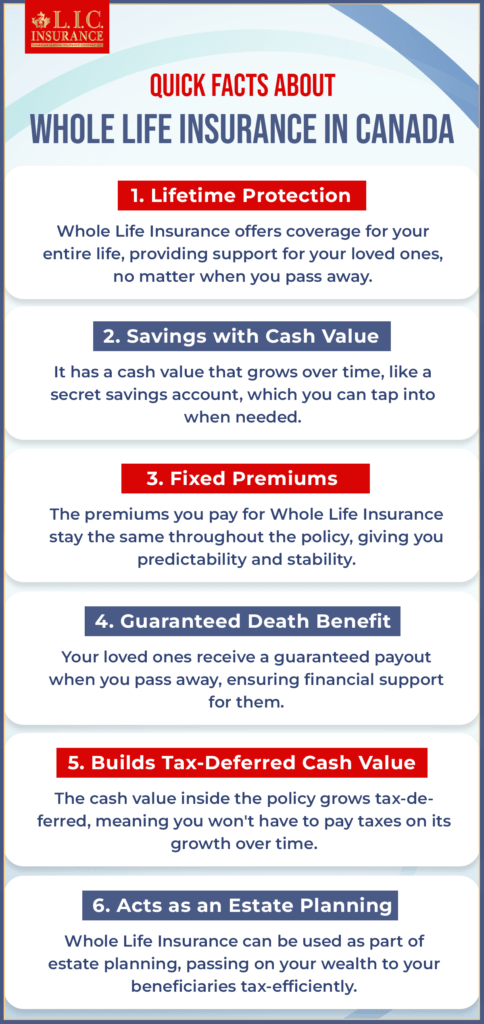

Insurance that covers a person for their whole life and builds cash value is called Whole Life Insurance. It does, however, come with some risks that policyholders should be aware of before spending, just like any other financial product.

Risks Associated with Whole Life Insurance

Suppose you are looking for a solution to get lifelong coverage along with a cash value component in an insurance product. In that case, Whole Life Insurance can be your perfect answer. Yet, it carries certain risks that potential policyholders should consider before they decide to invest in it.

Costly Premiums

One of the most notable risks of Whole Life Insurance is its cost. The premiums associated with whole-life policies tend to be significantly higher compared to those of Term Life Insurance. The reason behind this lies in the policy’s structure, which combines a death benefit with savings or cash value accumulation. This dual feature contributes to the higher costs associated with Whole Life Insurance. When considering a whole-life policy, evaluate whether the monthly premiums comfortably align with your budget or not that too without causing any financial strain.

Market Performance

Some Whole Life Insurance policies tie the cash value growth to the performance of the insurance company’s investments. If the company’s investments are underperforming, then it can negatively impact the cash value growth and the dividends the policyholder receives. However, it’s essential to note and keep in mind that several policies often provide a guaranteed minimum growth rate. This safeguard helps mitigate risk in connection with market fluctuations. It also ensures a minimum level of cash value accumulation despite market volatility.

Flexibility Constraints

The worst part is that Whole Life Insurance offers limited flexibility compared to other investment options. All the policyholders typically have restricted control over the cash value’s growth as it’s intricately tied to the investment decisions made by the insurer. Altering policy terms, adjusting coverage, or withdrawing funds might involve fees or surrender charges. Understanding all these constraints is super important before you make the decision to commit to a whole-life policy.

Opportunity Cost

Another potential risk linked with Whole Life Insurance is the opportunity cost. The funds allocated towards paying premiums for a whole life policy might yield higher returns if invested in alternative financial instruments like stocks or mutual funds. This risk urges individuals to assess the returns on investment in comparison to the policy’s cash value growth. Evaluating the potential returns from different investment avenues becomes crucial to determining the opportunity cost associated with a whole-life policy.

Hence, staying well aware of all these risks is crucial for potential policyholders to make the best decisions about Whole Life Insurance policies in Canada. Evaluating these factors as per each individual’s personal financial goals and risk tolerance levels is essential before committing to a policy.

Managing the Risks

Even though you get long-term financial security with Whole Life Insurance, still understanding and managing these risks are also very significant steps for a secure investment.

Thorough Research

Before you decide to buy Whole Life Insurance, deeply understand even its minutest details. Read and get to know the policy’s terms, what the premiums cover, and how the cash value grows over time deeply. It is also important to figure out whether the insurer guarantees cash value growth, dividends, and death benefits or not. You have to take into account the way policy aligns with your long-term financial goals.

Financial Assessment

Staying very well aware of your financial capabilities is of utmost importance as well. Make yourself very sure about whether the premiums that are in connection with the whole life policy fit comfortably within your budget or not. Staying balanced financially is important, as missed premium payments can lead to policy lapses or reduced benefits. Go and figure out your income, expenses, and long-term financial objectives to determine if the monthly costs are sustainable for you or not.

Seek Expert Consultation

The best thing is to go for help. Here is where the role of an expert comes into play. A financial advisor or insurance professional can be your guiding light. If you decide to go and get these experts’ help in assessing the policy’s suitability based on your financial goals and risk tolerance, then you will be sorted to a great extent. They can provide you with deep insights into how the policy aligns with your financial objectives, help you understand the costs, and clarify any doubts you might have regarding the policy’s terms and conditions.

