The decision to opt for the right policy becomes very important when it comes to securing your family’s financial future. Many Canadians prefer the Term Life Insurance Policy because of its simplicity and the lesser costs involved. However, even as many appreciate the advantages that come with such a policy, the disadvantages, most especially the main one, are hardly talked about.

40-year-old John, a father of two children, took a 20-year Term Life Insurance Policy in order to protect his family if he died before them. That financially sounded good at that time when the children were really small. Fast forward to John turning 60; his term policy is about to expire. His children are in college, and he knows the renewal of his policy or, for that matter, a new one at his age today would come up far more expensive; besides, rising health issues may not really allow him to purchase a new policy without hassles. Actually, this is a prevalent issue among policyholders who get Term Life Insurance, and it serves to highlight the primary drawback of this kind of coverage, which is impermanence.

This blog will talk about some of the reasons why temporality in Term Life Insurance might be a major downside, especially how it affects policyholders like John and the various ways howt this risk can be avoided. We help guide the decision-making process with full-of-information decisions regarding Term Life Insurance, all its benefits, and limitations. Travel with us to learn relatable problems, advice from experts, and stories that will motivate you to figure out how to get Term Life Insurance in Canada.

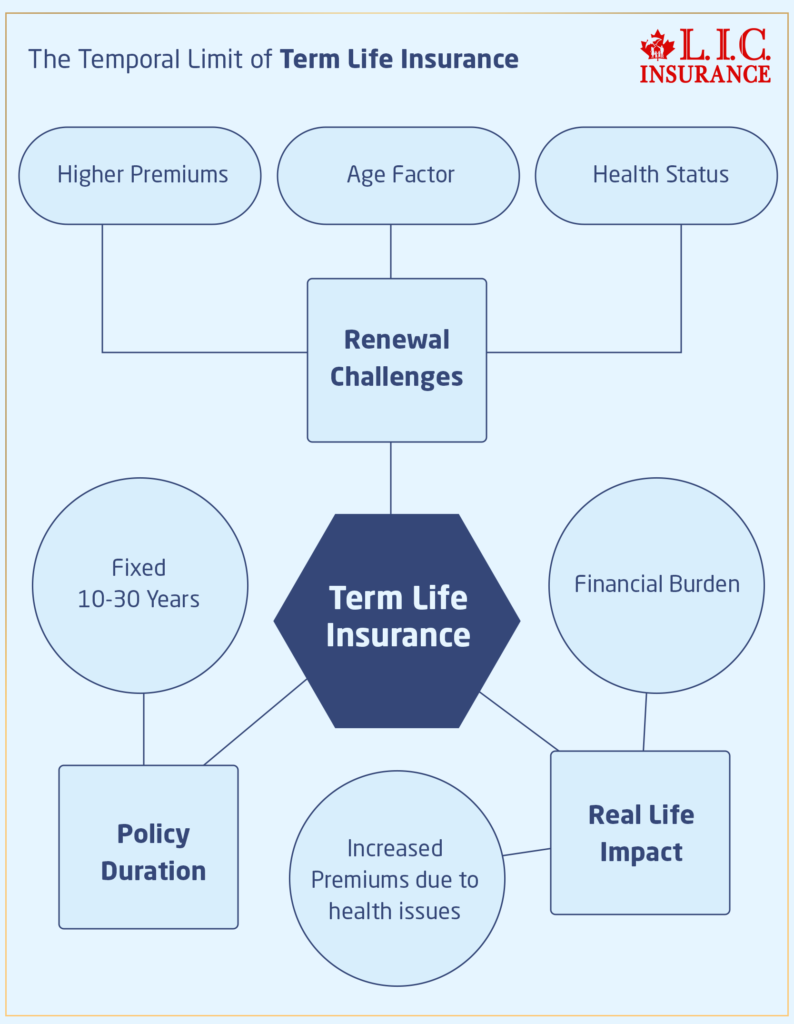

The Core Issue: The Temporal Limit of Term Life Insurance

The Expiry Problem

The very basic problem with a Term Life Insurance Policy is that by its very nature, it has a fixed number of years for coverage—usually between 10 to 30 years—set out by the policy. Your policy will be void of cover for any claims after this period until you either renew the policy or take out a different type of cover.

