- How Do I Apply For The Canada Education Savings Grant (CESG)?

- Understanding The Canada Education Savings Grant (CESG)

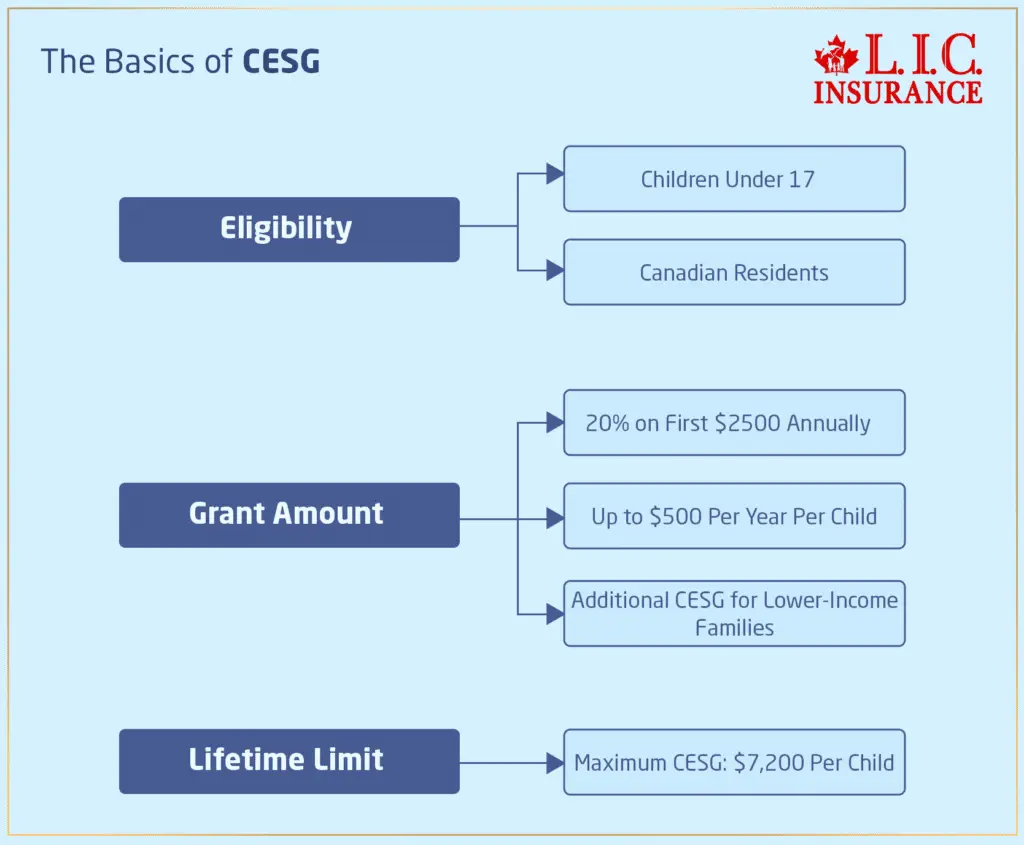

- The Basics Of CESG

- Step-By-Step Guide To Applying For CESG

- Common Challenges And How To Overcome Them

- Real-Life Insurance Struggles And RESP Success Stories

- Additional Considerations: Life Insurance And Retirement Savings

- Tips For Maximizing CESG Benefits

- Coming To The End

Imagine: You are a parent, working and juggling house chores, looking to make savings for the education of your children. You may have heard about the Canada Education Savings Grant but find the process of application rather overwhelming with all the other priorities at hand. You are definitely not alone in this sentiment—many parents feel confused by the available options and steps to be taken. Now is the time to uncomplicate things for you.

We will take you through a step-by-step process of exactly how to apply for a CESG. We will share some stories from Canadian LIC, the best insurance brokerage, on their experience in guiding clients through the world of education savings. By the end of this guide, you will be assured very confidently and be well-prepared to secure your child’s educational future.

Understanding the Canada Education Savings Grant (CESG)

The Canada Education Savings Grant is a government incentive that allows parents to save for their children’s post-secondary education. Essentially, when you add money to an RESP, the government joins in and adds some more so that your money can grow at an ever-faster rate. This is one of the more excellent ways in which an investor can get a jump-start on major support costs down the road.

