If you’re a parent in Canada, working, parenting, and managing all the expenses that come with raising a child, then among all the things you worry about, one thing tops the list – your child’s education. You’ve heard of Registered Education Savings Plans (RESP), and you’re interested, but the rules and contribution limits for 2024 are confusing and overwhelming. If that sounds like you, you’re not alone. Many Canadian parents are in the same boat, trying to figure out the RESP rules and make good decisions for their kids.

What are RESP Rules and Contribution Limits in 2026?

By Harpreet Puri, Januray 12, 2026, 11 Minutes

SUMMARY

The blog explains RESP rules and contribution limits in 2026, including annual and lifetime limits, CESG grants, tax benefits, withdrawal strategies, and RESP flexibility. It features real client stories from Canadian LIC to show how to maximize RESP savings, avoid penalties, and choose the right education investment plan using RESP Quote Online.

INTRODUCTION

If you’re a parent in Canada, working, parenting, and managing all the expenses that come with raising a child, then among all the things you worry about, one thing tops the list – your child’s education. You’ve heard of Registered Education Savings Plans (RESP), and you’re interested, but the rules and contribution limits are confusing and overwhelming. If that sounds like you, you’re not alone. Many Canadian parents are in the same boat, trying to figure out the RESP rules and make good decisions for their kids.

At Canadian LIC, the Best Insurance Brokerage, we meet parents like you every day. They come to us with stories of confusion and frustration and want to know the rules and how to contribute more to their RESP. Today, we’re going to break down the rules and limits for you. So grab a coffee to get into the world of RESPs.

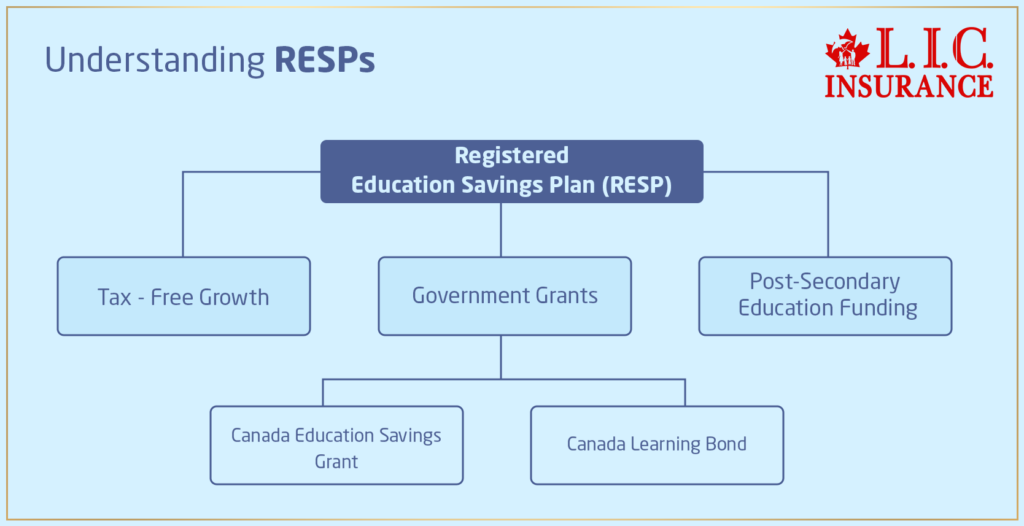

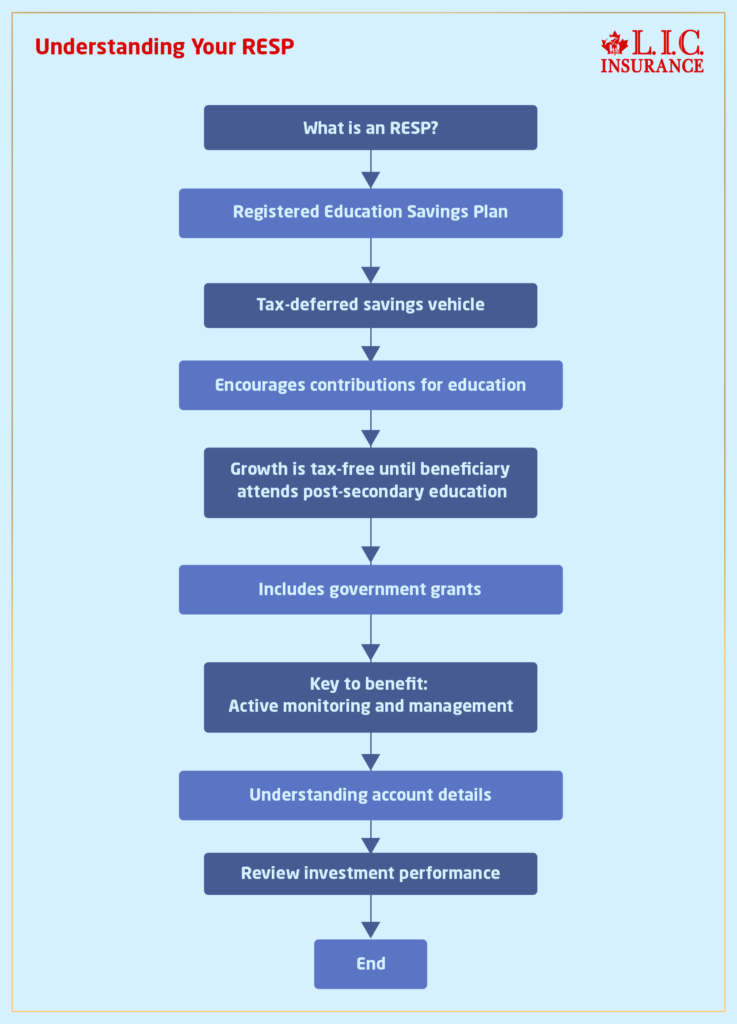

What is a RESP?

