The Future of Children’s Education is the topmost priority for every parent. Among the great questions that any expat has to face is how to go with the support of education from abroad. Many have heard of the Registered Education Savings Plan (RESP) but are unclear about its rules. Does the RESP beneficiary need to live in Canada? This is the critical question for one who wonders, “Should I be considering this valuable tool?” If you find yourself nodding along, wondering about the same issues, you’re in the right place. This blog will discuss these issues by sharing stories that mirror the experience of Canadian non-residents, guiding one through the RESP landscape, and explaining reasons that should encourage one to open a Registered Education Savings Plan.

Do RESP Beneficiaries Need to Reside in Canada?

Understanding the Basics

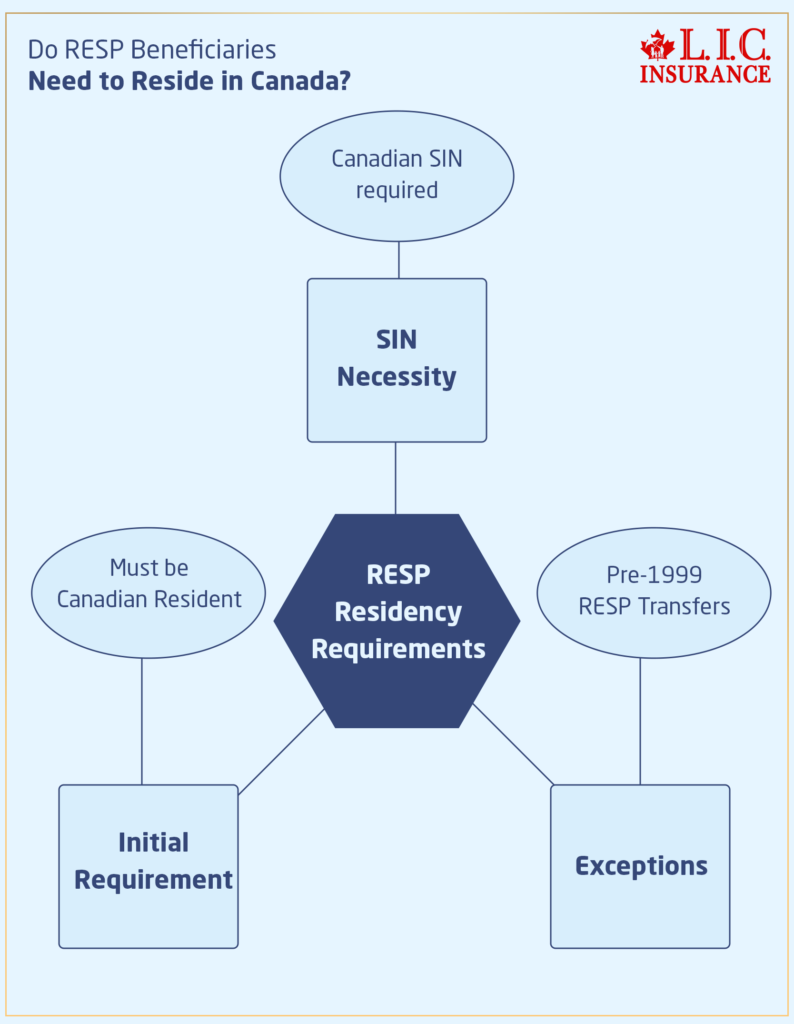

The question asked most often is, do the RESP beneficiaries need to live in Canada? The key here is that when the plan for the RESP is first established, the beneficiary must be a Canadian resident for whom the savings are to be used. This requirement is not just a formality but a crucial part of the process, as it ties directly to the beneficiary’s Social Insurance Number (SIN). Without a Canadian SIN provided to the promoter before the RESP is finalized, the designation cannot proceed. This rule underscores one of the primary reasons to open a Registered Education Savings Plan: ensuring your investment aligns with Canadian regulatory standards and maximizes available governmental contributions.

