Even when things are going smoothly, it can be hard to find your way through the Super Visa requirements, especially when it comes to health and insurance needs. Let’s say you are preparing to bring your parents and grandparents to Canada for a long-awaited homecoming. Even though you know what a Super Visa can do for you and are considering getting one, requirements for a medical exam and insurance are still worrying you. For many, this raises the question, “Is the medical test needed for a Super Visa to Canada?” How can someone make sure they follow all the stipulations so there are no bad surprises? A good Super Visa Insurance Policy can protect your family while they are in Canada. This blog aims to clear up some questions about the medical exam requirement for the Super Visa.

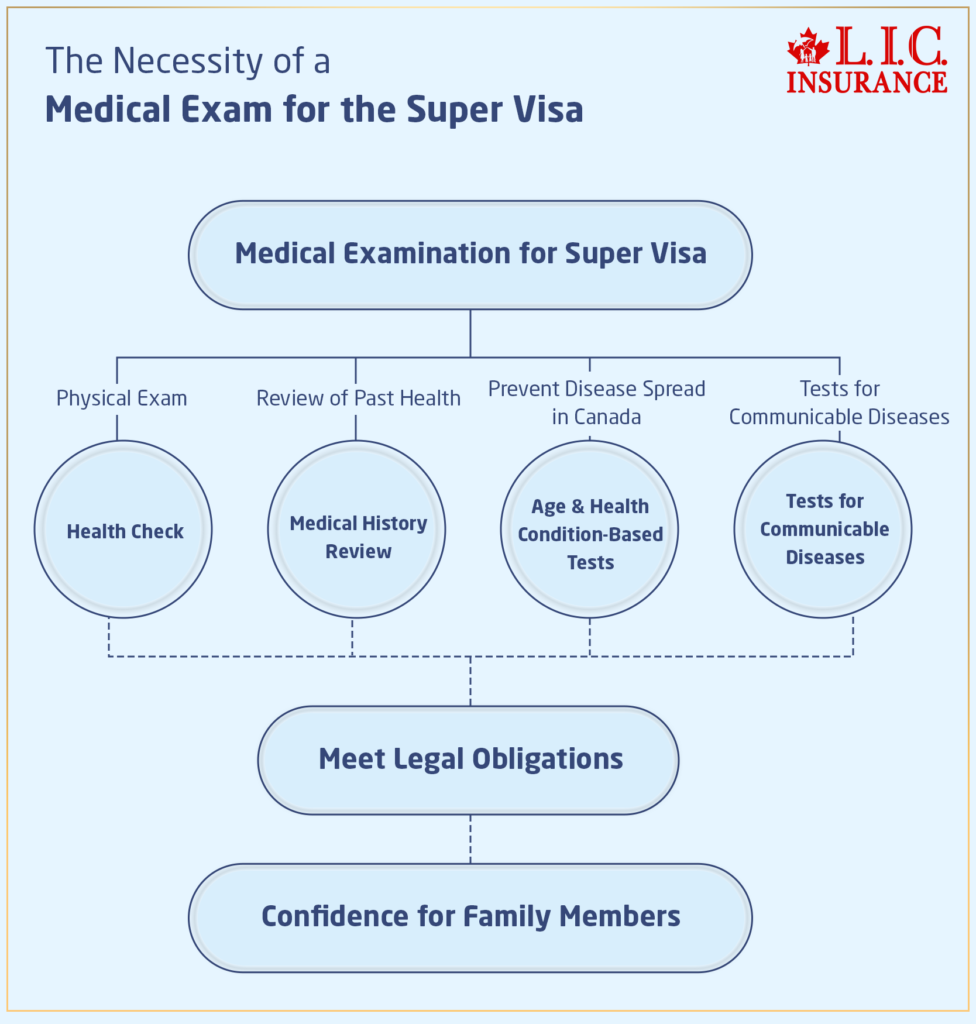

The Necessity of a Medical Exam for the Super Visa

Yes, all Super Visa applicants are required to go through a medical examination. The examination is one of the ways Canada ensures that parents and grandparents of Canadian citizens who come for extended visits are not only likely to be in good health but also unlikely to cause excessive demand on the Canadian healthcare system. Let’s get an overview of what the medical examination involves in detail, why it is necessary, and how getting good Super Visa insurance can help one avoid further stress.

What the Medical Exam Covers

The medical exam for a Super Visa application includes all the major tests that would normally be there in general health. This would normally be an examination that would involve:

- Physical Examination: A general health checkup to identify any immediate medical concerns.