Lisa is a young professional who, at 25, took out a 25-year term life policy. As she approaches her 50th birthday, Lisa finds herself in a robust career, still supporting her aging parents and a teenager heading to university soon. Her term policy is nearing its end, and she faces potentially high premiums for new coverage due to her age and the onset of diabetes.

Increasing Premiums upon Renewal

If you decide to renew your term insurance or convert it to a Permanent Plan, be prepared that the premiums most likely would be very high. Two of the largest considerations for the cost of your insurance in converting your plan could show significant increases in what you have to pay for them: age and health.

Michael has a term life policy and was diagnosed with a chronic condition just the other day. His premiums skyrocketed, and, quite affordably, an otherwise good plan turned into a financial burden, reflecting one of the more common worries among people who are fast approaching the expiration of their term life policies.

Evaluating the Implications: Financial Insecurity

Lack of Long-Term Security

The Term Life Insurance Policy doesn’t have a cash value. If you die before the end of the term of the agreement, you lose the payments you paid and get nothing in return. This can be disheartening as you get older.

Emily chose to have Term Life Insurance in her thirties. Now that she is in her sixties, everything she has been paying for through all the years—well, it’s gone with no benefits accrued, and she has no element of savings in her insurance to at least help her in retirement.

Reliance on Predicting Future Needs

This, in turn, requires that you predict the number of years over which you will need coverage. This prediction is extremely uncertain and, hence, rarely accurate. This inaccuracy may mean that your dependents remain unprotected at a time when they need protection.

When Tom and Karen were planning their family’s future, they thought a 20-year Term Life Insurance would suffice. Two years later, the policy expired, and so did Tom expire two years later in a fatal accident that left his family vulnerable and unprepared financially.

What Can Be Done? Strategies to Mitigate Risks

Understanding the limitations of a Term Life Insurance Policy is crucial, but it’s just as important to learn how to deal with them to maintain continuous and comprehensive protection. Here, we explore three strategic approaches to mitigate the inherent risks associated with term policies, ensuring you can enjoy the Term Life Insurance Benefits without undue worry.

Consider Layering Policies

One effective strategy to counter the temporary nature of Term Life Insurance is to layer multiple policies with staggered terms. This method allows you to adjust coverage as your financial responsibilities evolve over time, ensuring that you’re not over-insured or paying for unnecessary coverage.

Sarah, an entrepreneur who is 30 years old, got a 20-year Term Life Insurance Policy when her first child was born so that her family could pay for major expenses if she died too soon. As her business expanded, she found that her financial responsibilities were also growing, not decreasing as she had thought. Sarah layered a second 10-year term policy when she turned 40 to adjust to this new reality. This staggered approach allowed her to maintain adequate coverage during her peak financial obligations without overlapping or wasting resources.

Explore Conversion Options

Many Term Life Insurance policies come with an option to convert to Whole Life Insurance Policies or Universal Life Insurance Policies. This option can be activated without a medical exam, providing a safety net for those who might face health issues later in life. Conversion ensures that your insurance protection can evolve into a Permanent Plan, securing long-term benefits beyond the original term.

Mark, who was diagnosed with a chronic illness near the end of his Term Life Insurance Policy, was concerned about his insurability. He opted to convert his term policy into a whole life policy. This decision not only secured his coverage for the rest of his life but also allowed him to start building cash value that could support his wife and potentially cover medical costs in the future. The conversion feature in his Term Life Insurance was a saviour, enabling him to maintain insurance coverage despite his changed health circumstances.

