- 5 Steps To Ensure Your Life Insurance Application Is Approved

- Step 1: Understand The Basics Of Your Life Insurance Needs

- Step 2: Gather Essential Information And Documents

- Step 3: Answer All Application Questions Truthfully

- Step 4: Review Your Application With An Expert

- Step 5: Follow Up And Update Any Information Promptly

- Concluding Thoughts

Ever feel a twinge of anxiety when thinking about applying for Life Insurance? You’re not alone. Many Canadians find the Life Insurance application process overwhelming, with too many forms and questions. Some worry their application won’t get approved due to health concerns or job risks. This guide will turn that uncertainty into confidence. By sharing real-life scenarios from everyday Canadians at Canadian LIC, one of Canada’s top brokerages, we’ll give you the knowledge and tools to navigate the Life Insurance application process with ease. So, buckle up as we go through the must-dos to ensure your Life Insurance application goes smoothly, and you’ll be engaged with solutions that work in real life!

Step 1: Understand the Basics of Your Life Insurance Needs

Start with Self-Assessment

Be certain of what you want—the initial step towards a successful Life Insurance application. Life Insurance is not a one-size-fits-all product. It would help to consider the areas of your life that need protection, be it family, debts, or your estate. Underestimation or overestimation of their coverage needs is usually found in many clients by Canadian LIC. For example, a client named Maria applied for very high coverage before even assessing her actual needs, which complicated her application process.

Key Action: Begin with the assessment of financial responsibilities and dependents. Needs calculators via Canadian LIC can be very helpful in such a situation. Such a self-assessment will help clearly clarify your insurance needs, but it will also pave the way and make the process for Life Insurance applications easier.

Step 2: Gather Essential Information and Documents

Documentation is Key

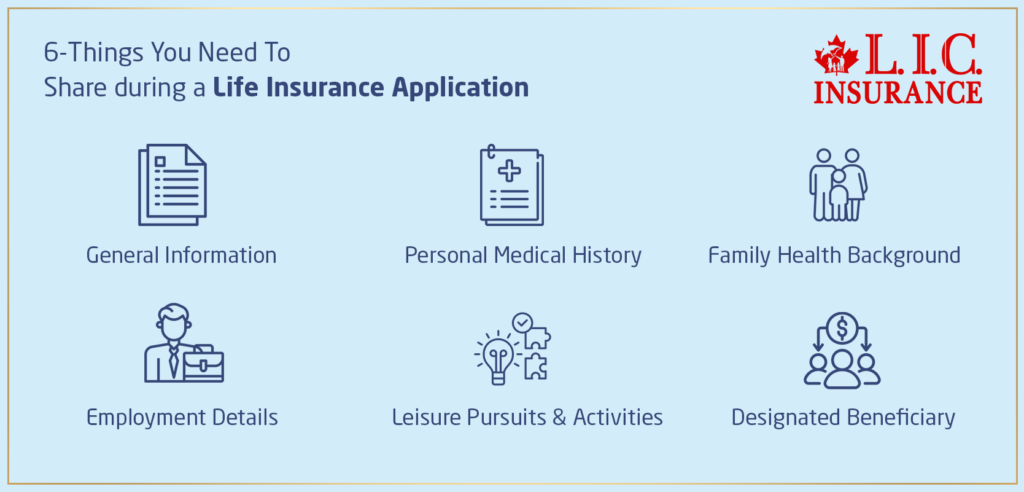

Second, gather all your documents. This is where, in most cases, most of the delay occurs. The Life Insurance application is going to have questions that ask for very specific information regarding your personal, financial, and medical history. Here’s a story that’s all too familiar at Canadian LIC: John has delayed his application because he cannot locate his medical records.

Key Action: Before applying, ensure that your recent medical reports, a list of medications, financial statements, and any other relevant documents are handy. Canadian LIC Advisors recommend keeping a digitized folder for easy access during your application process.

Step 3: Answer All Application Questions Truthfully

Honesty Builds Trust

Truthful answering is essential in any Life Insurance application. For instance, the insurance underwriter requires proper information so that he can evaluate or assess the risk accordingly. In Canadian LIC, for example, common cases were applicants like Sarah who thought minor health issues should not be disclosed, but this only complicated matters later.

