Are you also one of those who need help understanding all the Term Life Insurance options available in Canada? You might have heard stories from friends and family. Some went smoothly with it, and some went through the process with great rates. Others have gotten tangled in confusing terms and unexpected clauses. For most Canadians, securing life insurance is a future-oriented exercise; it is a common scenario, riddled with uncertainty and complex choices on their own behalf and that of their loved ones.

Whether you are nearing retirement age and beginning to think of Term Life Insurance rates for a senior citizen or you are a young professional just beginning to think about these types of financial protections, knowing how to go about the search is of great importance. That’s where this blog comes into play—taking away the mystery from the process, offering a clear way through the Term Life Insurance landscape with relatable stories and essential tips to make sure you find your perfect policy match.

The Basics of Term Life Insurance

What is Term Life Insurance, exactly?

Before we get into the what and how let’s first understand in brief what exactly Term Life Insurance is. It is life insurance offering coverage for a paid fixed rate for a defined time. Terms usually range from 1 year to 30 years. In such a way, this policy gives the policyholder an option to either renew his policy, convert it to Permanent Life Insurance, or let the policy terminate. This makes it easy and affordable for many Canadians.

Why Consider Term Life Insurance?

For example, a couple, John and Mary, finally decided to buy a house in Toronto. Both are enthused with the new beginning but, of course, at the same time, have some worries about the mortgage. This is when a Term Life Insurance Policy applies. That gives both of them peace of mind, knowing that should anything happen to either of them, the other would not be left with the task of solely making mortgage debt payments.

Find Out: Why get Term Life Insurance in detail

Choosing the Right Term Length

Assessing Your Needs:

Your insurance term should cover all of your biggest financial responsibilities. For example, if you have young children, you might want to get Term Insurance that lasts until they are financially independent. Think of Maria, a single mom in Vancouver who has opted for a 20-year Term Life Insurance Policy to ensure that her daughter will be able to go to university if something should happen to her.

Term Life Insurance Rates for Seniors

This is something that can give a person who is looking to find affordable Term Life Insurance for seniors quite the challenge. Though that holds somewhat true, rates generally increase as you age, but they still maintain affordability if one can find the right source. Take, for example, the story of Raj, 65, who has been thinking that he is uninsurable at his age for Term Life Insurance Coverage. After comparing several rates that are tailored for a senior, he was able to land a policy that was conducive to his budget and gave him enough coverage for his needs.

