The RRSP (Registered Retirement Savings Plan) isn’t just an account—it’s your secret weapon for securing a brighter financial future. It’s like planting little money seeds that grow into a comfy bundle of cash for when you stop working. But here’s the thing: figuring out when to press pause on these contributions? That’s the puzzle we’re here to solve.

Imagine your RRSP as a treasure chest where every contribution is a gold coin. Each coin adds up over time, turning into a chest full of opportunities for a comfortable retirement. But at some point, you might wonder, “Should I stop tossing coins into this treasure chest?”

That’s where the roadmap to your financial future begins. It’s like planning a journey—deciding when to take that scenic pause and when to keep moving forward. And this journey isn’t just about RRSPs; it’s about having security for tomorrow. It’s about ensuring that your RRSP (Registered Retirement Savings Plan) isn’t just about retirement—it’s about weaving together a financial web of safety, kind of like a life insurance policy for your savings.

So, think like this: you’re crafting a blueprint for life after 2024, and your RRSP is a key piece of that puzzle. It’s about making smart choices now that will let you relax and enjoy life later. Let’s jump into this puzzle to uncover the perfect timing to hit pause on those RRSP contributions.

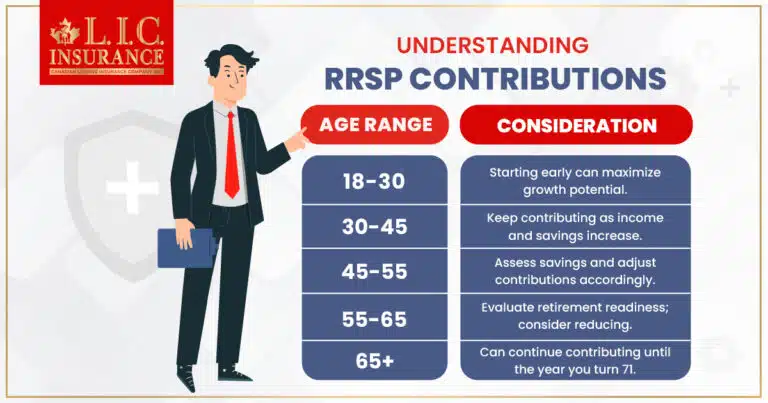

Understanding RRSP Contributions

Remember, these age ranges are general considerations. The decision of when to stop contributing to your RRSP depends on various personal factors like financial goals, retirement plans, and income stability. Consulting a financial advisor can provide tailored advice for your specific situation.

RRSP and its benefits

Think of an RRSP as a supercharged piggy bank for your retirement. It’s a savings account that’s got a special perk—when you put money in, it’s like planting a money tree. This tree grows tax-free until you’re ready to pluck its fruits in retirement. The best part? It’s not just about saving money; it’s about making it grow.

Life after work might seem far away, but an RRSP is like a cozy blanket for your future. It’s not just about tucking money away; it’s about letting it grow big and strong. And here’s the secret: your contributions aren’t just sitting idle; they’re out there, working hard, earning interest, and building a nest that’ll keep you comfy after 2024.

How Registered Retirement Savings Plan contributions affect taxes and retirement savings

Alright, here’s the cool part—RRSP contributions aren’t just about saving money for a rainy day; they’re about keeping more money in your pocket right now. When you put your hard-earned cash into an RRSP, it’s like doing a magic trick with taxes. You get to shrink the amount of income that gets taxed today, which means you pay less to the tax folks. It’s like giving yourself a little bonus!

But wait, there’s more! Remember that money tree we talked about? Well, it’s not just growing tax-free; it’s growing faster because you’re not paying taxes on the gains. That’s more money in your pocket when you’re ready to kick back and relax.

Importance of consistent contributions over time

Okay, here’s the secret ingredient to making your RRSP (Registered Retirement Savings Plan) magic work: consistency. It’s not about tossing a big bag of money in and calling it a day; it’s about planting those seeds regularly. Every time you contribute, it’s like giving your money a little boost, and those boosts add up big time.

Consistency is key, my friend. Even if it’s just a small contribution, it’s like adding fuel to the fire, making your retirement fund grow bigger and brighter. It’s like setting the stage for a comfy life after 2024—making sure your RRSP is there, shining like a lamp of financial security.

Remember, an RRSP isn’t just a savings account; it’s a lifeline for your future. It’s about making smart choices now so you can relax and enjoy life later. It’s about securing your savings, almost like having a life insurance policy for your retirement plans. So, keep those contributions coming, and watch your future blossom!

