Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

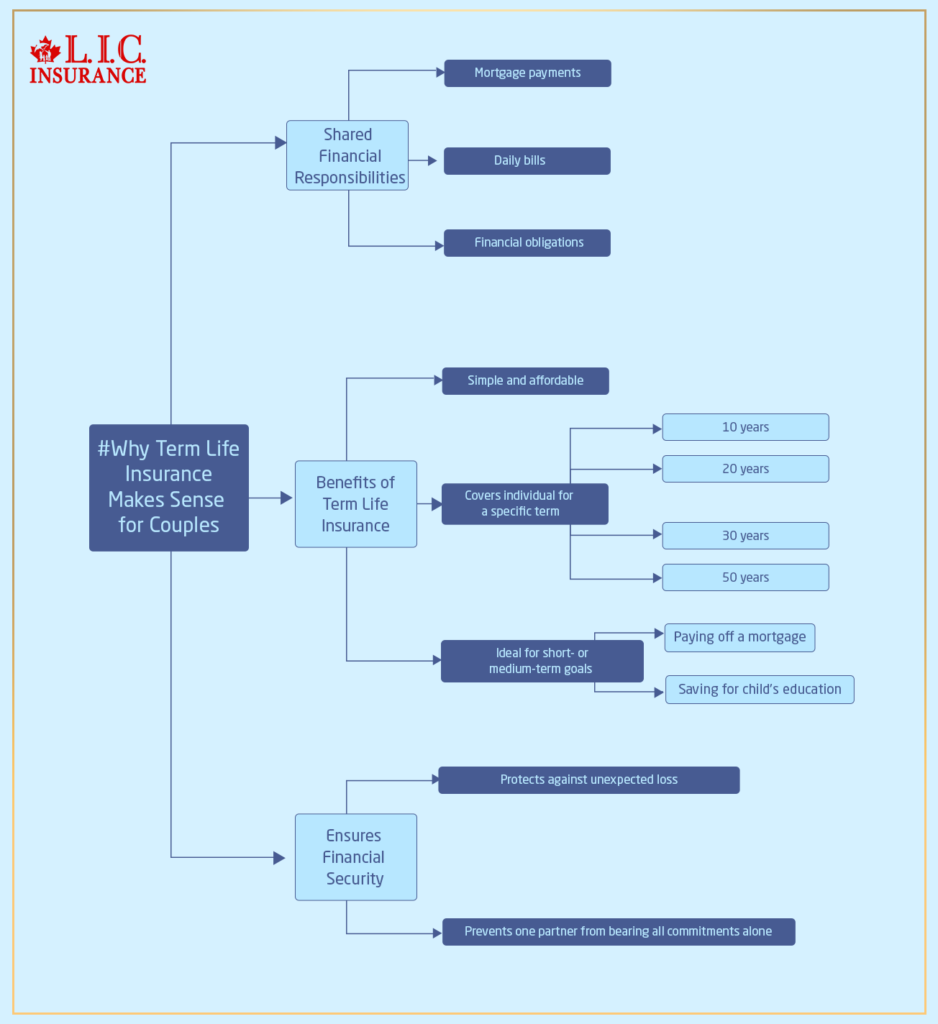

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

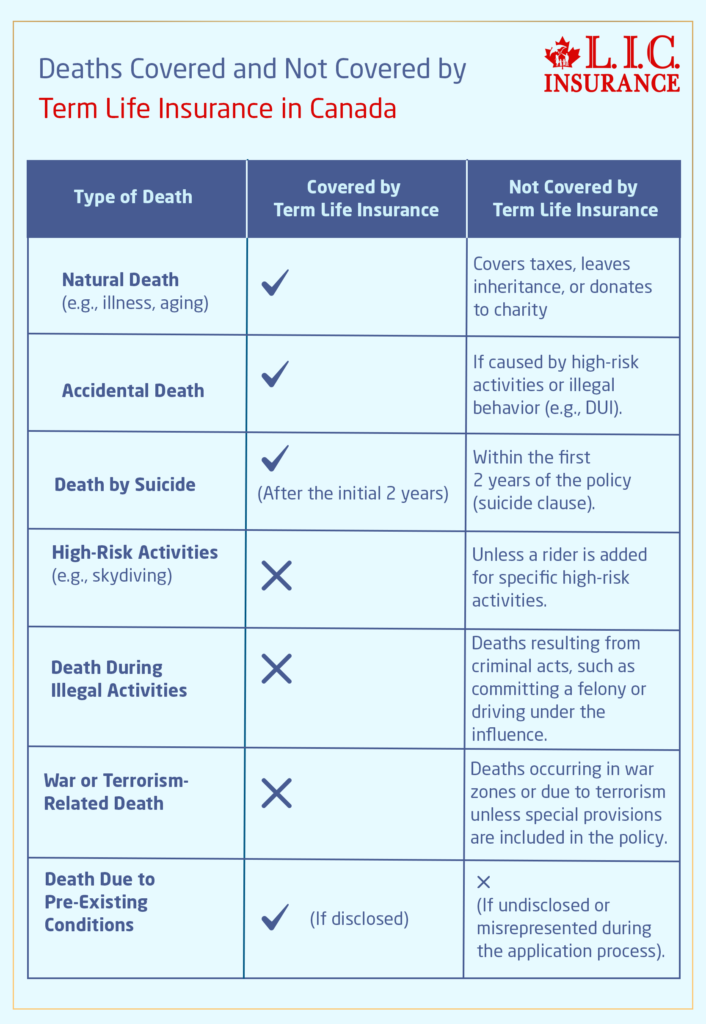

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Who Is The Largest Provider Of Term Life Insurance?

- Why the Biggest Life Insurance Company Matters for Your Term Life Insurance Plan

- Leading Term Life Insurance Providers in Canada

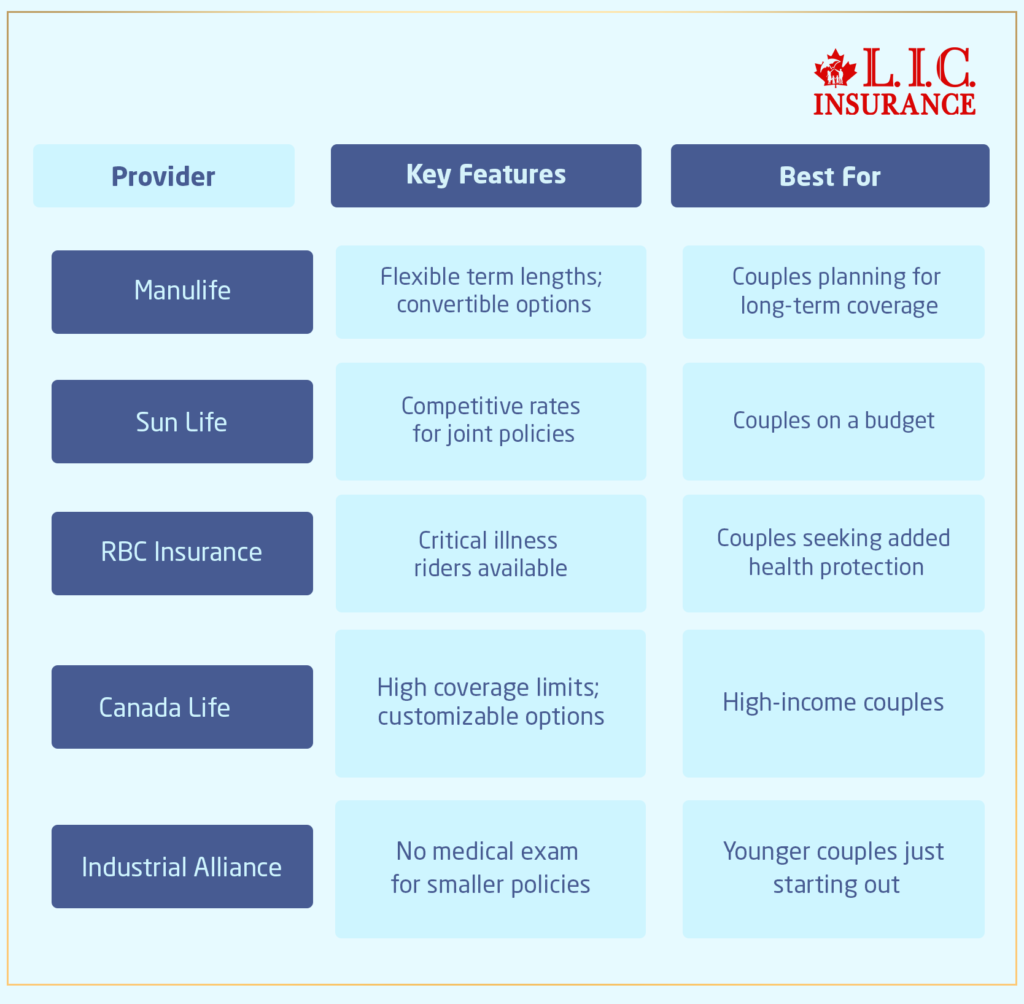

- Comparison of Leading Term Life Insurance Providers in Canada

- Key Features Shared by Top Providers

- Comparing Term Life Insurance Plans

- Real Struggles: The Importance of Choosing the Right Provider

- Advantages of Working with Canadian LIC

- Choosing Canadian LIC for Your Term Life Insurance Needs

- Common Misconceptions About Largest Life Insurance Companies

- Conclusion: Taking the First Step Toward Financial Security

Who Is The Largest Provider Of Term Life Insurance?

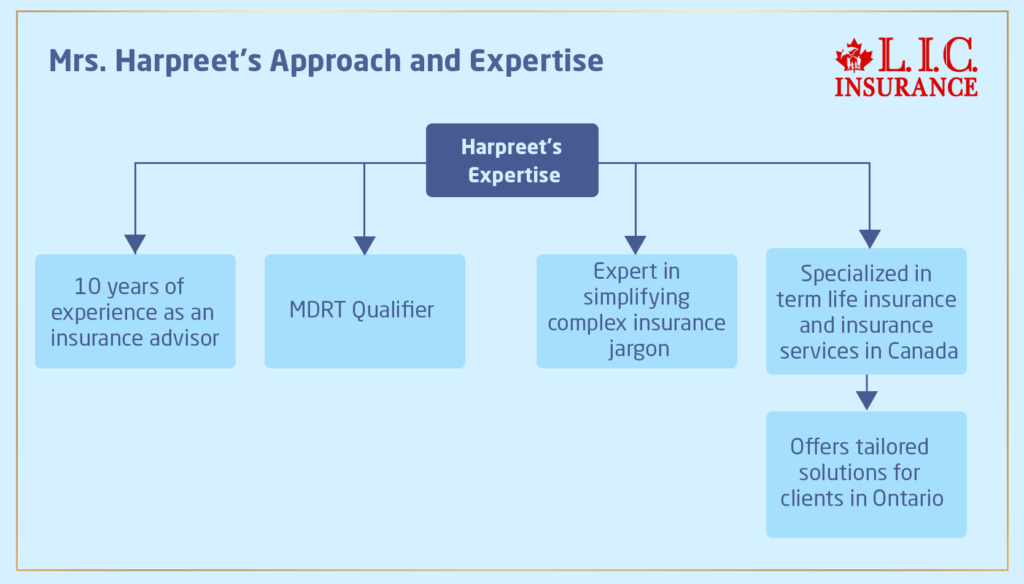

By Harpreet Puri

CEO & Founder

- 11 min read

- January 28th, 2025

SUMMARY

Learn about Canada’s largest Term Life Insurance providers, of which some trusted names are Manulife, Canada Life, Sun Life, and RBC Insurance, further illustrating their offerings: flexible Term Life Insurance Plans, customizable options, and tools like the estimator calculator to come up with the number of premiums. Its article also stresses the importance of Term Life Insurance Agents and buying Term Life Insurance online with Canadian LIC to get highly professional advice and competitive quotes on policies.

Introduction: The Search for Trustworthy Term Life Insurance Providers

Term Life Insurance is somewhat overwhelming when there is so much to choose from. Many people, actually, end up confused about which one to trust. Sometimes, it is the fear of not getting the best rate, and sometimes, it’s the stability and dependability of the insurers. You might be wondering, “Who is the biggest provider of Term Life Insurance in Canada, and why does that matter to me?

This is not a rare question, and at Canadian LIC, we often hear the same concerns from clients. For example, a family contacted us, unsure of whether their coverage was adequate or not. A smaller firm had insured them but was unsure of whether it was going to perform well in the long term. There are many examples like this. It is vital to find a strong, established provider. Now, let’s look at the leaders in the Term Life Insurance market in Canada and how one can make a good decision.

Why the Biggest Life Insurance Company Matters for Your Term Life Insurance Plan

When buying Term Life Insurance, the size and reputation of the organization are matters of great importance. Usually, the largest providers are the companies that have enough financial power and a record of stability and resources to pay claims within the given time frame, making policyholders stress-free about their arrangements. A strong provider also provides Term Life Insurance Plans for varying needs with excellent support services and flexibility, like a Term Life Insurance Calculator.

The smaller providers may offer a competitive rate, but without experience, some clients are hesitant to commit. The well-established Canadian Life Insurance Companies ensure you will benefit from the experience, reliability, and continued innovation.

Leading Term Life Insurance Providers in Canada

Many are the industry giants of Term Life Insurance in Canada, and each company is building its own competitive advantage in providing different solutions tailored to various customer needs. Many have earned credibility through financial soundness, strong customer satisfaction ratings, and leading-edge insurance innovation. Below is a closer examination of some of the largest players dominating the market in Canada:

Manulife Financial

Manulife Financial is a common name in the conversation when it comes to Term Life Insurance providers in Canada. Its scale alone, in combination with an international presence, means millions of people place their trust in the name. Manulife offers an expansive range of Term Life Insurance products, so clients have easy access to suitable Life Insurance options according to budget and level of coverage needed.