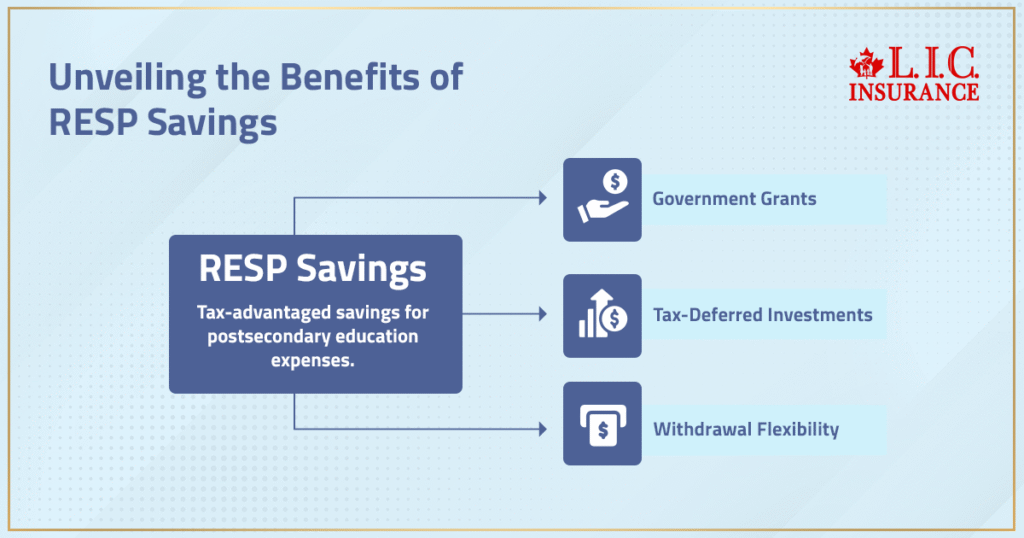

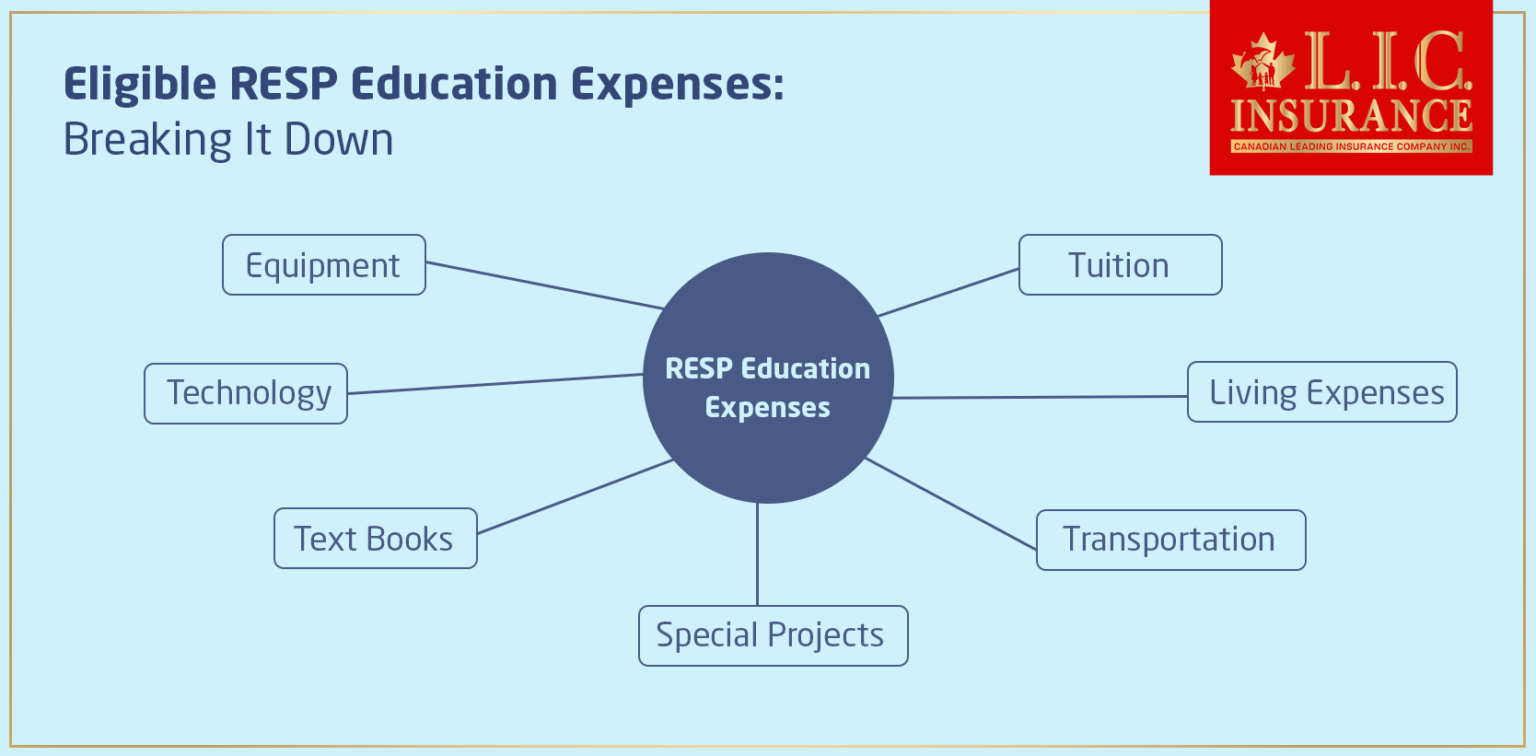

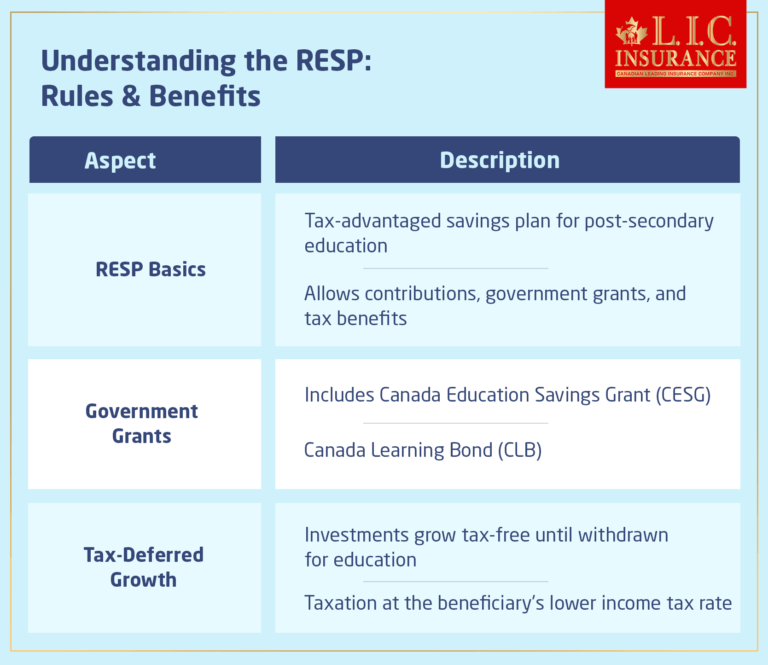

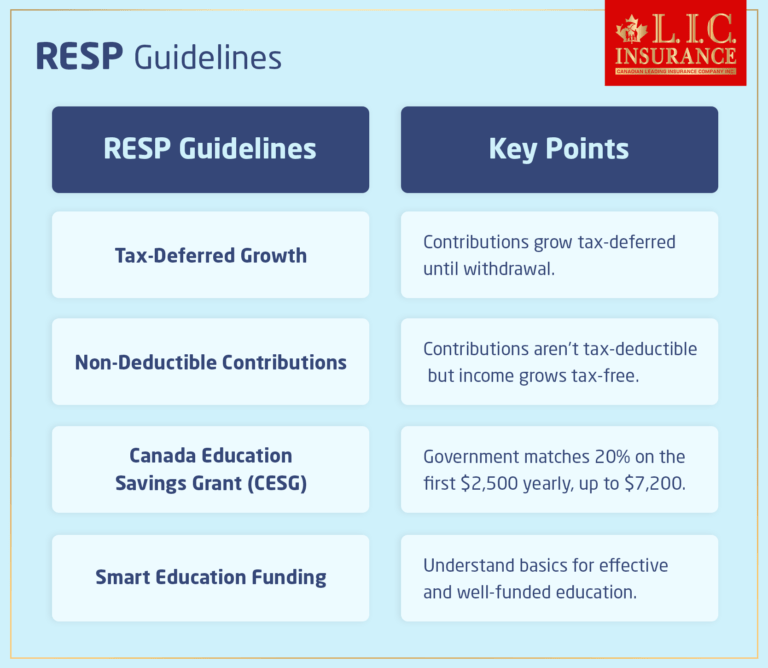

An RESP is an investment vehicle that is explicitly tax-advantaged to help people save for their beneficiaries’ post-secondary education in Canada. The government offers incentives, including grants, that help bump up your savings, but you need to know the rules and contribution limits to receive these benefits fully.

Why an RESP is Important

Contribution Limits For 2026

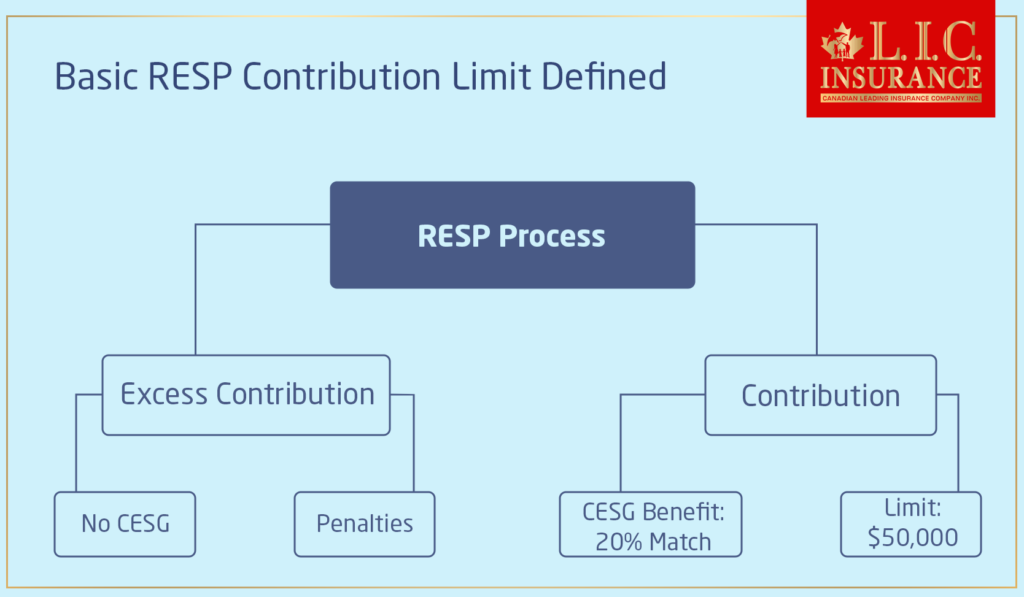

Although the rules governing RESP contributions are flexible, there are some limitations in place to ensure one gets the maximum benefits without penalties.

Annual Contribution Limit: There is no annual RESP contribution limit for Registered Education Savings Plans. However, to maximize government grants, contributing up to $2,500 per year per child is recommended.

Lifetime Contribution Limit: The lifetime contribution limit for each beneficiary is $50,000. This means that all contributions made by various subscribers for a single beneficiary cannot exceed this amount.

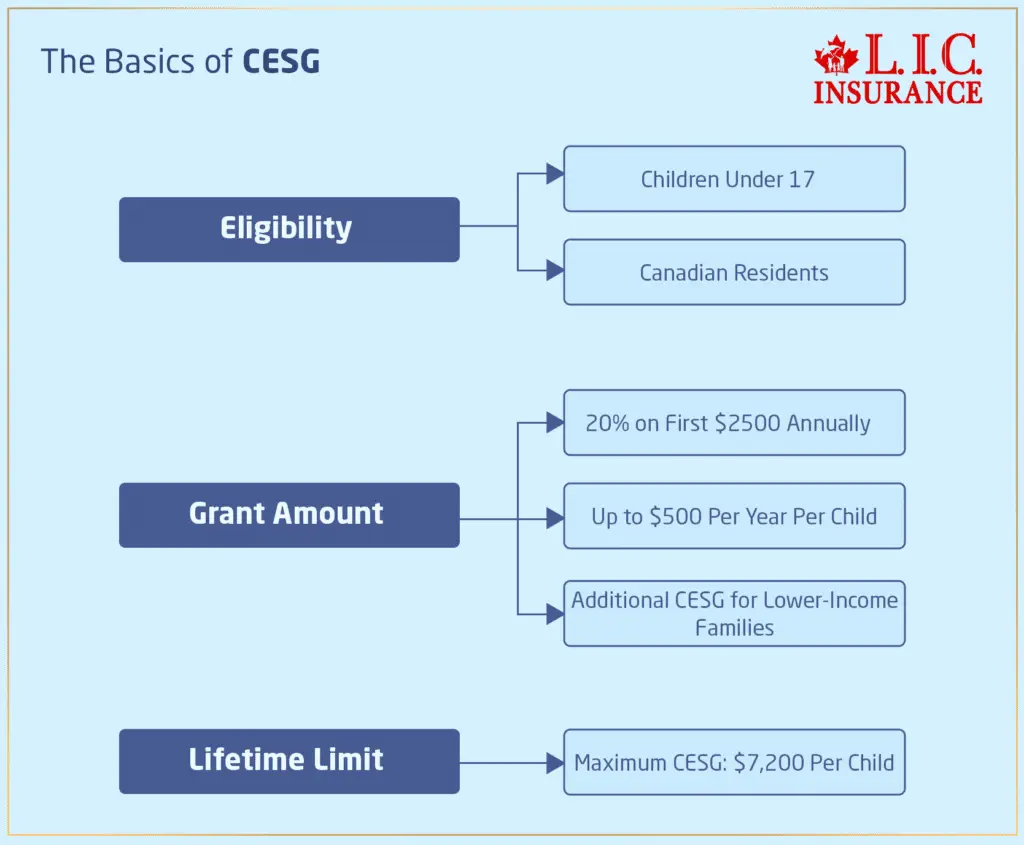

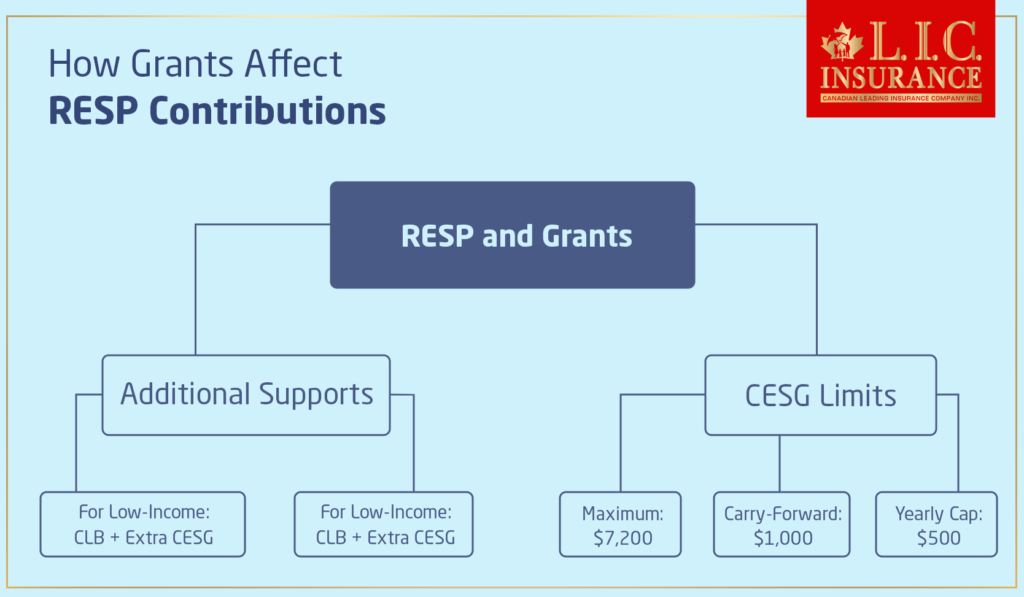

Canada Education Savings Grant (CESG): The CESG provides 20% on the first $2,500 contributed each year, with a maximum of $500 annually. The lifetime maximum Canada Education Savings Grant CESG is $7,200 per child.

