- Does Critical Illness Insurance Cover Heart Failure?

- Heart Failure: A Critical Condition

- Critical Illness Insurance: Does It Cover Heart Failure?

- Figuring Out The Critical Illness Insurance Costs In Canada

- Figuring Out The Critical Illness Insurance Costs In Canada

- Conclusion: Securing Your Future With Critical Illness Insurance

Have you at any one time found yourself or a close relation in a situation where, abruptly, a diagnosis of heart failure is thrown at you? The toll it takes on the emotions is really overwhelming, let alone the financial uncertainties that come up from a severe health issue. Heart failure—it happens when the heart does not pump blood as well as it should—is a diagnosis that could change the lives of many Canadians. The main question that comes up after this is: Does Critical Illness Insurance cover heart failure? That is a question many would be asking when looking through their insurance policies—most importantly, in the security of finances for such critical health issues.

In a nutshell, within this comprehensive blog, we are going to take a look at whether heart failure is covered under Critical Illness Insurance or not, and we will also understand the Critical Illness Insurance Costs in Canada. We will also get to know some real struggles and win stories showcasing what people go through when facing heart disease. Our aim is to provide value-added insight that informs you without boring you. By the end of this blog, you will have a clearer realization of how Critical Illness Insurance can be a saviour during such taxing times.

Heart Failure: A Critical Condition

In Canada, it is estimated that up to 600,000 people are affected by heart failure, which is quite an enormous number. Unfortunately, most of these people are even unaware of the fact that they have heart failure until the time their health complications do not develop very seriously. Common signs include shortness of breath, chronic coughing, swelling, and tiredness. These symptoms can severely limit your daily activities, making ordinary tasks difficult.

Therefore, the implications in the management of heart failure are huge and sometimes so intimidating. It involves constant treatment in order to meet the disease condition, routine medications, and, at times, some changes inside the home setting. These are changes of great importance to those affected by them so that they can maintain a semblance of normal life. However, the price paid is very high. Familiarity with such expenses will certainly come in handy in making financial preparations to meet those expenses and, therefore, will underline the importance of having solid financial backing, just as with Critical Illness Plans.

Critical Illness Insurance: Does It Cover Heart Failure?