At Canadian LIC, we have numerous clients who report that terms and conditions are confusing at first. Take the case of Smaira, a single mom of two who felt overwhelmed with a lot of jargon. After the basics were explained to her, she began to realize the simplicity and extraordinary value of the CESG program.

The Basics of CESG

Eligibility: The CESG is available to children under the age of 17 who are Canadian residents. The primary condition is that you need to open an RESP and contribute to it.

Grant Amount: The government provides a basic CESG of 20% on the first $2,500 contributed annually to an RESP. This means you could receive up to $500 per year per child. There are also additional CESG amounts for lower-income families.

Lifetime Limit: The maximum CESG you can receive for each child is $7,200.

Step-by-Step Guide to Applying for CESG

Step 1: Open an RESP

To apply for the CESG, you first need to open a Registered Education Savings Plan (RESP). This can be done through financial institutions, credit unions, or specialized RESP providers like Canadian LIC.

Choosing the Right RESP Provider: When selecting an RESP provider, consider factors such as fees, investment options, and the provider’s reputation. At Canadian LIC, we offer personalized advice to help you choose the best plan for your needs. For example, we helped Mark and Julia, who were new parents, select an RESP that matched their financial goals and comfort with risk.

Step 2: Apply for the CESG

Once you have an RESP, your provider will handle the Canadian Education Savings Grant application on your behalf. Here’s how it works:

Provide Necessary Information: You’ll need to provide your RESP provider with your child’s valid Social Insurance Number (SIN) and proof of identity. This is crucial for verifying eligibility for the grant.

Make Contributions: After setting up the RESP, you can start making contributions. The CESG will automatically be added to your RESP account based on your contributions and eligibility.

Step 3: Monitor and Adjust Your Contributions

It’s important to keep track of your RESP contributions and adjust them as needed. At Canadian LIC, we often advise clients to set up automatic contributions to make saving easier and more consistent. For instance, Emily, a busy nurse, found that automatic monthly contributions allowed her to save without worrying about missing deadlines.

Common Challenges and How to Overcome Them

Understanding Contribution Limits

One common issue parents face is understanding the contribution limits. The lifetime contribution limit for an RESP is $50,000 per beneficiary. Over-contributing can result in penalties. To avoid this, work closely with your RESP provider to track your contributions.

Story from Canadian LIC: When John and Lisa started their RESP, they needed guidance about how much to contribute. With guidance from our advisors, they set up a contribution plan that maximized their CESG benefits without exceeding the limits.

Accessing the Additional CESG

Families with lower incomes are eligible for an additional CESG. This can add an extra 10% or 20% on the first $500 contributed each year.

Navigating Income Thresholds: Understanding if you qualify for the additional CESG can be tricky. At Canadian LIC, we help clients like Tina, a single parent, by assessing their eligibility and ensuring they receive the maximum benefits.

Using CESG Wisely

The CESG is a valuable resource, but it’s essential to use it wisely. Ensure that the funds in your RESP are invested in a way that aligns with your risk tolerance and financial goals.

Investment Guidance: Canadian LIC provides investment advice tailored to your needs. For example, we helped Raj and Priya diversify their RESP investments, balancing growth potential with security.

Real-Life Insurance Struggles and RESP Success Stories

At Canadian LIC, we have seen many different clients for whom the system made a world of difference due to their different financial problems. Here are some real-life examples showing the importance of planning and the power of the CESG.

Sarah’s Story: Sarah, a single mother, was hesitant to start an RESP because she thought she couldn’t afford it. After speaking with our advisors, she realized even small contributions could accumulate significant CESG benefits over time. Today, Sarah is on track to cover her daughter’s university tuition.

Mark and Julia’s Journey: New parents Mark and Julia were overwhelmed by the options available. They worried about making the wrong investment choices. With our help, they opened an RESP and received the maximum CESG. They now feel secure about their son’s educational future.

Emily’s Experience: Emily, a busy nurse, struggled with managing her finances and finding time to plan for her daughter’s education. Automatic contributions and regular check-ins with her advisor at Canadian LIC helped her stay on track, ensuring she didn’t miss out on any CESG benefits.