Understanding the Limits

Let’s take the story of John and Lisa, a couple who came to us with concerns about their contributions. They had received the RESP Quote Online but needed clarification about the lifetime limits and government grants. They had already saved $10,000 each year for the past three years and worried about exceeding the limits.

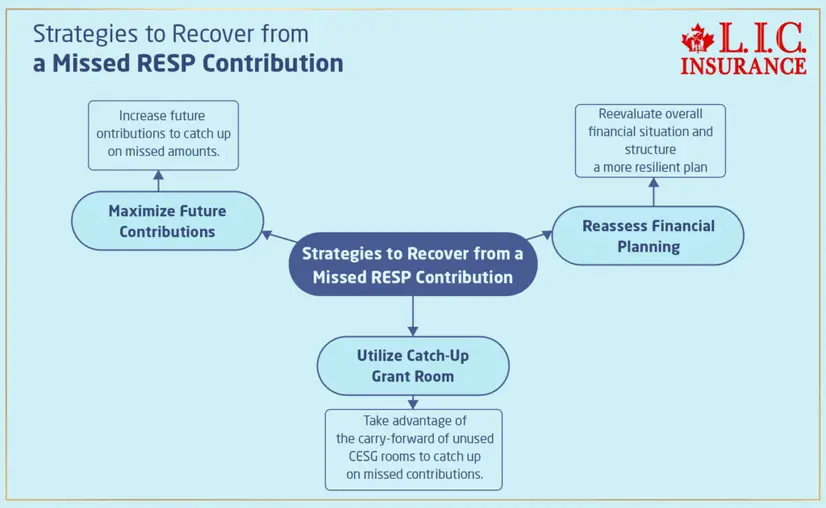

We explained that while there’s no annual limit, staying within the $2,500 annual contribution helps maximize the CESG. They risk not receiving the full government grant by contributing more in one year. Unused CESG room can be carried forward; however, the maximum CESG that can be received in a single year is $1,000, which requires a $5,000 contribution.

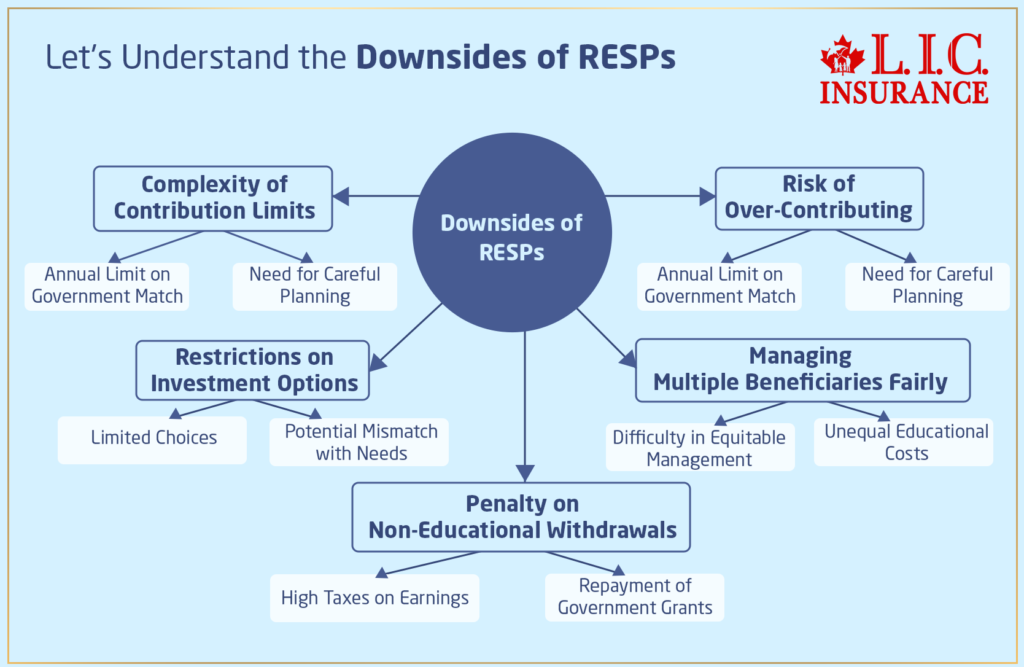

Penalties for Over-Contribution

Excessive contributions to the RESP can attract a penalty. If the total contribution for a beneficiary exceeds $50,000, there is a 1% per month penalty on the excess amount. It adds up pretty fast and would definitely chip away at the many gains of using an RESP.