Plan for the End of the Term

Proactive financial planning and regular reviews of your Term Life Insurance Policy are crucial for preparing for its expiration. This strategy involves setting aside funds specifically for end-of-life expenses or aligning your policy’s term with significant financial milestones like debt repayment or retirement.

Emily and Jack, a couple with a keen eye on the future, purchased a Term Life Insurance Policy aligned with their mortgage repayment schedule. They knew that their financial burden would significantly reduce once the mortgage was fully paid. By planning their Term Life Insurance to end concurrently with their mortgage, they could reallocate funds to retirement savings and other investments. They also set up a separate savings account to accumulate funds specifically for potential healthcare needs in later years, ensuring they were prepared for financial shifts post-term insurance coverage.

Concluding Thoughts: Making the Smart Choice with Canadian LIC

While Term Life Insurance coverage offers undeniable benefits, such as affordability and simplicity, its temporary nature poses a significant risk, particularly as you age. Understanding these limitations is crucial in crafting a comprehensive financial plan that ensures long-lasting security for you and your loved ones.

As you consider your insurance options, remember that Canadian LIC stands ready to assist you in understanding these complex choices. We specialize in helping Canadians like you find the Term Life Insurance Policy that best fits your needs while preparing for future transitions. Don’t wait until it’s too late—get in touch with Canadian LIC today to ensure that your insurance coverage adapts to your life’s changes and continues to protect those who matter most. Secure your legacy with Canadian LIC, and let us help you make the informed decision that will bring you peace of mind for years to come.

Find Out: Do I get Money Back from Term Life Insurance?

Find Out: Why get Term Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions(FAQs) About Term Life Insurance

Term Life Insurance can often raise many questions, especially when trying to determine how to protect your financial future best. Let’s discuss some of the most common questions about Term Life Insurance policies and their benefits based on solid, real-life stories of our clients that you will find quite relatable.

Term Life Insurance Policy refers to a life insurance contract that provides coverage at a fixed rate of payments for only a given limited period—the term of coverage. The policy runs only for the term duration, and at the expiry of the term, the policy expires unless it is renewed or converted to Permanent Life Insurance.

Tom bought a 20-year Term Life Insurance Policy when his first child was born. It is an income protection policy to meet Tom’s family’s financial security needs through the years when they most require it—such as while the children are dependent on his income or until his mortgage gets settled.

Select the term length that coincides with your major financial obligations and life milestones—the length you will need to be able to provide for your dependents.

Jason took a 25-year Term Life Insurance Policy matching the number of years he will have to be able to pay off his mortgage in full and have his children done with schooling. This strategic alignment ensured he would only pay for necessary coverage within his years of highest financial responsibility.

Coverage ceases at the end of the policy term. The benefits payable by the insurer in a Term Life Insurance Policy occur only after the death of the insured, but in case the insured outlives the term, there shall be no benefits to claim unless otherwise provided for in the policy by renewal or converting.

Linda, a 55-year-old healthy woman, was abruptly left without insurance after she turned 85 because she outlived the 30-year term for life insurance. Facing higher premiums for a new term at her current age, she explored other financial safety nets, including investing in a retirement fund.

The advantages of Term Life Insurance include its affordability, as it typically has lower premiums compared to Permanent Life Insurance. It provides a significant death benefit during the term of the policy, offering financial protection for dependents. Term Life Insurance is also simple to understand and easy to purchase, with clear terms and coverage amounts.

The disadvantage of term insurance is that it offers no cash value or investment component, unlike whole life insurance. If you outlive the policy, there’s no payout, and you may need to renew it, often at a higher premium. Additionally, coverage is only for a specific period, so if you still need life insurance beyond the term, it could become more expensive or harder to obtain.

Term Life Insurance is more affordable than Permanent Life Insurance, making it a great option for people looking for temporary coverage. However, Permanent Life Insurance builds cash value over time, while Term Life Insurance does not. If you need coverage for a longer duration or want to accumulate savings through your policy, Permanent Life Insurance may be more suitable.