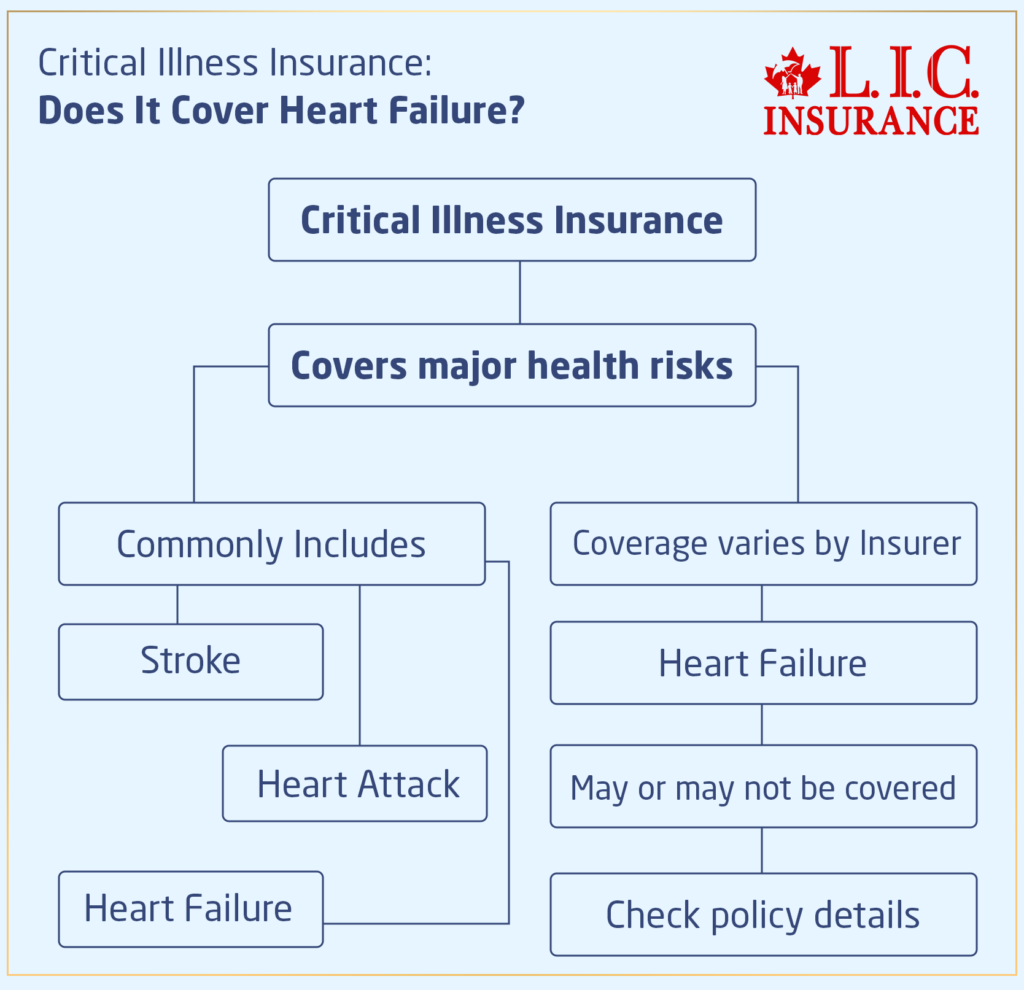

Figuring out how to get Critical Illness Insurance can feel like going through a mess. In general, such insurances are made to assist in relieving the financial pressure of a critical illness diagnosis through the provision of a lump sum payment if the insured person has been diagnosed with one of the listed critical illnesses. Usually, Critical Illness Insurance Policies take care of major health risks like cancer, stroke, and heart attack; however, each insurance company specifies to include or exclude some diseases, and the approach to heart failure can be anything from exclusive to inclusive.

We should look at the fine print in these Critical Illness Insurance Plans. The fact is, if heart failure is going to be covered or not, it will be a stipulation based on the details and specifics of the listings of such conditions in the covered plans. This thus brings an understanding of Critical Illness Insurance Cost in Canada, an exercise therefore that pertains not only to the premiums paid but also an understanding of what is covered and what is not so that it ensures one is not caught unaware when needed most.

John’s Journey with Heart Failure

Take John, one of our clients, a 54-year-old from Toronto who really did have a nasty surprise when he was diagnosed with heart failure. This was a diagnosis of probable financial disaster, not a health shock. With a long road to recovery ahead, the costs threatened to overwhelm his family’s finances.

In his earlier life, John had undertaken the wise thing of securing a Critical Illness Insurance Policy, but he needed to be reassured at first if he found the condition he was in covered under it. He went over the policy very thoroughly with us and was very relieved to find out that the explicit terms of the policy issued for conditions related to the heart actually covered heart failure. This discovery was relevant in the sense that it meant John would receive a lot of money from his insurance, therefore relieving his family from having to pay his medical bills.

This cover turned out to be a financial godsend. It enabled him to deal with the costs of his health care effectively and enabled the family to live without the sword hanging over their heads regarding the erosion of their savings. That is a compelling story because it really drives home the point of how critically important it is to know what is—and especially what is not—covered under a Critical Illness Insurance Policy and to have one in place when the need arises. That signifies that the much-needed Critical Illness Policies, in fact, provide peace of mind and, most of all, financial support at times during some of life’s most challenging moments.

This is a real-life story, a struggle many face and the value of making well-informed insurance choices. All these underline the value of Critical Illness Insurance in providing security and stability when one needs it most. These insights could come in handy while dealing with similar health problems and empower decision-making on Critical Illness Insurance Coverage in Canada.

Figuring Out The Critical Illness Insurance Costs in Canada

There are a lot of things that can change the cost of Critical Illness Insurance in Canada. These include age, health at the time of application, amount of coverage taken, and situations in which it will be paid out in full. That is, a basic policy may have lower premiums but offer coverage on fewer conditions, while a comprehensive policy may be high-priced but offer broad protection.

Calculating the Costs: What to Expect

The dynamics in the cost structure of Critical Illness Insurance Plans hold an understanding that is essential for anyone looking to secure financial stability against the risk of suffering from severe illnesses. Indeed, the cost of Critical Illness Insurance is outstandingly varied because of many personal factors in Canada, such as age, health status, and the level of coverage chosen. This is where we will take a deeper look at what one can expect by considering the coverage scenarios to give an in-depth look at how you, too, can possibly find a plan that meets your needs and your budget.