- Review of Medical History: Doctors look at past health issues to identify ongoing conditions or potential health risks.

- Tests for Communicable Diseases: These tests are essential to prevent the spread of diseases within Canada.

- Age and health condition-based tests: The Applicants will also have to go through certain other specific tests based on their age and present health condition.

This detailed health assessment not only meets legal obligations but also instills confidence in family members that their loved ones who are going to travel and stay in Canada will stay fine for a good duration.

Mr. Kabir intended to apply for a Super Visa to call his old-aged parents and grandparents in Ontario. He was very much concerned about the medical exam, keeping his father’s past heart illness in mind. He was worried about the outcome of the examination but also about the financial implications if there were health care needs. Thankfully, they had opted for a Super Visa Insurance Policy with detailed care regarding pre-existing conditions.

However, during the medical examination, it was found that his father would require periodic monitoring and medication, perhaps a huge financial burden on the family. But, since their Super Visa Medical Insurance did cover this condition, the family was able to take care of those medical needs without worries. So, this is a great example of how well-chosen insurance can help cover the cost of health problems, whether they were expected or not.

Mrs. Anand is a 68-year-old Indian widow who wanted to visit her son in Toronto. She was quite agitated about why she need a medical exam and had already begun to worry whether her diabetes would disqualify her. However, with a full medical checkup, all these were easily done, as she was assisted by her son—who understood the nitty-gritty involved in Super Visa Medical Insurance. After a few days, a thorough medical checkup revealed that she was under proper medical care, and in no way could her application be hindered due to a medical condition. This process not only assured her but also gave her son peace of mind about her health when she was in Canada.

Why the Medical Exam Is Beneficial

- Ensuring Comprehensive Care: Mandatory medical examination would ensure that all existing medical issues are known, and when deemed necessary by the examining physician, an appropriate health management plan put in place during the visitor's stay in Canada. It would decrease the risk of medical emergencies, which are not only stressful but also costly.

- Compliance with Health Standards: Canada maintains a high standard in public health issues; this medical examination maintains this to maintain freedom from entering potentially serious diseases.

Financial Security with Super Visa Insurance: A critical complementary aspect is acquiring Super Visa insurance. This insurance helps secure visitors from potentially large medical expenses and provides coverage for a variety of medical services. In most instances, the Super Visa Medical Insurance includes hospitalization, emergency services, and, in some severe cases, repatriation when required.

Engaging with Your Super Visa Insurance Provider

However, the right choice of Super Visa Insurance Policy must be marked with caution as to what specific medical conditions are being covered and to what degree. You are advised to discuss these specific health needs with your insurance provider openly. Transparent communication will help tailor a policy that best fits these needs, making sure that all potential scenarios are well covered.

Thus, the medical examination under the Super Visa is more than a procedural necessity; it is, in fact, a fundamental process to guarantee the health and safety of the visitor and the public. Coupled with a Super Visa Insurance Policy, these all form the base for a worry-free long-term visit to Canada for your loved ones. As such, an insurance policy is sought that would satisfy not only the government but also ease the minds of a customer from having to pay out of their pocket for big medical bills that can accumulate with long-term stays.

Make sure you fully understand why one needs a medical exam and what it involves before you go for it, and make sure you have Super Visa Medical Insurance to cover everything. This will open up doors for your relatives, and from there, they will have a comfortable and pleasant stay in Canada.