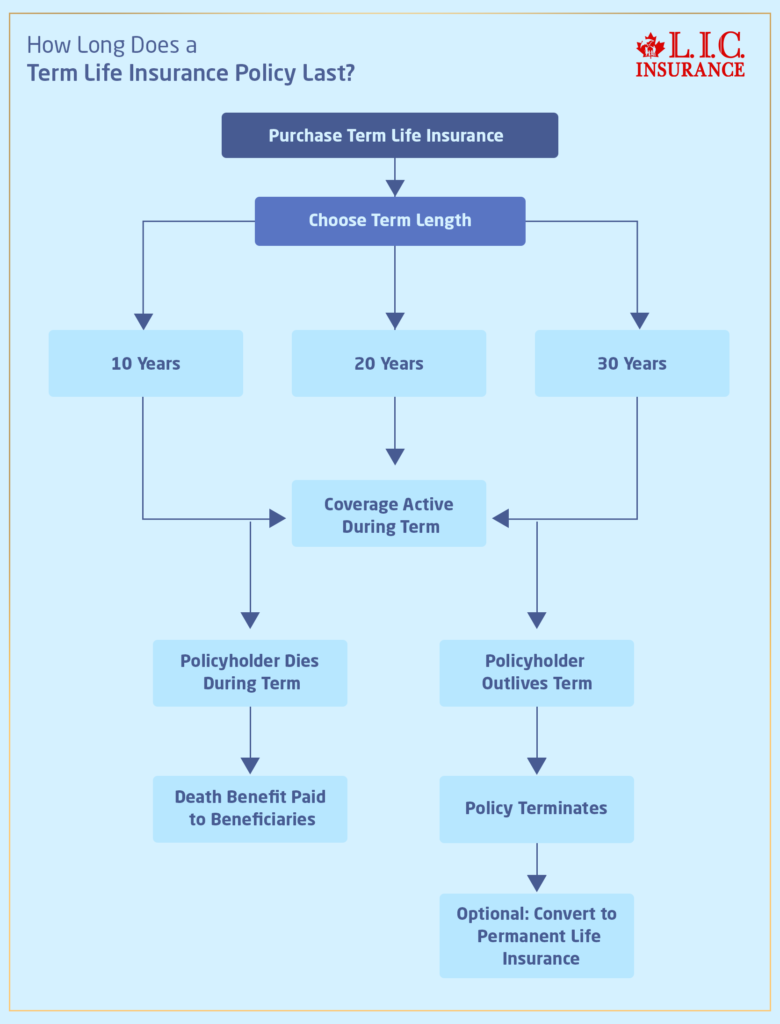

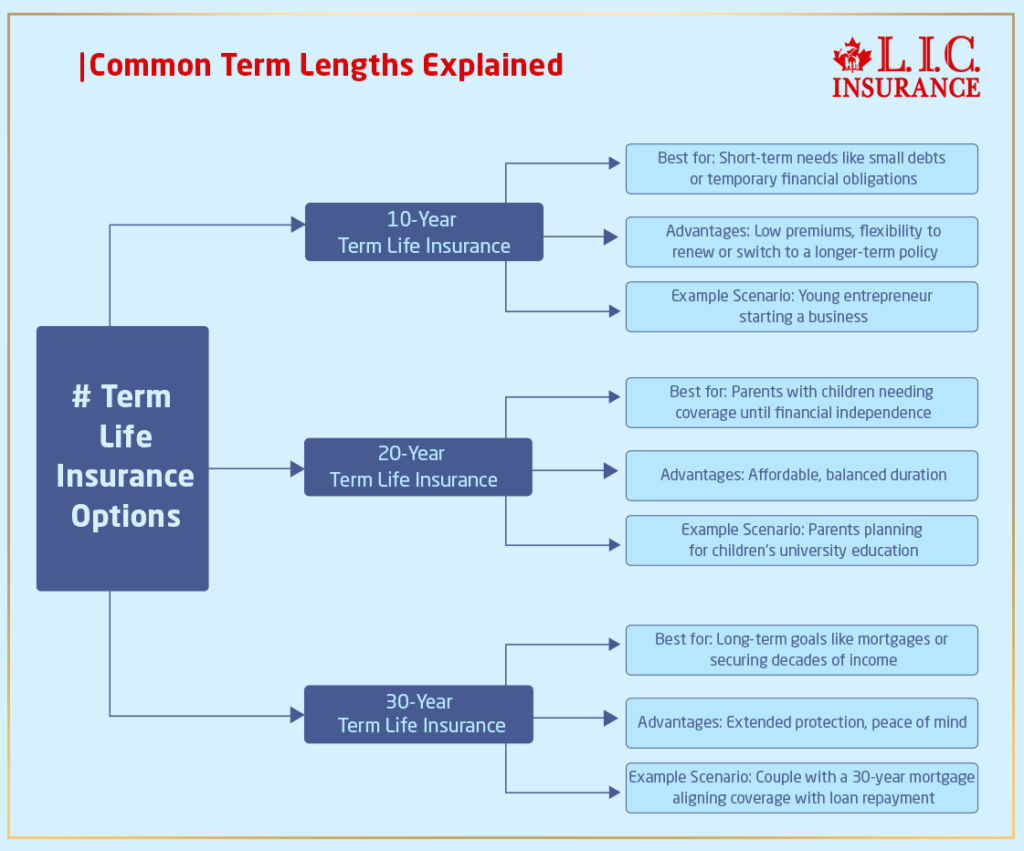

Flexibility in Plans: The products offer flexibility in plans. Manulife offers term policies for durations between 10 and 30 years. This appeal goes to the family, young professionals, and retirees, who may have different savings targets.

Online Tools: Using the Manulife Term Life Insurance Calculator, customers can determine the Life Insurance Premiums and vary the levels of coverage for more control over finances.

Strong Customer Support: Their network of Term Life Insurance Agents ensures that clients receive guidance every step of the way, from initial inquiries to claim settlements.

Manulife is innovative and committed to service, making this a top choice among many looking for Term Life Insurance bought online or through trusted brokers such as Canadian LIC.

Canada Life

Founded more than 175 years ago, Canada Life has truly earned its position of leadership in the Canadian life insurance market. The company, famous for its strength in finances as well as product diversity, appeals to a diverse clientele, from basic life coverages for individuals to Group Insurance solutions for businesses.

- Customizable Coverage: Canada Life provides Term Life Insurance Plans, which can be tailored to individual needs. Add-ons, such as Critical Illness or Disability Insurance, are also available for added coverage.

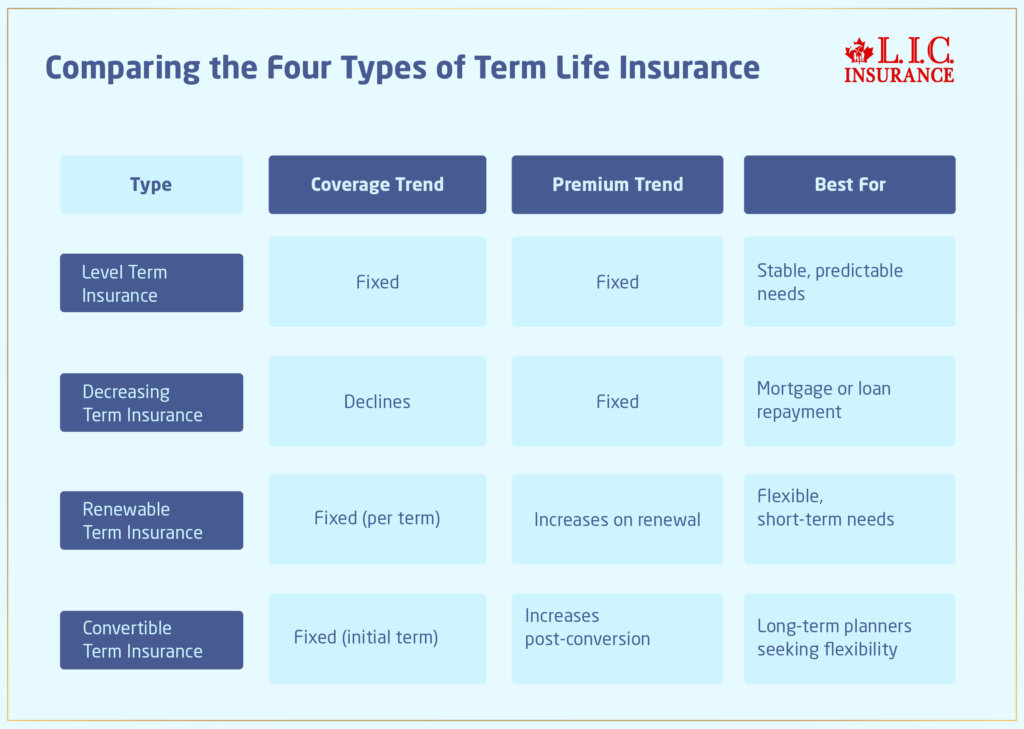

- Renewable and Convertible Policies: Renewal and conversion with convertible Canada life policies generally provide the advantage of renewables in Canada life and the option to make them available at maturity and the Convertibility of plans and policies end.

- Customer-Focused Service: Canada Life will develop strong relationships with its policyholders with the help of a strong network of Term Life Insurance Agents who are fully capable of breaking down the purchasing process.

This provider is especially popular among families and small business owners who value reliability and personalized service.

Sun Life Financial

Sun Life Financial is also a giant of the Canadian life insurance industry. With a motto of simplicity and accessibility, Sun Life has brought about a straightforward experience for those clients looking into Term Life Insurance Plans.

- Overall Protection: Sun Life offers term insurance options in every variety of premium coverage, ranging from small coverage plans to several million-dollar coverage packages according to the client’s different needs and sources of funds.

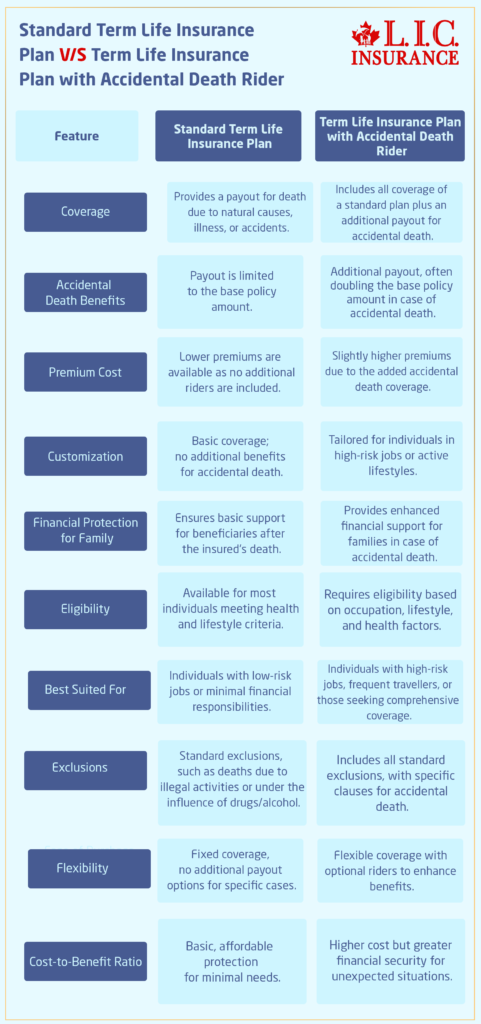

- Optional Add-Ons: Riders, such as accidental death or waiver of premiums, are available under optional add-ons. They can modify the policy based on their demand and create further comprehensive protection for a family.

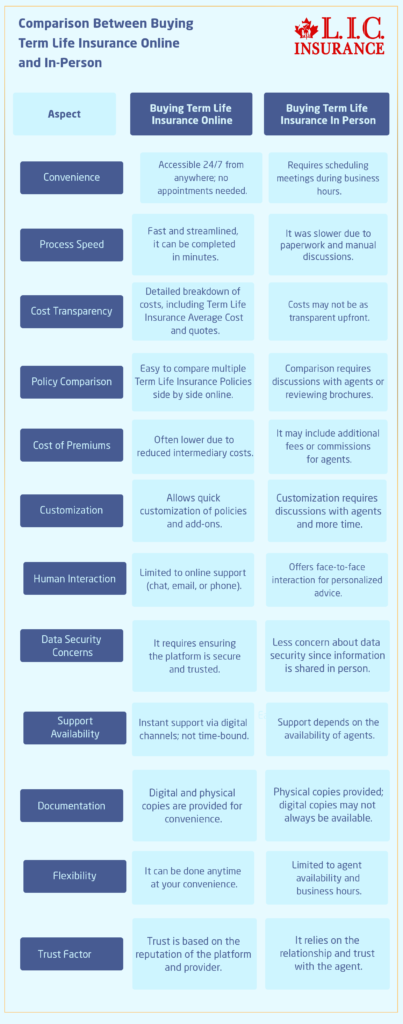

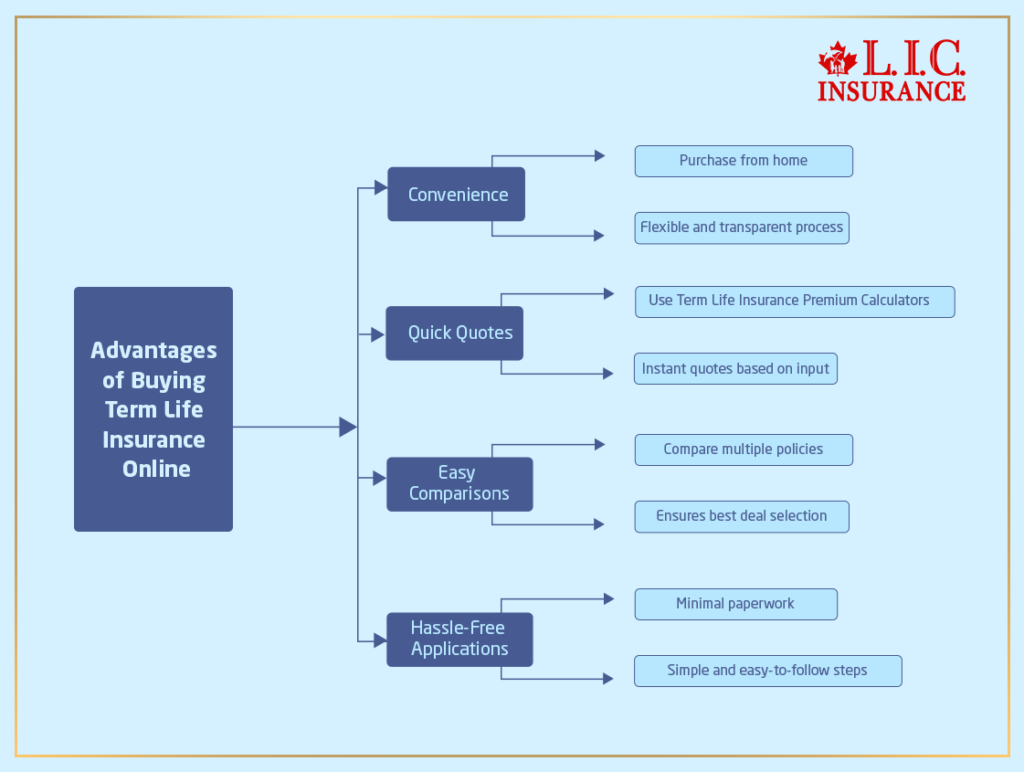

- Digital Innovations: The company offers a smooth online experience, enabling seamless client access for calculation of premiums, comparison of Term Life Insurance Policy Quotes, and even purchase of Term Life Insurance online.

