Have you ever seen a medical drama, either in reality or on TV, where a sudden severe illness changes someone’s life dramatically? This happens more often than many realize. Let’s know about John, a devoted father and the main breadwinner for his family, who recently suffered a major heart attack. He’s thankful to be alive but now faces huge medical bills, ongoing healthcare costs, and the harsh reality that he can’t work as he used to before. John’s situation is not rare; it highlights why many seek financial protection. This brings up the main question: Does Critical Illness Insurance cover death? This blog will explore the complexities of Critical Illness Insurance, especially addressing a common misconception about its relation to death coverage. By explaining the real benefits and limits of Critical Illness Insurance, you’ll understand why getting quotes for this insurance is one of the smartest financial decisions you can make.

Exploring What's Critical Illness Insurance?

Critical Illness Insurance Coverage provides a tremendous relief against financial pressure from certain serious Illnesses. This kind of insurance pays out a lump sum once you are diagnosed with the Illness included under the policy, making it very different from Life Insurance. Now, check out Maria’s case: she is a graphic designer with two kids; she thought of herself as a well-insured person. After her cancer diagnosis, Maria was just glad because her health insurance pretty much shouldered most of her hospital and treatment expenses. She had not anticipated other types of financial difficulties, such as lost income from being forced to take time off work, the need for special care, and the purchase of costly ongoing medications. On such a point, her Critical Illness Insurance provided her with a financial cushion that her health insurance had not given.

Find Out: More in detail on Critical Illness Insurance Coverage

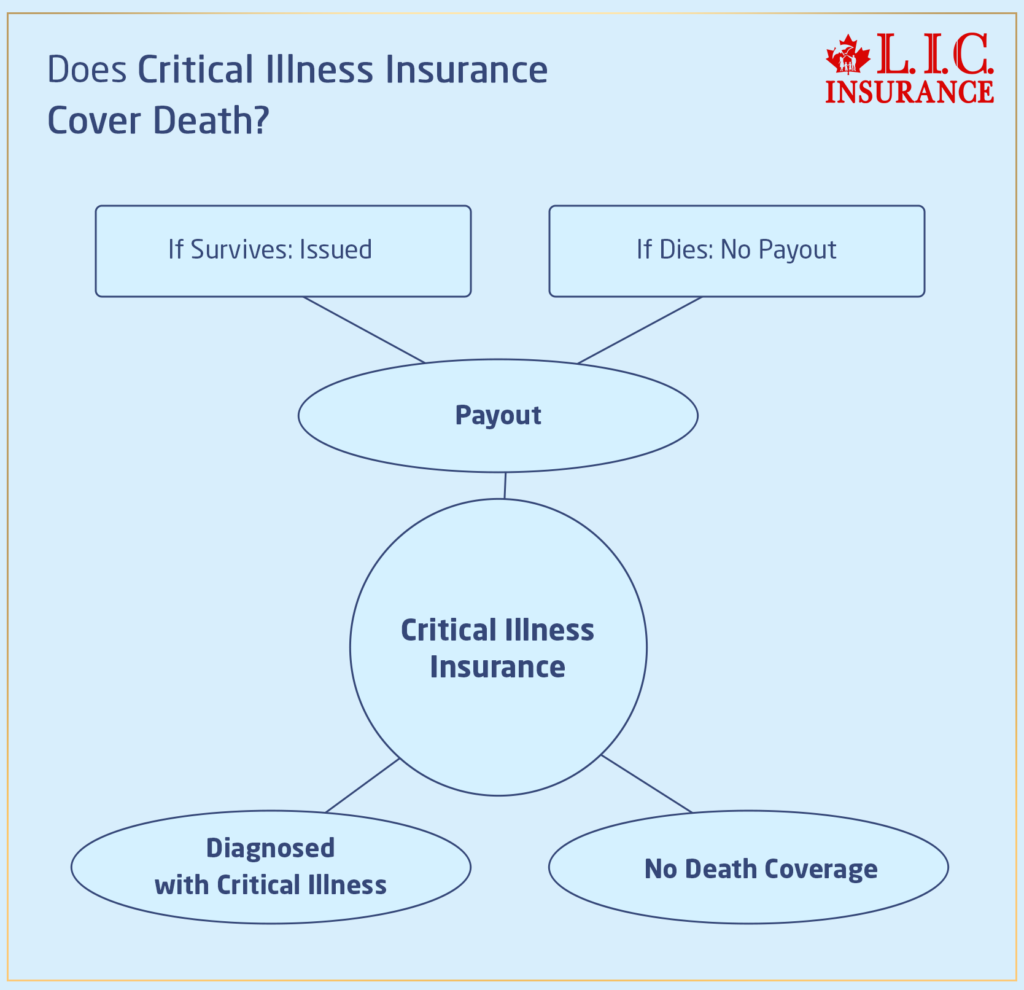

Does Critical Illness Insurance Cover Death?

