- Can I Use My Resp Outside Canada?

- RESP Rules And Interest Rates: A Foundation For The Future

- Using Your RESP Abroad

- Real Stories: The Journey To Education Abroad

- The Path Forward: Knowing RESP Withdrawals Abroad

- Understanding Academic Calendars, Currency Conversion, and RESP Withdrawals Abroad

- Conclusion: Embrace The Future With Canadian LIC

Are you trying to understand the RESP quotes or trying to find your way through the confusing RESP rules to figure out how the rates might affect your child’s college fund? Then don’t worry, as you’re not alone on this journey. To make sure their kids have the best future possible, many parents and guardians have to find their way through the RESP quotes and RESP rules and interest rates. That frequently brings up the following important question related to RESP, which is:’ Is it possible to use my RESP outside of Canada?

Today’s blog will walk you through all this knowledge. We will share stories that resonate, explain the tricky RESP rules, and understand the impact of the interest rates. At last, you will have more clarity in your thinking and the ability to make better decisions about a comprehensive savings plan for your child’s education. This plan may even enable you to send your child to historically significant universities in Europe, to an innovative college in Asia, or simply anywhere he desires.

So, can you use RESP for international schools or universities in the U.S., Europe, or Asia? Can RESP be used for US schools or even specialized colleges abroad? Many parents are now asking, “Can RESP be used outside Canada for full-time education?” and “Can I use RESP to study abroad without losing grants or benefits?” The answer lies in understanding which foreign institutions qualify and how to navigate the RESP rules effectively. This blog clears the air on whether RESP can be used for foreign university programs and how to make the most of RESP outside of Canada.

RESP Rules and Interest Rates: A Foundation for the Future

The story of Maya and her son Alex is, indeed, one that many people could well relate to. Maya had always, at least in her dreams, wanted to give Alex the best that education could afford. As soon as she had signed up for an RESP, she had been inundated with all sorts of “RESP quotes” and rates. It was confusing in the first place. But Maya is a very hard-headed person. She found that the interest associated with the Registered Education Savings Plan (RESP) would be such that Alex’s savings would grow tax-free until the time came for the withdrawal of the money for studies. The real turning point was understanding RESP rules and interest rates in great detail, most essentially while studying abroad. This knowledge was her first step towards realizing Alex’s dream of studying architecture in Italy.

