When thinking about securing your child’s future through education, have you considered an RESP? In communities across Canada, an RESP isn’t just a financial decision – it’s a way to empower the next generation. Today, let’s dig in and look at RESP uptake in different communities across Canada. We’ll share real-life stories from Canadian LIC clients, the best insurance brokerage that has been helping Canadian families with education savings plans for years.

Whether you’re just starting to shop or looking to optimize your current plan, understanding how different communities use RESPs will give you valuable information on this powerful financial tool. From “RESP Quotes Online” to real-life family experiences, we’ll cover it all to help you make a decision. Are you ready to see how an RESP fits into your family’s educational plans? Let’s get started and find out the magic of education savings plans in Canada!

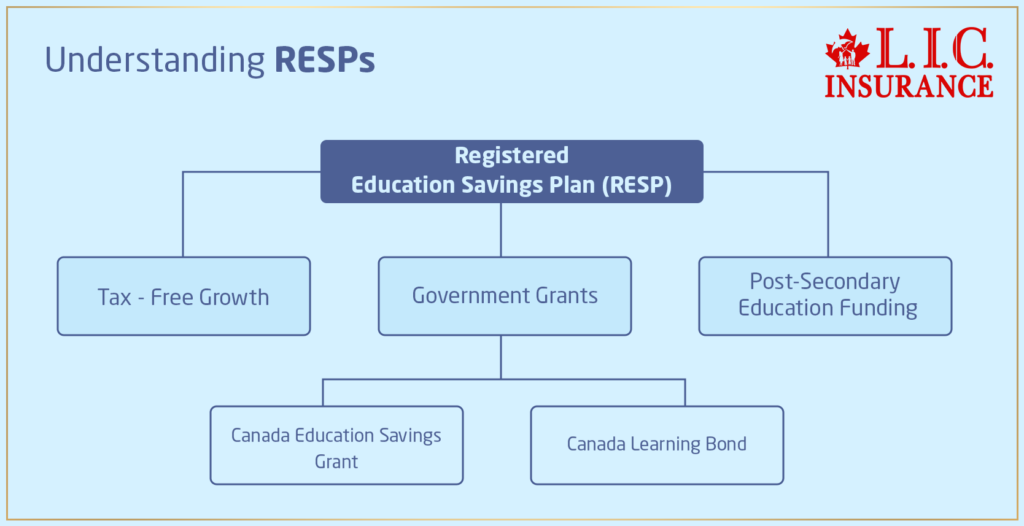

Understanding RESPs

What is a Registered Education Savings Plan?

An RESP, or Registered Education Savings Plan, is much more than a savings account—it’s a government-supported investment in a child’s future educational success. RESPs allow families in Canada to invest in tax-free growth for the beneficiary until he/she is ready to start a post-secondary education. But so is the government through grants such as the Canada Education Savings Grant and the Canada Learning Bond, which will add to this initial investment.

Real-Life Struggles and Triumphs

In the hustle and bustle of communities in Toronto, one client with Canadian LIC testified to being very apprehensive about opening an RESP. It wasn’t just affordability but how these plans worked that really scared them. This was where the brokers at Canadian LIC came in—to break down the complex terms and focus on the benefits. More touching, though, was just how generous government grants could supplement monthly contributions. This very real story identifies and parallels many families’ feelings of being overwhelmed at first but feeling clearer and more confident with professional help.

RESP Uptake Among Different Communities

Diverse Approaches to Education Savings

It’s truly a mosaic of cultures in Canada, reflecting very different approaches to education savings. For example, in Vancouver, RESPs have gained high take-up by families from Asian backgrounds due to the very strong cultural emphasis on education. A growing interest is developing in Indigenous communities after targeted educational sessions, which helped clarify how RESPs can act as a gateway to higher education opportunities.

Challenges and Solutions

One of the ongoing challenges that Canadian LIC faces is the general lack of understanding regarding the benefits of RESP by new immigrant families. Many families have a lot of new RESPonsibilities, so RESPs may not be given much consideration. Canadian LIC stepped up to the challenge by partnering with community centers to offer workshops in many languages, ensuring no family, regardless of their background or language barrier, should find “Education Savings Plan Canada” out of reach.

