Canada’s Registered Education Savings Plan (RESP) is a great way to help parents and guardians save for their children’s post-secondary education. However, life is unpredictable, and situations may arise where you have to leave Canada. In this blog, we will explore what happens to your RESP if you find yourself in this situation. We will discuss the rules and benefits associated with RESP in Canada to help you understand the implications of leaving the country.

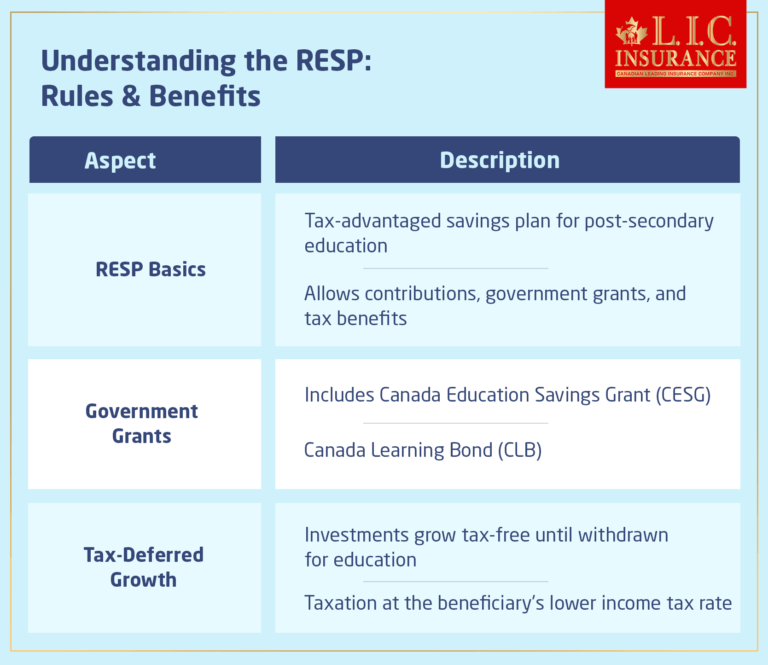

Understanding the RESP: Rules & Benefits

Before we understand what happens to your RESP when you leave Canada, we must clearly understand the RESP in Canada Rules and Benefits.

RESP Basics:

An RESP is a tax-advantaged savings plan that allows you to contribute money to fund your child’s higher education. It comes with several benefits, such as government grants and tax-deferred growth, making it an attractive option for Canadian families.

Government Grants:

One of the most significant advantages of an RESP is access to government grants, like the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). These grants can significantly boost your savings for your child’s education.

Tax-Deferred Growth:

RESP investments grow tax-free until the funds are withdrawn for educational purposes. This tax deferral can help your savings grow more rapidly over time.

What Happens to RESP If You Leave Canada?

Now, let’s get the answer to the most important question: What happens to your Registered Education Savings Plan (RESP) if you decide to leave Canada? This is an essential consideration, as RESP is designed to help you save for your child’s higher education within the Canadian system. The answer to this question depends on your specific situation and the type of RESP account you have.

Non-Contributory RESP:

If you possess a non-contributory RESP, where only government grants were contributed to the account, you will generally not encounter any penalties for leaving Canada. This type of RESP primarily consists of funds provided by the government in the form of grants, such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). These grants are intended to support your child’s educational journey, regardless of your geographical location.

In essence, government grants are like a gift to your child’s education fund, and they are not tied to your residency status. Even if you leave Canada permanently, the grants will remain safely within the RESP. Consequently, your child can access these funds when they pursue post-secondary education, whether they choose to study in Canada or abroad. This flexibility is one of the main benefits of a non-contributory RESP.

Self-Contributory RESP:

The situation becomes more complicated if you have a self-contributory RESP, where you have made personal contributions in addition to receiving government grants. In the event that you leave Canada temporarily, you can typically maintain the RESP and continue making contributions as long as you possess a valid Canadian Social Insurance Number (SIN). Your RESP provider will typically require you to update your contact information and inform them of your temporary departure.

However, should your departure become permanent, and you no longer have a valid SIN, you may face certain restrictions regarding contributing to the RESP. This is because the Canadian government uses the SIN as a means to identify and track RESP holders. With a valid SIN, making contributions or accessing the full suite of RESP benefits becomes easier.

Terminating the RESP:

In certain scenarios, you may decide to terminate the RESP due to your permanent departure from Canada. This choice could have tax implications, and it’s essential to understand the potential consequences.

When you terminate the RESP, you may be required to repay the government grants you received over the years. The government typically mandates this repayment if the RESP beneficiary (your child) does not pursue post-secondary education within a specified timeframe.

Additionally, any accumulated income within the RESP will be subject to taxation. Therefore, it’s crucial to carefully evaluate the financial implications of terminating the RESP and consult with a tax professional or financial advisor for guidance.

Transfer to a Family Member:

In certain instances, you might be able to transfer the RESP to a sibling or another family member who is a Canadian resident. This option allows you to ensure that the funds saved for your child’s education remain within the family and continue to support educational endeavours within Canada. It’s essential to understand the specific rules and eligibility criteria for such transfers, as they can vary depending on the RESP provider and the circumstances involved.

