We understand that paying for a whole year of Super Visa Insurance upfront can be tough. Luckily, the Canadian government now accepts super visa applications with monthly payment plans as proof of insurance. This means you can apply for a super visa without having to pay for a whole year of insurance all at once! So here in this blog, we will try to clarify this common question that many of you have: ‘Can I pay monthly for Super Visa Insurance in Canada?’ Don’t worry. Today, this doubt will be cleared forever. Let’s explore this question and understand your options.

Getting to know Super Visa Insurance

The Super Visa is an excellent opportunity for parents and grandparents to spend quality time with their families in Canada. One of the key requirements to be eligible is obtaining Super Visa Insurance. This insurance is designed to cover healthcare expenses during your stay and should meet specific criteria outlined by the Canadian government.

Super Visa Insurance Quote

Before we go into understanding the monthly payment aspect, let’s discuss the first step – getting a Super Visa insurance quote. Many insurance providers in Canada offer Super Visa Insurance plans. Obtaining quotes from different companies is crucial to compare coverage and costs. You just have to search online for “Super Visa Insurance quote simply,” and you’ll find several options to consider.

Canadian Super Visa Insurance Monthly Payments

Now, here comes the big question: Can you pay monthly for Super Visa Insurance in Canada? The answer depends on the insurance provider. While some companies may offer monthly payment plans, others may require an upfront annual payment. It’s imperative to carefully review the terms and conditions of each insurance plan to understand the payment options available.

If you want to know the right time to start Super Visa Insurance click here.

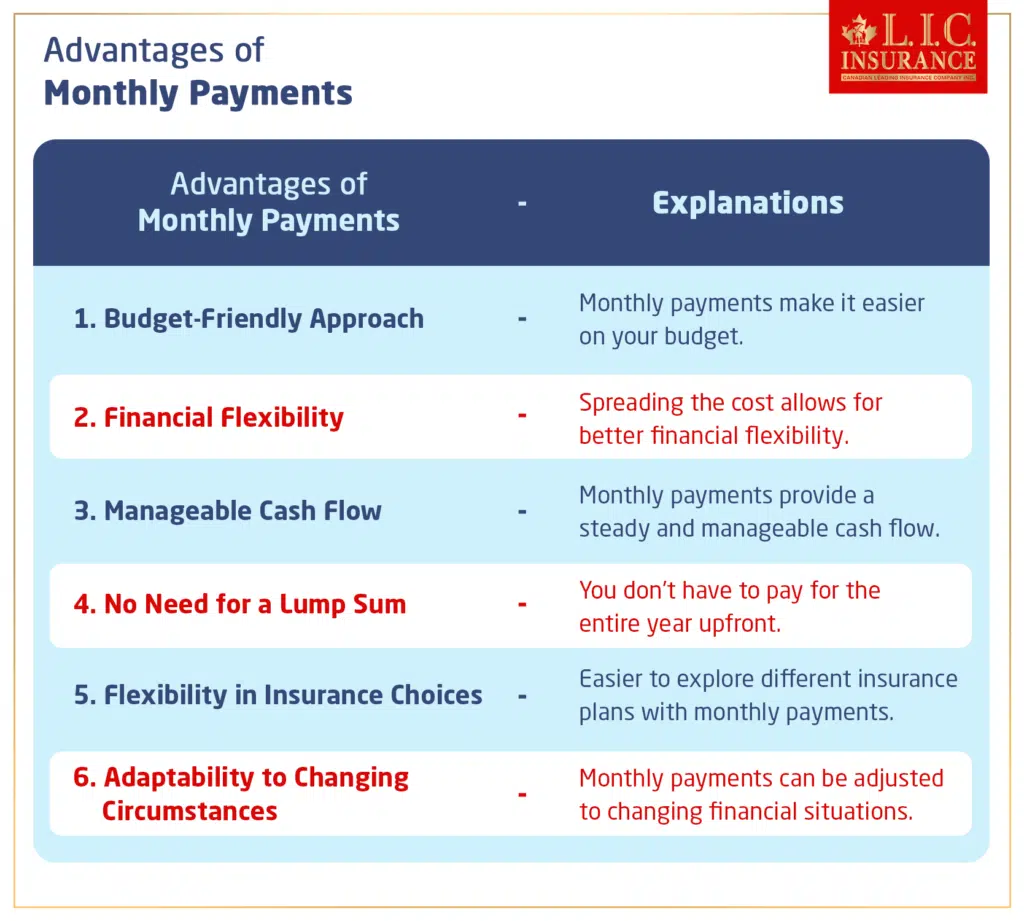

Advantages of Monthly Payments

When it comes to securing insurance for your Canadian Super Visa, the payment aspect is essential to keep in mind. While some insurance providers require an upfront lump sum payment for the entire coverage period, others offer the flexibility of monthly payments. Let’s find out the advantages of opting for monthly payments and how it can be a practical choice for your budget.

