Welcome to Canada, a beautiful country, compassionate people! You should be sure you are safe and healthy, whether you are here for business, fun, or family. You think you know everything about Visitor Insurance? But don’t fear — we’ll be there for you for the important stuff. Well, stop your…packing and join us as we take a look at the Canada Visitor Insurance plans. Let’s ensure your trip to Canada is not just a fun one but a stress-free one by covering the fundamentals and explaining the best plan to get. Let’s get started.

The CAN NOTs about Visitor to Canada insurance buying after arrival in Canada: Many inquirers frequently ask, “Can I buy visitor insurance after arriving in Canada?” The short answer is — yes, but not without a number of caveats. When buying after you have already landed, the timing, the kind of coverage, and even the provider policy all count. We’ll guide you through everything so you don’t overlook any crucial steps.

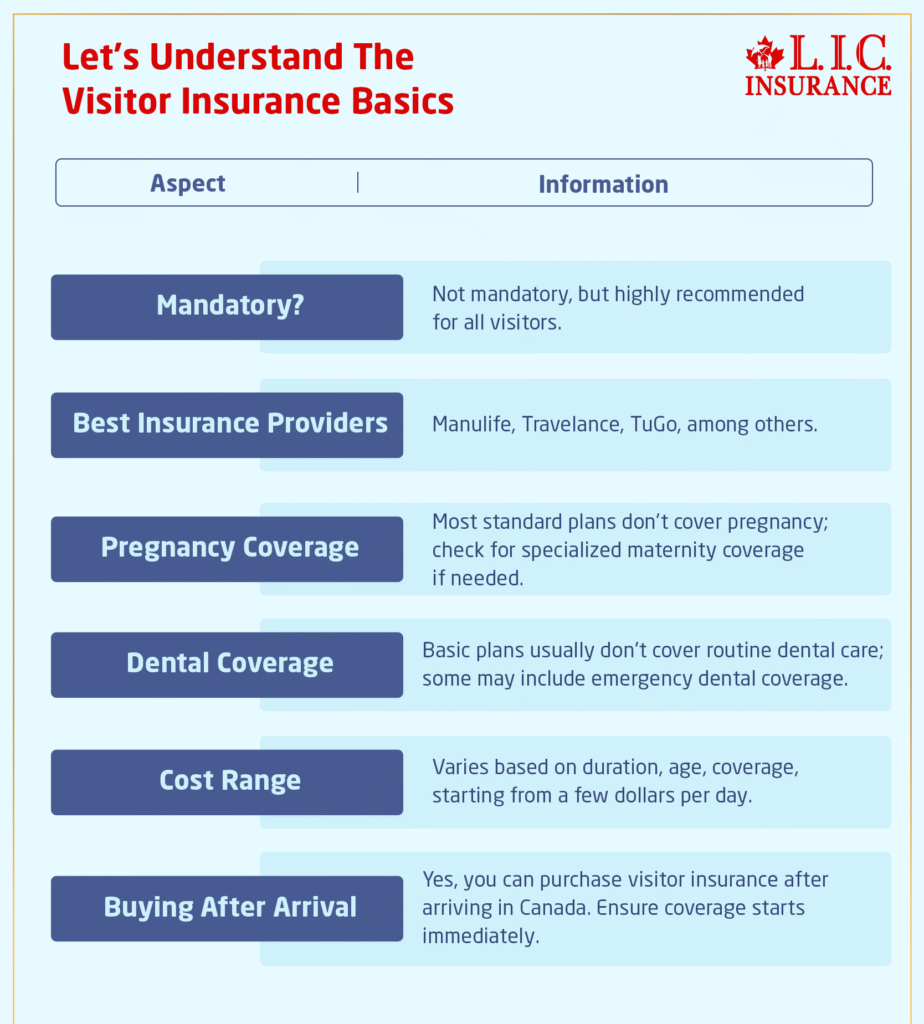

Let’s Understand The Visitor Insurance Basics

Having Visitor Insurance is like having a saviour protecting your health when you’re in a new place. It takes care of your medical bills if you get hurt or sick during your stay. Now for the important question: Can you get this saviour to protect your health once you land in Canada?

