You have reached a noisy school supplies shop, and just a couple of weeks are left until your school starts. So, now here you stand in the check-out line, notebook and brand-new laptop in your cart, asking yourself, “Can I use my kid’s RESP to pay for all this stuff?” You’re probably thinking about this because you’re one of many Canadians who think the Registered Education Savings Plan(RESP) rules are hard to understand.

Because of how difficult this is to understand, many people will fail to take advantage of this excellent insurance savings plan for higher education. That’s why today, we’re going to understand RESP expenses deeply. We’ll answer questions like what expenses qualify, draw on real-life examples from parents who have dealt with this before, and offer suggestions that might make your education savings plan more efficient. Whether this is your first Registered Education Savings Plan Quote or you’re at the point of making a withdrawal, we’re going to take you through this process and take the mystery out of it so you can confidently manage your RESP money.

We’ll also clarify what expenses can RESP be used for so you don’t get caught off guard at the checkout. From books to residence costs, RESP allowable educational expenses cover more than most parents realize. We’ll explore RESP eligible expenses in detail and help you avoid costly mistakes. And if you’re wondering, can I use my RESP to buy a car?—We’ve got that answer too.

Brief on RESP in Canada

Before going into detail about what is considered an eligible expense, let’s briefly go through what an RESP stands for. An RESP is a Registered Education Savings Plan account with a tax-sheltered, government-assisted plan that offers parents or guardians an opportunity to save for their children’s post-secondary education. The magic with an RESP account is that it can grow your RESP savings tax-free until the beneficiary decides to undertake their educational adventure. The government also pitches in some money towards your savings through grants such as the Canada Education Savings Grant (CESG) or Canada Learning Bond (CLB).

Find Out: Can you use your RESP outside Canada?