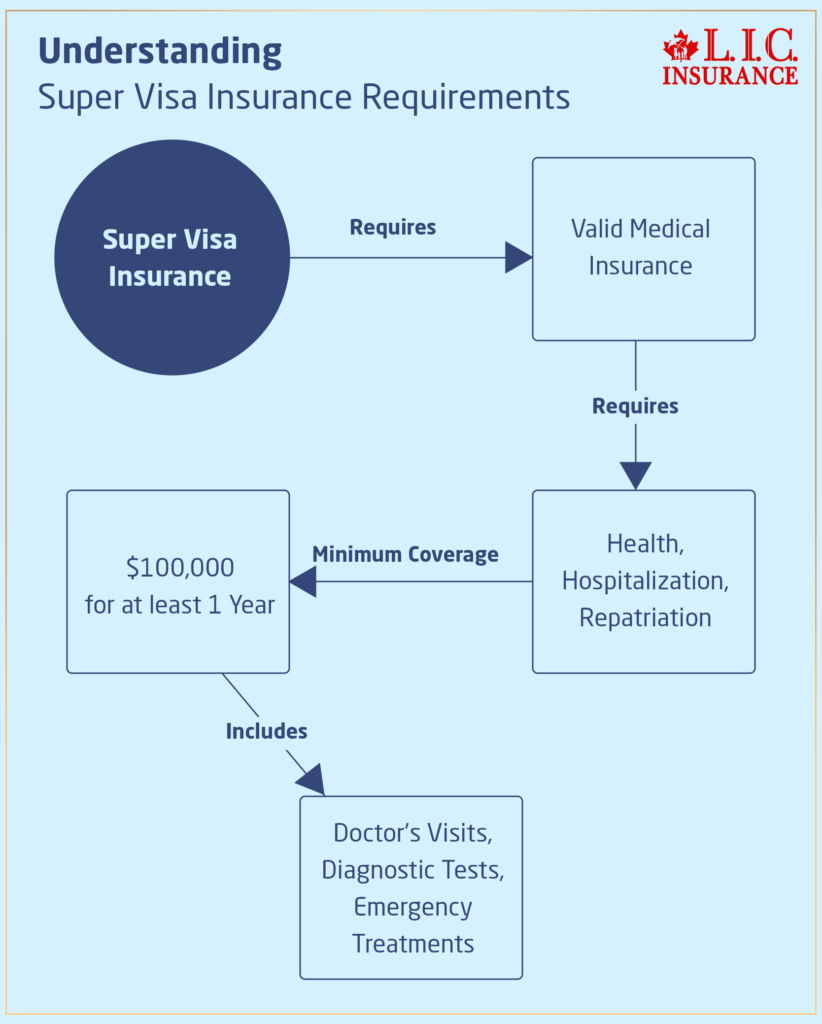

Understanding Super Visa Insurance Requirements

The most important step in making the Super Visa secure for loved ones is to provide proof of coverage with a valid medical insurance policy. This is not the mere formality of insurance; this ensures security under the head of your parents and grandparents against the head of unforeseen medical expenditures while staying in Canada. But what should the insurance consist of, and most importantly, why is it so necessary?

Essential Coverage Details of Super Visa Medical Insurance

The same should also include coverage for health, hospitalization, and repatriation. It should provide for the basic minimum of $100,000 for a period not less than one year from the date the family member steps on Canadian soil. Let’s go through these requirements.

- Healthcare cover: This includes doctors' visits, cover for diagnostic tests, and emergency medical treatments likely to accrue during the stay.

- Hospitalization: In case the loved one needs to be hospitalized, it is assumed that the cost of the stay at the hospital is very huge and is supposed to be covered by insurance.

- Repatriation: It is the reimbursement for the expenses of transporting the mortal remains to their home country that are incurred in returning them to their home country in case of death while in Canada.