A very frequent question is whether death is covered by Critical Illness Insurance. The answer is no. Critical Illness Insurance provides a financial safety net if one gets diagnosed with any of the listed critical Illnesses and survives beyond the stipulated period of survival of the policy, which is normally set at about 30 days post the critical Illness diagnosis. This unique feature means that the policy does not pay out if the policyholder dies within this timeframe.

Understanding the Survival Clause

Considering you were doing some shopping around for the best Critical Illness Insurance Quotes, what should you be looking at in the fine print? One of the clauses to keep an eye on is the survival clause. This clause provides that if an insured dies, in fact, from any covered disease during the survival period, then the benefits are not payable to his named beneficiaries. This is very important information, and it can mean a significant change in how you plan for your family finances. Why would this clause exist? Basically, this is to ensure that the insurance cover pays attention to assisting in recovery and controlling the costs related to illness for the survivors, as was intended by the policy.

Real-Life Impact: Lisa and Tom’s Story

Take Lisa. Her story vividly illustrates the stark realities that can come with Critical Illness Policies. Lisa’s husband, Tom, had taken out Critical Illness Insurance Coverage to protect against financial strain following severe health diagnoses like the stroke his friend had endured. Within two weeks of being diagnosed with a heart condition, Tom suddenly died. Thus, Lisa was left by herself in the middle of a very hard financial situation. She had counted on the amount she would get from the Critical Illness Insurance to pay for the funeral costs and other immediate expenses. However, since Tom’s passing occurred within the critical 30-day period, the policy did not provide any payout.

This situation again underscores a painful truth: Critical Illness Insurance really is not and never was a viable alternative to Life Insurance. Instead, this is a specialized product designed to offer financial relief to a person in the treatment and recovery stages of specific Illnesses, provided he does survive the initial critical period post-diagnosis.

The Importance of Comprehensive Planning

As you go through Critical Illness Insurance Quotes, this is what you must have in mind: how will this insurance fit in with your other coverage and your overall safety net? It could have saved a person like Lisa some money troubles after the tragic death of her husband if she had the information on how she could add Critical Illness Cover to her Life Insurance.

Advice for Potential Policyholders

But if you are considering the options, here is the best advice of all for protecting your family’s financial future: Pay very close attention to the fine print. What sort of illnesses could be covered? What would be the survival period? What if the policyholder dies after being diagnosed with the medical condition? Interact with an insurance advisor who demystifies these points and helps in coming up with a policy that is well-cut to fit your health risk and financial needs.

Engaging with Experts for Tailored Coverage

Whether you simply need a bit of help in the right direction or truly feel lost in regards to which Critical Illness Insurance Policy would be best for you, looking towards professionals in Critical Illness Insurance and offering individualized Critical Illness Insurance Quotes is absolutely invaluable. A professional financial adviser will be able to guide you through the different things associated with the policy, which will help you understand how different clauses, like the survival period, can actually provide you with a better understanding of the benefit to you.

Not serving the purpose of payment of death, Critical Illness Insurance becomes a very important part of the financial planning for the diagnosed person with that particular severe Illness. The lump-sum payments are given after the post-survival period to cater for such continuous medical costs and support daily living expenses that contribute to financial burden reduction during recovery phases. All those who take the correct, wise steps to protect their health and financial security need to know the possibilities and choose Critical Illness Coverage. Remember that each policy is your commitment to future security and must be chosen with care and consideration. Make sure your insurance strategy covers all bases, ensuring peace of mind for you and your loved ones.

