- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is The Rule Of Term Life Insurance?

- Understanding Term Life Insurance in Canada

- Rules That Guide Term Life Insurance in Canada

- How Premiums and Terms Influence Your Decision

- Regional Insights: Term Life Insurance in Ontario and Beyond

- The Role of Experts in Simplifying the Process

- Exploring Investment Aspects and Long-Term Benefits

- Stories from the Field: Building Trust Through Honest Conversations

- Examining the Features That Set Term Life Insurance Apart

- Building a Secure Future Through Honest Advice and Personalized Plans

- Making the Right Choice for a Brighter Tomorrow

- Final Thoughts: Taking the Next Step for Your Family's Security

What Is The Rule Of Term Life Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- February 5th, 2025

SUMMARY

This blog describes the role of Term Life Insurance in Canada. It talks about how the cost of Term Life Insurance is determined, how to compare Term Insurance Quotes in Canada, and what to expect with Term Life Insurance in Ontario, Canada. Term Life Insurance experts share client success stories to make choices clear and discuss Term Insurance Investments for temporary protection during key life stages.

Introduction: Facing Common Struggles in Securing a Future

Many people face the challenge of planning for the future in Canada. You have probably been browsing through term life insurance costs in search of accurate and honest information or possibly browsing through quotes for term insurance in Canada while wondering what gives term life insurance in Ontario, Canada, credence. We, as a Term Life Insurance team, often hear stories of worry about providing for loved ones in case something unforeseen happens while talking to our clients in everyday conversations. Some are worried about complicated rules, while others do not know if Term Insurance Investments will give them lasting security. These worries remind us that every client has unique hopes and doubts regarding his or her financial safety net. This piece aims to make light of the Term Life Insurance by sharing real-life struggles that we see during our everyday work at Canadian LIC, listening to them and responding with understanding and care.

Understanding Term Life Insurance in Canada

Term Life Insurance covers the risk for a particular term. Given that this particular product has come to be more and more liked by the majority of Canadians with respect to assuring the well-being of family members during insecure periods, there are a great many benefits to taking this out. The benefits of this sort of insurance product include being uncomplicated, especially compared to a Whole Life or any other insurance product with complexities.

Our customers continually tell us how confusing it is to have so many products in the market. They ask about Term Life Insurance Cost and how it compares to the alternatives. We point out that, for many people, Term Life Insurance is a lower-cost way to address risks at important times in their lives, such as while raising children or paying off a mortgage.

When discussing Term Insurance Quotes in Canada, clients appreciate a transparent approach. We actively review the particular circumstances of each applicant to ensure they get quotes that match up with their goals and financial situations. As Term Insurance Agents, we prioritize clear communication. We encourage our clients to ask questions and share their concerns, which helps us guide them through the selection process with empathy and expertise.