The customer education initiatives by Sun Life make it the best choice for first-time buyers since they give clear information to help clients make informed decisions.

RBC Insurance

RBC Insurance is one of the leaders in the Canadian market in providing Term Life Insurance. The balance sheet strength and wealth of the Royal Bank of Canada support this. Its Term Life Insurance products are tailored to suit the needs of individuals, family wealth protection, and business owner protection.

- Flexible Terms: RBC offers Term Life Insurance with flexible terms ranging from 10 to 40 years.

- Competitive Rates: The company has transparent pricing through a Term Life Insurance Calculator. This enables the client to compare quotes from various policies, saving money in the process.

- Streamlined application process: RBC has made the application and management of policies easier for clients, thereby ensuring easier coverage.

RBC Insurance is especially attractive to those who like the idea of dealing with a company that has financial experience combined with insurance specialization.

Industrial Alliance (iA Financial Group)

Industrial Alliance (iA Financial Group) has a long history of offering affordable and reliable Term Life Insurance Plans. As one of the largest insurance companies in Canada, iA aims to make life insurance accessible to a broad audience.

- Affordability: The best option for iA Financial Group is that they are known for their competitive pricing and are hence preferred by people seeking quotations for low-priced Term Life Insurance policies.

- Customizable Solution: Add a child rider to the policy to increase the scope or add Disability Cover.

- Strong Customer Support: iA’s Term Life Insurance Agents offer personalized support so that clients are well aware of their options and can choose the right plan for their needs.

With its client-first approach, iA Financial Group has become one of the most trusted names in the Canadian insurance landscape.

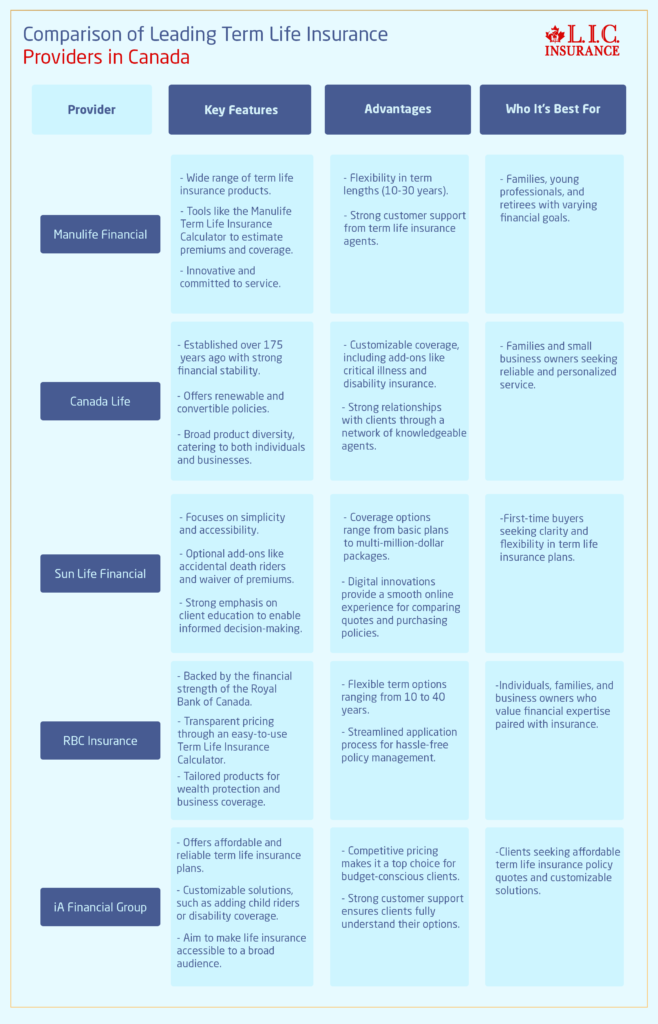

Comparison of Leading Term Life Insurance Providers in Canada

Key Features Shared by Top Providers

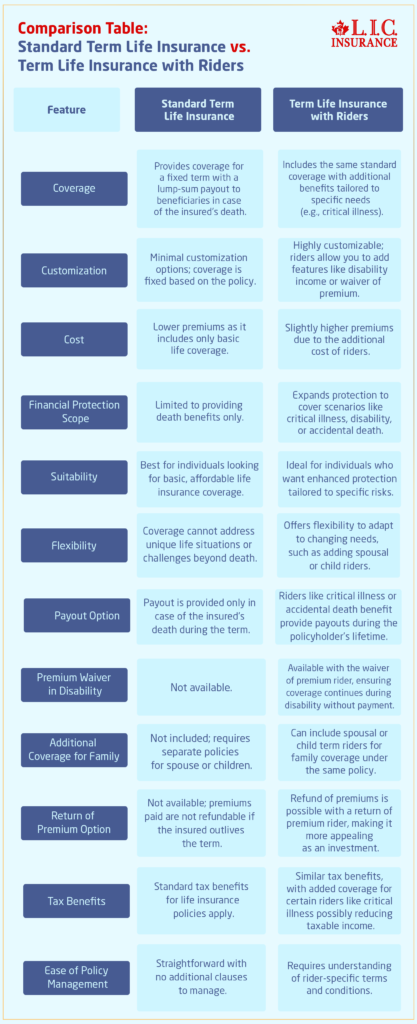

Some of the similarities and dissimilarities among Canada’s biggest insurance companies of Term Life Insurance include the following:

- Financial Stability: All the providers have an excellent record of financial stability to provide an adequate meeting of obligations.

- Wide Range of Options: They have several variations in the length of terms, coverage amount, and add-on options to suit any client’s needs.

- Digital Tools: Most service providers have simple platforms, including calculators, with which clients can estimate the premiums and make the right decisions.

- Customer Satisfaction: Another area is that such service providers make sure that the claims are dealt with very effectively and in a transparent manner.

Selecting one of these providers will make you feel confident about your family’s financial security for the future. At Canadian LIC, we collaborate with all these top players to provide you access to competitive quotes and expert advice that will be helpful for your needs. If you want to purchase Term Life Insurance online or have guidance in person, we are here to help you make the right choice.

Comparing Term Life Insurance Plans

The choice of a Term Life Insurance Plan would necessitate comparison from several providers. Though cost would generally be the determinant factor, there are other factors to consider. Here is what you should know:

Premium Costs

Use a Term Life Insurance Calculator to calculate premiums on other policies. For example, large providers like Manulife and Sun Life give clients good knowledge of exactly what they pay for.

Flexibility

Some companies provide conversion options, which enable policyholders to convert term into Permanent Life Insurance without further medical underwriting.

Coverage Amount

Make sure that your Term Life Insurance policy will be ample for the coverage of the family’s future financial expenses, mortgage, and education costs.

Real Struggles: The Importance of Choosing the Right Provider

We encounter many clients who wish they had compared Term Life Insurance quotes from bigger companies. One such instance was a single mother who, for the reason of lower premiums, chose a small life insurance company at first. However, she found that filing a claim was a nightmare, so she approached Canadian LIC. With our guidance, she switched to a policy of one of Canada’s biggest companies, and this gave her peace of mind about the future of her family.

Advantages of Working with Canadian LIC

As Canadian LIC, we bridge the gap between clients and Canada’s most esteemed Term Life Insurance providers. Understanding that finding an appropriate policy could be confusing in itself, experienced agents of Term Life Insurance at LIC guide you toward a personalized outcome aligned with your financial goals.

- Obtain Competitive Quotes: Get the best prices in Term Life Insurance policies using top providers from our list.

- Compare: Easily compare plans by using our resources, which may even include a Term Life Insurance Calculator.

- Receive Expert Advice: Our team will understand your specific needs and suggest the best option based on your priority.

Choosing Canadian LIC for Your Term Life Insurance Needs

At any time, buying a Term Life Insurance Plan would appear to be quite an endeavour, considering that so many providers are vying for attention. Thanks to Canadian LIC, many families have been successfully counselled on financial protection and security under Term Life Insurance Plans. Clients love that simplicity, clarity, and honesty resonate when dealing with us.

Upon making an online Term Life Insurance purchase from Canadian LIC, you obtain:

- Reliable policies backed by Canada’s largest providers.

- Dedicated Term Life Insurance Agents who are available to assist every step of the way.

- Customized solutions to ensure you get the most out of your coverage.

Common Misconceptions About Largest Life Insurance Companies

Some clients fear that the bigger companies will not give them personalized service or that their premiums will be higher. This is often an unfounded fear. Most of Canada’s biggest Term Life Insurance companies take pride in satisfying customers and even offer online calculators to help keep premiums competitive.

Conclusion: Taking the First Step Toward Financial Security

Selection of the right provider for Term Life Insurance is considered one of the most important decisions you can make. The major Life Insurance Companies in Canada, such as Manulife, Canada Life, and Sun Life, all offer stability and flexibility with very comprehensive coverage options for families. With Canadian LIC as your partner of choice, enjoy these benefits from the comfort of personalized service.

Ready to secure the future of your family? Find the right Term Life Insurance with Canadian LIC. Start now and get Term Life Insurance Policy Quotes, or use our Term Life Insurance Calculator today. Let’s secure your loved ones’ financial well-being, regardless of what lies ahead.

More on Term Life Insurance

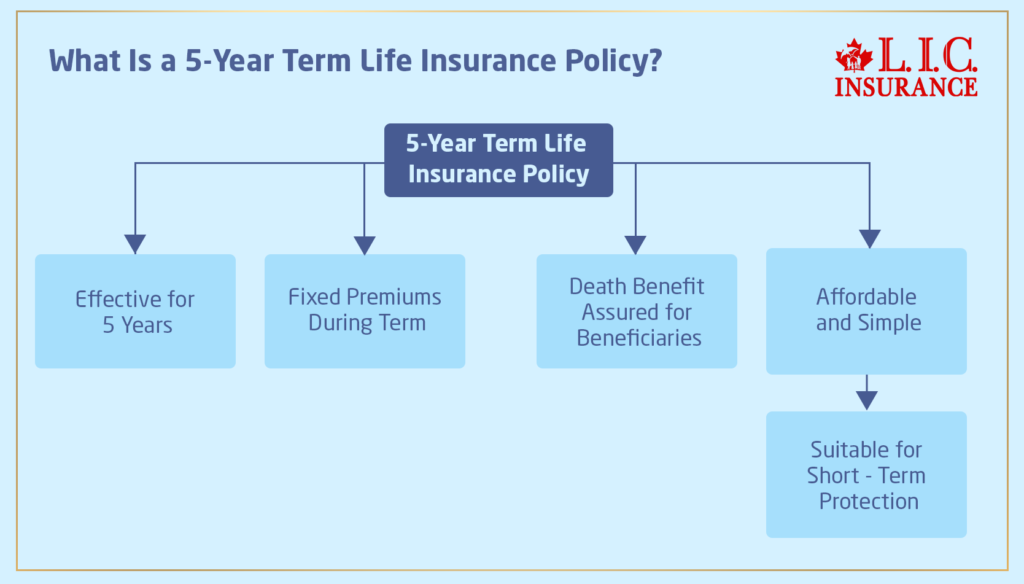

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

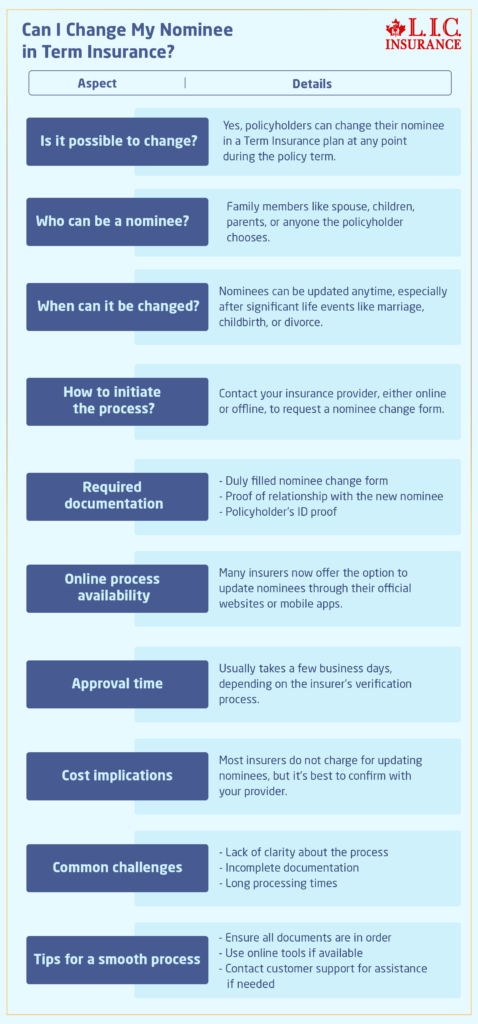

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

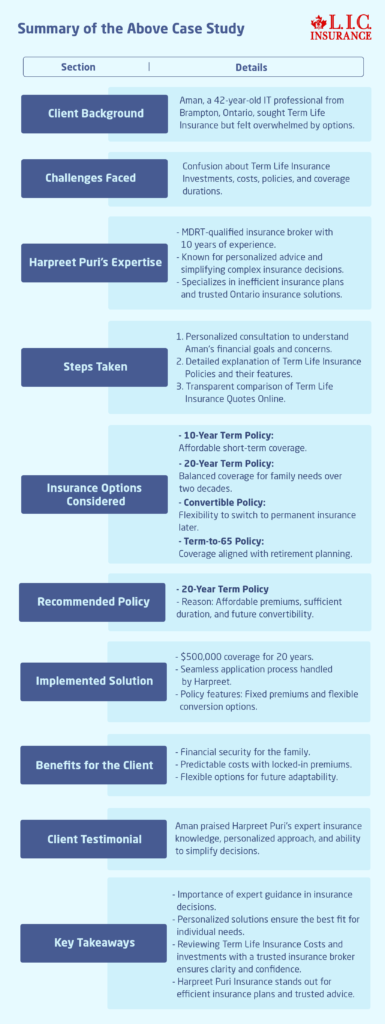

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

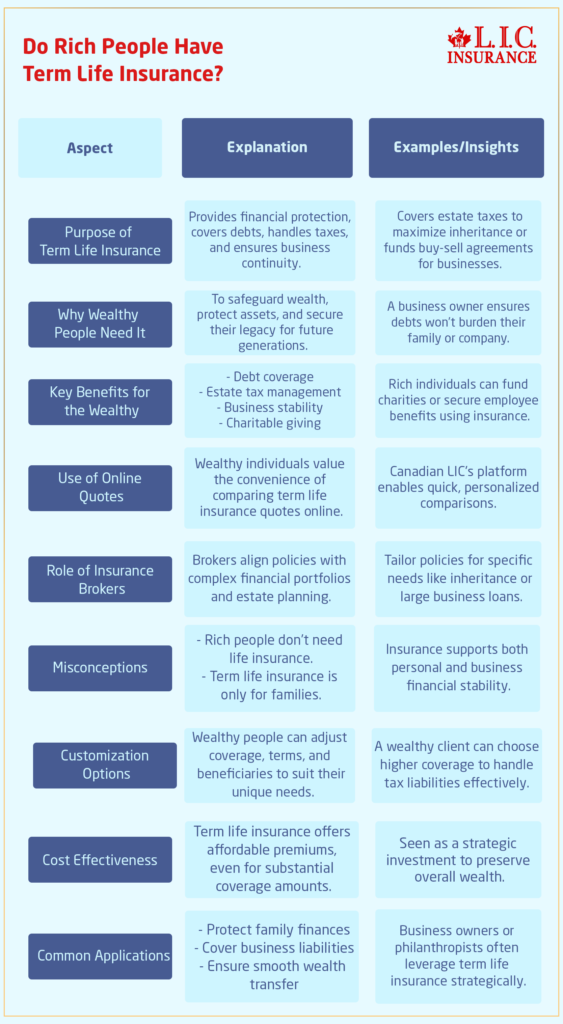

- Do Rich People Have Term Life Insurance?

