- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Does Term Life Insurance Payout Immediately?

- The Waiting Game That Many Face

- What Is the Term Life Insurance Claim Period?

- Why Do Delays Happen in Term Life Insurance Payouts?

- Steps to Ensure a Smooth Term Life Insurance Payout

- How Quickly Can You Expect a Payout?

- How Canadian LIC Supports Families

- Choosing the Right Term Life Insurance Plan Matters

- Why Work with Canadian LIC?

- Conclusion: Act Now to Secure Your Family's Future

Does Term Life Insurance Payout Immediately?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 17th, 2024

SUMMARY

This blog discusses the Term Life Insurance payout process in Canada, focusing on the time period for Term Life Insurance claims and factors that may lead to delays in the payouts. It identifies some common reasons for delays, such as incomplete documentation, the contestability period, and disputes over legal or beneficiary rights. The blog elaborates on how honesty in the application process, keeping the documents organized, and choosing the right Term Life Insurance policy with the aid of efficient Term Life Insurance Brokers are emphasized. It also explains to the beneficiaries the ways by which they can ensure smoother claims processing, along with outlining steps to avoid common problems. Further, it discusses timelines that vary depending on the insurer’s efficiency, nature of claims, and policy terms. With actionable advice, the blog provides clarity on ensuring timely financial support for families when they need it most.

Introduction

Life is full of uncertainties, and Term Life Insurance is essential to provide financial support to your loved ones if something unforeseen happens to you. However, it is natural that a number of questions arise when the Term Life Insurance payout is concerned. Does it happen immediately? Which factors can influence the time? So, let us discuss it and get an answer about the Term Life Insurance Claim Period and which steps can be taken to avoid any complications in the claims process.

The Waiting Game That Many Face

When families suffer the loss of a family member, it is quite common for them to rely on a Term Life Insurance payout to carry out financial obligations such as paying for funerals, mortgages, or everyday expenses. However, many of them face the usual problem of delayed payout. From waiting for documents to navigating through the claims process, families often feel overwhelmed during an already challenging time.

The daily concerns of Canadian LIC, a well-known name among Term Life Insurance Brokers, are the time taken by their family to get the benefits of their Term Life Insurance Plan. This blog answers the question while illuminating the claims process and tips for timely payouts.