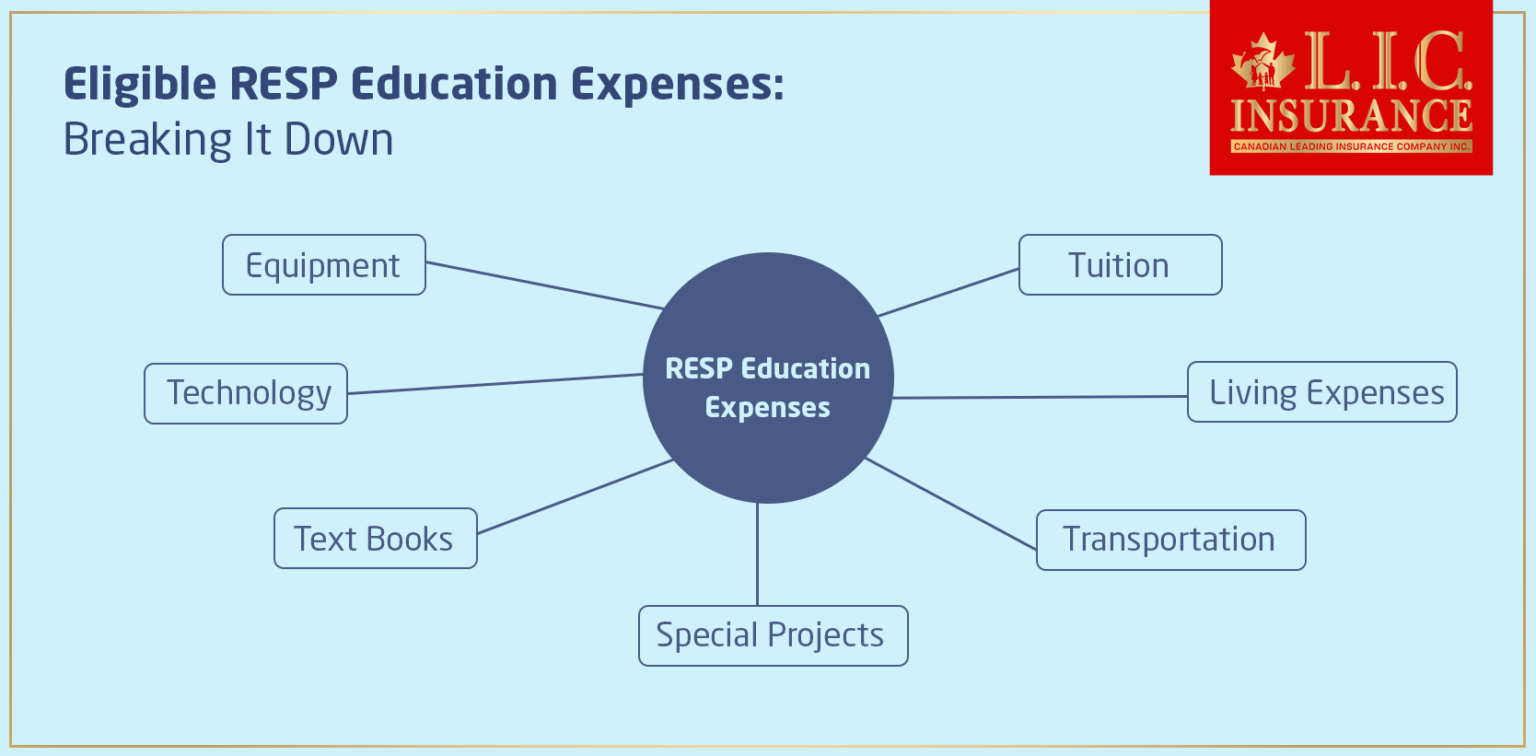

Eligible Education Expenses: Breaking It Down

Knowing, for example, how to use the money invested in a Savings Plan Insurance for Education, such as an RESP, to cover the many costs related to education is extremely relevant. The points below will explain in detail the various expenses that the funds from the RESP can be put towards, including real-life scenarios that prove the practical application of the said funds. This will guide you in planning and using your RESP investments effectively.

Tuition Fees

Understanding tuition costs: The amount paid as tuition forms part of the amount covered under RESP funds. Each could cost large sums of money, whether for full-time or part-time studies for your child.

Maitri is a very organized person. She was very pleased to know that the tuition fees for her two children in the university could be paid in full out of the RESP. This allowed her to tap other savings towards over-and-above educational expenses, therefore ensuring a complete plan in place.

Textbooks and School Supplies

Exploring Textbook Costs: Sometimes, text prices can be ridiculous, and they form a huge part of your expenses. John did not even realize in the first place that his RESP could actually cover not only textbooks but other very important school supplies such as lab kits and art materials. However, when this dawned on him, he would make all the necessary purchases in one semester, ensuring that the out-of-pocket spending was none but that the money from the RESP was fully utilized.

Equipment Necessary for School

Include special equipment: Some programs need special equipment and tools at a great cost.

Lila’s son needed high-quality cameras and lenses for his photography course. Through her RESP, Lila was able to purchase these, easing her financial burden while ensuring her son had the necessary tools to excel in his program.

Living Expenses

Look at the Reality of Living Costs: Many students are forced to live away from home, bringing their own costs.

Common Concern: Thomas used his RESP money for his daughter’s residence fees and monthly rent while she went away to university in a different city. This was common to many, helping both him and her manage cost expenditures and ensure that she was in secure, stable accommodation.

Transportation and Travel

Managing Every Day Rides and More: Travelling charges are so very expensive when you do not live at an approachable distance from your college.

At first, Sam was not very sure about the eligibility of the transportation cost. But when she called the Savings Plan insurance company to double-check, she found out that she was able to use some of the RESP funds for monthly bus passes for her daughter and even for some of her flights home during holidays.

Computers and Technology

Keeping up with the technological need: Most learning education programs today require access to the right kind of Technology.

Tech-Savvy Solutions: Kevin found that his son’s engineering course required a laptop with specific configurations. RESP funds were used to buy a suitable laptop, ensuring his son could handle the software needed for complex designs and simulations.

Special Project Fees

Grants to Academic Projects: Many courses require undertaking special projects or theses, which involve further costs.

Emily used some of the RESP funds for her daughter’s final-year project, just a few, to cover some materials and even some research travel.

Special Cases: Studying Abroad and Online Courses

The Challenge of the Unknown: Many parents like Raj find themselves going through unclear waters when their children choose less traditional paths, such as studying abroad or online courses. Thankfully, RESP funds can be used for international schools and online institutions, provided they meet government accreditation standards.

Managing Your RESP Funds Wisely

Understanding managing your RESP funds need not be a nerve-wracking exercise. Making a commitment to staying organized with your records and learning how to manage your Savings Plan Insurance for Education will be the way to make sure that you maximize every dollar for your child’s future. Here are some key strategies, complete with real-life examples, to help make sense of the chaos and noise and get your RESP organized so that you are best positioned to make more informed choices.

Keep all your receipts

Why it matters: Keeping receipts will help in ascertaining how the money in an RESP account is used, either for education or withdrawal according to government prescription.

Laura kept a file of all education-related receipts, so processing expenses for the provider of the RESP accounts was never a problem. In doing so, she saved herself many headaches during tax season or audits.

Maintain Detailed Records

Best Practices: Maintain a detailed record of all the withdrawals made and the expenses incurred against them. The record will help track the balance and ensure the money is put to use in the right manner.

Mark simply utilized a spreadsheet to keep a record of his withdrawals against eligible expenses. This stopped him from over-withdrawing and kept the money there for essential costs throughout his son’s university years.