Using Your RESP Abroad

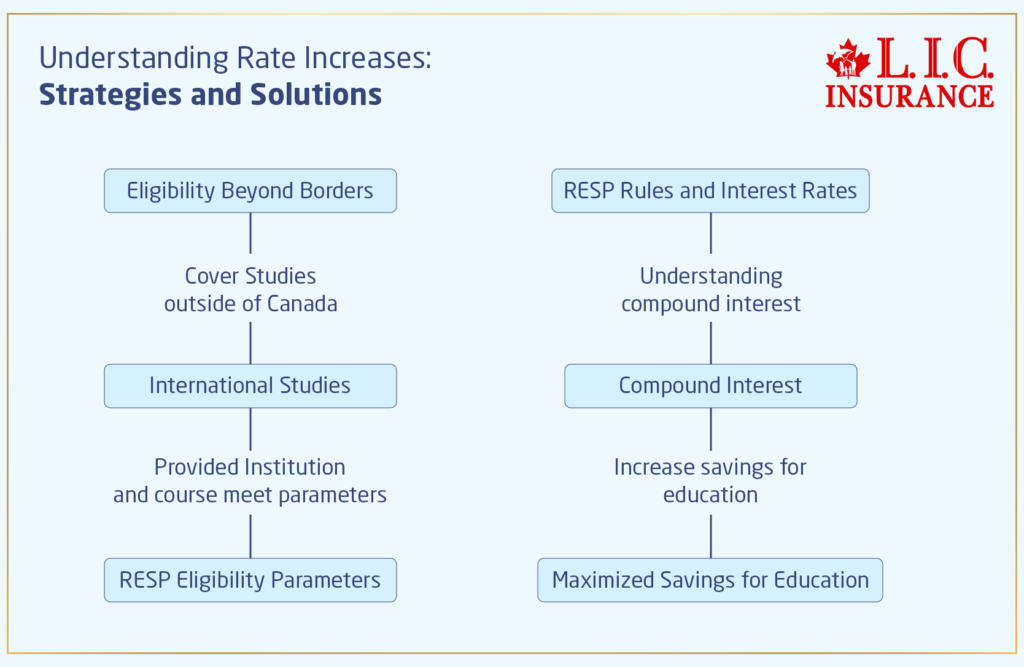

Eligibility Beyond Borders

Emily had been talking about marine biology since she was little. One of the ideal locations to study marine science is an Australian learning center. John and Li were a little bit confused, meaning they didn’t really know if their RESP would cover studies outside of Canada. This reflects a common question on the minds of many parents: “Can RESP funds be used for international studies?” The answer is unequivocally yes, provided the institution and the course are meeting some parameters laid down under the RESP rules. This revelation helped Emily reach her goals.

RESP Rules and Interest Rates: Maximizing Your Savings

For Carlos and Maria, getting to the depth of the interest rates associated with the RESP was a means of finding out how their contributions, along with the government grants, could effectively grow over time. This was, therefore, a pleasant surprise since, through it, they realized that compound interest in their Registered Education Savings Plan (RESP) would increase their savings, making them able to pay for their son’s tuition at one of the prestigious universities in Germany to take up engineering. As a family, they realized that if they had invested much earlier, they would have maximized their savings for education, thanks to the magic of compound interest.

Real Stories: The Journey to Education Abroad

Finding Flexibility in Family Plans

Noah and Sarah, the children of Ayesha and Mark, were quite opposite in their academic interests. Noah was looking for courses related to computer science in Canada, and Sarah had a plan to study fashion design in France. They considered that through a family RESP plan, it would be flexible to make an educational allocation according to the individual educational pathways of the children, such that even Sarah’s going to study abroad could be covered. This is the best example of how a family Registered Education Savings Plan (RESP) can be the perfect answer for every member of the family.

Transitioning from Dreams to Reality

Elena’s son, Daniel, was determined to go to South Korea to study film production. Elena will always be worried because she knows the monetary implications of such a great dream. It was with a lot of thought and research in regard to the RESP rules and interest rates that she finally allowed Daniel to pursue what he really wanted. From dreaming about international education to actually going for it by enrolling in a South Korean university, it is quite a long way. However, it just goes to show what informed planning and Registered Education Savings Plans can do.

Find Out: The importance of RESP

Find Out: Can you pay for your child’s full education with an RESP?

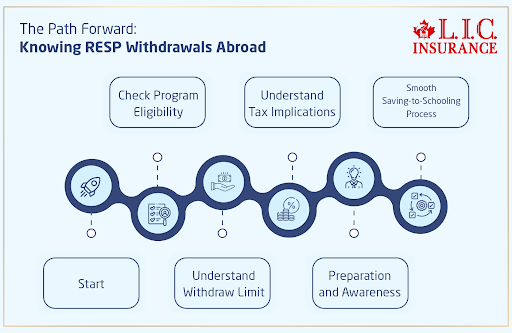

The Path Forward: Knowing RESP Withdrawals Abroad

Withdrawing from a Registered Education Savings Plan (RESP) to finance education abroad is not an easy thing. Just ask Naomi, who was ready to withdraw her RESP, to use it for her studies in environmental science in Brazil. Understanding that there was a withdrawal limit and the tax implications of Educational Assistance Payments (EAPs), as well as making sure that her program was eligible, was something that Naomi needed to look into. Naomi’s experience reinforces the fact that careful preparation and awareness about the RESP withdrawal rules have to be maintained to keep the saving-to-schooling process smooth and free from any hassles.

Understanding Academic Calendars, Currency Conversion, and RESP Withdrawals Abroad

When planning to use your Registered Education Savings Plan (RESP) for education outside Canada, one often-overlooked factor is the alignment of academic calendars and foreign currency exchange impact—key elements that can directly affect RESP withdrawals and payment timing.