Budget-Friendly Approach:

Opting for monthly payments means you don’t have to break the bank with a large, one-time payment. This budget-friendly approach allows you to allocate a portion of your budget each month, making it easier to manage your finances. This can be especially beneficial if you have other expenses associated with your trip, such as travel costs and accommodations.

Financial Flexibility:

Life is full of unexpected twists and turns, and financial situations can change. Monthly payments provide financial flexibility, allowing you to adapt to changes in your circumstances without being burdened by a huge one-time cost. This flexibility makes it possible to maintain your insurance coverage without compromising on other essential parts of your trip.

Easier Planning:

Monthly payments make it easier to plan for your Super Visa journey. Instead of setting aside a significant amount at once, you can plan your monthly expenses more effectively. This predictability in payments helps you stay organized and ensures that you are consistently covered throughout your stay in Canada.

Emergency Fund Preservation:

Life’s uncertainties may require you to dip into your emergency fund at times. Opting for monthly payments allows you to preserve your emergency fund while still maintaining essential coverage. It’s a prudent financial strategy, ensuring that you have protection in case of unforeseen circumstances.

Stress Reduction:

Dealing with the financial aspects of a Super Visa application can be stressful. Monthly payments alleviate some of this stress by breaking down the cost into manageable portions. This can make a contribution to a smoother planning process and a more relaxed state of mind as you prepare for your time in Canada.

Opportunity for Regular Review:

Monthly payments provide an opportunity for regular review of your insurance coverage. You can reassess your needs and make adjustments as necessary. This flexibility ensures that your insurance plan remains as per your requirements throughout the duration of your Super Visa.

So, the advantages of opting for monthly payments for your Canadian Super Visa Insurance are evident; hence, as you go through the process of obtaining Super Visa Insurance, consider exploring insurance providers that offer this convenient payment option. Remember to gather Super Visa Insurance quotes from various providers, inquire about monthly payment options, and choose a plan that aligns with both your needs and your budget. By doing so, you’ll be well-prepared to make the most of your time with family in Canada.

How to Find Monthly Payment Options

Let’s talk about how to get through the process and find the best way to pay for your Canadian Super Visa Insurance every month.

Online Research: The first and most accessible step is conducting online research. Start by searching for “Super Visa Insurance quote” and explore the websites of different insurance providers. Some companies may clearly display their payment options, including monthly plans, on their websites. Look for sections related to payment details or frequently asked questions (FAQs) where you might find relevant information. As you browse through the websites, take note of the keywords “Super Visa Insurance quote” and “Canadian Super Visa Insurance” – these are crucial phrases that can help you pinpoint the information you’re looking for and refine your search.

Advertised Monthly Payment Options: Some insurance providers actively promote their monthly payment options. Look for banners, callouts, or specific sections dedicated to payment plans. These might include details about the monthly premium amounts, payment schedules, and any additional information you need to know. In addition, keep an eye out for any promotions or discounts that may be available when you choose to pay on a monthly basis. Insurance companies occasionally offer incentives to encourage this payment method.

Direct Inquiry: If you need clear information on monthly payments during your online exploration, feel free to reach out directly to the insurance providers. Contacting them via phone or email allows you to get accurate and personalized information. Ask about the possibility of paying monthly for Super Visa Insurance and request a breakdown of the associated costs.

Additional Fees and Interest: When inquiring about monthly payment options, be diligent in understanding any additional fees or interest that may be associated with this payment method. Some insurance providers may charge a nominal processing fee for monthly payments, or there might be a slight interest rate applied. Clarify these details to avoid any surprises in the future. It’s important to make a well-aware decision by comparing not only the monthly premium but also the overall cost of the insurance when choosing a monthly payment plan.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Choosing the Right Super Visa Insurance Plan

Do you want the perfect Super Visa Insurance plan? Here’s a concise guide breaking down the essential factors to consider. These simple steps will easily make it possible for you to decide on a worry-free stay in Canada.

Assess Your Needs: Before diving into the world of Super Visa Insurance plans, take a moment to assess your healthcare needs. Keep in mind factors such as pre-existing conditions, potential medical emergencies, and any specific coverage requirements. Staying well aware of your needs is the first step towards finding a suitable insurance plan.

