BASICS

- Is Infinite Banking A Smart Financial Strategy?

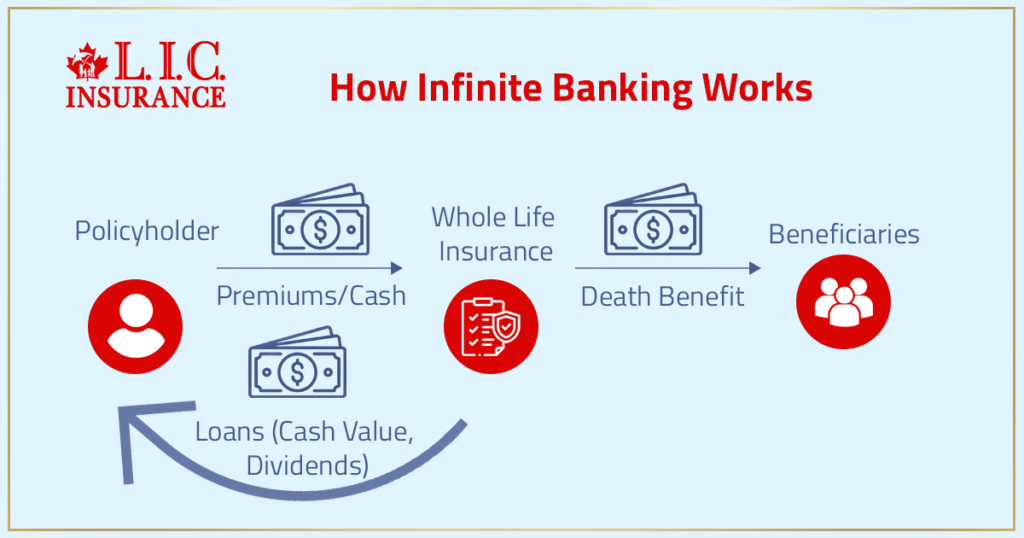

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

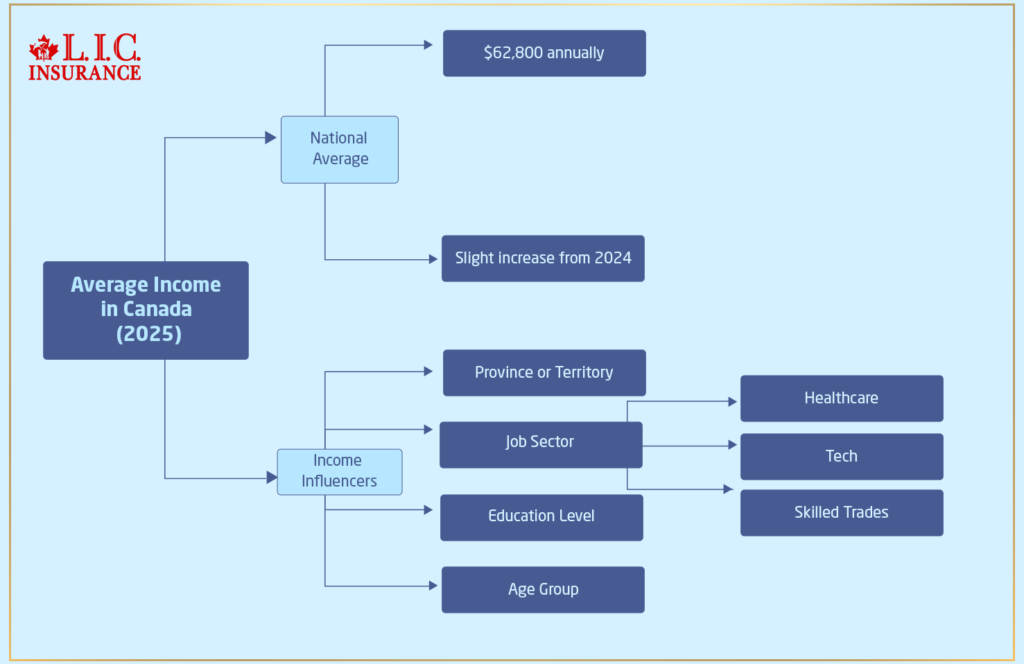

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Immediate Financing Arrangement In Canada: What It Is and How It Works

