Suppose you signed up for a Whole Life Insurance Policy when you were younger, but when you reach a milestone birthday, you realize that your life has changed drastically since then. Perhaps you now have a new child, purchased a house, or are planning for a future that is taking shape different from what you had imagined earlier. It may seem that adjusting your Whole Life Insurance Policy is a maze of confusing terms or unclear options. That’s a common reaction from clients who come to the Canadian LIC in a state of confusion and stress, not knowing if they can better change their policies to fit their new lives.

Today, we will explore the steps involved in updating your Whole Life Insurance Policy to continue matching your changing needs. We will talk about flexible plans and modification options for coverage, as well as riders who take advantage of insurance protection. Let’s start by taking the mystery out of the process, making it not just understandable but manageable!

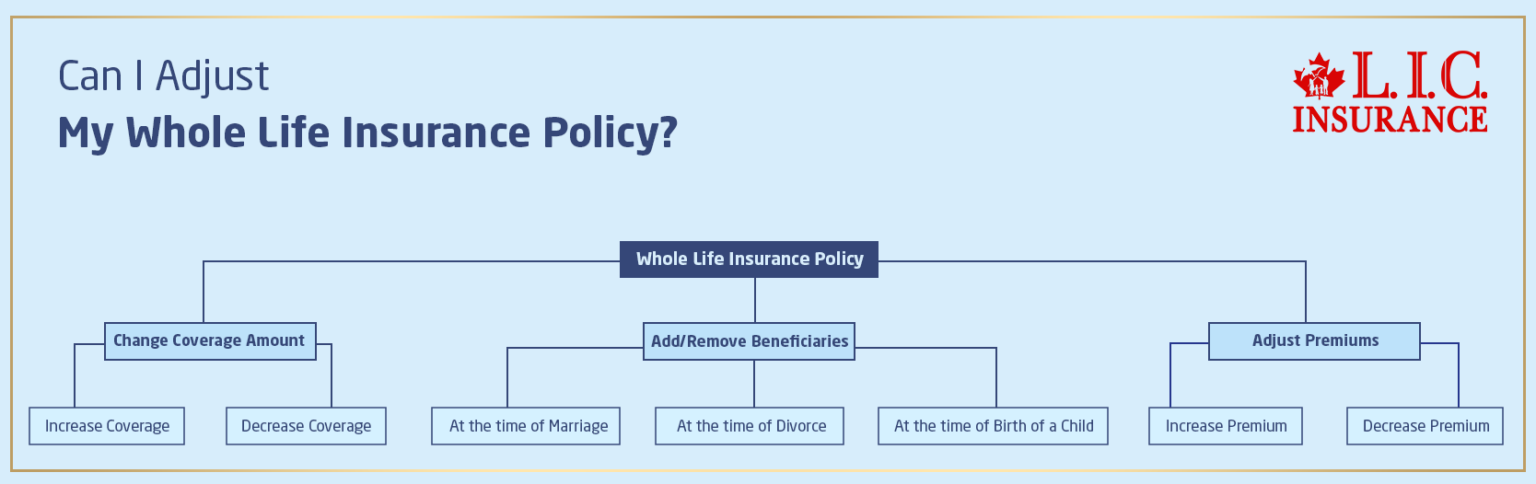

Can I Adjust My Whole Life Insurance Policy?

Changing Your Coverage Amount

One of the most common changes our clients at Canadian LIC request is adjusting the death benefit amount. Life doesn’t stand still—new financial responsibilities or decreasing liabilities means your insurance needs will change. You may need to increase your cover due to life events such as bringing a new member into your family or taking on a large debt like a mortgage. On the other hand, you may need less coverage if your financial obligations decrease—for example, after your children become financially independent or you pay off significant debts. Take Maria’s story, for example. As a new client at Canadian LIC, Maria initially purchased her Whole Life Insurance Policy when she was single. Life went on, with her eventually getting married and having two children. It wasn’t long before the realization dawned that the original coverage would not be adequate in the event of her demise. Knowing this, Maria met with one of our company’s dedicated advisors to reassess her Whole Life Insurance needs. Together, they increased her policy to a very high level of coverage, ensuring her growing family would be well taken care of financially.Adding or Removing Beneficiaries