Understand the Withdrawal Rules

Understanding the Regulations: Know the rules so as to save yourself lots of money when making RESP withdrawals by avoiding costly mistakes and penalties.

Susan once made a withdrawal without understanding the tax implications, leading to an unexpected tax bill. After this, she consulted with her RESP provider to better understand the rules, ensuring smoother management thereafter.

Plan Withdrawals Strategically

Maximize Benefits: The timing of your withdrawals can have tax implications and affect fund availability.

For example, John realizes that it is imperative for him to strategically plan disbursement deadlines by having them coincide with periods of tuition and major expenses of his daughter so that he handles inflow much better at all terms during the academic year.

Consult with Experts

Consult a professional person—that is, a financial advisor or an RESP specialist—to guide you on what is supposed to be done, especially when you get into the complicated stuff.

Anytime Emma would feel overwhelmed by all these choices and rules, she would reach an advisor from Canadian LIC, advising her what would be the best strategy for saving money and even offering her a quote on the subject of the RESP under her new circumstances.

Review Your Plan Annually

Keeping Up to Date: Annual reviews can help adjust your savings and investment strategies to match educational needs and market changes. Each year, Carlos reviews his RESP investments to ensure they align with his son’s approaching college years, adjusting his contributions and investment choices based on performance and projected needs.

Educate My Family Members

Involving Relatives: Informing family members about how they can contribute to and benefit from the RESP can amplify the financial support for the beneficiary’s education.

After learning about RESP contribution rules, Mia encouraged her parents to give part of their annual holiday contributions to the kids’ RESPs instead of buying expensive gifts. This not only boosted the RESP funds but also engaged the whole family in supporting the children’s educational futures.

Summary: Act Right Away with Canadian LIC

Knowing what expenses qualify under an RESP will give a face to an otherwise lifeless form or document; it may change how a person looks at saving and spending for their child’s education. With this knowledge, you can ensure that your savings plans get the most out of every dollar effectively and efficiently.

If you have not already started an RESP or are looking to optimize your current plan, feel free to reach out to us at Canadian LIC, the best brokerage in the field. They provide professional advice and quotes for individual registered education savings plans to help complete your child’s education. Do not procrastinate further; the best chance is just now. Your investment today can light up your child’s educational path for years to come. Join thousands of Canadian families who trust Canadian LIC to realize their educational dreams.

RESP Allowable Educational Expenses: Beyond Just Tuition

When families ask, What can you use RESP money for, the default assumption is that it only covers tuition fees. However, this is only part of the picture. The truth is that RESP allowable educational expenses include a wide range of costs associated with full-time or part-time post-secondary education at a qualifying institution.

Let’s break down the scope of RESP eligible expenses. Tuition and mandatory fees are just the beginning. You can also use RESP funds for books, transportation, on-campus meal plans, and even off-campus living arrangements. A common question we hear is, Does RESP cover residence? Yes, if your child lives in a university-managed dormitory or housing, those costs fall under eligible RESP expenses.

What about laptops or internet subscriptions? While the government does not explicitly list them, RESP withdrawals are flexible enough to accommodate these tools when deemed essential for coursework, especially in digital or hybrid learning programs.

One popular but often misunderstood query is: Can I use my RESP to buy a car? The short answer is no. While transportation is an eligible category, purchasing a vehicle is not considered a qualified educational expense under current guidelines.

Understanding what expenses RESP can be used for ensures you stay compliant with CRA rules and avoid grant repayments or tax penalties. This clarity helps maximize your RESP’s value, no matter where your child studies.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Managing Your RESP Funds

Dealing with the complexities of a Savings Plan Insurance for Education, like an RESP, can be quite overwhelming. Here are some frequently asked questions with straightforward, practical answers to help you manage your RESP more effectively.

Getting a Registered Education Savings Plan Quote is very simple. Contact a leading provider, such as Canadian LIC. Provide them with details about your financial situation and your child’s educational goals. They will then offer you a tailored quote. Just like Mary did, make sure to inquire and compare quotes to choose the best option within your budget.

If you lose a receipt, try to get a duplicate from the merchant as soon as possible. Tom found that most institutions or stores could reissue receipts for transactions, especially if paid by card, and they have a record of the transaction. Always back up digital copies of your receipts in cloud storage to avoid future problems.

Yes, family members can contribute to an RESP. These contributions are managed just like those made by the primary subscriber. For instance, Susan’s brother made a direct deposit into the RESP account for his nephew, which was recorded under the annual contribution limit. Inform your RESP provider about such contributions to ensure everything is documented correctly.

It is wise to review your RESP investment choices annually. This allows you to adjust to any changes in the financial landscape or your personal circumstances. When Eric noticed that the initial aggressive growth funds were not performing as expected, he switched to more stable investments as his daughter approached university age, ensuring the funds would be adequate when needed.

