to Travel Health Insurance

This guide by CLHIA is an invaluable resource for understanding the specifics of travel health insurance, including tips on what to consider before purchasing and how to make a claim.

CLHIA Guide to Travel Insurance

Insurance Bureau of Canada

The Insurance Bureau of Canada provides insights into the insurance market, including detailed explanations of personal insurance policies like visitor and Travel Insurance.

Canadian Immigration Blog

This blog covers a wide range of topics relevant to visitors to Canada, including detailed articles on why Visitor Insurance is necessary and how to choose the right policy.

Canadian Immigration Blog – Insurance Tips

Travel Insurance Review

An independent resource that offers reviews and comparisons of different Travel Insurance plans available to Canadians and visitors to Canada.

Travel Insurance Review – Canada

Canadian Consumer Handbook – Travel Insurance Tips

Provided by the Canadian government, this handbook offers practical advice on Travel Insurance, helping consumers make informed decisions.

Consumer Handbook – Travel Insurance

These sources will equip you with the necessary tools to navigate the complexities of insurance for your travels in Canada, ensuring you are well-protected throughout your journey. Whether you are researching for a future trip or looking to understand the intricacies of insurance products, these resources provide a robust foundation for making informed insurance decisions.

Key Takeaways

- Visitor Insurance primarily covers medical expenses, while Travel Insurance includes broader aspects like trip cancellations and baggage loss.

- Choose a coverage limit that securely covers potential healthcare costs in Canada, considering the worst-case scenarios.

- For those with pre-existing conditions, ensure the plan includes coverage for acute onsets to avoid high out-of-pocket expenses.

- Purchase Visitor Insurance before traveling to Canada to avoid limitations and ensure coverage for early trip emergencies.

- Visitor Insurance can often be extended to match your stay length, unlike Travel Insurance which is fixed to your trip dates.

- Always thoroughly read your insurance policy's terms and conditions to understand coverage scopes, limitations, and exclusions.

- Consult with insurance experts for personalized advice to choose the best plan based on your travel plans and health needs.

- Compare different Visitor Insurance plans and engage with credible, licensed providers for reliable coverage.

Your Feedback Is Very Important To Us

To better understand the common struggles and confusions people face when choosing between Visitor Insurance and Travel Insurance, the following feedback questionnaire can be distributed:

This questionnaire aims to gather insights on the personal experiences and challenges that individuals face when deciding on the appropriate type of insurance for their travels. The feedback received can help insurers improve their communication, tailor their products, and better meet the needs of their customers.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com