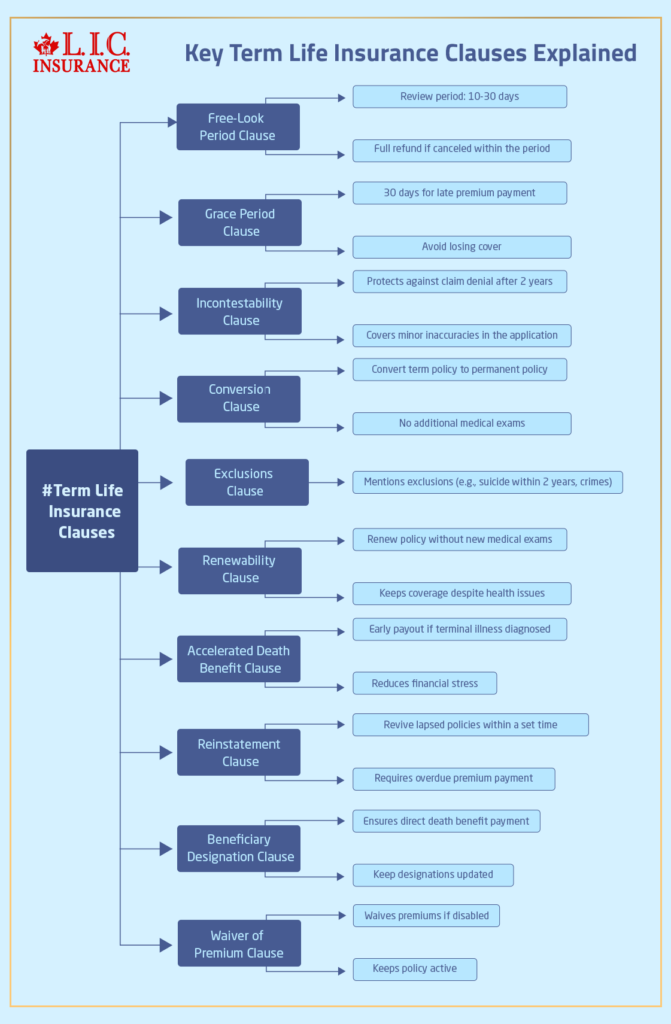

- What Are The Common Term Life Insurance Clauses?

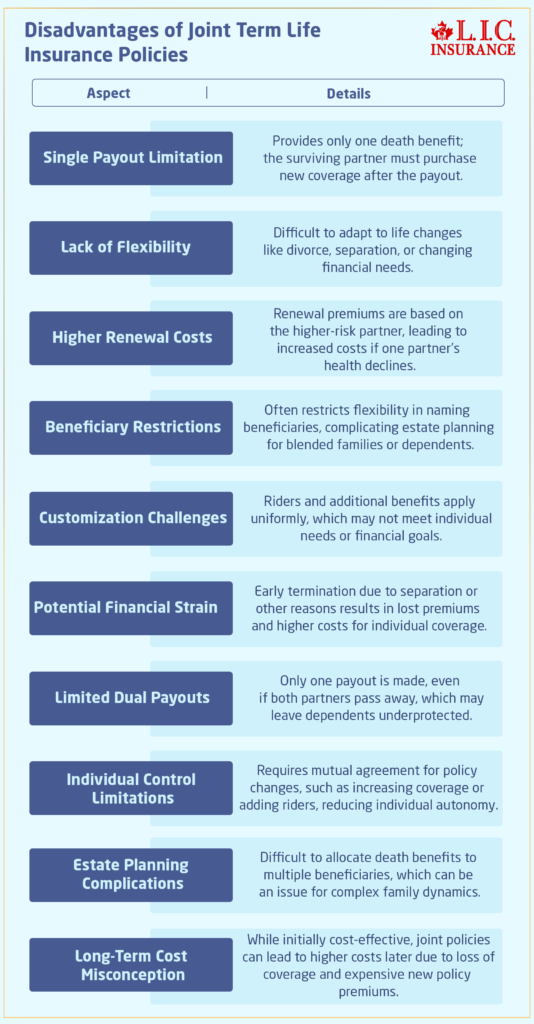

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

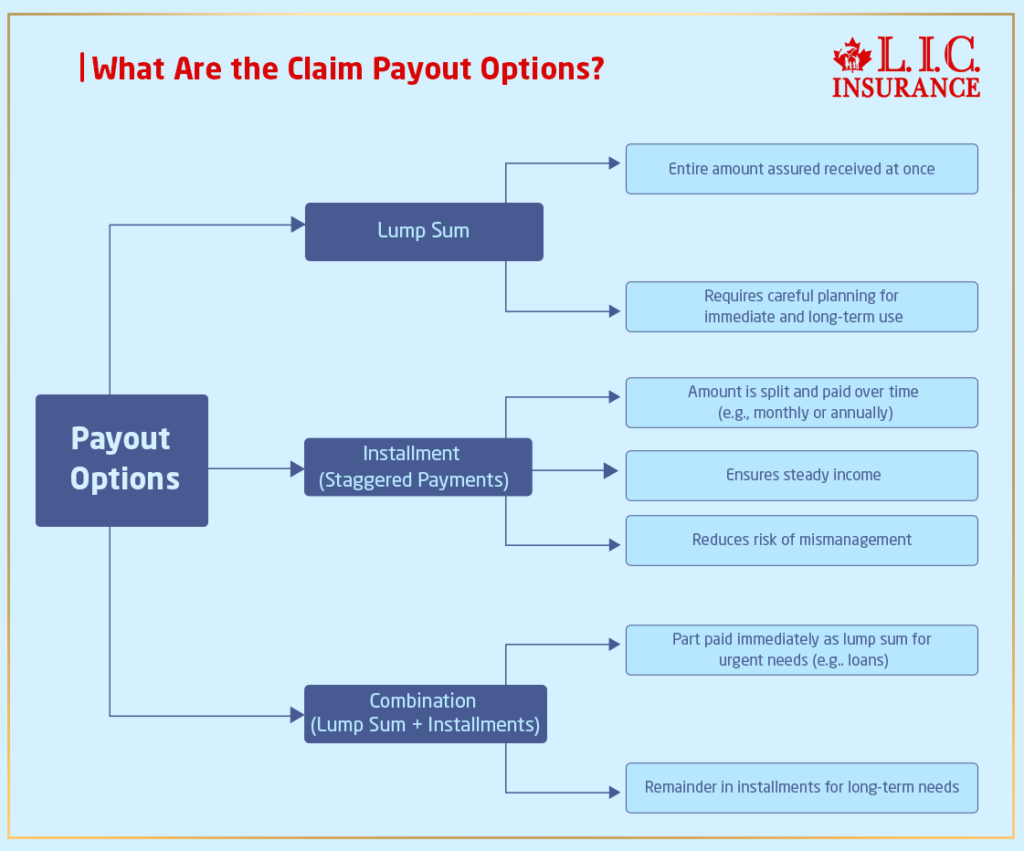

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

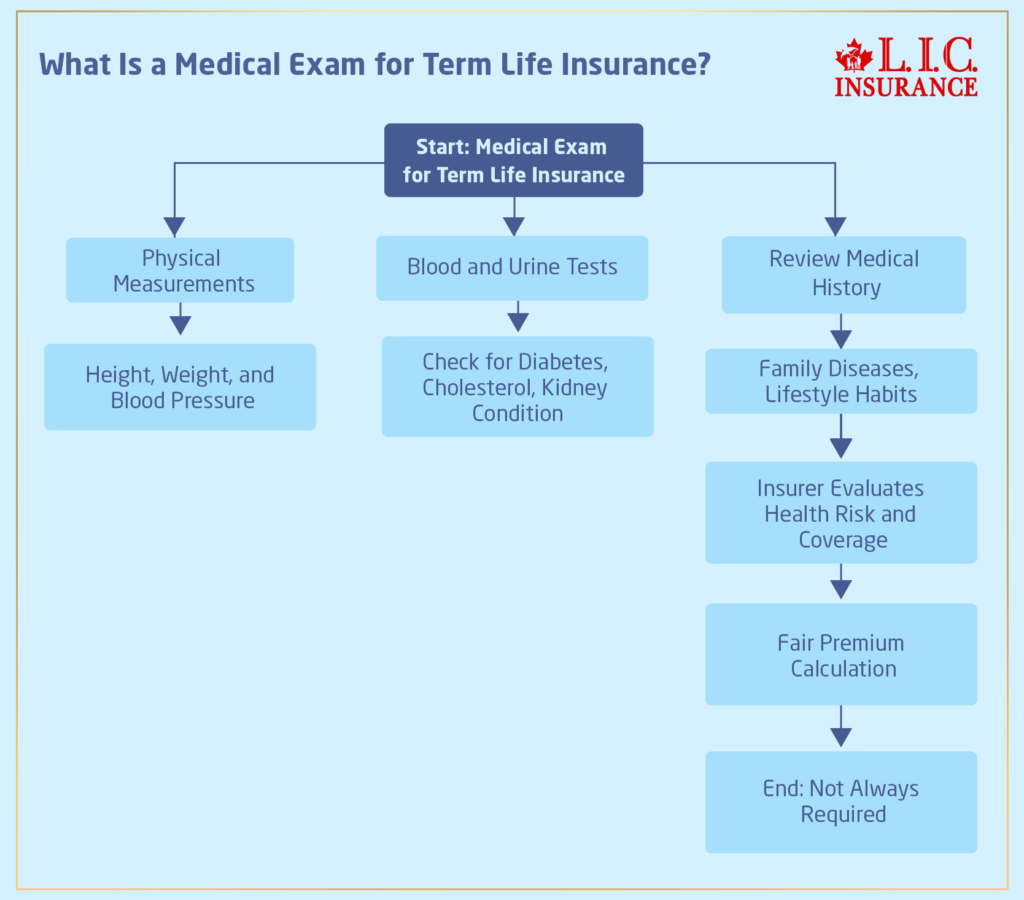

- Is There a Medical Exam for Term Life Insurance?