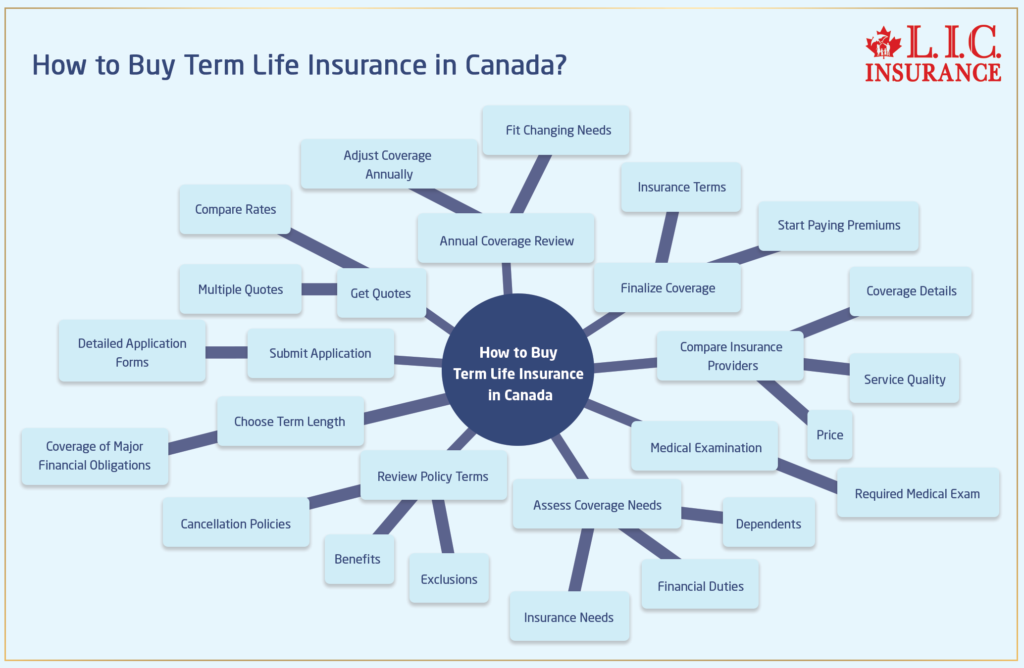

How to Buy Term Life Insurance in Canada

Very simple: buying Term Coverage in Canada is made up of a simple process, provided one follows the correct steps and uses the right tools. Whether you’re doing the Term Life Insurance rates for seniors or just now getting started on the process to get a Term Life Insurance Policy, every explained step really can make a huge difference. Walk through these to understand how to buy Term Life Insurance better.

Step 1: Assess Coverage Needs

First comes the Term Life Insurance purchase; therefore, you should make an assessment of your coverage needs. This would include considerations on the financial duties, dependents, and everything else one would want covered from the insurance payout. For example, Janet, a 58-year-old teacher from Ottawa, has the responsibility of ensuring that, indeed, the Term Life Insurance covers care of the mortgage while, at the same time, she ensures that it covers his husband’s need for retirement. She undertook this by considering the existing financial obligations and, possibly, future ones that may accrue to arrive at the right amount of coverage.

Step 2: Term Length

In other words, choose the term length very wisely, which suits your coverage needs. For seniors, selecting a term that covers them until their major financial obligations are reduced or eliminated is wise. Philip looked into Term Life Insurance rates for seniors and finally settled for a 10-year term, which would ideally cover him until his pension kicked in. At least for a short period, he had some peace of mind from the tumultuous retirement transition.

Step 3: Get More Than One Quote

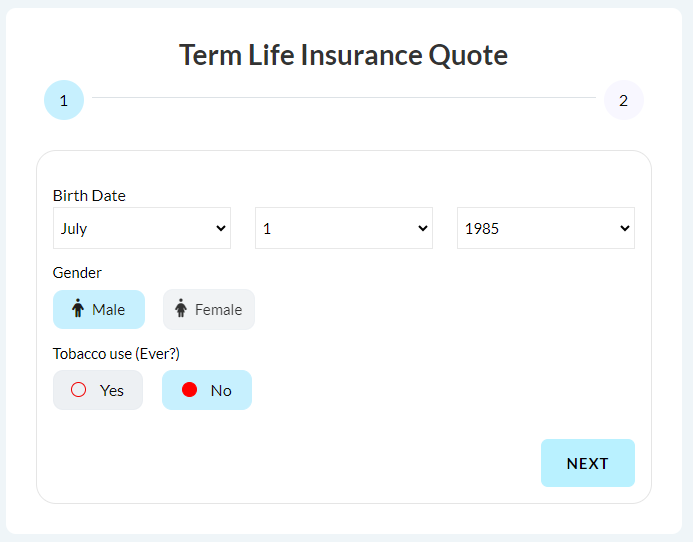

After getting a rough idea about your needs and the length of the term, the next step would be getting the quotes. This can be easily done online where platforms allow you to compare various Term Life Insurance policies side-by-side. A good example here is the story of Sania. She was in a position to obtain several quotes in one afternoon, compare these from her home office, and thus be able to save time while getting the best possible rates.

Step 4: Compare Insurance Providers

After you have obtained quotes, compare the insurers not only in terms of price but also with respect to service quality and the details of coverage. Look for what other customers have to say concerning experiences with the respective company. Mike, for that matter, would find that though some insurers have competitive prices, their service ratings are all terrible. He would, however, be influenced by online reviews that pointed out one particular insurer that not only had good rates but was good with customer support, too.

Step 5: Review Policy Terms

Look over the policy terms for what is being offered. Look out for fine prints, which include the exclusions, benefits, and cancellation policies. It was the hard way for Laura, who learned too late that her policy didn’t cover some kinds of illnesses. Take a little time to make sure you fully understand what is encompassed by the terms of the policy, and this may prevent surprise after-effects at a later period.