Visitor Insurance After Arrival – The Details

| Step | Details |

|---|---|

| 1. Research Providers | Explore insurance providers in Canada, such as Manulife, Travelance, and TuGo. |

| 2. Compare Quotes | Obtain quotes from different providers, comparing coverage, limits, and costs. |

| 3. Policy Duration | Ensure the policy starts immediately to provide coverage from the purchase date. |

| 4. Application Process | Complete the application process online or through the chosen provider’s channels. |

| 5. Documentation | Prepare necessary documents, including personal information and travel details. |

| 6. Premium Payment | Pay the premium for the selected coverage; payment methods may vary by provider. |

| 7. Policy Confirmation | Receive confirmation of your visitor insurance policy, including policy details. |

| 8. Contact Information | Save provider contact information for inquiries or assistance during your stay. |

You can finally take a sigh of relief; you can buy Visitor Insurance once you get to the beautiful country of Canada. In this case, you won’t miss the bus; you can still get on after it leaves the stop.

Real-Time Coverage Insights: What Many Don’t Know About Visitor Insurance Activation After Arrival

One of the unoffensive and unoffensive parts when purchasing visitor insurance after landing in Canada is the real-time gap in the activation coverage. Whereas the majority of insurance sites just tell you that “yes, you can purchase visitor insurance after you are already in the USA,” they get stuck around the explanation of what that looks like. We’ve also communicated directly with underwriters and support teams of top insurance companies and made a crucial discovery: Most plans require a waiting period for illness coverage, but offer immediate coverage for injuries, as long as you haven’t exhibited symptoms or sought care before you purchase their policy.

This nuance is not well communicated elsewhere on competitor sites, and so a lot of visitors here are falsely secure that they’re immediately covered for all things. And to make things trickier, every insurer defines the “start date” a little differently. Some start their clocks ticking at the time you get payment confirmation; others call for midnight of the following calendar day, and still others prohibit coverage until a phone verification or doc check is finalized.

So, can you buy visitor insurance after arrival? Yes. But guests need to actively inquire about how soon illness and injury coverage kicks in, how pre-existing symptoms are evaluated and what documents expedite activation. This clarity is so you know you really are protected — and not just holding a piece of paper that says you are.

Getting a Visitor Insurance Quote

So, get ready to explore the world of Visitor Insurance – it’s as simple as ensuring your health is covered during your stay in Canada. Let’s discuss how you can get a Visitor Insurance quote with the help of the following steps!

Step 1: Connect with the Insurance Professionals

Just as you’d reach out to your favourite service, getting a Visitor Insurance quote involves connecting with insurance professionals. You can do this online through their websites or by giving them a friendly phone call.

Step 2: Simple Questions, Easy Answers

Once connected, they’ll ask you a few really simple questions to customize the quote as per your needs, like:

- Your Age: This helps customize the quote to suit your age group and individual requirements.

- Duration of Your Stay: Specify how long you plan to enjoy Canadian hospitality, ensuring your coverage is suitable as per the length of your visit.

- Coverage You’re Looking For: Clearly define the type of coverage you desire – whether it’s just the basic or more comprehensive – to match your specific needs.

Why It’s That Simple:

- No Jargon, Simple and Straightforward Language: The process is devoid of complicated insurance terms, making it easy for you to understand.

- Tailored to Your Needs: The questions aim to customize your Visitor Insurance quote to match your specific needs and requirements.

Friendly Service: Insurance professionals are there to help, ensuring you have a friendly and accessible experience.

Understanding Your Quote:

Once you’ve answered their questions, they’ll present you with your Visitor Insurance quote. This provides a clear overview of the coverage included and the associated costs related to your Visitors to Canada Insurance.