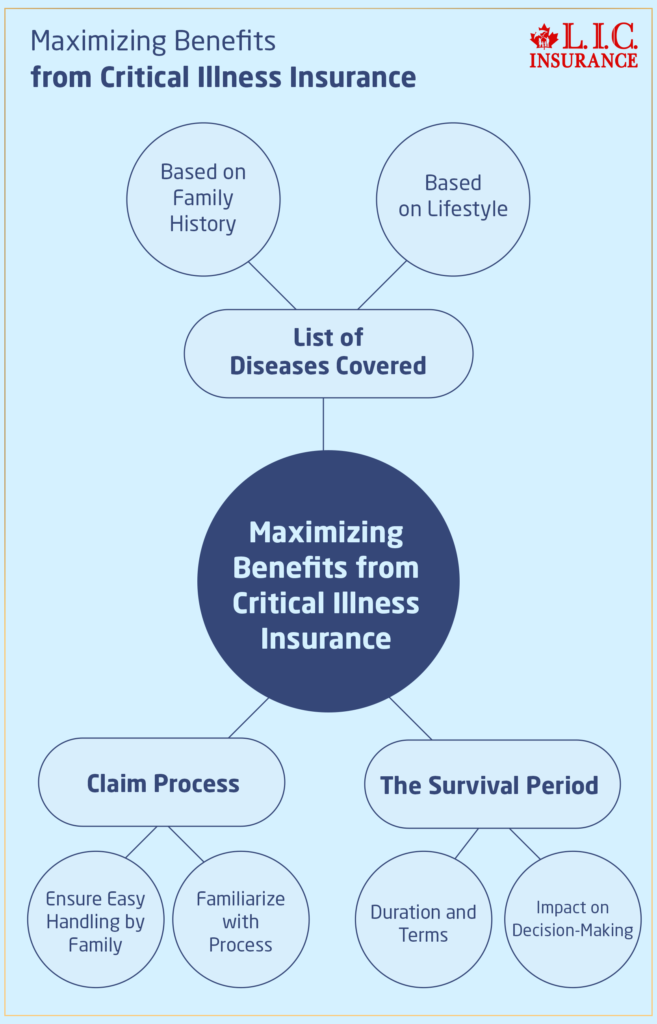

Maximizing Benefits from Critical Illness Insurance

Understanding the terms and conditions of your policy is crucial. Here’s what you typically need to look into:

- List of diseases covered: Ensure that the diseases listed are only those where there is a high probability of exposure and risk based on family history and lifestyle.

- The Survival Period: It becomes very vital. The knowledge of just how long the survival period is and exactly what it entails can make a whole lot of difference in your decision-making.

Claim Process: You should familiarize yourself with the claim process in such a manner that, in future, when it comes to seeking benefits, you or your family can easily handle it without wasting time.

The Bottom Line: Act Today for Your Mental Peace

Insurance is generally a field that hasn’t been explored much. Still, knowing the unique benefits of Critical Illness Insurance could be like having a life jacket on hand in case of an unexpected health disaster. Canadian LIC is not just a leading brokerage in the market when it comes to insurance; rather, it is a brokerage that knows the real impact of these crises on the lives of people. Partnering with Canadian LIC means you have to ensure that when life throws in a curveball, you are ready not to catch it but throw it right back.

Do not allow another day to just run out without you securing your financial future. Contact Canadian LIC today for your Critical Illness Insurance quote for a secure tomorrow. Remember, in the game of life, it’s not just about surviving; it’s about thriving. Secure your safety net now!

Find Out: Can you have two Critical Illness Policies?

Find Out: Can you take out Critical Illness Cover without Life Insurance?

Find Out: The right age to get Critical Illness Insurance Plan

Find Out: How Critical Illness Insurance can be your lifesaver?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

Critical Illness Covers financial help if you are diagnosed with a severe Illness as identified in the policy.

Consider Michael, a web developer who has recently been diagnosed with cancer. The payout from his Critical Illness Insurance helped support him in meeting his immediate medical costs and coping with lost income during treatment. It has to be noted that this insurance does not cover all medical conditions but rather works out some severe illnesses, e.g., cancer, heart attacks, or strokes.

Getting Critical Illness Insurance Quotes is much easier than you may think. Get in touch with your insurance companies or compare policies on the internet to get Critical Illness Cover.

Take Julia, for instance. She compared the options online and called up insurance agents later to get the finer details of it. By comparing quotes, she ensured she received the best coverage for her needs at a price that fit her budget.

Most Critical Illness Insurance plans do have a waiting period. This is the time between when your coverage starts and when you can make a claim.

In Ahmed’s case, he got a diagnosis of a covered illness three months after buying the insurance. As a matter of fact, he had to wait for the stipulated period of 90 days to file a claim.

