Becoming a Life Insurance Agent in Canada is exciting and intimidating. Imagine climbing a mountain; the path isn’t always clear, and sometimes the weather changes suddenly. Just like that, aspiring agents face their own set of challenges—licensing requirements, complex products, and building trust with clients who are wary of discussing their deepest financial concerns.

Take Samaira, for example; she’s one of many of us. Samaira struggled with the fine print of Life Insurance policies and the strict compliance rules. Her journey was filled with moments of self-doubt, especially when clients wouldn’t discuss their personal financial matters, fearing the “sales pitch.” However, with persistence and the right guidance, she learned that her role wasn’t just about selling but becoming a trusted advisor to her clients and helping them secure their family’s future.

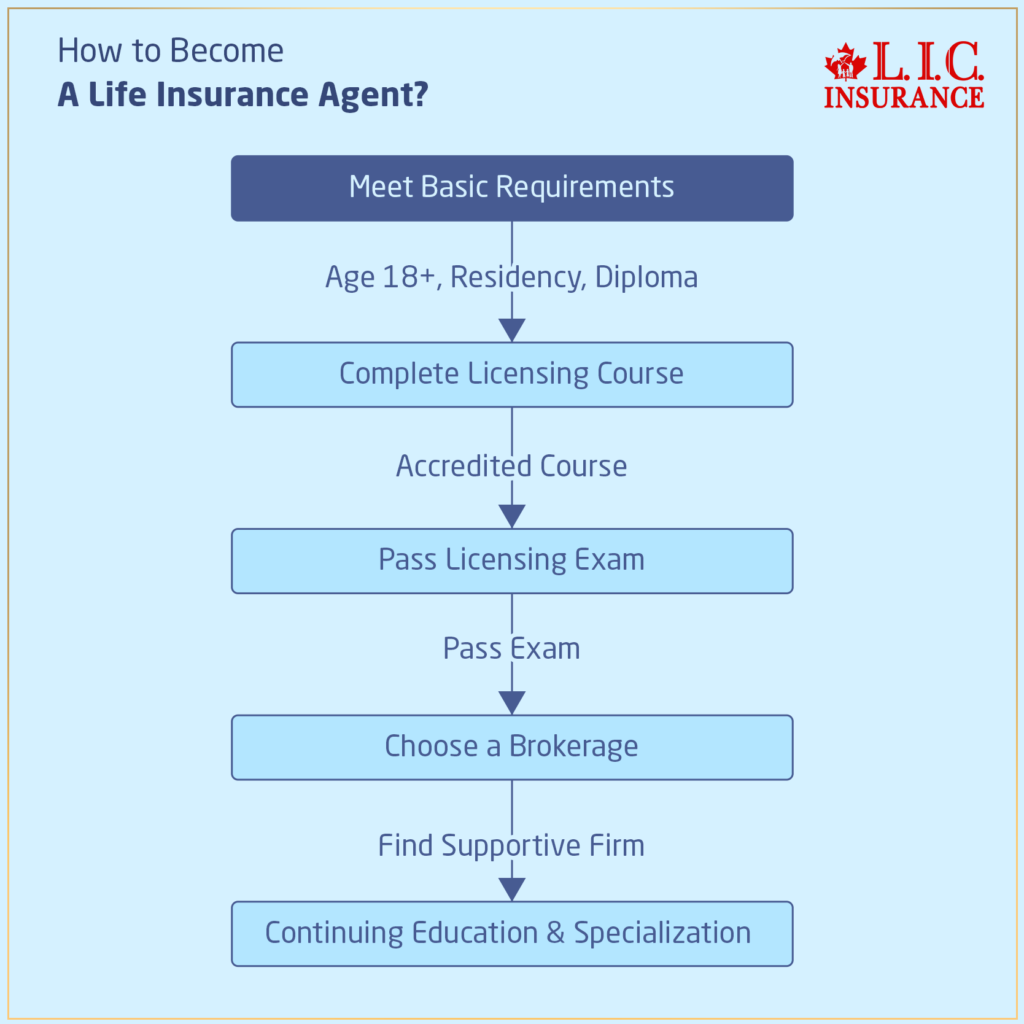

As you read this, you’ll see the step-by-step process of becoming a licensed Life Insurance Agent in Canada. This is an interactive guide that will speak to you personally, address your fears, inspire you with success stories and get you on your way to a great career.