Step 6: Reviewing the Offer of Insurance

Work through their complete offer, respectively. This will encompass all the policy terms, premiums, and any additional value or riders that they might attach. Align these with your overall financial plan. That’s how Alex—a young entrepreneur from Montreal—found an offer with a critical illness rider that is absolutely perfect for his lifestyle and the risks associated with the business.

Step 7: Submit the Application

The next step is to submit your application. It normally involves filling out very detailed forms about your health, lifestyle, and financial background. When James applied for the insurance, he ensured that all details were correct and filled to avoid any delays in the same.

Step 8: Complete Medical Exam

Most applications for Term Life Insurance require a medical exam. This helps the insurer gauge your health and adjust your premiums accordingly. Grace had arranged her medical examination just after applying for the Term Life Insurance Policy, and she prepared for it by following what the doctor had told her. This enabled her results to run smoothly and get processed in good time.

Step 9: Finalize Coverage

Once your application and medical exam are complete, the insurer will finalize your coverage and issue your policy. This is when you’ll start paying premiums. Ensure that all the details are correct in your policy as received. Sam looked through the document and verified that all the agreed terms were properly reflected as soon as he received the document.

Step 10: Annual Coverage Review

Finally, he or she should review their policy every year. This will keep the coverage limits in line with their needs as life elements change. Lisa’s story is an excellent lesson to learn from; after the birth of her second child, she reviewed her policy and found that she needed to increase her coverage to ensure both children were protected.

Each of these steps is very critical in ensuring that you get the best Term Life Insurance to satisfy your needs. Understanding the process and being prepared at each turn will make even the most novice consumer able to wade through all the ups and downs that are involved in buying Term Life Insurance. Start this journey today, give no second thought, and secure your future and that of your loved ones.

The Final Verdict: Safeguard Your Future with Canadian LIC

As we have explored the avenues and heard the stories of those exploring the world of Term Life Insurance in Canada, the one thing that became more than clear is this: with the right information handled correctly, this process becomes very simple. Thus, the initial complexities should not scare you. Like most Canadians, you too can take advantage of a Term Life Insurance Policy that shall befit individual needs and provide a feeling of reassurance.

Now, it’s all up to you. Talk to Canadian LIC, the number one insurance brokerage firm, and start on one of the most important journeys of your financial life with your own people. With friendly financial experts from Canadian LIC, you can avail yourself of the best Term Life Insurance Policy tailor-made to your life goals. Don’t hesitate, as it is about your future that needs to be secured.

By the end of this blog, you should feel equipped and ready to navigate the Term Life Insurance market in Canada with confidence. Whether you’re at the very beginning, headed toward retirement, or anywhere in between, the best Term Life Insurance Policy is at your fingertips. Choose to look into your options now and secure your legacy with peace of mind.

Find Out: The main disadvantage of Term Life Insurance

Find Out: Do Term Life Insurance rates go up?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Term Life Insurance in Canada

When comparing Term Life Insurance rates for seniors, an individual should consider their existing health and all financial obligations in determining for how long the coverage should remain intact. It was the case of Eleanor—a 70-year-old retiree from Edmonton—where she found that rates differed drastically based on the term length and if she was healthy. Eleanor spoke with various insurers, taking their quotes and comparing them quite thoroughly so that she could take up a policy that would meet her needs and also be quite affordable.

Choosing the right term for your Term Life Insurance Policy involves an assessment of how long you need the coverage to last. For instance, if you have young children, you might want a term that lasts until they are financially independent. Here’s the story of Amit, a dad from Surrey. He went for a 20-year Term Life Insurance Policy that would take care of his daughter’s education and upbringing in case something happened to him. By aligning the term with his daughter’s age, he was making sure that he had to provide financial support for her during those years of critical development.

Factors such as age, health, lifestyle, and how long you want coverage have to be considered. Take Paula, for example; she is an active and healthy non-smoker. She was able to get lower rates than her friend Tom, who was the same age but had health issues and was a smoker. That said, your own health status and lifestyle choices can significantly influence the rates offered to you.