Periodic Policy Reviews

Another essential part is to keep reviewing your Whole Life Insurance policy on a regular basis. As life situations and financial circumstances keep on changing, the same way your insurance needs might also keep changing. If one keeps reviewing their policy regularly, then it will be possible for them to assess whether the policy aligns with their current financial goals or not. The best way is to keep reviewing the policy every few years or after significant life events take place, such as marriage, the birth of a child, or career changes.

Diversification of Investments

You can also go with diversifying your investments. Even though a Whole Life Insurance policy is a stable financial product, solely relying on it might limit your investment portfolio’s diversity. Go and explore other investment options as well, like mutual funds, stocks, or retirement accounts, to complement your insurance policy and balance out your financial portfolio.

Understanding Surrender Values and Loans

Make yourself very well familiar with the surrender values and policy loan options. Surrendering a policy prematurely or taking out loans against the cash value might impact the policy’s long-term benefits. Understanding the implications and costs associated with these actions is crucial before making any decisions.

Coming to the end: Weighing Risks in Whole Life Insurance

The idea of Whole Life Insurance is appealing because it covers you for your whole life and builds cash value over time. Still, it’s important to know the risks before buying a Whole Life Insurance policy in Canada.

Evaluating Your Financial Objectives

Understanding the risks involved, particularly the higher monthly cost compared to term insurance, is fundamental. Carefully assess if the premium aligns with your budget and long-term financial goals. This introspection ensures that the policy doesn’t strain your finances but rather serves as a beneficial tool for investment.

Risk Assessment for Informed Decisions

Comparing the benefits against the risks linked to Whole Life Insurance is crucial. The cash value growth, though enticing, could be affected by market performance or constrained flexibility. By balancing the benefits and costs, individuals can make smarter choices that harmonize with their financial aspirations and appetite for risks.

Seeking Professional Guidance

Deciding to consult with a financial advisor or insurance professional can provide invaluable knowledge. These professionals can help you understand the policy’s details and understand what the monthly costs and risks mean. Their knowledge helps you make sure that the insurance fits with your financial plan and enables you to reach your goals instead of getting in the way.

Concluding Thoughts

Overall, Whole Life Insurance can be an essential part of a long-term financial plan because it covers you for life, and the cash value could grow over time. However, it is very important to fully understand the policy’s monthly costs and the risks that come with it. People in Canada can get the most out of a Whole Life Insurance policy while successfully managing possible risks by making knowledgeable choices, weighing risks against financial goals, and getting professional help.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

Whole Life Insurance provides coverage for your entire life, while term life insurance offers coverage for a specific term, typically 10, 20, or 30 years. Whole life also includes a cash value component that grows over time, unlike term life insurance.

The primary risks include higher premiums compared to term life insurance, potential policy lapses due to missed payments, and the possibility of lower returns on cash value compared to other investment options.

If you stop paying premiums, the policy may lapse, and the coverage and cash value benefits could be affected. Some policies may have a grace period during which you can make payments to prevent lapses or explore options like reducing the death benefit.

Yes, most whole life policies allow you to take out loans against the cash value. However, outstanding loans accrue interest and could impact the policy’s cash value and death benefit if not repaid.

Whole Life Insurance provides lifelong coverage and a savings component. While it offers financial security, its returns might not match those of other investment options. It’s essential to consider your financial goals and risk tolerance before investing in Whole Life Insurance.

Periodic reviews are advisable, especially after significant life events or every few years. Life changes, and so do financial goals. Regular reviews ensure that the policy aligns with your current needs and objectives.

Yes, you can surrender your policy, but doing so might lead to surrender fees and taxes on any cash value withdrawal. Make sure to understand the implications before cancelling the policy.

Whole Life Insurance can serve as a retirement supplement due to its cash value growth and tax advantages. However, it’s essential to consider other retirement investment options and consult a financial advisor for a holistic retirement plan.

No, Whole Life Insurance premiums are not tax-deductible in most cases. However, the cash value growth is tax-deferred, and withdrawals up to the total premiums paid are usually tax-free.

Dividends in Whole Life Insurance policies represent a portion of the insurer’s profits shared with policyholders. They’re not guaranteed and can be used to increase the policy’s cash value, buy additional coverage, or receive cash payouts.

Some policies offer flexibility in adjusting the death benefit, typically through policy riders or options provided by the insurer. This change might involve underwriting and could impact premiums.

Whole Life Insurance policies typically don’t have a specific maturity date like term policies. As long as premiums are paid, the coverage continues throughout your lifetime.

Some term life insurance policies offer conversion options that allow policyholders to convert to a whole life policy without undergoing additional medical exams or proving insurability. Check your policy details for specific conversion terms.

While Whole Life Insurance offers cash value growth, solely relying on it as an investment might limit potential returns. Diversification across various investment options is often recommended for a well-rounded financial plan.

Using cash value might have restrictions or conditions. Policy loans, withdrawals, or surrenders can impact the cash value and death benefit. Understanding these limitations before accessing cash value is crucial.

Many whole life policies offer riders or options to increase coverage. However, additional coverage usually requires underwriting and may affect premiums.

Cash value grows through premiums and interest credited by the insurer. The growth rate varies among policies and might be affected by factors like market conditions and policy expenses.

Yes, as the policy owner, you can purchase Whole Life Insurance for someone else, provided you have an insurable interest. The insured person might need to provide consent or undergo underwriting.

Missing premiums might lead to a grace period during which you can pay, but the policy could lapse if premiums remain unpaid. Some policies offer options to cover missed payments using the cash value, but this can vary among insurers and policies.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com