Step 1: Meet the Basic Requirements

Before getting into Life Insurance, there are some basic requirements that one has to fulfill. In Canada, the minimum age limit is 18 years and a valid Canadian residency status. In addition, you need a high school diploma; however, higher education may be to your advantage.

For instance, Mark, who is one of the composite characters who came to Canada as an immigrant, was juggling learning a new language while preparing for his licensing exam—just a nightmare. Canadian LIC supported Mark through their preparatory classes, highlighting the importance of having a supportive environment when facing such educational challenges.

Step 2: Complete the Licensing Course

You will need to take a course that is accredited for licensing. These courses will prepare you for the basics of Life Insurance products, law, and ethics. Providers like the Insurance Institute of Canada offer these courses both in-class and online.

Julia, a young mother and aspiring agent, struggled with complex insurance concepts, feeling overwhelmed by the volume of new information. With some mentoring from Canadian LIC, Julia found ways of making these concepts simple— that really helped her grasp the material, further understand it, and explain it effectively to clients.

Step 3: Pass the Licensing Exam

Passing the provincial licensing exam is critical. This exam provides a foundation for Life Insurance policies, regulations, and skills related to service to clients. Needless to say, one must be prepared; pass rates vary greatly.

Described here is Devesh, who suffered from a bad case of test anxiety. He had a literal phobia of failing an examination. He learned some anxiety management skills like structured study schedules and relaxation techniques from the Canadian LIC, which worked wonders.

Step 4: Choose a Brokerage

The right brokerage can define your career. Look for firms that support their agents through training, technology, and growth opportunities. Canadian LIC’s supportive culture and robust training programs make it an excellent choice for too many new agents.

Emma has researched several brokerages, but none of them seemed truly transparent to her and had the interest of the client as their top priority. She joined Canadian LIC because their core values align with hers personally and professionally. This emphasizes the fact that cultural fit was very important in her decision.

Step 5: Continuing Education and Specialization

Life Insurance is a topic that is ever-changing. Continuing education is mandated but more of a necessity to keep one updated. Specialization in subjects like estate planning or corporate insurance will also aid in better career prospects.

Many agents at the Canadian LIC felt overwhelmed when new rules were introduced. Our regular training on new laws and trends in the marketplace keeps them informed and confident when advising their clients.

Conclusion: Start Your New Career with Canadian LIC

Becoming a Life Insurance Agent in Canada is a journey of lifelong learning and personal development. At Canadian LIC, we know the obstacles you will face, and we will be with you every step of the way. Join us to build a career and make a real difference in people’s lives. Don’t let the complexity scare you; let it challenge you to become a better advisor, a trusted friend and a pillar in your community. Start your journey with Canadian LIC today and turn your career dreams into reality. Go for it – your future awaits!

More on Insurance Agents

How Can I Find Job Opportunities as an Insurance Advisor in Canada?

How Can I Prepare for an Interview for an Insurance Advisor Position?

10 Reasons You Should Consider a Career as an Insurance Advisor

Why You Should Use An Insurance Broker?

Benefits Of Using An Insurance Broker

Top 10 Reasons to Choose Canadian LIC – The Best Insurance Broker in Canada

How To Pick The Right Insurance Broker?

Why You Should Use An Insurance Broker To Purchase An Insurance Plan?

Hiring An Insurance Broker In Brampton- A Comprehensive Guide

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Becoming a Life Insurance Agent in Canada

This would be helpful if you are at least 18 years old, have finished high school or its equivalent, and are a legal resident of Canada. Completing a licensing course and passing a provincial exam are also required.

Mike came to Canadian LIC last year straight from high school. From a very conventional background, he was scared about never having gone to college. Our ‘skills over degree’ training programs instilled confidence in him. Today, Mike confidently builds his client base, proving that hard work and the right training really put you on the path to success.

The duration differs, and usually, it only takes a few weeks or some months to finish a licensing course, depending on the mode of study you opt for. After completing the course, you have to pass the provincial exam.

Anna was afraid it would take too long to switch careers. However, the Canadian LIC allowed flexible online course options, and it took Anna only three months to be licensed while studying and working part-time.

The level of difficulty differs from person to person. There are vast topics that are included, from policy types to the legal regulatory environment. A good amount of preparation and knowledge of the subjects is required.