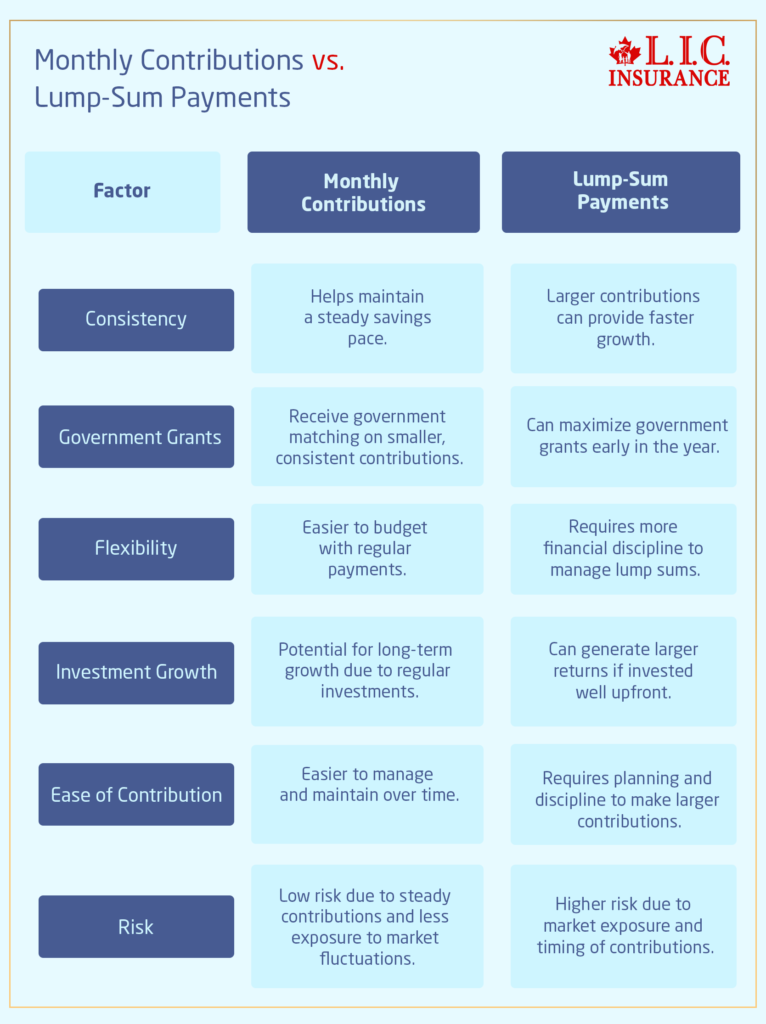

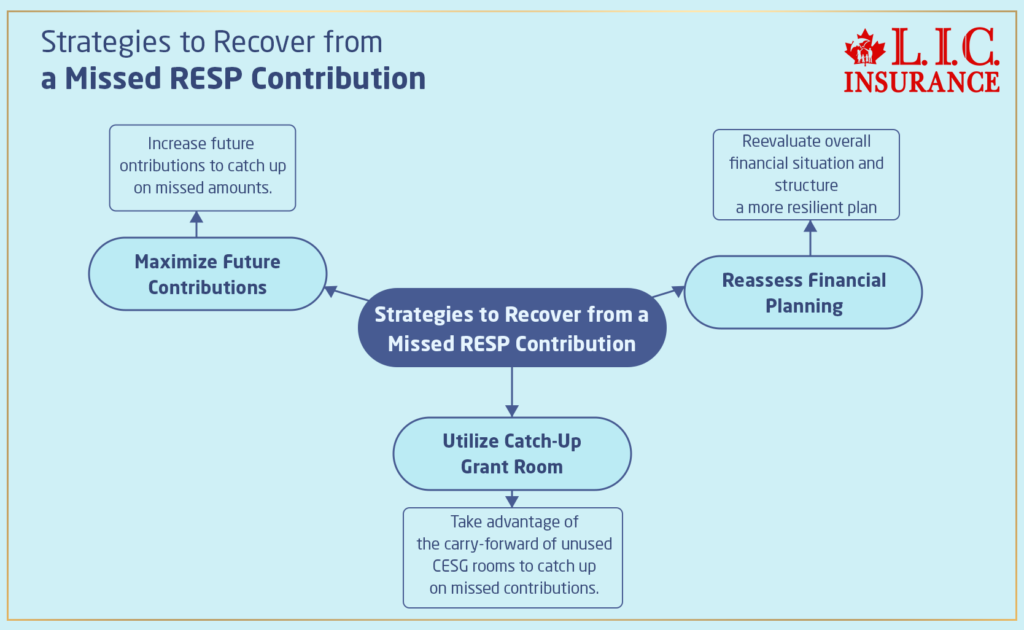

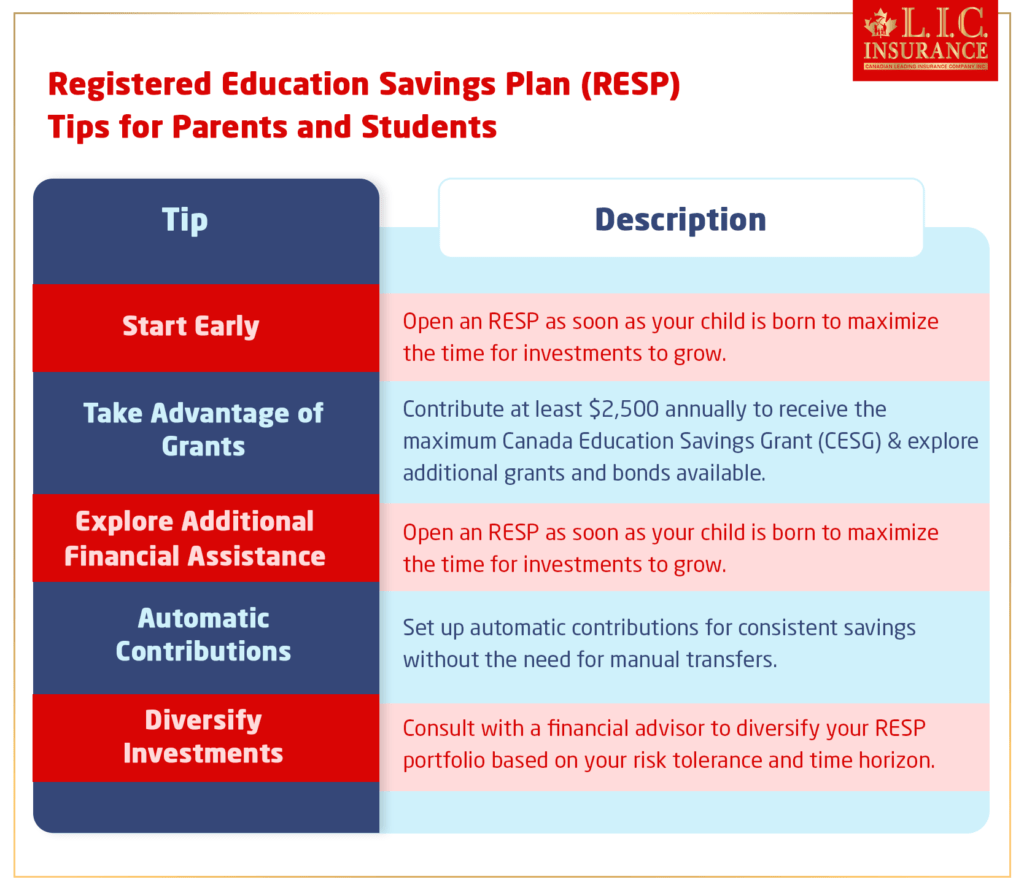

Strategies to Maximize Your RESP

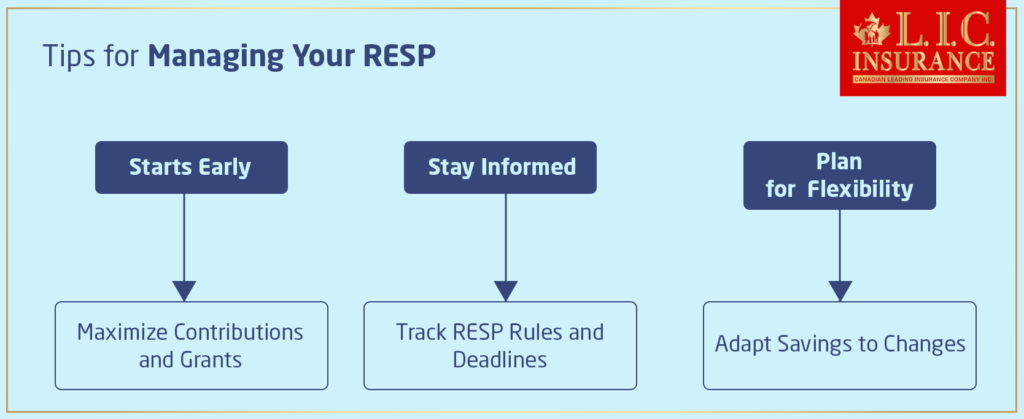

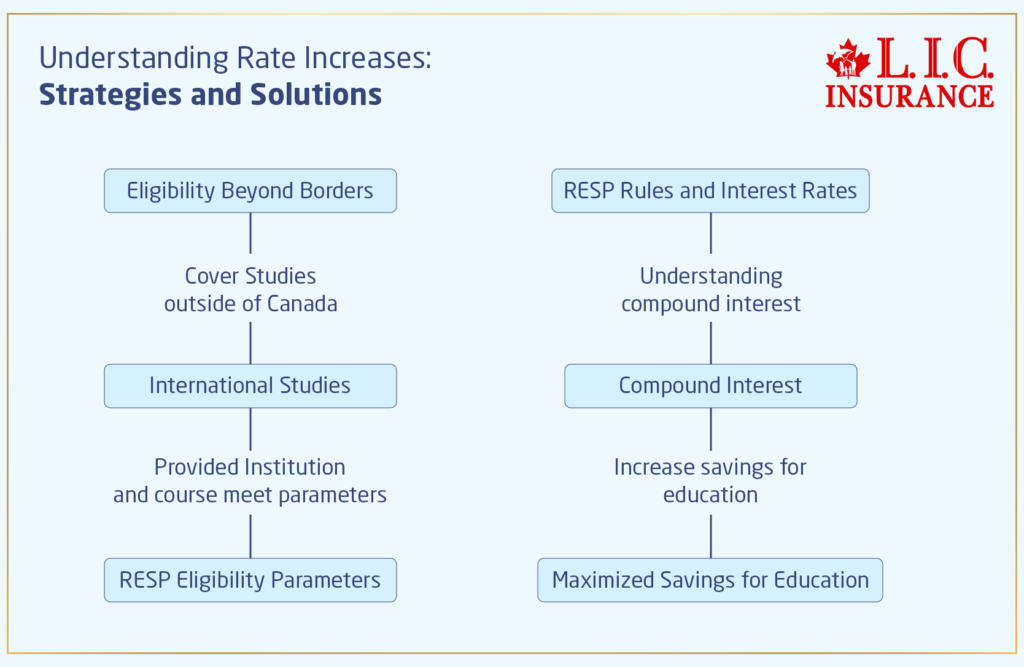

Begin Early: The earlier you start, the more you benefit from compound interest and government grants. Starting an RESP when your child is born can significantly boost your savings.

Consistent Contributions: Make regular contributions to take full advantage of the CESG. Even small, consistent amounts can grow substantially over time.

Catch-Up Contributions: If you miss a year, you can carry forward unused grant room. For instance, if you didn’t contribute the full $2,500 one year, you can contribute more in subsequent years to catch up.

We had a client, Emily, who missed contributing in the first five years of her daughter’s life. By the time she came to see us, she was concerned that she had lost out on the opportunity for the CESG. We explained to her that she could still catch up on the missed contributions and get the grant by contributing more in subsequent years. That flexibility really helped Emily get back on track and maximize her RESP benefits.

Government Grants and Bonds

The Canadian government offers several grants and bonds to boost your RESP savings:

Canada Education Savings Grant (CESG): As mentioned earlier, the CESG matches 20% of annual contributions, up to a maximum of $500 per year. Additional CESG is available for lower-income families.

Canada Learning Bond (CLB): The CLB is aimed at helping lower-income families. It provides an initial $500, followed by $100 per year for eligible children, up to a lifetime maximum of $2,000, without requiring any personal contributions.

Maximizing Government Grants

Meet Ahmed. He’s another one of our hard-working clients trying to support his family. Quite simply, he didn’t know about the Canada Learning Bond and had missed out on the initial grants. After we had enlightened him about the CLB, with a little persistence, he applied for and received the grants that were going to give his children a better start on their education savings. This little extra help from the government made all the difference for Ahmed in being able to save for his kids’ future.

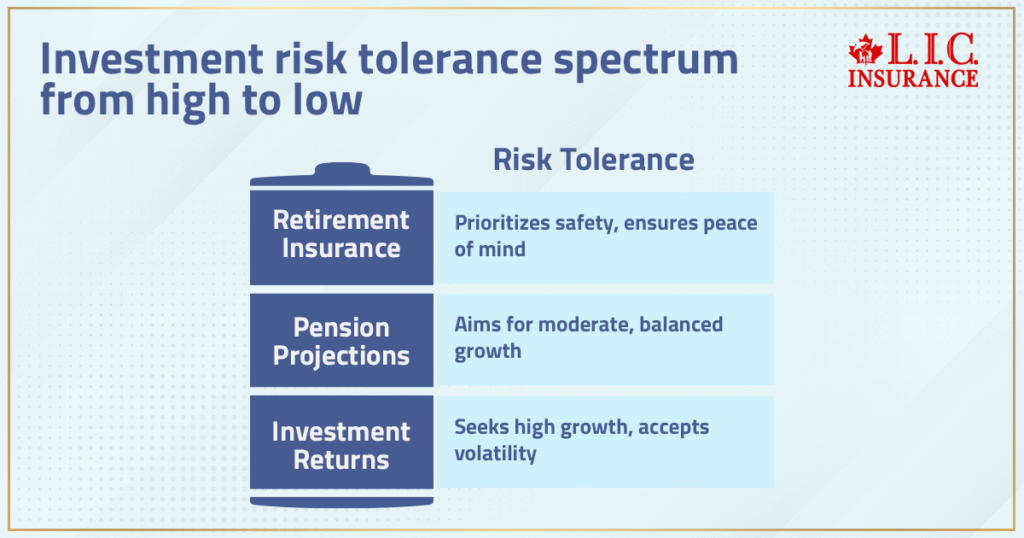

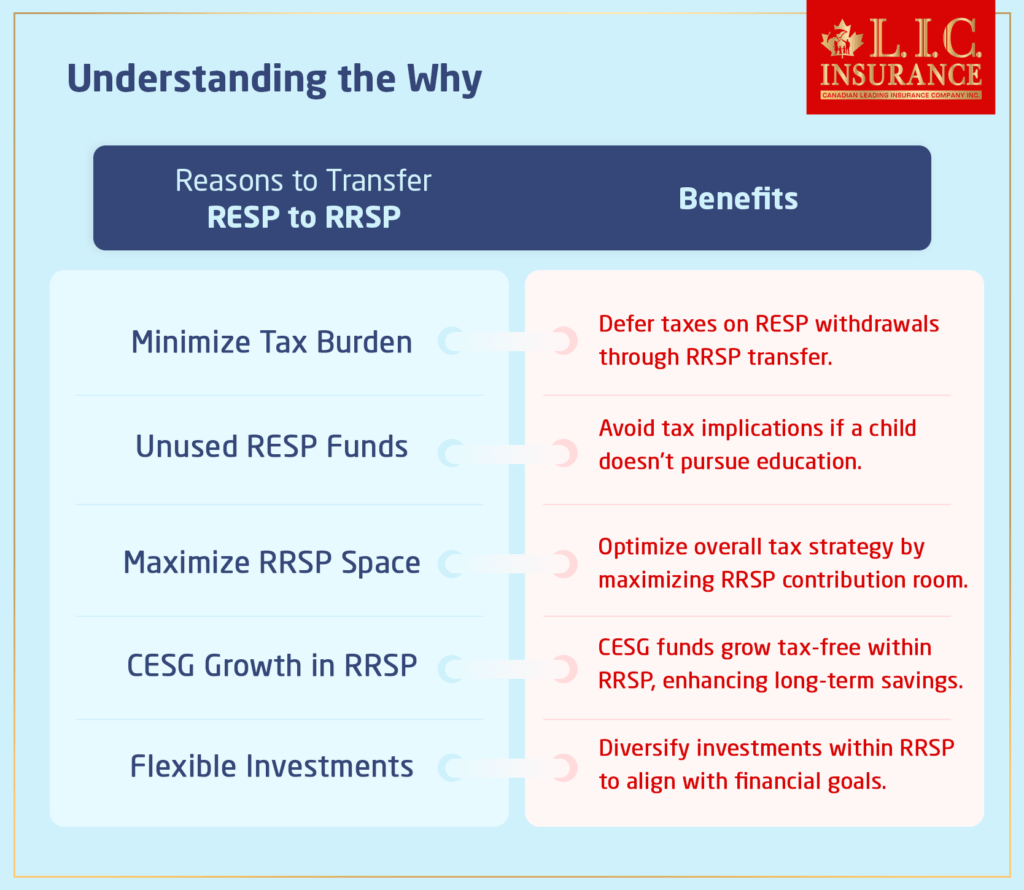

Tax Benefits of a RESP

One of the key advantages of an RESP is the tax benefits. Although the contributions will not be deducted from your taxable income, the investment income permitted to accumulate inside the plan will do so tax-deferred. Contributions can be withdrawn tax-free, while investment earnings and government grants are taxed in the hands of the beneficiary, who is typically in a lower tax bracket.