Raj and Priya’s Success: Raj and Priya wanted to ensure their RESP investments were both safe and growing. With our tailored advice, they diversified their portfolio, balanced growth and security, and maximized their CESG benefits. Their daughter’s education fund is now robust and well-managed.

Additional Considerations: Life Insurance and Retirement Savings

As you do so to your child’s education, you must think of your financial security. You can be at ease with your mind by including Life Insurance and retirement savings in your financial plan.

Life Insurance: Having a Life Insurance policy ensures that your family is protected financially in case of an unexpected event. At Canadian LIC, we often advise clients to consider Life Insurance as part of their overall financial strategy. For instance, when Sarah opened her RESP, we also discussed her Life Insurance needs to ensure her daughter’s future was fully protected.

Saving for Retirement: It’s crucial to balance saving for your child’s education with saving for your retirement. Registered Retirement Savings Plans (RRSPs) are a great tool for this. We helped John and Lisa set up both an RESP for their children and an RRSP for their retirement, creating a balanced approach to their long-term financial goals.

Tips for Maximizing CESG Benefits

To make the most of the CESG, consider these tips:

Start Early: The sooner you start contributing to an RESP, the more time your money has to grow and the more CESG you can accumulate.

Contribute Regularly: Set up automatic contributions to ensure consistent saving. Even small, regular contributions can add up over time.

Take Advantage of Additional CESG: If you qualify for the additional CESG, make sure you’re receiving it. Check with your RESP provider to confirm your eligibility.

Review Your Plan Annually: Regularly review your RESP and investment strategy to ensure it aligns with your goals and risk tolerance. Adjust as necessary based on your financial situation and market conditions.

Coming to the end

You do not have to feel that applying for a Canada Education Savings Grant is difficult. By simply following this blog and some consultant advice from someone you can trust—like Canadian LIC—you’ll be able to secure your child’s educational future with confidence.

We understand all your difficulties and the questions you may have, so we are here to help you. Each case is treated individually, making sure that at every step of the way, you will be delivered the needed support and information. Just getting started or maximizing your RESP benefits—whatever the case may be—Canadian LIC is your partner for making informed financial decisions.

Be sure to secure your child’s future. Let Canadian LIC, the best insurance brokerage, help you set up an RESP and apply for the CESG today. Collectively, let us make your child’s future bright and full of promise while securing peace of mind about finances.

More to Learn

How Long Can An RESP Remain Open?

What Happens If I Miss Contributing To An RESP For A Year?

Can I Open An RESP For A Child Who Is Not My Own?

What Are The Disadvantages Of RESP?

What Expenses Are Eligible For RESP In Canada?

What Is The RESP Limit In Canada?

How Do I Withdraw Money From RESP Canada?

Does A RESP Beneficiary Need To Live In Canada?

Can I Use My RESP Outside Canada?

How Do I Check My RESP In Canada?

What Happens To RESP If You Leave Canada?

Can You Transfer An RESP To An RRSP?

Important Things To Know About RESP In Canada

Everything You Should Know About RESP In Canada

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions

First, you’ll need to open a Registered Education Savings Plan with a provider like Canadian LIC. We will apply for the CESG using your child’s Social Insurance Number once you set up the RESP and make contributions. Steady contributions maximize grant benefits. For example, Marie is our client who sets up a monthly contribution that fits very comfortably in her budget to ensure she gets the maximum yearly CESG.

Life Insurance is essential for the protection of your family’s financial stability. Life Insurance will help ensure you have funds to keep your contributions running if something unfortunate were to happen. Take, for instance, Tom’s case: his Life Insurance payout ensured his children could attend college even after his untimely passing. Planning like this is what we so strongly promote at Canadian LIC.

Registered retirement insurance plans merge the power of retirement savings plans with Life Insurance coverage. This dual benefit means that while you are saving for a comfortable retirement, you are also securing financial protection for your family. Our client, Heena, found that integrating a registered retirement insurance plan helped her manage her retirement savings while ensuring her family would be financially secure, no matter what the future holds.