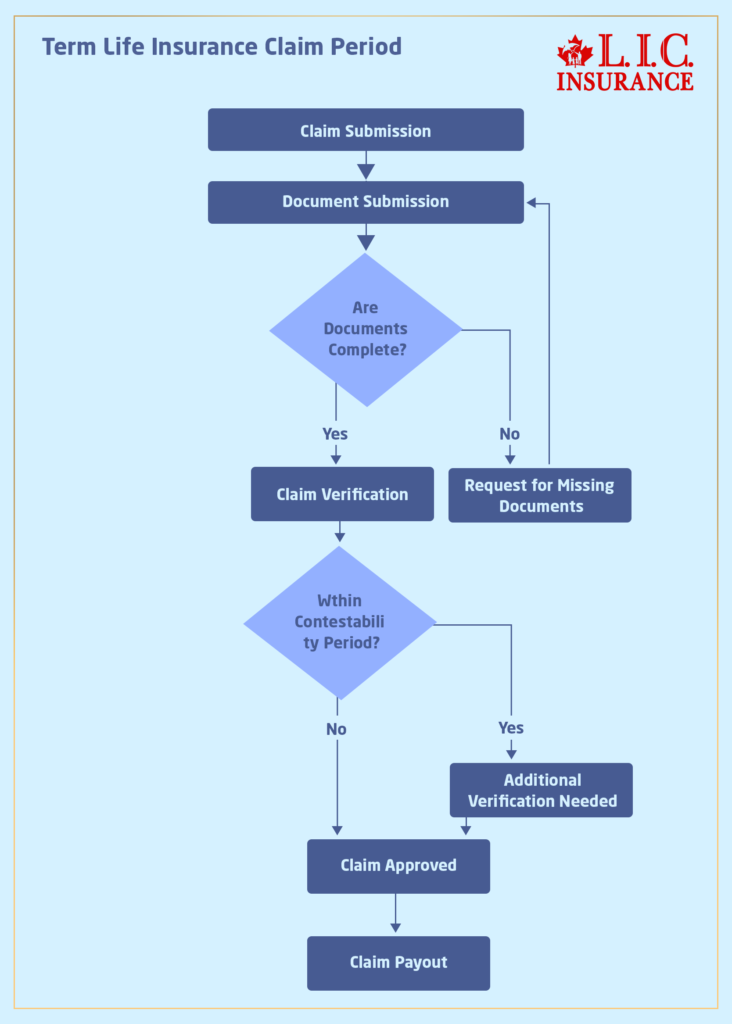

What Is the Term Life Insurance Claim Period?

The Term Life Insurance Claim Period refers to the amount of time the insurance provider will take to process and pay out the death benefit following a claim submission. Most insurance companies in Canada would expect to settle claims as promptly as possible; however, the timespan for doing so can range quite a bit due to many factors:

- Submission of necessary documents: Proper documentation is essential. Lacking or incomplete paperwork delays the processing.

- Verification of the Claim: Insurers must verify the validity of the claim to ensure it aligns with the policy’s terms.

- Contestability Period of the Policy: The insurer will verify whether the claim is valid under the terms of the policy.

According to Canadian LICs, Term Life Insurance Brokers state that transparency and accuracy during the application process can dramatically reduce potential delays at the claims stage.

Why Do Delays Happen in Term Life Insurance Payouts?

Even though the Term Life Insurance is conceived to offer prompt financial relief, there are times when they may delay the payment; let’s discuss some reasons for the delay and how you might avoid them.

Incomplete Claims Documentation

Most delays occur when paperwork is not completed in time. Insurance, for example, usually requests a death certificate, a proof of identity, and the original policy document. Sometimes, due to family members’ unawareness of the requirements, they lose a very crucial time getting these documents ready.

How Canadian LIC Helps:

Canadian LIC makes sure that all clients are educated about the documentation required to ensure a smooth claims process. In this light, pre-planning is encouraged to avoid confusion, especially at the time of planning.

Policy Contestability Period

The claim is usually subjected to extra scrutiny if the policyholder dies within two years after he purchase Life Insurance. Insurers will review medical records and other information to ensure there is no misrepresentation at the application stage.

Advice from Term Life Insurance Brokers:

Disclose all relevant health and lifestyle details when applying for a policy. Honesty helps avoid complications during the claim review process.

Outstanding Premium Payments

If premiums were not paid up to date, the payout process could be a little complicated. However, some policies may carry a grace period, beyond which an unpaid premium results in a lapsed policy.

Tip:

Set up automatic payments or reminders to ensure Term Life Insurance premiums are always paid on time.

Legal or Beneficiary Disputes

Sometimes, claims may also be delayed due to fights between beneficiaries or legal causes. For example, if more parties share a death benefit, then the insurer waits for all sides to be settled before making a payout.

How Canadian LIC Assists:

With the expertise of its Term Life Insurance Brokers, Canadian LIC helps clients clearly define beneficiaries when purchasing a policy, reducing the likelihood of disputes.

Steps to Ensure a Smooth Term Life Insurance Payout

While insurers do their best to process claims promptly, you can take steps to minimize delays and ensure your loved ones receive the benefits they need without unnecessary stress.

Choose the Right Term Life Insurance Plan

Work with educated Term Life Insurance Brokers so that you get a plan suited to your needs. Brokers will make sure that the terms and conditions of the policy do not surprise you later on.

Be Transparent During the Application Process

Provide accurate information about your medical history, lifestyle, and other required details. Misrepresentation can lead to claim denials or delays.

Keep Documents Organized

Store all policy-related documents in a safe and accessible place. Inform your beneficiaries about the policy’s existence and where to find the documents.