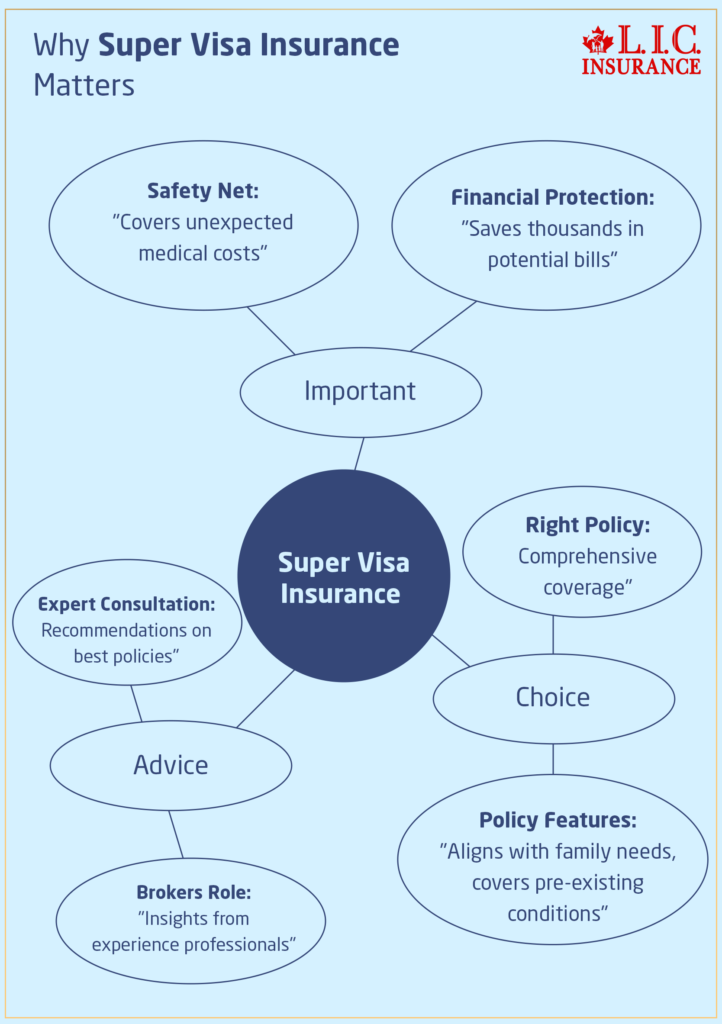

Why Super Visa Insurance Matters

Someone who wants to apply for a Super Visa should fully understand why getting a good Super Visa insurance cover is so important. This is more than just a bureaucratic need. Furthermore, this insurance is an important safety net because it could save a lot of money if there are any unexpected medical problems during the stay in Canada.

The Protective Role of Super Visa Medical Insurance

Think about walking on a lovely autumn evening with your visiting parents, and suddenly, one of them gets a slip and falls, requiring you to give first aid. Without Super Visa Medical Insurance, you are only left with a daunting pile of medical bills. That can quickly mount into thousands of dollars. This doesn’t happen very often, so getting the right kind of insurance becomes not only helpful but also necessary.

Take the case of Maria and her mother, who were visiting from Brazil. On arrival in Canada, her mother had a minor stroke. Because they were smart, they saved tens of thousands of dollars in hospital bills, which were paid for by an all-inclusive Super Visa Medical Insurance policy. This unlikely but significant event opened Maria’s eyes to how important it was to have comprehensive coverage. It confirmed that the Super Visa Insurance was not just a norm but rather another important investment toward good health and well-being for her mother.

Financial Implications Without Adequate Coverage

The financial implications of not having adequate Super Visa Medical Insurance can be disastrous. Medical attention in Canada is of an exceptionally high standard but comes at a price equally high, more so to

Just ask the Johnsons: They probably thought they were going to save a few by taking out the minimum required coverage on their insurance. When Mr. Johnson Sr. from England needed an emergency appendectomy, his basic coverage couldn’t help and left his family to face very unexpected debt. Only such an occurrence could be put under control with a more holistic Super Visa Insurance Policy that had wider coverage for medical emergencies.

Choosing the Right Super Visa Insurance Policy

So, choosing the right Super Visa Insurance plan is a decision that goes far beyond just assuring that one is meeting set government requirements; it comes with knowledge about what is offered specifically in different plans and how each one is tailored to one-of-a-kind to fit the needs of your family. This, in turn, will give you peace of mind that you are meeting the requirements and ensuring that your loved one will be safe during the extended stay in Canada.

Delving into Super Visa Insurance Offerings

While going through the Super Visa Medical Insurance options, each detail must be looked at critically. Each policy has underlying factors to cover different sorts of scenarios. Some of the policies may provide broad protection, such as emergency medical costs, while some are more towards essential care or repatriation.

Ever wonder what would happen if, say, while in Canada, the dear ones needed urgent medical attention? This is where the right Super Visa Insurance Policy comes in handy. How sure are you of the coverage that your present policy offers?

Aligning Policy Features with Your Family’s Needs

When aligning a Super Visa Insurance Policy with your family, what is most important is considering factors such as the age and health of the visiting relative, his or her pre-existing conditions, and the probability of such relative needing medical attention during the visit. These considerations will guide you in choosing a policy that not only meets but exceeds your expectations.

The Patel family had bought a very basic Super Visa Insurance for their visiting grandparents from India. They realized their mistake within a few days when their grandfather, already having a history of respiratory ailments, had to be treated at a hospital, and the expense of the treatment surprisingly cost them a bomb. This episode has highlighted the need to have a policy that covers pre-existing conditions—one of those costly lessons that forces one to adopt a different, elaborate policy.

Making the Right Choice

Making a decision, therefore, involves thorough research and often consultation with experts. All these are usually considered, and hence, it is advisable that one compares different Super Visa Medical Insurance policies, reads the fine print, and gets to understand all the terms and conditions.

Now, consider this: it’s not the cheapest policy on the market, but if you do choose the one with pre-existing conditions included, you might pay a bit more at the start and save thousands in potential medical bills. Perhaps it’s better to be safe than sorry, especially when it involves family.