Raj, a new immigrant, was very nervous regarding the exam—more so with the questions regarding Canadian regulations. Additional tutoring from Canadian LIC changed his anxiety into joy when he passed on his first try.

Canadian LIC provides full support, from initial training to further professional development and mentors with extensive experience, the most modern tools for CRM.

When Sofia joined us, she was overwhelmed by the amount and capabilities of our insurance software tools. It is our dedicated mentorship program that helped her master them, and now she trains new agents in them, showcasing her expertise.

Yes, with experience, it is possible to decide on specializations in niche areas of practice, such as estate planning or business insurance, which would make one different and better suited to handle the needs of a particular type of clientele.

Tarun specialized in estate planning, having found that most of his target customers were small business owners. With specialized training from Canadian LIC, Tarun is now the person to whom his colleagues come for business-related Life Insurance solutions.

Continuing education generally keeps most licenses current. Requirements vary by province.

Worried about the time dedication that CE courses would require, Emma found it manageable because the online CE programs at Canadian LIC were flexible and made it easier to juggle her professional development with her personal life.

The volume of clients, product complexity, and time management usually challenge new agents.

Kevin initially found it hard to make his clients trust him. He was able to fine-tune his communication skills through role-play training at Canadian LIC, which in turn helped him to increase his circle of loyal clients.

Knowing insurance products inside out, meeting customer service skills, and a client relationship management system are the ingredients for success as a Life Insurance Agent.

Customer service was her niche. Thus, the rapport that Lucy had built with her clients through attending Canadian LIC’s workshops on client engagement and satisfaction paid richly in the form of many referrals that followed, building her thriving career.

What makes Canadian LIC special is that it has a culture supporting its people, one of the best training programs, and support for the success of agents. We very clearly understand the challenges that a new agent may possibly face and provide a platform with tools and support to rise above them.

When James had to deal with a tricky claim issue, the whole Canadian LIC team was there to support him—from legal advisers and senior agents, so he could deliver the best solution to his client. It is this sort of collaborative environment that underpins our success and appeal as a brokerage.

The process of becoming an agent involves expenses incurred for licensing courses, fees for exams, and sometimes even licensing application fees. These costs vary between provinces and the type of training provider one chooses to pursue.

Up-front costs were a concern for Linda. We at Canadian LIC realize this may be a barrier and that it will sometimes help out promising candidates by way of sponsorship or reimbursement. Linda applied for and is currently using our reimbursement program, which makes all the difference for her and allows her to concentrate on her training.

It begins with networking, using social media, and getting referrals with a little help from your brokerage. Effective marketing strategies and adding a personal touch to communication also work.

John, a new agent at Canadian LIC, used old contacts from a community center where he used to work and started off his client list. Our support in professional marketing materials and strategies played out a community-based approach that built his first clients.

Many think that the role is purely sales-oriented, while others think it involves aggressive selling techniques. Actually, it’s more about advising clients and building long-lasting relationships based on trust.

What scared Carol was the idea of having to ‘sell’ insurance. It was through our training at Canadian LIC that she began to understand that it was really more on the educational side and peace-of-mind end for the clients—something that really changed her perspective and approach toward the work.

Yes, working part-time is possible, and this is always a good way to start off if one is transitioning from another career. Many agents start off on a part-time basis to gradually build their clientele as well as the skills needed in the business.

After Priya had her second child, she decided to work part-time. Canadian LIC gave her flexible time options, which helped her easily balance her profession and her family.

These would include enhanced communication, being empathetic, organizational, and resilience skills. Being proactive in learning and adapting to new technologies and regulations is no less important.

Sam, who has been with Canadian LIC for five years, credits his success to continuous learning and adaptability. He regularly engages in skills enhancement workshops and uses the latest tools to manage client interactions efficiently.

We give full support—from training in objection handling to role-playing tough conversations and access to mentors who can advise and guide.

It was a Canadian LIC mentor who helped Nina tailor a more sensitive approach that eventually won him over when she once ran into an unwilling client who did not want to discuss his financial future.

On top of the initial training, Canadian LIC provides many more opportunities for professional development, technology tools for the management of clients, and industry practice updates; this is not to mention the community of peers for further follow-up.

Alex appreciates the regular industry updates and professional development sessions provided by Canadian LIC, which help him stay ahead in a competitive field.

For a relevant business person today, being relevant means continuous education, information about industry trends, and flexibility in front of technological change or changes in consumer behaviour.