Key Action: Be honest about your health history and the lifestyle choices you have made. This openness prevents the possibility of claim denial and ensures accurate coverage for your situation.

Step 4: Review Your Application with an Expert

Expert Guidance is Invaluable

Before you send in that application, let a Life Insurance expert review it. Very often, advisors of Canadian LIC have found that a second pair of eyes will catch an error or an omission. In one example, Tom forgot to include a beneficiary, which could have complicated things for his family later.

Key Action: Let Canadian LIC advisors help you. One of our experts will review your application to significantly enhance the possibilities of approval and ensure that all details are correctly filled out.

Step 5: Follow Up and Update Any Information Promptly

The last step is follow-up after the submission of an application. More often than not, additional information will be required, as in the case of Emily’s application, which got delayed because she was not timely in responding to an order for more information.

Key Action: Be proactive in the event of any responses to inquiries being raised by the life insurer. Being responsive at your end to your Canadian LIC Consultant can make this exercise quicker and result in a quicker application process.

Concluding Thoughts

It isn’t necessary to battle with Life Insurance applications. These five steps will set you on a much smoother journey toward getting approved. Remember, Canadian LIC is here to sell insurance and partner with you to secure your future comprehensively. Don’t let another day pass by in uncertainty—reach out to Canadian LIC, your trusted insurance brokerage, and take that critical step towards peace of mind for you and your loved ones today. Together, we can ensure that your Life Insurance application is not just submitted but approved!

More on Life Insurance

Which Life Insurance Is Most Popular?

Can I Leave My Life Insurance To My Child?

Are There Any Tax Benefits For Life Insurance?

Why Buy Life Insurance For Kids?

Is Life Insurance Worth It After 70?

What Is The Best Age To Buy Life Insurance?

Is Life Insurance A Good Investment In Canada?

10 Best Life Insurance Plans For 2024

What Is The Difference Between Life Insurance And Critical Illness Insurance?

Can I Adjust My Whole Life Insurance Policy?

What Does Term Life Insurance Cover And Not Cover?

What Are The Advantages Of Short-Term Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs)

The most common mistake is incomplete or incorrect information. For example, a Canadian LIC client named Alex underestimated his income, and it further resulted in a variance with recommended coverage; therefore, it had to be reviewed. Always cross-check your data and seek consultation from a Canadian LIC-licensed Life Insurance Agent to fill in all the information correctly and completely.

This may, however, vary significantly depending on the complexity of your situation and how fast you can respond with the documentation required. Another is the underwriting requirements of your insurer. For example, a Canadian LIC client named Priya had a delay because she was travelling and could not promptly answer follow-up questions to her Life Insurance application. Typically, it takes a few weeks to a couple of months. We encourage you to file as early as possible and remain very responsive to avoid delays in the process.

Your Life Insurance application questions will be on all subjects, from your health history to your lifestyle choices like smoking or alcohol consumption, your financial status, and the medical history of your family. Another client of Canadian LIC, Mark, was surprised at the kind of detail required but found that thorough preparation really makes things smoother. Be prepared to be detailed in your responses to make sure you are accurately covered.

Yes, sometimes applications can be declined due to risk assessment variables, such as serious health conditions or high-risk jobs. This was the case with one of Canadian LIC’s clients named, Lisa, who had a history of serious medical conditions. If your application gets declined, do not lose hope. Consulting Canadian LIC advisors will help you clearly understand alternative options involving an application to other insurers or buying various insurance products that may be more suitable to your situation.

Errors must be corrected as soon as possible; the process might complicate things later, more so in the case of a claim. Call your Canadian LIC advisor immediately to help you make the necessary amendments. There’s a classic case of a client called Jeff. He mistakenly provided the wrong date of birth. Quick correction ensured his coverage terms were retained.

Organize all your documents in advance to speed up the procedure, respond to additional information requests, and make sure you’re regularly in touch with your Canadian LIC advisor. This organized approach can help significantly cut down on the processing time, as happened with the case of Nora, who had prepared all her paperwork in advance and immediately responded to follow-up questions.

