- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the best age to buy a Long Term Life Insurance Policy?

- Why Timing Matters for Long Term Life Insurance

- Buying a Long Term Life Insurance Policy in Your 20s

- Purchasing Long Term Life Insurance in Your 30s

- Buying Long Term Life Insurance in Your 40s

- Buying Life Insurance in Your 50s and Beyond

- The Role of Term Life Insurance Broker

- Finding Term Life Insurance Quotes Online

- The Best Age to Buy Life Insurance: Key Considerations

- How to Choose the Right Long Term Life Insurance Policy

- Real Struggles and Success Stories from Canadian LIC

- Canadian LIC: Your Partner in Life Insurance

- More on Term Life Insurance

What Is the Best Age to Buy a Long Term Life Insurance Policy?

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 25th, 2024

SUMMARY

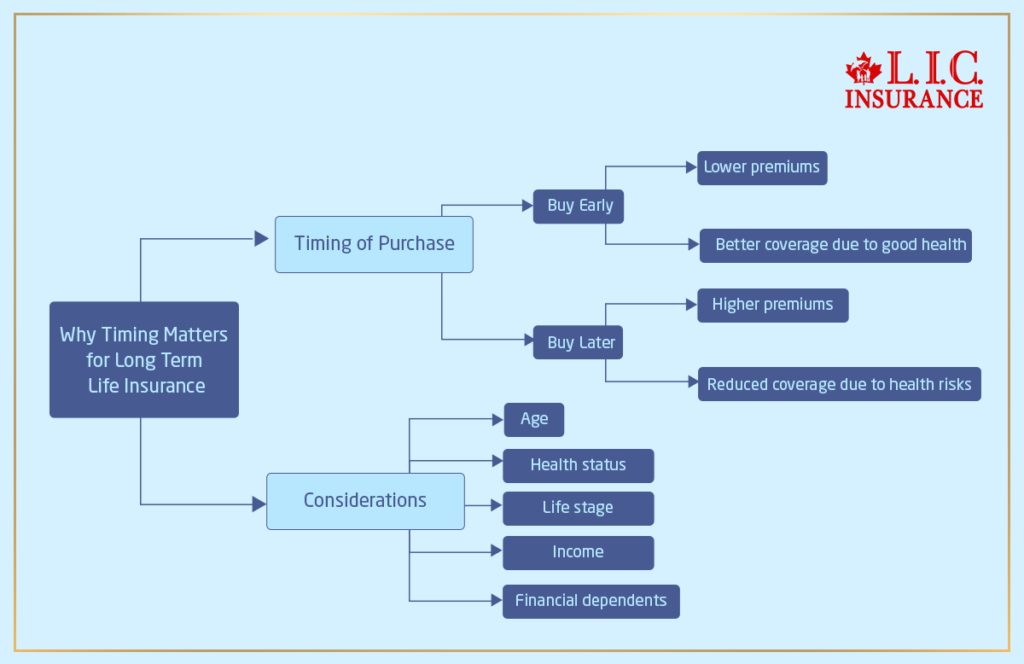

Why Timing Matters for Long Term Life Insurance

We’ve worked with so many clients who waited far too long and, consequently, had to pay greatly higher premiums based on age or other unforeseen health conditions that arose later in life. It’s an everyday issue we confront. People think they can purchase Life Insurance when they “need it” – but what they soon discover is that waiting comes at a price.

However, although younger might seem better in terms of affordability, there are other factors to consider, including your stage in life, your income, and the people depending on you financially.

Buying a Long Term Life Insurance Policy in Your 20s

Maybe Life Insurance isn’t really on your priority list when you’re in your 20’s. There’s a good number of our younger clients in Canadian LIC who confided in us that they thought of themselves as invincible or that Life Insurance was something to worry about when they have a family or mortgage. The real truth is that your 20s are really one of the best times to get a Long Term Life Insurance Policy. Why? You can secure a locked-in low premium rate while you are young and likely healthy.

Lower Premiums: At this stage, you’re likely at your healthiest, and that means you’ll qualify for the lowest premiums. Term Life Insurance Brokers often emphasize how much you can save over the long term by getting insured early. We’ve seen clients in their 20s securing policies with significantly lower Life Insurance Rates than those who wait until later in life.

Financial Security for the Future: Even if you’re single or without dependents, Life Insurance still provides financial security for your future. A Long Term Life Insurance Policy will build in value over time, offering both protection and, in some cases, an investment element. If you develop a medical condition later, you’ll already be covered.