Your Critical Illness Cover work subject to conditions required by the insurer upon renewal.

Sarah was coming up with the expiration date of her policy, so she got in touch with the insurer to get information on the options regarding the renewal. They assessed her state of health and increased age, then offered her renewal, which bears a higher premium since she is at higher risk.

Survival period under Critical Illness Insurance is a period within which you have to survive after a critical disease diagnosis has been declared for the insurance company to pay out a claim. It is important in that it reflects the time the illness commences in relation to when you start benefiting from financial assistance.

For instance, in the case of Paul being diagnosed with a critical illness, he would have to survive 30 days before actually getting his claim from the insurer settled.

Yes, conditions and diseases—usual exclusions in Critical Illness Insurance include chronic diseases like diabetes and diseases caused by drug or alcohol abuse.

When Linda was reviewing her policy, she noted these exclusions and realized that it was crucial to understand what her insurance would fully and would not cover.

Critical Illness Insurance and health insurance have quite different functions. Health insurance covers almost all types of health care expenses incurred from treatments taken and is usually of a reimbursement nature. On the other hand, Critical Illness Insurance provides a lump sum benefit payable after diagnoses of the insured critical illness, which can be used for any purpose.

This is a big difference to Tom. He used his critical illness payout in order to have the means to pay for things like his living expenses while not being able to work. This was something that his health insurance policy would not provide.

However, if you compare Critical Illness Insurance Quotes, you should pay a closer look not only at the price but also at the depth of coverage provided and the terms of the policy.

Take, for example, Robert, who brought quotes from several insurers and compared them. He has a note of critical illnesses they cover, the amount the premium would be, and the sum assured. He also noted the specific clauses like the survival period and what’s excluded. This method allowed him to make an informed decision based on his personal health risks and financial situation.

In the event of diagnosis, your insurer is going to look at the timing of a diagnosis with critical illness shortly after the policy has been bought.

For example, Emily bought her policy in January and was diagnosed with one of the covered illnesses in March. Since she was diagnosed beyond the expiry of the first waiting period as per policy, she qualified for the payout, assuming all other terms are met. Understand this waiting period clause very well when you receive your Critical Illness Insurance Quotes.

Sometimes, Critical Illness Insurance is packaged under the coverage of other forms of insurance in a more all-inclusive safety package, like that of Alex, who had both a Life Insurance policy and an add-on critical illness. This is something that gave him satisfaction in the sense that if at all he is to suffer from any fatal illness or even face death, he is assured of financial support. Probably, even premium discounts may also apply by combining policies.

The Critical Illness Policy usually increases its premiums every year depending on the policyholder’s age and, more critically, at various stages in the occurrence of pre-existing health ailments.

When Nora at age 45 shopped for Critical Illness Insurance, she got some ridiculous quotes—much higher than, say, what she would pay for the same policy had she bought it at age 35. Insurers see older applicants as higher risks. Always consider your age and health when obtaining Critical Illness Insurance Quotes.

In fact, most jurisdictions allow the premiums paid on Critical Illness Insurance to be entitled to receive some tax benefits.

For example, Jack was able to deduct premiums that he had paid in relation to his Critical Illness Insurance from his reportable income, equivalent to annual tax savings. It may be noted that tax benefits offered in some countries may differ, and advice from a tax advisor on the exact rule application within the region is always advisable.

In case the insurer denies a claim, the very first thing should be to check out the reasons for doing so. Most of the time, this emanates from the fact that the illness is not covered in the policy; there was a misunderstanding about the terms, or perhaps there wasn’t enough documentary support.

When the claim was initially declined, Sarah asked for reconsideration by providing additional medical records and a proper letter from the doctor with full information. Sometimes, such issues are solved with strong insistence and clear communication.

Although the time it will take for the processing of a payout varies, successful claims are paid within 30 to 60 days from the date that all required documents were submitted and the survival period was satisfied.

George had filed a claim under his diagnosis of critical illness. After filing a claim, he received a lump-sum payment in the next 45 days, which helped him ease the stress of financial obligations.

Normally, the eligibility for Critical Illness Insurance Coverage could be age, medical history, or specific policy requirements from the insurer.

For example, when Anita wanted to apply for cover, first of all, she went through the eligibility criteria, which stated that she had to be below the age of 65 and not have had a major, existing health condition. It’s important to review these criteria closely when gathering Critical Illness Insurance Quotes to ensure you qualify.