The Importance of Expert Advice

Super Visa Insurance policies can get very tricky, and the best recommendation would be to seek the counsel of insurance brokers who have experience in the matter in order to advise on the best way to buy Super Visa Insurance. That would mean advice from experienced insurance brokers to give insights on the best policies available and how best to reap benefits in a situation.

Sarah, from the Philippines, had an appointment with an experienced insurance broker to finalize the best Super Visa Insurance Policy for her parents at this age. Along with the policy details, the broker walked her through everything, including which plan would cover their parents’ long-term illnesses. This way, they wouldn’t have to worry during their first two years in Canada.

Find Out: How to apply for Super Visa Insurance?

Find Out: When should Super Visa Insurance start in Canada?

Find Out: Benefits of Super Visa Insurance

Find Out: The mistakes to avoid when you buy Super Visa Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

The Final Words: Secure Your Family's Future

Super Visas for parents or grandparents of Canadian citizens is yet another way of making the family complete and bridging the gap. The medical exam and the Super Visa Insurance are not mere formalities but the founding elements to ensure their health and safety at the time of the visit.

These requirements should remind you of the importance of applying for a Canadian Super Visa. Being one of the leading insurance brokerages in Canada, Canadian LIC will take care of your worries and guide you in choosing the best policy for Super Visa Insurance. Don’t let complexity stand in the way of bringing your family together. Contact Canadian LIC today so you can finally reunite your whole family in Canada. Get your Super Visa Insurance from Canadian LIC to secure your loved ones during their memorable stay.

Find Out: Can parents work on Super Visa in Canada?

Find Out: Can we cancel Super Visa Insurance?

Frequently Asked Questions (FAQs) about Super Visa Insurance

Super Visa Insurance is specifically designed medical insurance that provides coverage for parents and grandparents during their stay in Canada on a Super Visa. It includes care for medical treatment, hospitalization, and repatriation with a minimum coverage amount of $100,000 to safeguard the immediate family from any unforeseen medical expenses during the stay.

Super Visa Medical Insurance is required to fulfill the Super Visa requirements set by the Canadian government. It ensures that visitors can adequately pay for medical costs in the event they require unexpected medical care after they enter Canada, without becoming a financial burden on the Canadian health system.

Consider Ana’s story from Brazil: her father came to visit on a Super Visa and suffered a minor heart attack. Thanks to their reliable Super Visa Medical Insurance, all the costs from the hospital and treatment, which were surprisingly high, were fully covered, keeping Ana’s family’s potential financial strain at bay.

Your Super Visa Insurance Policy must provide a minimum of $100,000 in coverage. However, it is advisable to consider more comprehensive policies if the visiting family member has known health issues. This ensures that all potential medical costs are fully covered for a safer and more carefree visit.

Have you read the fine details of your coverage to make sure you know what it covers? How do you think these limitations might affect the peace of mind of your family?

Yes, most Super Visa Medical Insurance policies can be renewed from within Canada, provided that the original policy was purchased for a duration of less than one year. Renewal is at the discretion of the insurance provider and may vary according to the health condition of the insured person during their stay.

Maria from the Philippines had purchased a policy for her mother for six months. When they decided to extend her stay, they were able to renew her insurance smoothly without any hassle, as her mother had been in good health throughout her visit.

If your Super Visa Insurance Policy expires while one of your parents is in Canada, you could face the possibility of very high medical costs without coverage. Ensuring continuous coverage throughout their stay is of great importance.

Think about what would happen if there was an accident while coverage was missing. Emergency services can cost a lot of money, making what could be a manageable problem into a big money problem. Isn’t it better to have constant coverage?

Finding the best Super Visa Insurance Policy will involve comparing different plans from various providers against coverage limits, deductibles, exclusion of pre-existing conditions, and the insurance company’s reputation.

Consider the type of specific medical needs that your parents would have. Do they have any existing conditions that require medication or treatment on a regular basis? How do these factors influence the policy you choose for them?

Without Super Visa Medical Insurance, one exposes themselves to huge financial risks. When a visiting parent or grandparent gets into a medical emergency, the costs without insurance can be sky high, potentially leaving them in debt or receiving inadequate care.

Karim’s mother from Egypt had a medical emergency during her visit to Canada without insurance. The family faced huge medical bills that could have been avoided with proper Super Visa Medical Insurance. This situation underscores the importance of having solid coverage.