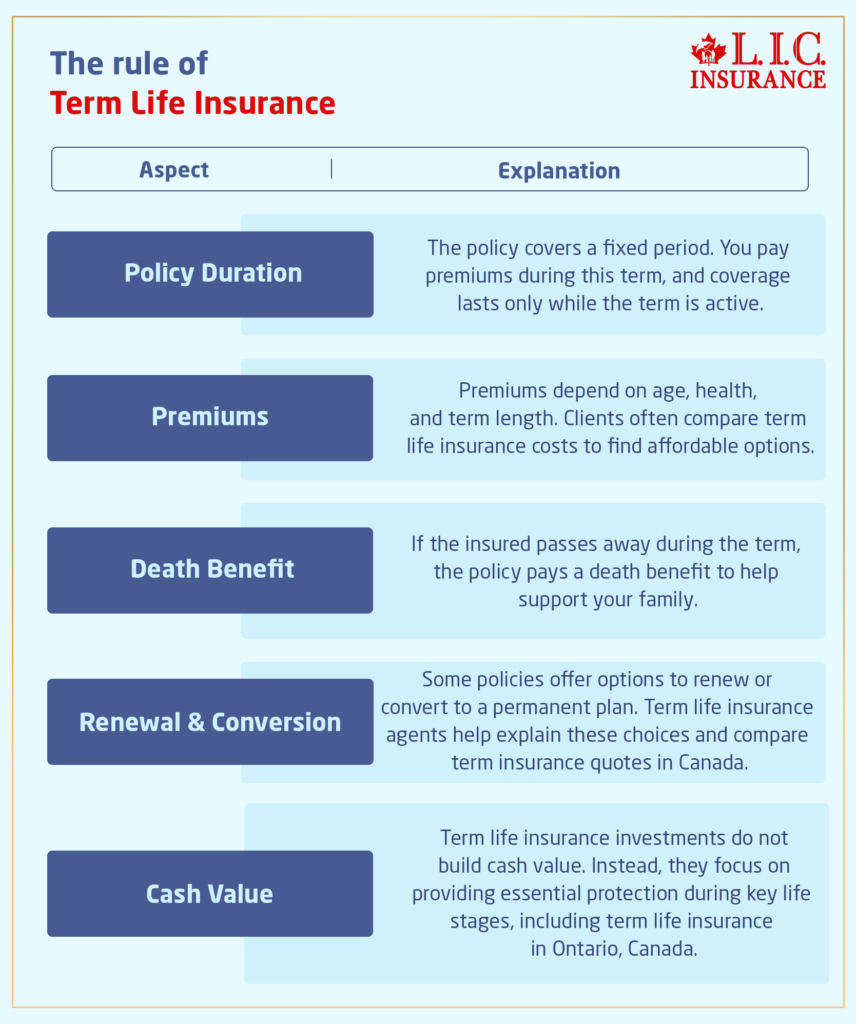

Rules That Guide Term Life Insurance in Canada

Term Life Insurance follows a straightforward premise. The client pays premiums over a specific period, and for that time period, the company promises to pay a death benefit if the insured dies. Still, when interviewing clients, there seems to be confusion as to the exact regulations of such a policy.

Probably among the common fights are the terms of policies that are not known. Most people assume that if the term of the policy runs out, the benefits continue. We take our time to explain that with Term Life Insurance, protection is only limited to the term. And that our clients appreciate that fact for better planning in advance without unwelcoming surprises.

This gives our clients throughout Canada, even those who look for Term Life Insurance in Ontario, Canada, an understanding of whether a policy can be renewed or converted. While there are policies that offer renewal, others might permit conversion to a permanent policy without having to undergo any medical exam, which may serve as an excellent option for one who anticipates changes in one’s health or finances. We share stories from our experiences. A client was not moving forward because of uncertain health conditions. After discussing the options, he felt reassured that he could convert his policy later if needed.

We also explain the Term Life Insurance price influence that the underwriting requirements have on cost. A fitter individual could, for example, enjoy relatively lower premium quotations than one who has previous health conditions. As such, we emphasize that obtaining multiple-Term Insurance Quotes in Canada is key so that our clients can choose an optimal combination between coverage and price.

How Premiums and Terms Influence Your Decision

Many people in Canada wonder what decides the Term Life Insurance Cost. Our discussions with clients reveal that premiums are directly or indirectly related to multiple factors, such as age, health, lifestyle, and the duration of the term. Therefore, for instance, a younger person in good health may pay a lower premium, while someone older and in poor health will probably pay much more.

We inform our clients that Term Life Insurance Agents work diligently to make these factors less complex. They can help you understand how each of these variables will affect your premium. One client, who previously had difficulty understanding the pricing model, later thanked us for taking the time to explain how premiums change over time. The openness in our communication is not only trust-building but also empowering to the client, allowing them to make decisions that suit their financial realities.

This involves age and health but, most importantly, term length. Generally, short terms cost less money but do not provide protection for as long as necessary. More extended terms, on the other hand, cost more but extend the period for coverage to cover a longer time. We will advise clients carefully to assess their needs at this point and into the future as well. We emphasize that thoughtful planning today can secure a more stable tomorrow by sharing personal stories of clients who reevaluated their coverage as their circumstances changed.

Some equate Term Insurance Investments with other financial products. They ask, “Will I get any cash value from this policy? “We explain that, unlike whole life insurance, term policies do not build cash value over time. However, many see a potential reason that the trade-off with reduced premiums may be worthwhile: Term Life Insurance provides protection during critical periods in life. This clarity helps clients choose policies that align with their financial strategies.