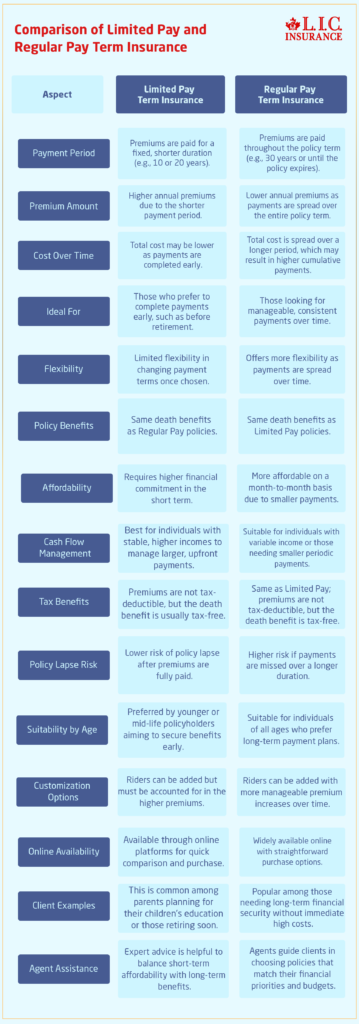

- Limited Pay vs Regular Pay Term Insurance

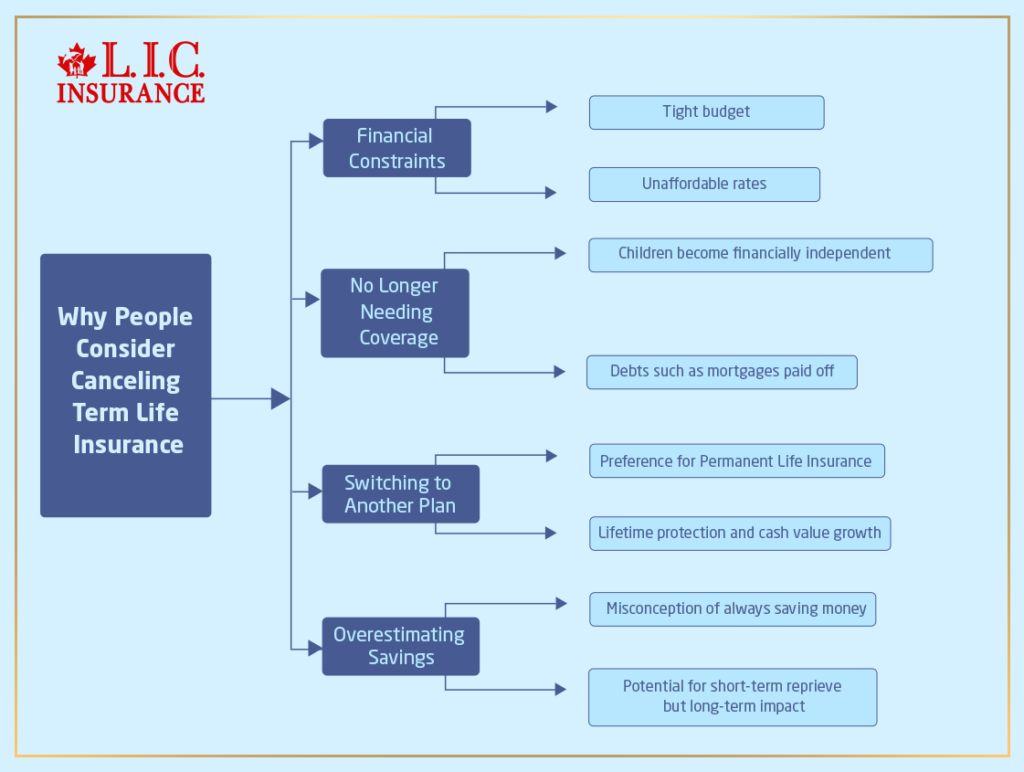

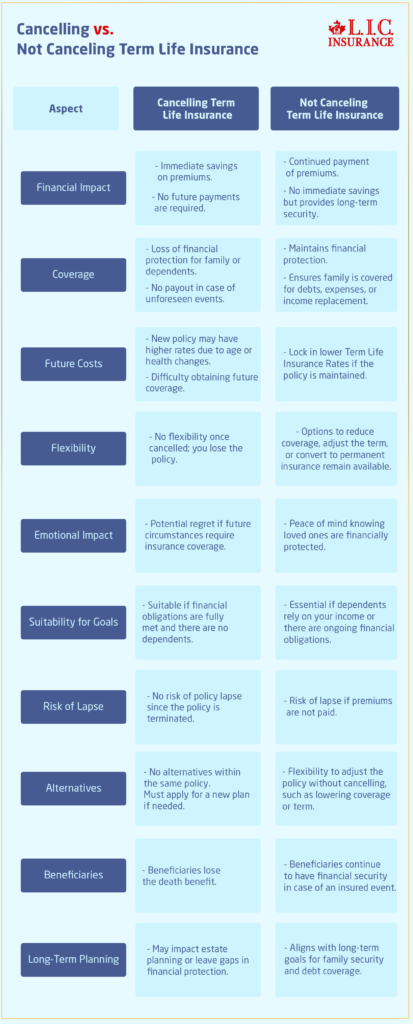

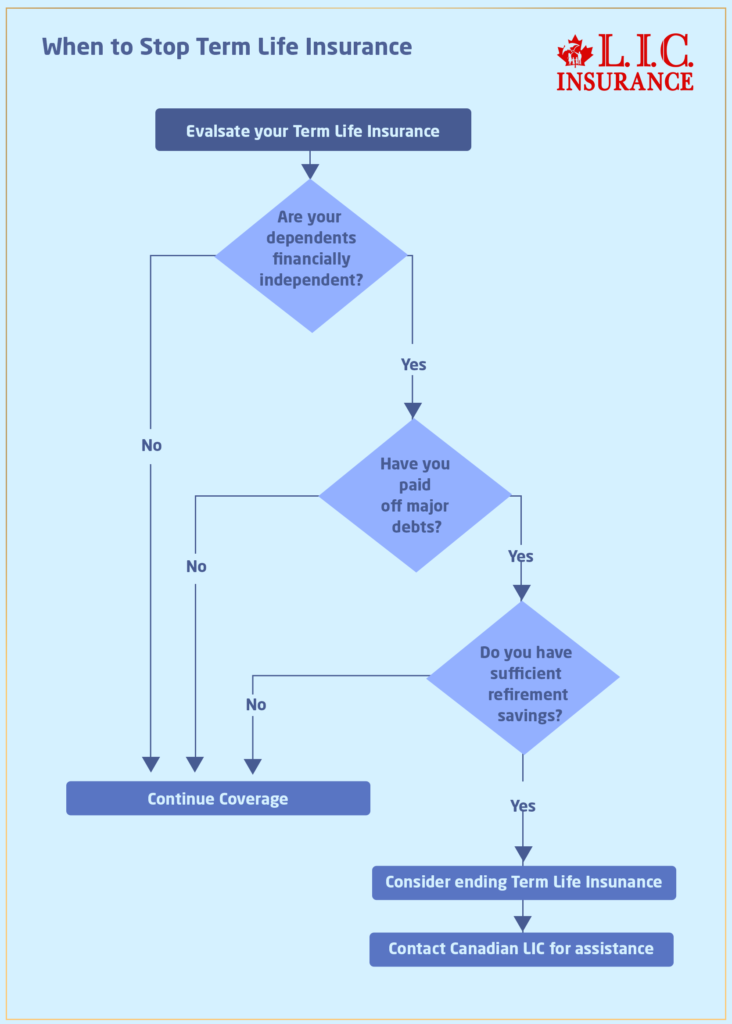

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

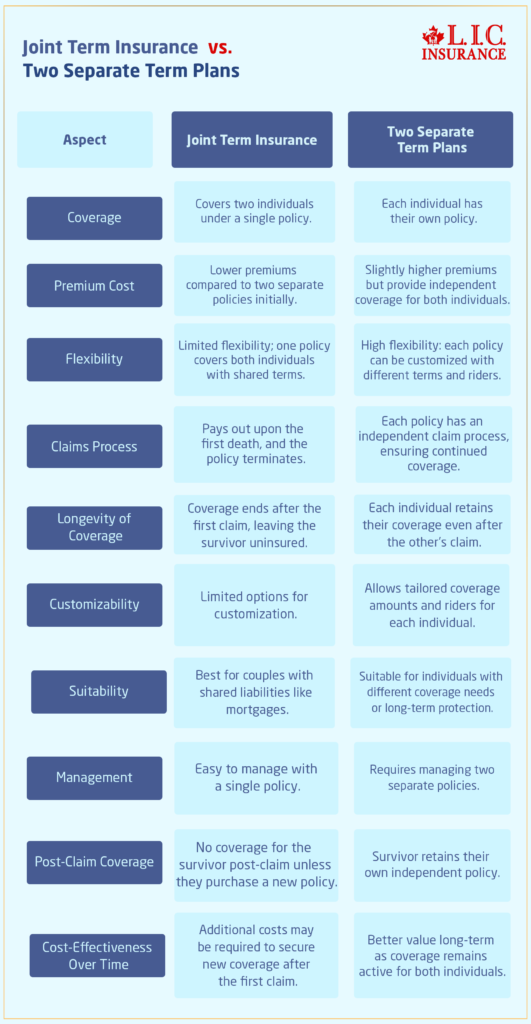

- Joint Term Insurance VS. Two Separate Term Plans

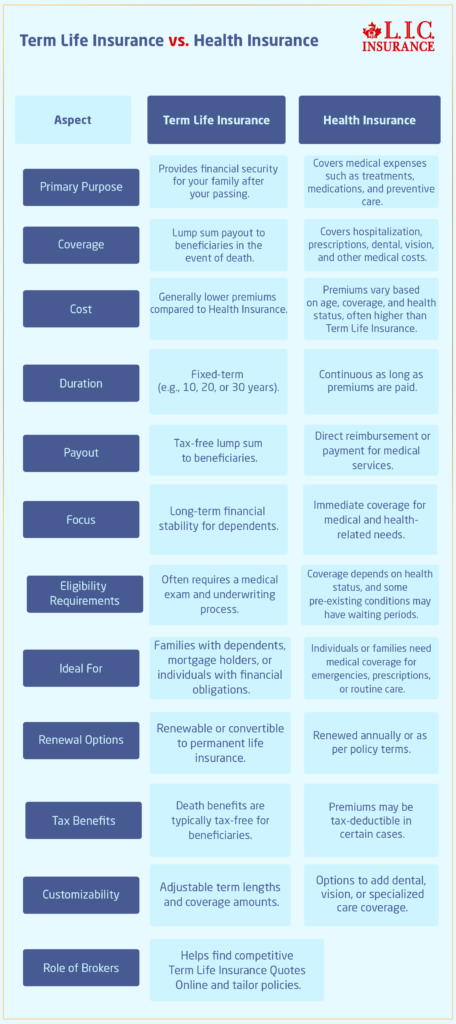

- Which Is Better – Term Insurance Or Health Insurance?

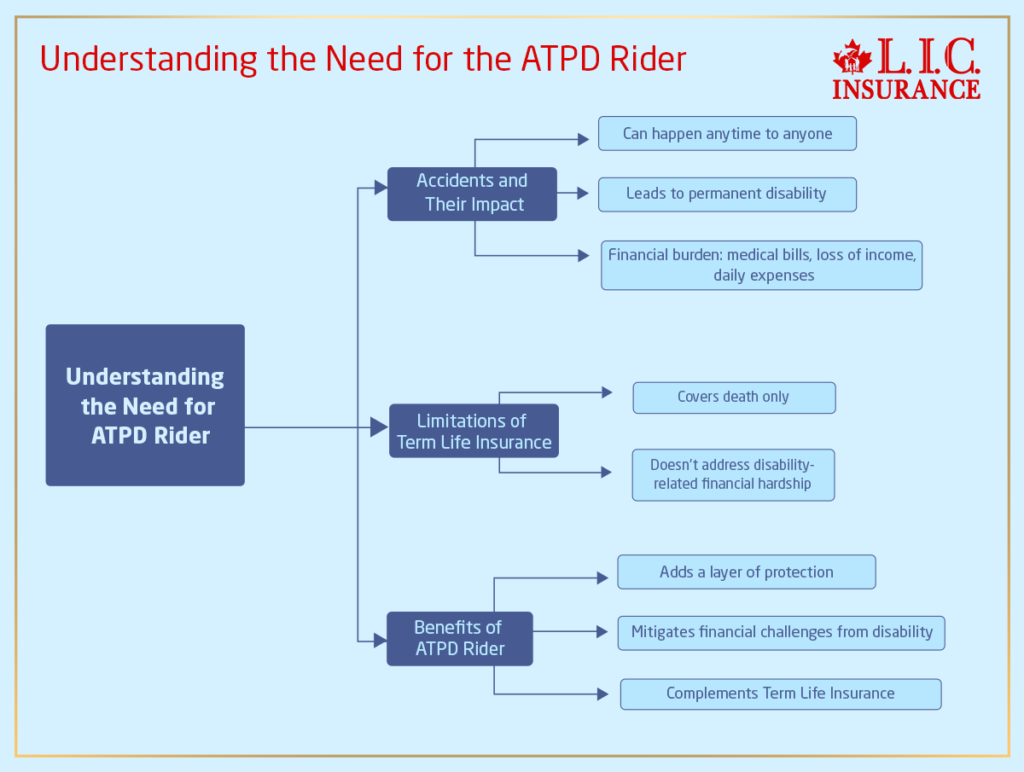

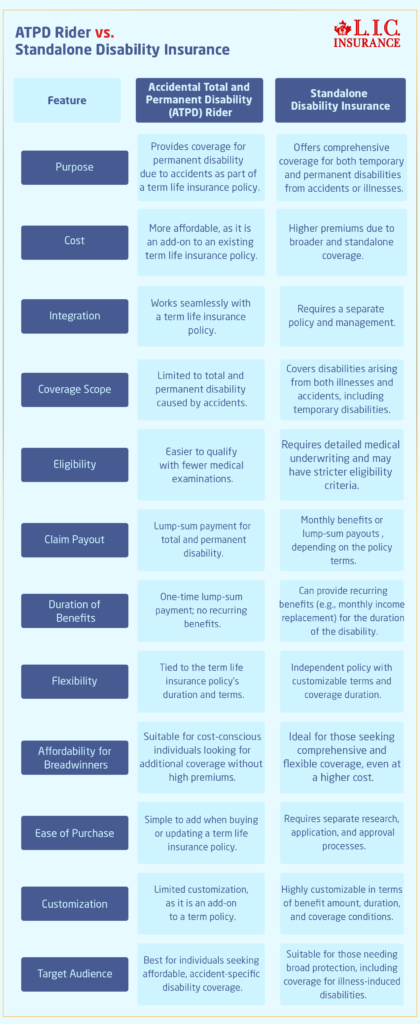

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

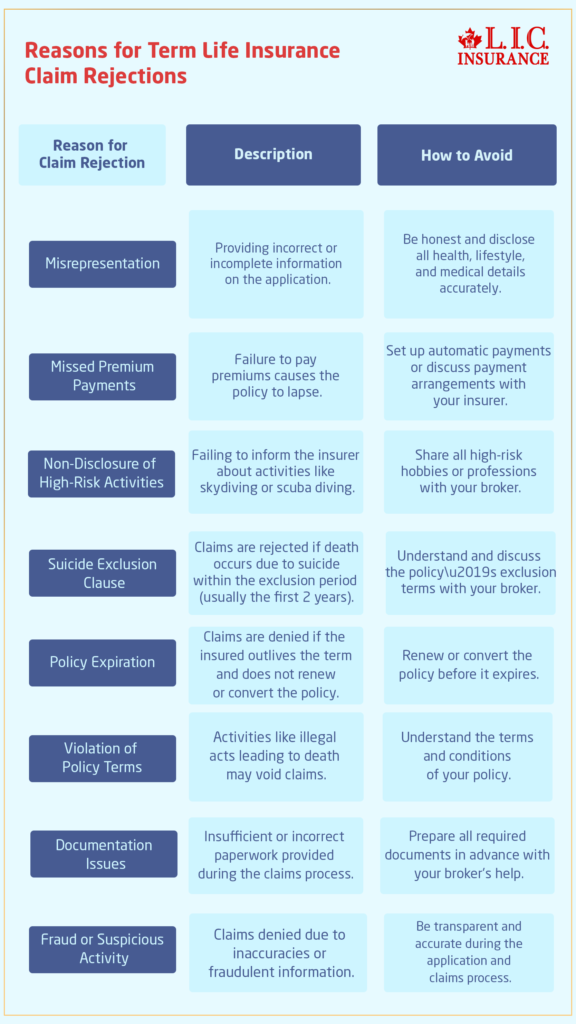

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

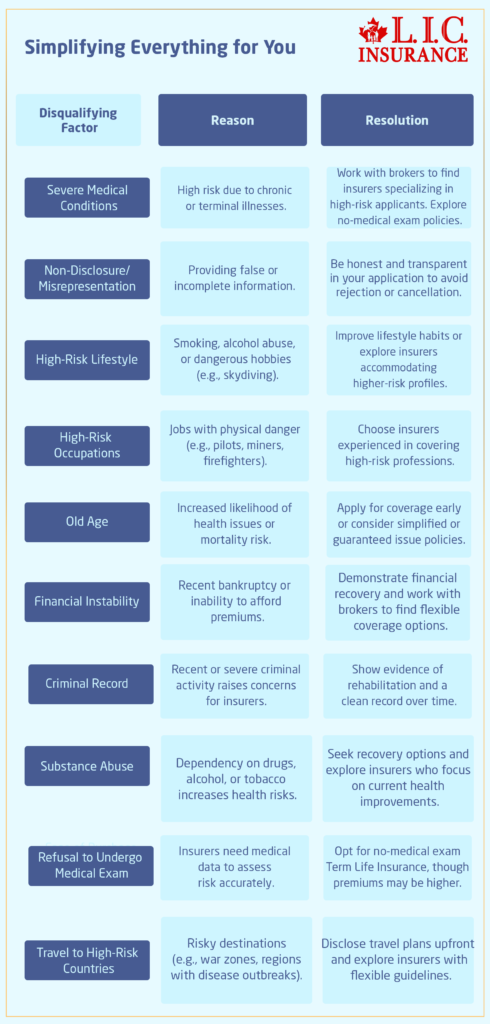

- What Will Disqualify You From Term Life Insurance?