Maybe one of the most common myths we encounter when speaking with people about Life Insurance is that you don’t really need it if you’re purchasing it when you’re in your 20s. Actually, that’s often one of the smartest things you’ll ever do for your finances. When clients receive quotes from Term Life Insurance Broker early in life, they are often surprised at how affordable it can be.

Purchasing Long Term Life Insurance in Your 30s

Your 30s may be a decade in which people really start to consider more mature financial responsibilities, which may include a mortgage, growing family, or other major financial commitments. At that point in life, most people start to see the need for Life Insurance.

We noticed, at Canadian LIC, that customers approaching their 30s become significantly more conscious of the risks involved and the need for some financial protection. Thus, they find their way to us with Term Life Insurance Quotes Online after experiencing life changes, such as marriage or the birth of a child.

Building Family Security: If you have a family or are planning to start one, a Long Term Life Insurance Policy becomes more of a necessity. Should anything happen to you, your Life Insurance would ensure that your spouse and children are financially supported.

Affordable Premiums, But Rising: In your 30s, you’re still young enough to secure reasonable premiums, although they will be higher than if you had purchased in your 20s. We see clients in this age group often regretting not buying insurance earlier, but fortunately, you’re still in a good position to get a policy that won’t break the bank.

Balancing Costs: We also find that clients in their 30s need to balance the cost of Life Insurance with other financial obligations, such as a mortgage or student loans. However, buying a Long Term Life Insurance Policy at this stage is about protecting those who depend on you financially—like your spouse, children, or even aging parents.

Buying Long Term Life Insurance in Your 40s

Buying Life Insurance in your 40s is definitely a good move, especially if you haven’t done so before. During this stage of life, many of our clients at Canadian LIC come to us with concerns about rising premiums, and they are often shocked to see how much they could have saved by purchasing earlier. But then all hope isn’t lost; buying Life Insurance in your 40s is still a good decision, especially if you have dependents.

- Protecting Loved Ones: At this point, you’re likely well-established in your career, perhaps with children nearing college age or other significant financial commitments. If you’re the primary income earner, your Life Insurance policy becomes essential for providing security for your family should something happen to you.

- Higher Premiums: Premiums will undoubtedly be higher in your 40s compared to your 20s or 30s. This is something we frequently discuss with our clients who are exploring term insurance quotes online. That being said, the peace of mind that comes with knowing your family is financially protected often outweighs the cost.

- Addressing Health Concerns: As we age, health concerns start to arise. In your 40s, you may already be dealing with conditions like high blood pressure, diabetes, or other health issues that can affect your insurance premiums. That’s why we always encourage people not to wait too long to get a term life policy. We’ve seen many clients regret waiting until they have health issues, as it often leads to higher premiums or limited coverage options.

Buying Life Insurance in Your 50s and Beyond

Life Insurance premiums shoot through the roof when you enter your 50s and beyond. We’ve worked with numerous clients in this age range who came to Canadian LIC looking for a solution to protect their families, only to be shocked by how much their premium has ballooned in comparison to when they first started out in life.

- Financial Protection for Retirement: In your 50s, you’re likely thinking about retirement, and many clients consider Life Insurance as a way to protect their spouse or children during this period. While the premiums are higher, it’s still possible to find coverage that fits your budget. We often recommend getting quotes from multiple-Term Life Insurance Brokers to ensure you’re getting the best rate.

- Caring for Loved Ones: At this stage, you might have children who are still financially dependent on you, or perhaps you’re helping aging parents. Either way, a Long Term Life Insurance Policy can provide for them after you’re gone, ensuring they’re not burdened with financial obligations.

Why You Shouldn't Wait

This has been one of the key takeaways from years and years of working with so many clients at Canadian LIC: the longer you wait, the more you pay. Age is the biggest determinant of Life Insurance premiums. While buying a Life Insurance policy early in life might seem unnecessary, waiting will make it significantly more expensive later on.

Many clients come to us saying they wished they had bought a policy earlier when they were younger and healthier. Some waited too long and found that their premiums were unaffordable. Life Insurance is not something to be acquired for today alone but helps ensure that your future and the future of your family are secured.

The Role of Term Life Insurance Broker

We work with seasoned Term Life Insurance Brokers at Canadian LIC to assist clients in sifting through all the intricacies to find the right policy. You will receive personalized advice, more than one quote from different insurers, and, while filling up your application, a guide to walk you through the process. In this way, we help you save money and time and get the best insurance for you.