Significant life changes, such as marriage, divorce, or the birth of a child, all mean that your policy’s beneficiaries may need to be reviewed. There is a simple process to update who your policy will benefit so these loved ones continue to be provided for by your policy. For example, consider Robert, who was also a customer of Canadian LIC. Following his divorce, he wanted to change the beneficiaries of his policy to reflect these new circumstances in his life. Now he can do that with our proper guidance and rest assured that his benefits will flow according to his wish as updated by him.Premium Adjustments

Your financial landscape may change, so adjustments to the premium you’re paying for your policy need to be made. Various Whole Life Insurance Policies allow adjustment in premium payments, a flexibility that can help reshape cash flow or accelerate the timeline to complete your payments. Take the example of Saba, who had been with Canadian LIC for quite some time. After her promotion from work, she began far better off financially compared to when she bought her Whole Life Insurance Policy. Currently, she could easily afford to increase her premium payments and pay off the policy earlier. This step not only helped her release income for later years but also accelerated her other investment plans ahead of schedule.Getting Whole Life Insurance Quotes

If you’re thinking of making any sort of change to your policy, it might be beneficial to get new Whole Life Insurance Quotes. This new quote gives a foundation for where the current rate resides and can help determine if the adjustment of an existing policy or an additional policy might better suit your needs. At Canadian LIC, we do this as openly and transparently as possible and will arm you with all the information you’ll need to decide on the best course of action for your situation. Over the years, consulting with Whole Life Insurance Advisors—like Canadian LIC—would ensure that every change in your policy is very well thought out and based on your current state of life. Your life insurance policy is there to move with you in life’s journey. Whether it is revising your coverage, naming alternate beneficiaries, or just changing the terms with which you pay, Canadian LIC does all this and more for you. Together, we will ensure that your policy keeps pace with your ever-changing needs—to give you security and peace of mind for the future.hCan I Add Riders to My Whole Life Insurance Policy?

Riders are additional benefits that may be attached to a primary Whole Life Insurance Policy, resulting in other ways of protection or features in line with your discriminative needs. At Canadian LIC, highly trained and professional Whole Life Insurance Advisors often help our clients tailor their policies to include riders that provide the flexibility and security you need. Let us take a closer look at some of the more popular riders you may be interested in including.

Critical Illness Rider

Of these, the most in-demand is the Critical Illness Rider. It provides for a lump sum in case one is diagnosed with any of the specified critical illnesses as outlined in the policy. Let’s put this in a real-life perspective: Consider the peace of mind this would bring to someone such as Sana; all her life has been healthy, but suddenly, being smacked with a serious illness. When she was diagnosed with multiple sclerosis, her Critical Illness Rider kicked in to provide the financial backing necessary to handle health care without fiscal worry. This support allowed her to focus on recovery and make lifestyle adjustments for the new challenges in her life; thus, much of the stress over how she would afford her care was alleviated. This becomes an important component that will help to boost your Whole Life Insurance Policy with financial relief during times that become the most critical in your life.

Waiver of Premium Rider

Another useful add-on available for this purpose is the Waiver of Premium Rider. Let us consider another case which happens more often than we like to think. Michael, another customer with Canadian LIC, met an accident and got temporarily disabled, rendering him unfit to work. Michael’s Waiver of Premium Rider enabled his insurance premiums to be taken care of automatically. This meant that even when he was out of work for a while recuperating, his entire life insurance policy remained in effect to protect his family and his future. More than financial benefits, this rider provides a buffer in the face of such unforeseen life interruptions so that the continuation of coverage for your security and that of your family goes unabated.

Term Conversion Rider

The Term Conversion Rider makes it possible to easily convert from Term Life Insurance policy to Whole Life Insurance without the right of rejection or further medical examinations. Take, for example, Emma, who initially got a Term Life Policy since it was less expensive. Years rolled by, and her health deteriorated; she feared that she was not going to get another policy. The Term Conversion Rider gave her the right to exchange the current term policy for a whole life policy. With this option, she will be insured irrespective of health problems. This rider is very useful for the person who expects his health or financial position to go down and wants permanent coverage.

It’s very important to consult expert Whole Life Insurance Advisors so that you get personalized Whole Life Insurance Quotes and advice based on your personal situation. At Canadian LIC, we know from our wide array of experience that the right advice and the right riders can make even generic insurance policies into lifesavers that much more closely reflect and respond to your circumstances. Our team is dedicated to finding the best solution that will fit your life now and into the future.