Most Term Life Insurance plans are renewable at the end of the term, although premiums can rise based on your age at the time of renewal. That’s something George from Toronto learned firsthand when he renewed his policy at age 65. His premiums did go up, but the option to renew without submitting to a medical exam, in this case, gave him the continuity of coverage he needed for peace of mind.

Coverage ends at the end of the term on your Term Life Insurance Policy unless you renew the policy, convert it to a Permanent Life Insurance Plan, or buy a new one. Lily is 80 years of age and still vibrant; she has outlived her 30-year Term Life Policy. She had decided to convert her term policy into Whole Life Insurance Coverage, which would allow her to continue coverage and, in the end, allow for inheritance by her grandchildren. Remember that change is possible in your insurance, just as your life and needs evolve.

The plans of “simplified” or “guaranteed issue” under certain policies certainly wouldn’t require a person to have any kind of medical examination, though a majority of the insurers certainly would require a person to be submitted to a medical examination if a person desires to have a Term Life Insurance Policy. Of course, such policies are usually much more expensive in nature. Jack from Montreal took a simplified issue plan just because he hated doctors and hospitals. It meant higher premiums but required fewer questions and offered faster coverage.

Regular policy reviews and adjustments in your Term Life Insurance Policy are necessary to ensure that it always meets your requirements. Olivia from Calgary just needed to update her policy following her divorce to ensure proper financial protection was put in place for her new circumstance in life. In these situations, it is a clear necessity to have a yearly or post-majority life event review.

Of course, seniors can find affordable Term Life Insurance Coverage rates, but more often, it does entail doing their homework. For example, 72-year-old retiree Helen from Quebec was first looking at pretty stiff rates at the outset, just by how old she was. But she didn’t give up. Compare policies from competing providers, and you may find yourself eligible for a senior discount. She was able to negotiate a policy that would work within her fixed income. It’s all about shopping around and seeing what different insurers have to offer.

If you opt for a Term Life Insurance plan, do not shop for the premium only. You will want to compare the coverage amount, term length, renewal options, and benefits included or available, such as riders for critical illness. This is something Raj from Winnipeg learned when he found a great rate in a policy only to find out it didn’t cover enough of his health conditions. Don’t be that guy. Make sure you read all the details to have your policy cover what really matters to you.

To help you determine the right amount of Term Life Insurance, consider your financial obligations, future plans, and any existing debt or expense that would need to be covered if you were gone. Consider the case of Sarah and Tom from Brampton. They have calculated in such a manner that their needs are met, including children’s education, mortgage cost, and lifestyle maintenance. All this was properly taken care of; the family was sure of becoming financially secure without one another.

Common pitfalls by those who buy Term Life Insurance Coverage include:

Underestimating the needed coverage amount and the associated rates.

Not shopping around for the best rates.

Reading the fine print in an agreement.

For example, taking the case of Amit from Surrey, he is quoted the first amount, and after some time, he realizes that he would have got a better rate and more detailed coverage elsewhere. Always take your time comparing different policies and really know what you are getting into before jumping on the bandwagon.

Make sure to revisit your Term Life Insurance Policy after a couple of years at the very least or after making significant changes in life circumstances like marriage, divorce, having a child, or experiencing a significant leap in financial status. “When Maria from Toronto reviewed, she made it a point to check that the coverage fits her life every three years. When beginning her own business, a review showed a cover change.” Regular reviews of your policy will help ensure it continues to meet your needs.

In the event that you miss a premium payment, most insurers have a grace period thereafter, within which you can still manage to make the payment without your cover getting forfeited. But if you fail to make payment within the set grace period, your policy may lapse, leaving you without coverage. Michael from Halifax learned that lesson the hard way when he simply forgot to make a payment in the midst of his really tough financial stretch. Fortunately, he did contact his insurer right away, and he was able to get his policy reinstated by paying the overdue premium along with a small fee.

