- How to Save Money on Mortgage Insurance?

- What is a mortgage insurance policy?

- Benefits of Buying Mortgage Insurance from Canadian LIC

- How is Canadian LIC’s mortgage insurance better than mortgage insurance through a lender or bank?

- How can an individual save money on a mortgage insurance plan?

- Choose the right mortgage insurance plan with Canadian LIC

A dream home is the biggest investment of one’s life. Owning a home is the topmost priority for most Canadians, but not everyone is able to do that in their lifetime. That is the reason why it is so important to possess good knowledge about mortgage insurance and how it works so that you can make smarter decisions while saving for your dream home.

What is a mortgage insurance policy?

Mortgage Insurance is a type of insurance policy that a mortgage lender typically offers. This insurance plan pays off your outstanding mortgage debt if you cannot pay your scheduled monthly mortgage payments due to sickness, injury, or untimely death. It is imperative that, as the insured, you protect your most valuable asset, i.e., your home, if you suffer from any unfortunate financial situation.

For further details or inquiries on our mortgage insurance plans, please do not hesitate to reach out to our team at Canadian LIC; we will be more than happy to help you.

Benefits of Buying Mortgage Insurance from Canadian LIC

If you choose to go for mortgage insurance through Canadian LIC, then your beneficiaries will be able to receive a specific amount of money if you die. If your policy is active, then your family and beneficiaries would get a tax-free amount of money( the amount they will receive depends on the amount of your coverage), known as the death benefit.

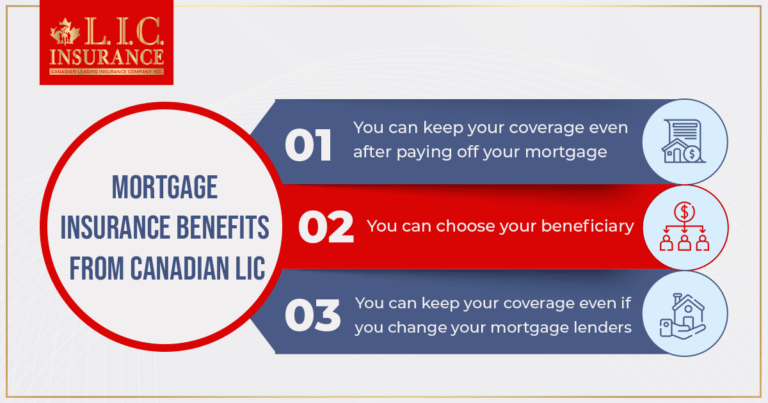

You will be enjoying the following benefits with the mortgage insurance policy through Canadian LIC:

- Even after paying off your mortgage, you will get to keep your coverage.

- Even if you move still, you will get to keep your coverage

- You can choose your beneficiary who will receive the death benefit.

The most amazing part is that your beneficiaries can use the death benefit they will receive in any way they want and for whatever they need. They can use the death benefit amount they will receive to cover the following:

- debts

- Mortgage Payments

- Childcare cost or

- Other living expenses cost

It is essential to ensure that you have a good amount of coverage to meet your family’s financial needs for making mortgage payments, debts or any other requirements.

However, the mortgage insurance through a bank or lender that you might be aware of is something different.

You can only use it to pay off some or all the amount remaining on your mortgage at the time of your death. But your beneficiary or family doesn’t receive any money, and it goes straight away to your lender or the bank. A part or all of your mortgage debt is paid off, but no money remains for your family or beneficiaries. Hence, your family’s other financial needs won’t be taken care of in this situation. That is why it would be a smarter choice to go for mortgage insurance through Canadian LIC.

How is Canadian LIC’s mortgage insurance better than mortgage insurance through a lender or bank?

| Canadian LIC Mortgage Insurance | Mortgage Insurance through a lender or bank | |

|---|---|---|

| Will my mortgage get covered? | Yes | Yes |

| Will expenses apart from mortgage be covered? | Yes | No, the lender or the bank receives the money |

| Will I be able to choose who gets the death benefit? | Yes | No, the lender or the bank receives the money |

| Will my coverage be lost after I pay off my mortgage? | No, it will remain the same | Yes, it will start reducing |

| Will my coverage be lost if I change my mortgage lenders? | No, as the insurance is separate to your mortgage | There are chances to lose the coverage and you will have to reapply |

| How can I apply? | Consult an insurance advisor or get quote online | Get in touch with your lender or bank |

Mortgage Insurance- Pros

Did you know that insured mortgages get better rates than uninsured ones? If you want to own your dream house as soon as possible, then you must go for mortgage insurance. You will start to build your equity along with getting ownership of your home.

Save Money on Mortgage Insurance

Buying your dream property in today’s real estate market is quite expensive. This is where Canadian LIC comes into the picture. At Canadian LIC, we can help you save money on your mortgage Insurance with a reasonably priced mortgage insurance policy. The best way is to evaluate your options online, or you can choose from the best at Canadian LIC to save you time and hassle. When house hunting, you must also make sure that you are looking at ways to save money on mortgage insurance to protect your home.

Incentives like the “First Time Homebuyer Incentive” can help individuals potentially get a top-up on their property down payment. If saving money on your mortgage insurance interests you, then get in touch with the team at Canadian LIC to help you explain the various mortgage insurance plans.

How can an individual save money on a mortgage insurance plan?

Traditional big banks and lenders are taking an unreasonable amount of your hard-earned money. Do you want to end up paying more money to these lenders for a mortgage insurance product when there are affordable alternatives out there? Like, from Canadian LIC! This sounds great, and we will explain why. The best way mortgage insurance is served is through a term life insurance plan. If you want to ensure your mortgage for $500,000 for 25 years, we can help you with Term Life Insurance, ensuring your needs are well looked after. Instead of visiting bank after bank searching for the best rates, you can save a significant amount of money for 25 years with mortgage insurance plans from private lenders like Canadian LIC, and the money saved can be better utilized on furniture, appliances, and most importantly, create memories for your new house.

Choose the right mortgage insurance plan with Canadian LIC

If you have more questions on Mortgage Insurance you can visit the Canadian government website to get more information in detail related to your specific queries…

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

If your down payment is more than 20%, then in those cases, you don’t need to have mortgage insurance, but if your down payment is less than 20%, you will have to pay the mortgage insurance.

You will have to wait for a few more months in order to avoid paying the mortgage insurance so that you can save some extra money; you can borrow through the home buyers plan from your RRSP in case you are eligible. It is advised to lower your home cost so that your down payment becomes a greater percentage.

If required, the lender is the one who enjoys the advantages of the insurance, so he is the one who chooses the mortgage insurance provider. But you can compare the cost of your mortgage with different lenders. There are chances that a different lender will opt for an insurance provider at a lower cost.

The lender will do something while preparing the documents of the mortgage. This occurs between the date your offer is formally accepted and the day the closing papers are signed. You don’t have to do anything, especially except for arranging if anything is required for the mortgage application and paying it to the lender.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]