The right level of coverage will depend upon your financial responsibilities, your lifestyle, and your long-term goals. Talk to one of our Canadian LIC advisors, who will prepare a personal analysis for you. For example, Robert, of Canadian LIC, had the ability to receive an in-depth evaluation that accounted for his debt, his income, and his family’s needs so that he is adequately insured and not overpaying.

Having a pre-existing condition does not exclude one from buying a Life Insurance Policy. The important thing is to declare this when filling out the Life Insurance form. One of our clients at Canadian LIC, Helen, was afraid that because of her condition, she would not be insured. Our consultants at Canadian LIC helped her get the right plan for her. Be honest and provide full details of your medical records to enable insurance companies to make a proper assessment of your application.

Yes, the application process for Life Insurance Coverage normally raises questions related to smoking, alcohol consumption, and extreme sports. All this affects your risk factor and, hence, the premiums to be paid. Canadian LIC had a client, Derek, who didn’t initially disclose his skydiving hobby. Advising honesty, Canadian LIC helped him revise his application, which slightly increased his premium but properly covered his activities.

You should update your insurer for some of life’s important milestones: getting married, having a child, buying a new home, and developing health problems. These changes may impact the required cover. Canadian LIC regularly advises clients through this process. When one of their clients, Emily, got married, she wanted to add her spouse to the policy. It is vital to keep the insurer up-to-date.

Preparing for the Life Insurance medical exam can help ensure your results reflect your health accurately. Twenty-four hours before the test, the client should not use alcohol, cigarettes, and caffeine. It will be good to have some sleep at night before the test. Canadian LIC advised a client, Tom, to follow these guidelines, which helped him secure a favourable assessment. Make sure to follow any additional instructions provided by your insurer.

The financial evaluation usually includes reviewing your income, assets, debts, and overall financial stability. The whole process forms the basis of the correct insurance you should enroll in. Canadian LIC client Sarah found the first financial disclosure daunting but got it cleared by her advisor. Accurate financial information helps to guarantee that you purchase enough coverage.

Bringing down the cost of your Life Insurance premium is quite easy. All you need to do is maintain a healthy lifestyle, get an appropriate policy term, and shop around various insurers for the best rates available. More often than not, Canadian LIC helps people like George get cheap options. He obtained lower premiums by going for a long-term policy with a healthy lifestyle.

It is in regard to these very important concerns that a Life Insurance broker proves most valuable:

Comparing various policies

Answering all those confusing application questions

Taking your case before the insurance companies

Canadian LIC has helped many clients like Lara get through the intricacies of the insurance application process and ensured that they had the best policy they needed. Their professional advice is invaluable to finding a policy that matches your specific circumstances.

These questions and answers arise out of the day-to-day activities at Canadian LIC. The most crucial factor in an application for Life Insurance is to understand what is taking place and participate actively in the process. If you are well-informed and proactive, then you can successfully go through this process for your financial security and peace of mind.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA): A comprehensive guide to understanding Life Insurance in Canada, outlining industry standards and best practices. CLHIA Guide

Insurance Bureau of Canada: Offers detailed information on various types of Life Insurance and tips on choosing the right policy. Useful for anyone new to Life Insurance. Insurance Bureau of Canada

Financial Consumer Agency of Canada (FCAC): Provides advice on financial planning, including how to effectively manage insurance needs, and what to consider before applying for Life Insurance. FCAC Advice

Investopedia – Life Insurance: A reliable source for understanding the basics of Life Insurance, different policy types, and the application process. This resource breaks down complex terms and procedures. Investopedia Life Insurance

These resources provide a mix of practical advice, industry standards, and deeper financial insights to help you navigate the Life Insurance application process effectively.

Key Takeaways

- Assess financial responsibilities to determine your needed coverage level.

- Prepare all necessary documents like medical records and financial statements beforehand.

- Provide accurate and complete information about your health and lifestyle.

- Have your application reviewed by an insurance expert before submission.

- Stay proactive in communication with the insurer after submitting your application.

- Engage with professionals like Canadian LIC for personalized advice and navigation assistance.

Your Feedback Is Very Important To Us

Thank you for participating in our survey. Your feedback is crucial in helping us understand the challenges Canadians face during the Life Insurance application process. Please answer the following questions to the best of your ability:

Please provide any additional comments or experiences you would like to share about your journey through the Life Insurance application process. Thank you for your valuable feedback!

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]