Illustrating With a Story

Take Emily, for example—an expat Canadian living in Dubai. Her son, Liam, was born there, so he didn’t get a Canadian SIN immediately. Her goal, therefore, was quite cut and dry: to secure Liam’s educational future through an RESP. First, it was the block related to Liam not being a resident of Canada, and this looked like it was going to risk his plans. However, they found a way around the hurdle. One summer, their family visited Canada, where they were actually applying for and receiving only SIN for Liam, the very time he officially realized the status of residence of a Canadian and the possibility for RESP. In this way, temporary returns to Canada become strategic opportunities as part of meeting the RESP requirement.

Exploring Exceptions

Now, a few exceptions are linked to the general rule and provide for some degree of specificity under certain conditions, as follows: It is worth noting that regulations are an exception to some flexibility for older accounts. For example, an RESP transfer between plans in which a beneficiary was already named before 1999 would not require an additional designation if the beneficiary is not a resident at the time of a new designation. This exception greatly favoured Emily and Liam in their decision to return to Dubai. It has allowed them to keep the RESP without having to re-establish the residency of Liam again in Canada. Such exemptions, of course, are critical for situations like this one, wherein geographical and logistical challenges may have been countless.

Another Real-Life Story

For example, Anita is a Canadian who has moved to the United States, and her daughter, Sophie, was a named beneficiary of an RESP established for her by her grandparents in Toronto in the late 1990s. The two ladies were on the move: Sophie was getting married, and Anita was off to a different country. Both had taken for granted that they would have to close the RESP, but then along came the exception to pre-1999 plans. They got to transfer the RESP to another family member’s Canada plan without Sophie having to maintain her resident status. This flexibility can be a significant relief for families who find themselves navigating life across borders.

Why Open an RESP?

Every parent would love to offer the best to their children, be it anything. Opening an RESP takes care of a financial base for their future learning; on the other hand, it avails government grants that multiply the original investment. It often quotes for RESP: “Invest in your child’s future today, and the compound interest will thank you tomorrow.” This is the principle for which many parents are inspired in such a way that they are ready to take daunting regulations head-on, be it Emily or Anita, ensuring their children get full access to all available resources.

Advantages of Opening an RESP

Building Educational Savings

One of the very solid reasons for opening a Registered Education Savings Plan is financial security for the educational future of your child. RESP allows for tax-deferred income growth, along with government grants, which will increase the investment made in the beginning.

Now, hear this story of a single parent, John, living in Vancouver and working two jobs just to save up. Paying rent and buying groceries take away from his budget for life and certainly make it hard to think about school. And while he doesn’t have much to contribute every month, opening an RESP secures a matching grant for him from the government that effectively doubles the meagre sum he could save every month—this considerably eases his burden.