Yes, Term Life Insurance is often a good option for young families. It provides affordable coverage that can help protect the family’s financial security in case of the unexpected death of a breadwinner. The policy can be tailored to match the years when the family is most financially dependent.

Some Term Life Insurance Policies offer a conversion option that allows you to switch to Permanent Life Insurance without undergoing another medical exam. This can be advantageous if your health has changed, and you still need long-term coverage.

Term Life Insurance coverage is an excellent option for many, but not for everyone. It’s generally best for someone looking for affordable coverage during some high-need years. However, if you are seeking to have lifelong coverage with a feature of saving, then the whole or Universal Life Insurance policy will be the best choices.

Emily,bought term insurance as a young career woman, the time of retirement was around the corner, and she surely wished that she had bought a life policy that had a savings element to it. Reflecting on her needs, she advises younger friends to consider their long-term financial goals when choosing between term and permanent insurance.

It is imperative that you revisit your Term Life Insurance Policy in case of a major change in your financial condition. You may increase your coverage or take out other policies to cover new responsibilities.

After receiving a major promotion at work, Raj realized that his increased income allowed him to afford better security for his growing family. So, he bought another Term Life Insurance Policy that would, in case of his death, be sure to support the family living if something happened to him; this policy did not allow the foreclosure to be made from the new home.

It is imperative that you revisit your Term Life Insurance Policy in case of a major change in your financial condition. You may increase your coverage or take out other policies to cover new responsibilities.

After receiving a major promotion at work, Raj realized that his increased income allowed him to afford better security for his growing family. So, he bought another Term Life Insurance Policy that would, in case of his death, be sure to support the family living if something happened to him; this policy did not allow the foreclosure to be made from the new home.

Usually, the younger a person is when he takes out Term Life Insurance, the lesser the amount of premiums he will pay. It’s just because the younger persons are considered lesser risks by the insurers.

Mia, being 25 years of age, undertook a Term Life Insurance Policy with a negligible premium to be paid, as she was young and proper health was certified at the time of policy issuance. Her brother had waited until he was 45, facing much higher premiums for the same insurance because he was at much more risk due to his age.

Yes, holding several Term Life Insurance policies at the same time is actually a form of “laddering,” and this could work very well in helping to make the coverage period more accurately suited to your specific time-bound financial obligations.

Simon, the man of forethought, structured three staggered Term Life Insurance policies with different maturities to match the milestones in his financial liabilities. One of these policies covered the early career debts, the second covered the children’s education costs, and the third covered the expected retirement expenses, ensuring that this coverage did not unnecessarily duplicate each other and corresponded with his decreasing financial requirements.

The standard Canadian rule for Term Life Insurance, as a death benefit, is issued free from tax in Canada. However, premiums paid for standard Term Life Insurance draw no tax benefit either.

On the part of Anita’s family, they were relieved that the death benefit arising from her Term Life Insurance was free from income tax, allowing them to use the full amount to deal with their financial needs without worrying about a tax burden.

To maximize the benefits of a Term Life Insurance Policy to your family, ensure that the designations of the beneficiaries on the policy are updated and that the coverage amount is enough for the needs of the beneficiaries to be met without straining from any financial source.

Every year, when Carlos reviewed his term life policy, he would make updates to the beneficiary designations by including his new daughter and increasing the benefit amount to reflect the current increase in the cost of living and education expenses for his children.

Of course, if you do cancel your Term Life Insurance, there are usually no penalties, just that you lose all those paid premiums, and no benefits are going to be paid out. So, it’s worth considering why you’re canceling it and whether there might be better alternatives better fitting to your needs.

Julie was much better off financially than she had expected to be, and so she was ready to cancel the Term Life Insurance. However, a financial consultation with a pro convinced her to keep the cheap cushion, reassured by the financial security it offered her family.