Finding Term Life Insurance Quotes Online

Today, it’s easier than ever to get Term Life Insurance quotes on the internet. Many of our clients find and research their Life Insurance from the web, and it is extremely convenient to do so. After you have shopped the free quotes online, however, it is often a good idea to follow up with a Term Life Insurance broker to make sure your particular needs are met and that particular situation.

We always advise calling an expert who can go through all the details, answer any questions, and help you in getting the best possible rate.

The Best Age to Buy Life Insurance: Key Considerations

While we have already discussed the benefits of buying a Life Insurance Policy at various points in life, do remember that this stage can vary depending on several factors as well. Here are a few key considerations that will help you decide which one is best for you:

Health and Medical History

Health is one of the biggest influencers of insurance premiums. The younger and healthier you will have, the greater your tendency to have smaller premiums upon getting insured. We have seen numerous Canadian LIC clients wait until health problems come about before getting insurance coverage. Not only did this make their insurance policies more expensive, but it even left them with little choice in regard to being covered. Even when you think that you are invincible, it is always wise to secure the policy early since it could protect you from complications in health and costs in times later on.

Financial Dependents

A second major concern is who financially relies on you. If you have a family—particularly if you have children—it is crucial to make sure that they are protected in case something happens to you. We have had many customers seek us out in their 30s and 40s specifically for Term Life Insurance Quotes Online, usually following large milestones in life, such as when a child is born or a home is purchased. These milestones are, therefore, times when the urgency for having Life Insurance is sure to emerge.

Even if one is single and does not have dependents, there can be other uses for a Long Term Life Insurance Policy, such as paying off debts, covering funeral expenses, or leaving behind an inheritance. Among our younger clients who purchased Life Insurance early on were clients who reported being glad they made the decision because their financial obligations changed over time, and they were able to adjust the coverage based on new circumstances.

Affordability and Budget

Affordability is a huge factor in deciding when to get Life Insurance. While premiums are often lower when you are younger, that has to be balanced with your budget. We often tell our clients here at Canadian LIC that getting a policy that fits their financial situation is more important than getting the “biggest” policy. A smaller, affordable policy is always better than none at all.

Well, at this time, you just can’t afford a big policy if you are in your 20s or 30s, as you possibly use or are saving for a house, most likely through student loans. But getting even a very small, Long Term Life Insurance Policy when you are young is going to lock in low premiums, giving you an opportunity to increase coverage when your income rises.

Job Benefits and Employer Policies

For others, having access to group Life Insurance through an employer discourages them from purchasing individual Life Insurance. Although this could be a viable alternative, employer-based policies are typically low in terms of coverage levels, and moreover, they do not port to new employers when a job changes. Many of our clients realize that it is only too late, and that alone is insufficient to meet their needs.

At Canadian LIC, we always recommend supplementing any group Life Insurance plan with your own individual policy. This ensures that your coverage continues even if you leave your job, retire, or lose access to the employer’s benefits. For this reason, purchasing Life Insurance at any age—regardless of your employment situation—provides added security and flexibility.

How to Choose the Right Long Term Life Insurance Policy

Once you decide on the best time to buy Life Insurance, it may be necessary to choose the right policy. The process becomes really confusing due to so many options. However, our brokers in Term Life Insurance at Canadian LIC can steer you through these options by just asking you a few key questions:

How Much Coverage Do You Need?

The coverage amount will depend on your current debts, income, and your dependents’ financial requirements. A more general rule is that you buy Term Life Insurance Coverage equal to 10 to 12 times your annual income so as to ensure sufficient funds to cover mortgage and funeral costs and continue a quality lifestyle for your dependents in case you are gone.

For example, a client in their thirties, with a mortgage and two children, would need to have a more substantial policy than an individual in their 20s who is single and debt-free. At Canadian LIC, we take each client and calculate how much they want to cover them based on their current financial situation and what they are working to achieve in the future.

How Long Do You Need Coverage For?

Long Term Life Insurance may last for decades or even a lifetime, depending on the type of policy you choose. In this respect, the common one is Term Life Insurance, which has provisions for a specified period, usually 10, 20, or even 30 years. This also corresponds to online Term Life Insurance quotes represented by the length of the term and the amount of coverage you select.

If you wish to cover at a working stage, then it would be helpful to consider Term Life Insurance. Most of our clients at Canadian LIC opt for term policies since they are economical and straightforward. Conversely, when you are looking for lifetime cover and earnings with cash value, whole Life Insurance would be helpful.