The Impact of Age on Premiums

One major determinant in the cost of Critical Illness Insurance is age. The youngest people, especially those in their 30s, will most often have the lowest premiums since they are at less risk of getting critically ill. For example, a 30-year-old, healthy person might be allowed to spend as little as $25 every month on Critical Illness Coverage. This affordability, therefore, is associated with a great way to lock in the low rates of comprehensive coverage that provide peace of mind for years.

Emily’s Early Decision

Thirty-two-year-old graphic designer Emily, from Vancouver, looked on as one of her co-workers struggled with the financial aftermath of a sudden diagnosis. She knew it wouldn’t be long before she would need some kind of Critical Illness Insurance herself. Emily’s monthly premium had surprisingly been on the cheaper side, and it was in this hindsight that, out of the blue, the diagnosis of multiple sclerosis came five years later. In a sense, her insurance payout for acting early has allowed covering her treatment without derailing financial goals.

Premium Variations for Older Applicants

The older those above their 50s or those suffering from pre-existing conditions, however, would attract higher premiums. This is a reflection of increased risk and possible immediacy of claiming benefits. The premium might actually be several times higher than the baseline costs for younger applicants—often scaling to several hundred dollars a month, depending on the coverage specifics and an individual’s health.

John’s Late Entry

Take John, who is 55 years old and lives in Montreal. He was thinking of buying Critical Illness Insurance after surviving a minor heart attack. Premiums in insurance are based on experience, and surviving that heart attack came with a price tag on John’s premiums due to pre-existing conditions and age. However, the securing of a policy was still very wise. A few years later, he again suffered a serious stroke, and the Critical Illness Coverage gave him financial support. It is a testament to how expensive it was indeed, and it was an excellent investment toward his security and well-being.

The Role of a Knowledgeable Broker

At times, it can be difficult to find your way through Critical Illness Insurance premiums in Canada; therefore, having a knowledgeable broker is literally invaluable. An insurance broker could help guide a person through the minute details of different Critical Illness Insurances, explain the exclusions and benefits, and show how premiums are calculated. Their value is essential in matching you to a policy that ensures your coverage without overstretching your financial commitments.

How Brokers Facilitate Better Decisions

This is the part where the broker can be most valuable in assisting you to compare policies. He should be able to explain how different conditions are covered and advise on how policy options are likely to affect your premiums. A broker can predict from your personal and family medical history conditions that are pre-disposed and, therefore, recommend a plan that will give comprehensive coverage to conditions likely to affect your health.

Making an Informed Choice

Whether these are John’s or Emily’s stories, this goes to show that an informed decision on when and how much to invest in Critical Illness Insurance will very easily significantly affect your financial health and stress levels during a medical crisis. Being young and just starting a career, or even considering some specific health conditions in your older age, one may want to look upon the benefits of such a Critical Illness Insurance Plan.

Do not leave your financial security to chance. Speaking with a broker or a financial adviser can provide a personal way to find the right Critical Illness Insurance in Canada. Such professionals will guide you through the maze of insurance options to make sure that you choose a particular plan that is very pocket-friendly and, at the same time, gives ample security in the future. What’s the point of getting Critical Illness Insurance if it cannot help to be ready for the worst case scenario and make sure that it is handled?

Comprehensive Coverage: The Canadian LIC Advantage

The choice of an insurance provider is as important as the coverage in itself. Canadian LIC comes out as one of the leading brokerages in the provision of tailor-made Critical Illness Insurance that meets the diversified needs of Canadians. Through Canadian LIC, you will be in a position to compare different plans to ensure that you get the cover that would best befit you as per your health and financial situation.

The Canadian LIC Process

Canadian LIC makes this process both transparent and easily understandable for the customers. You can start by discussing your health history and coverage needs with a licensed, experienced broker who can walk you through different scenarios and options. And all this approach, of course, also allows making a decision that suits your life goals and financial plans.

Conclusion: Securing Your Future with Critical Illness Insurance

As mentioned above, in all the details about heart failure and coverage of the same under Critical Illness Insurance, one is very clear: getting the right insurance coverage is very important. While heart failure sometimes tends to be emotionally challenging, it should never leave your finances or ability to care for your loved one at risk. We bring you real-life insights and stories that can help you feel more equipped to buy Critical Illness Insurance.