Stay in Touch with Your Insurance Broker

Communicate with your broker at all times in order to enjoy the services, support, and guidance in changes of your circumstances and assist your family during the filing of a claim.

How Quickly Can You Expect a Payout?

In Canada, the life insurance claim term usually takes a few weeks to several months. Many insurers make an effort to settle the claims within 30 days; however, the time of settlement would depend on various other factors. Let’s take a closer look at the key factors that could influence how soon your beneficiary might get the death benefit payout under your Term Life Insurance Plan.

Claims Submitted with Proper Documentation

A prompt payout requires that all and proper documentation be submitted accurately. These include basic documents usually requested by the insurer:

- A certified copy of the death certificate.

- Evidence of the recipient’s identity (e.g. government ID).

- A filled-up claims form.

- The original policy document or policy number.

In many cases, the Term Life Insurance Claim Period can last for an extended period as beneficiaries may delay gathering and submitting such documents. Most families will be confused during this point; hence, one needs to be organized and ready.

How Canadian LIC Supports You:

With the assistance of experienced Term Life Insurance Brokers, families are guided through the process step-by-step. Canadian LIC brokers ensure you’re informed about all required documents in advance, helping you avoid unnecessary delays.

Insurer’s Efficiency in Handling Claims

The efficiency of the Life Insurance company is very important in determining the speed at which a claim is processed. An insurer with streamlined claims procedures is faster compared to others, which may take longer for internal processes or larger volumes of claims.

In comparing policies on Term Life Quotes Online, it becomes important to consider the reputation of an insurer when handling claims. Working with knowledgeable Term Life Insurance Brokers can help you find providers who have the best reputations for this kind of service.

Pro Tip:

While cost is an important factor, always consider the claims process and the customer service reputation of the insurer when choosing a Term Life Insurance Plan.

Nature of the Claim

The timing of the claim has a big influence on the payment schedule. Claims made outside the two-year contestability period are processed faster than those made during the contestability period. The insurer may conduct more investigations into the details, such as:

- The truthfulness of the information given during the application process.

- Vulnerability to cases of fraud or misrepresentation.

- Once a claim is declared non-contestable, the review process that an insurer must follow also becomes straightforward and quicker.

Advice from Canadian LIC:

Honesty in the application procedure for a Term Life Insurance scheme is of utmost importance. Misrepresentation of health, lifestyle, or other critical issues can cause complications for your beneficiary in case the claim becomes due during the contestability period.

Additional Factors Influencing the Payout Timeline

Besides the three major factors outlined above, other factors that may influence the Term Life Insurance Claim Period include:

- Multiple Beneficiaries: In the case of multiple beneficiaries, the insurance company may require some time to verify the distribution of funds. To avoid delays, clearly state your beneficiaries at the time of policy creation and communicate your decisions with your family.

- Legal Challenges: Conflicts between the family or disputes over claims with disputable wills can create delays. However, an appropriate choice of policy is always guided by reputed Term Life Insurance Brokers who are able to ensure that it is appropriate according to your plans.

- Difficulty in Claims Process: Some situations, like accidents or problems that require lengthy investigations of the claims, would take relatively more time to resolve.

Setting Realistic Expectations for Your Family

The average payout timeline for a Term Life Insurance Plan is around 30 days. While that might seem fast, it is reassuring to have prepared your family in advance of such a delay. Talking over the claims process with your beneficiaries can be reassuring to them, especially at such a difficult time, in terms of what to expect.

How Canadian LIC Can Help:

Term Life Insurance Brokers at Canadian LIC work closely with clients to ensure their policies are clear, the beneficiaries are well-informed, and the claims process is smooth. They help in choosing an insurer with a history of paying claims on time by reviewing and comparing Term Life Insurance Quotes Online.

How Canadian LIC Supports Families

One of Canadian LIC’s clients, a young family in Toronto, recently faced the sudden loss of a primary breadwinner. Thanks to the family’s well-prepared documentation and the guidance of Canadian LIC’s Term Life Insurance Brokers, the claim was processed within 20 days. The timely payout helped the family cover funeral costs and manage ongoing expenses without financial hardship.