Coverage You Can Count On

Now, let’s talk about the good things – what does the Visitors to Canada Insurance coverage include? Just like you choose the toppings on your pizza, similarly, you can choose what you want. Coverage typically takes care of unexpected medical expenses, hospital stays, and even emergency dental work. Just make sure you check the policy details to know precisely what you’re getting.

Why You Should Consider It

Alright, now let’s talk about some real-life scenarios. You’re strolling through the streets of Canada, and suddenly, you feel a bit off. It could be something minor, like a sneeze or a sudden headache. Of course, if you don’t have Visitor Insurance, your trip could go in the wrong direction.

The Unexpected Obstacles of Health Without Visitor’s Insurance

Put yourself in the situation where you were exploring the beauty of a new destination, and that good old health flares up. It may be a small injury or sudden sickness, however, if you don’t have Visitor Insurance, your money may not do much good.

Medical expenses, even for minor things, can add up. It could be visiting the doctor, an impromptu trip to the pharmacy, or in a worst-case scenario, an overnight in the hospital — and these are costs that could eat into your budget. Not that you’d want to turn your exploration adventure into a financial stress session, let’s be real.

Focus on the Fun, Not the Finances

Now, let’s turn the situation around. Now, imagine the same scenario, but you have Visitor Insurance. Meanwhile, that little health concern suddenly doesn’t seem so awful. If you are covered, you can be free to enjoy your time in Canada without wondering what the medical care will cost.

When you have visitor insurance, you don’t have to dread surprise medical bills. It protects you, allowing you to discover Canada’s distinctive activities, cuisine, and landscapes without having to be concerned that an unforeseen financial mishap will spoil your journey.

How Visitor Insurance Works for You

A Visitor’s Insurance Policy is as if you have all the power by your side. When you have coverage, you don’t have to go it alone with sudden health challenges. Whether it is an unexpected cold, a sprained ankle, or anything in between, your Visitor Insurance has got you covered and is here to help with the costs.

The trick is that when you are covered, you generally pay a relatively small charge to the insurance company, called a premium. This is called the premium. In return, they help cover some of your medical bills, according to your chosen plan. It’s a win-win for both you and your wallet, since now you can roam worry-free.

Tips for Getting Visitor Insurance After Arrival

You are now in the hot, happy land of Canada! What is Visitor Insurance? Now, let us tell you about Visitor Insurance, an essential companion when you set out for a beautiful journey. Here are a few useful tips to guide you through the process and ensure a stress-free visit.

- Don’t Procrastinate: Suppose you are waiting for a bus that will take you to see the waterfall in all its glory. We know you’d kick yourself for not being there. Visitor Insurance is in the same boat. Yes, you can grab it upon arrival, but don't wait until the very last minute. It’s like purchasing a bus ticket before the bus is full, so do it early and often. Don’t get caught off guard by unexpected situations; protect yourself early.

- Understand Your Needs: Now on to what is going to cover your visit. Read about what you can do during your visit. You should ensure that if you wish to discover and taste adventurous activities, then your Visitor's Insurance covers you for the same. Opt for a policy that meets your specific needs.

- Compare Quotes: Obtain quotes from at least a few decent and best insurance companies in Canada before making a purchase of Visitor Insurance. You might consider it like checking out different options to see which one is the best for your needs and budget, but also works well. Every quote you receive contains a complete description of the extent of coverage, the deductible, and what restrictions apply. Compare. The insurance quotes will vary greatly between providers, and researching a range of insurance plans will make it easier to pick the right one for you.

- Seek Complete Protection: Your Visitors Insurance should cover a wide range of things. Seek one with comprehensive coverage including hospital stays, unexpected medical bills, and, all the better, dental work. This is a safety measure, a way to ensure that should something unforeseen occur with your health while you are in Canada, you’re covered.

- Pre-existing Medical Condition Check: The way you inform a chef about your food allergies before you order a meal, you must also inform the insurance company when you quote for a Visitor Insurance about any Pre-existing Medical Conditions you have. That way, there are no surprises later, and you’ll know how your pre-existing conditions will affect your coverage going forward.