Yes, withdrawing funds for non-eligible expenses can lead to penalties. These include the repayment of government grants and taxes on income earned within the RESP. When Lisa mistakenly used RESP funds for non-eligible expenses, she faced a hefty tax bill and had to repay the grants, which was a costly lesson in ensuring expenses were always eligible.

If the child opts out to pursue post secondary education, you have options such as transferring the RESP to another child or withdrawing the contributions tax-free. The earnings on the contributions, however, would be subject to tax and a penalty. For example, John transferred the funds to his nephew when his daughter decided not to attend college, thus continuing to support education within the family.

Withdraw government grants and earnings (EAP) early, while the student is in a low tax bracket, to minimize the tax impact. These withdrawals are taxed in the student’s hands. George used this strategy for his twin daughters, planning their withdrawals to incur minimal taxes during their college years.

Start by researching reputable Registered Education Savings Plan providers, like Canadian LIC, and discuss your financial goals and your child’s educational plans with them. Provide accurate financial and educational details. Anita, for instance, consulted several advisors to compare services and quotes to find the best fit for her family’s needs.

Use a dedicated tracking system, such as a spreadsheet or financial software, to monitor all transactions. This helps maintain clear records for tax purposes and future planning. James, for example, set up automatic alerts for every transaction in his RESP, ensuring all contributions stayed within the annual limit.

RESP funds are generally for children’s post-secondary education courses at eligible institutions. However, if summer courses or extracurricular programs are credit-bearing and part of a diploma or degree program, they qualify. Sarah successfully used RESP funds for her son’s summer language course, which was part of his university curriculum.

Regularly review your investment options, especially after significant market changes. Consider consulting with a financial advisor to adjust your strategy based on market performance and the remaining time until your child starts education. For example, when Mark’s RESP investments declined during a market downturn, he worked with his advisor to switch to more conservative investments, protecting the funds from further volatility.

If your child is awarded a scholarship, you can still utilize RESP funds for other eligible educational expenses. This is an opportunity to cover costs not included in the scholarship, such as living expenses or equipment. Julie, for instance, used the RESP to cover her daughter’s living expenses after a scholarship fully covered the tuition, thus ensuring her education was fully funded without additional loans.

Over-contributing to a Registered Education Savings Plan, RESP results in penalties. A 1% penalty per month is charged on the excess contributions for as long as the excess remains in the account. To avoid this, monitor your contributions carefully. Bob, for example, realized he had over-contributed when reviewing his annual RESP statements and quickly withdrew the excess funds to avoid further charges.

Grandparents can contribute to an RESP by coordinating with the child’s parents to make deposits into an existing plan or by opening a family RESP where they can manage contributions themselves. Elaine set up a family RESP for her grandchildren, contributing on birthdays and holidays, thus significantly growing the educational fund over the years.

Sources and Further Reading

To provide a comprehensive understanding of managing Registered Education Savings Plans (RESPs) and their eligible expenses, the following sources and further reading suggestions will be useful:

Government of Canada – RESP Official Page: This official resource offers detailed information on how RESPs work, including contributions, withdrawals, and eligible educational institutions.

Canada.ca-RESP

Canada Revenue Agency – RESP and Taxes: Understand the tax implications related to RESPs directly from Canada’s tax authority.

Canada Revenue Agency – RESP

Canadian Securities Administrators – Investing in RESPs: Provides insight into how RESPs can be invested and managed effectively.

Canadian Securities Administrators – RESPs

GetSmarterAboutMoney.ca: Managed by the Ontario Securities Commission, this site offers practical advice and tips on RESP management and usage.

Get Smarter About Money – RESPs

Financial Consumer Agency of Canada: Learn about choosing the right RESP provider and understanding the different types of RESP plans available.

FCAC – Choosing an RESP Provider

These resources will provide a solid foundation for understanding and managing RESPs effectively, ensuring you can maximize the benefits of this Savings Plan Insurance for Education.

Key Takeaways

- RESP funds cover a wide range of educational expenses including tuition, textbooks, and necessary equipment

- Ensure expenses are directly related to the beneficiary's education and meet RESP guidelines.

- Plan RESP withdrawals strategically to align with tuition and other major expenses.

- Maintain detailed records and keep all receipts for compliance and audit readiness.

- Consult financial experts or get a Registered Education Savings Plan quote for informed decision-making.

- Regularly review your RESP's investment strategy and performance.

- Encourage family contributions to increase the RESP fund while avoiding exceeding the limit.

- Understand the tax implications of RESP withdrawals, especially for taxable portions.

Your Feedback Is Very Important To Us

This questionnaire aims to gather insights into common areas of confusion and challenges that parents face with RESP management, helping us provide more targeted and useful content in the future.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]