Choosing the Right Term Life Insurance Plan Matters

Not all Term Life Insurance policies are the same. When selecting a policy, keep the following considerations in mind:

- Premium Costs: Find a balance between price and what is needed.

- Claim Process: Find insurers that have a smooth claims process.

- Additional Benefits: Some plans offer riders or have additional benefits such as Critical Illness Coverage.

Canadian LIC offers customized recommendations to the clients since they work hand in hand with them. Making decisions on a term of life insurance is possible through quotes online.

Why Work with Canadian LIC?

Canadian LIC is known to be one of the most dependable Term Life Insurance Brokers in Canada. They have an experienced team that will do more than just present policies; they will educate you, support you, and guide you step by step to make you feel sure about your choices. From a vast pool of providers, Canadian LIC helps you determine the best choices for you.

Conclusion: Act Now to Secure Your Family's Future

With proper planning and guidance, Term Life Insurance will avoid delays in claims received, and your loved ones shall receive much-needed monetary support in their time of need. From choosing the right Term Life Insurance Plan to understanding the Term Life Insurance Claim Period or even online Term Life Insurance quotes, Canadian LIC is here to guide you through all of it.

Act now, and contact Canadian LIC today to take that first step toward having peace of mind for you and your family.

More on Term Life Insurance

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About Term Life Insurance Payouts in Canada

In Canada, the payment is usually made within a short time, from a couple of weeks to a number of months. In a general sense, most claims usually get processed within 30 days if all the paperwork submitted is correct. With the Canadian LIC, they have seen families enjoy benefits by receiving their payouts promptly.

Typically, the beneficiaries of Term Life Insurance from a Canadian LIC will need a certified death certificate, identification proof, completed claims form, and either the original policy document or the policy number. To make sure nothing is omitted, Term Life Insurance Brokers often guide families through such processes.

Indeed, a lack of or incomplete papers would prolong the Term Life Insurance Claim Period. Canadian LIC regularly encourages their clients to keep all their policy-related documents in a safe place and reminds them to inform their beneficiaries of the location.

Yes, suppose the claim falls within the contestability period. In that case, the insurer may take more time to process the claim by perhaps scrutinizing the medical records or even checking the information on the application. Being honest at the application stage means fewer complications later.

Apply for Term Life Insurance coverage with reliable Term Life Insurance agents. Be honest during the application process, pay premiums timely and keep important policy documents handy. Inform beneficiaries about the existence of the cover and how to make a claim if necessary.

If there are multiple beneficiaries, it might take the company some more time to ensure the correct transfer of funds. Normally, Canadian LIC advises the client to clearly outline the beneficiary when taking the policy to avoid disputes or delays.

No, the payout timeline could differ between insurers and simple versus complex claims. If comparing term life quotes online, look for insurance companies that are known to process claims efficiently.

Brokers like those at Canadian LIC act as a bridge between the insurer and the beneficiaries. The intermediary explains the claim process and verifies that all proper documents have been presented and the matter is rectified in case it arises; hence, there is much less tension for the families.

This indeed contributes to a lapsed policy, which may result in a claim denial. Canadian LIC does advise setting up automatic payments or reminders to keep the premiums updated so as not to run into such issues.

Review research or consult an experienced Term Life Insurance broker on the claims handling of an insurer. Many Canadian LIC brokers recommend insurers that have shown a history of quick and efficient payouts so your family will be supported when they need it most.

If your policy document gets lost, inform your insurance company or Term Life Insurance Brokers immediately. They can lead you to where to go to recover your policy information and will guide your beneficiaries during the claim period for Term Life Insurance.

Insurers usually charge no fees for a claim processing on a Term Life Insurance Plan. However, it would be wise to confirm this with your insurer or brokers when comparing Term Life Insurance Quotes Online.

Most Term Life Insurance Plans usually cover deaths that take place abroad if the terms of the policy are met. Canadian LIC has supported families in such a situation by ensuring claims are submitted with documentation, including an international death certificate and associated proof.