Regional Insights: Term Life Insurance in Ontario and Beyond

Living in Ontario presents unique financial challenges and opportunities, and many residents seek Term Life Insurance in Ontario, Canada, to ensure their families are covered in case of an emergency. We have often found that advice is needed specifically for a province, and one of the top questions people pose is regarding regulation in Ontario in comparison to regulation in other areas.

Our team further explains that, although the underlying principles of Term Life Insurance do not change with location in Canada, there could be differences with regard to detail. For instance, premium charges may be based on local market conditions, the cost of living, and health trends in specific regions. In Ontario, this is well-received by clients as we present Term Insurance Quotes in Canada that relate to the locality.

We recall a recent meeting with a new client in Ontario. She came to us stating that she recently moved and worried about moving the existing policy over to the new environment, as the financial obligations were quite different. Our team reviewed her current situation and produced a plan that not only allowed her to continue coverage but also matched her new circumstances in life. This discussion explains why Term Life Insurance needs such trusted agents in the locality who can offer workable solutions to the problem at hand.

Other relevant factors would also include policy terms and renewal options based on regional differences. Our agents elaborate that, in fact, certain policies offer benefits that are specially formulated for people from Ontario. Therefore, special riders and add-ons exist for those looking to fine-tune their policies according to unique requirements. And from such an interaction, a relationship is fostered through which support continues way beyond policy execution.

The Role of Experts in Simplifying the Process

Without expert advice, finding the right insurance product is confusing. Most people consult Term Insurance Agents to help them compare different options, understand the costs, and evaluate possible investments. Our team at Canadian LIC works alongside our clients to answer their questions and explain everything in simple terms.

Recently, in discussing planning for their children’s future with a couple, we heard their worries over the Term Life Insurance Cost. They received a number of Term Insurance Quotes from Canada that sounded quite overwhelming. Our agents were very patient in breaking down details, comparing the difference in premium rates and benefits, and explaining how every factor, starting from term length up to the requirements of underwriting, had its impact on the policy overall. Thus, we helped them to feel comfortable in their decisions.

We also make sure that term life investment is positioned as a part of the overall financial planning for clients. Many question whether the money spent on Term Life Insurance Premiums could be better deployed elsewhere. We explain that while some insurance products build cash value, Term Life Insurance provides affordable protection at the very point in time when families are likely to need stability the most. Many customers relate that understanding the reason for Term Life Insurance really helped them commit to a policy that fits their life stage and goals.

Our conversations never go one way. We actively encourage our clients to ask questions and express concerns. Such interaction not only leads to the community but also leaves each client feeling that he has a full grasp of the situation. It transforms a difficult, complicated subject into a workable, personal program through mutual respect and open discussion.

Exploring Investment Aspects and Long-Term Benefits

Term Life Insurance Investments, contrary to most investment types, never try to gain cash values; however, in the long term, the benefits acquired are tremendous. As clients constantly pose questions about whether such an investment, which could easily be obtained on a Permanent Product, is actually worthwhile, explain how term life is essentially insurance against risks to serve as coverage.

Many clients weigh their options on the basis of both benefits and costs. The team here makes it clear that Term Life Insurance offers vital cover during significant points in life: when the kids are small, or the mortgages are big. In that regard, the price of the policy is an investment in your family’s future security. This perspective has helped many clients choose term policies confidently, knowing they are securing financial support for their loved ones during the most vulnerable periods of life.

We also share stories of clients who had second thoughts about buying it because of no cash value in term policies. One such client had the fear that permanent will give him better financial flexibility. However, after discussing and analyzing his financial goals, he found that the term policy was better for him at the present moment due to its affordability and the clarity of his coverage. His experience is to remind one that the best insurance decision will always depend on personal circumstances and future plans.

Many clients like how our team presents that Term Insurance Investments can be an avenue for making room in your budget by allowing the utilization of resources into other parts of your financial plan. That could be something like retirement accounts, paying off debt, or saving for higher education. By taking a view of your overall financial situation, you would then realize that Term Life Insurance covers a core aspect of a balanced strategy.

