Let’s say you have saved a lot of money for your child’s schooling through a RESP and hope they will have a great career in academia. As college acceptance letters start arriving, reality sets in—it’s time to make those savings count. There will always be a lot of terms to learn, though, like “EAPs” and “CESG limits.” Dont stress yourself out if such a process seems daunting. Most parents have gone through this, not knowing exactly when it’s really appropriate to be withdrawing money and also how to go about reaping the most from benefits without any additional penalties involved. Keep reading further to find out how to withdraw from the RESP account with the help of reading the given step-by-step clear instructions that you can easily follow.

In the following sections, we will look at everything from the basic RESP withdrawal rules to the exact limits that you need to know. We will be sharing stories from parents—just like you—who figured out how to withdraw money from an RESP and shed light on their actual, lived experience of how they successfully dealt with those difficulties. So, if you are first-time or even fine-tuning your knowledge of the RESP, this guide will keep you interested and informed right from the beginning.

Understanding RESP Basics

Understanding what an RESP entails before discussing how to withdraw money from your RESP is essential. An RESP is a Registered Education Savings Plan, an investment that one uses to assist their children in pursuing post-secondary education in a tax-sheltered manner. Governments contribute to the savings through grants and bonds, which accumulate tax-free until withdrawal.

Find Out: The important things for an RESP

Find Out: The reasons to open an RESP

Find Out: The reasons to choose an RESP

Key Components of RESP

Contributions: The money you deposit can be withdrawn tax-free by the contributor.

Government Grants: These include the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB), in which the government contributes to the RDSP plan holder’s savings.

Investment Growth: Any income earned from the investments within the RESP.