But now the time to act has come; you don’t have to wait around for some health diagnosis to start thinking about your insurance needs. Contact Canadian LIC today and let our expert team help you put together the perfect plan for your needs. Protecting yourself and your family from the financial impact of serious illnesses is not just a choice—it’s a necessity. We shall help care for you tomorrow and give you peace of mind.

Find Out: Does Critical Illness Insurance cover death?

Find Out: Can you have two Critical Illness Insurance Policies?

Find Out: Can you take out Critical Illness Insurance without Life Insurance?

Find Out: What age can you get Critical Illness Insurance?

Find Out: The difference between Critical Illness Insurance and Disability Insurance

Find Out: The difference between Life Insurance and Critical Illness Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Critical Illness Insurance Plans and Costs in Canada

Critical Illness Insurance is an in-depth, complex world. Here, we have put together some of the most common questions to help you become an expert in this type of insurance knowledge.

In general, the Critical Health Insurance Policy gives out a lump sum payment in the event that a person is diagnosed with an illness listed in the policy. Typically, these will include such serious illnesses as cancer, heart attack, and stroke, together with many other conditions such as multiple sclerosis and kidney failure. Financial support can be offered to cover medical bills, lost income, or anything else that may be a necessity when one is recovering.

There is the case of Maria from Calgary, who was diagnosed with breast cancer. While battling the disease, she was not in a position to go to work; therefore, the treatment expenses were catered for her from her critical illness plan, and the family did not need to alter their way of living. This financial relief allowed Maria to focus fully on her recovery without the added stress of financial strain.

Critical Illness Policies in Canada are subjected to a number of factors that are likely to impact the associated costs. These factors include the age that you are in, the state of health that you are in, the amount of coverage you will select, and the number of conditions that you wish to be covered under. Young and healthy people have the lowest premiums; however, the older generation and those with pre-existing medical conditions will fall victim to more expensive rates.

29-year-old Alex, a healthy Toronto resident, was paying $30 per month for a critical health insurance policy with comprehensive coverage, including diseases of a rare kind. His 62-year-old father, judging by his age and former health conditions noted before, currently pays an amount of $150 every month for the same.

Not all comprehensive plans for Critical Illness Insurance automatically include heart failure. In fact, the coverage of such kind is very dependent on the plan and, of course, the provider. The key in this case is that you really look at the list of conditions covered when you buy a Critical Illness Insurance Plan.

Due to a family history of heart failure, Sarah from Ottawa was truly researching heart failure when she was looking for insurance. When she was 47 and was told she had heart failure, this kind of thoughtful planning ahead of time made sure she had the coverage.

The coverage required would depend on your own personal situation, the financial obligations you have, and the kind of lifestyle you live. It might be a good idea to make a list of all the regular bills, possible hospital bills, and other money needs that will come up if someone gets really sick.

Raj from Vancouver calculated and reckoned that he needed a $200,000 policy to cover the mortgage payments, provide for the children’s education, and any possible medical treatments not covered by his health plan. That level would assure him that his family’s financial needs would always be well catered for, even when he might have been incapacitated from work for a long period.

Critical Illness Cover usually pays a lump sum shortly after the diagnosis of a covered critical illness, on fulfillment of policy criteria. Timings can vary by insurer, but usually, the payment is 30-90 days after diagnosis and submission of the necessary documentation.

Tom, a resident of Quebec, was diagnosed with a critical cancer coverage type; he submitted the claim documents at one go, and the Critical Illness Policy was duly paid within 30 days. This amount helped him in two ways: to pay the immediate costs of treatment and the household bills pertaining to the treatment.

Age restrictions are normally included in the purchase of a Critical Illness Insurance Plan. Insurers usually set a minimum entry age of around 18 years, and at times, a maximum age can be around 65 years. It is a good practice to confirm the set age limits with the insurer you are considering.

Anita from Halifax was looking to get Critical Illness Insurance at the age of 67. She found a lot of plans to not cater to new applicants at her age. With the help of a broker, however, she could locate an enhanced plan that would be receptive to applicants up to the age of 70—but only at much higher premium costs.

Most people will merge their Critical Illness Insurance with other kinds of insurance to create a comprehensive protection plan, such as Life Insurance Policy or Disability Insurance. Combining policies can sometimes save some costs, while in other cases, it can enhance coverage options.

David from Toronto took up Critical Illness Insurance and bunched it with life insurance. He simplified his payments not only for premiums but also availed himself of possible discounts on them, which made it even more cost-effective for broader coverage.