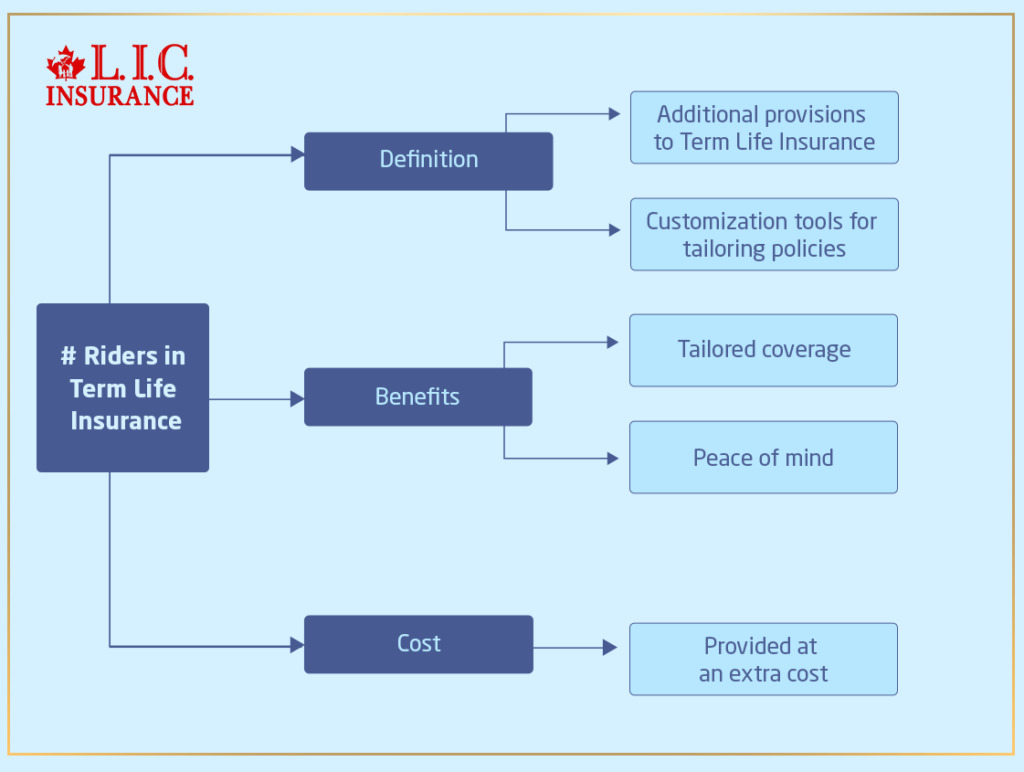

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

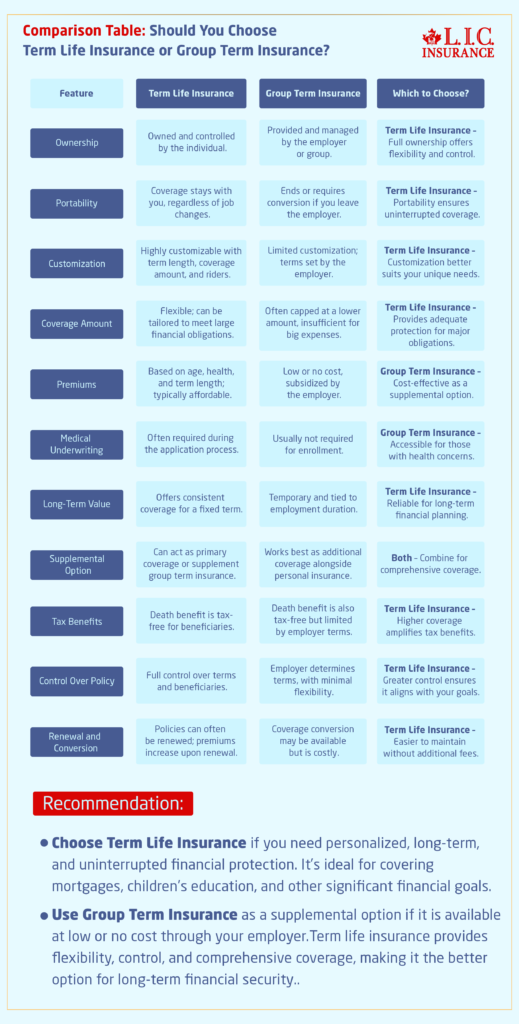

- What Is The Difference Between Term Insurance And Group Term Insurance?

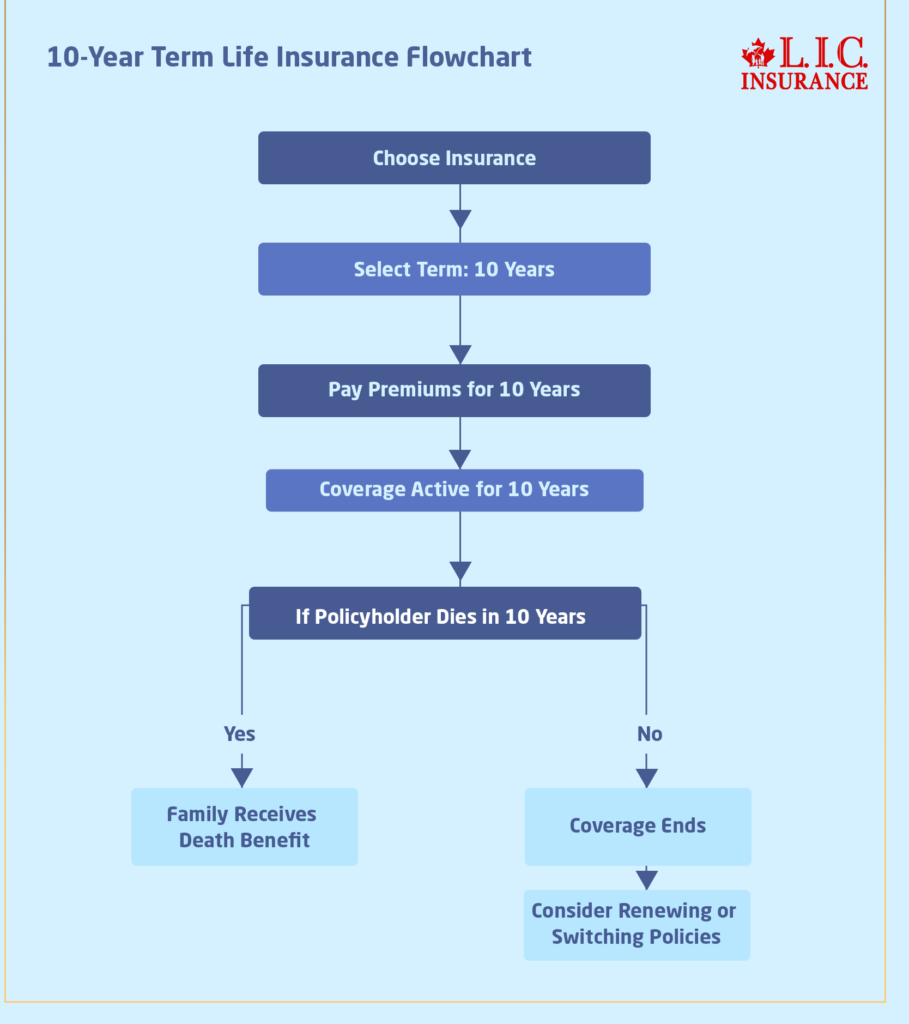

- Is There 10-Year Term Life Insurance?

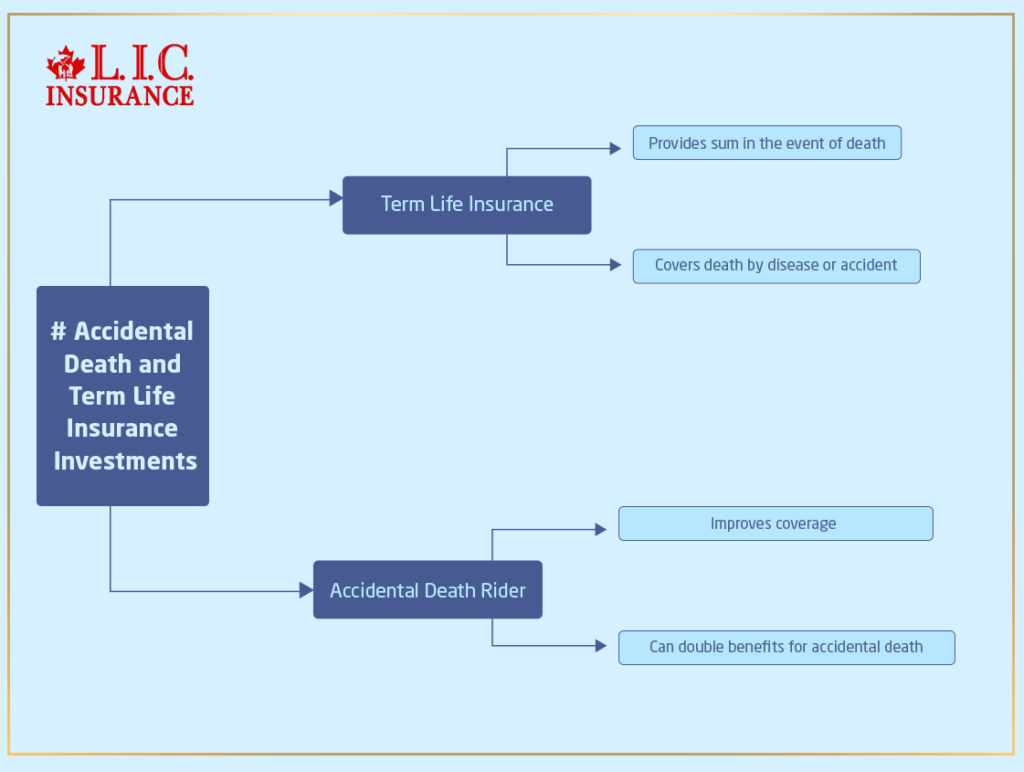

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

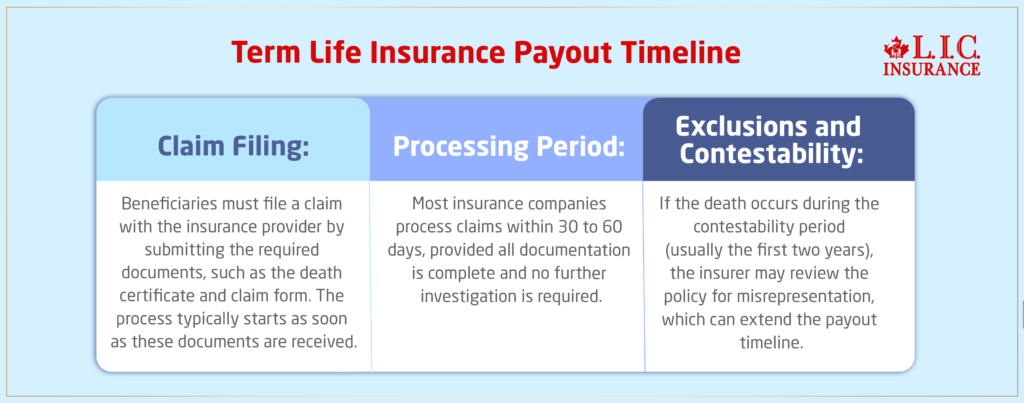

- When Does Term Life Insurance Payout?