What to Consider When Opening an RESP

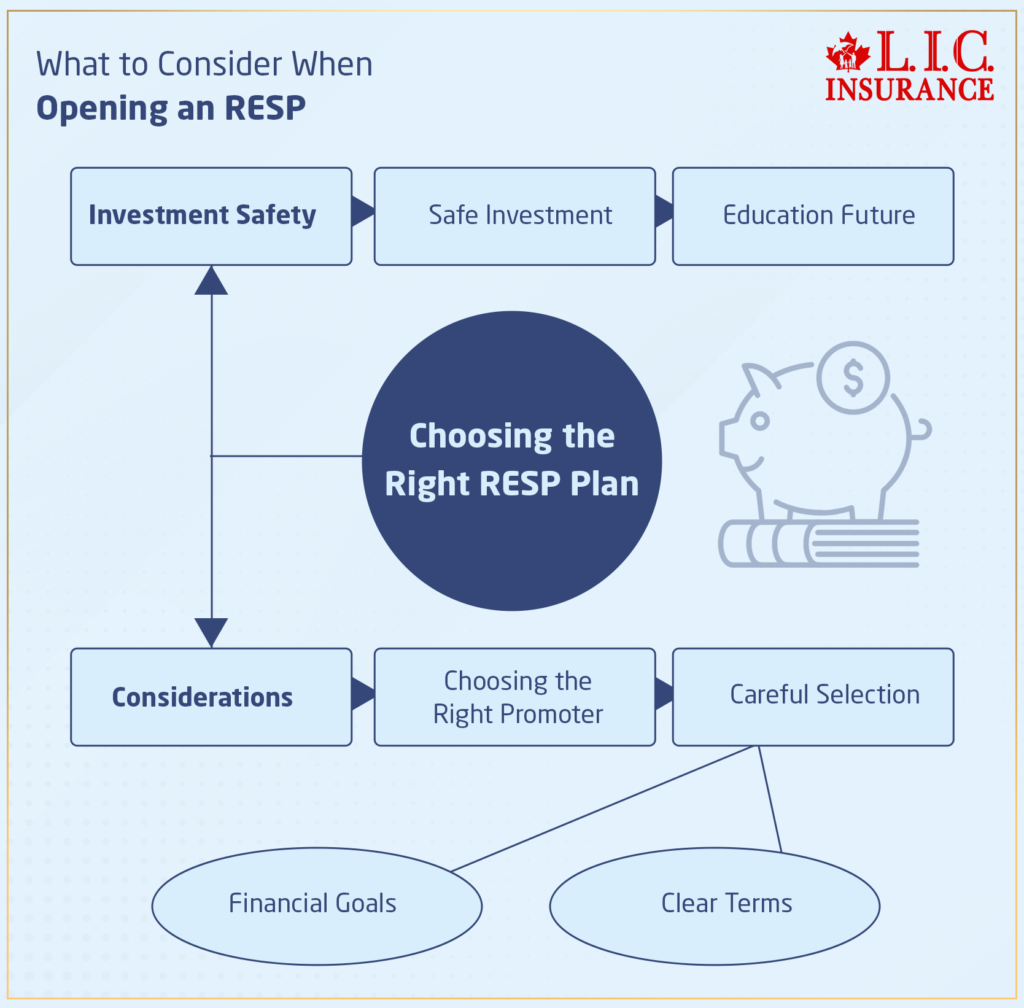

Choosing the Right Plan and Promoter

Not all savings plans have all the features mentioned above. Some cater to different needs and offer various investment options. So, very carefully consider choosing a promoter who really respects your financial goal and offers clear terms.

Sarah, a nurse in Ontario, was misled by a promoter who promised unrealistic returns. The struggle of this lady emphasizes the point that one should choose a reputed promoter for your RESP such that your investment stays safe. Hence, the future for which the investment was done, i.e., education, is safe.

One Frequently Asked Question

Can I change the beneficiary if we move back to Canada?

There can also be more than one potential beneficiary, or alternatively, the beneficiary can be changed to achieve the required criteria, including residency status.

The example of Paul’s niece doesn’t want to go to college, but he succeeds in reallocating the money saved in the RESP to his son so that family education intentions are protected.

Concluding Words

As previously mentioned, a Registered Education Savings Plan (RESP) does require the child to be in Canada upon distribution, but there are ways and exceptions that the Canadian expat or temporary resident abroad may be able to manage. The stories of Emily, John, Sarah, and Paul explain how flexible and advantageous an RESP is in planning for the education of your child’s success.

So, are you a Canadian expat or a non-resident willing to open an RESP? The best insurance brokerage in Canada, “Canadian LIC,” is here for you. Canadian LIC can walk with you through the fine details of the RESP, ensuring your child’s education is safe. Don’t wait; the best time to act on securing an RESP with Canadian LIC is now. Secure your child’s educational journey today, and rest assured that their dreams are well within reach.

Find Out: Can you use RESP outside Canada?

Find Out: How do I check my RESP in Canada?

Find Out: Can you transfer an RESP to an RRSP?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Registered Education Savings Plans (RESPs)

Opening an RESP account comprises both a saving tool for your children’s post-secondary education and access to government grants that serve to supplement your contribution amount. The Canada Education Savings Grant, on top of all this, may contribute as much as 20% of the first $2,500 annually—a real help to the education fund. A well-known resp quote to remember is, “A small step in savings today, a giant leap in education tomorrow.” Opening an RESP is a step forward, rather the right one, towards building that strong and solid financial foundation for the academic pursuit of your child.