By Pushpinder Puri

CEO & Founder

- 10 min read

- October 24th, 2025

SUMMARY

An immediate financing arrangement in Canada lets you access liquidity while maintaining Life Insurance Coverage. By assigning a Permanent Life Insurance Policy to a financial institution, you may borrow loan proceeds and reinvest in business or investment portfolio needs. When used to generate income, interest expense may be tax-deductible. The strategy combines tax-free growth, additional collateral, and financial flexibility.

Introduction

New data from the Canadian Life & Health Insurance Association indicates that 23 million Canadians have a Life Insurance Policy, with total coverage in force estimated at $5.7 trillion. CLHIA That’s significant — and much of that value consists of permanent policies that accrue cash value, often not accessed.

It is in this space that an interim financing agreement (IFA) can be interesting for business owners. Think of being able to obtain a line of credit against part of the cash value in your Life Insurance Policy, rather than siphoning off premiums from your working capital. IFAs allow you to do exactly that — maintain robust Life Insurance but gain access to liquidity for growth or investment.

Here’s how Canadian business owners are employing this type of strategy in 2025 — and what sorts of gotchas to watch out for on that journey.

How Popular Is Life Insurance in Canada Today?

- Twenty-three million Canadians own Life Insurance, with $5.7 trillion in total coverage.

- Most of that growth is in individual (vs group or workplace plans), primarily in permanent products or mixed permanent vs. term usage.

- Many high-net-worth people have such policies and repeatedly say in surveys that they don’t understand how life policies can serve as financing tools or estate planning devices. According to one 2023 study, just 17% of affluent Canadians knew that Life Insurance policies could provide tax and other financial advantages beyond basic protection.

That chasm is part of what makes an IFA potentially so effective: It exploits something many already have, yet few use in creative or optimized ways.

What Is An Immediate Financing Arrangement

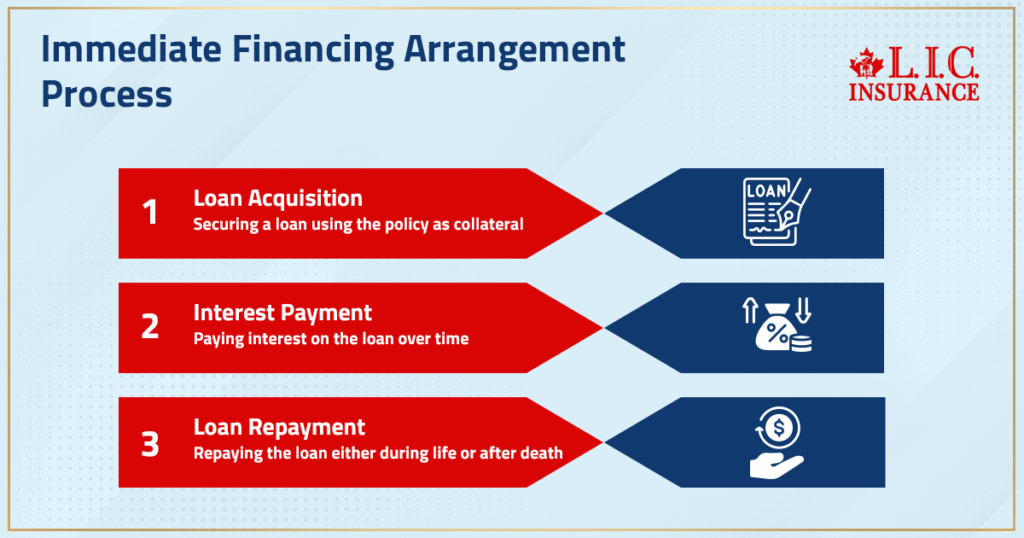

Here’s what this means in real-world terms with an IFA. You buy a Whole Life Insurance Policy (a type of Permanent Life Insurance Policy), which generates cash surrender value as you go along. But as soon as you make the premium payment, you go into a financial institution and get a loan or line of credit using the policy as collateral.