The Role of Online Tools

Leveraging Technology for Better Access

This revolution to internet services has revolutionized the way that families engage in RESP. The company said that the early parents are the bulk of the RESPonse to their “RESP Quotes Online” mainly because it has the capacity to direct and carry out monetary affairs over the web. Canadian LIC has designed and developed a user-friendly web page where parents can compare various RESP plans, understand what they have to gain in interests at the end and start saving from the comfort of their home.

Impact of Digital Outreach

A heartwarming story from one of our Calgary clients illustrates how this digital shift impacts real lives. A single mom working two jobs found it hard to come in for a meeting between 9 and 5. Online tools from Canadian LIC empowered her to open up an RESP for her daughter late at night, which worked perfectly with her time-stricken schedule. Now, this kind of convenience is going to be a game changer when it comes to making RESPs more accessible to more families than ever.

Tailored Strategies for Different Needs

Although every community is as unique as its needs and aspirations, so is the approach to education savings that must be taken. Canadian LIC does exactly that by tailoring RESP advice based on cultural, economic, and personal factors in each family. For instance, considering a more rural area where accessibility to post-secondary institutions may be more limited, what Canadian LIC emphasizes is the flexibility of the RESP investments so that families can use the funds for alternative forms of educational paths that would include trade schools or even online courses.

Success Story from Rural Quebec

Take, for example, this rural Quebec family who believes they cannot afford to send their children to university. Canadian LIC introduced them to the RESP as an option not only for university education but also for apprenticeships. It was a broadened perception that now transformed their approach, wherein the eldest one apprenticed to be an electrician, with funds still growing for the younger ones.

Overcoming Financial Barriers

Education as a Priority in Tight Budgets

Probably the biggest challenge RESPs face is perception: one has to have a lot of extra money to contribute. Canadian LIC helps clients realize that small, constant contributions can add up over time—especially with government grant money at work. Their motto is “Every dollar counts,” which should encourage every kind of family from all walks of economic life to start early.

Story from an Urban Immigrant Family

For instance, a new family in Toronto after immigration, working on a rather thrifty budget, did not consider an RESP a priority at first. However, after a full prompting session with Canadian LIC, they realized that their very modest monthly contributions still allowed them to collect the Canada Learning Bond and other grants, which do not require any personal contributions. For them, this was a great realization since, from that moment ahead, they were saving without putting much strain on their current budget.

The Power of Community Outreach

Building Awareness Through Education

Community outreach has been one of the most salient features of Canadian LIC’s policy. Seminars and workshops in community centers, libraries, schools, etc. enable them to shed mystery from the details of the “Registered Education Savings Plan” and open it as an avenue for all. The scheme especially targets communities with relatively low participation rates and brings them on par with others by having them be informed about investing in their children’s future.

Transformative Community Events

One of the most memorable events was held at the community center in Halifax, which families from all walks of life greatly attended. The interactive session, fueled by real-life stories and practical advice, provided education on RESPs while building a sense of community around shared educational goals. This kind of direct engagement has greatly raised awareness and increased participation in RESP plans.

Conclusion: Act Right Away with Canadian LIC

As we’ve seen the varied stories of RESPs across Canada, it’s clear that education savings are key to your child’s future. Canadian LIC has been sharing this message with different communities so every Canadian family can benefit from an RESP.

Don’t wait another day to see how an RESP fits into your financial plan. With personalized advice, online tools, and community outreach, Canadian LIC is here to help you navigate the world of education savings. Join the many families who have already done this and are now seeing their education dreams for their children become a reality.

Get started today with Canadian LIC, the top insurance brokerage for your RESP and start building a better tomorrow. Remember, education is an investment in the future—and with Canadian LIC, you’re not alone.

More on RESP’s

- What are RESP Rules and Contribution Limits in 2024?

- How Long Can an RESP Remain Open?

- What Happens If I Miss Contributing to an RESP for a Year?

- Can I Open an RESP for a Child Who Is Not My Own?

- Can RESP Be Used for Rent?

- What Are the Disadvantages of RESP?

- What Expenses Are Eligible for RESP in Canada?

- What Is The RESP Limit In Canada?

