Making sure that our loved ones are safe and secure has become our top priority in today’s unpredictable world. This concern extends to Canadian parents’ decisions regarding the future and the welfare of their kids. Kids insurance is a crucial approach to offer that security. While the relevance of life and health insurance for adults is widely understood in Canada, the significance of insurance for children is frequently disregarded. In this blog post, we’ll examine the significance of children’s insurance in Canada and look at the benefits that parents should get from making this wise investment.

Understanding Kids Insurance

Let’s first clarify what Kids Insurance covers before we get into the specific reasons why it is crucial. Children’s insurance, commonly referred to as kid insurance or juvenile insurance, is a specific type of insurance made to protect and support children financially. Usually, it consists of a number of different parts, including life insurance, critical illness insurance, and education savings plans. These laws assist parents in securing their children’s futures since they are designed to accommodate the special requirements of kids.

Why do you need Kid’s Insurance?

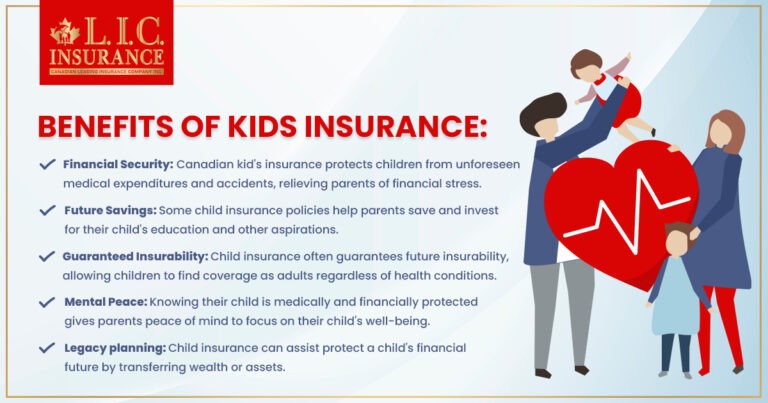

What are the benefits of getting a kid’s insurance?

The Kid’s Insurance you purchase will help finance your baby’s future, and if they do not end up using their cash value life insurance plan, it could even help them in their retirement.

A kid’s insurance can be used to finance post-secondary education, help them finance their first car or other dreams, and alternatively, even be used for their retirement income or even finance their grandchildren’s dreams.

Reasons for the Importance of Kids Insurance in Canada

Let’s understand them one by one:

- Financial Protection in the Face of Unforeseen Events

Life is unpredictable, and no one can predict when tragedy might strike. Kids Insurance ensures that your child’s financial future is secure, even if the worst were to happen. If a child were to pass away prematurely, the policy would provide the parents or guardians a death benefit. While no one wants to think about such a scenario, the financial support provided by Kids Insurance can help cover funeral expenses and alleviate the burden of additional costs during a difficult time.

- Providing for Your Child’s Education

Education is a top priority for Canadian parents. Kids Insurance can play a vital role in ensuring that your child has access to quality education, regardless of your financial circumstances. Many child insurance policies come with education savings plans, allowing parents to accumulate funds that can be used for tuition fees, books, and other educational expenses. This helps parents safeguard their child’s future and provide them with the best possible opportunities for success.

- Protecting Against Critical Illness

Childhood illnesses can be devastating, and the medical expenses associated with treating critical illnesses can be astronomical. Kids Insurance often includes critical illness coverage, which provides a lump-sum payout if a child is diagnosed with a covered critical illness. This financial support can help parents cover medical bills, seek specialized treatments, and take time off work to care for their child during a challenging period.

- Ensuring Insurability for the Future

Another significant advantage of Kids Insurance is that it guarantees insurability for your child’s future. When you purchase a child insurance policy, you are essentially locking in your child’s eligibility for insurance coverage at a young age. As children grow, they may develop health conditions that could make it challenging to secure affordable insurance in the future. By investing in Kids Insurance early on, you ensure that your child has access to the protection they need throughout their life, regardless of their health status.

- Building a Financial Foundation

Kids Insurance policies often come with cash value or savings components, such as a cash accumulation feature. This means that over time, the policy can grow in value, providing a financial foundation for your child’s future. This cash value can be used for various purposes, including helping your child with major life expenses such as buying a car, starting a business, or making a down payment on a home. It can also serve as an emergency fund if needed.