You will need a confirmation letter from the insurance company to prove that your Super Visa Medical Insurance meets the minimum requirements. This letter should clearly state the level of coverage and the terms of coverage, including repatriation, hospitalization, and health care.

How would you feel knowing all your basics are covered with a confirmation letter in hand when your parents arrive in Canada? Such preparedness not only meets legal obligations but also sets the stage for a stress-free visit.

If your parent’s health changes after purchasing Super Visa Medical Insurance, it’s important to notify the insurance provider immediately. Changes in health could affect the coverage, and adjustments might be needed to ensure that the policy still provides adequate protection.

You could feel more at ease if you knew that your insurance could be changed to better meet your parent’s changing health needs. It would be better to update the insurance now than to have to pay for medical bills that you didn’t know about later.

Remember these stories and tips as you go through the complexities of choosing and maintaining a Super Visa Insurance Policy. They are not just abstract pieces of advice but real-life implications that could impact your family’s experience in Canada. These FAQs will help you manage the insurance process more effectively, ensuring your loved ones enjoy a safe and fulfilling visit.

Sources and Further Reading

To ensure you have access to the most accurate and comprehensive information regarding Super Visa requirements and insurance policies, here is a list of recommended sources and further reading. These resources can provide detailed insights, official guidelines, and practical advice to help you navigate the process effectively

Official Resources

Immigration, Refugees and Citizenship Canada (IRCC)

Website: Canada.ca

Specific Page: Super Visa overview, eligibility, and application process.

Usefulness: The official IRCC website is the definitive source for up-to-date information on the Super Visa, including all legal requirements and procedural guidelines.

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA.ca

Specific Page: Information on health and travel insurance options in Canada.

Usefulness: CLHIA provides comprehensive details about insurance policies, including what consumers should look for in medical insurance plans.

Educational Resources

Settlement.Org

Website: Settlement.org

Specific Page: Articles and FAQs on navigating life in Canada as an immigrant, including healthcare and insurance.

Usefulness: This site offers practical advice and tips for immigrants and visitors to Canada, including how to choose insurance and prepare for healthcare needs.

Canadian Visa Law Blog

Specific Page: Insights and updates on visa applications and requirements.

Usefulness: This blog provides expert analysis and commentary on changes in visa laws and insurance requirements, which can be particularly useful for understanding the nuances of the Super Visa.

Books

“The Canadian Immigration Handbook”

Author: A group of Canadian immigration lawyers.

Usefulness: Offers a comprehensive look at immigration policies, including visas and insurance requirements. Available at major book retailers and libraries.

Expat Forums and Communities

Examples: BritishExpats.com forums, Expat.com forums

Specific Section: Canada

Usefulness: Forums provide real-life experiences and advice from other people who have applied for Super Visas or purchased related insurance. These can offer practical tips and personal stories that help in making informed decisions.

Gathering information from these sources will help you build a solid understanding of Super Visa requirements, especially regarding the critical aspect of medical insurance. By consulting a mix of official guidelines, expert advice, and community wisdom, you can ensure a smooth application process and a secure stay for your loved ones in Canada. Always check for the most recent updates and consult with professional advisors to tailor decisions to your specific circumstances.

Key Takeaways

- Every Super Visa applicant must undergo a medical exam to confirm their health status.

- Super Visa Insurance must provide at least $100,000 in coverage for health care and hospitalization for a minimum of one year.

- Choose a Super Visa Insurance Policy that aligns with the visitor's health needs, including coverage for pre-existing conditions.

- Proper preparation and understanding of all application requirements, such as insurance and medical tests, prevent application delays.

- Applicants need to show financial proof through a support letter and meeting the Low Income Cut Off requirements.

- Consulting with insurance brokers or immigration experts can help clarify Super Visa requirements and improve application success.

- Super Visa Insurance policies can be renewed or adjusted if the visitor's circumstances change.

- Insurance premiums can be fully refunded if the Super Visa application is denied, provided no claims have been made.

Your Feedback Is Very Important To Us

We are conducting a survey to better understand the challenges Canadians face with the medical test requirements for the Super Visa and to assess the helpfulness of our recent blog post on this topic. Your feedback is invaluable and will help us improve our information offerings.

Please take a few moments to respond to the following questions:

Please share any other comments or suggestions on how we can improve our content to better assist you and others during the Super Visa application process.

Thank you for participating in our survey. Your insights are crucial in helping us enhance our resources and support for all Canadians dealing with the Super Visa process.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]