Many international institutions, particularly in Europe or Australia, operate on academic calendars that differ significantly from Canada’s. If you’re wondering, “Can I use RESP to study abroad?” or “Can RESP be used for US schools with different start dates?”—the answer is yes, but with planning. The Canadian RESP provider may require proof of enrollment aligned with specific dates to approve Educational Assistance Payments (EAPs). This affects tuition payment schedules, housing deposits, and living expenses.

Additionally, families must account for currency fluctuations. While RESP earnings grow tax-free, any conversion from Canadian dollars to another currency (e.g., USD, EUR, AUD) can impact how much is ultimately available. This adds a layer of strategy when deciding how and when to withdraw RESP funds for expenses in the U.S., Europe, or Asia. So yes, RESP outside of Canada use is valid, but the timing of disbursement plays a huge role in how effective your funds are.

If you’re asking, “Can RESP be used for foreign university?”, “Can RESP be used in USA?”, or “Can you use RESP for international school?”—absolutely, but coordinating withdrawals to match tuition due dates and exchange rate advantages can optimize your RESP’s value abroad. Canadian LIC guides families through these timing and financial nuances so their children’s international dreams aren’t short-changed by logistics.

Conclusion: Embrace the Future with Canadian LIC

As we’ve walked through real-life stories and unravelled the complexities of RESP rules and interest rates, as well as the possibilities of studying abroad, one thing is certain: knowledge is the main thing that makes things simple and smooth. Isn’t it? Whether your child dreams of the ancient universities of Europe, the technology hotspots of Asia, or really just about any place in the world, an RESP is an outstanding solution to turn those dreams into reality.

At Canadian LIC, we understand the aspirations you hold for your children’s future. We are committed to providing you with not just RESP quotes but also a partnership to help you plan your child’s educational journey. Canadian LIC not only gives access to expertise but also ensures the RESP rules are simple and get you the best interest rates to get your savings working diligently towards the academic ambition of your child.

Planning for your child’s schooling abroad can be hard, but that shouldn’t stop you. Like Maya, John, Li, Carlos, Maria, Ayesha, Mark, Elena, and Naomi, you can also confidently guide your child toward a bright academic future. Contact LIC Canadian today at +1 416 543 9000 and start the very first step in the world of opportunities for your child. Let’s make your dreams of international education a reality together.

Find Out: Can you transfer an RESP to an RRSP?

Find Out: Important things to know about RESP

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Maximizing Your RESP for Education Abroad

Absolutely! An RESP does not limit itself to Canadian studies; its doors are also open to benefits for eligible post-secondary institutions located outside of Canada. Just one point to remember: your child’s post secondary education should meet some criteria set by the educational institution and the Canadian government. It’s a bit like having a universal key; as long as the lock (in this case, the educational institution) is recognized, you can use your RESP funds.

RESP rules and interest rates for international studies operate in much the same way they do within Canada. They are set to provide you with the most from your savings. The interest on your contributions can grow tax-free until they are withdrawn. The same withdrawal rules apply when your beneficiary enrolls in a qualified educational program in another country. Just like planting a tree—whether in your backyard or elsewhere—its growth stays yours to harvest.

Consider this from one of the ads: “Education is the passport to the future, and an RESP is your ticket to get there—anywhere in the world.” It highlights the RESP’s versatility and global reach, emphasizing its role in securing a bright future for your child, regardless of geographical boundaries.

There is a list of foreign universities that the Government of Canada has recognized for accepting your RESP funds. However, you must always confirm with your RESP provider or a financial advisor. Imagine being sure your GPS is updated before an important trip. You have to make sure your destination is recognized and reachable.

Yes, it is allowed to use social grants offered by the government, such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB), to study in an educational institution outside of Canada. It is more or less similar to having a travel fund valid all over, subject to travelling only to approved places.

If your child decides not to study abroad or attend children’s post-secondary education altogether, you have options. If this is the case, the RESP may be transferred to another beneficiary or, in certain circumstances, the subscriber may withdraw the money, though with some repercussions on the government grants and investment earnings. Think of it as rerouting your journey if the original destination changes.