Yes, there are options to take if your child chooses not to pursue any form of post-secondary education. While the CESG funds must be returned to the government, the contributions you made can be taken out tax-free. Additionally, in the case of an RESP, up to $50,000 of the earnings can be rolled to your RRSP if you have sufficient contribution room. This was a welcome development for my clients Derek and Linda when their son decided to launch his business rather than attend college.

A well-thought-out financial strategy is therefore required to reconcile retirement savings with educational savings. At Canadian LIC, we will help you plan so that contributing to an RESP for the education of your child does not come at the cost of retirement savings. For example, we can help an individual like Robert and his wife, Emily, to set up direct contributions to RRSPs and a child’s RESP, ensuring that they remain on track towards retirement while their child’s aspirations are protected for life goals in education.

Management can devolve to the named successor in the event of death, and he will carry out the plan. You should also make sure that the Life Insurance that you buy has provisions for continued contributions to the RESP. It is this way that Jenna’s family was bailed out, as education savings for her children continued to grow, even after her death.

Yes, the lifetime contribution limit for an RESP is $50,000 per child. Although there are no annual contribution limits, these need to be managed in order to receive the maximum CESG. In such a case, when our client, Alex, ended up contributing more than the limit without knowing about it, we helped him adjust future contributions and advised him on how to maximize the growth of his investments within the plan.

Contribute at least $2,500 per child per year to obtain the full $500 grant for maximum CESG benefits. If you have missed contributions in previous years, move forward with grant room. One of our financial advisors—like those who helped Anita—can help you calculate how much you are able to contribute annually to catch up and maximize grants without going over the limit.

This means that Life Insurance will always provide protection for your family from a financial point of view and stability in the face of changing events. Registered retirement insurance plans, on the other hand, are designed to provide security for your financial future by really bringing together the benefits of Life Insurance and retirement savings. It is this holistic approach that has made all of the difference to Michael and Julia by giving them peace of mind to secure the future while covering all their current financial needs.

Canadian LIC is tailored to provide you with personal service in opening an RESP, applying for the CESG, and managing contributions effectively. That is not all; we are going to help you integrate your educational savings into a larger financial plan that also includes Life Insurance and retirement planning. Working with us ensures you have a solid, comprehensive, family-focused financial strategy like we did for Nicole, who feels confident that her financial planning will support both her children’s education and her retirement seamlessly.

Though attempting to balance your contributions into your child’s RESP and retirement savings may sound impossible, it really can be done with the proper planning. Here at Canadian LIC, we will give you a plan that takes into account every area of your financial picture. For instance, as reviewed in Samantha and Eric’s case, we told them that allocating a fair portion of their income into both RRSPs and their child’s RESPs would alleviate some of the concerns plaguing them about not saving enough for retirement. This balanced approach will help ensure that they are not damaging their retirement while investing in their child’s education.

This will ensure that Life Insurance works as a strategic tool to protect your child’s education goals if something happens to you. You can plan for the Life Insurance proceeds to fund ongoing contributions to an RESP while choosing such Life Insurance. Of course, this was quite a relief to our clients, Mark and Jennifer, who set up a life assurance policy to provide specifically for their children’s education in the event that they were no longer able to provide.

Now, therefore, there are two types of payments involved in withdrawing from an RESP: contributions (which are not taxed on withdrawal) and Educational Assistance Payments, including the CESG plus earnings of all contributions. EAPs are taxable in the hands of the student, who usually has a low family income and may pay little or no taxes. This was a big selling point for our client Nora, who planned her withdrawals to minimize her son’s tax burden when he started university.

Registered retirement insurance plans combine the growth potential of a retirement savings plan with protection against death: effectively, you’re not only saving for retirement but also delivering a death benefit intended to support your family if need be. Well, that’s a holistic solution—something our client, Carl, especially liked, as he wanted his investments to grow while providing financial security to his family.

You should review your financial plan whenever your financial situation changes. You can adjust the RESP contributions temporarily. For example, at Canadian LIC, we help clients like Angela revisit financial plans when Angela lost her job. We revisited the plan by trimming RESP contributions and maintaining her Life Insurance with a minimum retirement savings plan until things got better for her.