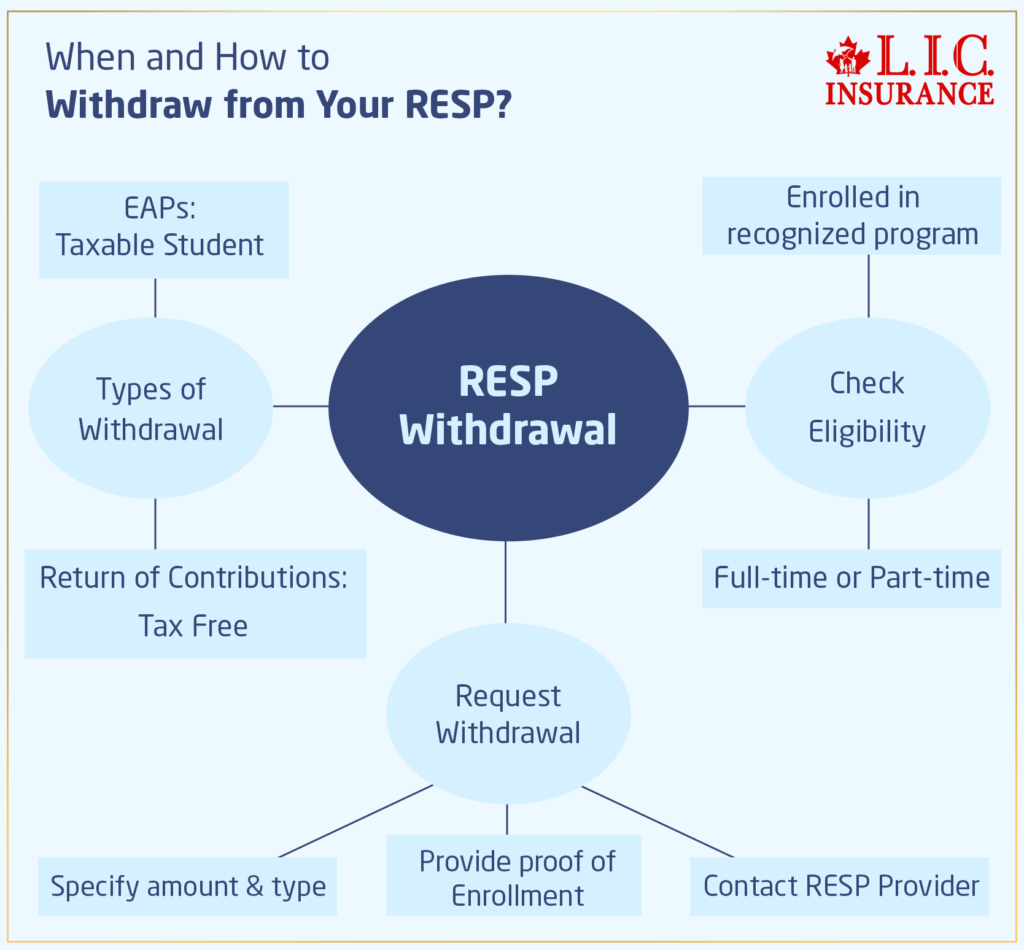

When and How to Withdraw from Your RESP

Withdrawing from your RESP correctly is critical to avoid taxes and penalties. Here’s how you can do it efficiently:

Determine the Type of Withdrawal Needed

Educational Assistance Payments (EAPs)

EAPs are meant for the student (beneficiary) and contain government grants and investment earnings. Taxation applies to the student, who usually earns a lower income and hence has a low liability.

Return of Contributions

These are the initial funds you put into the RESP, which can be returned to you or the student tax-free.

Check Eligibility

Before you make any withdrawals of EAPs, ensure that the beneficiary is registered at a post-secondary institution and in a program that is recognized. Here are the criteria:

They are enrolled full-time or part-time in a qualifying educational program at a post-secondary educational institution.

The program should meet the minimum required hours and weeks as prescribed by the RESP rules.

Take Maria’s example. She saved in an RESP for her daughter. When her daughter got admission to a culinary school in Italy, she had to verify the institution’s eligibility according to the RESP Rules. It was a relief when she found out that the school really did qualify and that the tuition fee could be paid out of the RESP proceeds along with other related education expenses.

Requesting Withdrawals

Contact your RESP provider to initiate a withdrawal. You’ll need to provide:

Proof of enrollment

Details on the amount needed

Whether the withdrawal is an EAP or a return of contributions

Initially, the father of two, John, grappled with this and the paperwork involved with RESP withdrawal. It was only after he organized a head-to-head meeting with his RESP provider that he got the explicit listing of required documents and, hence, could successfully proceed to closure.

Tracking and Managing Your RESP Withdrawals

Understand the Limits

- The lifetime CESG limit for each beneficiary is $7,200. Keep track of the amount of CESG used; to make sure you do not exceed this limit, any excess must be paid back.

- In the first 13 weeks, EAP up to $5,000 is allowed for withdrawal for a full-time student; after that, there is no restriction provided the enrollment continues.

Sarah, however, withdrew an amount of EAP(Educational Assistance Payment) for her son’s first semester in engineering without knowing that she had not observed the initial limit, and, in this case, the withdrawal attracted some unexpected tax implications. She had to re-strategize how she would make the withdrawal for the next semester accordingly.

To Sum It All Up

The rules of withdrawal and limits RESPs impose may sound complicated. However, if you have these guidelines in mind, you will be making the most of your savings plan.

If securing a child’s educational future excites you, you are in the right place. Set up an RESP with Canadian LIC, the best insurance brokerage. We will not only guide you with proper professional advice but also ensure that your investment is handled very carefully and precisely to set your child up for a win without having to suffer from financial hassles. So, why wait? Go for this best funding resource, your child’s RESP for your child’s education.

Engage with Canadian LIC today and ensure your RESP is in expert hands, ready to support your child’s learning journey from day one.

Find Out: Does a RESP beneficiary need to live in Canada?

Find Out: Can I use my RESP outside Canada?

Find Out: How do I check my RESP in Canada?

Find Out: Can you transfer an RESP to an RRSP?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions: Exploring RESP Withdrawal Rules & Limits

There are two types of withdrawals: Educational Assistance Payments (EAPs) and Return of Contributions, which may be made when you’re ready to access the funds within your Registered Education Savings Plan (RESP) for educational purposes. The EAP is included in the student’s taxable income but may consist of government grants and investment earnings, an essential way to pay for educational expenses. Return of Contributions, on the other hand, are the initial deposits made into the RESP and can be taken out tax-free.

Tom had just subscribed to an RESP and was naturally not very conversant with the timing of making withdrawals, so he reached out to his provider. The provider explained to him that it would be okay to make withdrawals at any time from contributions but wait until his daughter enrolls in college to withdraw EAPs without penalties.

The critical limits to remember include the following:

- The lifetime limit of $7,200 on the Canada Education Savings Grant (CESG) for the beneficiary.