Yes, there may be additional costs such as travel, accommodations, or even the possible higher living standards if one does reside outside of the country while studying. Keep in mind, while planning your contributions to the RESP, that there is a child to raise and educate for a full 18 to 25 years. It’s like packing for all seasons, in a manner of speaking.

Starting as early as possible allows you to maximize the compounding interest and government grants available. Think of it as booking your flight tickets very well in advance; the earlier you do so, the better the benefits will be, and the journey will be smoother.

Yes, RESP withdrawals, particularly Educational Assistance Payments (EAPs), may be used for expenses related to tuition and the student’s living costs when schooling outside the country. It’s as if one has a flexible travel budget, catering to everything from your flight to the daily coffee.

Think of your RESP contributions like a garden: It is important to ensure that you diversify your investments within the plan and, from time to time, be aware of its performance by reviewing it with your financial advisor. Think of it as taking care of a garden, where it finally gives us a beautiful and fruitful space with the right proportion of plants and constant care.

Establishing an RESP is similar to laying the foundation of the castle in which your child’s dream will be realized. First, get a Social Insurance Number (SIN) for both you and your child. Next, choose a financial institution or provider and discuss with them your goals in terms of international education flexibility, after which you can start a plan. Remember that the early start means a bigger size, which in turn enhances the growth potential through compounding both the interest rates and government contributions.

Absolutely, you can always switch your RESP provider if you find somewhere else with more favourable terms. It will be just like changing lanes on a highway to the same destination, but moving faster. However, do watch for transfer fees or charges and ensure the new plan aligns more with the goals for international education.

Using RESP funds for education abroad follows similar tax rules to using them within Canada. When your child makes withdrawals for educational purposes (known as Educational Assistance Payments), these are taxable in their hands. Often, due to their lower income bracket, the tax impact is minimal. It’s the same as carrying goods across borders; taxes may apply, but with proper planning, you can minimize the burden.

Maximizing government grants is like catching all the available wind in your sail. Contribute regularly to your child’s RESP to ensure you receive the maximum Canada Education Savings Grant (CESG) each year, up to $500 on a $2,500 contribution. Also, explore eligibility for the Canada Learning Bond (CLB) and any provincial grants available. Regular contributions, even in small amounts, can lead to significant growth over time.

If your child decides to delay their education or opts for a non-traditional educational path, your RESP remains flexible. You can keep the RESP open for up to 36 years, allowing time for your child to make educational decisions. If they choose a non-traditional route, verify if the program or institution qualifies under RESP rules. It’s like keeping your travel tickets open; your destination might change, but you’re still prepared for the journey.

Regularly reviewing your RESP investment choices is crucial, especially with the aim of studying abroad. Consider doing so annually or whenever there are significant changes in your financial situation, education goals, or the financial markets. This practice ensures your investments align with your goals and adapt to any RESP rules and interest rate changes. It’s the same as adjusting your sails according to the wind’s direction, ensuring you’re always on the most efficient route.

RESP funds, specifically through Educational Assistance Payments, are intended to cover educational expenses such as tuition, books, and living expenses while studying. While abroad, this can also include reasonable housing and travel costs. However, it’s essential to keep receipts and documentation in case your RESP provider or the Canada Revenue Agency requests proof of these expenses. It’s similar to keeping a travel diary; documentation can help validate your journey.

Living abroad doesn’t prevent you from contributing to an RESP for a beneficiary in Canada. You can make contributions online or set up automatic contributions through your bank. Ensure you and the beneficiary have valid SINS and that you stay within the annual and lifetime contribution limits to maximize the plan’s benefits.

When you apply abroad, the tax rules about using RESP money for school are the same as when you apply in Canada. When your child makes withdrawals for education, which, by the way, are called educational assistance payments, these are taxable in your child’s hands. Often, the impact of taxes is very low on the lower income bracket. It’s almost like moving goods from one border to another. Taxes might apply, but they could be minimized or well-executed through proper planning.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]