Yes, the beneficiaries under RESPs are required to be Canadian residents right from the beginning. This requirement is tied to the requirement to have a Social Insurance Number (SIN), which in turn has to be provided to the promoter at the time of opening the plan. Still, remember Emily’s and Liam’s story. They did adhere to the number of residence days while in temporary residence in Canada. It just goes to show that there really is a need to properly plan your visits in case your beneficiary may not fulfill the residency criteria at one go

Of course, a change in the beneficiary for the RESP can be made in the event of a change in circumstance. Great benefits are accorded to the original beneficiary since the latter can opt not to further his or her education, and the plan could benefit another family member more. For example, Mark had set up an RESP for his niece. When she decided not to go to college and opted for a dance career instead, he reassigned it to his son, as it was still going to family children’s dreams.

In the event that your beneficiary leaves Canada, the beneficiary can still avail of the educational funds so long as he becomes a Canadian resident the year that he is named a beneficiary for the first time and all the other conditions of the RESP are met. Clara’s story: Her son went to high school in Germany, yet he had been raised in Montreal. Being a resident at the time the RESP was opened, he had all the rights to the RESP funds when the time came to go to university.

For non-residents who return to Canada and wish to avail themselves of RESP benefits, re-establishing residency and ensuring the beneficiary has a valid SIN is of paramount importance. This process mirrors what Emily did for her son when they moved back to Dubai. Once these requirements are met, the RESP can be either continued or newly opened. It’s a good reminder of why keeping up with residency status updates and maintaining Canadian documentation is vital for expatriates.

Stay in touch with your overseas RESP provider and work out what the exchange rates might do to your savings, not to mention potential international transfer fees. For instance, Noah, who lives in Australia, makes all contributions to his daughter’s RESP at one go throughout the year when the exchange rate is in his favour, thus ensuring she is getting the best possible value for the Canadian dollar contribution. Also, setting up a Canadian bank account linked to the RESP can simplify the process and reduce transaction costs.

RESPs are smart investments not simply because it makes one prepared financially for the educational future of the child but also because it leverages government contributions and tax-deferred growth. The idea is that, with time, you develop a substantial educational fund that can bring relief when the child attains university or college. As they say, “Invest in education, and the returns are immeasurable.” That sums up lasting value for RESPs.

The most compelling reason to open an RESP for your child would be an opportunity to grow tax-free until drawn for educational purposes. It comes with the Canadian government’s incentive, such as the Canada Education Savings Grant (CESG), which will actually kick in 20% of your contribution to a maximum of $500 per year. That’s an instant return that could add up to $7,200 over the life of the plan. Linda is a nurse in Toronto, and this is how she realized that through an RESP account, she collected government contributions to plant seeds of education for her daughter and the savings today to reap the rewards of a brighter future.

You may, as a non-resident, open an RESP(Registered Retirement Savings Plan) for a beneficiary child who resides in Canada, but he or she must have a valid Social Insurance Number (SIN). This situation was faced by Raj, who worked in Silicon Valley while his son lived with relatives in British Columbia. By ensuring his son had a valid SIN and was listed as a resident, Raj could invest in his future through an RESP, highlighting the flexibility of the RESP system to accommodate diverse family situations.

The other influence, whereby the government contributes to a Canada Education Savings Grant (CESG) that corresponds to your contribution, is a direct influence on your decision to open an RESP. For every dollar that you save, the government will put in 20 cents, up to $500 in any one year, and with a lifetime limit of $7,200. This is, for all practical purposes, free money on top of the sums that you save. Take, for example, “Halifax’s Sophia,” who maximized her annual contributions to ensure she received a full government match every year—basically ensuring that the government’s contribution doubled her initial investment over time.

If your child does not opt for post-secondary education, then some options are open to you. You could always transfer the RESP to another child without any penalty or withdraw the contributions tax-free. “Any income generated in the RESP and government grants will need to be returned or subjected to taxes and penalties if not used for educational purposes.” This was a real concern for Ahmad and his son in Montreal. When his son chose to establish a business in his area of interest instead of going to college, Ahmad withdrew the RESP funds and transferred them to his young daughter, hence keeping the educational investment in the family.

For the best of an RESP, consider making monthly contributions that help in getting the full matching from the government through the Canada Education Savings Grant (CESG). Get started early, and it will also help in compounding the growth of investments. Of course, further diversification of investments within the RESP can be done to help manage the risk, including the possible returns. “For example, one may advise the customer to adjust the investment portfolio closer to the beneficiary’s college-age by switching from stocks to bonds—all for preserving capital,” says Vancouver-based financial planner Chloe. This strategy ensures that the funds are not only maximized but also protected as the need for withdrawal approaches.

