- Do Term Life Insurance Rates Go Up?

- The Relatable Struggles With Term Life Insurance

- Decoding Term Life Insurance Rates In 2024

- Understanding Rate Increases: Strategies And Solutions

- Average Cost Of Term Life Insurance By Age

- Engaging with Your Insurance Provider: Tips and Tactics

- The Final Verdict: Making The Wise Choice With Canadian LIC

Welcome to the elaborate study of the Term Life Insurance Rates in 2024 in Canada. Many people find it hard to understand the ins and outs of Term Life Insurance. This is especially true if they are new to the world of insurance or wish to make changes to a Term Life Insurance coverage they already have. This route is genuinely loaded with intricate details, unexpected turns, and, sure, a few inconveniences spread throughout the journey. But don’t worry! We’re here to help you see your way through all these challenges, especially when it comes to that most-important question, “Do Term Life Insurance Rates go up?”

The Relatable Struggles with Term Life Insurance

What if, one evening, you receive a Term Life Insurance Policy renewal notice in the mail? Your heart sinks a little as you notice the rates have gone up since you last checked. This all-too-common situation among Canadians often makes them feel confused and frustrated by the apparent unpredictability of term insurance life rates 2024. Why does this happen? How can you go through these changes without feeling lost or overwhelmed? Now, therefore, stay with us as we take you through these questions, sharing relatable stories with you and giving you the knowledge to make decisions with regard to your Term Life Insurance in 2024.

Decoding Term Life Insurance Rates in 2024

The Basics of Term Life Insurance Rates

So, first of all, let’s understand what is meant by “Term Life Insurance Rates.” Basically, these are the monthly payments that you are going to be required to make in order to be assured of a Term Life Insurance coverage in force for a certain “term” or period of time. This is what will be paid out if you die within that period. But here’s where it gets interesting – what determines these rates, and why might they change over time?

Let’s understand this better with a real-life story. Just like any other couple, Alex and Jordan decided to buy Term Life Insurance while purchasing their first home together. The premiums that they needed to pay at first were relatively within the budget. But as they were on their way through the renewal period, they were surprised that the rates were up. In this matter, a question arises: “Is it just normal? Did we make mistakes?”

Find Out: Do you get money back from Term Life Insurance?

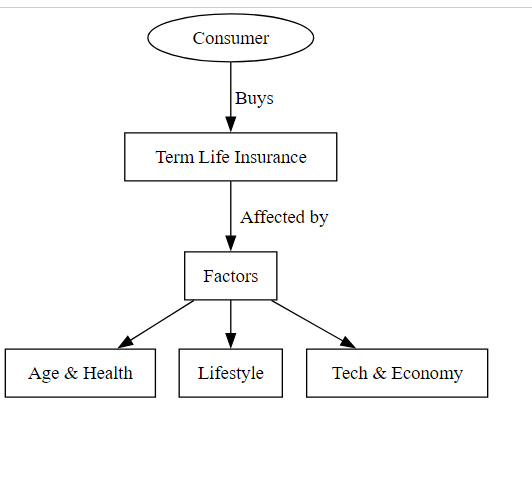

Factors Influencing Term Life Insurance Rates

The Term Life Insurance cost may be influenced by a number of things, which might include your age, health, lifestyle, and the amount of coverage you want. Naturally, as a person grows older, so will the level of premiums go up, since the level of risk to be taken by the insurers increases as one gets older. Changes in your health or lifestyle (like starting to smoke) can also impact your rates.

But beyond individual factors, there’s a broader picture. The industry itself is set at the mercy of economic conditions, regulation changes, and medical technology advances. All these factors could cause insurers to adjust how they assess risk and, therefore, premiums.

Trends in Term Life Insurance Rates for 2024

And in 2024? The trend tells us that while remaining very competitive, several factors contribute to rate adjustments. For example, advanced technology in health monitoring gives insurers a reason to offer even more personalized rates, which are a double-edged sword for policyholders.