Two different objectives are solved by Critical Illness Insurance and Disability Insurance. It pays a lump sum if you are diagnosed with one of the critical illnesses listed on the policy, irrespective of whether it affects your work or not. On the other hand, Disability Insurance is the kind of insurance under which payment of one’s income is made when one falls ill or gets injured and, by doing so, the person is incapable of working.

Monica, when she was diagnosed with cancer, the company paid out money for a critical illness. Her brother received money from disability insurance. It meant that when he got into a car accident and became disabled, he was still taken care of. Both insurance policies proved indispensable support for each of their life situations.

Yes, you can buy Critical Illness Insurance for your family members as well, securing them with the same financial blanket.

Suppose Javier had asked for Critical Illness Insurance Quotes for himself and his wife. This made sure that if either of them got critically ill in any case, the family was able to get financial support in managing the costs related to the illness and, at the same time, managed to live an average level of lifestyle.

Critical Illness Insurance means that they pay you a lump sum if you are diagnosed with one of a range of serious conditions. Commonly included are cancer, heart attacks, strokes, and major organ transplants.

Lisa made sure that those major illnesses were covered first when she looked over the insurance, taking into account the medical history of her family. You should compare these quotes to other Critical Illness Insurance Quotes and make sure that the list of illnesses it covers fits your needs.

The level of Critical Illness Insurance one needs might vary from person to person, but he has to consider his personal and financial situations, bearing in mind his monthly expenses, his family needs, and the savings already in place.

For example, as Derek considered the amount of coverage he was to buy, he calculated a year’s family expense; hence, he chose a policy that could comfortably pay for this amount. In light of this, it is necessary to appreciate personal needs and the value of discussing this with an insurance advisor so that an appropriate amount of coverage can be derived from them.

Check on the following information as you look for the policy:

Comprehensiveness of the coverage.

Inclusion of the illnesses that ail you.

Amount of lump sum payment.

The terms and conditions of the policy.

Consider also the insurer’s reputation and the claims process’s ease. For instance, by reading the customer reviews and comparing the customer service ratings, Noah made sure there could be reliable support during the time of need.

For a detailed guide regarding Critical Illness Insurance, discover these FAQs and be informed of the options in preparing for the worst. Each Critical Illness Policy has its unique features and benefits, so it is very important to get informed and choose the one that will be right for your conditions.

Remember, in health, forewarned is truly forearmed. For those who are at least interested in knowing what to get, getting personal Critical Illness Insurance quotations would be your first step to help secure your finances from serious health issues.

Sources and Further Reading

Understanding the Basics and Benefits of Critical Illness Insurance

For a comprehensive introduction to what Critical Illness Insurance is and how it can benefit you, visit Investopedia’s Guide to Critical Illness Insurance. This resource explains the key concepts, including the list of diseases covered and the mechanics of claim payouts.

Real-Life Cases and Impact Stories

For personal stories and real-life cases about the impact of Critical Illness Insurance, Consumer Reports often features articles on consumer experiences with different types of insurance, including Critical Illness Coverage. These stories can provide valuable insights into the practical benefits and challenges of holding such policies.

Legal and Financial Advice on Critical Illness Insurance

If you’re considering purchasing Critical Illness Insurance, legal and financial advice can be invaluable. Websites like Nolo offer free resources on the legal aspects of insurance, while financial advice can be sought from certified professionals through platforms like CFP Board.

These resources provide a good starting point for understanding Critical Illness Insurance, evaluating its benefits, and deciding on the right coverage for you. They also offer practical advice on navigating the complexities of insurance policies and understanding the financial implications of the survival clause and other terms.

Key Takeaways

- Critical Illness Insurance provides a lump sum for specific illnesses, not for death within the survival period.

- The survival clause requires surviving a set time after diagnosis to receive payment, distinguishing it from Life Insurance

- This insurance is an essential part of financial planning for those with severe illnesses, offering support for recovery costs.

- Integrate Critical Illness Insurance with other plans to create a comprehensive safety net.

- Understanding policy details, including covered illnesses and exclusions, is crucial before committing.

- Knowing the claims process is essential for efficiently accessing benefits when needed.

- Eligibility for this insurance depends on factors like age and medical history; review these to ensure proper coverage.

- Comparing quotes from multiple providers helps secure the best coverage at a reasonable cost.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]