What Can You Afford?

While we’re always driving home the need for ample lifelong coverage, it’s very much equally important that one selects a policy that fits the budget. Many of our clients come to us overwhelmed by what they feel they cannot afford in Life Insurance, only to find that upon exploring all their Life Insurance options, they not only can but should be purchasing a policy that covers them properly.

For most people, especially those in their 20s and 30s, Term Life Insurance would be the cheapest Life Insurance option. This policy is a bit more expensive than longer periods, but it provides protection over a longer period. The concern here is how to balance enough coverage with comfortably paying the premium.

Real Struggles and Success Stories from Canadian LIC

At Canadian LIC, we have helped many clients find the right Long Term Life Insurance. One client shared with us that he always kept putting off the idea of purchasing a Life Insurance policy simply because he felt that, as a young man in his 20s, he did not need it. By the time they decided to buy in their mid-30s, his premiums were really high. Though they had managed to get a policy to take care of the family, this made them realize how helpful it would have been to buy insurance much earlier.

Another client was 50-plus years old. Because he thought he had failed in his bid to acquire low-cost cover, he came to us. With such clients, their age increased their premiums. We thus told our Term Life Insurance Broker to find a specific policy that met his budget and covered his spouse and children.

The stories portray the need not to delay too long over purchasing a policy. Whether you are still in your 20s, 30s, 40s, or even on your dotage, it’s never too soon nor too late to ensure security for your family’s money.

Canadian LIC: Your Partner in Life Insurance

Even the decision to buy Life Insurance can be daunting in itself, given the question of when it’s a good time to consider taking action. That is why we work closely with our clients to identify suitable policies that meet the unique needs of each person. Whether it involves the online comparison of Term Life Insurance quotes or seeking individualized advice from a Term Life Insurance broker, our team guides you through this process.

Whether you’re just starting to think about Life Insurance in your 20s or need coverage in your 50s, Canadian LIC can help you find the right Long Term Life Insurance Policy at the best possible rate.

Don’t wait to protect your loved ones and your future. Take the first step today to get Long Term Life Insurance.

More on Term Life Insurance

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions: Best Age to Buy a Long Term Life Insurance Policy

Sources and Further Reading

- Canadian Life Insurance Association (CLHIA)

Visit the official website of CLHIA for insights on Life Insurance policies, including long-term options and industry guidelines.

CLHIA Life Insurance Guide - Government of Canada – Life Insurance Overview

Explore the basics of Life Insurance in Canada, including different types of policies, such as term and Long Term Life Insurance.

Government of Canada: Life Insurance - Insurance Bureau of Canada (IBC)

The IBC offers comprehensive information on the importance of insurance, including FAQs on Long Term Life Insurance.

Insurance Bureau of Canada - Financial Consumer Agency of Canada (FCAC)

Find valuable resources on budgeting for insurance, the role of brokers, and how to select the right Life Insurance coverage.

FCAC Life Insurance Information

These sources provide further reading on Long Term Life Insurance Policies, Term Life Insurance Broker, and related insights for making informed decisions in Canada.

Key Takeaways

- Buying early saves money – Purchasing a Long Term Life Insurance Policy in your 20s or 30s leads to lower premiums and long-term savings.

- Coverage depends on the stage – The right time to buy depends on your financial responsibilities, such as dependents, debts, or future obligations.

- Health impacts premiums – The younger and healthier you are, the lower your Life Insurance premiums will be, making early purchase beneficial.

- Term Life Insurance Brokers can help – They can guide you through different policies, find the best options, and provide personalized advice.

- You can get Term Life Insurance Quotes Online – Start your search online, but it’s best to work with a broker to tailor the policy to your needs.

Your Feedback Is Very Important To Us

IN THIS ARTICLE

- What is the best age to buy a Long Term Life Insurance Policy?

- Why Timing Matters for Long Term Life Insurance

- Buying a Long Term Life Insurance Policy in Your 20s

- Purchasing Long Term Life Insurance in Your 30s

- Buying Long Term Life Insurance in Your 40s

- Buying Life Insurance in Your 50s and Beyond

- The Role of Term Life Insurance Broker

- Finding Term Life Insurance Quotes Online

- The Best Age to Buy Life Insurance: Key Considerations

- How to Choose the Right Long Term Life Insurance Policy

- Real Struggles and Success Stories from Canadian LIC

- Canadian LIC: Your Partner in Life Insurance

- More on Term Life Insurance

Sign-in to CanadianLIC

Verify OTP