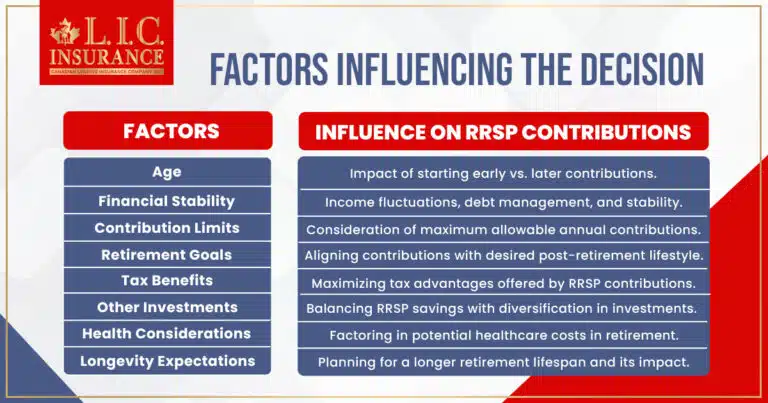

Factors Influencing the Decision

Age-related considerations:

Early vs. later contributions: Impact on growth

Alright, let’s talk about timing! Contributing to your RRSP early is like planting seeds in fertile soil. The sooner you start, the more time your money has to grow. It’s like giving your retirement savings a head start, and trust us, time is your best friend here. Even small contributions early on can sprout into substantial life savings, thanks to the magic of compound interest.

But hey, if you’re late and still need to jump on the RRSP train, don’t sweat it. You can still start now. Sure, you might miss out on some of that early growth, but every little bit counts. The key is to start as soon as you can and let time work its magic.

Contribution limits and room for growth

Now, here’s a little something to keep in mind—there’s a limit to how much you can put into your RRSP (Registered Retirement Savings Plan) each year. It’s like a savings sandbox with boundaries. The government sets these limits and can change, so keeping tabs on them is essential.

But don’t worry; even with these limits, there’s room for your money to stretch its legs. You can explore other investment avenues if you’ve maxed out your contributions. Think of it as diversifying your savings garden—planting different seeds in different pots to ensure your retirement garden grows lush and green.

Contribution limits and room for growth

Life’s a rollercoaster, especially when it comes to finances. Your income might shoot up like a skyrocket one year and take a dip the next. That’s where financial circumstances come into play. You’ve got to consider these twists and turns when deciding how much to put into your RRSP.

If your income fluctuates, it might affect how much you can comfortably put aside in your RRSP. It’s about finding that sweet spot—contributing enough without straining your finances. And here is the place where that life insurance piece fits in. It’s like a safety cushion for your savings. If unexpected bumps come along, having a safety cushion can make sure your retirement plans stay on track.

Saving for retirement after 2024 isn’t just about crunching numbers; it’s about adapting to life’s changes. It’s about being flexible with your contributions and ensuring your savings stay secure, almost like having a guardian angel for your retirement dreams. So, consider your age, keep an eye on those contribution limits, and adapt to life’s financial rollercoaster—your future self will thank you!

Evaluating Retirement Goals

Retirement lifestyle expectations:

Assessing the desired lifestyle post-retirement:

Think this out: lounging on a beach, pursuing hobbies, or travelling the world—that’s your retirement dream, right? Well, assessing your desired lifestyle after 2024 is crucial. Do you aim for a simple, relaxed life or a more extravagant one? Knowing this helps gauge how much you’ll need in your RRSP to fund that dream.

Estimating retirement expenses:

Let’s talk numbers! Retirement isn’t just about fun and games; it’s about expenses, too. Consider housing, food, travel, and entertainment. Don’t forget those sneaky expenses like healthcare, which can add up. Estimating these expenses helps set a savings target for your RRSP.

Health and longevity considerations

Factoring in potential healthcare costs:

Healthcare can be a big-ticket expense post-retirement. It’s vital to factor in potential healthcare costs from routine check-ups to unexpected medical emergencies. Your RRSP isn’t just for sipping cocktails on a beach; but RRSP is a lifeline for potential healthcare expenses, too.

Longevity risk and financial planning:

Life is full of surprises, and longevity is one of them. Longevity risk means living longer than expected, which is great, but it can strain your finances. Imagine your RRSP as a financial safety guard, ensuring you’re financially equipped for those extra golden years.

Planning for retirement in 2024 isn’t just about dreamy beach days; it’s about the essentials, too. It’s about painting a realistic picture of your future lifestyle and being prepared for whatever life throws at you. Your RRSP isn’t just a savings plan; but RRSP is your partner in crafting a secure and fulfilling post-retirement life. It’s like having a financial toolkit ready for any situation that may arise—making sure your retirement dreams become a reality. So, envision your dream retirement, calculate those expenses, consider your health needs, and plan for a longer, fulfilling life after 2024. Your RRSP isn’t just a savings account; it’s your passport to the retirement you’ve always imagined.