Understanding Rate Increases: Strategies and Solutions

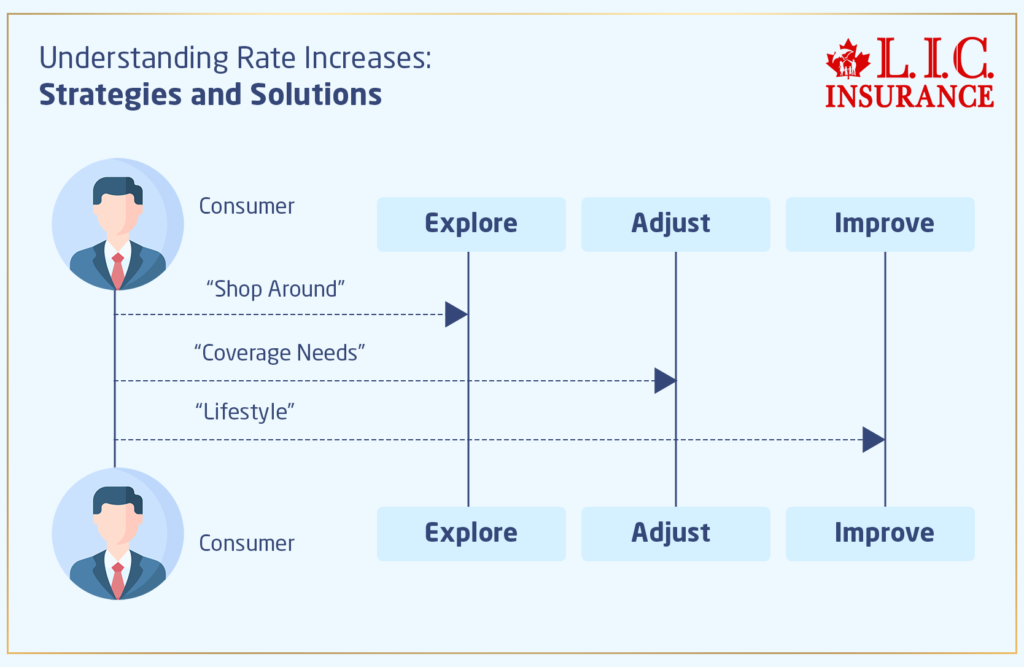

Shop Around for Competitive Rates

This, then, is all the more reason to shop around when your rates on your Term Life Insurance coverage are headed north. Rates from insurers can differ greatly, and in fact, what was the best deal just a few years ago could be far from it now. Use online comparison tools or consult with an insurance broker to find the best rates available to you.

Reevaluate Your Coverage Needs

Your insurance needs change with every stage of life. For example, you may have initially purchased insurance to protect a mortgage you now have very little balance on. Reevaluating your coverage amount may lead to lower life insurance premiums.

Consider Lifestyle Changes for Better Rates

Basically, the life you lead largely determines the rates you pay for your insurance. Simple changes, such as quitting smoking or improving your fitness, can lead to lower premiums. Insurers often offer better rates to individuals who demonstrate a commitment to healthy living.

Average Cost of Term Life Insurance by Age

Tabular Representation of Annual Term Life Insurance Rates ($500,000 Coverage for 20 Years, Preferred Health Applicants)

Rates for Non-Smokers

| Age | Men’s Yearly Rate | Women’s Yearly Rate |

|---|---|---|

| 20 | $221 | $181 |

| 30 | $225 | $190 |

| 40 | $340 | $288 |

| 50 | $288 | $655 |

| 60 | $4,575 | $3,187 |

Rates for Smokers

| Age | Men’s Yearly Rate | Women’s Yearly Rate |

|---|---|---|

| 20 | $775 | $557 |

| 30 | $815 | $670 |

| 40 | $1,497 | $1,163 |

| 50 | $3,526 | $2,565 |

| 60 | $8,773 | $6,155 |

- Data source: Quotacy, based on the lowest three rates averaged for each category. Premiums are calculated monthly over one year, as of March 20, 2024.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Engaging with Your Insurance Provider: Tips and Tactics

With Term Life Insurance Rates changing constantly, it’s more important than ever to keep the lines of communication open with your life insurance companies. We will, therefore, try to guide you on how to hold a constructive discussion with your insurer so that your Term Life Insurance does not fall out of line with what you need and expect.