- Tax Benefits

In Canada, Kid’s Insurance policies can offer tax advantages. The cash value within these policies typically grows tax-deferred, meaning you won’t have to pay taxes on the investment gains until you withdraw them. Additionally, when appropriately structured, the death benefit paid out to beneficiaries is typically tax-free. These tax benefits can make Kids Insurance an attractive financial tool for Canadian parents.

- Peace of Mind for Parents

One of the most important reasons for parents to consider Kids Insurance is the peace of mind it provides. Knowing that your child is financially protected and that their future is secure can alleviate stress and anxiety. Parents can focus on raising their children without the constant worry about what might happen in the future, knowing that they have taken proactive steps to protect their family’s financial well-being.

Final Thoughts

In Canada, the importance of Kids Insurance cannot be overstated. It provides essential financial protection for your child, ensures access to quality education, and safeguards against the uncertainties of life. Moreover, it offers parents peace of mind, knowing they have taken steps to secure their child’s future. While the hope is always for a bright and healthy future, being prepared for the unexpected is a responsible and caring choice. So, if you haven’t already, consider discussing Kids Insurance options with a qualified insurance professional to find the right policy for your child and your family’s needs. After all, there is no better investment than securing your child’s future.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

How do you get Kid’s Insurance?

Now that we’ve established that getting a kid’s life insurance plan is a sound choice, we need to understand how we can get it.

Just like with any other life insurance policy, bringing in the experts for your Kid’s Insurance plan is always a good idea. They can help you put together the way your plan is going to work and negotiate easily with providers.

There are many providers whom you can connect with to get an overview of the plans available. While you can get child insurance in other ways, a cash value life insurance for your child is still considered one of the smartest investments.

Get in touch with an expert like Canadian LIC today. Secure your child’s future with a Kid’s insurance plan!

Find Out: Top 10 reasons to choose Canadian LIC

Find Out: Why Buy Life Insurance for Kids

Importance Of Kids Insurance

Making sure that our loved ones are safe and secure has become our top priority in today’s unpredictable world. This concern extends to Canadian parents’ decisions regarding the future and the welfare of their kids. Kids insurance is a crucial approach to offer that security. While the relevance of life and health insurance for adults is widely understood in Canada, the significance of insurance for children is frequently disregarded. In this blog post, we’ll examine the significance of children’s insurance in Canada and look at the benefits that parents should get from making this wise investment.

Faq's

Kids Insurance, also known as child insurance, is a specialized form of insurance designed to protect the financial well-being and future of children. It is important in Canada because it offers financial protection, education savings, and critical illness coverage for children, ensuring their security in case of unexpected events.

The key benefits of Kids Insurance in Canada include financial protection in case of a child’s passing, education savings for future academic expenses, critical illness coverage for medical expenses, guaranteed insurability for the child’s future, and the potential to accumulate cash value over time.

Parents can consider getting Kids Insurance as soon as their child is born. If they start early, they will have to pay lower premiums, and they will get guaranteed child’s insurability, even if they develop health conditions later in life.

There are several types of kids insurance policies in Canada, including child life insurance, critical illness insurance for children, and child education insurance. These policies offer various benefits tailored to the child’s and family’s needs.

Child education insurance combines life insurance with an investment component, allowing parents to save for their child’s future educational needs. It is important because it ensures that parents have funds available to cover tuition fees and related educational expenses when the child reaches college or university age.

Premiums for Kids Insurance are generally not tax-deductible in Canada. However, the death benefit paid out to beneficiaries is typically tax-free, providing a financial advantage to the family.

Yes, Kid’s Insurance policies in Canada can often be customized to suit the specific needs and budget of the family. You can adjust coverage amounts, policy duration, and add optional riders for additional coverage.

The cash value of a Kid’s Insurance policy may grow over time, depending on the policy’s design and investment options. This cash value can be used for various purposes, such as making a down payment on a home or funding other financial goals.

Yes, grandparents or other relatives can purchase Kids Insurance for a child in Canada. Having the child’s legal guardians’ consent and cooperation is essential during the application process.

To find the right kids insurance policy in Canada, consider working with a qualified insurance professional like Canadian LIC, as they can assess your family’s specific needs and help you choose the most suitable policy from reputable insurance providers.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]