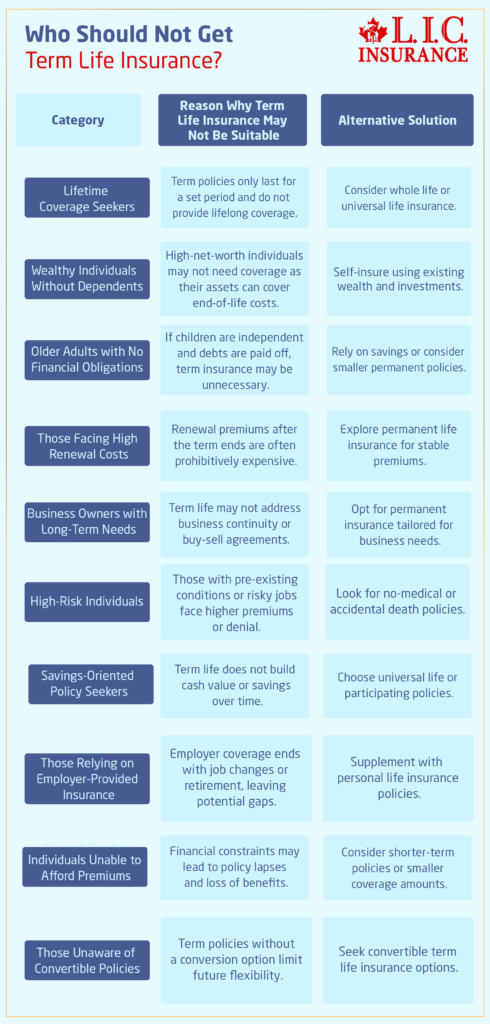

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

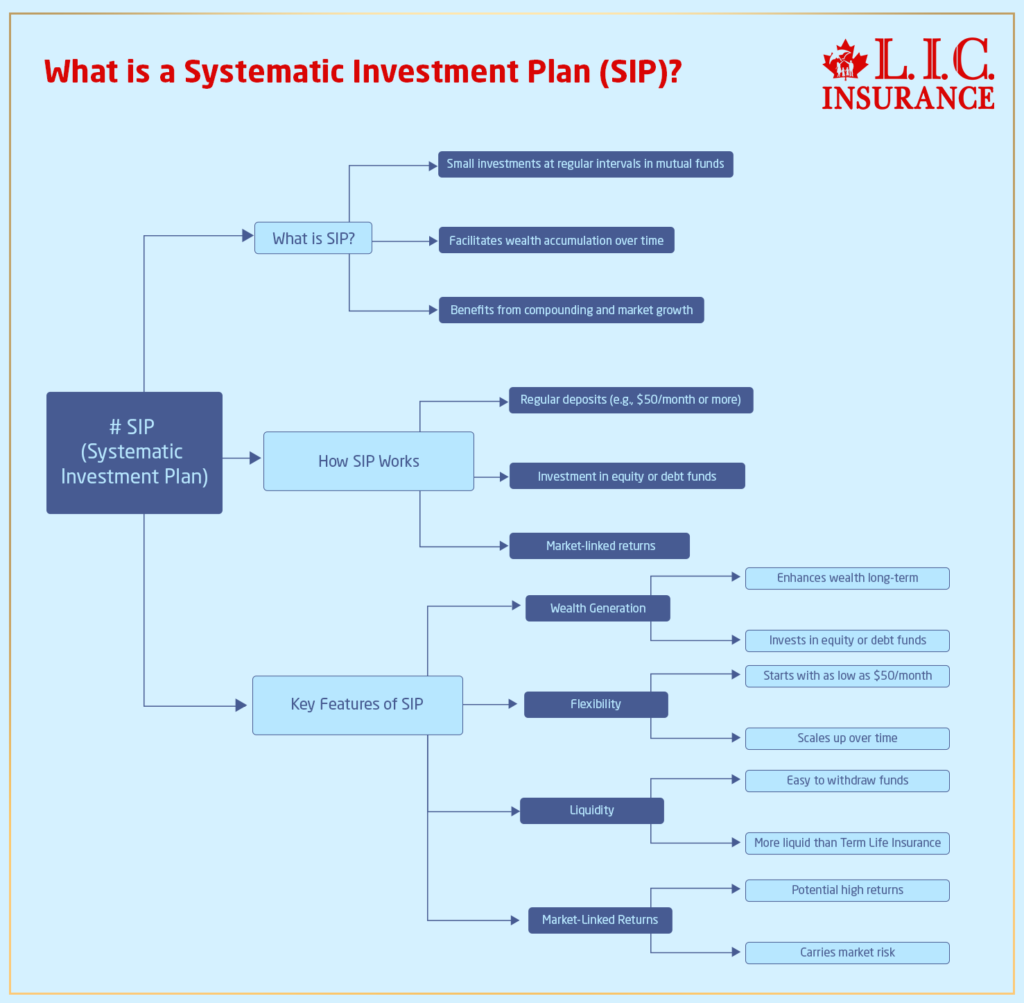

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

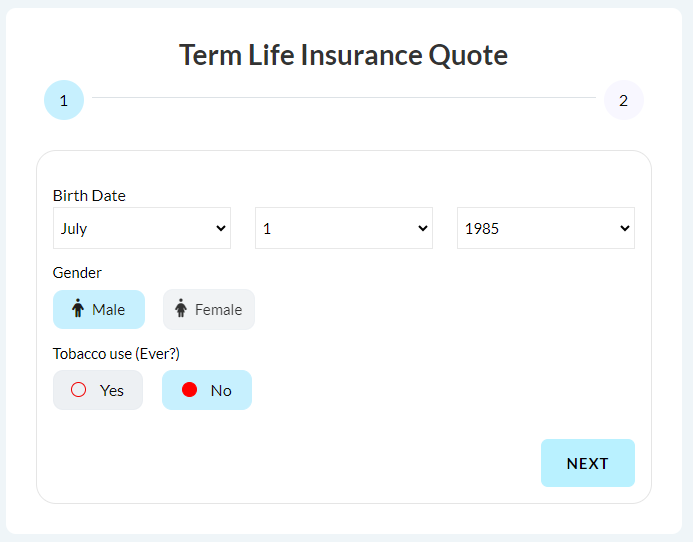

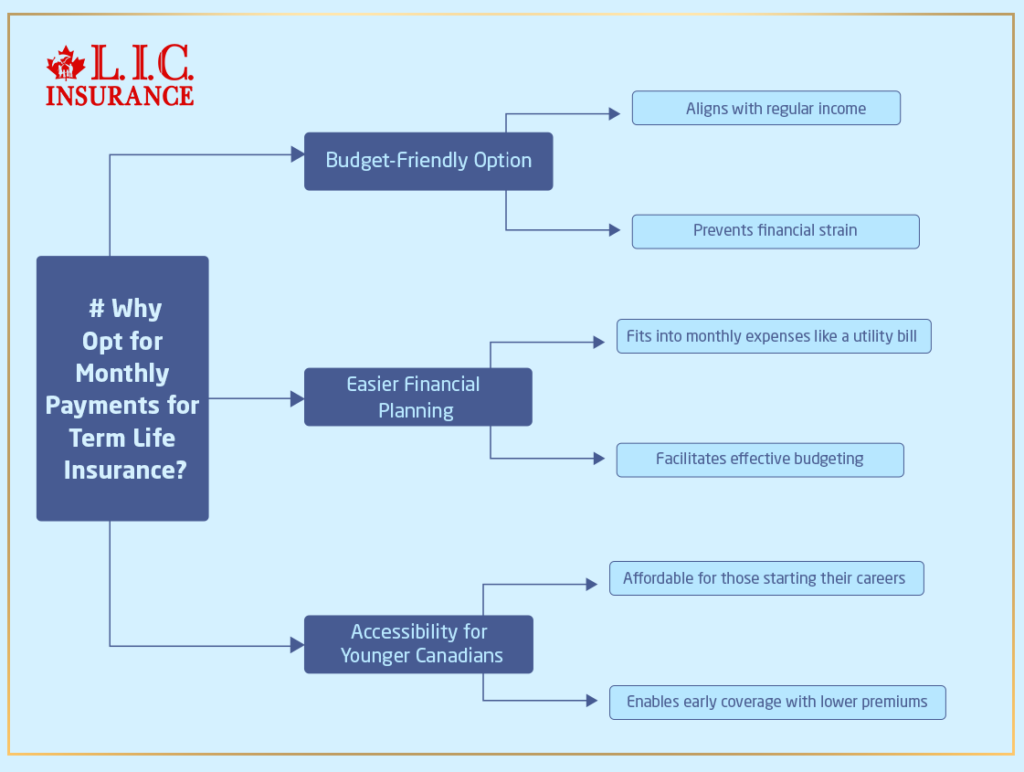

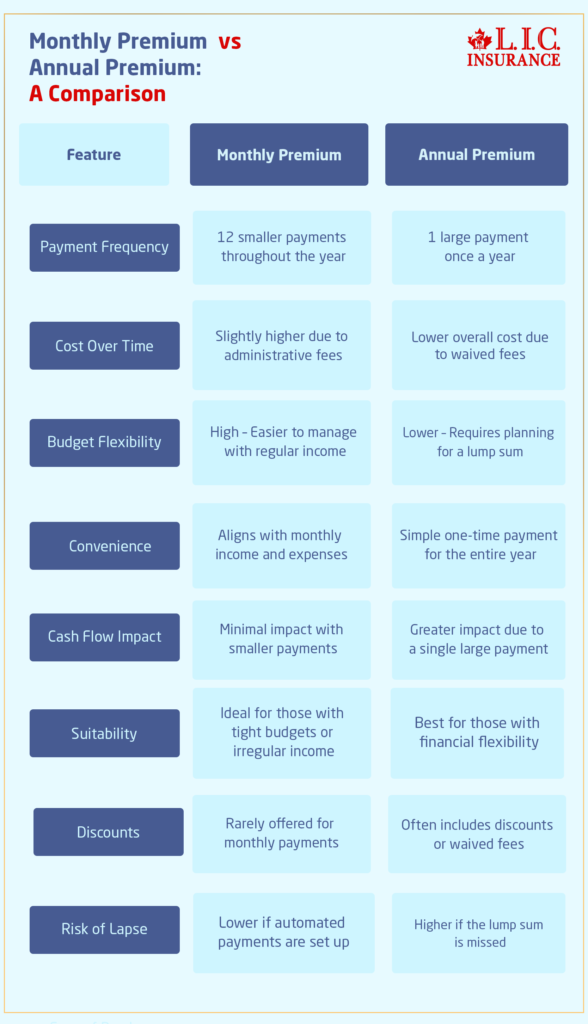

- Can I Pay Term Insurance Monthly?

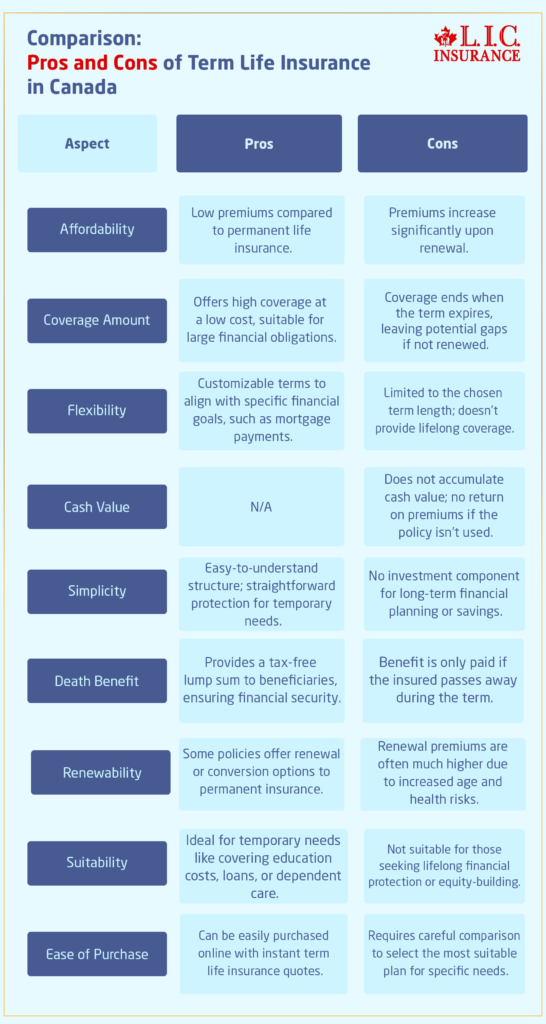

- Pros and Cons of Buying Term Life Insurance Plans

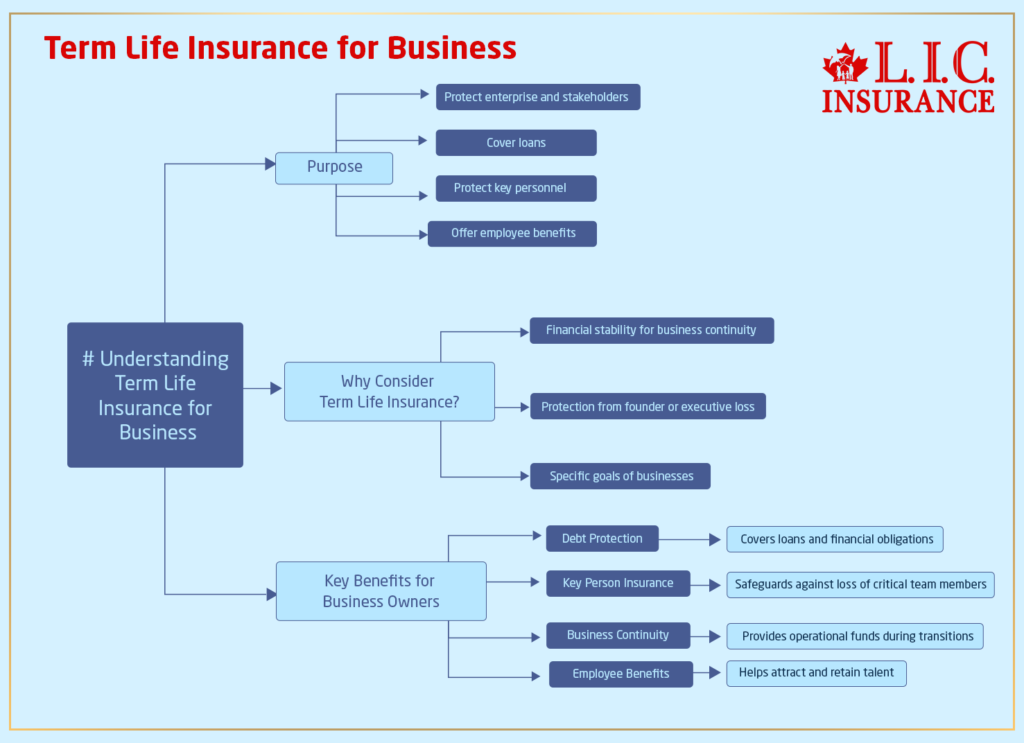

- Can Term Life Insurance Be a Business Expense?