Tax Benefits in Action

Take Maria and David, for example. They were worried about taxation with their RESP. We had heard some mixed information about how the earnings get taxed when it’s time to take money out of the account. We clarified that while the contributions can be withdrawn tax-free, the earnings and government grants are taxed in the hands of the beneficiary, usually a student in a lower tax bracket. This means minimal tax impact, allowing more of their savings to go towards education expenses.

Withdrawal Rules

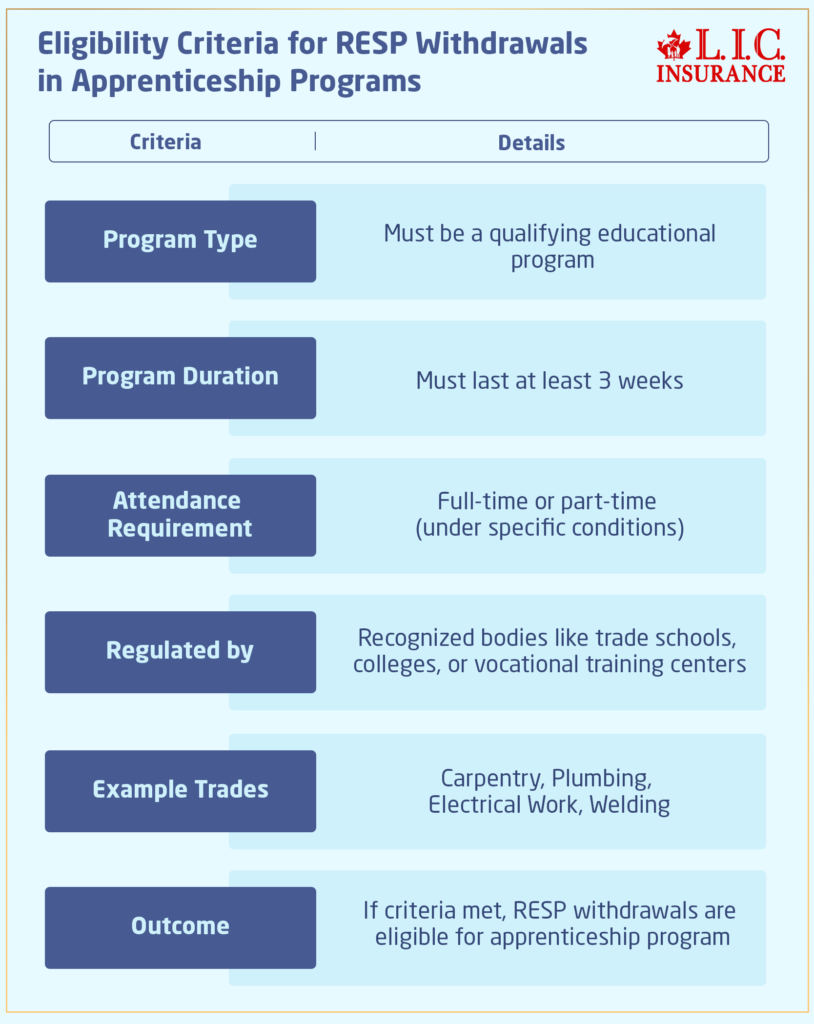

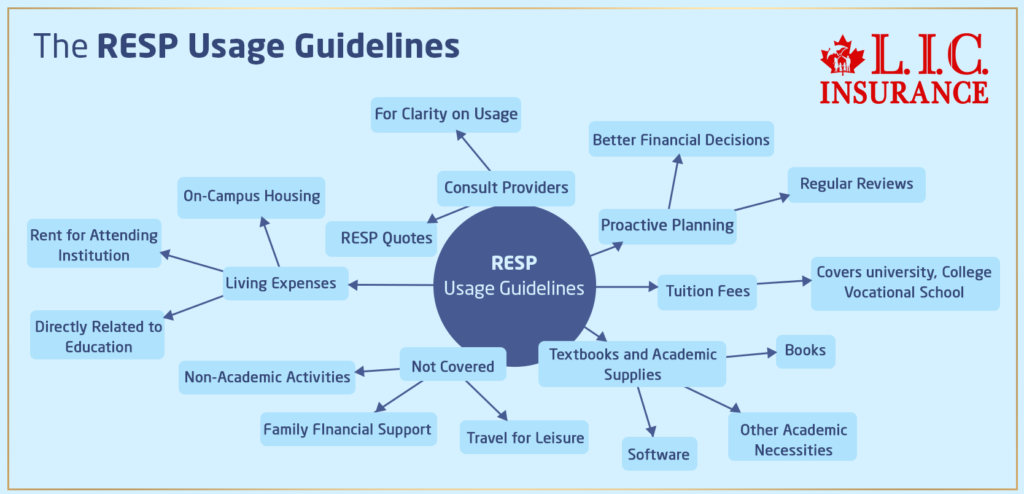

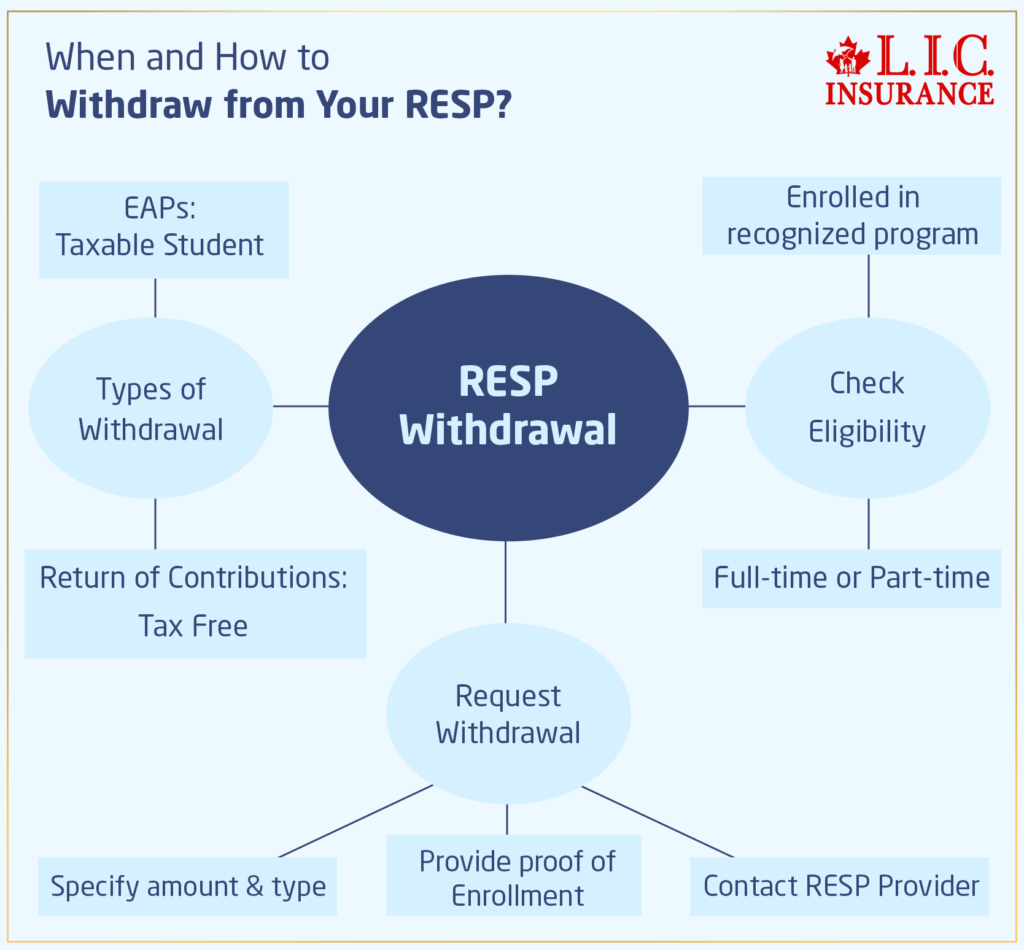

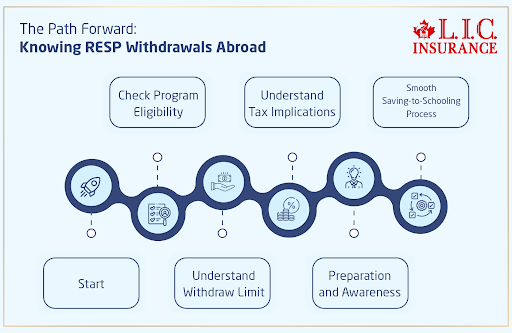

When it comes time to use the RESP funds, understanding the withdrawal rules is crucial:

Educational Assistance Payments (EAPs): EAPs include investment earnings and government grants. These are taxable in the hands of the student.

For full-time students, EAP withdrawals are limited to $8,000 during the first 13 consecutive weeks of enrollment ($4,000 for part-time studies). After this period, withdrawals are not capped as long as the student remains eligible.

Post-Secondary Education (PSE) Withdrawals: Contributions can be withdrawn tax-free at any time, as they were made with after-tax dollars.

Withdrawal Strategies

Let’s take the case of Laura, a client whose son was entering university. She wanted to ensure they used the RESP money efficiently. We suggested she start with an EAP, as it would be taxed in the student’s hands, and only then would she use the Post-Secondary Education withdrawals when necessary. This minimized their tax and maximized the funds available to fund education expenses to the fullest.

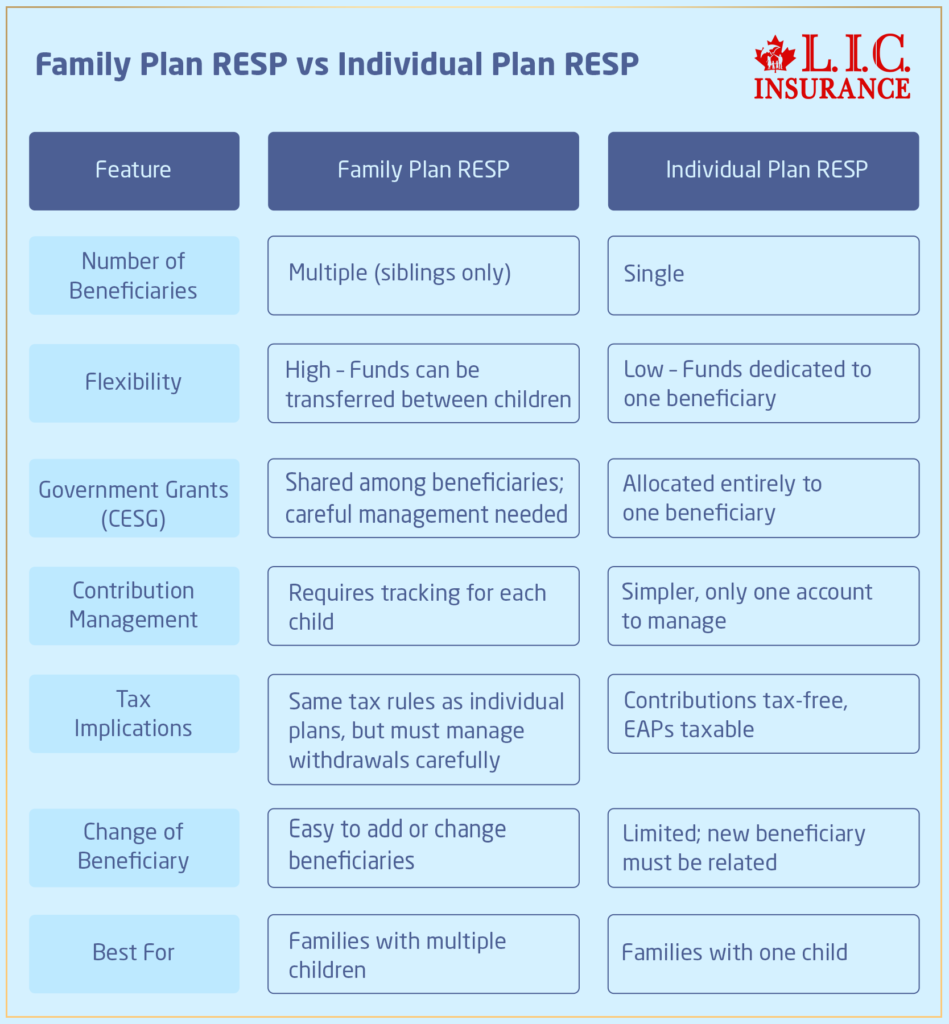

RESP and Changing Beneficiaries

Sometimes, life doesn’t go as planned, and the original beneficiary may not pursue post-secondary education. In such cases, you have options:

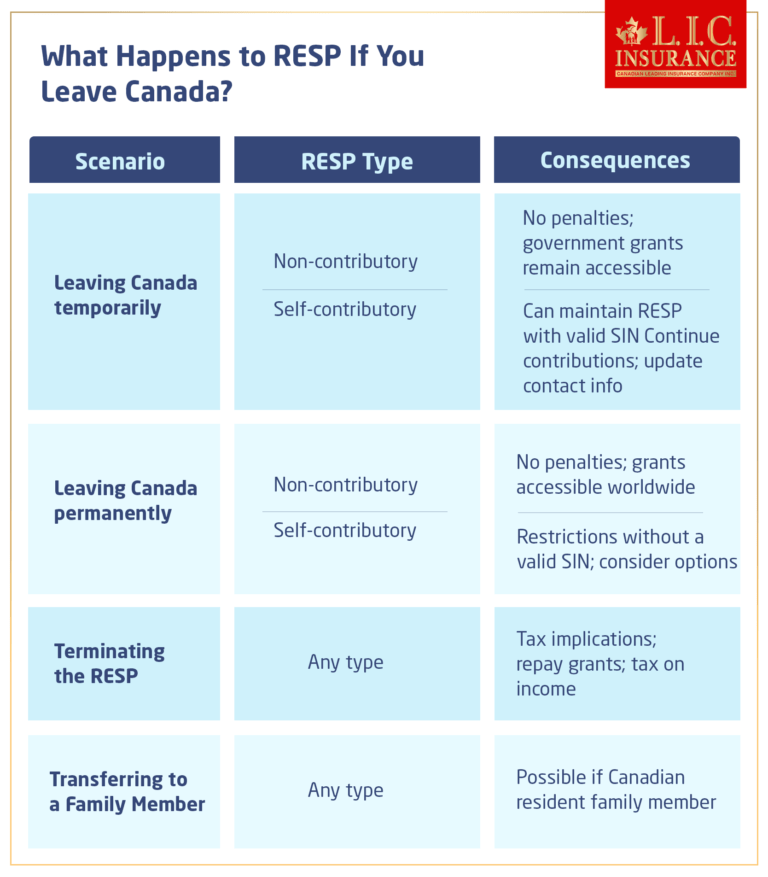

Changing the Beneficiary: You can transfer the RESP to another eligible beneficiary, such as a sibling, without penalties.

Keeping the Plan Open: You can keep an RESP open for up to 35 years.

For beneficiaries eligible for the Disability Tax Credit (DTC), the RESP can remain open for up to 40 year

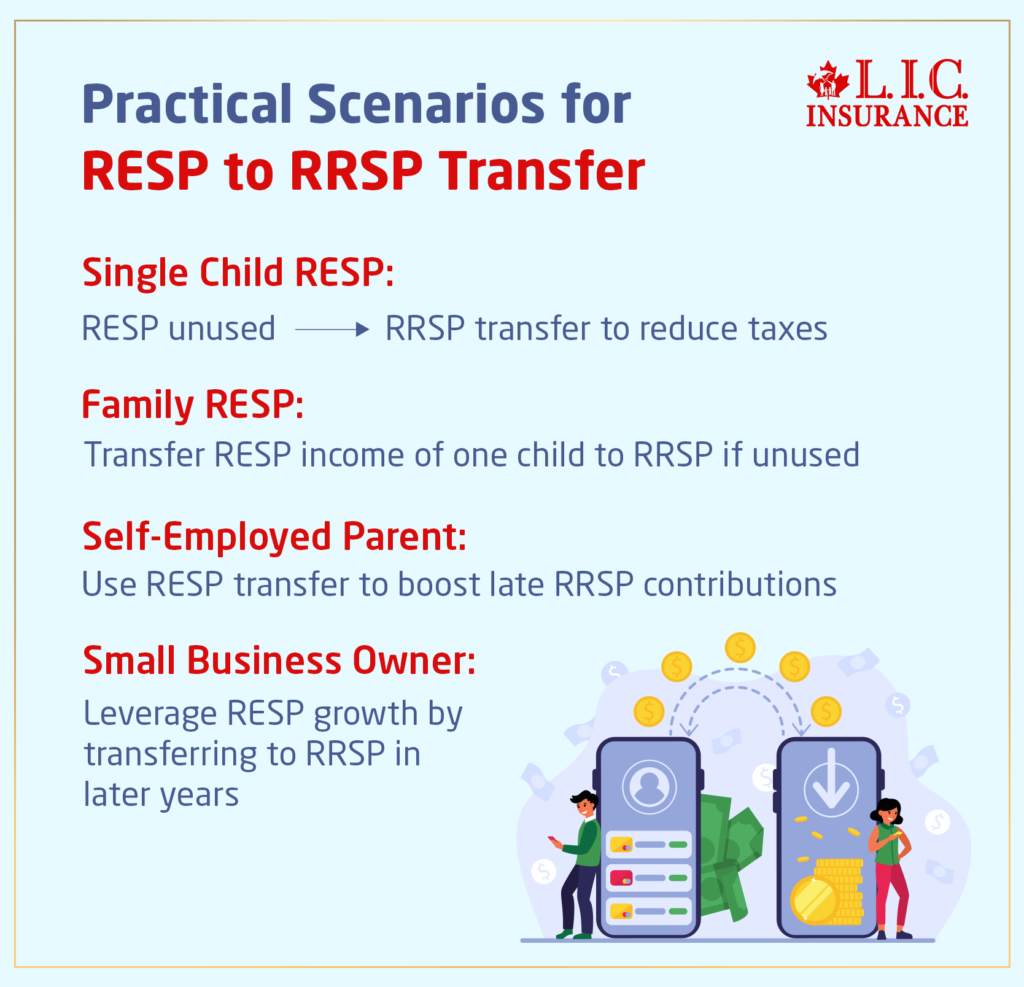

Changing Beneficiaries

We had a client, Mark, whose daughter decided not to pursue any education that would take her to post-secondary education. He was worried that now he was going to lose the benefits of the RESP. We advised that he could transfer the RESP to his younger son to ensure that the family still benefited from these savings and grants. This flexibility gave Mark peace of mind and kept his Education Investment Plan on track.