Understanding Your Policy Inside Out

Now, suppose you are Maria, and you have just finished looking over your Term Life Insurance Policy with terms and clauses that you can’t quite understand. Maria, being Maria, got a hold of her life insurance company for clarification on the matter regarding the policy. Make sure you understand the coverage, from how much is provided to even the possibility of changing rates, and don’t ever be surprised by it later on. Never hesitate to ask your life insurers to explain any complex insurance jargon or complicated insurance matters. This understanding forms the foundation of a transparent and beneficial relationship with your insurer.

Regularly Reviewing Your Policy

Life changes, and so do your insurance needs. Take the example of David, who has children just out of college, and he is left over-insured. You can also keep your Term Life Insurance Policy up to date and lower your rate by telling the life insurance company about all the changes in your life. This way, the coverage will change to reflect those changes. It is helpful to review either annually or when life-significant events have occurred, such as marriage, the birth of children, or purchasing a home; this will ensure that the coverage does not get out of alignment with the needs and financial goals.

Understanding Rate Changes

When Sarah noticed her Term Life Insurance Rates 2024 had increased, her initial reaction was one of frustration. However, rather than accepting the hike as a given, Sarah engaged in a conversation with her provider to understand the reasons behind the rate adjustment. It’s vital to inquire why your rates have changed and what factors have contributed to this increase. This may clear or, in some cases, even result in an allowance to understand the reason for the changes in rates and negotiate rates or find alternative coverage that is more favoured on either side.

Exploring Discounts and Loyalty Programs

Most companies provide discounts and loyalty programs, a fact many policyholders are not aware of. Take, for example, the case of Alex, who finds out he is liable for receiving a discount because he belongs to a professional association. Looking at discounts can, in fact, see your Term Life Insurance premiums knocked down a peg or two. Those can be from your profession, lifestyle habits, or the simple fact that you have multiple Term Life Insurance policies from the same insurer. Do not hesitate to ask your provider what kind of discount programs you could avail of to make your Term Life Insurance Policy cheaper.

Providing Feedback and Expressing Concerns

Remember, communication is a two-way street. Just as you are seeking clarity and support from your life insurance companies, they are also seeking it from your feedback. In case, like Jenna, you have some concerns with regard to your policy or, for that matter, the level of service that you are receiving, make it a point to address these concerns. Constructive feedback may lead to better services and policies that will ensure quality service delivery to the policyholders. Your insurance provider is supposed to serve you, and you can be of great help in making them better at serving their clients.

Staying Informed About Industry Trends

Economic conditions, technological advances, regulatory reforms—the life insurance landscape is always changing. Knowing and being aware of such trends may help one make a future-based decision in coverage. For instance, since you find out that the rates across the industry are projected to rise, you may want to consider locking into a longer-term policy so that you are guaranteed of the current rates.

In doing so, you will keep your Term Life Insurance Policy within the limits of your specifications while at the same time establishing a relationship with your insurer based on mutual understanding and respect for each of the parties. Therefore, engaging your insurer should not be an annual one-off task but the beginning of a perpetual dialogue that will help protect your financial future. Let your journey with Term Life Insurance in 2024 be one of informed decisions, clear communication, and confidence in the coverage you’ve chosen.

The Final Verdict: Making the Wise Choice with Canadian LIC

As we wrap up our journey through the landscape of Term Life Insurance Rates 2024, remember that knowledge is power. Like most great things in life, insurance coverage can be daunting, but you can surely get what you need. Whether you meet those rate increases face to face or just looking to make the most informed decision about your insurance needs, Canadian LIC is here to help. We want to provide you with the best coverage options that adjust to your particular case. Don’t let confusion or uncertainty hold you back from securing the protection you and your loved ones deserve. Contact Canadian LIC today, and take the first step towards peace of mind with a Term Life Insurance Policy that’s right for you.