- $5,000 maximum in EAP withdrawals during the first 13 weeks of your child’s post-secondary education.

Keeping up to your limits means keeping accurate records of each withdrawal and consulting with your RESP provider before making significant withdrawals.

Susan’s son was halfway through his first semester when she realized they might exceed the EAP limit. By quickly adjusting their withdrawal strategy with their RESP promoter, they managed to stay within the rules and avoid costly penalties.

You have several options if the funds in the Registered Education Savings Plan are not used for educational purposes. You could keep the RESP open—perhaps, at some point in the future, the beneficiary would like to use it for their educational purposes. The other option may involve transferring the RESP to another beneficiary or closing the plan. However, should an individual close the RESP, they have to return all the money from the government grants, including taxes on the investment earnings plus an extra penalty tax.

When the youngest of the Robinsons decided not to go off to college, they had a family meeting with their financial advisor. They decided to reallocate the remaining RESP funds to another family member who is younger, so the government contributions remain in place, as well as to support their family with education.

The good news is that one can use EAPs from an RESP for more than just tuition payments. The process can also facilitate the payment of other incidental expenses, which include books, housing, transport, and supplies, among others. All that will be required of you is to show that such costs are related to the beneficiary’s education.

Emily was filled with relief the moment she found out that the RESP could be used to cover far more than just tuition, dormitory fees, and textbooks, the total killer of any budget. It all went a long way toward easing her financial stress during her first year at University.

Keep things organized: a simple spreadsheet noting the date, amount, and whether it was an EAP or a Return of Contributions will keep everything organized in terms of tracking each withdrawal. Additionally, most RESP providers offer online tools that enable easy tracking of all activities occurring within the account.

When the Martins started withdrawing from their RESP, they created a dedicated folder for all RESP-related documents and statements. This method helped them keep an excellent track of their withdrawals and balances, ensuring they never missed a grant or exceeded limits.

First, go through your RESP agreement’s terms and make sure you understand the RESP withdrawal rules & limits. If the issue isn’t clear or resolved yet, contact your provider. If you are still unsatisfied, feel free to take your complaint to a financial expert.

During a withdrawal process, the Thompson family encountered discrepancies in the reported amounts. The family contacted their RESP provider and was candid about their concerns. Both parties properly cleared the withdrawals.

You can begin withdrawing money from your Registered Education Savings Plan (RESP) when the beneficiary is enrolled in a post-secondary education program at a recognized learning institution. Please note that while your contributions can be withdrawn at any time, Educational Assistance Payments (EAPs), which include government grants and investment income, can only be withdrawn when the beneficiary is enrolled in an educational program.

Being a mother, Linda wanted to get her hands on the RESP money as soon as her son had the university acceptance letter in his hands. She was frustrated that she had to wait until he registered and classes began. By preparing the necessary documents in advance and communicating with her RESP provider, she ensured the funds were available right when her son started his semester.

The contributions you withdraw from the RESP are not taxed. However, Educational Assistance Payments (EAPs) are subject to tax at the beneficiary’s income rate, which is usually minimal due to the low income of students. It’s important to consider how much you withdraw as EAPs each year to manage potential tax impacts effectively.

When Raj withdrew a large amount of money as an EAP for his daughter’s first year at University, he did not consider the tax implications. Fortunately, his tax advisor helped him plan future withdrawals more strategically, spreading out the EAPs to minimize taxes each year.

Yes, you can change the beneficiary of an RESP if the new beneficiary is a blood relative of the original beneficiary. This flexibility allows families to adapt to changing educational paths without losing the financial benefits accrued in the RESP.

After the eldest son of the Chen’s dropped out of college, the parents converted the RESP for that child to their second daughter, who was planning to go to graphic design school. This way, another family member benefited, and the money saved for education was used as intended.

Any overcontribution made over the lifetime limit of $50,000 to each beneficiary shall attract a 1% per month penalty on the contributed amount in excess until the withdrawal is made. For this reason, it is essential that you monitor your contributions.

The Harding family inadvertently exceeded the contribution limit due to a clerical error. They acted quickly to withdraw the excess amount and addressed the penalty fees directly with their RESP provider, effectively resolving the oversight.