Stories from the Field: Building Trust Through Honest Conversations

We meet many clients throughout our work who come to us with hope as well as anxiety. One common story is that of a middle-aged individual who recently lost a close member of his family and was worried about leaving his children unprotected while he was away. He had looked at several Term Insurance Quotes in Canada and found it quite confusing. Our Term Insurance Agents took the time to explain each and every detail so that he would understand how a term policy would work and what benefits it would provide. He, therefore, was clear about the option he wanted, which matched his needs.

The second client was a woman living in the suburbs of Ontario. She had uncertainty about how much insurance would cost her when the economy was unstable. She asked if it would be affordable in the long run and if her premiums might change over time. The group explained that premiums are based on age and health, and a policy now will be in force before changes that may occur can take effect. This conversation smoothed out her worry, and she went ahead to purchase a policy that she would comfortably maintain.

These interactions illustrate how our experts make a subject that many people fear understandable. We share these stories not to call out people but to show that the problems you are facing have been overcome before and that straightforward, candid communication can solve even the most complex issues. The experience of working with clients who have overcome similar challenges guides those still looking for answers.

We also find in our conversations with clients that Term Life Insurance is not a decision entered into lightly. It reflects a commitment by the client to protecting his family from uncertainty. In this way, we help facilitate the decision with practical advice and thorough explanations of every question and concern that the client may have. Mutual idea exchange has always led to a supportive environment where financial planning is less of a burden and more like a journey shared with someone.

Examining the Features That Set Term Life Insurance Apart

One important aspect that our clients often discuss is the difference between term and Permanent Life Insurance. Term Life Insurance provides a death benefit for a specified period, which many find to be a straightforward solution for protecting family finances. In contrast, Permanent Life Insurance Policies include additional features, such as cash value accumulation, which might not be necessary for everyone.

According to our agents, Term Life Insurance is just the right fit for people looking for a safety net for specific periods. As an example, most parents would want to be covered until their children become financially independent. This focused protection lowers the premiums and makes the whole process less complicated. Clients like the notion that the policy is designed to meet a special need as opposed to this being an investment vehicle.

We always work with customers who inquire whether term life investments are more efficient than other forms of investment tools. Our explanation is that while term insurance products do not acquire cash value, they give you immediate and very necessary coverage right away. Then, we tell our clients that they can also purchase other forms of insurance or invest in other forms of accounts for this added layer of protection so that their finances are not so one-dimensional.

Another main difference that Term Life Insurance offers is the possibility of adding riders for a more customized coverage option. For instance, some clients would want to add a rider that covers accidental death or critical illness, making the policy more personal. The firm agents work individually with clients to ensure they determine the best upgrades. By having a variety of customizable features, Term Life Insurance can be tailored according to the specific financial needs of families in Canada.

Some practical examples of our discussion on some of the unique features of Term Life Insurance include when one client was a bit hesitant about going with extra riders and ended up adding a rider for critical illness based on learning that it would ease financial burdens in medical emergencies. This was from a detailed discussion where every minute detail was communicated. The client later appreciated this and felt reassured about his decision for the future of his family.

Building a Secure Future Through Honest Advice and Personalized Plans

Understand your needs and priorities before getting the right Term Life Insurance policy. At our firm, we take a consultative approach to help clients assess current financial obligations, future goals, and security needs for their loved ones. Most of our clients report feeling less anxious about the future when working closely with us on their plans.

As we converse, we delve into the key questions in a bid to try and understand what matters most for you. Do you need insurance that will provide coverage up to when your children graduate? Are you likely to have financial commitments that you want covered, like a mortgage? Based on this unique situation, Term Insurance Agents can help you devise a plan that suits your needs.

We have seen clients, in the past, who were not comfortable with Term Life Insurance; they would not buy it as they found it was too complex or too expensive. Our open dialogue and careful analysis allow the breakdown of the factors that could be considered, such as the length of a term, premium structure, and other deductibles, and how all of that fits into your financial strategy. Many clients have discovered that the simplicity of Term Life Insurance allows them to focus on other important aspects of their lives, knowing that their family is well-protected.

A more memorable case is the client with many financial priorities. After a detailed discussion about Term Insurance Quotes in Canada and the benefits of a Term Policy, she decided that the lower premiums allowed her to invest in other areas, such as education funds and retirement accounts. She later shared that this balanced approach gave her greater control over her finances and helped reduce her anxiety about unforeseen events.