The best way for expatriate contributors living abroad to manage their contributions to the RESP would be an automatic contribution that is arranged directly from a Canadian bank account. This would further reduce the inconvenience of the contributors having to manage international transfers and fluctuations in currency exchange. Consider this: James lives in Germany but is investing in an RESP for his niece located in Ontario. He is automating contributions and discussing the RESP provider to ensure that they are made when most suitable for a timely and cost-effective investment.

Sources and Further Reading

To deepen your understanding of Registered Education Savings Plans (RESPs) and the residency requirements for beneficiaries, I recommend exploring the following sources and further readings. These resources can provide valuable insights and additional context to help you navigate the complexities of RESPs, especially if you are managing them from abroad or considering setting one up for your children.

Official Government Resources:Canada Revenue Agency (CRA) – RESP and HELPS Enrolment Requirements

Website: Canada.ca

This official page provides comprehensive information about the rules and regulations governing RESPs, including detailed sections on enrolment criteria, the impact of beneficiary residency, and how to apply for and manage an RESP.

Employment and Social Development Canada (ESDC) – Learning Bond

Website: Canada.ca – Learning Bond

ESDC offers details on the Canada Learning Bond, an initiative that complements the RESP, including eligibility criteria and how to claim the bond for eligible beneficiaries.

Financial Planning Resources

Investopedia – What is a Registered Education Savings Plan – RESP

Link: Investopedia – RESP

A detailed article that breaks down what an RESP is, how it works, and various strategies to maximize its benefits. This resource is especially useful for understanding the financial implications and advantages of RESP investments.

Canadian Bankers Association – Understanding RESPs

Link: Canadian Bankers Association

Offers insights into different banking perspectives on RESP accounts, including how banks handle these savings plans and what to expect in terms of services and support.

Academic and Professional Articles

Scholarly articles on family savings and educational planning

Academic databases like JSTOR or Google Scholar can be searched for research articles on the impact of educational savings accounts on long-term educational outcomes. Use search terms like “RESP benefits” or “educational savings plan impact”.

Blogs and Personal Finance Experts

Personal Finance Blogs

Many Canadian personal finance bloggers discuss RESPs extensively. Websites such as MoneySense or Canadian Couch Potato often publish user-friendly articles and guides that discuss various aspects of RESPs, including how to start one, tax implications, and managing RESPs for non-residents.

Books

“The RESP Book: The Simple Guide to Registered Education Savings Plans for Canadians” by Mike Holman

This book is a great resource for anyone looking to start an RESP. It covers everything from basic concepts to more advanced topics like dealing with RESP withdrawals and managing plans over the long term.

These resources should serve as a solid foundation for understanding and maximizing the benefits of RESPs. Whether you’re a new parent planning your child’s educational future or an expat managing cross-border financial planning, these resources offer valuable guidance and expert advice.

Key Takeaways

- Initially, RESP beneficiaries must be Canadian residents with a valid Social Insurance Number (SIN).

- Exceptions allow non-residents as beneficiaries in specific cases, such as transfers from plans opened before 1999.

- RESPs offer tax-deferred growth and government grants like the CESG, which matches up to 20% of contributions.

- Stories like Emily's highlight how expatriates can meet RESP requirements through strategic planning and temporary stays in Canada.

- RESP accounts allow for beneficiary changes, accommodating shifts in educational paths or family circumstances.

- Canadian expats managing RESPs from abroad should plan contributions carefully, considering exchange rates and automated banking.

- Effective RESP management includes starting early, maximizing government matches, and adjusting investments as the beneficiary nears college age.

Your Feedback Is Very Important To Us

To better understand the challenges and questions Canadians face regarding the residency requirements of RESP beneficiaries, we’d appreciate your insights through this feedback questionnaire. Your responses will help us tailor our content to better meet your needs and provide relevant, actionable information.

Your feedback is invaluable to us, and we thank you for taking the time to help us understand your needs better. We aim to provide you with the most relevant and practical information to assist you in managing your RESP investments effectively.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]