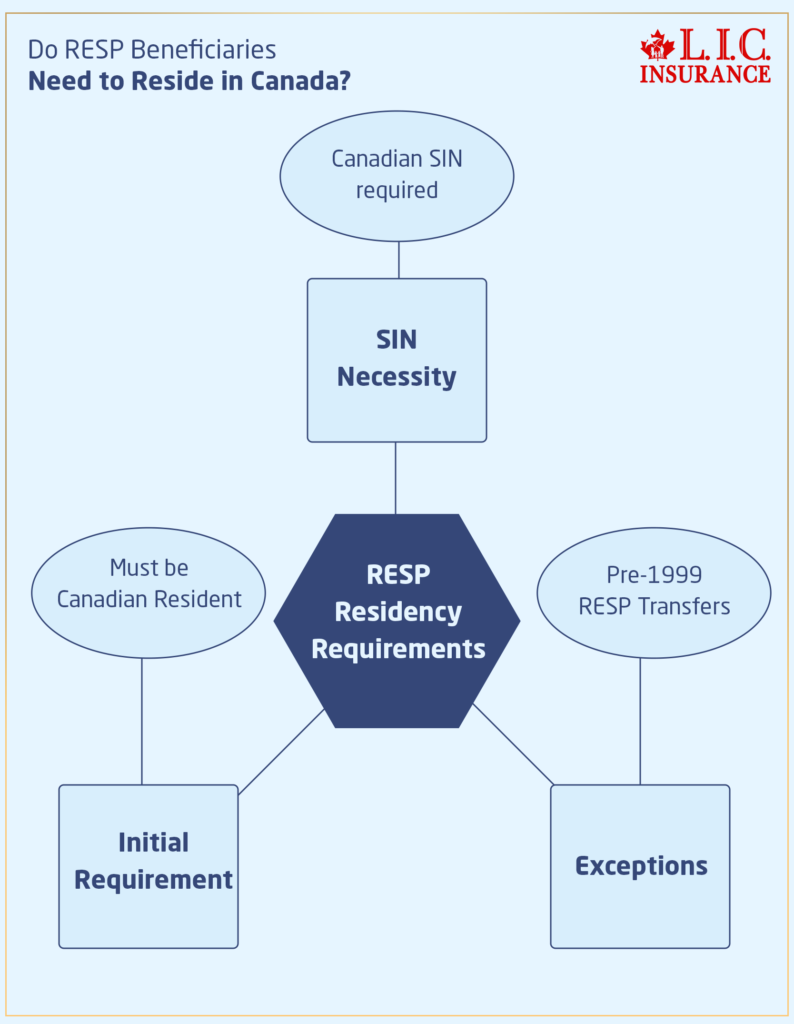

Learn more about Does a RESP Beneficiary need to live in Canada

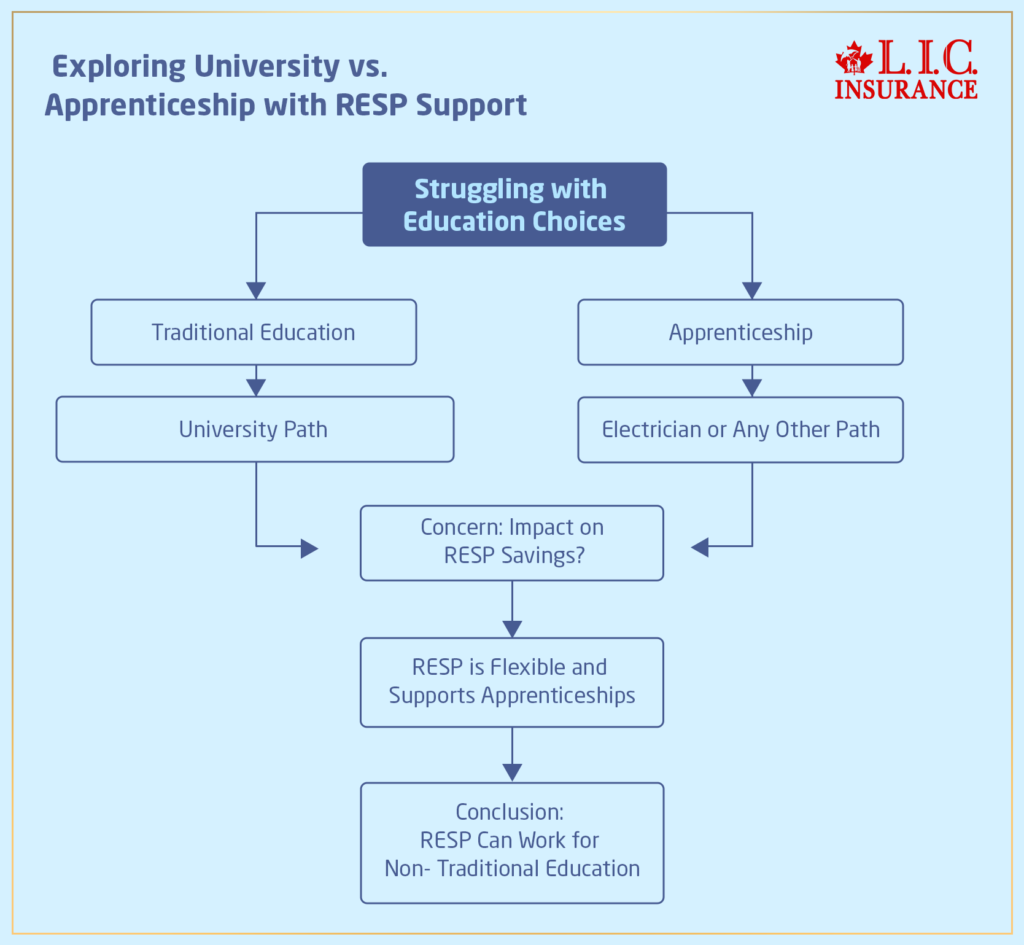

RESP Flexibility for Changing Life Plans

At Canadian LIC, we understand that no two families follow the same path. Life throws curveballs—job changes, relocations, new children, or even shifts in your child’s academic interests. That’s why the flexibility of RESP accounts is one of their most underappreciated strengths.

Take the story of Harjit and Simran, a couple who had set up an individual RESP for their first child. Later, they had two more children and needed a plan that could benefit all three. We helped them convert to a family RESP, allowing them to allocate the grants and investment growth more efficiently across their kids based on who needed the funds first.

You’re not locked in. Whether you want to switch from an individual to a family RESP plan, or reassign the beneficiary because one child skips post-secondary education, RESP rules make room for those shifts without wasting your savings or losing out on government grants.

That kind of flexibility allows families to make smart decisions as their circumstances evolve—and with our support, you can adjust your RESP strategy to ensure it works for your real-life needs at every stage.

We don’t just set up RESPs—we guide you through their growth, every step of the way.

The Bottom Line

Understanding the rules and contribution limits of a Registered Education Savings Plan in Canada can be tough, but it’s crucial for your child’s education. By knowing the contribution limits, maximizing government grants, and taking advantage of tax benefits, you can get the most out of your RESP.

At Canadian LIC, The Best Insurance Brokerage, we’re here to help you every step of the way. We’ve seen firsthand how proper planning and understanding of RESP rules can change the lives of families and make education affordable. Don’t wait – start your RESP today and give your child the best start in life. Contact us for personalized advice, and let’s secure your child’s future together.

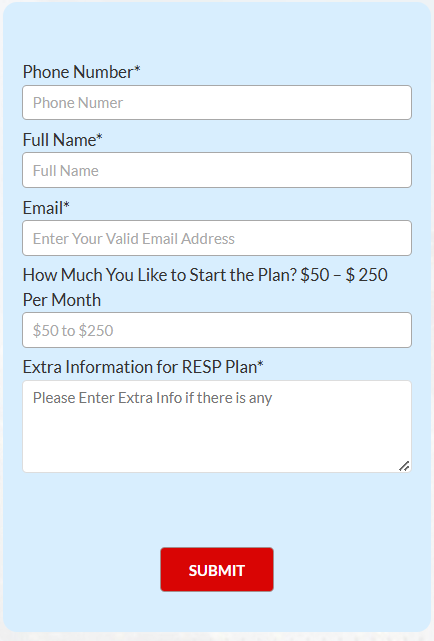

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

An RESP is a Registered Education Savings Plan, which is a tax-advantaged savings account that helps parents save for a child’s post-secondary education. The Canadian government can offer incentives, like grants, to boost your savings.

RESPs are excellent Education Investment Plans. The money that one invests in the plan grows without any taxation, and the government adds grants to help your savings grow. One of our clients, Sarita, was able to systematically save for Lokesh’s education by including growth and grants together.

There is no annual contribution limit, but there is a lifetime contribution limit per beneficiary of $50,000. Contributions of $2,500 per year help maximize CESG benefits.

If you exceed this $50,000 lifetime contribution limit, 1% per month of the excess will be the penalty. This can quickly add up. We always recommend that our clients keep a record of their contributions to avoid these penalties.

To maximize the CESG, contribute $2,500 per annum. If you miss a year, the unused grant room carries forward and can be caught up. My client, Emily, who did not contribute in the first five years, could catch up on lost grants by contributing more in subsequent years.

Yes, there is a Canada Learning Bond of up to $2,000 for lower-income families. One of our clients, Ahmed, was able to significantly enhance his savings by applying for the CLB after he learned about it from us.

Contributions can be withdrawn tax-free since they were made with after-tax dollars. It’s the earnings and government grant, Educational Assistance Payments—EAP—that are taxed in the hands of the student. Maria and David were concerned about the tax implications and were very relieved to find out that their son’s withdrawals would be taxed at a lower rate, thus minimizing the tax impact.

You can transfer it to another beneficiary if one is eligible, or hold the plan for up to 36 years if your child does not attend post-secondary education. When Mark’s daughter decided not to pursue a post-secondary education, he was able to transfer the RESP to his young son so that all those years of savings and the grants would still benefit the family.

Yes, one can withdraw funds from an RESP for eligible post-secondary institutions outside Canada; however, one has to verify that the institution fits within the eligible category for the RESP withdrawals.

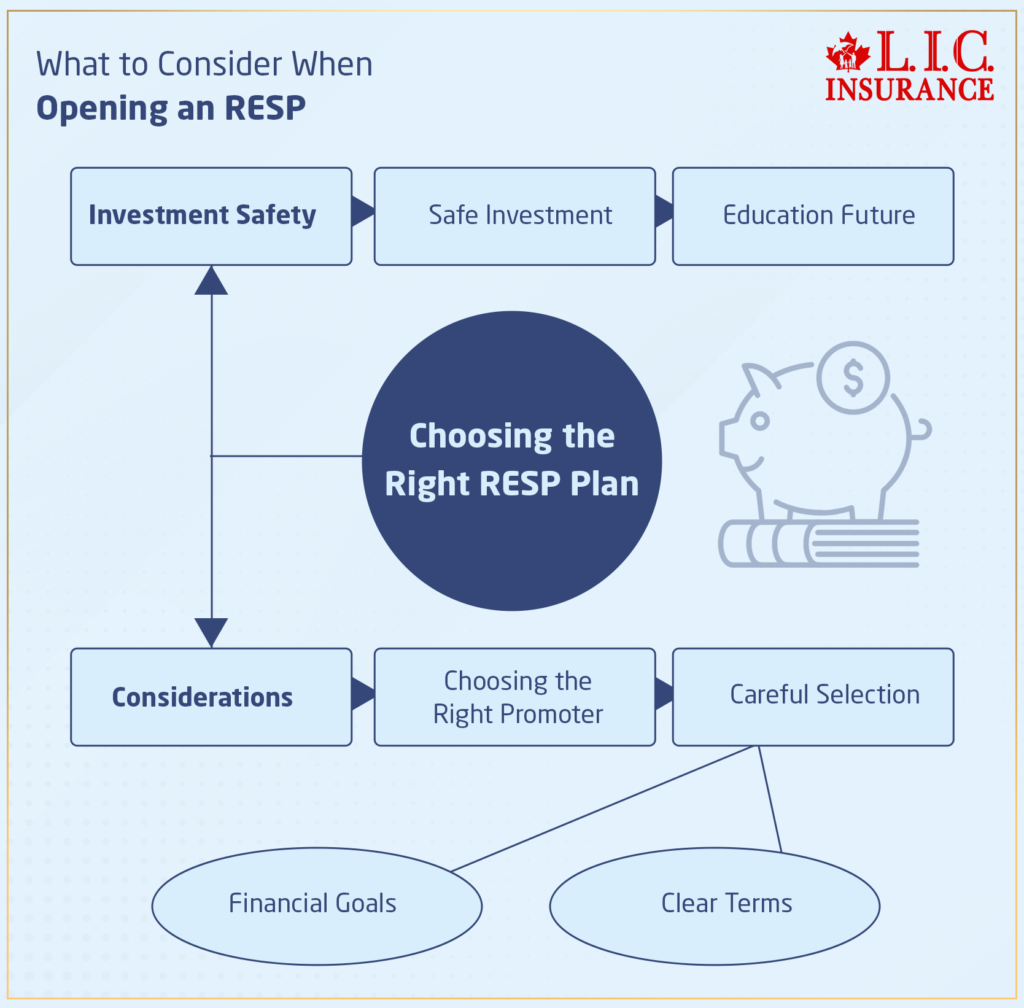

Opening an RESP account with Canadian LIC is very straightforward. Get in touch for a consultation, and we will walk you through it step-by-step and help you with tailored advice on how to maximize your educational investment plan. We’ve helped numerous individuals like you protect their children’s educational future through our customized RESP solutions.

It’s never too late to open an RESP. Even if your child is older, you can still take advantage of the government grants and tax benefits. Regular and catch-up contributions will help maximize available benefits. We have helped many families in similar situations make the most of their savings, even with a late start.

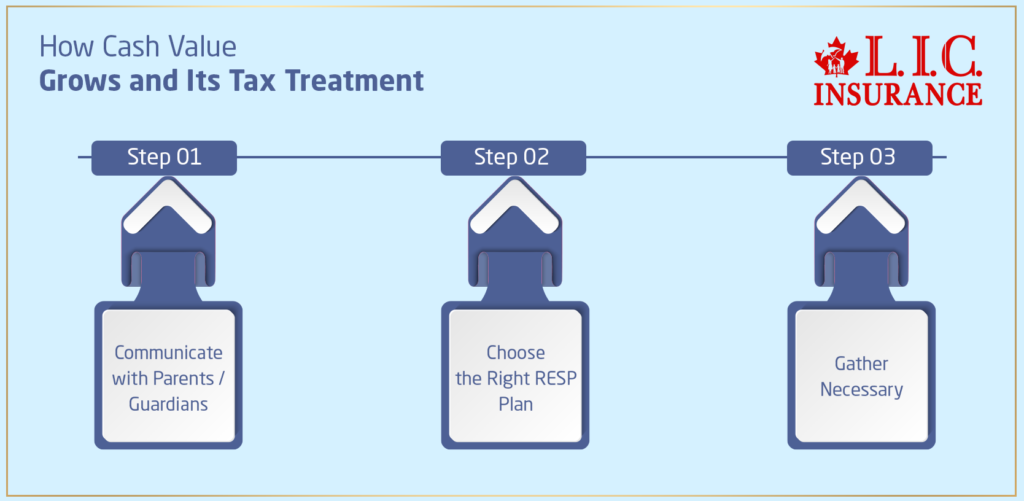

Yes, grandparents, as well as any other member of the family, including friends, can contribute to an RESP. All contributions on behalf of one beneficiary cannot overstep the $50,000 lifetime limit. For this very reason, it can be quite an interesting way for the whole family to get involved in saving some money for the education of a beloved child.