Riders can be added to a Whole Life Insurance Policy to significantly enhance coverage and provide critical protection based on the various twists and turns in one’s life. Riders can be obtained to ensure that, in times of critical illness, loved ones are financially protected, also to continue maintaining a policy during disability, and even to have lifelong coverage without worrying about medical exams. Customization of this nature is what many Canadians really need. Speak with one of our advisors at Canadian LIC today to discuss these options and learn how you can build on this foundation to create peace of mind for you and your future. In this regard, adjusting Whole Life Insurance is not adding benefits but rather shifting with changes in life confidently.

Summary

You can change your Whole Life Insurance Policy depending on where you are in life right now. We at Canadian LIC understand all the intricacies that go into making such decisions and are dedicated to giving our clients befitting advice and solutions. Be it adjusting coverage, adding riders, or getting new whole-life insurance quotes—whatever the case may be—we go on to keep helping you.

Your Whole Life Insurance Policy is not entirely a contract but part of a foundation in your financial plan. It’s supposed to guard you and your loved ones for as long as you live. If your policy doesn’t reflect your current situation in life, then action needs to be taken. Canadian LIC is the best insurance brokerage in Canada. Get in touch with us to talk about options so that you can make sure that your coverage meets current and future needs. Let us help you make the right adjustments, providing peace of mind for years to come.

Find Out: How Is The Cash Value Of A Whole-Life Policy Taxed?

Find Out: How Can You Find The Best Whole Life Insurance Without A Medical Exam?

Find Out: What Age Does Whole Life Insurance End?

Find Out: What Are The 2 Disadvantages Of Whole Life Insurance?

Find Out: At What Age Is Whole Life Insurance Good?

Find Out: Can I Buy Whole Life Insurance For My Child?

Find Out: Who Should Opt For Whole Life Insurance?

Find Out: Is Whole Life Insurance Expensive?

Find Out: What Is The Biggest Risk For Whole Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions(FAQs)

It is designed to insure an individual’s whole life, making it possible to provide coverage for the whole of one’s life as long as premiums are being paid. A part of the premium goes toward providing life insurance coverage, while the remaining goes into a buildup for cash value. At Canadian LIC, we often meet clients like Tom, who initially didn’t realize the potential of the cash value that can be borrowed in times of need, providing flexibility during financial strains.

Getting Whole Life Insurance Quotes is pretty easy. Once you get in touch with a whole life advisor at Canadian LIC, we will be more than happy to guide you through the process. We would need to know a little about your health and lifestyle, and a little about your financial goals to help provide appropriate quotes. For example, when Lisa contacted us, she was looking for affordable options that fit her budget while still providing ample coverage for her family. We offered several personalized quotes for her to consider.

A Whole Life Insurance advisor is trained personnel who can help you understand and pick up the best insurance option that will suit you. Our advisors at Canadian LI\C work along with clients to help them through a plethora of policies and riders to find their best fit. Recently, one of our advisors worked with a young couple who are expecting their first child to modify their insurance plan, adding some more riders to protect the future of their growing family.

Of course, adjustments can be made to your Whole Life Insurance Policy even after it has been issued. Be it a death benefit increase, adding of a rider, or updating of your beneficiary, our advisors at Canadian LIC shall assist and walk you through. For instance, Clara added a critical illness rider with her policy when her mom fell ill due to serious illness issues so she would be financially prepared in case she ever had to go through something similar herself.

Some of the riders that are normally attached to a life insurance policy include Critical Illness Rider, Waiver of Premium Rider, and Term Conversion Rider. Each comes with its unique advantages, which may be an assurance of financial help based on the diagnosis of the illness, avoiding cancellation of your policy in a time of disability, or even converting term insurance to whole life without undergoing further medical tests. We helped a client, Robert, who was initially very skeptical about riders and their benefits, understand how the waiver of premium rider would help safeguard the financial security of his family in the event something happened to him, leading him to add it to his policy.

You should discuss this with a Whole Life Insurance advisor to make sure that you are aware of all your options and to make informed decisions. Our Advisors will bring insight from years of experience and dedication to understanding your personal needs. One of our advisors recently guided a client through the process of adding a Term Conversion Rider, which was crucial as the client had developed a health condition that would have made it difficult to obtain insurance later.

Regular reviews with your Whole Life Insurance advisor can ensure that your policy continues to meet your changing needs. Life can be full of changes, whether you get married, have a child, or change your financial status—which may cause the need to update your policy. After getting married and becoming a father of twins, for example, we reviewed Daniel’s policy at Canadian LIC and adjusted the protection to his expanded family.