Hence, when you leave Canada, your RESP’s fate depends on several factors, including the type of RESP, the account you hold and the permanency of your departure. A non-contributory RESP primarily composed of government grants offers greater flexibility, as these funds are not tied to your residency status. However, temporary departures may allow you to maintain the account for self-contributory RESPs, while permanent departures could lead to restrictions and tax implications. Terminating the RESP is an option but involves potential repayments and taxes, so careful consideration is necessary. Transferring the RESP to a Canadian family member is another avenue to explore to ensure that the educational funds continue to benefit your loved ones within Canada’s education system. Always seek advice from financial experts or RESP providers when you face these decisions to make the best choices about your RESP.

Wrapping It Up

In summary, understanding the rules and benefits of the Registered Education Savings Plans (RESP) in Canada is crucial for securing your child’s future education. Whether you have a non-contributory RESP or a self-contributory one, being informed about what happens when you leave Canada ensures that you can make the best decisions for your family’s educational savings.

Now, We encourage you to take action:

- Stay Informed: Keep yourself updated on RESP(Registered Education Savings Plan) rules and regulations, especially if you’re planning to leave Canada temporarily or permanently.

- Consult a Professional: If you have specific questions or concerns about your RESP in relation to leaving Canada, consider consulting a financial advisor or RESP provider for personalized guidance.

- Share Knowledge: Share this knowledge you gained with friends and family who might benefit from the information. Education is a valuable asset, and your shared knowledge could help others make wise decisions about their RESPs.

- Plan Ahead: If you’re considering leaving Canada, plan ahead to ensure a smooth transition for your RESP and your child’s education savings.

Keep in mind that a Registered Education Savings Plan RESP is an excellent means to protect your child’s future education and that taking action can make all the difference. Thanks for reading, and good luck with your efforts to save for school!

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Registered Education Savings Plan

An RESP, or Registered Education Savings Plan, is a tax-advantaged savings plan in Canada that helps parents and guardians save for their child’s post-secondary education. It allows for contributions, government grants, and tax-deferred growth.

No, RESP contributions are not tax-deductible at the federal level in Canada. You make contributions with after-tax income.

Yes, RESPs can be worth it, thanks to government grants, tax-deferred growth, flexibility, and the specific focus on education savings. However, their worthiness depends on your financial goals and circumstances. Consult with a financial advisor to determine if an RESP aligns with your plans.

If you leave Canada temporarily and maintain a valid Canadian Social Insurance Number (SIN), you can generally continue to contribute to and manage your RESP without significant issues.

Yes, you can access government grants (like the CESG and CLB) in your RESP, even if you leave Canada permanently. These grants are not tied to your residency status and can be used for your child’s education, whether in Canada or abroad.

If you leave Canada permanently and no longer have a valid SIN, contributing to your self-contributed funds may become challenging. It’s essential to consider the options, including transferring the RESP to a family member or terminating the account.

Terminating an RESP when leaving Canada permanently may lead to the repayment of government grants and taxation of the accumulated income. The specific tax implications can vary, so consulting with a tax professional is advisable.

Yes, in certain cases, you may be able to transfer your RESP to a sibling or another family member who is a Canadian resident. This option can help ensure that the educational funds remain within the family.

A non-contributory RESP primarily consists of government grants and offers flexibility as the grants are not tied to your residency status. You can access these funds for your child’s education even if you leave Canada.

When leaving Canada temporarily, you should update your contact information with your RESP provider to ensure they are aware of your situation. This helps in maintaining your RESP account.

Generally, there are no penalties for leaving Canada with an RESP. However, the specific rules and tax implications may vary based on your circumstances and the type of RESP account you hold.

It’s recommended to consult with a financial advisor, RESP provider, or tax professional to address any questions or concerns related to your RESP when leaving Canada. They can provide guidance tailored to your specific situation.

Yes, if you are living abroad temporarily but maintain a valid Canadian SIN, you can typically continue contributing to your RESP without major restrictions.

You do not need to notify the government when leaving Canada with an RESP. However, keeping your RESP provider informed of your contact information and status is crucial.

You can withdraw money from your RESP when you leave Canada, but it should be used for your child’s post-secondary education or be subject to taxation.

If you use RESP funds for non-educational purposes when leaving Canada, you may face taxation on the accumulated income, and government grants may need to be repaid.

There is no specific time limit for using RESP funds after leaving Canada. However, it’s essential to ensure that the funds are used for your child’s qualified educational expenses to avoid taxation and repayment of grants.

Generally, RESP funds are intended for use in Canadian educational institutions. Transferring the funds to international institutions may not be a simple process and can have tax implications.

Suppose your child decides to study abroad after you’ve left Canada. In that case, you can still use the RESP funds to support their education, provided the institution meets the eligibility criteria for RESP withdrawals.

Alternatives to terminating an RESP include transferring it to a family member or maintaining the account while adhering to the rules and regulations for non-residents.

Depending on the RESP provider and the specific circumstances, it may be possible to designate a new beneficiary for your RESP, such as another child or family member.

If you return to Canada after leaving temporarily, you can generally resume contributing to and managing your RESP as long as you have a valid SIN. Your RESP provider can guide you through the process.

Remember that the rules and regulations surrounding RESP accounts can vary and are subject to change. It’s crucial to stay aware and seek professional advice when facing unique circumstances related to your RESP, especially when leaving or returning to Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com