Sources and Further Readings

To deepen your understanding of Term Life Insurance and to assist you in making informed decisions about your insurance needs, here are some recommended sources and materials for further reading. These resources provide valuable insights into the intricacies of Term Life Insurance policies, their benefits, and strategies to optimize your coverage.

Recommended Sources

Life Insurance Basics by the Insurance Bureau of Canada

This comprehensive guide offers an overview of life insurance options available in Canada, including detailed sections on Term Life Insurance. It’s an excellent resource for understanding policy basics and comparing different types of insurance.

Insurance Bureau of Canada – Life Insurance

Canadian Life and Health Insurance Association (CLHIA) Guide to Life Insurance

CLHIA provides a detailed booklet that explains life insurance in a straightforward manner, including chapters on choosing the right type of policy and the specific advantages of Term Life Insurance.

“Personal Finance for Canadians for Dummies” by Eric Tyson and Tony Martin

A primer on personal finance that includes practical advice on managing life insurance, this book is great for understanding how Term Life Insurance fits into a broader financial strategy.

Available on Amazon and other book retailers.

“The Intelligent Investor: The Definitive Book on Value Investing” by Benjamin Graham

While not specifically about insurance, this book provides foundational knowledge on investment and risk management, which are crucial when considering life insurance as part of your financial portfolio.

Available on Amazon and other book retailers.

Online Resources

Investopedia – Term Life Insurance

A resourceful online platform for financial education, Investopedia offers detailed articles on Term Life Insurance, including its pros and cons, ideal candidates for policies, and how it compares to other types of life insurance.

Investopedia – Term Life Insurance

NerdWallet – Compare Life Insurance Plans

NerdWallet provides tools for comparing different life insurance plans, including Term Life Insurance, and offers advice tailored to Canadian consumers.

Government of Canada – Financial Consumer Agency

This official site includes resources to help consumers understand various financial products, including life insurance policies. It offers guidance on purchasing insurance and understanding your rights and responsibilities as a policyholder.

Financial Consumer Agency of Canada – Life Insurance

Blogs and Articles

MoneySense – How to Choose the Right Type of Life Insurance

MoneySense is a Canadian financial education website that features articles on choosing the right life insurance. Their content is straightforward and tailored to Canadian audiences.

MoneySense – Choosing Life Insurance

The Globe and Mail – Financial Health Section

This national news outlet provides insightful articles about financial planning and insurance strategies, often featuring expert advice and user-friendly guides on navigating life insurance decisions.

The Globe and Mail – Financial Health

By exploring these sources and further reading materials, you can gain a more comprehensive understanding of Term Life Insurance policies, their benefits, and how to effectively integrate them into your financial planning. Whether you are a new policyholder or looking to refine your existing insurance strategy, these resources will equip you with the knowledge to make confident and informed decisions.

Key Takeaways

- Term Life Insurance provides coverage that expires at the end of the term, potentially leaving you uninsured as renewing can be expensive due to age or health.

- Term policies do not accumulate cash value, offering no financial return if you outlive the policy.

- Renewing or converting a term policy can lead to significantly higher premiums based on age and health at the time.

- Layer multiple term policies with staggered terms to maintain continuous coverage and adapt to changing financial needs.

- Many term policies allow conversion to a permanent policy without a medical exam, useful for those with health issues.

- Plan financially for the end of your term life policy by aligning it with major financial obligations or saving separately.

- Regularly review your Term Life Insurance to ensure it matches current needs, adjusting for life changes like marriage or children.

- Consulting a financial advisor can help tailor your Term Life Insurance strategy to your specific circumstances and needs.

Your Feedback Is Very Important To Us

better understand the challenges and concerns that people commonly face with Term Life Insurance, particularly regarding its main disadvantage of temporary coverage, we would appreciate your participation in this short feedback questionnaire. Your responses will help us improve our content and provide more targeted advice to meet your needs.

Term Life Insurance Feedback Questionnaire

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]