Strategies for Optimizing RRSP Contributions

Contribution strategies for different life stages

Early career vs. mid-career vs. pre-retirement:

Let’s talk about timing! Early career, mid-career, or nearing retirement—each stage has its own RRSP game plan. In the early career phase, you’ve got time on your side. Even putting in just a little money can grow into a big bunch for your retirement. Mid-career? Try boosting those contributions as your income grows. Pre-retirement? Keep an eye on maximizing savings and consider catch-up contributions to shore up your RRSP.

Maximizing tax benefits while contributing:

Tax time can be friendlier with RRSP contributions. It’s like a double win—saving for the future and paying less tax now. Aim to contribute enough to snag those tax benefits, but be mindful of contribution limits to make the most of those tax perks.

Diversification and alternative retirement savings

Exploring other retirement savings vehicles:

Your RRSP isn’t the only player in the retirement game. There are other avenues like Tax-Free Savings Accounts (TFSAs) or workplace pension plans. Each has its perks, so exploring these options can diversify your savings. It’s like having a retirement buffet—choose what suits your appetite!

Balancing RRSP contributions with other investments:

See this: a financial juggling act. It’s not just about dumping everything into your RRSP. Consider spreading your savings across different investment baskets. Balancing RRSP contributions with other investments ensures a diversified portfolio.

Planning for retirement in 2024 isn’t just about putting money away; it’s about playing the long game smartly. It’s about knowing when to put your foot down on contributions and when to diversify your financial garden. Your RRSP isn’t just a savings account; it’s your partner in crafting a secure and fulfilling post-retirement life. It’s like having a financial toolkit ready for any situation that may arise—making sure your retirement dreams become a reality. So, embrace those different life stages, maximize tax perks, explore diverse savings options, and create a balanced investment plan. Your RRSP isn’t just a savings account; it’s your passport to the retirement you’ve always imagined.

Deciding the Ideal Age to Stop RRSP Contributions

Analyzing retirement readiness

Assessing retirement savings and income sources:

Let’s take stock of your retirement toolbox. Calculate how much you’ve put aside in your RRSP and other savings pots. Consider any potential income sources post-retirement, like pensions or government benefits. It’s like ensuring you have enough ingredients for the recipe for a comfy retirement after 2024.

Considering potential sources of income in retirement:

Your RRSP isn’t the lone star in your retirement galaxy. Think about other income sources—maybe rental properties, part-time gigs, or even a side hustle. These can supplement your RRSP and contribute to a more financially robust retirement plan.

Impact of continuing vs. halting RRSP contributions

Pros and cons of extending contributions:

Alright, it’s decision time! Continuing those RRSP contributions?

It can make your retirement savings bigger, making sure you have more money saved up for when you stop working. But there’s a flip side, too—contributing might mean less cash flow for present needs. It’s a balancing act between present comfort and future security.

Benefits of redirecting savings to other investments:

Halting RRSP contributions doesn’t mean the end of the road. Redirecting those savings into other investments can diversify your portfolio. Think about it like planting different crops; each has its season to grow and flourish. You’re spreading the risk and potential rewards by exploring other investment avenues.

Deciding when to put the brakes on your RRSP contributions is a challenging choice. It’s about weighing your retirement readiness, considering your income sources, and balancing the pros and cons. Your RRSP isn’t just a savings account; it’s your partner in crafting a secure and fulfilling post-retirement life. So, assess your retirement toolbox, explore various income sources, weigh the pros and cons of continuing contributions, and consider redirecting savings.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Conclusion

Figuring out when to stop putting money into your RRSP is different for everyone. It’s a personal journey influenced by various factors. Consultation with insurance experts can provide tailored advice to align your retirement goals with your financial strategy, ensuring a secure and comfortable future.

Ultimately, planning for retirement involves understanding the nuances of RRSP contributions, balancing current financial circumstances with future aspirations, and making informed decisions along the way.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

There’s no one-size-fits-all answer. It depends on various factors like your retirement goals, financial situation, and other income sources. Assessing these factors helps determine the right time for you.

You can contribute to your RRSP until the year you turn 71. However, it’s essential to consider if contributing after retirement aligns with your financial goals and tax situation.

You can over-contribute up to a certain limit without facing penalties. However, exceeding the limit significantly may result in tax penalties, so monitoring your contributions is crucial.

Not necessarily. Your RRSP can still play a vital role in your retirement plan, even if you have other savings. Assess the tax advantages and growth potential before making a decision.

Yes, it is possible to withdraw money. You can withdraw funds from your RRSP after retirement. However, these withdrawals are considered taxable income and may impact your taxes in the year of withdrawal.

Life insurance can complement your retirement plan by providing financial security for your loved ones. It’s important to understand how life insurance fits into your overall retirement strategy.

Generally, you can’t directly use RRSP funds to buy life insurance. However, you can name a beneficiary, such as a spouse or child, who can receive the RRSP funds tax-free upon your passing.

It is all dependent on your financial goals and risk tolerance. Diversifying your investments, including RRSPs and other options, is often recommended for a balanced retirement portfolio.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]