Our intention is to allow you to be at ease, and you’ll be able to tell us anything you want, such as questions or concerns, which will serve to create an ideal policy according to your values and financial plans for each customer. Clear words plus relevant and comprehensible data allow you to see how the Term Life Insurance will fit in the general plan of your economy and help during crucial periods of your life.

Making the Right Choice for a Brighter Tomorrow

It is a serious decision to acquire a Term Life Insurance policy, and you should have an approach that is transparent and supportive. Many Canadians are frustrated and confused while trying to compare policies and understand the benefits of those policies. Our team listens to your concerns and answers them with practical and easy-to-understand advice. We draw on that experience with customers around the nation to make certain that every piece of advice is based on real-world experiences and challenges for success.

When you check Term Insurance Quotes in Canada, you’ll see that there are many different options available. Some clients like a shorter term with lower payments, and others prefer a longer policy with longer coverage. Our job is to help you understand how each choice will affect the overall cost and protection level so you can choose a plan that works both for your budget and meets all of your needs.

We hear stories of clients who, at first, are overwhelmed by the choices but come out clearly after discussing the specifics of Term Life Insurance Cost, premium factors, and policy features. This particular client had previously battled the decision-making process but was eased off after a detailed discussion that covered even the most minute underwriting standards and policy riders. That experience not only built trust but also helped him see the practical benefits of securing coverage during a crucial period of his life.

Our experts, moreover, advise you to think of Term Life Insurance as part of your long-term financial planning. It does not come with the cash value other insurance products hold, but it provides necessary protection, especially when you need it the most. Choosing to get a term policy now sets the stage for a more secure future, and you can go back to concentrating on the other investments and savings opportunities that await you. This balanced way can make much of a difference in how one manages finances as time goes on.

The interaction that we encourage is a two-way dialogue. Come and share your concerns with us and ask as many questions as you want regarding every policy aspect. This could be a necessity to know better about the Term Life Insurance Ontario, Canada has in store or even know how this rider would finish your coverage-our agents would be glad to give you a clear, action-oriented response to that. It’s always that this cooperative approach would make you remain in the know, therefore guaranteeing you decisions that will better resonate with the personal and financial circumstances you happen to be in.

Final Thoughts: Taking the Next Step for Your Family's Security

Your journey to securing a bright future for your loved ones begins with a simple, thoughtful decision. Many clients have said that choosing a Term Life Insurance policy gave them clarity and confidence in uncertain times. With an easy-to-understand structure and a focus on protecting your family during key periods, Term Life Insurance stands out as a dependable choice for Canadians from all walks of life.

Common concerns, be it the subtlety of Term Life Insurance Cost or comparison of quotes for Canada term insurance, were the first things that Canadian LIC team members faced in helping clients feel more secure and confident in their decisions. The guidance from our experienced Term Insurance Agents turned confusion into confidence and worry into well-planned security.

Every question you ask, every concern you share, and everything that comes into your mind all play an important role in building a financial safety net that will support your family through the best times ahead. Our stories represent the real challenges many people face, and our solutions are designed with compassion and savvy expertise to knock on their door. Through Term Life Insurance, you’re making an investment in a future where your family is protected through life’s moments of uncertainty.

You can opt for Term Life Insurance and achieve the additional security you think your present financial strategy is still not entirely safe. Relatively simple guidelines and affordable premiums mean you can get fully covered during important times of life. We encourage you to find out the options available, ask questions, and engage in an honest conversation about the whole truth from our experts.

This is not something you put off for your family’s security. With each passing day, you have the potential to establish a solid foundation for the future. You make a choice that stands in support of your financial objectives while protecting and securing those close to you against unfortunate events that may come. We’ve guided countless clients from uncertainty into confidence, and we can help you do the same.

Thank you for taking the time to read this detailed guide. Please sit back and introspect about your needs and how such a Term Life Insurance policy will be a simple, supportive investment for your future.