Coverage for Medical Emergencies: The primary purpose of Super Visa Insurance is to ensure you’re covered in case of medical emergencies. Look for a plan that provides comprehensive coverage for unexpected health issues. This should include coverage for doctor visits, diagnostic tests, and emergency medical transportation if needed.

Hospital Stays: Hospital stays can be a significant expense, so make sure your chosen insurance plan covers these costs properly. Check the maximum coverage limit for hospital stays, ensuring it aligns with potential expenses in Canada. A good plan should cover a good portion of hospital bills.

Essential Healthcare Services: Beyond emergencies, consider essential healthcare services that you may require during your stay. This could include prescription medications, specialist consultations, and preventive care. Get a plan that offers coverage for these services to ensure complete healthcare support.

Balance Cost and Benefits: While budget considerations are essential, it’s equally crucial to balance the medical expenses of the insurance plan with its benefits. Cheaper plans may offer less coverage, potentially leaving you financially vulnerable in case of a significant medical event. Aim for a balance that provides adequate coverage without straining your budget.

Compare Multiple Plans: It is not at all a good idea to settle for the first Super Visa Insurance plan that you see. Take the time to compare multiple plans from different providers. Look at the coverage details, policy limits, and any additional perks or benefits offered. This comparison will help you make a better decision.

Read Reviews and Testimonials: Real-life experiences can give very meaningful insights into the effectiveness of an insurance plan. Read reviews and testimonials from individuals who have used the same insurance coverage. This can give you a better understanding of how well the plan performs in real-world situations.

Concluding Thoughts

Thus, to conclude, paying monthly for Super Visa Insurance in Canada is a possibility, but it depends on the insurance provider. Obtain Super Visa Insurance quotes from different companies, inquire about monthly payment options, and carefully review the terms and coverage of each plan before you purchase Super Visa Insurance. By doing so, you will have the right insurance coverage to make the best utilization of your quality time with loved ones in Canada.

Faq's

Monthly payment options may be available depending on the insurance provider. It’s essential to inquire about payment plans and any associated fees.

Super Visa Insurance covers medical emergencies, hospital stays, and essential healthcare services. Coverage varies, so it’s crucial to review the details of each plan.

Simply search online for “Super Visa Insurance quote,” and you’ll find various providers offering quotes. Compare these quotes to choose the plan that best suits your needs and budget.

Refund policies vary among insurance providers. While some may offer partial refunds under specific circumstances, others may have non-refundable policies. It’s crucial to inquire about the refund policy before purchasing Super Visa Insurance.

Yes, Super Visa Medical Insurance can often be cancelled, but cancellation policies differ among providers. Some may allow cancellation with a refund within a certain period, while others may have specific terms and conditions. Get in touch with your insurance provider for details on their cancellation process.

To obtain medical insurance for Super Visa, you can begin by researching and obtaining quotes from various insurance providers. Many companies offer online quotes, and you can contact them directly to finalize the purchase. Ensure the selected plan meets the requirements outlined by the Canadian government.

Super Visa Medical Insurance can be purchased from various insurance providers in Canada. You can buy it directly from insurance companies online or through insurance brokers. Make sure to choose a reputable provider and thoroughly review the coverage options before making a purchase.

Super Visa Insurance costs vary based on factors such as age, coverage limits, and pre-existing conditions. You can obtain quotes from different providers by searching online for “Super Visa Insurance quote” to compare prices and find out a plan that suits your budget.

Refund policies for Super Visa Medical Insurance depend on the insurance provider. Some may offer partial refunds under specific circumstances, while others may have non-refundable policies. It’s crucial to inquire about the refund policy before purchasing Super Visa Insurance.

The insurance requirements for a Super Visa include coverage for at least $100,000, valid for a minimum of one year, and issued by a Canadian insurance company. The coverage should include healthcare, hospitalization, and repatriation. Verify with your chosen insurance provider that the plan meets these specific criteria.

Consider your healthcare needs, coverage for medical emergencies, hospital stays, essential healthcare services, and the balance between medical expenses and benefits. Comparing multiple plans and reading reviews can also guide your decision.

Coverage for pre-existing conditions may different among insurance providers. It’s crucial to review the policy details and inquire about specific coverage for pre-existing conditions.

Generally, changes to insurance coverage may be possible, but it’s advisable to check with your insurance provider. Some modifications may require approval, and there could be associated terms and conditions.

Certain plans may also have additional benefits such as coverage for prescription medications, specialist consultations, or preventive care. Reviewing the details of each plan will help you identify any extra perks.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]