- The proceeds from the loan can equal a substantial portion — even close to 100% in some cases (of what you paid in premium or a percentage of the policy’s cash surrender value), depending on the lender and policy design.

- Interest on the loan — only interest, over the life of the arrangement — is paid by you, while the policy remains in force and continues to build cash surrender value.

- Your remaining loan may be repaid while you are living, if necessary, or it may be taken from the policy’s death benefit/proceeds after your death.

As most borrowers have income-producing activities, the interest expense associated with these loans is tax-deductible if the funds are used in a business or investment portfolio.

Why This Arrangement Appeals To Business Owners

It addresses a quandary that many people have: the desire for strong Life Insurance Coverage, frequently of the permanent kind, without losing cash flow to hefty premium payments.

Why entrepreneurs are attracted to IFAs:

- Prevents your working capital from being tied up in operations, growth, or investments.

- Enables the use of an existing asset (your policy) instead of other investments.

- The cash value increases even while the loan is outstanding.

- May reduce tax burden if structured properly, since interest payments may be deductible.

Key Risks & What To Check

This isn’t a “set-it-and-forget-it” strategy. Some pitfalls to be aware of:

- If interest rates go up, your interest expense could climb faster than your returns.

- If the cash surrender value of the policy isn’t fully developed, lenders may require you to put up additional collateral upfront.

- When the loan balance with interest becomes large enough, unless repaid, the death benefit on the policy can be substantially reduced.

- There are strict tax rules, and misuse or lack of proper documentation can disqualify deductions.

What Data Shows About The Value

A couple of numbers help make the case:

- CLHIA states that approximately 65% of the value of all Life Insurance in Canada is contained in individual policies, with a significant portion associated with permanent policies that have a growing cash value attached.

- In the high-net-worth survey (2023), 54 percent of people with $1 million or more in investible assets reported owning Life Insurance, but only about a third of them said they knew how to use it beyond providing for death, as liquidity or estate strategy.

FAQs

Yes — some owners also stack LTC as a rider next to the Life Insurance for more comprehensive financial protection in later years.

Keep the current financing mechanism distinct so that claim benefits do not complicate tracing.

Your financial adviser will model premiums, cash flow, and any impact on interest expense coverage.

Lenders consider the assigned life policy as collateral, not a direct lien on operating assets.

If the balance of your loan is fairly modest and cash on the policy has been compounding, refinancing stays clean.

Before you chase investment opportunities, inquire about the financial institution’s inter-creditor terms.

Yes — a few policy owners arrange gifts so that the charity receives net policy proceeds.

You still maintain liquidity with the line of credit, but a Permanent Life Insurance Policy provides ballast to the bequest.

Your tax shop can cherry-pick donation receipts and not disrupt cash surrender value planning.

Lower dividends would also slow policy performance, further minimizing early advance ratios.

You safeguard the loan size by maintaining a cushion or investing more money temporarily while you have borrowed funds.

It’s a cautious adjustment, not a failure of the sophisticated financial strategy.

Not if the documents precisely identify the insurance company, beneficiaries, and terms of assignment.

The financing structure can meet buy-sell requirements while leaving capital in the business or investments.

Valuation, tax deductions, and policy proceeds directions. Your attorney will need to know what direction these elements should take.

With some lenders, this interest can accumulate on the IFA loan, but it raises the total cost and risk.

“In a nutshell, most use the interest part from operations to keep ratios neat and clean every review, no longer isolated.”

Turn your capitalization into a fleeting undertaking, not the new normal.

That’s doable: clear the whole loan at sale and retain the Permanent Life Insurance for estate purposes.

Or, pay back some, reduce the line of credit, and have the cash value grow again after a transaction.

Your banker can pre-wire a closing statement and arrange advance approval so funds move the same day.

Some stay corporate-only; others request limited guarantees in the early years.

It’s how comfortable you are with cash surrendering it matures, negotiate a negotiated ratio that burns off as the CSV goes up.

Your banker and financial adviser will script the step-down.

If it’s an everyday business use to earn income, CRA typically honours the purpose test.