It can be tailored to your pocket. Our professionals for Whole Life Insurance at Canadian LIC are dedicated and always ready to prepare Whole Life Insurance Quotes that fit your pocket and, at the same time, ensure adequate coverage. For example, when Kevin felt that his financial obligations were too stretched, We sat with him and adjusted his premium amount and coverage to continue his current financial position without stepping back on coverage.

If your health changes after purchasing a Whole Life Insurance Policy, you should contact your insurance advisor. While your policy premium and coverage usually will be based on your health at the time an application is made, some kind of changes may mean a difference in your future options or coverage needs. Mark had bought his policy at Canadian LIC, but further down the line, he was diagnosed with a chronic condition. He kept us informed and could discuss with us changes to the policy and other additional riders that might be available to provide more complete protection.

Whole-life insurance advisors can guide clients through the claims process much more easily and with less stress. Canadian LIC’s professional advisors will take every client through each step of the claim process, offering advice on the documents to be produced and ensuring their timely submission before the deadline elapses. One of our best advisors recently assisted a deceased client’s family in successfully processing a claim in record time, which served to help them by providing much-needed financial support for the family.

If you find yourself in times when you can no longer afford your Whole Life Insurance premiums, contact your advisor immediately. There are other options, such as changing the policy terms, tapping the cash value to help cover premiums temporarily, or even reducing the amount of coverage to bring premium costs down. One of Canadian LIC’s advisors helped a client who lost his job, using the cash value of the policy to keep his coverage current until he could get back on his feet again.

Whole Life Insurance Quotes differ from other types of insurance quotes primarily because they include a savings component and offer coverage that lasts for your entire life. While comparing quotes, it’s not only the premiums one has to consider but the growth in cash value and permanence of policy that matter. Our team at Canadian LIC ensures that each client understands how these factors affect their overall financial planning and insurance needs.

Canadian LIC has tried to help you understand your Whole Life Insurance Policy better by addressing these frequently asked questions. This information will arm you with the ability to make prudent decisions and safeguard your future financially. Be it any query or even adjustments, our advisors are always there to help you so that your insurance protection grows as your life’s journey unfolds.

Sources and Further Reading

To enhance your understanding of Whole Life Insurance Policies and how they can be adjusted to better suit your needs, consider exploring these sources and further reading materials:

“Life Insurance 101: A Step-by-Step Guide for Canadians” by Sarah Smith – This book offers a comprehensive overview of life insurance in Canada, including detailed chapters on Whole Life Insurance, its benefits, and customization options.

“The Canadian Guide to Protecting Yourself with Life Insurance” by Michael James – Michael James provides insights into different types of life insurance available in Canada and practical advice on choosing and adjusting policies based on changing life circumstances.

Insurance Bureau of Canada (IBC) – The IBC website contains a wealth of information about life insurance products, including whole life policies. Their resources are invaluable for understanding industry standards and regulatory considerations in Canada. Visit IBC Website

Financial Consumer Agency of Canada (FCAC) – The FCAC provides objective advice about financial products, including life insurance. Their guides and tools can help you understand your rights and responsibilities under Canadian insurance policies. Visit FCAC Website

Investopedia: Whole Life Insurance – Investopedia has several articles that break down the nuances of Whole Life Insurance, including how to choose additional riders and what to consider when adjusting a policy. These articles are great for getting a clear and concise understanding of complex insurance concepts. Read Investopedia Articles

“Modern Strategies in Whole Life Insurance” by John Doe – This text explores advanced strategies for leveraging Whole Life Insurance in financial planning, including adjusting policies and using cash value effectively.

These sources will provide you with a solid foundation of knowledge to help you make informed decisions about your Whole Life Insurance Policy and ensure that it aligns with your long-term financial goals.

Key Takeaways

- Whole Life Insurance Policies are flexible, allowing adjustments in coverage, beneficiaries, and premiums.

- Policyholders can enhance coverage by adding riders like Critical Illness and Waiver of Premium.

- Regularly review your Whole Life Insurance Policy, especially after major life changes.

- Consulting with insurance advisors helps navigate policy adjustments and align strategies with financial goals.

- Obtain personalized Whole Life Insurance Quotes to compare and choose suitable coverage options.

Your Feedback Is Very Important To Us

We aim to understand the challenges and struggles you face while adjusting your Whole Life Insurance Policy in Canada. Your feedback will help us improve our services and provide better support. Please take a few moments to answer the following questions:

Thank you for taking the time to provide your valuable feedback. Your insights are crucial in helping us enhance our services and support our clients more effectively.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]