- How Do I Withdraw Money from RESP Canada?

- Does a RESP Beneficiary Need to Live in Canada?

- Can I Use My RESP Outside Canada?

- How Do I Check My RESP in Canada?

- What Happens to RESP If You Leave Canada?

- Can You Transfer an RESP to an RRSP?

- Important Things To Know About RESP in Canada

- Everything You Should Know About RESP in Canada

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Registered Education Savings Plans (RESPs)

Opening an RESP account is pretty easy. First, select a provider—like the Canadian LIC, known for its reliable guidance when it comes to opening Education Savings Plans across Canada. Next, the beneficiary of your RESP could be your child, relative, or even your family friend. Finally, some identification for you and your beneficiary will be required. Keep in mind that you can get individual RESP Quotes directly online from our website, so it really does not matter where you are or what time it is. One of our clients, a busy mother of two, used our online platform to set up her plan during her lunch break!

Absolutely! RESPs are flexible and can include full- or part-time studies at colleges, universities, trade schools, or any other vocational programs. We once had a family where the eldest child used the funds to pursue studies in culinary arts at a vocational school with the help of an RESP, showing how versatile the plan is. The important thing is that it has to be an educational facility that falls under the guidelines of the Registered Education Savings Policy.

When you set up an RESP in Canada, you automatically get many government grants. A chief among them is the Canada Education Savings Grant (CESG), which matches up to 20% on the first $2,500 put in an RESP annually. There’s also the Canada Learning Bond (CLB) for eligible families, which is nothing short of a bonus since there’s no requirement for parents to make personal contributions. Most of the time, we find our clients pleasantly surprised by how much the grants can help with their savings!

Yes, there are some limits to which you need to be aware. The lifetime contribution limit for an RESP is $50,000 per beneficiary. There is no annual contribution limit; however, a strategic approach to contributions is important in maximizing government grants. A father from Montreal shared how he spaced out contributions to ensure he maximized the government match each year, planning effectively for his daughter’s education.

Suppose the beneficiary does not attend any post-secondary education. In that case, you then have a few options to consider: You can transfer money to another beneficiary or withdraw your contribution without penalty. Any growth in the account and government grants can be transferred to your RRSP or withdrawn with implications. We have dealt with a client whose son decided to pursue business instead of furthering his education in college. We helped them restructure their plan in such a way that they could best support their child in entrepreneurship.

An RESP requires one to sign up, open an account, and ultimately make contributions. Canadian LIC can walk a person through these steps so that the individual will truly understand all the fine details involved. Our agents are skilled at explaining complex information in simple terms to help you make the best decisions for your family’s educational future.

Yes, you can change your investment options over time, depending on your risk tolerance and how many years are left until your child starts their education. We will, on a regular basis, review plans with the client to ensure that the investments remain appropriate for their changing needs and goals. This could be illustrated by the recent example of the couple who were transferring into more conservative investment choices as their child was approaching the end of high school.

Comparing RESP options is of key importance. Consider those plans that have flexible contribution schedules, numerous choices of investment, and competitive fees. You can easily compare a number of plans using the “RESP Quotes Online” tool from the Canadian LIC website. This tool was especially helpful to a family who were new to Canada in understanding their options and choosing which one was best for them.

RESP is an extremely good instrument for providing safety to your child’s future education.

You can begin withdrawing from your RESP when your beneficiary starts a post-secondary qualified educational program. In this regard, Canadian LIC suggests planning to withdraw early in education to benefit from the longest possible investment time. A recent example is a client who initiated withdrawal prior to the first semester starting so that tuition fees and the price of books could still be covered on time.

With several children, it is more economical to administer one RESP with several beneficiaries all under one plan. This method ensures that the distribution of the funds across the children is more flexible. A family of three children spoke on the flexibility provided by a family plan. “Since the beginning, we knew at what time and how the money would be divided among children, given their age and time of entry to college. This flexibility helped us plan accordingly for them.”

Canadian LIC has an “RESP Quotes Online” that is user-friendly when comparing the various RESP plans. It makes the features and benefits of the various plans understandable at a single glance. For example, a young couple was able to select the most suitable plan for their newborn after comparing several options online, making their decision-making process smoother and more informed.