Record the invoices and timing so that your file accurately reflects the agreement between interest expense and loan proceeds.

That’s simply how the financing deal goes without drama.

However, UL may benefit owners who desire investment flexibility within the Life Insurance Policy, for which theta is too large.

But the cash value in early years is steadier, and cash surrender is more predictable with a whole life policy — hence lenders’ preference.

Choose the chassis that meets the strategy, not vice versa.

You might design a less expensive annual premium, or one that incorporates a more lenient paid-up addition schedule.

The bank will verify advance values in the event of any funding changes.

Ifa_ Protect ifa ifa Keep the cash flow discussion to keep the near-term financing deal honest.

An experienced third-party lender can take assignment from the first bank and maintain the facility.

Expect fresh underwriting of the Life Insurance Policy, interest rate, and collateral tests.

Transfers paperwork, not a reset—if your numbers still generate income.

Corporate structures usually ring-fence the credit line from personal ratios.

Where guarantees exist, the underwriters still look at income stability and risks holistically.

Plan buffers so you never chase leverage to “make numbers”.

Yes—equipment that helps earn income fits the purpose test and can align with tax-deductible interest.

Keep invoices, delivery dates, and funding trails tidy.

That’s the boring admin that protects a smart financial strategy.

Shrinking spreads, rising interest rates, or a thinner project pipeline.

If investment returns fall below carry, reduce draws, repay principal, or pause borrowing.

Protect the strategy first; growth can wait a quarter.

Usually, the financial institution discloses the line of credit, but the assigned Permanent Life Insurance Policy isn’t scored like revolving retail debt.

Underwriters care more about covenants and cash flows than a vanity score.

Good reporting supports future IFA loan reviews.

Yes—many owners place the Life Insurance Policy and financing arrangement at HoldCo and send loan proceeds down as needed.

Clean intercompany paperwork keeps interest expenses and tax deductions defensible.

Ask your financial advisor to map dividend flows and tests.

You can add on Life Insurance Coverage either through paid-up additions or a rider, then come back later to the advance ratio.

The lender can then re-review the cash and cash surrender value of the policy prior to making changes.

And staggered upgrades keep the strategy mobile.

If you replace a whole life policy in midstream, the adjusted cost basis and early-year dynamics might be reset.

Reg, your third-party lender will come back as well with collateral and covenants.

Only change if the long-run math is clearly superior.

Yes— one solution can address buy-sells while the leverage structure drives growth.

The owner and beneficiary of the policy should correspond to juristic documents.

Clarity in this case eliminates noise when IFA operates at an exit.