By engaging with this blog and seeking solutions together, we can demystify Term Life Insurance and make informed decisions that benefit us all. Do not let fears of rate hikes keep you from saving up your future in good financial shape. Instead, let’s approach Term Life Insurance with confidence, equipped with all the information and encouragement you might require to make the best decisions for your family and yourself.

Find Out: The longest Term Life Insurance you can get

Find Out: All about Term Life Insurance in detail

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

Imagine Sarah: she had this great rate locked in for her Term Life Insurance Policy at age 30. Now, at 40, she is seeing her rates for the renewals of her policy coming in at a higher bracket. So, just like Sarah, you may be wondering why this happens. Term Life Insurance Rates can generally change because of the age and the health of the insured, as well as because of the risk assessment by the insurer. With age, the risk increases, and the insurance company may need to pay out benefits. Economic factors and advancements in healthcare and technology also play roles in adjusting these rates over time.

Alex just doesn’t want to suffer through another increase in rates, so he asks his insurance broker if he can “lock them up.” The answer is “yes,” and the answer is “no.” When purchasing a Term Life Insurance Policy, you set your rates for that term. For example, if you purchase a 20-year term policy in the year 2024, your rates are level until the term has expired; however, when it comes time for renewal, your rates are then recalculated based on your age and possibly other factors at that time. Choosing a longer term can help you enjoy stable rates for more years.

Liam wants to make sure he’s getting the best deal on his Term Life Insurance. To find out which company offers the cheapest Term Life Insurance in 2024, Liam needs to shop for Term Life Insurance policies with at least three to five different insurers. Tools and websites which compare rates can be invaluable. Therefore, you may want to work with an independent insurance broker who gives impartial advice and is always looking to get you the best rates for your specific needs. And, of course, reevaluate your needs from time to time. Perhaps your life situation has qualified you for lower rates or changed in a way that you don’t need the high-dollar policy.

Jenna, a new fitness enthusiast, wonders whether quitting smoking really will make a difference in her life insurance premiums. Age, health, lifestyle choices (such as smoking), term length, and the length of the term life policy are among the factors affecting it. In the event of positive changes in your health and lifestyle, this may warrant more favourable rates. It’s always a good thing to let your insurer know of such changes so that you may be eligible to pay lower Term Life Insurance premiums.

Miguel is comparing a 10-year Term Life Insurance Policy with a 20-year term. He does find that rates for the longer term period are indeed higher. And he wonders why it is so. In fact, the term length has a direct effect on your rates, and it does this by changing the risk to the insurer over the changed period of time. A longer one would lock your rate in for more years, reducing the risk of increasing rates as you age within that period of time. However, that also means the insurer assumes greater risk in paying out, which is reflected in the higher premium. Choosing the right term length depends on balancing your need for coverage with the life insurance premium you’re comfortable paying.

Elena, who is trying to tighten up her budget, searches for ways to cut down her life insurance premiums without cutting off her coverage. Several ways can be followed to reduce the Term Life Insurance Policy premium: One is leading a healthy lifestyle; insurers do offer lower rates most of the time to those who are at very minimal risk of developing health-related issues. You could also consider adjusting your coverage amount if your financial responsibilities have decreased. Also, shopping around is likely to unravel cheaper alternatives for insurance. One would also be wise to review one’s policy regularly to ensure that it is offering the needed protection and not over-insured.

After getting a renewal notice with such a massive increase, Tom wonders what can be done. If your rates on Term Life Insurance have gone up considerably, then one thing to do would be to call the insurer and understand the reason for the same. There could be an error, or there could even be provisions in your current policy pertaining to making an adjustment in the rates. The error could also emanate from your insurer, or within your current policy, there are provisions that give room for rate adjustment. One should also consider shopping around for quotes from other insurers to find a better rate. Finally, consulting with a financial advisor or insurance broker can provide personalized advice on how to proceed.

So, with these FAQs, we tried to dig deeper into Term Life Insurance Rates 2024 and the Term Life Insurance policies. Remember, each case is different, and what worked for Sarah, Alex, or Jenna may not be an ideal solution for you. Always consider your individual needs and circumstances when making insurance decisions.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]