- Take into account every possible detail: Be knowledgeable and aware of the insurance policy information of your visitors to Canada. Understand what is and is not covered. By that, you will be able to easily get what you expect and won’t have to go through any issues while spending a good time.

- Ask for Recommendations: Just as you might ask the locals where to eat, sleep, or play, ask fellow travellers or friends who have been to Canada for advice. They could inform you about their personal experience with several insurance companies, and that could be very useful for you to make the right choice.

To Sum Everything Up

To put it simply, you can buy Visitor Insurance Coverage once you get to Canada. Similar to buying a theme park ticket after the park opens, you’ll still have a great time! Right?

So, don’t forget to consider Visitor to Canada Travel Insurance. Get your quote, understand your coverage, and enjoy your time in Canada without worrying about unexpected challenges in your health journey. Cheers to a safe and enjoyable visit!

Know more on: Can you get Travel Insurance as a visitor to Canada? Here

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ’s on Visitors to Canada Insurance

Visitors to Canada do not need insurance, but it is strongly recommended for all visitors. The Canadian health care system does not cover visitors, and medical costs can be very expensive. Be assured with Visitors to Canada Insurance in the event of an unexpected health problem while you are away.

Absolutely! Yes, you can purchase Visitor Insurance after arriving in Canada. It ensures that you’re covered for a great experience during your stay, even if you didn’t arrange it before your arrival.

Getting a visitor to Canada Insurance quote is very simple. Reach out to insurance providers either online or by giving them a call. They’ll ask about your age, the duration of your stay, and the coverage you’re looking for.

Visitors’ insurance coverage typically includes unexpected medical expenses, hospital stays, and emergency dental work. It’s your safety net for health-related surprises during your stay in Canada.

Visitors to Canada Insurance is not mandatory in Canada, but it is strongly recommended for all visitors. Visitors are not covered by the Canadian health care system, and medical costs can be very expensive. Be ensured with Visitors to Canada Insurance in the event of an unexpected health problem while you are away.

Basic Visitor Insurance plans typically do not provide routine dental care coverage. However, some plans may provide limited coverage for dental emergencies, such as sudden pain or injury. If complete dental coverage is important to you, purchase Visitor Insurance that specifically includes dental benefits.

Consider Visitor Insurance to avoid unexpected financial stress. With it, your budget will not be overburdened; instead, it will be easily manageable. With coverage, you can focus on enjoying your time without stressing about potential medical costs.

Absolutely! Visitors to Canada Insurance can be a lifesaver for minor health issues. From a common cold to a twisted ankle, it ensures you don’t get stressed out by unexpected medical expenses, making it possible for you to focus on the fun, not the finances.

While you can purchase Visitor Insurance after arriving, it’s advisable not to delay. The earlier, the better. Ensuring coverage early on ensures a stress-free exploration.

Choosing the right Visitor Insurance plan involves understanding your needs and preferences. Consider factors like your age, the duration of your stay, and the coverage options. Exploring different insurance quotes helps you find the plan that suits your taste – or, in this case, your budget and requirements.

Visitor Insurance is beneficial for visits of any duration. Even for short visits, it provides a safety net against unexpected medical expenses, allowing you to explore Canada worry-free.

Absolutely! You can compare Visitor Insurance options. Different providers offer different plans, so exploring and comparing quotes helps you find the one that is convenient for you, your preferences, and your budget.

The cost of visitor health insurance varies based on factors such as the duration of the visit, the age of the visitor, the coverage amount, and any additional features. On average, Visitors to Canada Insurance can range from a few dollars per day to higher amounts for more comprehensive coverage. It’s advised to obtain quotes from different insurance providers and compare plans to find out the one that is the best for your budget and needs.

The best Visitor Insurance depends on your unique needs and preferences. It’s essential to compare different plans, considering coverage, limits, exclusions, and cost. Popular insurance providers in Canada include Manulife, Travelance, and TuGo, but it’s advisable to research and choose a plan that is the best as per your individual requirements.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]