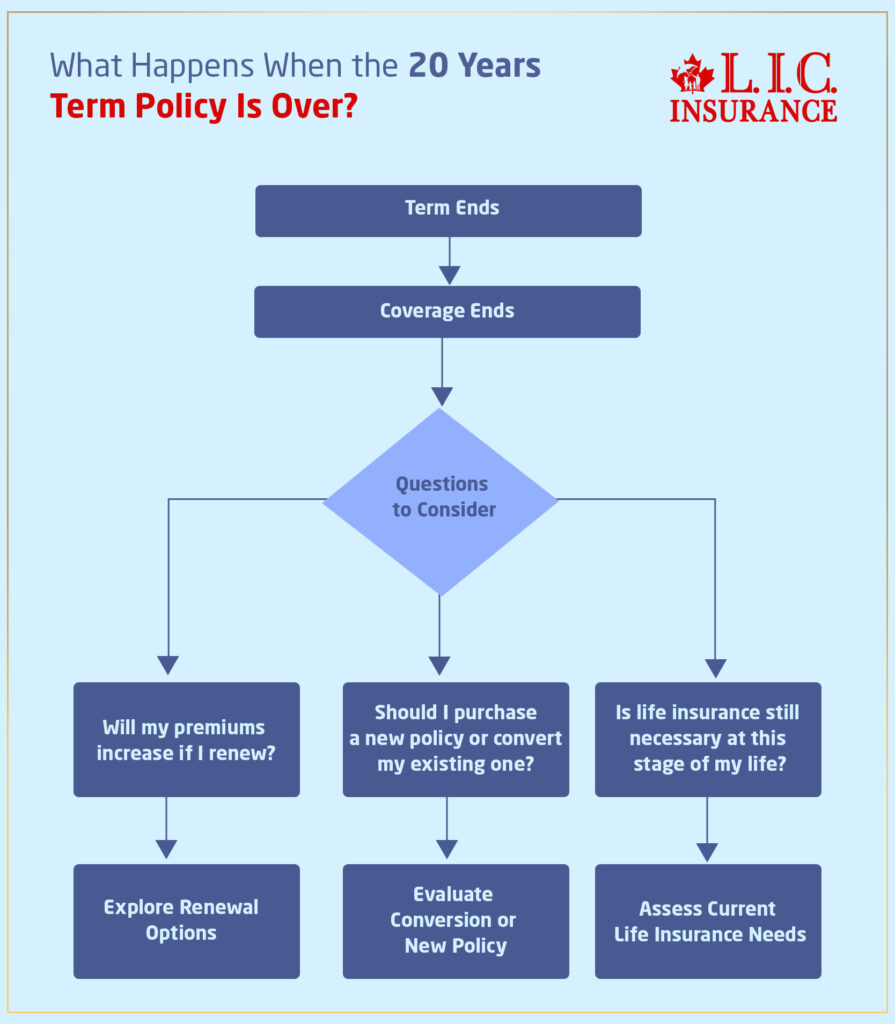

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

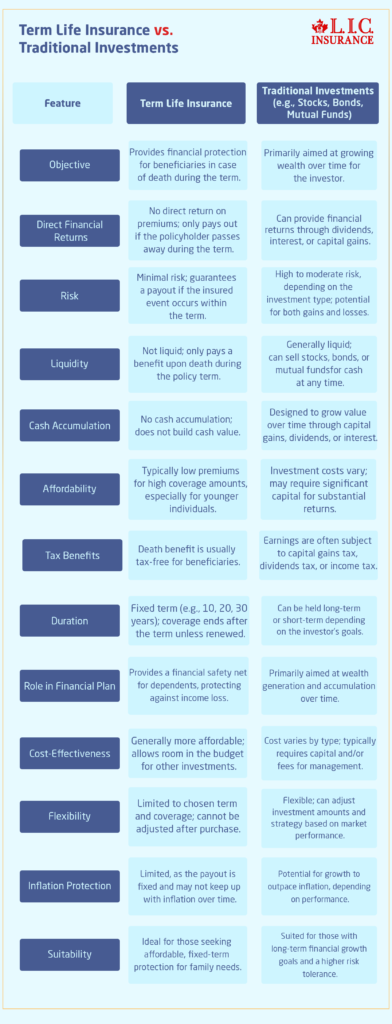

- Can Term Life Insurance Be an Investment?

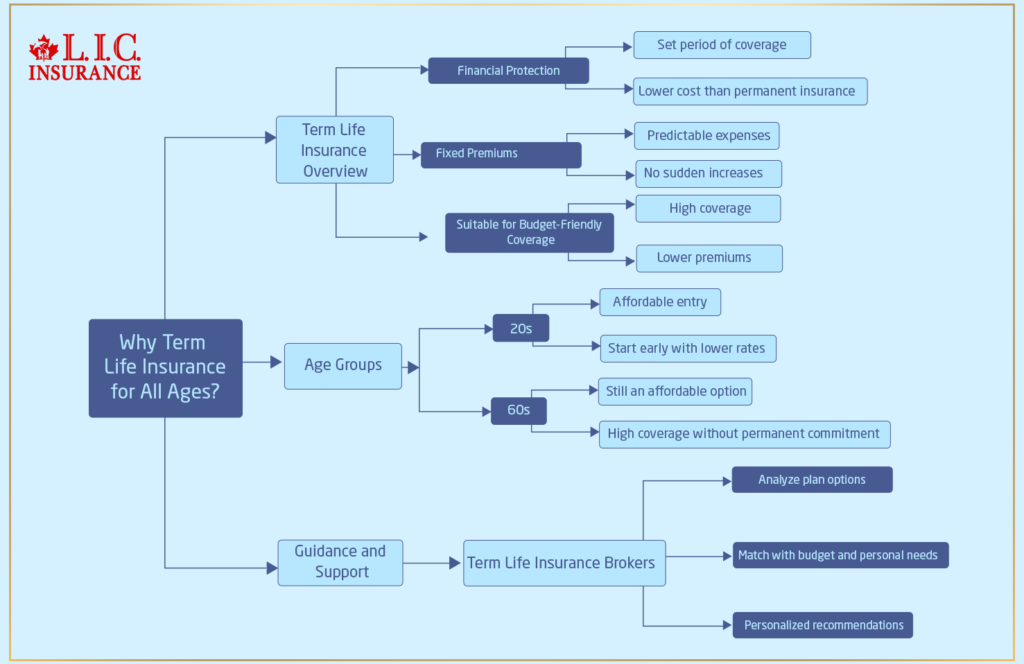

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

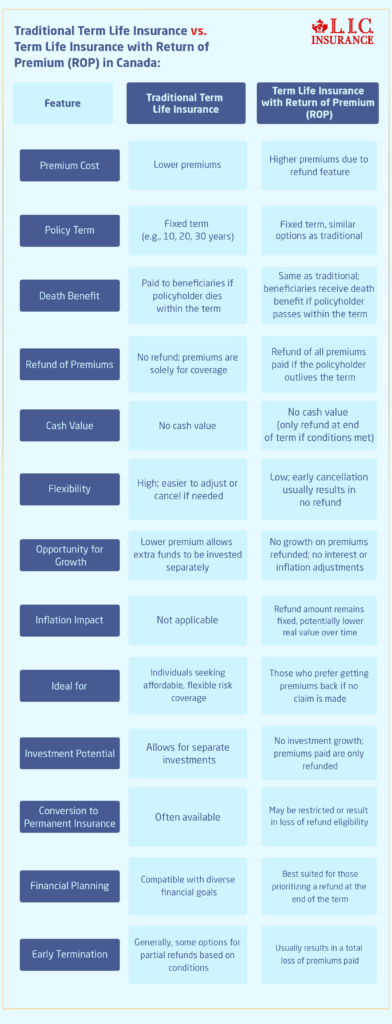

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

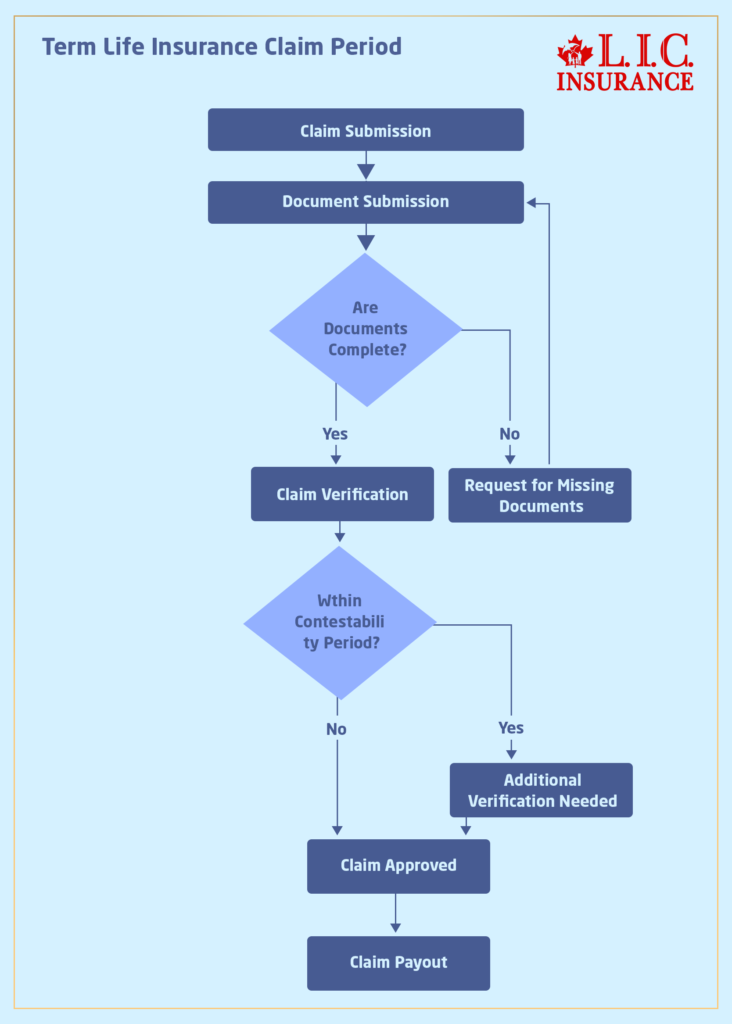

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs: Who is the Largest Provider of Term Life Insurance in Canada?

The larger providers give you financial security, more reliable claims, and a wide variety of Term Life Insurance Plans. We have witnessed some clients facing challenges with the smaller providers, as they cannot provide for their needs. Larger companies guarantee that the claims are paid in time and also offer flexible options to customize your coverage.

The Term Life Insurance policy quotation can be best compared through a Term Life Insurance Calculator that will help calculate premiums based on coverage, age, and terms. Canadian LIC can give you multiple quotes from leading providers so that you can acquire the most suitable deal for yourself.

Yes, many larger providers, such as Manulife and Sun Life, allow you to buy Term Life Insurance Online. Canadian LIC works with some of these major providers to make the online buying process pretty simple and seamless. You might be able to get quotes online, calculate some premiums, and shop from home itself.

The decision to purchase Term Life Insurance depends on coverage amount, term length, premium rates, and optional riders. Our term life agents often come across clients who do not understand how much coverage their family requires to meet their financial needs. We advise them on the kind of plans that will protect their loved ones sufficiently.

Some of the biggest providers include Manulife, Canada Life, Sun Life Financial, RBC Insurance, and iA Financial Group. They are considered reliable for their competitive quotes for term life policies and offer calculators to help manage the premium.

Yes, online Term Life Insurance Calculators from reputable providers or brokers such as Canadian LIC are accurate and easy to use. They allow you to determine premiums and compare plans without a commitment to purchase. Many of our clients first use these tools before planning their coverage.

Term Life Insurance Agents make the whole process of finding the right coverage easy. Agents at Canadian LIC help clients understand jargon, compare quotes, and obtain the best possible coverage. They ensure you do not miss the critical details and guide you in making informed decisions.

No, not necessarily. While large providers may seem more expensive, they often have available discounts or flexibility that can minimize premiums. Utilizing a Term Life Insurance Calculator allows you to see the costs, and you realize that large providers do deliver excellent value for stability and benefits.

Yes, you may switch providers if you find a better one elsewhere. In fact, we at Canadian LIC often help clients change over to bigger and more stable insurance companies. Our Term Life Insurance Agents make this process smooth with little to no lapse in coverage.

Large providers ensure that claim processes are efficient in making quick and hassle-free payouts. Here, Canadian LIC would work closely with such companies to help clients navigate the intricacy of claims. Many of our clients appreciate how easy it is to work with larger providers during stressful times.

Most large providers enable customization of a term life policy through add-ons such as Critical Illness Riders or Accidental Death Riders. Many of our clients have enhanced their policies to fit their unique financial goals and family needs better.

Start by checking the amount and period you would require. To give you a quote, use the Term Life Insurance Calculator. Feel free to reach out to experts at Canadian LIC; we compare quotes for you so that you can choose the best one that suits your future.

These FAQs should address some common concerns while also providing guidance to get good, reliable Term Life Insurance coverage. Contact Canadian LIC to help make your search easier and get a policy that suits your requirements. Let us work together in order to ensure financial security for your family.

Sources and Further Reading

- Manulife Financial

Manulife Official Website

Explore Term Life Insurance Plans, policy options, and calculators offered by Manulife. - Canada Life

Canada Life Official Website

Learn about Term Life Insurance solutions and customizable coverage options from Canada Life. - Sun Life Financial

Sun Life Official Website

Find details on Term Life Insurance policies, premium calculators, and rider options. - RBC Insurance

RBC Insurance Official Website

Review Term Life Insurance Plans, flexible terms, and the application process from RBC Insurance. - iA Financial Group

iA Financial Group Official Website

Discover affordable Term Life Insurance Plans and tailored coverage options. - Insurance Bureau of Canada (IBC)

IBC Website

Access general information about life insurance providers and the Canadian insurance industry. - Canadian Life and Health Insurance Association (CLHIA)

CLHIA Website

Understand the standards and regulations governing Term Life Insurance in Canada.

Key Takeaways

- Top Providers in Canada: Leading Term Life Insurance providers include Manulife, Canada Life, Sun Life, RBC Insurance, and iA Financial Group, known for their reliability and diverse plan offerings.

- Importance of Choosing Large Providers: Larger providers ensure financial stability, efficient claims processing, and flexible coverage options, making them a trusted choice.

- Role of Term Life Insurance Agents: Agents simplify policy selection, provide expert advice, and assist with comparing Term Life Insurance Policy Quotes.

- Convenient Online Tools: Tools like Term Life Insurance Calculators help estimate premiums, compare plans, and buy Term Life Insurance online easily.

- Customized Solutions: Large providers offer add-ons such as critical illness riders to tailor Term Life Insurance Plans to specific needs.

- Canadian LIC Advantage: Partnering with Canadian LIC connects you with the best providers, competitive quotes, and personalized support for your Term Life Insurance needs.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts with us. Your feedback will help us better understand the challenges people face when searching for Term Life Insurance. Please fill out the form below.

Thank You

Your feedback is invaluable in helping us improve our services and guide you toward the best Term Life Insurance options. If you have any further questions, please don’t hesitate to contact us.

IN THIS ARTICLE

- Who Is The Largest Provider Of Term Life Insurance?

- Why the Biggest Life Insurance Company Matters for Your Term Life Insurance Plan

- Leading Term Life Insurance Providers in Canada

- Comparison of Leading Term Life Insurance Providers in Canada

- Key Features Shared by Top Providers

- Comparing Term Life Insurance Plans

- Real Struggles: The Importance of Choosing the Right Provider

- Advantages of Working with Canadian LIC

- Choosing Canadian LIC for Your Term Life Insurance Needs

- Common Misconceptions About Largest Life Insurance Companies

- Conclusion: Taking the First Step Toward Financial Security