Yes, you can update beneficiaries at any time. Canadian LIC recommends regularly reviewing and updating your beneficiary information to avoid complications during the Term Life Insurance Claim Period.

If an insurer has a claim dispute, they do further investigations to clarify certain details. Canadian LIC has provided support to clients by helping them file claims accurately, and they also help families navigate through disputes.

There is no deadline as such, although filing as soon as possible is recommended. This ensures that the payout reaches your family in time and that the Term Life Insurance claim process does not take too long.

Most Term Life Insurance policies provide coverage for death by accident, but there are conditions attached to the coverage. Canadian LIC’s Term Life Insurance Brokers can help you select a policy that aligns with your needs by providing detailed insights when comparing Term Life Insurance Quotes Online.

Yes, a Term Life Insurance Plan lapses if the term expires before a policyholder’s death. If you are looking at lifetime coverage, Canadian LIC brokers can explain options such as Whole Life or Convertible Policies to you.

No, you are not required to notify your insurance company about any health changes once the policy is issued. Canadian LIC ensures that this is taken care of as long as the client divulges accurate health information during the application process.

Brokers such as those at Canadian LIC are your family’s advocates. They help with paperwork, communicate with the insurers on your behalf, and ensure that claims are processed smoothly, hence reducing stress on the beneficiaries.

These FAQs focus on the frequent questions concerning claim periods of Term Life Insurance and how such a process can be made as smooth as possible in practice, with input from Canadian LIC.

Sources and Further Reading

- Government of Canada – Life Insurance Overview

Visit the official Government of Canada website for detailed insights into life insurance, including types, benefits, and claims processes.

https://www.canada.ca - Canadian Life and Health Insurance Association (CLHIA)

Access reliable resources on life insurance policies, claims, and the rights of policyholders in Canada.

https://www.clhia.ca - Insurance Bureau of Canada (IBC)

Explore IBC’s resources to understand the basics of life insurance and tips for selecting a policy.

https://www.ibc.ca - FSRA Ontario (Financial Services Regulatory Authority of Ontario)

Learn about regulatory standards for life insurance policies and brokers in Ontario.

https://www.fsrao.ca

Key Takeaways

- Term Life Insurance Claim Period: Most claims in Canada are processed within 30 days, but delays can occur due to incomplete documentation or disputes.

- Factors Influencing Payout Timelines: Proper documentation, insurer efficiency, and the claim’s nature (e.g., contestability period) play significant roles in payout speed.

- Prepare Your Beneficiaries: Organize policy documents, disclose all health details during application, and keep premiums up-to-date to ensure a smooth claims process.

- Role of Term Life Insurance Brokers: Brokers help you choose the right plan, guide your family through claims, and minimize stress during the process.

- Importance of Choosing the Right Plan: Compare Term Life Insurance Quotes Online and select a reliable insurer with a reputation for timely payouts and excellent service.

- Beneficiary Management: Regularly update beneficiary information to avoid disputes and ensure benefits are distributed as intended.

- Canadian LIC Expertise: Trusted brokers like Canadian LIC provide personalized support, making the claims process efficient for families.

Your Feedback Is Very Important To Us

We would love your feedback to better understand the challenges people face when learning about Term Life Insurance Payouts. Please fill out the short questionnaire below to help us serve you better.

Thank you for sharing your insights! Your feedback will help us provide better information and support regarding Term Life Insurance Plans and payouts.

IN THIS ARTICLE

- Does Term Life Insurance Payout Immediately?

- The Waiting Game That Many Face

- What Is the Term Life Insurance Claim Period?

- Why Do Delays Happen in Term Life Insurance Payouts?

- Steps to Ensure a Smooth Term Life Insurance Payout

- How Quickly Can You Expect a Payout?

- How Canadian LIC Supports Families

- Choosing the Right Term Life Insurance Plan Matters

- Why Work with Canadian LIC?

- Conclusion: Act Now to Secure Your Family's Future

Sign-in to CanadianLIC

Verify OTP