The claiming process normally includes submitting a duly filled claim form, a diagnosis report from duly certified medical practitioners, and possibly further medical records. So, the insurance company will look over these papers to see if they meet the requirements for a diagnosis that is covered by the policy.

Lisa, who lives in Winnipeg, submitted her claim with all the medical documentation required after she learned about her illness—coronary artery disease. The insurer fairly processed her case and paid a benefit to her. That benefit allowed her to pay for her recovery and rehabilitation.

Choosing the right plan has to understand one’s nature of health risks, current financial position, and Critical Illness Insurance Costs in Canada. You would need to compare quite a few plans to the depth of the diseases covered by insurance while taking into account the cost of the policy against the relative benefits it would provide.

Suresh from Vancouver had some time to compare different variants of Critical Illness Insurance. He concentrated on the plans that covered the diseases from his family history and checked each one for cost-benefit balance. He was able to choose a plan with great coverage, and it was also very friendly to the pocket through the help of an intermediary, thus assuring him and his family peace of mind.

These FAQs are meant to increase your understanding of Critical Illness Insurance Plans, including the cost one may incur while buying a Critical Illness Insurance Plan in Canada. Real-life insights and stories have been used to give advice that will practically guide your decision-making. Investigate further into the details of all these aspects so that you can make an informed choice of the plan that will offer you the best protection in terms of financial future against the uncertainties of critical illnesses.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA Homepage

Description: The CLHIA provides comprehensive information on life and health insurance products including Critical Illness Insurance. Their resources include guides on choosing the right insurance products and understanding insurance terms.

Insurance Bureau of Canada

Website: Insurance Bureau of Canada

Description: This bureau offers detailed insights into various types of insurance available in Canada, including Critical Illness Insurance. They also provide tips on how to file insurance claims and what consumers should know before purchasing insurance.

Heart and Stroke Foundation of Canada

Website: Heart and Stroke Foundation

Description: This foundation’s site offers valuable information on heart conditions and strokes, the very ailments often covered under Critical Illness Plans. Understanding these conditions can help you assess the relevance of certain coverage options in Critical Illness Insurance.

Canadian Cancer Society

Website: Canadian Cancer Society

Description: As cancer is a major illness covered under many Critical Illness Insurance Plans, the Canadian Cancer Society provides extensive information on cancer types, treatments, and survivor support, which can be crucial for understanding insurance needs related to cancer.

“The Advisor’s Guide to Life Insurance” by Harold D. Skipper & Wayne Tonning

Description: This book offers an in-depth look at life insurance and related products like Critical Illness Insurance, providing advisors and consumers with detailed analyses of how these products work and the benefits they offer.

Financial Consumer Agency of Canada

Website: FCAC – Insurance

Description: The FCAC provides objective advice on financial products including insurance, aiming to improve overall financial literacy among Canadians. Their resources on Critical Illness Insurance can help you understand your rights and responsibilities under such plans.

“Understanding Health Insurance” by Krysia Mossakowski

Description: This book provides a broad overview of health insurance mechanisms, including Critical Illness Insurance, and discusses the economic and social factors influencing insurance policies.

Articles and Blogs by Industry Experts

Description: Various financial blogs and insurance industry websites regularly publish articles that analyze trends in insurance, discuss new products, and provide consumer advice. These can be a great source of up-to-date information and practical tips.

By exploring these resources, you can gain a more thorough comprehension of Critical Illness Insurance, its importance, and strategic considerations when choosing a plan that best fits your needs and those of your family. Whether you are looking to deepen your knowledge or are in the process of selecting a policy, these sources can provide valuable guidance and support.

Key Takeaways

- Not all Critical Illness Insurance Plans cover heart failure; check policy details for specific illness coverage.

- Premium costs vary significantly with age and health, with younger, healthier individuals paying less.

- Using an insurance broker can simplify navigating complex coverage options and help balance costs with needs.

- Stories from individuals like Emily and John demonstrate the financial benefits and peace of mind provided by Critical Illness Insurance.

- Combining Critical Illness Insurance with other insurance types can enhance coverage and potentially reduce costs.

- The claims process involves timely submission of accurate medical documentation to ensure efficient payout processing.

- Assess financial obligations and potential medical costs to determine necessary coverage amount.

- Shopping around for Critical Illness Insurance Plans ensures optimal coverage at competitive prices.

- Being proactive with insurance coverage can protect against financial strain from unexpected health issues.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com