Key Takeaways

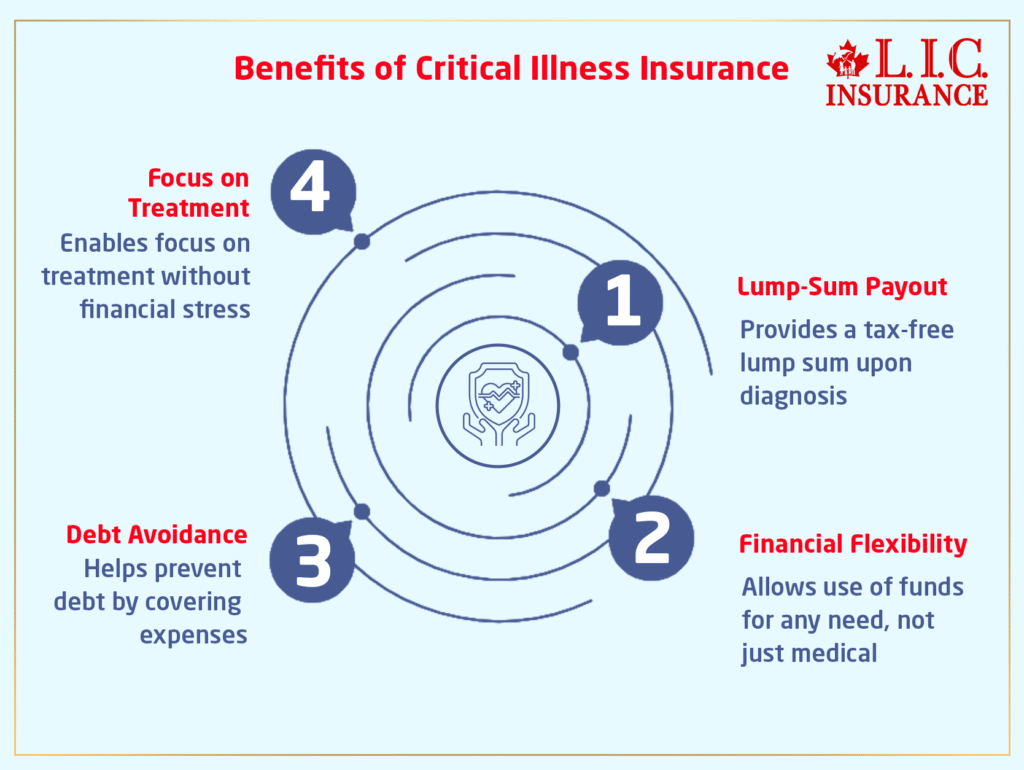

- Critical illness insurance is often overlooked in traditional employee benefits plans, but it’s increasingly vital due to rising medical costs and long recovery times.

- Group critical illness insurance plans provide a tax-free lump sum payout upon diagnosis of a serious illness, offering financial stability when it’s needed most.

- Not all employee plans automatically include critical illness coverage — many require employees to opt in or purchase additional supplementary benefits.

- Employers offering critical illness coverage see improved retention and morale, especially among mid-career professionals and senior employees.

- This coverage can help with non-medical expenses too — such as mortgage payments, travel for treatment, or replacing lost income during recovery.

- For small business owners, adding CI coverage to group plans can be a cost-effective value-add, especially when paired with disability or extended health insurance.

- Coverage amounts, waiting periods, and eligible conditions vary widely — it’s essential to compare group and individual critical illness insurance quotes carefully.

- Employees and employers alike benefit from clear communication and enrollment support during onboarding and benefits renewals to avoid gaps in coverage.

Sources and Further Reading

- Government of Canada – Benefits and Leaves

- Learn about employer obligations, taxable benefits, and group insurance benefit structures in Canada.

- https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/benefits-allowances.html

- Employment and Social Development Canada (ESDC) – Employer Services

- Comprehensive resource for business owners and HR departments managing employee insurance programs.

- https://www.canada.ca/en/employment-social-development.html

- Canadian Life and Health Insurance Association (CLHIA) – Critical Illness Guide

- Details the role of CI insurance in the broader life and health insurance ecosystem in Canada.

- https://www.clhia.ca/web/clhia_lp4w_lnd_webstation.nsf/page/5CBE118B22C4F47C85258AC20057011A

📊 Research & Industry Reports

- Fraser Institute – Canada’s Health Insurance Landscape

- Offers statistics and analysis on public vs. private healthcare financing and the rise of critical illness plans.

- https://www.fraserinstitute.org/studies/the-private-cost-of-public-queuing-2022

- Benefits Canada – Critical Illness Trends in Group Insurance

- Real-world case studies and insights into CI plan uptake among Canadian employers.

- https://www.benefitscanada.com → Search: “Critical Illness Insurance Trends”

- Sun Life Canada – Employee Benefits and Wellness Research

- Tracks awareness and claims trends around critical illness within group benefits platforms.

- https://www.sunlife.ca/en/workplace/

🩺 Health & Advocacy Groups

- Canadian Cancer Society – Financial Help When Diagnosed

- Outlines how critical illness insurance supports Canadians during serious health diagnoses.

- https://cancer.ca/en/living-with-cancer/how-we-can-help/financial-support

- Heart & Stroke Foundation – Coping With Costs

- Highlights the financial burden of serious illness and how insurance mitigates these risks.

- https://www.heartandstroke.ca/ → Search: “financial impact stroke or heart condition”

Feedback Questionnaire:

Help Us Improve – Share Your Experience

Thank you for your valuable feedback. Our expert team may contact you (only if requested) to help tailor the right solution for your financial goals.