This blog has presented an in-depth look at Term Life Insurance’s principles, elaborate details on the cost factors involved, and stories of personal experiences from our day-to-day working with clients. Your questions and concerns are welcome, and experts can guide you at every stage. We, therefore, ask you to contemplate the security and peace that ensue from an insurance strategy that is well-planned and get on with your act soon so that the family is safeguarded.

The rule of Term Life Insurance

More on Term Life Insurance

- Is Natural Death Covered In Term Insurance?

- Should I get a 20 or 30-year Term?

- How Do I Claim Term Insurance?

- Can I Use My Term Life Insurance To Pay Off Debt?

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQ's on the rules of Term Life Insurance

Term Life Insurance pays a death benefit for a specific term. Many clients inquire about this as they are afraid of leaving their families unsecured. The team explains to the clients that if the insured dies during the term, the policy pays the benefit. Many clients compare the cost of Term Life Insurance with other options. Clients feel relieved knowing that the policy only covers a specific term.

You can compare the different offers, and thus, it will become clear which of them fits your needs. Our experts help clients get Term Insurance Quotes in Canada, checking all key details. A client, to begin with, felt puzzled by many numbers. Our agents explained each quote step by step. Such clear talk brought the client confidence in choosing.

Term Life Insurance in Ontario, Canada, works in the same way that any Term Life Insurance in Canada works. The client pays a premium for a set period. If the insured person dies within that period, the policy pays out a benefit. A client from Ontario once worried about changing rules after moving provinces. Our agents clarified that the rules stay similar in Ontario. This helped the client have peace over his insurance coverage.

Term Life Insurance Costs vary with age, health, and the duration of the term. Many customers come to share tales of high medical history, increasing their costs. Our term life agents work very hard to clarify such factors for our clients. You see how, in many instances, a healthy person tends to pay lesser premiums. It helps clients feel understood when planning budgets.

Term Insurance Investments do not create cash value. This usually causes clients to compare it to others who benefit by saving money. Our professionals say this type of policy protects your family when they need it the most. A client chose Term Coverage and saved the money for others. That gave him the right balanced view, in which he invested wisely in his future.

Term Insurance Agents explain everything in simple words. They sit with you and discuss your requirements and budget. A client was once confused about many options. Our agents spent time answering every question. Clear guidance helped the client pick a policy that would suit his family’s needs.

Many policies are available for renewal or conversion. Our team informs clients of options in their Term Insurance Quotes in Canada. One of our clients worried about losing his coverage when the term was to end. The agents explained some options: he could renew his policy or convert it to another type. It was this discussion that alleviated his anxiety and prepared him for the future.

All answers here derive from experiences that we share at Canadian LIC. We see all these questions each day. Our agents work with the clients very closely to ensure that each decision is clear and easy. Your questions matter, and we are here to guide you through every step. Please don’t hesitate to ask more questions if you need help.

Sources and Further Reading

- Insurance Bureau of Canada

Visit www.ibc.ca for insights on insurance trends and consumer tips in Canada. - Canadian Life and Health Insurance Association (CLHIA)

Learn more about industry standards and policy details at www.clhia.ca. - Financial Consumer Agency of Canada

Access government resources on financial protection and insurance at www.canada.ca/en/financial-consumer-agency.html. - Investopedia

Read clear explanations on term life insurance and related concepts at www.investopedia.com. - MoneySense

Explore articles and advice on personal finance, including insurance strategies, at www.moneysense.ca.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts. Your feedback helps us improve our explanations and support. Please answer the questions below.

Thank you for your feedback. We value your input and are committed to making our information as clear and helpful as possible.

IN THIS ARTICLE

- What Is The Rule Of Term Life Insurance?

- Understanding Term Life Insurance in Canada

- Rules That Guide Term Life Insurance in Canada

- How Premiums and Terms Influence Your Decision

- Regional Insights: Term Life Insurance in Ontario and Beyond

- The Role of Experts in Simplifying the Process

- Exploring Investment Aspects and Long-Term Benefits

- Stories from the Field: Building Trust Through Honest Conversations

- Examining the Features That Set Term Life Insurance Apart

- Building a Secure Future Through Honest Advice and Personalized Plans

- Making the Right Choice for a Brighter Tomorrow

- Final Thoughts: Taking the Next Step for Your Family's Security

Sign-in to CanadianLIC

Verify OTP