Laura is a mature Canadian LIC agent who attends the annual industry conferences and subscribes to many insurance news feeds to keep her knowledge current and applicable.

The best Life Insurance companies offer products with complete training, are competitively paying, have a very supportive culture, and offer opportunities for growth. Canadian LIC ranks very highly in the industry in terms of agent development and client satisfaction—two top reasons many aspiring agents may consider this company.

When Ali was deciding where to start his career, he compared several firms. He chose Canadian LIC because of its reputation for agent support and its status among the best Life Insurance companies in Canada, which he felt would give him a strong start.

A good Life Insurance Agent would have developed interpersonal skills and is genuinely interested in helping other people out of integrity and professionalism. The ability to learn continuously and adapt is critical, too.

Melanie is one of the top-selling agents at Canadian LIC, and she constantly upgrades her knowledge about the products so that she can offer the best possible advice and service to her clients—explaining why personal and professional development is the key to success.

Yes, there are hundreds of positions for Life Insurance advisors across Canada, from entry-level insurance consultants to professional, experienced job roles. The demand for knowledgeable and ethical advisors continues to grow as the population ages and financial planning needs increase.

James started as a junior advisor, and he noticed quite a number of job postings. It was under the extremely structured career progression plan in Canadian LIC that he moved up quickly, reflecting the ample opportunities that lay ahead of one in this field.

Search for such opportunities that do not just offer a good entry package but also provide an environment in which to learn persistently and advance in a career. An organization that values technology investment and ethical practices—just like Canadian LIC—offers a more fulfilling career working with them.

Sana had considered several alternative Life Insurance advisors in Canada but chose to go with Canadian LIC because the company puts a lot of focus on ethics in dealing with clients and investing in the most modern facilities, machinery, and advisor training.

Differentiating oneself encompasses the establishment of a strong personal brand, the development of exceptional customer service, and often an area of specialization. Coupled with this is an efficient engagement with digital marketing tools and maintaining a high ethical standard of practice.

Carlos found his niche with small business owners. Because he specialized, his advice was directly pertinent and focused on the needs of his clients, unlike so many other Life Insurance Agents across the country.

There are many advantages to working with a reputable brokerage like Canadian LIC: exposure to a large clientele, extensive training programs, and a good working atmosphere that enables an individual to grow professionally.

Lalita joined Canadian LIC. She enjoyed the backing of its brand name, inspiring consumer trust, all of which helped her a great deal in getting a large and loyal clientele within no time at all.

These FAQs answer questions in simple and very relevant ways with respect to joining Canadian LIC as a Life Insurance Agent. Do not hesitate to contact us for further questions. We stand ready to empower you in your new career!

Sources and Further Reading

Insurance Institute of Canada: Provides courses and certifications for insurance professionals in Canada. Visit Insurance Institute of Canada

Canadian Life and Health Insurance Association (CLHIA): Offers information on life and health insurance products, industry statistics, and regulatory issues. Visit CLHIA

Financial Services Commission of Ontario (FSCO): Governs the licensing process for Life Insurance Agents in Ontario. Check similar organizations in other provinces. Visit FSCO

Advocis, The Financial Advisors Association of Canada: Provides professional development and advocacy for financial advisors, including Life Insurance Agents. Visit Advocis

Canadian Securities Institute (CSI): Offers the Life License Qualification Program (LLQP) which is required to become licensed as a Life Insurance Agent in Canada. Visit CSI

These resources will provide you with a comprehensive understanding of the requirements, challenges, and opportunities in the Life Insurance industry in Canada, supporting your journey to becoming a skilled and knowledgeable Life Insurance Agent.

Key Takeaways

- Meet age, educational, and residency requirements before starting your career in Life Insurance.

- Enroll in a licensing course and pass the provincial exam to become a qualified Life Insurance Agent.

- Partner with a reputable brokerage like Canadian LIC for training and career support.

- Engage in continuous learning and specialization to stay competitive in the industry.

- Build trust and empathize with clients to effectively address their needs.

- Leverage brokerage resources and support systems to overcome initial challenges and grow professionally.

- Develop skills in communication, ethics, and client management for long-term success.

Your Feedback Is Very Important To Us

This structured questionnaire aims to thoroughly assess the challenges and needs of new Life Insurance Agents, enabling targeted improvements in training and support from brokerages like Canadian LIC.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]