Integrating your financial planning can help in making retirement and your child’s education funding top priorities. We at Canadian LIC take a holistic stance and evaluate all your financial matters to draw up a balanced plan for you. One example is David and Clara. We matched their portfolios for investment to coordinate their contributions’ schedules. Hence, they were able to comfortably save for their retirement and their children’s education without one having to be compromised.

Yes, over-contributing to an RESP carries a penalty. Each eligible beneficiary is entitled to a lifetime contribution limit of $50,000, and any amount over this limit is hit with a monthly penalty of 1% until the excess contribution is withdrawn. We help clients like Tom be very careful in tracking their contributions to avoid such penalties and get the most from the effort at education savings.

At Canadian LIC, we provide comprehensive support in setting up and managing registered retirement insurance plans by evaluating your financial goals, current financial status, and future needs. We offer customized advice and manage the plans to suit your unique circumstances. For example, we helped Rachel set up a plan that secures her retirement and integrates her Life Insurance needs, providing her peace of mind about her family’s financial future.

If your child has won a scholarship and doesn’t really need the funds in the RESP, there are a number of things you can do. You can keep the RESP open up to 36 years in case your child decides to pursue further education later. You can move up to $50,000 of the earnings to your RRSP if you have contribution room. This flexibility was a key factor for our client, Denise, whose daughter had been awarded a full scholarship but might be thinking about graduate studies later.

You can, indeed, transfer the RESP to any other child, which will not come with any penalties, so long as the transfer respects the $50,000 lifetime contribution limit per beneficiary. This option gave some relief for our clients, the Chen family, when their eldest daughter decided not to attend college, and they were able to redirect the funds to their younger child.

These are questions that delve more deeply into managing your financial priorities properly. At Canadian LIC, we commit to making you knowledgeable about these intricacies, all for the safety of your child’s financial future.

Please feel free to contact Canadian LIC to discuss your special financial requirements.

Sources and Further Reading

Here are some sources and suggestions for further reading related to the topics covered in the blog about applying for the Canada Education Savings Grant (CESG), Life Insurance, and retirement planning:

Government of Canada – Canada Education Savings Grant (CESG)

Explore the official government page on CESG for detailed information about eligibility, contribution limits, and how the grant works. This is an excellent resource for understanding the official regulations and procedures.

Canada Education Savings Grant (CESG)

Financial Consumer Agency of Canada

This site provides comprehensive information on various financial products including RESPs, Life Insurance, and retirement savings plans. It’s a trustworthy source for learning how to manage your personal finances effectively.

Financial Consumer Agency of Canada

Canada Revenue Agency – RESP and Grant Information

For detailed tax information related to RESPs and how to report your savings and withdrawals, the CRA website is invaluable. It also provides specifics on how the CESG is taxed when withdrawn.

Investopedia – Understanding Registered Retirement Savings Plans (RRSPs)

This resource offers a clear, easy-to-understand overview of RRSPs, including benefits, limitations, and advice on how to use these tools for retirement savings.

Registered Retirement Savings Plan – RRSP

Insurance Bureau of Canada

Provides resources and articles on choosing the right Life Insurance and how it can integrate with your overall financial planning.

Each of these resources can provide you with additional insights and help you make informed decisions about saving for education through RESPs, securing your family’s future with Life Insurance, and planning for retirement using registered plans.

Key Takeaways

- The CESG helps Canadian families by matching 20% of the first $2,500 contributed annually to an RESP.

- Open an RESP through a financial institution or a provider like Canadian LIC to start applying for CESG.

- Make regular contributions to your RESP to ensure full government matching and growth of your savings.

- Integrate education savings with Life Insurance and retirement planning for a comprehensive financial strategy.

- Incorporate Life Insurance to ensure financial stability for your family and ongoing RESP contributions.

- Balance your child's education savings with your retirement planning using tools like RRSPs.

- Consult a financial advisor at Canadian LIC to create a tailored, comprehensive financial plan.

- RESP and CESG offer flexibility for future educational paths and financial adjustments.

Your Feedback Is Very Important To Us

We appreciate your participation in this survey. Your responses will help us understand the common challenges Canadians face when applying for the CESG and how we can improve the process.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]