This will ensure that your annual contributions reach the threshold necessary to qualify for maximum government grants, which are $500 annually for every $2,500 in contributions. Canadian LIC can help you set up a contribution schedule that works with your finances and maximizes grant eligibility. We once had a client who lost a year’s grant because he needed to contribute more; we helped the client adjust his future contributions so as not to have this happen again.

While contributions to an RESP cannot be deducted from income, the growth on the investments, along with government grants, goes untaxed until the money is taken out. When those funds are withdrawn for education expenses, they are taxed in the hands of the student, usually resulting in little or no tax payable because they have little or no income. We helped a family plan their withdrawals to minimize their tax burden, effectively using the RESP to cover their son’s entire university tuition without additional taxes.

RESPs should be part of your bigger financial strategy, notably in regard to retirement savings and debt management. Canadian LIC will give you advice on how to strike this very balance: making sure that saving for the education of your child isn’t at the detriment of your overall financial well-being. For example, we helped a family ensure that their contributions to RESPs were aligned with a good retirement plan so that they would have both their children’s futures and retirement in good hands.

Congratulations if your child lands a scholarship! That doesn’t affect the RESP at all—those funds can be used for other educational expenses. Any leftovers are handled according to whatever flexibility the plan offers. We had a client whose daughter earned a full scholarship, and they used the RESP to fund her off-campus and overseas expenses.

Be it entering into a new plan or just getting a better understanding of the one you already have in place, Canadian LIC is here to guide you through every step. Don’t hesitate to reach out with any questions and begin your journey in education savings today!

Canadian LIC works hard to empower you with all knowledge in regard to your Whole Life Insurance so that you are confident and secure about your decisions. Whether it is getting a quote for the adjusting of your policy to better suit you or simply understanding the options at hand, be it for any sort of help that you may require at any step, our team is always ready. Do not hesitate to just get in touch and begin a conversation about securing your financial future today.

Sources and Further Reading

Here are some recommended sources and further reading materials to deepen your understanding of Registered Education Savings Plans (RESPs) in Canada:

- Government of Canada – RESP Information

- URL: https://www.canada.ca/en/services/benefits/education/education-savings.html

- Description: Official government page providing comprehensive details on how RESPs work, including information about the Canada Education Savings Grant and Canada Learning Bond.

- Canadian Securities Administrators – Understanding RESPs

- Description: This resource offers clear, straightforward information on choosing, opening, and managing RESPs.

- Investopedia – Registered Education Savings Plans (RESPs)

- URL: https://www.investopedia.com/terms/r/RESP.asp

- Description: A detailed article that explains the mechanics of RESPs, including contributions, withdrawals, and tax implications.

- RESP Resource Center

- Description: A hub for learning about different RESP plans, how to maximize government grants, and strategies for managing education savings effectively.

- Canadian Scholarship Trust Plan

- URL: https://www.cst.org

- Description: Focuses on providing specific insights and tools for RESP subscribers, including calculators and planning tools to help families plan their education savings.

These sources provide a solid foundation for understanding how RESPs work and how to effectively utilize them for future educational planning.

Key Takeaways

- RESPs are utilized variably across different cultural and socio-economic backgrounds in Canada.

- Educating communities about the benefits and workings of RESPs is crucial for increased enrollment.

- Online platforms enhance accessibility, allowing families to easily compare and choose RESP plans.

- Utilizing government grants like the CESG and CLB can significantly boost RESP contributions.

- RESPs offer flexibility in funding types of education and managing fund redistribution or withdrawal.

- Professional guidance from financial advisors improves outcomes by providing tailored advice.

- RESPs should be integrated into a family’s broader financial plan, balancing various financial priorities.

Your Feedback Is Very Important To Us

We appreciate your participation in understanding the challenges and struggles different communities in Canada face regarding the uptake of Registered Education Savings Plans (RESPs). Your feedback will help improve our services and outreach efforts. Please select the appropriate options for the following questions:

Please submit your RESPonses. Your input is valuable and will contribute significantly to our efforts to improve RESP accessibility and effectiveness across diverse Canadian communities. Thank you!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]