You can also track your contributions and grants for your RESP in the statements from the financial institution. At Canadian LIC, we have regular reviews and updates that assure our clients are on the right track toward their goals of education savings.

The best RESP plan will depend upon your financial situation and your goals. At Canadian LIC, we help people like Raj and Priya get a detailed RESP Quote Online and personalized advice that suits their needs. One can, therefore, compare the options and choose the best investment plan for education for one’s child.

Yes, you can transfer your RESP from one provider to another without losing your government grants. We assisted Lisa, a client who wasn’t happy with her previous provider, in moving her RESP. We made it absolutely easy and hassle-free while ensuring she found a better-registered Education Savings Plan in Canada.

Your child needs to have a Social Insurance Number and must be a resident of Canada to apply for the CLB. We can walk you through the application as we did for Ahmed to ensure that you are receiving all government incentives your family is entitled to.

Yes, one can use RESP funds for part-time studies in an accredited post-secondary institution. Even our client, Jenna herself, drew from an RESP that supported her during her part-time studies in parallel with working. This kept her on her feet while managing her education and career simultaneously.

If the money is not used for education, you can transfer the investment growth into your RRSP(Registered Retirement Savings Plan) if you have contribution room or take it out as an Accumulated Income Payment, which will get hit with tax and a penalty. All these penalties were avoided for Mark as he was able to push his RESP down to his younger son and kept the plan in the family.

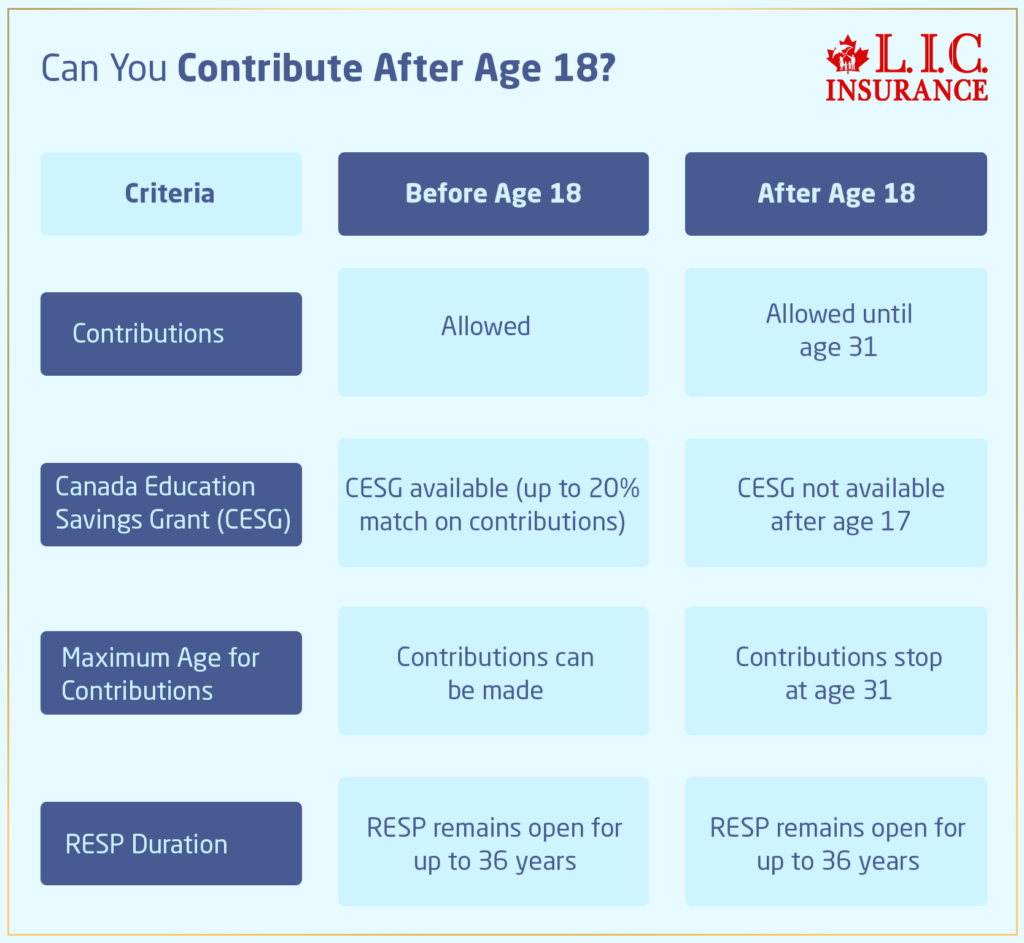

Contributions can continue until the end of the calendar year in which the beneficiary turns 31; however, government grants are only available until the end of the year the beneficiary turns 17, with limited exceptions.

You can establish a family plan RESP, which provides for multiple beneficiaries under one plan, all blood-related or adopted. This worked well with John and Lisa, who have two children, in managing the contributions and grants efficiently in one account.

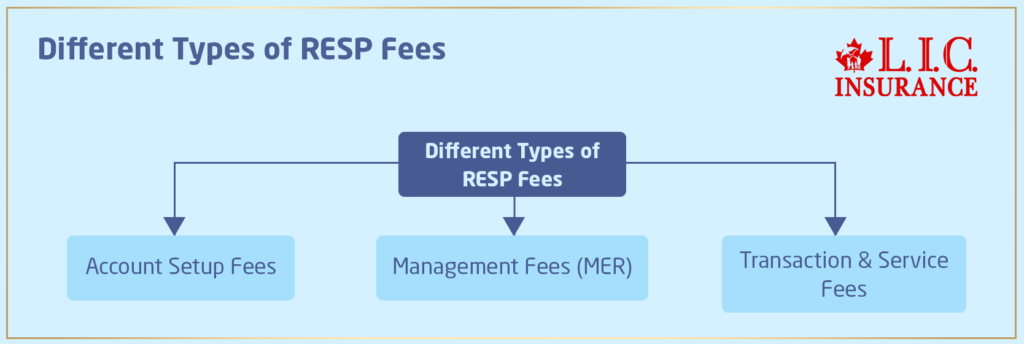

Yes, some RESP providers charge for setup annually and even per transaction. These are some of the items you should compare when you get a RESP Quote Online. At Canadian LIC, we help clients understand these fees and choose plans with the best overall value for money.

If you move out of Canada, you can still maintain and contribute to your RESP, but your government grant eligibility may be affected. Maria and David were thinking about moving abroad and contacted us to ensure their RESP remained beneficial and compliant with the regulations.

Yes, at any time, one can withdraw contributions without penalty since the withdrawals themselves are not taxed. Withdrawing contributions too early can impair government grants. We advised Laura to strategize her withdrawals so that she could derive maximum benefits from them.

Yes, you would have to repay the government grants in case you do not use the RESP account for education. You can transfer the RESP, like Mark did, to another eligible beneficiary in your family so that you do not forfeit the government grants and still reap some benefit from the savings.

RESP Quotes Online compares plans to help one make a very informed decision. Our clients, Raj and Priya, appreciated how easy it was to get quotes online to choose the best Education Investment Plan for their child’s future.

One flexible RESP plan ensures that the plan changes according to your needs. In this case, we shall have regular reviews with a financial adviser at Canadian LIC and provide ongoing support for clients, such as Jenna, who will adjust their plans as their circumstances change.

Canadian LIC provides end-to-end support, from initial setup to management and advisory services afterward. Our clients get assistance in maximizing grants, optimizing contributions, and planning the withdrawal process effectively.

Knowing the RESP rules and limits is key to getting the most out of your Education Investment

Plan. At Canadian LIC, we see every day how proper planning can change the lives of families. If you have more questions or need personalized advice, get in touch with us. Let’s get your child’s education plan in order with a RESP.

These FAQs are filled with real-life scenarios to help you understand clearly. We hope they help you feel more comfortable with RESPs. Ready to start your RESP or need more help? Contact us at Canadian LIC today – The Best Insurance Brokerage in Canada.

Sources and Further Reading

To deepen your understanding of Registered Education Savings Plans (RESPs) and their rules and contribution limits, here are some authoritative resources and relevant links that provide detailed information and guidance:

Canada Revenue Agency (CRA) – RESP Information

Visit the official CRA website for comprehensive information about RESP rules, contribution limits, and tax implications.

URL: Canada Revenue Agency – RESP

GetSmarterAboutMoney.ca

Provided by the Ontario Securities Commission, this site offers clear, unbiased information about financial products, including RESPs.

URL: Get Smarter About Money – RESP

Investopedia – Understanding RESPs

A comprehensive guide to how RESPs work, including investment options and strategies for maximizing your savings.

URL: Investopedia – RESPs

Canadian Scholarship Trust Foundation

The foundation provides resources and tools for planning post-secondary education financing, including detailed information on RESP strategies.

These resources will provide you with reliable and detailed information to help make informed decisions about saving for education through RESPs. Whether you’re just starting to plan or looking to optimize an existing plan, these links are valuable tools in your educational investment journey.

Key Takeaways

- Lifetime RESP contribution limit is $50,000 per beneficiary with recommended annual contributions of $2,500 to maximize grants.

- Utilize the Canada Education Savings Grant (CESG) which matches 20% of contributions up to $500 annually.

- Starting RESP contributions early capitalizes on compound interest and maximizes government grant usage.

- Use online tools to compare RESP plans and get quotes to make informed decisions.

- RESPs are flexible; funds can be transferred to another beneficiary if the original does not pursue higher education.

- Contributions grow tax-free, and withdrawals are taxed at the beneficiary's lower rate when used for education.

- Strategically plan withdrawals to minimize taxes, using Educational Assistance Payments (EAPs) effectively.

- RESP accounts can remain open for up to 36 years, allowing flexibility in education timing.

- Strategically plan withdrawals to minimize taxes, using Educational Assistance Payments (EAPs) effectively.

- RESP accounts can remain open for up to 36 years, allowing flexibility in education timing.

- Seek advice from experts like Canadian LIC to navigate RESP rules and maximize education savings.

Your Feedback Is Very Important To Us

We are interested in understanding the challenges Canadians face regarding RESP rules and contribution limits. Your feedback will help us provide better support and resources. Please take a few moments to answer the following questions:

Your RESPonses are invaluable to us and will help in enhancing the services and support for Canadian families planning for their children’s education. Thank you for taking the time to provide your feedback!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com