Keep in touch with your RESP provider, who will advise you of the rules and limits for regular withdrawals. They can provide detailed information on recent and updated legislative changes that may affect your plan. Also, keeping a record of each transaction and statement will facilitate following up on compliance.

Paul and Anita regularly reviewed their RESP statements and stayed in touch with their RESP promoter. This proactive approach helped them understand each withdrawal’s impact and kept them informed about the regulatory landscape, ensuring they used their RESP funds optimally.

Understanding how to make RESP withdrawals work for you will mean managing them wisely. Whether planning the first withdrawal or understanding potential problems, knowledge and interest with your provider about RESP will ensure your education savings find their way to their purpose.

Sources and Further Reading

For a better understanding of the rules, limits, and best practices regarding RESP withdrawals, refer to the following resources. Most of the information presented is very detailed and helpful since it will carry one successfully along with their RESP and enable them to make the best choices about funding education with this indispensable saving tool.

Official Government Resources

Canada Revenue Agency (CRA) – RESP Withdrawals

This page provides comprehensive details on how RESP accounts work, including contributions, withdrawals, and tax implications.

Employment and Social Development Canada (ESDC) – RESP and Government Grants

Here you can find information on how the Canadian government supports RESPs through various grants and the conditions associated with these grants.

Educational Articles and Guides

Investopedia – Understanding RESPs

Investopedia offers a clear and detailed guide that explains the different aspects of RESPs, including strategic withdrawal tips to minimize taxes and maximize growth.

Canadian Bankers Association – Planning for Education with RESPs

Canadian Bankers Association – Education Planning

This resource provides insights into planning for future education needs using RESPs, with practical advice on contributions and withdrawals.

Books

“The RESP Book: The Simple Guide to Registered Education Savings Plans for Canadians” by Mike Holman

Available on Amazon and other book retailers

This book is an essential read for anyone managing an RESP. It offers a straightforward approach to understanding how RESPs work, how to open an RESP, and how to withdraw funds effectively.

Financial Blogs and Websites

MoneySense – How to Use RESPs

MoneySense provides practical advice on using RESPs effectively, including real-life scenarios and expert tips on managing education savings.

The Globe and Mail – RESP Strategies

The Globe and Mail – Education Savings

This article discusses strategies to maximize the benefits of your RESP, focusing on withdrawal timings, beneficiary rules, and more.

Forums and Community Discussions

Reddit – PersonalFinanceCanada

Reddit Personal Finance Canada

A community where you can ask questions and share experiences regarding RESP management, withdrawals, and other financial decisions.

Consulting with Professionals

Financial Advisors Specializing in Family Planning

It is always recommended to consult with a certified financial planner or advisor who specializes in family financial planning and RESPs. They can provide personalized advice based on your specific financial situation and goals.

You will notice that through these resources, you get well-equipped to handle your RESP. The person with a newly registered plan starting and intending to make well-informed decisions on how to make withdrawals benefits from the valuable insights and expert advice available through these resources.

Key Takeaways

- Understand the two types of withdrawals: Educational Assistance Payments (EAPs) for educational expenses and Return of Contributions, which can be withdrawn tax-free.

- Ensure the beneficiary is enrolled in an eligible post-secondary program before making an EAP withdrawal.

- Manage the $50,000 lifetime contribution limit and $7,200 CESG limit to avoid penalties and maximize benefits.

- Plan withdrawals strategically to minimize taxes, leveraging the lower tax bracket of most students.

- Use RESP funds for a broad range of educational expenses, including tuition, books, and housing.

- If education is not pursued, consider transferring the RESP to another beneficiary or withdrawing contributions without penalty.

- Keep in regular contact with your RESP provider and adjust your strategy based on legislative changes.

- Prepare for withdrawals with the necessary documentation, such as proof of enrollment.

- Consult with financial advisors or RESP specialists for personalized guidance and to navigate complex situations.

Your Feedback Is Very Important To Us

To better understand the challenges and questions people have about withdrawing money from Registered Education Savings Plans (RESP) in Canada, the following feedback questionnaire can be used. This survey aims to gather insights that can help improve guidance and support for RESP users.

RESP Withdrawal Feedback Questionnaire

This questionnaire is designed to be conducted online or in paper form, allowing RESP holders to share their experiences and struggles. The responses will help in understanding common issues and improving the support structure around RESP withdrawals.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com