The premiums you pay on a term life policy are not tax-deductible in Canada. However, the benefit generally paid tax-free to your beneficiaries from the time of your death may well be considered your reward. This was a significant factor for Lisa from Vancouver, who was planning her estate and wanted to ensure her children would not have to worry about taxes on their inheritance from her life insurance.

These questions and stories expose the usual dilemmas and decisions involved in choosing and managing a Term Life Insurance Policy in Canada. With this perspective and that advice in mind, you can now approach your Term Life Insurance purchase informed and prepared, with confidence that you will be able to find a policy that suits your life situation and provides you with reassurance toward the future.

Sources and Further Reading

Financial Consumer Agency of Canada (FCAC)

Website: Canada.ca/en/financial-consumer-agency

Resource: The FCAC provides comprehensive guides and tips on choosing the right insurance products, including detailed sections on life insurance in Canada. It’s an official source for understanding regulatory aspects and consumer rights.

Insurance Bureau of Canada (IBC)

Website: IBC.ca

Resource: This bureau offers resources on various types of insurance available in Canada, including Term Life Insurance. It’s useful for gaining insights into insurance industry standards and practices.

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA.ca

Resource: The CLHIA provides information on life and health insurance products, offering guides and FAQs that can help consumers understand the nuances of Term Life Insurance policies.

Rate comparison websites

Examples: Websites like Ratehub.ca and Kanetix.ca allow users to compare insurance rates across different providers, which is particularly useful when searching for the best Term Life Insurance rates for seniors.

Further Reading

“The Life Insurance Toolkit” by the Financial Consumer Agency of Canada

This toolkit offers a breakdown of life insurance choices, including term life, helping you understand what type of insurance fits your needs.

“Understanding Life Insurance” by the Canadian Association of Insurance Brokers

This book offers insights into the life insurance industry in Canada, discussing different policy types and what consumers should be aware of before making a purchase.

“Insurance Essentials for Canadians” by Doreen Pendgracs

This book provides a primer on various forms of insurance, including life insurance, from a Canadian perspective, making it easier for consumers to make educated decisions.

Academic articles and research studies available on JSTOR and Google Scholar

For those interested in the academic perspective or detailed studies, searching terms related to “Term Life Insurance,” “insurance rates for seniors,” and “consumer insurance behavior in Canada” can provide scholarly articles and research findings.

Online Forums and Community Groups

Reddit communities such as r/PersonalFinanceCanada and r/Insurance

These forums can be invaluable for real-time advice and personal experiences shared by users who have navigated buying Term Life Insurance in Canada.

By exploring these resources and further reading materials, you can gain a richer understanding of the Term Life Insurance landscape in Canada, empowering you to choose a policy that best meets your personal and financial needs. These tools will also help you stay informed about changes and trends in the insurance industry that could impact your decisions.

Key Takeaways

- Assess your financial obligations and coverage needs to determine the right amount and term of coverage.

- Use online platforms to compare different Term Life Insurance policies and rates, saving time and effort.

- Consult with insurance agents or brokers for personalized guidance and to navigate complex insurance landscapes.

- Verify the financial strength of insurance companies through rating agencies like AM Best or Standard & Poor’s.

- Thoroughly understand the terms and conditions of your policy, including exclusions and coverage limits.

- Regularly review your policy to ensure it aligns with life changes such as marriage, childbirth, or buying a home.

- For seniors, plan for how age affects premiums and consider options for renewing or converting policies for longer coverage.

- While premiums aren't tax-deductible, the payout to beneficiaries is generally tax-free, making it a smart part of estate planning.

- Use resources like the Financial Consumer Agency of Canada and comparison websites to stay informed on insurance options.

- Stay updated on industry changes and new products to make informed decisions that optimize coverage and costs.

Your Feedback Is Very Important To Us

To better understand the challenges and concerns people face when buying Term Life Insurance in Canada, we have prepared a short feedback questionnaire. Your responses will help us improve our resources and provide more tailored guidance. Please take a few moments to share your experiences:

Your feedback is invaluable, and we appreciate the time you have taken to help us understand the Term Life Insurance landscape better. Thank you for sharing your experiences!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]